|

Arrangement of Sections

|

-

THE VALUE ADDED TAX (DISTRAINT) REGULATIONS, 1990

-

THE VALUE ADDED TAX (TRIBUNAL) RULES, 1990

-

THE VALUE ADDED TAX (DISTRAINT) REGULATIONS, 1990

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX REGULATIONS, 1994

-

THE VALUE ADDED TAX ACT ORDER, 2002

-

THE VALUE ADDED TAX ACT ORDER, 2002

-

THE VALUE ADDED TAX (REMISSION) (OFFICIAL AID FUNDED PROJECTS) ORDER, 2003

-

THE VALUE ADDED TAX (REMISSION) (OFFICIAL AID FUNDED PROJECTS) ORDER, 2003

-

THE VALUE ADDED TAX (REMISSION) (OFFICIAL AID FUNDED PROJECTS) ORDER, 2003

-

THE VALUE ADDED TAX (REMISSION) (INVESTMENTS) REGULATIONS, 2004

-

THE VALUE ADDED TAX (TAX WITHHOLDING) REGULATIONS, 2004

-

THE VALUE ADDED TAX (TAX WITHHOLDING) REGULATIONS, 2004

-

THE VALUE ADDED TAX (REMISSION) (INVESTMENTS) REGULATIONS, 2004

-

THE VALUE ADDED TAX (ELECTRONIC TAX REGISTERS) REGULATIONS, 2004

-

THE VALUE ADDED TAX (ELECTRONIC TAX REGISTERS) REGULATIONS, 2004

-

THE VALUE ADDED TAX (REMISSION) ORDER, 2007

-

THE VALUE ADDED TAX (REMISSION) ORDER

-

THE VALUE ADDED TAX (REMISSION) (LOW INCOME HOUSING PROJECTS) ORDER, 2008

-

THE VALUE ADDED TAX (REMISSION) (LOW INCOME HOUSING PROJECTS) ORDER, 2008

-

THE VALUE ADDED TAX REGULATIONS, 2017

-

THE VALUE ADDED TAX REGULATIONS, 2017

-

THE VALUE ADDED TAX REGULATIONS, 2017

-

THE VALUE ADDED TAX REGULATIONS

-

THE VALUE ADDED TAX (DIGITAL MARKETPLACE SUPPLY) REGULATIONS, 2020

-

THE VALUE ADDED TAX (ELECTRONIC TAX INVOICE) REGULATIONS, 2020

-

THE VALUE ADDED TAX (DIGITAL MARKETPLACE SUPPLY) REGULATIONS, 2020

-

THE VALUE ADDED TAX (DIGITAL MARKETPLACE SUPPLY) REGULATIONS

-

THE VALUE ADDED TAX (ELECTRONIC TAX INVOICE) REGULATIONS

-

THE VALUE ADDED TAX (ELECTRONIC, INTERNET AND DIGITAL MARKETPLACE SUPPLY) REGULATIONS, 2023

-

THE VALUE ADDED TAX (ELECTRONIC TAX INVOICE) (REVOCATION) REGULATIONS, 2023

|

|

THE VALUE ADDED TAX (DISTRAINT) REGULATIONS, 1990

ARRANGEMENT OF REGULATIONS

| 4. |

Distraint agent to furnish security

|

| 8. |

Steps subsequent to attachment

|

| 9. |

Limitation on sale of attached goods

|

| 10. |

Return on completion of sale

|

| 11. |

Restoration of attached goods on payment, etc.

|

| 13. |

Costs for levying distress

|

| 14. |

Remuneration of distraint agents

|

| 15. |

Commission payable to auctioneer

|

| 16. |

Matters included in rates of remuneration

|

SCHEDULES

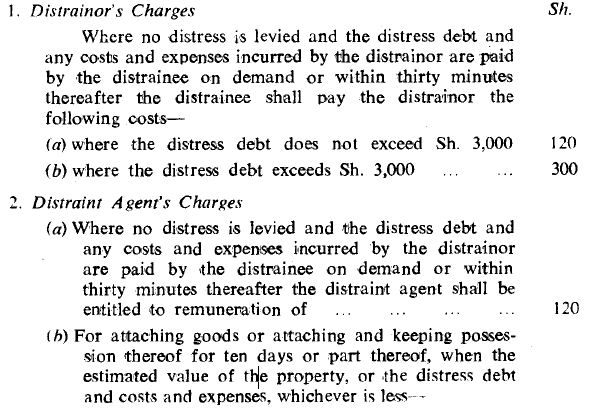

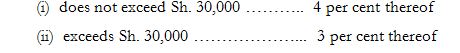

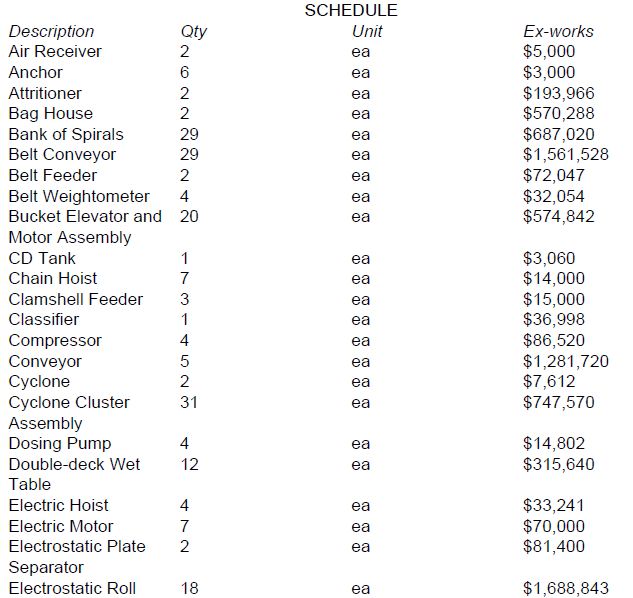

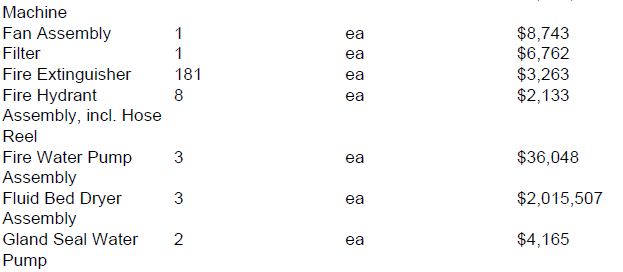

| SCHEDULE — |

RATES OF REMUNERATION

|

THE VALUE ADDED TAX (DISTRAINT) REGULATIONS, 1990

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

| 1. |

Citation

These Regulations may be cited as the Value Added Tax (Distraint) Regulations, 1990.

|

| 2. |

Interpretation

In these Regulations, unless the context otherwise requires—

"distrainee" means the registered person or debtor named in an order;

"distrainor" means an officer in the service of the Value Added Tax Department who is authorized to levy distress;

"distraint agent" means a person appointed as such under regulation 3;

"distress" means a distress levied pursuant to an order;

"distress debt" means the amount of tax, and interest charged thereon, specified in the order;

"goods" means all movable property of distrainee (other than growing crops and goods which are liable to perish within ten days of attachment) which is liable under the law to attachment and sale in execution of a decree of a court;

"order" means an order issued by the Commissioner under section 18(I) of the Act.

|

| 3. |

Distraint agents

| (1) |

An authorized officer may appoint distraint agents to assist him in the execution of orders.

|

| (2) |

No person shall be appointed a distraint agent unless he satisfies the authorized officer that he—

| (a) |

is of good repute and of good financial standing;

|

| (b) |

is qualified under the law relating thereto to levy distress by way of attachment of movable property in execution of a decree of a court; and

|

| (c) |

has contracted a policy of insurance in an adequate sum against theft, damage or destruction by fire of goods which may be placed in his custody by reason of the performance of his duties as a distraint agent.

|

|

|

| 4. |

Distraint agent to furnish security

| (1) |

A distraint agent shall on appointment furnish the Commissioner with security, by means of deposit of the sum of thirty thousand shillings, or in such other manner as the Commissioner may approve, and that security shall be refunded or cancelled on the termination of the appointment of the agent unless it is forfeited under this regulation.

