|

|

THE PROCEEDS OF CRIME AND ANTI-MONEY LAUNDERING REGULATIONS

ARRANGEMENT OF REGULATIONS

PART I – PRELIMINARY

PART II – THE FINANCIAL REPORTING CENTRE

| 3. |

Functions of the Centre

|

| 4. |

Registration with the Centre

|

PART III – OBLIGATIONS OF A REPORTING INSTITUTION

| 5. |

Obligations of reporting institutions

|

| 7A. |

Policies and procedures

|

| 8. |

Cross border conveyance of monetary instruments

|

| 9. |

Internal Control Obligations

|

| 10. |

Money Laundering Reporting Officer

|

| 11. |

Anonymous or fictitious accounts

|

PART IV – DUE DILIGENCE REQUIREMENTS

| 12. |

Customer Due Diligence

|

| 13. |

Information on natural persons

|

| 14. |

Information on legal persons

|

| 15. |

Information on partnership

|

| 16. |

Information on trusts

|

| 17. |

Information on eligible introducers

|

| 18. |

Enhanced due diligence measures

|

| 19. |

Establishment of ultimate beneficiaries

|

| 20. |

Life insurance related business

|

| 22. |

Politically exposed persons

|

| 23. |

Foreign branches or subsidiaries

|

| 24. |

Correspondent relationships

|

| 25. |

Prohibition on dealings with shell banks

|

| 26. |

Money or value transfer services

|

| 28. |

Reliance on third parties

|

| 31. |

Legitimacy of source funds

|

PART V – REPORTING REQUIREMENTS

| 32. |

Reporting of suspicious activities by reporting institutions

|

| 33. |

Reporting of suspicious activities by supervisory bodies

|

| 34. |

Reporting of cash transactions

|

PART VI – GENERAL PROVISIONS

| 39. |

Powers of the Centre to issue directives and guidelines

|

| 40. |

Sharing of information

|

| 41. |

Mechanisms for suitability of financial institutions

|

SCHEDULES

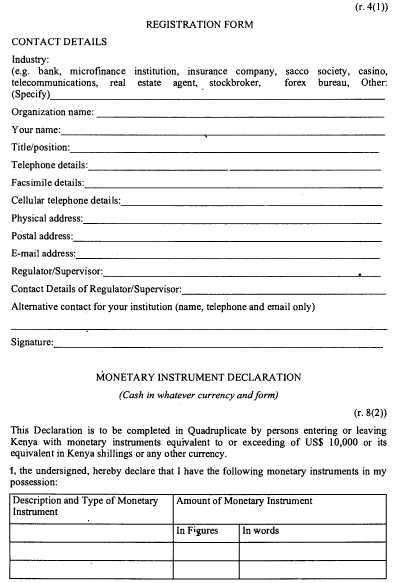

| SCHEDULE [r. 4(1)] — |

REGISTRATION FORM

|

THE PROCEEDS OF CRIME AND ANTI-MONEY LAUNDERING REGULATIONS, 2013

PART I – PRELIMINARY

| 1. |

Citation

These Regulations, may be cited as the Proceeds of Crime and Anti-Money Laundering Regulations, 2013.

|

| 2. |

Interpretation

In these Regulations unless the context otherwise requires—

"Act" means the Proceeds of Crime and Anti-Money Laundering Act (No. 9 of 2009);

"applicant" means a person seeking to form a business relationship, or to carry out a one-off transaction, with a reporting institution;

"beneficial owner" means a person who ultimately owns or controls a customer or the person on whose behalf a transaction is being conducted, and any person who ultimately exercises effective control over a legal person or arrangement;

"business relationship" means an arrangement between a person and a reporting institution, where the purpose or effect of the arrangement is to facilitate the carrying out of transactions between the person and the reporting institution on a frequent basis;

"competent authority" means a public authority other than a self-regulatory body with designated responsibilities for combating money laundering;

"customer" in relation to a transaction or an account, includes—

| (a) |

the person in whose name a transaction or account is arranged, opened or undertaken;

|

| (b) |

a signatory to a transaction or account;

|

| (c) |

any person to whom a transaction has been assigned or transferred;

|

| (d) |

any person who is authorised to conduct a transaction; or

|

| (e) |

such other person as the Centre may specify;

|

"Customs Officer" means an officer whose right or duty is to require the performance, or to perform the acts referred to in the East African Community Customs Management Act, 2004;

"eligible introducer" means any person who introduces an applicant for business to a reporting institution in Kenya and—

| (a) |

is regulated under the Act or any similar legislation in an equivalent jurisdiction, or is subject to rules of professional conduct relating to the prevention of money laundering; and

|

| (b) |

is based either in Kenya or in an equivalent jurisdiction;

|

"equivalent jurisdiction" means a jurisdiction having standards pertaining to measures on anti-money laundering comparable to Kenya as may be specified from time to time by the Centre in guidelines;

"express trust" means a trust created by a settlor usually by form of a document such as a trust deed or written deed of trust;

"group introducer" means an introducer who is part of the same group as the reporting institution to whom the applicant for business is introduced and is, for anti-money laundering purposes, subject to either the consolidated supervision of a regulator in Kenya or in an equivalent jurisdiction or is subject to the anti-money laundering regulations of a regulator in Kenya or in an equivalent jurisdiction;

"international organisation" means an entity established by formal agreements between member States that has the status of an international treaty and whose existence is recognized by law in the member countries;

"know your customer" means requirements consisting of obtaining full particulars of the customer’s identity and having a sound knowledge of the purpose for which the customer is seeking to establish a business relationship with a reporting institution;

"Money Laundering Reporting Officer" means an officer appointed under regulation 10;

"money or value transfer services" means a financial service that involves the acceptance of cash, cheques, other monetary instruments or other stores of value in one location and the payment of a corresponding sum in cash or other form to a beneficiary in another location by means of a communication, message, transfer, or through a clearing network to which the money or value transfer services provider belongs;

"official documents" means the original or certified copies of documents, or official records set out in section 43(1) of the Act;

"one-off transaction" means any transaction carried out other than in the course of a business relationship;

"shell bank" means a bank that has no physical presence in the country in which it is incorporated and licensed, and which is unaffiliated with a regulated financial group that is subject to effective consolidated supervision; and

"wire transfer" means any transaction carried out on behalf of an originator through a financial institution by electronic means with a view to making an amount of funds available to a beneficiary person at a beneficiary financial institution, irrespective of whether the originator and the beneficiary are the same person.

|

PART II – THE FINANCIAL REPORTING CENTRE

| 3. |

Functions of the Centre

The Centre shall, in addition to functions set out in the Act—

| (a) |

implement a registration system in respect of all reporting institutions;

|

| (b) |

supervise and enforce compliance with the Act or any directive, guideline or rules made in terms of the Act by reporting institutions and other persons to whom the provisions of the Act apply; and

|

| (c) |

annually review the implementation of the Act and submit a report thereon to the Minister.

|

|

| 4. |

Registration with the Centre

| (1) |

Every reporting institution shall register with the Centre within one year of these regulations or such other longer period as the Centre may allow using the form prescribed in the Schedule.

|

| (2) |

The Centre shall keep and maintain a register of every reporting institution registered under subregulation (1).