|

| (2) |

If a distraint agent is convicted of an offence involving fraud or dishonesty in connection with any function performed by him as agent, the court by which he is convicted may make an order as to forfeiture of the security furnished by him under paragraph (1), or any part thereof, and the provisions of the Criminal Procedure Code (Cap. 75), in so far as they relate to forfeiture of recognizance, shall apply mutatis mutandis to the forfeiture of security under this regulation.

|

|

| 5. |

Execution of orders

| (1) |

An order may be executed at any time after it has been duly served on the distrainee in the manner provided by regulation 6.

|

| (2) |

An order shall be executed by attachment of such goods of the distrainee as in the opinion of the distrainor are of a value which on sale by public auction, would realize a sum sufficient to meet the distress debt and the costs and expenses of the distress incurred by the distrainor.

|

|

| 6. |

Service of orders

| (1) |

Every order shall be issued by the Commissioner in duplicate and service thereof shall be affected by service by the distrainor of a copy of the order on the distrainee in person or, if after using all due and reasonable diligence the distrainee cannot be found, by service of a copy on an agent of the distrainee empowered to accept service or an adult member of the family of the distrainee who is residing with him.

|

| (2) |

A person served with a copy of an order under this regulation shall endorse on the order acknowledgement of service, and if he refuses to make endorsement the distrainor shall leave the copy of the order with the person or his agent after stating in writing thereon that the person or his agent upon whom he served the order refused to sign the acknowledgement and that he left at the time, date and place stated therein, a copy of the order with that person and the name and address of the person (if any) by whom the person on whom the order was served was identified, and thereupon the order shall he deemed to have been duly served.

|

|

| 7. |

Forceable entry

| (1) |

In executing any distress, no outer door of a dwelling-house shall be broken open unless the dwelling-house is in the occupancy of the distrainee and he refuses or in any way prevents access thereto, but when the distrainor executing distress has duly gained access to a dwelling-house he may break open the door of any room in which he has reason to believe any goods of the distrainee to be.

|

| (2) |

When a room in a dwelling-house is in the actual occupancy of a woman who, according to her religion or local custom does not appear in public the distrainor shall give notice to her that she is at liberty to withdraw; and after allowing reasonable time for her to withdraw and giving her reasonable facility for withdrawing, he may enter the room for the purpose of attaching any goods therein, using at the time every precaution consistent with these provisions to prevent their clandestine removal.

|

|

| 8. |

Steps subsequent to attachment

As soon as practicable after the attachment of goods under these Regulations, the distrainor shall—

| (a) |

issue a receipt in respect thereof to the distrainee;

|

| (b) |

forward to the Commissioner a report containing an inventory of all items attached, the value of each item as estimated by the distrainor, the address of the premises at which the the goods are kept pending sale, the name and address of the distraint agent in whose custody the goods have been placed and the arrangements, if any, made or to be made for the sale by public auction of the goods on the expiration of ten days from the date of attachment.

|

|

| 9. |

Limitation on sale of attached goods

On the sale by public auction of any goods attached under these Regulations, the distrainor shall cause the sale to be stopped when the sale has realized a sum equal to or exceeding the distress debt and the costs and expenses incurred by the distrainor, and there-upon any of the goods remaining unsold shall at the cost of the distrainee be restored to the distrainee.

|

| 10. |

Return on completion of sale

Immediately after the completion of a sale by publication of goods attached under these Regulations, the distrainor shall make a return to the Commissioner specifying the items which have been sold, the amount realized by the sale and the manner in which the proceeds of the sale were applied.

|

| 11. |

Restoration of attached goods on payment, etc.

| (1) |

Where a distrainee has within ten days of attachment of his goods under these Regulations, paid or given security accepted by the Commissioner for the whole of the tax due from him together with the whole of the costs and expenses incurred by the distrainor in executing the distress, the distrainor shall at the cost of the distrainee forthwith restore the attached goods to the distrainee and return the order to the Commissioner who shall cancel it.

|

| (2) |

Any money paid by a distrainee under this regulation shall be applied by the Commissioner first in settlement of the costs and expenses incurred by the distrainor and as to the balance in settlement of the distress debt or such part thereof as the Commissioner shall direct.

|

|

| 12. |

Livestock

Where any goods attached under these Regulations comprise or include livestock, the distrainor may make appropriate arrangements for the transport, safe custody and feeding thereof and any costs and expenses incurred by the distrainor.

|

| 13. |

Costs for levying distress

In addition to a claim for any other costs and expenses which may be incurred by the Commissioner or the distrainor in levying distress under these Regulations, there may be claimed by the distrainor and recovered under regulations 9 and 11, as the case may be, costs at the rate specified in the Schedule.

|

| 14. |

Remuneration of distraint agents

The maximum rates of remuneration which a distraint agent shall be entitled to demand from the distrainor for his assistance in executing a distress under these Regulations, and which may be recovered by the distrainor under regulation 9 or 11, as the case may be, shall be those specified in the Schedule.

|

| 15. |

Commission payable to auctioneer

The maximum rates of commission to be paid to an auctioneer by the distrainor as remuneration for his services for the sale by public auction of any goods attached under these Regulations, and which may be recovered by the distrainor under regulation 9, shall be five per cent of the amount realized on the sale, and where an auctioneer has also rendered services as a distraint agent he shall be entitled, in addition to any commission, to remuneration for those services as provided in regulation 14.

|

| 16. |

Matters included in rates of remuneration

The rates of remuneration specified in the Schedule shall be deemed to include all expenses of advertisements, inventories, catalogues, insurance and necessary charges for safeguarding goods attached under these Regulations.

|

SCHEDULE

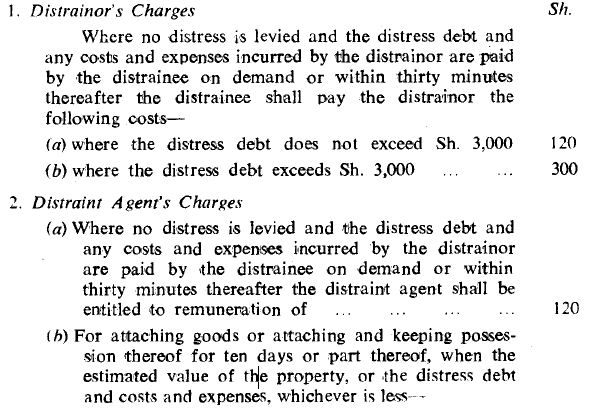

RATES OF REMUNERATION

[Reg. 16.]

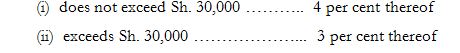

| (c) |

Where the goods or any part thereof are sold by public auction, the distraint agent's charges shall instead be calculated in the manner directed above by reference to the total amount realized on sale after deduction of the auctioneer's commission under regulation 15.

|

| (d) |

For keeping possession of any attached goods after the expiration of ten days from the date of attachment for each day, or part thereof—

1/4 per cent of the value of the goods with a maximum of Sh. 60.

|

| (e) |

Reasonable expenses incurred by the distraint agent in transporting goods attached, and such travelling expenses by car, or a rateable proportion thereof, as the Commissioner may approve.

|

THE VALUE ADDED TAX (DISTRAINT) REGULATIONS, 1990

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

| 1. |

Citation

These Regulations may be cited as the Value Added Tax (Distraint) Regulations, 1990.

|

| 2. |

Interpretation

In these Regulations, unless the context otherwise requires—

"distrainee" means the registered person or debtor named in an order;

"distrainor" means an officer in the service of the Value Added Tax Department who is authorized to levy distress;

"distraint agent" means a person appointed as such under regulation 3;

"distress" means a distress levied pursuant to an order;

"distress debt" means the amount of tax, and interest charged thereon, specified in the order;

"goods" means all movable property of distrainee (other than growing crops and goods which are liable to perish within ten days of attachment) which is liable under the law to attachment and sale in execution of a decree of a court;

"order" means an order issued by the Commissioner under section 18(I) of the Act.

|

| 3. |

Distraint agents

| (1) |

An authorized officer may appoint distraint agents to assist him in the execution of orders.