|

| (3) |

A reporting institution shall notify the Centre, in writing, of any changes to the particulars furnished under this Regulation within ninety days after such change.

|

| (4) |

Any reporting institution that fails to register with the Centre as required by subregulation (1) commits an offence.

|

| (5) |

Despite the obligation to register with the Centre as set out in this regulation, every reporting institution shall report suspicious transactions in accordance with the Act.

|

|

PART III – OBLIGATIONS OF A REPORTING INSTITUTION

| 5. |

Obligations of reporting institutions

A reporting institution shall adhere to the obligations set out in these Regulations in addition to the obligations set out in sections 44, 45, 46 and 47 of the Act.

|

| 6. |

Risk Assessment

| (1) |

Every reporting institution shall undertake a Money Laundering Risk Assessment to enable it identify, assess, monitor, manage and mitigate the risks associated with money laundering.

|

| (2) |

In undertaking the risk assessment, a reporting institution shall develop and implement systems that will enable it identify and assess money laundering risks consistent with the nature and size of the institution and the outcome of such assessment shall be documented.

|

| (3) |

On the basis of the results of the assessment, a reporting institution shall develop and implement Board approved policies, controls and procedures that will enable it to effectively manage and mitigate the identified risks.

|

| (4) |

Every reporting institution shall put in place procedures and mechanisms for monitoring implementation of the controls and enhance them, where necessary.

|

| (5) |

A reporting institution shall update its risk assessment policies or programs regularly but at least once every two years taking into account changes such as the entry of the institution into new markets and the introduction of new products and services.

|

|

| 7. |

New Technologies

| (1) |

A reporting institution shall take reasonable measures to prevent the use of new technologies for money laundering purposes.

|

| (2) |

A reporting institution shall conduct a money laundering risk assessment—

| (a) |

prior to the introduction of a new product, new business practice or new technology for both new and pre-existing products;

|

| (b) |

so as to assess money laundering risks in relation to—

| (i) |

a new product and a new business practice, including a new delivery mechanism; and |

| (ii) |

new or developing technologies for both new and pre-existing products. |

|

|

| (3) |

The outcome of such assessment shall be documented and be availed to the Centre or the reporting institution’s supervisory authority upon request.

|

|

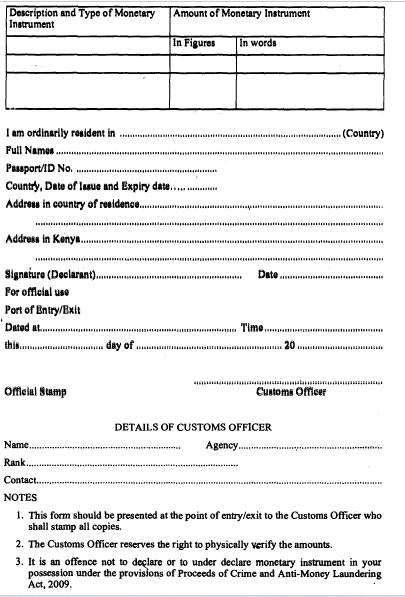

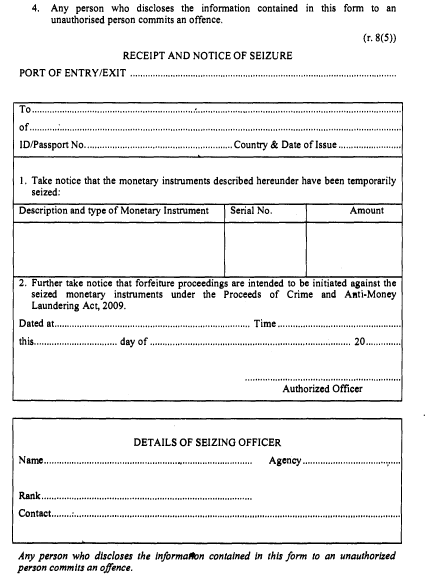

| 8. |

Cross border conveyance of monetary instruments

| (1) |

Any person intending to convey into or out of Kenya monetary instruments equivalent to or exceeding US$10,000 or its equivalent in Kenya shillings or any other currency, shall before doing so declare the particulars of those monetary instruments to a customs officer at the port of entry or exit in the form prescribed in the Schedule.

|

| (2) |

The customs officer shall submit the completed declaration forms to the Director of the Centre in accordance with section 12(2) of the Act.

|

| (3) |

Where the customs officer has reason to suspect that the person has not made a true declaration or has failed to declare the monetary instruments referred to in subregulation (1), the customs officer shall require that person to produce and show to the customs officer all the monetary instruments in his possession.

|

| (4) |

Any temporary seizure done in accordance with section 12(4) of the Act, the customs officer shall acknowledge receipt of the monetary instrument by way of issuing an official receipt in the form prescribed in the Schedule.

|

| (5) |

For purposes of conducting his duties under this regulation, the duties and powers of the customs officer to search and arrest under the East African Community Customs Management Act, 2004 shall apply.

|

| (6) |

Where the customs officer has made a seizure pursuant to these Regulations, he shall in accordance with sections 12(5) and (6) immediately but not later than five days, report the details of the seizure and surrender the seized monetary instruments to the Agency Director.

|

|

| 9. |

Internal Control Obligations

| (1) |

A reporting institution shall formulate, adopt and implement internal control measures and other procedures to combat money laundering and these measures include—

| (a) |

programmes for assessing risks relating to money laundering;

|

| (b) |

the formulation of a control policy that will cover issues of timing, degree of control, areas to be controlled, responsibilities and follow-up;

|

| (c) |

monitoring programmes in relation to complex, unusual or large transactions or suspicious activities;

|

| (d) |

enhanced due diligence procedures with respect to persons and business relations and transactions carrying high risk and with persons established in jurisdictions that do not have adequate systems in place to combat money laundering;

|

| (e) |

providing employees, including the Money Laundering Reporting Officer, from time to time, with training to facilitate recognition and handling of suspicious transactions;

|

| (f) |

making employees aware of the procedures under the Act, these Regulations or directives, codes and guidelines issued thereunder or and any other relevant policies that is adopted by the reporting institution;

|

| (g) |

establishing and maintaining a manual of compliance procedures in relation to anti-money laundering;

|

| (h) |

providing for the necessary processes and working methods to ensure compliance with the Act, these Regulations and the internal rules; and

|

| (i) |

provide for the responsibility of the management of the reporting institution in respect of compliance with the Act, these Regulations and the internal rules.

|

|

|

| 10. |

Money Laundering Reporting Officer

| (1) |

A reporting institution shall appoint a Money Laundering Reporting Officer.

|

| (2) |

The Money Laundering Reporting Officer shall be of management level and shall have relevant and necessary competence, authority and independence.

|

| (3) |

All staff in a reporting institution shall monitor and report to the Money Laundering Reporting Officer any suspicious activity on money laundering.

|

| (4) |

The Money Laundering Reporting Officer shall report forthwith to the Centre, any transaction or activity that he has reason to believe is suspicious in the form prescribed in the Schedule.

|

| (5) |

Where the Centre receives a report made by a Money Laundering Reporting Officer pursuant to subregulation (4), it shall acknowledge receipt of the report forthwith.