|

| (2) |

No person shall be appointed a distraint agent unless he satisfies the authorized officer that he—

| (a) |

is of good repute and of good financial standing;

|

| (b) |

is qualified under the law relating thereto to levy distress by way of attachment of movable property in execution of a decree of a court; and

|

| (c) |

has contracted a policy of insurance in an adequate sum against theft, damage or destruction by fire of goods which may be placed in his custody by reason of the performance of his duties as a distraint agent.

|

|

|

| 4. |

Distraint agent to furnish security

| (1) |

A distraint agent shall on appointment furnish the Commissioner with security, by means of deposit of the sum of thirty thousand shillings, or in such other manner as the Commissioner may approve, and that security shall be refunded or cancelled on the termination of the appointment of the agent unless it is forfeited under this regulation.

|

| (2) |

If a distraint agent is convicted of an offence involving fraud or dishonesty in connection with any function performed by him as agent, the court by which he is convicted may make an order as to forfeiture of the security furnished by him under paragraph (1), or any part thereof, and the provisions of the Criminal Procedure Code (Cap. 75), in so far as they relate to forfeiture of recognizance, shall apply mutatis mutandis to the forfeiture of security under this regulation.

|

|

| 5. |

Execution of orders

| (1) |

An order may be executed at any time after it has been duly served on the distrainee in the manner provided by regulation 6.

|

| (2) |

An order shall be executed by attachment of such goods of the distrainee as in the opinion of the distrainor are of a value which on sale by public auction, would realize a sum sufficient to meet the distress debt and the costs and expenses of the distress incurred by the distrainor.

|

|

| 6. |

Service of orders

| (1) |

Every order shall be issued by the Commissioner in duplicate and service thereof shall be effected by service by the distrainor of a copy of the order on the distrainee in person or, if after using all due and reasonable diligence the distrainee cannot be found, by service of a copy on an agent of the distrainee empowered to accept service or an adult member of the family of the distrainee who is residing with him.

|

| (2) |

A person served with a copy of an order under this regulation shall endorse on the order acknowledgement of service, and if he refuses to make endorsement the distrainor shall leave the copy of the order with the person or his agent after stating in writing thereon that the person or his agent upon whom he served the order refused to sign the acknowledgement and that he left at the time, date and place stated therein, a copy of the order with that person and the name and address of the person (if any) by whom the person on whom the order was served was identified, and thereupon the order shall he deemed to have been duly served.

[L.N. 123/1996, r. 2(i).]

|

|

| 7. |

Forceable entry

| (1) |

In executing any distress, no outer door of a dwelling-house shall be broken open unless the dwelling-house is in the occupancy of the distrainee and he refuses or in any way prevents access thereto, but when the distrainor executing distress has duly gained access to a dwelling-house he may break open the door of any room in which he has reason to believe any goods of the distrainee to be.

|

| (2) |

When a room in a dwelling-house is in the actual occupancy of a woman who, according to her religion or local custom does not appear in public the distrainor shall give notice to her that she is at liberty to withdraw; and after allowing reasonable time for her to withdraw and giving her reasonable facility for withdrawing, he may enter the room for the purpose of attaching any goods therein, using at the time every precaution consistent with these provisions to prevent their clandestine removal.

|

|

| 8. |

Steps subsequent to attachment

As soon as practicable after the attachment of goods under these Regulations, the distrainor shall—

| (a) |

issue a receipt in respect thereof to the distrainee;

|

| (b) |

forward to the Commissioner a report containing an inventory of all items attached, the value of each item as estimated by the distrainor, the address of the premises at which the the goods are kept pending sale, the name and address of the distraint agent in whose custody the goods have been placed and the arrangements, if any, made or to be made for the sale by public auction of the goods on the expiration of ten days from the date of attachment.

|

|

| 9. |

Limitation on sale of attached goods

On the sale by public auction of any goods attached under these Regulations, the distrainor shall cause the sale to be stopped when the sale has realized a sum equal to or exceeding the distress debt and the costs and expenses incurred by the distrainor, and there-upon any of the goods remaining unsold shall at the cost of the distrainee be restored to the distrainee.

|

| 10. |

Return on completion of sale

Immediately after the completion of a sale by publication of goods attached under these Regulations, the distrainor shall make a return to the Commissioner specifying the items which have been sold, the amount realized by the sale and the manner in which the proceeds of the sale were applied.

|

| 11. |

Restoration of attached goods on payment, etc.

| (1) |

Where a distrainee has within ten days of attachment of his goods under these Regulations, paid or given security accepted by the Commissioner for the whole of the tax due from him together with the whole of the costs and expenses incurred by the distrainor in executing the distress, the distrainor shall at the cost of the distrainee forthwith restore the attached goods to the distrainee and return the order to the Commissioner who shall cancel it.

|

| (2) |

Any money paid by a distrainee under this regulation shall be applied by the Commissioner first in settlement of the costs and expenses incurred by the distrainor and as to the balance in settlement of the distress debt or such part thereof as the Commissioner shall direct.

|

|

| 12. |

Livestock

Where any goods attached under these Regulations comprise or include livestock, the distrainor may make appropriate arrangements for the transport, safe custody and feeding thereof and any costs and expenses incurred by the distrainor thereby shall be recoverable from the distrainee under regulation 9 or 11, as the case may be, as costs and expenses.

[L.N. 123/1996, r. 2(ii).]

|

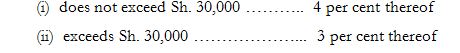

| 13. |

Costs for levying distress

In addition to a claim for any other costs and expenses which may be incurred by the Commissioner or the distrainor in levying distress under these Regulations, there may be claimed by the distrainor and recovered under regulations 9 and 11, as the case may be, costs at the rate specified in the Schedule.

|

| 14. |

Remuneration of distraint agents

The maximum rates of remuneration which a distraint agent shall be entitled to demand from the distrainor for his assistance in executing a distress under these Regulations, and which may be recovered by the distrainor under regulation 9 or 11, as the case may be, shall be those specified in the Schedule.

|

| 15. |

Commission payable to auctioneer

The maximum rates of commission to be paid to an auctioneer by the distrainor as remuneration for his services for the sale by public auction of any goods attached under these Regulations, and which may be recovered by the distrainor under regulation 9, shall be five per cent of the amount realized on the sale, and where an auctioneer has also rendered services as a distraint agent he shall be entitled, in addition to any commission, to remuneration for those services as provided in regulation 14.

|

| 16. |

Matters included in rates of remuneration

The rates of remuneration specified in the Schedule shall be deemed to include all expenses of advertisements, inventories, catalogues, insurance and necessary charges for safeguarding goods attached under these Regulations.

|

SCHEDULE

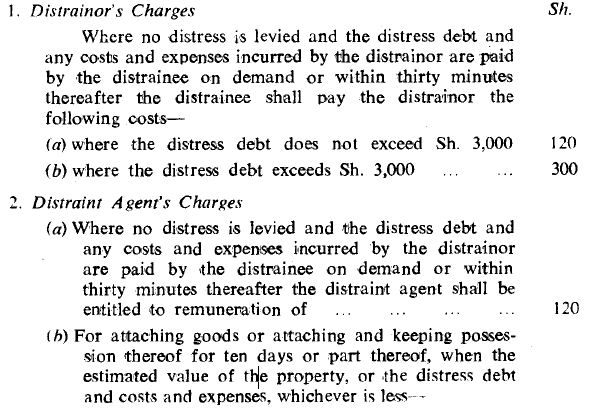

RATES OF REMUNERATION

[Reg. 16.]

| (c) |

Where the goods or any part thereof are sold by public auction, the distraint agent's charges shall instead be calculated in the manner directed above by reference to the total amount realized on sale after deduction of the auctioneer's commission under regulation 15.

|

| (d) |

For keeping possession of any attached goods after the expiration of ten days from the date of attachment for each day, or part thereof—

1/4 per cent of the value of the goods with a maximum of Sh. 60.

|

| (e) |

Reasonable expenses incurred by the distraint agent in transporting goods attached, and such travelling expenses by car, or a rateable proportion thereof, as the Commissioner may approve.

|

THE VALUE ADDED TAX (DISTRAINT) REGULATIONS, 1990

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

THE VALUE ADDED TAX (TRIBUNAL) RULES, 1990

ARRANGEMENT OF RULES

| 3. |

Appointment of secretary

|

| 4. |

Form and time for lodging an appeal

|

| 6. |

Statement of facts of Commissioner

|

| 7. |

Service of memorandum of appeal

|

| 8. |

Statement of facts of Commissioner

|

| 9. |

Notice and place of hearing

|

| 10. |

Procedure at hearing of appeal

|

| 11. |

Tribunal to determine own procedure in certain matters

|

| 12. |

Copies of documents admissible

|

THE VALUE ADDED TAX (TRIBUNAL) RULES, 1990

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

| 1. |

Citation

These Rules may be cited as the Value Added Tax (Tribunal) Rules, 1990.

|

| 2. |

Interpretation

In these Rules, unless the context otherwise requires—

"appeal" means an appeal to the Tribunal under section 33(2);

"appellant" means a person entering an appeal and the advocate or duly authorized agent of that person;

"chairman" means the chairman of the Tribunal appointed under section 32(2);

"memorandum" means a memorandum of appeal presented under rule 4;

"secretary" means the secretary to the Tribunal appointed pursuant to rule 3;

"section" means a section of the Act.

|

| 3. |

Appointment of secretary

| (1) |

The Commissioner shall appoint a person to be the secretary to the Tribunal, and that person may be an officer of the Value Added Tax Department.

|

| (2) |

The secretary shall, in matters relating to appeals to the Tribunal and procedure therefor, comply with general and special directions lawfully given by the chairman.

|

| (3) |

The secretary shall by notice in the Gazette notify his address for the presentation or service of documents for the purposes of these Rules, and shall in the same manner notify any change in that address.

|

|

| 4. |

Form and time for lodging an appeal

An appeal shall be entered by presentation of a memorandum of appeal, together with five copies thereof, to the secretary within fourteen days after the date on which the appellant gives notice of appeal in writing to the Commissioner pursuant to section 33(2); but where the Tribunal is satisfied that, owing to absence from his normal place of residence, sickness or other reasonable cause, the appellant was prevented from presenting a memorandum within that period, and that there has been no unreasonable delay on his part, the Tribunal may extend that period notwithstanding that the period has already expired.

|

| 5. |

Memorandum of appeal

A memorandum shall be signed by the appellant and shall set out concisely under distinct heads, numbered consecutively, the grounds of appeal without argument or narrative.

|

| 6. |

Statement of facts of Commissioner

Each copy of a memorandum shall be accompanied by—

| (a) |

a copy of the decision of the Commissioner disputed by the appellant;

|

| (b) |

a copy of the notice of appeal; and

|

| (c) |

a statement, signed by the appellant, setting out precisely all the facts on which the appeal is based and referring specifically to documentary or other evidence which it is proposed to adduce at the hearing of the appeal, and to which shall be annexed a copy of each document or extract from a document upon which the appellant proposes to rely as evidence at the hearing of the appeal.

|

|

| 7. |

Service of memorandum of appeal

Within forty-eight hours after the presentation of a memorandum to the secretary, a copy thereof and of the statement of facts of the appellant and the documents annexed thereto shall be served by the appellant upon the Commissioner.

|

| 8. |

Statement of facts of Commissioner

| (1) |

The Commissioner shall, if he does not accept any of the facts of the appellant, within twenty-one days after service thereof upon him under rule 7, file with the secretary a statement of facts together with five copies thereof and the provisions of rule 6(c) shall mutatis mutandis apply to the statement of facts.

|

| (2) |

At the time of filing a statement of facts pursuant to paragraph (1), the Commissioner shall serve a copy thereof, together with copies of any documents annexed thereto, upon the appellant.

|

| (3) |

If the Commissioner does not desire to file a statement of facts under this rule, he shall forthwith give written notice to that effect to the secretary and to the appellant, and in that case the Commissioner shall be deemed at the hearing of the appeal to have accepted the facts set out in the statement of facts of the appellant.

|

|

| 9. |

Notice and place of hearing

| (1) |

As soon as may be convenient after receipt by him of the memorandum the secretary shall notify the chairman thereof.

|

| (2) |

The chairman shall, after the Commissioner has filed a state-ment of facts or has notified the secretary that he does not intend to do so, fix a time, date and place for a meeting of the Tribunal for the purpose of hearing the appeal, and the secretary shall cause notice thereof to be served on the appellant and the Commissioner.

|

| (3) |

The secretary shall cause to be supplied to each member of the Tribunal a copy of the notice of hearing and of all documents received by him from the parties to the appeal.

|

| (4) |

Unless the parties to the appeal otherwise agree, each party shall be entitled to not less than seven days' notice of the time, date and place fixed for the hearing of the appeal.

|

|

| 10. |

Procedure at hearing of appeal

At the hearing of an appeal, the following procedure shall be observed—

| (a) |

the Commissioner shall be entitled to he present or be represented;

|

| (b) |

the appellant shall state the grounds of his appeal and may support it by any relevant evidence, but, save with the consent of the Tribunal and upon such terms as it may determine, the appellant may not at the hearing rely on a ground of appeal other than a ground stated in the memoran-dum and may not adduce evidence of facts or documents unless those facts have been referred to in, and copies of those documents have been annexed to, the statement of facts of the appellants;

|

| (c) |

at the conclusion of the statement, and evidence on behalf of the appellant, the Commissioner may make submissions, supported by relevant evidence, and subparagraph (b) shall mutatis mutandis apply to evidence of facts and documents to be adduced by the Commissioner;

|

| (d) |

the appellant shall be entitled to reply but may not raise a new issue or argument;

|

| (e) |

the chairman or a member of the Tribunal may at any stage of the hearing ask any questions of the appellant or the Commissioner or a witness examined at the hearing, which he considers necessary to the determination of the appeal;

|

| (f) |

a witness called and examined by either party may be cross-examined by the other party to the appeal;

|

| (g) |

a witness called and examined by the Tribunal may be cross-examined by either party to the appeal;

|

| (h) |

the Tribunal may adjourn the hearing of the appeal for the production of further evidence or for other good cause, as it considers necessary, on such terms as it may determine;

|

| (i) |

before the Tribunal considers its decision, the parties to the appeal shall withdraw from the meeting, and the Tribunal shall deliberate the issue according to law and reach its decision thereon;

|

| (j) |

the decision of the Tribunal shall be determined by a majority of the members present and voting at the meeting, and in the case of an equality of votes the chairman shall have a casting vote in addition to his deliberative vote;

|

| (k) |

minutes of the meeting shall be kept and the decision of the Tribunal recorded therein.

|

|

| 11. |

Tribunal to determine own procedure in certain matters

In matters of procedure not governed by these Rules or the Act, the Tribunal may determine its own procedure.

|

| 12. |

Copies of documents admissible

Save where the Tribunal in any particular case otherwise directs or where a party to the appeal objects, copies of documents shall be admissible in evidence, but the Tribunal may at any time

(INCOMPLETE - YET TO GET MISING CONTENT -PGS)

NEXT VERSION as amended by LN 71/2000.. which Not found

|

THE VALUE ADDED TAX (TRIBUNAL) RULES, 1990

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

THE VALUE ADDED TAX REGULATIONS, 1994

ARRANGEMENT OF SECTIONS

| 1. |

Citation and commencement

|

| 3. |

Application for registration

|

| 5. |

Simplified tax invoice

|

| 6. |

Credit note and debit note

|

| 7. |

Records to be kept by taxable persons

|

| 8. |

Samples of taxable goods

|

| 9. |

VAT returns and payments by cheques

|

| 10. |

Export of taxable goods and services

|

| 11. |

Application for tax refund

|

| 12. |

Claims for tax refund

|

| 13. |

Tax paid on stocks on hand, assets, building, etc.

|

| 15. |

Powers of Commissioner of Customs

|

| 16. |

Determination of selling price

|

| 18. |

Sale of taxable goods in returnable containers

|

| 19. |

Where taxable goods or taxable services are supplied to unregistered persons

|

| 20. |

Services supplied in Kenya

|

| 20. |

Revocation of Legal Notice 400 of 1989

|

THE VALUE ADDED TAX REGULATIONS, 1994

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

| 1. |

Citation and commencement

These Regulations may be cited as the Value Added Tax Regulations, 1994 and shall come into operation on the 17th June, 1994.