|

| (6) |

In addition to the responsibilities provided in these regulations, the Money Laundering Reporting Officer shall ensure that—

| (a) |

he is informed of all suspicious activities available to the reporting institution and take action on suspicious disclosures from officers and employees of the reporting institution as soon as practical so as not to delay the reporting of such disclosures;

|

| (b) |

where a disclosure is made, he applies internal risk-management procedures on a suspicious transaction;

|

| (c) |

he reports disclosures deemed suspicious to the Centre in a manner provided for under paragraph (b);

|

| (d) |

officers and employees of the reporting institution are made aware of the Act as well as the audit systems adopted by the reporting institution; and

|

| (e) |

in liaison with the reporting institution’s human resource department, persons are screened before being hired as employees.

|

|

| (7) |

The appointment or removal of the Money Laundering Reporting Officer shall be communicated to the Centre and the reporting institution’s supervisory body within fourteen days of the appointment or removal.

|

| (8) |

An Internal Auditor and a Chief Executive shall not qualify to be appointed as a Money Laundering Reporting Officer except in the circumstances where the Chief Executive is a sole proprietor.

|

|

| 11. |

Anonymous or fictitious accounts

| (1) |

No person shall, in the course of his conduct of business as a reporting institution, open or maintain an anonymous or fictitious account.

|

| (2) |

A reporting institution shall, at the time of establishing a business relationship, take reasonable measures to determine whether the applicant for business is acting on his own behalf or on behalf of a third party.

|

| (3) |

In determining what constitutes reasonable measures for the purpose of sub-regulation (2), all the circumstances of the case shall be taken into account and in particular, regard shall be given to any guideline or code applicable to the reporting institution and, in the absence of any guideline or code, to best practice which, for the time being, is followed in the relevant field of business and which is applicable to those circumstances.

|

| (4) |

A reporting institution shall not knowingly establish or maintain a business relationship or conduct any transaction with a customer who is entering into a business relationship or conducting any transaction under a false name.

|

|

PART IV – DUE DILIGENCE REQUIREMENTS

| 12. |

Customer Due Diligence

| (1) |

Customer due diligence measures are to be undertaken by a reporting institution to enable it achieve the following objectives—

| (a) |

identify the customer and verify that customer’s identity using reliable, independent source documents, data or information;

|

| (b) |

identify the beneficial owner, and take reasonable measures to verify the identity of the beneficial owner, such that the reporting institution is satisfied that it knows who the beneficial owners is and it understands the ownership and control structure of the customer in case of legal persons and arrangements;

|

| (c) |

understand and, as appropriate, obtain information on the purpose and nature of the business relationship; and

|

| (d) |

conduct on going due diligence on the business relationship and scrutiny of transactions undertaken throughout the course of that relationship to ensure that the transactions being conducted are consistent with the reporting institution’s knowledge of the customer, their business and risk profile, including where necessary the source of funds.

|

|

| (2) |

A reporting institution shall take measures to satisfy itself as to the true identity of any applicant seeking to enter into a business relationship with it, or to carry out a transaction or series of transactions with it, by requiring the applicant to produce an official record for the purposes of establishing the true identity of the applicant and for the purpose of verifying that identity.

|

| (3) |

Every reporting institution shall, in the circumstances set out in subregulation (2), establish and verify in accordance with these Regulations, the following particulars regarding the applicant for business—

| (b) |

the purpose and nature of his business or principal activity;

|

| (c) |

his financial status; and

|

| (d) |

the capacity in which he is entering into the business relationship with the reporting institution.

|

|

| (4) |

The circumstances under subregulation (2) shall be carried out—

| (a) |

when establishing initial business relations;

|

| (b) |

when undertaking occasional or one-off transactions;

|

| (c) |

when there is cause to be suspicious; and

|

| (d) |

when there is doubt about veracity or adequacy of previously obtained customer information.

|

|

|

| 13. |

Information on natural persons

| (1) |

For the purposes of complying with the Act and these Regulations, where a reporting institution seeks to establish the identity of a natural person, it shall in addition to the requirements set out in section 45(1)(a) of the Act, request the following in relation to such person—

| (a) |

full names of the person; and

|

| (b) |

such other particulars as the Centre may prescribe.

|

|

| (2) |

Additional measures that may be used to identify and verify the identity of the customer include—

| (b) |

current physical or residential address;

|

| (c) |

utility bill including among others an electricity or a water bill;

|

| (d) |

occupation or employment details;

|

| (f) |

nature and location of business activity;

|

| (g) |

income tax personal identification number (PIN) issued by Kenya Revenue Authority if such a number has been issued to the customer;

|

| (h) |

where applicable, written references from acknowledged persons attesting to the customer’s identity; and

|

| (i) |

for accounts with more than one party and where one of the parties has identified the others, written confirmation shall be obtained to the effect that the first party has known the other(s) personally for at least twelve months.

|

|

|

| 14. |

Information on legal persons

| (1) |

For the purposes of complying with the Act and these Regulations, where a reporting institution seeks to establish the identity of a legal person or other body corporate, it shall in addition to the requirements set out in section 45(1)(b) of the Act, request the following in relation to such person—

| (b) |

evidence of registration or incorporation such as a certified copy of Certificate of Registration or Certificate of Incorporation, or Memorandum and Articles of Association or other similar documentation evidencing the legal status of the legal person or body corporate;

|

| (c) |

certified copy of board resolution stating authority to open an account or transact business with the reporting institution, and designating persons having signatory authority thereof;

|

| (d) |

the full names, date of birth, identity or passport number and address of the natural persons managing, controlling or owning the body corporate or legal entity;

|

| (e) |

for corporate bodies, audited financial statements for the last full year;

|

| (f) |

for sole traders, un-audited financial statements for the last full year:

|

Provided that an exemption may be considered by a reporting institution for a new sole proprietorship business in the production of audited accounts or un-audited accounts if there exists practical difficulties in obtaining financial statements from it;

| (g) |

personal identification number; or

|

| (h) |

where applicable, written confirmation from the customer’s prior bank, if any,

|

attesting to customer’s identity and history of account relationship.

|

|

| 15. |

Information on partnership

| (1) |

For the purposes of complying with the Act and these Regulations, where a reporting institution seeks to establish the identity of partnerships, it shall obtain the following particulars—

| (a) |

the name of the partnership or where applicable its registered name;

|

| (c) |

its registered address or principal place of business or office;

|

| (e) |

the full names, date of birth, identity card number or passport number and address of every partner;

|

| (f) |

the person who exercises executive control over the partnership;

|

| (g) |

the name and particulars of each natural person who purports to be authorized to establish a business relationship or to enter into a transaction with the reporting institution on behalf of the partnership; or

|

| (h) |

un-audited financial statements for the last full year.