|

| 2. |

Interpretation

In these Regulations, unless the context otherwise requires—

"personal identification number" means the personal identification number required under section 132 of the Income Tax Act.

|

| 3. |

Application for registration

| (1) |

Applications for registration under paragraphs 1 and 3 of the Sixth Schedule to the Act shall be submitted on Form VAT 1.

|

| (2) |

Any person who knowingly:—

| (a) |

gives false information on Form VAT 1; or

|

| (b) |

fails to give full information on Form VAT 1; or

|

| (c) |

makes application on Form VAT 1 to register a person who is already registered,

|

shall be guilty of an offence.

|

| (3) |

The certificate of registration shall be issued on Form VAT 2.

|

|

| 4. |

Tax invoice

| (1) |

The tax invoice to be issued under paragraph 1 of the Seventh Schedule to the Act shall be serially numbered and shall be issued in serial number order.

|

| (2) |

The tax invoice shall include the following information—

| (a) |

the name, address, VAT registration number and personal identification number of the person making the supply;

|

| (b) |

the serial number of the invoice;

|

| (d) |

the date of the supply, if different from that given under sub-paragraph (c);

|

| (e) |

the name and address, and VAT registration number, if any, of the person to whom the supply was made, if known to the supplier;

|

| (f) |

the description, quantity and price of the goods or services being supplied;

|

| (g) |

the taxable value of the goods or services, if different from the price charged;

|

| (h) |

the rate and amount of tax charged on each of those goods and services;

|

| (i) |

details of whether the supply is a cash or credit sale and details of cash or other discounts, if any, that apply to the supply; and

|

| (j) |

the total value of the supply and the total amount of VAT charged.

|

|

|

| 5. |

Simplified tax invoice

| (1) |

The simplified tax invoice referred to in the proviso to paragraph 1 of the Seventh Schedule to the Act shall include the following information—

| (a) |

the name, address, VAT registration number and personal identification number of the person making the supply;

|

| (b) |

the serial number of the invoice;

|

| (d) |

a brief description of the goods or services being supplied;

|

| (e) |

the total amount charged to the customer, VAT included; and

|

| (f) |

the explicit statement that the price includes VAT.

|

|

| (2) |

Where, under the proviso to paragraph 1 of the Seventh Schedule to the Act, the Commissioner has authorised other methods of accounting for tax—

| (a) |

the registered person shall record the value and brief details of each supply as it occurs and before the goods, or the customer, leaves the business premises;

|

| (b) |

the registered person shall keep a cash register, book, or other suitable record at each point of sale in which shall be entered details of all cash received and cash payments made at the time that they are made and at the end of each day the record shall be totalled and a balance shall be struck;

|

| (c) |

at the end of each day the output tax chargeable on supplies made and the deductible input tax shown on tax invoices in respect of supplies received shall be recorded in the appropriate records.

|

|

|

| 6. |

Credit note and debit note

| (1) |

Where goods are returned to the registered person or, for good and valid reason the registered person decides for business reasons to reduce the value of a supply after the issue of a tax invoice, a credit note may be issued for the amount of the reduction.

|

| (2) |

Where a credit note is issued under this regulation it shall be serially numbered and shall include details of the name, address, registration number and personal identification number of the person to whom it is issued and sufficient details to identify the tax invoice on which the supply was made and the tax that was originally charged.

|

| (3) |

A registered person who issues a credit note under the conditions specified in this regulation may reduce the amount of his output tax in the month in which the credit note was issued by an amount that bears the same proportion to the tax originally charged as the amount credited bears to the total amount originally charged and the amount of tax so credited shall be specified on the credit note.

|

| (4) |

A registered person who receives a credit note for the supply in respect of which he has claimed deductible input tax, shall reduce the amount of deductible input tax in the month in which the credit note is received, by the amount of tax so credited.

|

| (5) |

Where a registered person has issued a tax invoice in respect of a taxable supply and subsequently makes a further charge in respect of that supply, or any transaction associated with that supply, he shall in respect of the further charge being made, issue either a further tax invoice, or a serially numbered debit note containing all the details specified in regulation 4, and shall show on it the details of the tax invoice issued at the time of the original supply.

|

| (6) |

A registered person who receives a further tax invoice or a debit note issued in compliance with paragraph (5) may, if the supply is eligible therefor and in so far as it has not previously been claimed, claim as deductible input tax such further amount of tax that is being charged, in the month in which the further charge was made, or in the next subsequent month.

|

|

| 7. |

Records to be kept by taxable persons

| (1) |

Records to be kept and produced to an officer under this regulation include —

| (a) |

copies of all invoices issued in serial number order;

|

| (b) |

copies of all credit and debit notes issued, in chronological order;

|

| (c) |

all purchase invoices, copies of customs entries, receipts for the payment of customs duty or tax, and credit and debit notes received, to be filed chronologically either by date of receipt or under each supplier's name;

|

| (d) |

details of the amounts of tax charged on each supply made or received;

|

| (e) |

totals of the output tax and the input tax in each period and a net total of the tax payable or the excess tax carried forward, as the case may be, at the end of each month;

|

| (f) |

details of goods manufactured and delivered from the factory of the taxable person;

|

| (g) |

details of each supply of goods and services from the business premises, unless such details are available at the time of supply on invoices issued at, or before, that time.

|

|

| (2) |

All records required to be kept under this regulation shall be included in the audit of accounts of the taxable person that may be subject to such audit by a competent person.

|

| (3) |

Where the Commissioner considers that a taxable person is not complying with requirements of this regulation, or where he considers that other records should be kept by the taxable person to safeguard the tax revenue, he shall issued a notice to the taxable person requiring him to keep such records or take such action as the Commissioner may specify and any person failing to comply with such notice shall be guilty of an offence.

|

| (4) |

Where a notice issued under sub-paragraph (3) is not complied with and without prejudice to any other action that he may take, the Commissioner may, from such information as is available to him, assess the amount of tax that he considers to be due from the taxable person during each period that the offence continues.

|

| (5) |

All records required to be kept under this regulation shall be maintained up-to-date and details of all tax charged shall be entered in the appropriate records without delay.

|

| (6) |

All records shall be kept in the Kiswahili or English language and shall be kept for a period of seven years from the date of the last entry made therein.

|

| (7) |

Where records relating to a business are being kept in any language other than those prescribed, the Commissioner may require a registered person to produce, at that person's expense, an authenticated translation of those records.

|

|

| 8. |

Samples of taxable goods

| (a) |

are distributed free as samples by a registered person for furtherance of his business; and

|

| (b) |

have a value of less than two hundred shillings for each sample; and

|

| (c) |

are freely available; and

|

| (d) |

are not limited in distribution to fewer than thirty persons in any one calender month,

|

they shall not be liable to tax.

|

| 9. |

VAT returns and payments by cheques

| (1) |

The return required by paragraph 6 of the Seventh Schedule to the Act shall be on Form VAT 3.

|

| (2) |

Where payment is made by cheque, the cheque shall be made payable to the "Commissioner of Value Added Tax" and shall be crossed and endorsed with the words "account payee only".

|

| (3) |

Where tax exceeds Kenya shillings twenty thousand payment thereof shall be made by banker's cheque or bank guaranteed cheque.

|

| (4) |

Where any cheque is not honoured upon presentation, the amount stated thereon shall be deemed not to have been paid and additional tax shall become due and payable in respect of that amount until such time as it is paid, notwithstanding that the cheque may subsequently be honoured on representation.

|

| (5) |

Any fraction of a shilling due on any return shall be ignored.

|

|

| 10. |

Export of taxable goods and services

| (1) |

Subject to section 8 of the Act and the Fifth Schedule to the Act, any taxable goods or taxable services exported by a registered person shall be zero-rated if evidence of exportation consisting of —

| (a) |

a copy of the invoice showing the sale of the goods or services to the purchaser; and

|

| (b) |

in the case of goods, copies of the bill of lading, road manifest or airway bill, as the case may be; and

|

| (c) |

in the case of goods, the export entry duly certified by the proper officer of customs at the port of export,

|

is maintained on file by the registered person for examination by an authorized officer on demand.