|

|

|

| 16. |

Information on trusts

For the purposes of complying with the Act and these Regulations, where a reporting institution seeks to establish the identity of trust it shall obtain the following particulars—

| (a) |

its registered name, if any;

|

| (b) |

its registration number, if any;

|

| (c) |

evidence of registration or incorporation such as a Certificate of Incorporation or registration;

|

| (e) |

formative document such as partnership agreement, memorandum and articles of association;

|

| (f) |

official returns showing registered office and if different the principal place of business;

|

| (g) |

full names and details of the management company of the trust or legal arrangement, if any;

|

| (h) |

names of the relevant persons having senior management position in the legal person or trustees of the legal arrangement;

|

| (i) |

full names of the trustee, beneficiaries or any other natural person exercising ultimate effective control over the trust;

|

| (j) |

full names of the founder of the trust;

|

| (k) |

any other documentation from a reliable independent source proving the name, form and current existence of the customer; and

|

| (l) |

such other document or particulars as the Centre may prescribe.

|

|

| 17. |

Information on eligible introducers

| (1) |

Where an applicant for business is introduced to a reporting institution by an eligible introducer or a group introducer, it shall be sufficient compliance with these Regulations where the reporting institution—

| (a) |

obtains and maintains documentary evidence that the eligible introducer or group introducer is regulated for the purposes of preventing money laundering; and

|

| (b) |

is satisfied that the procedures laid down by the eligible introducer or group introducer meet the requirements specified in the Act, or any code or guidelines issued by a supervisory authority.

|

|

| (2) |

A reporting institution relying on customer identification documentation in the possession of a group introducer shall not be required to retain copies of that customer identification documentation in his own records where he is satisfied that he may obtain that customer identification documentation from the group introducer upon request.

|

| (3) |

A reporting institution shall comply with the requirements specified in any code or guidelines issued by its supervisory authority, relating to the conduct of business with eligible introducers or group introducers.

|

|

| 18. |

Enhanced due diligence measures

Enhanced due diligence measures shall be applied to persons and entities that present a higher risk to the reporting institution through the following measures—

| (a) |

obtaining further information that may assist in establishing the customer’s identity;

|

| (b) |

applying extra measures to verify the documents supplied;

|

| (c) |

obtaining senior management approval for the new business relationship or transaction;

|

| (d) |

establishing the person’s or entity’s source of funds; and

|

| (e) |

carrying out on going monitoring of the business relationship.

|

|

| 19. |

Establishment of ultimate beneficiaries

| (1) |

A reporting institution shall ensure that it is able to identify and verify the natural persons behind a legal person and arrangement.

|

| (2) |

In addition, a reporting institution will be required to ensure that it understands the nature of business, ownership and control structure when performing customer due diligence measures in relation to a customer that is a legal person or legal arrangement.

|

| (3) |

The objective of undertaking the functions in subregulations (1) and (2) is to identify the natural person exercising control and ownership in the legal person or arrangement through the following—

| (a) |

details of Incorporation;

|

| (d) |

particulars of directors and shareholders;

|

| (e) |

names of the relevant persons having senior management position in the legal person or trustees of the legal arrangement;

|

| (f) |

names of the trustees, beneficiaries or any other natural person exercising ultimate effective control over the trust;

|

| (g) |

any other documentation obtained from a reliable independent source proving the name, form and current existence of the customer.

|

|

| (4) |

The relevant identification data in subregulation (3) may be obtained from a public register the customer or other reliable sources.

|

| (5) |

Where a person is purporting to act on behalf of another person, the reporting institution shall ensure that it is able to identify and verify that person.

|

|

| 20. |

Life insurance related business

| (1) |

For life or other investment-related insurance business, financial institutions shall, in addition to the customer due diligence measures required for the customer and the beneficial owner, conduct the following customer due diligence measures on the beneficiaries of life insurance and other investment related insurance policies, as soon as the beneficiary or beneficiaries are identified or designated, for a beneficiary—

| (a) |

that is identified as specifically named natural or legal persons or legal arrangements, taking the name of the person;

|

| (b) |

that is a legal arrangement or designated by characteristics or by category such as spouse or children, at the time that the insured event occurs or by other means such as under a will, obtaining sufficient information concerning the beneficiary to satisfy the financial institution that it will be able to establish the identity of the beneficiary at the time of the payout.

|

|

| (2) |

The information collected under subregulation (1) shall be recorded and maintained in accordance with the provisions of the Act and these Regulations.

|

|

| 21. |

Compliance

| (1) |

A reporting institution shall as soon as reasonably practical comply with the obligation under regulation 12(2), after it has entered into a business relationship with an applicant for business, with a view to—

| (a) |

agreeing with the applicant for business to carry out an initial transaction; or

|

| (b) |

reaching an understanding, whether binding or not, with the applicant for business that it may carry out future transactions.

|

|

| (2) |

For the purposes of subregulation (1), where the applicant for business does not supply evidence of identity as soon as reasonably practicable, the reporting institution shall—

| (b) |

not commence any business relationship with the customer;

|

| (c) |

not perform the transaction;

|

| (d) |

where it has commenced a business relationship with the customer—

| (i) |

discontinue any transaction it is conducting for him; |

| (ii) |

bring to an end the business relationship or any understanding it has reached with him; and |

|

| (e) |

file a suspicious transaction report with the Centre.

|

|

|

| 22. |

Politically exposed persons

| (1) |

A reporting institution shall have appropriate risk management systems to determine whether the customer or beneficial owner is a politically exposed person.

|

| (2) |

A reporting institution will be required to take the following measures where a customer or beneficial owner is a politically exposed person—

| (a) |

obtain approval from senior management to transact or establish the relationship with that person;

|

| (b) |

take adequate measures to establish the source of wealth and the source of funds which are involved in the proposed business relationship or transaction;

|

| (c) |

obtain information on the immediate family members or close associates of the person who may be having transaction authority over the account;

|

| (d) |

determine the purpose of the transaction or account and the expected volume and nature of account activity;

|

| (e) |

review public sources of information on the politically exposed person; and

|

| (f) |

once the account has been established, conduct enhanced on-going monitoring of the relationship.

|

|

| (3) |

In these Regulations, a politically exposed person means a person who has been entrusted with a prominent public function in a country or jurisdiction including—

| (b) |

senior executives of state owned corporations;

|

| (c) |

important political party officials;

|

| (d) |

senior military officials and other members of the disciplined forces;

|

| (e) |

members of the Judiciary;

|

| (h) |

senior Official of an International Organisation;

|

| (i) |

any immediate family member or close business associate of a person referred to under this subregulation; and

|

| (j) |

any other category of persons as the Centre may determine.

|

|

|

| 23. |

Foreign branches or subsidiaries

| (1) |

A reporting institution shall ensure that its foreign branches and subsidiaries observe anti money laundering measures consistent with the Act and these Regulations.

|

| (2) |

Where the minimum requirements of the host country are less strict than those applicable in Kenya, a reporting institution shall ensure that its branches and subsidiaries apply the requirements of the Act and these Regulations to the extent that the laws of the host country permit.

|

| (3) |

A reporting institution shall inform the Centre and its Supervisory Authority when their foreign branch or subsidiary is unable to observe appropriate anti-money laundering measures.

|

|

| 24. |

Correspondent relationships

| (1) |

In relation to correspondent banking and other similar business relationships, a financial institution which intends to establish a correspondent financial relationship either as the correspondent financial institution or the respondent financial institution shall undertake the following measures before establishing a business relationship—

| (a) |

gather sufficient information about the correspondent financial institution regarding the nature of its business activities;

|

| (b) |

determine from available information, the reputation of the correspondent financial institution and the quality of its supervision;

|

| (c) |

determine the quality of anti-money laundering regulation in the correspondent financial institution’s jurisdiction or country of domicile;

|

| (d) |

assess the correspondent financial institution’s anti-money laundering controls;

|

| (e) |

obtain approval from senior management before establishing a new correspondent financial institution relationship;

|

| (f) |

in respect to the correspondent financial institution’s customers, be assured that it verifies the identity of its customers and conducts on-going monitoring;

|

| (g) |

verify the ownership and management structures of the correspondent financial institution including whether a politically exposed person has ownership or control of the financial institution.

|

|

| (2) |

For purposes of this Regulation—

| (a) |

"correspondent financial relationship" means the provision of financial services by a local financial institution to another local financial institution or foreign financial institution; and

|

| (b) |

"respondent financial institution" means a financial institution in receipt of financial services from a correspondent financial institution.

|

|

|

| 25. |

Prohibition on dealings with shell banks

| (1) |

A reporting institution shall not—

| (a) |

open a foreign account with a shell bank;

|

| (b) |

permit its accounts to be used by a shell bank; or

|

| (c) |

enter into or continue a correspondent financial relationship with—

| (ii) |

a respondent financial institution that permits its account to be used by a shell bank. |

|

|

|

| 26. |

Money or value transfer services

A reporting institution that offers money or value transfer services as a product shall ensure that the provider of such services—

| (a) |

is licensed or registered;

|

| (b) |

has anti-money laundering programmes in place; and

|

| (c) |

is subject to an effective system for monitoring and ensuring compliance with anti-money laundering measures and that such systems are regularly monitored for compliance.

|

|

| 27. |

Wire transfers

| (1) |

A reporting institution undertaking a wire transfer shall ensure that information accompanying domestic or cross-border wire transfers always have the following information—

| (a) |

the name of the originator;

|

| (b) |

the originator account number where such an account is used to process the transaction;

|

| (c) |

the originator’s address, or national identity number, or passport number or date and place of birth;

|

| (d) |

the name of the beneficiary; and

|

| (e) |

the beneficiary account number where such an account is used to process the transaction;

|

| (f) |

in the absence of an account number, a unique transaction reference number shall be included which makes it possible to trace the transaction.

|

|

| (2) |

The requirements under subregulation (1) apply to reporting institutions in circumstances where the institution is acting as—

| (a) |

the ordering financial institution;

|

| (b) |

the beneficiary financial institution; or

|

| (c) |

the intermediary financial institution.

|

|

| (3) |

Wire transfers to and from persons or entities that are designated under the United Nations Security Council Resolution 1267 (1999) and other United Nations resolutions relating to the prevention of terrorism and terrorist financing are prohibited.

|

| (4) |

For purposes of this Regulation—

| (a) |

"beneficiary" means a person or legal arrangement identified by the originator as the receiver of the requested wire transfer;

|

| (b) |

"beneficiary financial institution" means a financial institution which receives the wire transfer from the ordering financial institution directly or through an intermediary financial institution and makes the funds available to the beneficiary;

|

| (c) |

"cross-border wire transfer" includes any wire transfer where either the ordering financial institution or the beneficiary financial institution is located outside Kenya and any chain of wire transfer in which at least one of the financial institutions involved is located outside Kenya;

|

| (d) |

"domestic wire transfer" includes any wire transfer where the ordering financial institution and beneficiary financial institution are located in Kenya, and any chain of wire transfer that takes place entirely within the country, even though the system used to transfer the payment message may be located in another country;

|

| (e) |

"intermediary financial institution" means a financial institution in a serial or cover payment chain that receives and transmits a wire transfer on behalf of the ordering financial institution and the beneficiary financial institution, or another intermediary financial institution;

|

| (f) |

"ordering financial institution" means a financial institution which initiates the wire transfer and transfers the funds upon receiving the request for an wire transfer on behalf of the originator; and

|

(g) "originator" means an account holder who allows the wire transfer from that account, or where there is no account, the person that places the order with the ordering financial institution to perform the wire transfer.

|

|

| 28. |

Reliance on third parties

| (1) |

A reporting institution may rely on a third party to perform elements of customer due diligence measures provided that the institution meets the criteria set out in these Regulations.

|

| (2) |

A reporting institution relying on a third party shall enter into an agreement with the third party outlining the responsibilities of each party.

|

| (3) |

Where a reporting institution relies on a third party to perform elements of customer due diligence measures as permitted, the ultimate responsibility for customer due diligence measures remains with the institution that is relying on the third party.

|

| (4) |

A reporting institution relying on a third party shall immediately obtain the necessary information concerning the relevant elements of customer due diligence measures as required by these Regulations.

|

| (5) |

A reporting institution relying on a third party to perform elements of customer due diligence measures shall take adequate steps to satisfy itself that copies of identification data and other relevant documentation relating to the customer due diligence requirements shall be made available from the third party without delay upon request.

|

| (6) |

A reporting institution intending to rely on a third party shall ensure that that the third party is regulated, supervised or monitored by a competent authority and has measures in place for compliance with, customer due diligence and record-keeping requirements in line with international best practice.

|

| (7) |

Where a reporting institution intends to rely on a third party that is based in another country, the institution shall assess the anti-money laundering risks that the country poses and the adequacy of customer due diligence measures adopted by financial institutions in that country.

|

| (8) |

For purposes of this Regulation, the term "third party" means another financial institution or designated non-financial business or a person that is supervised or monitored by a competent authority.

|

|

| 29. |

On-going monitoring

| (1) |

A reporting institution shall monitor the business or account activity and transactions of their customers on a continuous basis.

|

| (2) |

On-going monitoring of business or account activity and transactions may be conducted on a risk-sensitive basis.

|

| (3) |

A reporting institution shall conduct on-going due diligence on its customers and develop risk based systems and procedures.

|

|

| 30. |

Numbered accounts

| (1) |

The requirements set out in these regulations shall apply to numbered accounts.

|

| (2) |

A reporting institution shall monitor transactions involving a numbered account and shall report any suspicious activity on the account to the Centre.

|

|

| 31. |

Legitimacy of source funds

| (1) |

A reporting institution shall, for purposes of determining the legitimacy of funds and transactions, consider the following information—

| (a) |

for large, frequent or unusual cash deposits or withdrawals, written statement from the customer confirming that the nature of his business activities normally and reasonably generates substantial amounts of cash;

|

| (b) |

for large, frequent or unusual currency exchanges, written statement from the customer confirming the reason and need for acquired currencies;

|

| (c) |

for multiple or nominee accounts, or similar or related transactions, written statement from the customer confirming the reason and need for multiple or nominee accounts, or similar or related transactions;

|

| (d) |

for large, frequent or unusual transfers or payments of funds, appropriate documentation as to the identity of the recipient or sender of the transferred or paid funds, and the reason for the transfer or payment;

|

| (e) |

for large or unusual investments or requests for advice or services, written statement from the customer confirming that the investments or advice or services being requested are bona fide and consistent with the objectives of the customer’s reasonable and normal business activities;

|

| (f) |

for large or unusual foreign transactions, written confirmation from the customer indicating the nature, reason and appropriate details of the foreign transactions sufficient to determine the legitimacy of such transactions.