|

| (2) |

Subject to section 8 of the Act and the Fifth Schedule to the Act, any taxable goods or taxable services supplied by a registered person to an export processing zone enterprise, or to a registered person manufacturing goods in a customs bonded factory for export, or to any person or organization as specified in the Eighth Schedule to the Act shall be zero rated if evidence of the supply consisting of—

| (a) |

a copy of the invoice showing the supply of the goods or services to the purchaser;

|

| (b) |

proof of the payment made in respect of the goods or services supplied; and

|

| (c) |

a certificate signed by the purchaser that the goods have been received,

|

is maintained on the file by the registered person for examination by an authorized officer on demand.

|

| (3) |

Subject to paragraph (4), where an exporter who is not a registered person exports by way of business any taxable goods that he has imported or purchased from a registered person and claims a refund of the tax paid on those goods he shall submit his claim to the Commissioner on Form VAT 4 and shall attach to any such claim, the following —

| (a) |

a copy of the invoice showing the sale of the goods to the purchaser; and

|

| (b) |

the export entry duly certified by the proper officer of customs at the port of export; and

|

| (c) |

evidence of the value of the goods and the payment by him of tax due thereon, being a copy of the tax invoice issued by a registered person, or a copy of the customs entry on which the goods were imported, as the case may be; and

|

| (d) |

evidence that foreign exchange has been credited to the account of the purchaser with his commercial bank in Kenya.

|

|

| (4) |

The Commissioner shall not issue a tax remission certificate referred to in Form VAT 4B unless the application is accompanied by—

| (a) |

bond security on Form VAT 4 B1 duly executed and guaranteed by a bank, insurance company or financial institution licensed to operate in Kenya; and

|

| (b) |

an irrevocable letter of credit, or evidence that the account of the exporter has been credited with payment in foreign currency for the exported goods; and

|

| (c) |

a proforma invoice from the registered manufacturer or dealer.

|

|

| (5) |

A VAT remission certificate issued under paragraph (4) shall be valid for ninety days only from the date of issue.

|

| (6) |

Upon completion of exportation, the exporter shall resubmit to the Commissioner within ninety days from the date of issue, the duplicate copy of the VAT remission certificate supported by documentary evidence of exportation of the goods.

|

| (7) |

A bond security provided under paragraph 4(a) shall be cancelled upon the exporter satisfying the Commissioner —

| (a) |

that the goods have been duly exported;

|

| (b) |

that the appropriate payment in foreign currency or in an approved manner has been received by him.

|

|

| (8) |

Where an exporter fails to comply with the provisions of paragraphs (6) and (7), the appropriate tax shall be payable in full forthwith together with a penalty of 3% per month or part thereof calculated from the date of issue of the tax remission certificate by the Commissioner under paragraph (4).

|

| (9) |

No refund shall be made under this regulation—

| (a) |

where the amount to be refunded is less than five hundred shillings; or

|

| (b) |

where the exportation took place more than twelve calendar months previously or such further period as the Commissioner may in any particular case determine.

|

|

| (10) |

Zero-rating of exported goods or refund of tax paid shall not be allowed under this regulation in respect of any goods which have been used before they were exported.

|

| (11) |

Where the Commissioner considers that there is doubt about the exportation of any goods he may require any person exporting the goods to produce to him within a reasonable time a certificate, signed and stamped by a competent customs authority overseas, that the goods were duly landed and reported to the proper customs authority at the port or place of foreign destination, and payment of any claim may be deferred until such a certificate has been produced and accepted as satisfactory by the Commissioner.

|

| (12) |

Where a person who is not a registered person supplies by way of business any taxable goods that he has imported or purchased from a registered person to an export processing zone or to a foreign aid funded investment project and claims a refund of the tax paid on those goods he shall submit his claim to the commissioner on Form VAT 4 and shall attach to any such claim, the following—

| (a) |

a copy of the invoice showing the sale of the goods to the purchaser; and

|

| (b) |

evidence of the value of the goods and the payment by him of tax due thereon, being a copy of the tax invoice issued by a registered person or a copy of the Customs entry on which the goods were imported, as the case may be; and

|

| (c) |

a certificate signed by the purchaser that the goods have been received and that they have been purchased as part of a specified project or in accordance with the approved operations of the export processing zone, as the case may be.

|

|

|

| 11. |

Application for tax refund

An application for tax refund under section 24(b) and (c) of the Act shall be made on Form VAT 4.

|

| 12. |

Claims for tax refund

| (1) |

Any claim for refund of tax by a registered person under section 24A of the Act shall be accompanied by—

| (a) |

a document issued to him by the person with whom he proves in the insolvency of the debtor, specifying the total amount proved, except where a claim is made because over three years have elapsed since the registered person paid the tax;

|

| (b) |

a copy of the tax invoice provided in respect of each taxable supply upon which the claim is based;

|

| (c) |

records or other documents, showing that the tax has been accounted for and paid on each supply upon which the claim for a refund of tax is based;

|

| (d) |

evidence that every reasonable effort has been made to have the debt settled; and

|

| (e) |

a declaration by him that he and the buyers are independent of each other.

|

|

| (2) |

No refund is payable unless the registered person is up-to-date in submitting all VAT returns on Form VAT 3 together with the appropriate tax.

|

|

| 13. |

Tax paid on stocks on hand, assets, building, etc.

| (1) |

A registered person shall submit to the Commissioner, his claim for relief from tax paid on stocks on hand, assets, building or civil works on the date he becomes registered on Form VAT 5 within thirty days of that date.

|

| (2) |

Where the Commissioner considers that there is good and valid reason why the registered person could not submit his claim under paragraph (1) within the thirty days he may accept a claim made within such longer period as he deems to be fair and reasonable.

|

| (3) |

The Commissioner may require the registered person to produce to an authorised officer evidence of—

| (a) |

the quantities, descriptions and values of goods in stock on the date of registration;

|

| (b) |

the proper use or disposal of such goods after the date of registration.

|

|

|

| 14. |

Security

| (1) |

A security required by the Commissioner under section 29 of the Act shall be in such sum not exceeding the total tax payable and, unless the person from whom the security is required opts to deposit the required sum or equivalent securities with the Commissioner, shall take the form of a bond in such form, and given by such sureties, as the Commissioner may approve.

|

| (2) |

Where a bond given under this regulation is discharged, the Commissioner shall cause the bond to be cancelled and shall advise the person giving it accordingly.

|

| (3) |

Where any person who is a surety to a bond under this regulation—

| (b) |

is adjudged bankrupt or enters into any composition with his creditors; or

|

the person on whose behalf the bond was given shall notify the Commissioner accordingly and the Commissioner may cancel the bond and require a fresh surety to be given.

|

|

| 15. |

Powers of Commissioner of Customs & Excise

By virtue of section 57 of the Act—

| (a) |

the Commissioner of Customs and Excise appointed under section 3 of the Customs and Excise Act (Cap. 472) shall be responsible for the collection of tax chargeable in respect of imported taxable goods and shall account for that tax to the Commissioner; and

|

| (b) |

the Commissioner of Customs and Excise and other proper officers of Customs appointed under the Customs and Excise Act shall, subject to the Act and Customs and Excise Act have and exercise in respect of imported taxable goods all the powers and duties conferred or imposed on them by the Customs and Excise Act.

|

|

| 16. |

Determination of selling price

For the purposes of section 9(b) of the Act, the price determined by the Commissioner shall be the open market selling price where the seller and buyer are independent of each other.

|

| 17. |

Deductible input tax

| (1) |

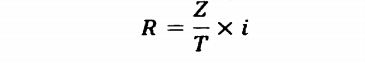

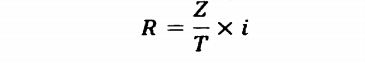

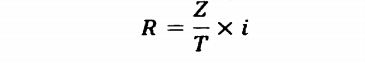

Where a registered person supplies both taxable goods and services and exempt goods and services, he can only deduct that part of his input tax which is attributable to taxable supplies which attribution shall be approved by the Commissioner, but he may use either of the under mentioned methods to determine the amount of deductible input tax without the approval of the Commissioner—

| (a) |

Value of taxable supplies x Input tax = Deductible input tax

Value of total supplies

|

| (b) |

(i) full deduction of all the input tax attributable to taxable goods purchased and sold in the same state;

| (ii) |

no deduction of any input tax which is directly attributable to exempt outputs; and |

| (iii) |

deduction of the input tax attributable to the remainder of the taxable supplies, calculated as under sub-paragraph (a). |

|

|

| (2) |

Notwithstanding paragraph (1) where the amount of input tax attributable to exempt supplies is less than five per cent of the total input tax, then all the input tax can be deducted.

|

|

| 18. |

Sale of taxable goods in returnable containers

Where taxable goods are sold by a registered person in returnable containers then—

| (a) |

if the registered person has purchased or imported those containers tax paid, the amount of any tax payable by virtue of subsection (2) of section 9 of the Act in respect of the containers shall be remitted; or

|

| (b) |

in any other case, the amount of tax so payable upon those containers which are returned to the registered person, and upon which he has given a credit to the purchaser, shall be remitted by means of a credit taken by the registered person on his next succeeding tax return.

|

|

| 19. |

Where taxable goods or taxable services are supplied to unregistered persons

| (a) |

Where a registered person is a retailer or is primarily supplying taxable goods or taxable services to unregistered persons, prices of such goods or services shall be quoted or labelled including the amount of the tax;

|

| (b) |

Where prices are quoted inclusive of tax, the value of the tax shall be estimated in the case of ad valorem tax rate by a tax that is multiplied by such a tax inclusive price reduced by any exclusion from the taxable value allowed under section 9 of the Act. The tax factor is equal to (t/(l + t)) where t is the ad valorem tax rate specified in the First Schedule to the Act.

|

|

| 20. |

Revocation of Legal Notice 400 of 1989

The Value Added Fax Regulations are revoked (L.N. 400/1989).

|

THE VALUE ADDED TAX REGULATIONS, 1994

Revoked by Legal Notice 54 of 2017 on 7th April, 2017

| 1. |

Citation and commencement

These Regulations may be cited as the Value Added Tax Regulations, 1994 and shall come into operation on the 17th June, 1994.

|

| 2. |

Interpretation

In these Regulations, unless the context otherwise requires—

"personal identification number" means the personal identification number required under section 132 of the Income Tax Act.

|

| 3. |

Application for registration

| (1) |

Applications for registration under paragraphs 1 and 3 of the Sixth Schedule to the Act shall be submitted on Form VAT 1.

|

| (2) |

Any person who knowingly:—

| (a) |

gives false information on Form VAT 1; or

|

| (b) |

fails to give full information on Form VAT 1; or

|

| (c) |

makes application on Form VAT 1 to register a person who is already registered,

|

shall be guilty of an offence.

|

| (3) |

The certificate of registration shall be issued on Form VAT 2.

|

|

| 4. |

Tax invoice

| (1) |

The tax invoice to be issued under paragraph 1 of the Seventh Schedule to the Act shall be serially numbered and shall be issued in serial number order.

|

| (2) |

The tax invoice shall include the following information—

| (a) |

the name, address, VAT registration number and personal identification number of the person making the supply;

|

| (b) |

the serial number of the invoice;

|

| (d) |

the date of the supply, if different from that given under sub-paragraph (c);

|

| (e) |

the name and address, and VAT registration number, if any, of the person to whom the supply was made, if known to the supplier;

|

| (f) |

the description, quantity and price of the goods or services being supplied;

|

| (g) |

the taxable value of the goods or services, if different from the price charged;

|

| (h) |

the rate and amount of tax charged on each of those goods and services;

|

| (i) |

details of whether the supply is a cash or credit sale and details of cash or other discounts, if any, that apply to the supply; and

|

| (j) |

the total value of the supply and the total amount of VAT charged.

|

|

|

| 5. |

Simplified tax invoice

| (1) |

The simplified tax invoice referred to in the proviso to paragraph 1 of the Seventh Schedule to the Act shall include the following information—

| (a) |

the name, address, VAT registration number and personal identification number of the person making the supply;

|

| (b) |

the serial number of the invoice;

|

| (d) |

a brief description of the goods or services being supplied;

|

| (e) |

the total amount charged to the customer, VAT included; and

|

| (f) |

the explicit statement that the price includes VAT.

|

|

| (2) |

Where, under the proviso to paragraph 1 of the Seventh Schedule to the Act, the Commissioner has authorised other methods of accounting for tax—

| (a) |

the registered person shall record the value and brief details of each supply as it occurs and before the goods, or the customer, leaves the business premises;

|

| (b) |

the registered person shall keep a cash register, book, or other suitable record at each point of sale in which shall be entered details of all cash received and cash payments made at the time that they are made and at the end of each day the record shall be totalled and a balance shall be struck;

|

| (c) |

at the end of each day the output tax chargeable on supplies made and the deductible input tax shown on tax invoices in respect of supplies received shall be recorded in the appropriate records.

|

|

|

| 6. |

Credit note and debit note

| (1) |

Where goods are returned to the registered person or, for good and valid reason the registered person decides for business reasons to reduce the value of a supply after the issue of a tax invoice, a credit note may be issued for the amount of the reduction.

|

| (2) |

Where a credit note is issued under this regulation it shall be serially numbered and shall include details of the name, address, registration number and personal identification number of the person to whom it is issued and sufficient details to identify the tax invoice on which the supply was made and the tax that was originally charged.

|

| (3) |

A registered person who issues a credit note under the conditions specified in this regulation may reduce the amount of his output tax in the month in which the credit note was issued by an amount that bears the same proportion to the tax originally charged as the amount credited bears to the total amount originally charged and the amount of tax so credited shall be specified on the credit note.

|

| (4) |

A registered person who receives a credit note for the supply in respect of which he has claimed deductible input tax, shall reduce the amount of deductible input tax in the month in which the credit note is received, by the amount of tax so credited.

|

| (5) |

Where a registered person has issued a tax invoice in respect of a taxable supply and subsequently makes a further charge in respect of that supply, or any transaction associated with that supply, he shall in respect of the further charge being made, issue either a further tax invoice, or a serially numbered debit note containing all the details specified in regulation 4, and shall show on it the details of the tax invoice issued at the time of the original supply.

|

| (6) |

A registered person who receives a further tax invoice or a debit note issued in compliance with paragraph (5) may, if the supply is eligible therefor and in so far as it has not previously been claimed, claim as deductible input tax such further amount of tax that is being charged, in the month in which the further charge was made, or in the next subsequent month.

|

|

| 7. |

Records to be kept by taxable persons

| (1) |

Records to be kept and produced to an officer under this regulation include —

| (a) |

copies of all invoices issued in serial number order;

|

| (b) |

copies of all credit and debit notes issued, in chronological order;

|

| (c) |

all purchase invoices, copies of customs entries, receipts for the payment of customs duty or tax, and credit and debit notes received, to be filed chronologically either by date of receipt or under each supplier's name;

|

| (d) |

details of the amounts of tax charged on each supply made or received;

|

| (e) |

totals of the output tax and the input tax in each period and a net total of the tax payable or the excess tax carried forward, as the case may be, at the end of each month;

|

| (f) |

details of goods manufactured and delivered from the factory of the taxable person;

|

| (g) |

details of each supply of goods and services from the business premises, unless such details are available at the time of supply on invoices issued at, or before, that time.

|

|

| (2) |

All records required to be kept under this regulation shall be included in the audit of accounts of the taxable person that may be subject to such audit by a competent person.

|

| (3) |

Where the Commissioner considers that a taxable person is not complying with requirements of this regulation, or where he considers that other records should be kept by the taxable person to safeguard the tax revenue, he shall issued a notice to the taxable person requiring him to keep such records or take such action as the Commissioner may specify and any person failing to comply with such notice shall be guilty of an offence.

|

| (4) |

Where a notice issued under sub-paragraph (3) is not complied with and without prejudice to any other action that he may take, the Commissioner may, from such information as is available to him, assess the amount of tax that he considers to be due from the taxable person during each period that the offence continues.

|

| (5) |

All records required to be kept under this regulation shall be maintained up-to-date and details of all tax charged shall be entered in the appropriate records without delay.

|

| (6) |

All records shall be kept in the Kiswahili or English language and shall be kept for a period of seven years from the date of the last entry made therein.