|

|

| (2) |

A reporting institution shall, in consultation with its regulatory body, set up policies setting out limits on the maximum cash transaction amounts non-customers can undertake with it.

|

| (3) |

For purposes of subregulation (2), a regulatory body may issue guidelines or directions as it may consider necessary.

|

|

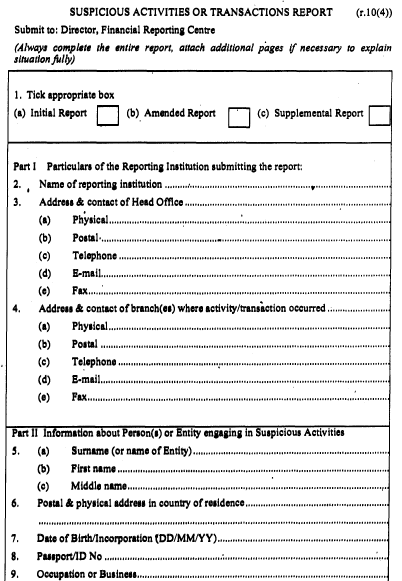

PART V – REPORTING REQUIREMENTS

| 32. |

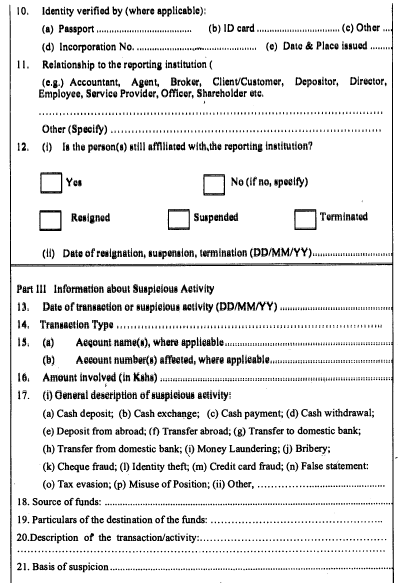

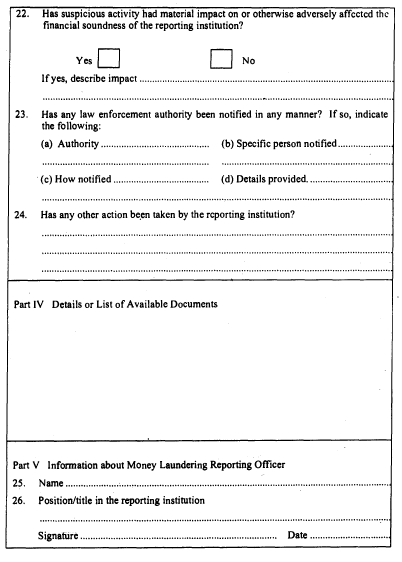

Reporting of suspicious activities by reporting institutions

| (1) |

If a reporting institution becomes aware of suspicious activities or transactions which indicate possible money laundering activities, the reporting institution shall ensure that it is reported to the Centre immediately and within seven days of the date of the transaction or occurrence of the activity that is considered suspicious.

|

| (2) |

Sufficient information shall be disclosed which indicates the nature of and reason for the suspicion, and where the reporting institution has additional supporting documentation that should also be made available.

|

| (3) |

The Suspicious Activity or Transaction Report shall be in the form prescribed in the Schedule

|

|

| 33. |

Reporting of suspicious activities by supervisory bodies

| (1) |

A supervisory body and its staff shall, in accordance with section 36 of the Act, report to the Centre any suspicious transaction that the supervisory body or its staff may encounter within the normal course of its duties in the form prescribed in the Schedule:

Provided that the supervisory body may complete the applicable parts of the form with or without such modifications as may be necessary.

|

| (2) |

The supervisory body shall send the report in subregulation (2) to the Centre in accordance with regulation 33(1).

|

|

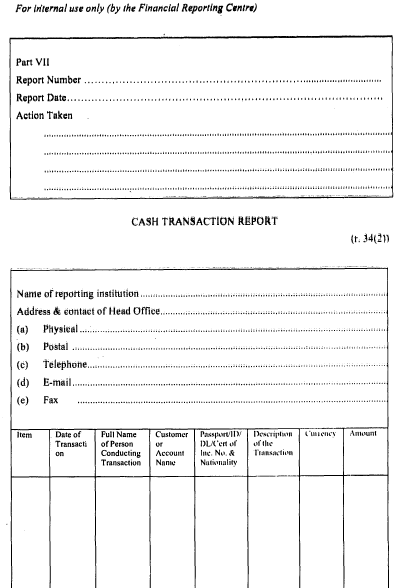

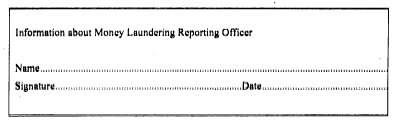

| 34. |

Reporting of cash transactions

| (1) |

A reporting institution shall file reports with the Centre on all cash transactions equivalent to or exceeding US$10,000 or its equivalent in any other currency carried out by it, whether or not the transaction appears to be suspicious.

|

| (2) |

The report under subregulation (1) may be made in the form prescribed in the Schedule or such other format as the Centre may specify.

|

| (3) |

Subject to subregulation (2), the report shall be sent to the Centre electronically—

| (a) |

by such means provided by the Centre for this purpose; or

|

| (b) |

any other method as may from time to time be determined by the Centre, whether as an alternative means or an exclusive means;

|

| (c) |

by the friday in the week in which the transaction occurred or at such other time as the Centre may prescribe.

|

|

| (4) |

If a person or reporting institution required to make a report under subregulation (3) does not at that time have the technical capability or for another reason, acceptable to the Centre, is unable to make a report in accordance with that subregulation, such person shall make a report substantially in the form as set out in subregulation (2), and shall provide such completed form to the Centre, including such further information as may be requested by the Centre, by—

| (a) |

sending it by facsimile to the Director at the facsimile number specified in writing by the Centre from time to time for this purpose;

|

| (b) |

delivering it to the Centre’s offices or to an address specified, from time to time, in writing by the Centre; or

|

| (c) |

sending it by any other method as may be determined by the Centre, whether as an alternative means or as an exclusive means.

|

|

| (5) |

A report under subregulation (1) shall be made at the end of the week in which the transaction occurred unless circumstances demand for the report to be made without delay in which case it shall be reported to the Centre immediately.

|

|

| 35. |

Tipping off

A reporting institution which obtains information which is suspicious or indicates possible money laundering activity shall not disclose such information to an unauthorised person but shall report it to the Centre as required by these Regulations.

|

| 36. |

Record keeping

| (1) |

A reporting institution shall ensure that it maintains and keeps records of all transactions for a minimum period of seven years from the date the relevant business or transaction was completed or following the termination of an account or business relationship.

|

| (2) |

A reporting institution shall ensure that it keeps all records obtained through customer due diligence measures such as copies or records of official documents like passports, identification cards or similar documents, account files and business correspondence including the results of any analysis undertaken such as inquiries to establish the background and purpose of complex, unusual, large transactions for the period specified in subregulation (1).

|

| (3) |

Where the transaction involves a negotiable instrument other than currency, the name of the drawer of the instrument, the name of the institution on which it was drawn, the name of the payee if any, the amount and date of the instrument, the number if any of the instrument and details of any endorsements appearing on the instrument shall be retained.

|

| (4) |

The record keeping requirements under these Regulations are made without prejudice to any other records required to be kept by or under any other written law.

|

| (5) |

Transaction records kept under this regulation shall, as and when required be made available to competent authorities on a timely basis.

|

|

| 37. |

Independent audit

A reporting institution shall adopt an independent audit function to check compliance by the institution with the Act and these Regulations.

|

| 38. |

Annual compliance

At the end of each calendar year, a reporting institution shall submit to the Centre by the 31st of January of the following calendar year or as may be required by the Centre, from time to time, a compliance report detailing the institution’s compliance with the Act, these Regulations and the institution’s internal anti-money laundering rules.

|

PART VI – GENERAL PROVISIONS

| 39. |

Powers of the Centre to issue directives and guidelines

| (1) |

The Centre may issue instructions, directions, guidelines or rules to reporting institutions as it may consider necessary, for the better carrying out of its functions under the Act or regarding the application of the Act.

|

| (2) |

Any instructions, directions, guidelines or rules issued under subregulation (1) may—

| (a) |

be either general or specific;

|

| (b) |

prescribe particulars or matters including forms considered necessary or expedient for the operation, or use in the operation of the Act or of these Regulations;

|

| (c) |

be revoked or varied by subsequent instructions, directions, guidelines or rules;

|

| (d) |

be given to such persons and in such manner as the Centre considers appropriate.

|

|

| (3) |

The Centre may, where it considers appropriate, delegate powers to a supervisory body to issue instructions, directions, guidelines or rules regarding the application of the Act to reporting institutions regulated or supervised by the supervisory body:

Provided that a supervisory body shall consult the Centre before issuing any instructions, directions, guidelines or rules under this regulation.

|

| (4) |

Notwithstanding subregulations (1), (2) and (3), the Centre or a supervisory body may by notice in writing, issue a directive to any reporting institution to whom the provisions of this Act apply, to—

| (a) |

provide the Centre or that supervisory body —

| (i) |

with the relevant information, reports or statistical returns specified in the notice, at the time or at the intervals specified in the notice; |

| (ii) |

within the period specified in the notice; |

| (iii) |

with any relevant document in its possession or custody or under its control; |

|

| (b) |

cease or refrain from engaging in any act, omission or conduct in contravention of the Act or of these Regulations or of any direction or guidance issued thereafter;

|

| (c) |

perform such acts as may be necessary to remedy an alleged non-compliance with the Act or of these Regulations; or

|

| (d) |

perform such act as may be necessary to meet any obligation imposed by the Act or these Regulations.

|

|

| (5) |

The Centre or supervisory body may examine a document submitted to it in terms of subsection (4)(a) or make a copy thereof or part thereof.

|

|

| 40. |

Sharing of information

| (1) |

The Centre may make information collected by it available to any financial regulatory authority, supervisory body, fiscal or tax agency, or fraud investigations agency or the appropriate law enforcement authority within or outside Kenya to facilitate the administration and enforcement of the provisions of the Act and these Regulations.

|

| (2) |

The Centre may request a supervisory body, a monetary or financial regulatory authority to provide it with such information for purposes of supervising and enforcing compliance of the provisions of the Act and these Regulations.

|

|

| 41. |

Mechanisms for suitability of financial institutions

| (1) |

A supervisory body having oversight over a financial institution, shall put in place mechanisms to determine the suitability of—

| (a) |

the financial institution for the grant of a licence or authority by the supervisory body;

|

| (b) |

persons managing or controlling the financial institution.

|

|

|

| 42. |

Penalty

Any person, reporting institution or supervisory body who contravenes the provisions of these Regulations commits an offence and shall, on conviction, be liable to a fine not exceeding five million shillings or to imprisonment for a term not exceeding three years or both fine and imprisonment.

|

THE PROCEEDS OF CRIME AND ANTI-MONEY LAUNDERING REGULATIONS, 2013

PART I – PRELIMINARY

| 1. |

Citation

These Regulations, may be cited as the Proceeds of Crime and Anti-Money Laundering Regulations, 2013.

|

| 2. |

Interpretation

In these Regulations unless the context otherwise requires—

"Act" means the Proceeds of Crime and Anti-Money Laundering Act (No. 9 of 2009);

"applicant" means a person seeking to form a business relationship, or to carry out a one-off transaction, with a reporting institution;

"beneficial owner" means a person who ultimately owns or controls a customer or the person on whose behalf a transaction is being conducted, and any person who ultimately exercises effective control over a legal person or arrangement;

"business relationship" means an arrangement between a person and a reporting institution, where the purpose or effect of the arrangement is to facilitate the carrying out of transactions between the person and the reporting institution on a frequent basis;

"competent authority" means a public authority other than a self-regulatory body with designated responsibilities for combating money laundering;

"customer" in relation to a transaction or an account, includes—

| (a) |

the person in whose name a transaction or account is arranged, opened or undertaken;

|

| (b) |

a signatory to a transaction or account;

|

| (c) |

any person to whom a transaction has been assigned or transferred;

|

| (d) |

any person who is authorised to conduct a transaction; or

|

| (e) |

such other person as the Centre may specify;

|

"Customs Officer" means an officer whose right or duty is to require the performance, or to perform the acts referred to in the East African Community Customs Management Act, 2004;

"eligible introducer" means any person who introduces an applicant for business to a reporting institution in Kenya and—

| (a) |

is regulated under the Act or any similar legislation in an equivalent jurisdiction, or is subject to rules of professional conduct relating to the prevention of money laundering; and

|

| (b) |

is based either in Kenya or in an equivalent jurisdiction;

|

"equivalent jurisdiction" means a jurisdiction having standards pertaining to measures on anti-money laundering comparable to Kenya as may be specified from time to time by the Centre in guidelines;

"express trust" means a trust created by a settlor usually by form of a document such as a trust deed or written deed of trust;

"group introducer" means an introducer who is part of the same group as the reporting institution to whom the applicant for business is introduced and is, for anti-money laundering purposes, subject to either the consolidated supervision of a regulator in Kenya or in an equivalent jurisdiction or is subject to the anti-money laundering regulations of a regulator in Kenya or in an equivalent jurisdiction;

"international organisation" means an entity established by formal agreements between member States that has the status of an international treaty and whose existence is recognized by law in the member countries;

"know your customer" means requirements consisting of obtaining full particulars of the customer’s identity and having a sound knowledge of the purpose for which the customer is seeking to establish a business relationship with a reporting institution;

"Money Laundering Reporting Officer" means an officer appointed under regulation 10;

"money or value transfer services" means a financial service that involves the acceptance of cash, cheques, other monetary instruments or other stores of value in one location and the payment of a corresponding sum in cash or other form to a beneficiary in another location by means of a communication, message, transfer, or through a clearing network to which the money or value transfer services provider belongs;

"official documents" means the original or certified copies of documents, or official records set out in section 43(1) of the Act;

"one-off transaction" means any transaction carried out other than in the course of a business relationship;

"shell bank" means a bank that has no physical presence in the country in which it is incorporated and licensed, and which is unaffiliated with a regulated financial group that is subject to effective consolidated supervision; and

"wire transfer" means any transaction carried out on behalf of an originator through a financial institution by electronic means with a view to making an amount of funds available to a beneficiary person at a beneficiary financial institution, irrespective of whether the originator and the beneficiary are the same person.

|

| 2A. |

Application

These Regulations shall apply to all preventive measures that apply to anti-money laundering activities including measures for combating terrorism financing.