|

| (7) |

Where records relating to a business are being kept in any language other than those prescribed, the Commissioner may require a registered person to produce, at that person's expense, an authenticated translation of those records.

|

|

| 8. |

Samples of taxable goods

| (a) |

are distributed free as samples by a registered person for furtherance of his business; and

|

| (b) |

have a value of less than two hundred shillings for each sample; and

|

| (c) |

are freely available; and

|

| (d) |

are not limited in distribution to fewer than thirty persons in any one calender month,

|

they shall not be liable to tax.

|

| 9. |

VAT returns and payments by cheques

| (1) |

The return required by paragraph 6 of the Seventh Schedule to the Act shall be on Form VAT 3.

|

| (2) |

Where payment is made by cheque, the cheque shall be made payable to the "Commissioner of Value Added Tax" and shall be crossed and endorsed with the words "account payee only".

|

| (3) |

Where tax exceeds Kenya shillings twenty thousand payment thereof shall be made by banker's cheque or bank guaranteed cheque.

|

| (4) |

Where any cheque is not honoured upon presentation, the amount stated thereon shall be deemed not to have been paid and additional tax shall become due and payable in respect of that amount until such time as it is paid, notwithstanding that the cheque may subsequently be honoured on representation.

|

| (5) |

Any fraction of a shilling due on any return shall be ignored.

|

|

| 10. |

Export of taxable goods and services

| (1) |

Subject to section 8 of the Act and the Fifth Schedule to the Act, any goods or taxable services exported by a registered person or supplied by that person to an export processing zone enterprise shall be zero-rated if evidence of exportation consisting of—

| (a) |

a copy of the invoice showing the sale of the goods or services to the purchaser; and

|

| (b) |

in the case of goods, copies of the bill of lading, road manifest or airway bill, as the case may be; and

|

| (c) |

in the case of goods, the export entry duly certified by the proper officer of Customs at the port of export;

|

is maintained on file by the registered person for examination by an authorized officer on demand.

|

| (2) |

Subject to section 8 of the Act and the Fifth Schedule to the Act, any taxable goods or taxable services supplied by a registered person to a registered person manufacturing goods in a customs bonded factory for export, or to any person or organization as specified in the Eighth Schedule to the Act shall be zero rated if evidence of the supply consisting of—

| (a) |

a copy of the invoice showing the supply of the goods or services to the purchaser;

|

| (b) |

proof of the payment made in respect of the goods or services supplied; and

|

| (c) |

a certificate signed by the purchaser that the goods have been received,

|

is maintained on the file by the registered person for examination by an authorized officer on demand.

|

| (3) |

Subject to paragraph (4), where an exporter who is not a registered person exports by way of business any taxable goods that he has imported or purchased from a registered person and claims a refund of the tax paid on those goods he shall submit his claim to the Commissioner on Form VAT 4 and shall attach to any such claim, the following —

| (a) |

a copy of the invoice showing the sale of the goods to the purchaser; and

|

| (b) |

the export entry duly certified by the proper officer of customs at the port of export; and

|

| (c) |

evidence of the value of the goods and the payment by him of tax due thereon, being a copy of the tax invoice issued by a registered person, or a copy of the customs entry on which the goods were imported, as the case may be; and

|

| (d) |

evidence that foreign exchange has been credited to the account of the purchaser with his commercial bank in Kenya.

|

|

| (4) |

The Commissioner shall not issue a tax remission certificate referred to in Form VAT 4B unless the application is accompanied by—

| (a) |

bond security on Form VAT 4 B1 duly executed and guaranteed by a bank, insurance company or financial institution licensed to operate in Kenya; and

|

| (b) |

an irrevocable letter of credit, or evidence that the account of the exporter has been credited with payment in foreign currency for the exported goods; and

|

| (c) |

a proforma invoice from the registered manufacturer or dealer.

|

|

| (5) |

A VAT remission certificate issued under paragraph (4) shall be valid for ninety days only from the date of issue.

|

| (6) |

Upon completion of exportation, the exporter shall resubmit to the Commissioner within ninety days from the date of issue, the duplicate copy of the VAT remission certificate supported by documentary evidence of exportation of the goods.

|

| (7) |

A bond security provided under paragraph 4(a) shall be cancelled upon the exporter satisfying the Commissioner —

| (a) |

that the goods have been duly exported;

|

| (b) |

that the appropriate payment in foreign currency or in an approved manner has been received by him.

|

|

| (8) |

Where an exporter fails to comply with the provisions of paragraphs (6) and (7), the appropriate tax shall be payable in full forthwith together with a penalty of 3% per month or part thereof calculated from the date of issue of the tax remission certificate by the Commissioner under paragraph (4).

|

| (9) |

No refund shall be made under this regulation—

| (a) |

where the amount to be refunded is less than five hundred shillings; or

|

| (b) |

where the exportation took place more than twelve calendar months previously or such further period as the Commissioner may in any particular case determine.

|

|

| (10) |

Zero-rating of exported goods or refund of tax paid shall not be allowed under this regulation in respect of any goods which have been used before they were exported.

|

| (11) |

Where the Commissioner considers that there is doubt about the exportation of any goods he may require any person exporting the goods to produce to him within a reasonable time a certificate, signed and stamped by a competent customs authority overseas, that the goods were duly landed and reported to the proper customs authority at the port or place of foreign destination, and payment of any claim may be deferred until such a certificate has been produced and accepted as satisfactory by the Commissioner.

|

| (12) |

Where a person who is not a registered person supplies by way of business any taxable goods that he has imported or purchased from a registered person to an export processing zone or to a foreign aid funded investment project and claims a refund of the tax paid on those goods he shall submit his claim to the commissioner on Form VAT 4 and shall attach to any such claim, the following—

| (a) |

a copy of the invoice showing the sale of the goods to the purchaser; and

|

| (b) |

evidence of the value of the goods and the payment by him of tax due thereon, being a copy of the tax invoice issued by a registered person or a copy of the Customs entry on which the goods were imported, as the case may be; and

|

| (c) |

a certificate signed by the purchaser that the goods have been received and that they have been purchased as part of a specified project or in accordance with the approved operations of the export processing zone, as the case may be.

|

|

|

| 11. |

Application for tax refund

An application for tax refund under section 24(b) and (c) of the Act shall be made on Form VAT 4.

|

| 12. |

Claims for tax refund

| (1) |

Any claim for refund of tax by a registered person under section 24A of the Act shall be accompanied by—

| (a) |

a document issued to him by the person with whom he proves in the insolvency of the debtor, specifying the total amount proved, except where a claim is made because over three years have elapsed since the registered person paid the tax;

|

| (b) |

a copy of the tax invoice provided in respect of each taxable supply upon which the claim is based;

|

| (c) |

records or other documents, showing that the tax has been accounted for and paid on each supply upon which the claim for a refund of tax is based;

|

| (d) |

evidence that every reasonable effort has been made to have the debt settled; and

|

| (e) |

a declaration by him that he and the buyers are independent of each other.

|

|

| (2) |

No refund is payable unless the registered person is up-to-date in submitting all VAT returns on Form VAT 3 together with the appropriate tax.

|

|

| 13. |

Tax paid on stocks on hand, assets, building, etc.

| (1) |

A registered person shall submit to the Commissioner, his claim for relief from tax paid on stocks on hand, assets, building or civil works on the date he becomes registered on Form VAT 5 within thirty days of that date.

|

| (2) |

Where the Commissioner considers that there is good and valid reason why the registered person could not submit his claim under paragraph (1) within the thirty days he may accept a claim made within such longer period as he deems to be fair and reasonable.

|

| (3) |

The Commissioner may require the registered person to produce to an authorised officer evidence of—

| (a) |

the quantities, descriptions and values of goods in stock on the date of registration;

|

| (b) |

the proper use or disposal of such goods after the date of registration.

|

|

|

| 14. |

Security

| (1) |

A security required by the Commissioner under section 29 of the Act shall be in such sum not exceeding the total tax payable and, unless the person from whom the security is required opts to deposit the required sum or equivalent securities with the Commissioner, shall take the form of a bond in such form, and given by such sureties, as the Commissioner may approve.

|

| (2) |