[L.N. 142/2018, r. 2.]

|

PART II – THE FINANCIAL REPORTING CENTRE

| 3. |

Functions of the Centre

The Centre shall, in addition to functions set out in the Act—

| (a) |

implement a registration system in respect of all reporting institutions;

|

| (b) |

supervise and enforce compliance with the Act or any directive, guideline or rules made in terms of the Act by reporting institutions and other persons to whom the provisions of the Act apply; and

|

| (c) |

annually review the implementation of the Act and submit a report thereon to the Minister.

|

|

| 4. |

Registration with the Centre

| (1) |

Every reporting institution shall register with the Centre within one year of these regulations or such other longer period as the Centre may allow using the form prescribed in the Schedule.

|

| (2) |

The Centre shall keep and maintain a register of every reporting institution registered under subregulation (1).

|

| (3) |

A reporting institution shall notify the Centre, in writing, of any changes to the particulars furnished under this Regulation within ninety days after such change.

|

| (4) |

Any reporting institution that fails to register with the Centre as required by subregulation (1) commits an offence.

|

| (5) |

Despite the obligation to register with the Centre as set out in this regulation, every reporting institution shall report suspicious transactions in accordance with the Act.

|

|

PART III – OBLIGATIONS OF A REPORTING INSTITUTION

| 5. |

Obligations of reporting institutions

A reporting institution shall adhere to the obligations set out in these Regulations in addition to the obligations set out in sections 44, 45, 46 and 47 of the Act.

|

| 6. |

Risk Assessment

| (1) |

Every reporting institution shall undertake a Money Laundering Risk Assessment to enable it identify, assess, monitor, manage and mitigate the risks associated with money laundering.

|

| (2) |

In undertaking the risk assessment, a reporting institution shall develop and implement systems that will enable it identify and assess money laundering risks consistent with the nature and size of the institution and the outcome of such assessment shall be documented.

|

| (3) |

On the basis of the results of the assessment, a reporting institution shall develop and implement Board approved policies, controls and procedures that will enable it to effectively manage and mitigate the identified risks.

|

| (4) |

Every reporting institution shall put in place procedures and mechanisms for monitoring implementation of the controls and enhance them, where necessary.

|

| (5) |

A reporting institution shall update its risk assessment policies or programs regularly but at least once every two years taking into account changes such as the entry of the institution into new markets and the introduction of new products and services.

|

|

| 7. |

New Technologies

| (1) |

A reporting institution shall take reasonable measures to prevent the use of new technologies for money laundering purposes.

|

| (2) |

A reporting institution shall conduct a money laundering risk assessment—

| (a) |

prior to the introduction of a new product, new business practice or new technology for both new and pre-existing products;

|

| (b) |

so as to assess money laundering risks in relation to—

| (i) |

a new product and a new business practice, including a new delivery mechanism; and |

| (ii) |

new or developing technologies for both new and pre-existing products. |

|

|

| (3) |

The outcome of such assessment shall be documented and be availed to the Centre or the reporting institution’s supervisory authority upon request.

|

|

| 7A. |

Policies and procedures

| (1) |

A reporting institution shall have policies and procedures to address any money laundering or terrorism financing risks associated with non-face-to-face business relationships or transactions.

|

| (2) |

The policies and procedures referred to in paragraph (1) shall apply when establishing customer relationships and when conducting on-going due diligence.

[L.N. 142/2018, r. 3.]

|

|

| 8. |

Cross border conveyance of monetary instruments

| (1) |

Any person intending to convey into or out of Kenya monetary instruments equivalent to or exceeding US$10,000 or its equivalent in Kenya shillings or any other currency, shall before doing so declare the particulars of those monetary instruments to a customs officer at the port of entry or exit in the form prescribed in the Schedule.

|

| (2) |

The customs officer shall submit the completed declaration forms to the Director of the Centre in accordance with section 12(2) of the Act.

|

| (3) |

Where the customs officer has reason to suspect that the person has not made a true declaration or has failed to declare the monetary instruments referred to in subregulation (1), the customs officer shall require that person to produce and show to the customs officer all the monetary instruments in his possession.

|

| (4) |

Any temporary seizure done in accordance with section 12(4) of the Act, the customs officer shall acknowledge receipt of the monetary instrument by way of issuing an official receipt in the form prescribed in the Schedule.

|

| (5) |

For purposes of conducting his duties under this regulation, the duties and powers of the customs officer to search and arrest under the East African Community Customs Management Act, 2004 shall apply.

|

| (6) |

Where the customs officer has made a seizure pursuant to these Regulations, he shall in accordance with sections 12(5) and (6) immediately but not later than five days, report the details of the seizure and surrender the seized monetary instruments to the Agency Director.

|

|

| 9. |

Internal Control Obligations

| (1) |

A reporting institution shall formulate, adopt and implement internal control measures and other procedures to combat money laundering and these measures include—

| (a) |

programmes for assessing risks relating to money laundering;

|

| (b) |

the formulation of a control policy that will cover issues of timing, degree of control, areas to be controlled, responsibilities and follow-up;

|

| (c) |

monitoring programmes in relation to complex, unusual or large transactions or suspicious activities;

|

| (d) |

enhanced due diligence procedures with respect to persons and business relations and transactions carrying high risk and with persons established in jurisdictions that do not have adequate systems in place to combat money laundering;

|

| (e) |

providing employees, including the Money Laundering Reporting Officer, from time to time, with training to facilitate recognition and handling of suspicious transactions;

|

| (f) |

making employees aware of the procedures under the Act, these Regulations or directives, codes and guidelines issued thereunder or and any other relevant policies that is adopted by the reporting institution;

|

| (g) |

establishing and maintaining a manual of compliance procedures in relation to anti-money laundering;

|

| (h) |

providing for the necessary processes and working methods to ensure compliance with the Act, these Regulations and the internal rules; and

|

| (i) |

provide for the responsibility of the management of the reporting institution in respect of compliance with the Act, these Regulations and the internal rules.

|

|

|

| 10. |

Money Laundering Reporting Officer

| (1) |

A reporting institution shall appoint a Money Laundering Reporting Officer.

|

| (2) |

The Money Laundering Reporting Officer shall be of management level and shall have relevant and necessary competence, authority and independence.

|

| (3) |

All staff in a reporting institution shall monitor and report to the Money Laundering Reporting Officer any suspicious activity on money laundering.

|

| (4) |

The Money Laundering Reporting Officer shall report forthwith to the Centre, any transaction or activity that he has reason to believe is suspicious in the form prescribed in the Schedule.

|

| (5) |

Where the Centre receives a report made by a Money Laundering Reporting Officer pursuant to subregulation (4), it shall acknowledge receipt of the report forthwith.

|

| (6) |

In addition to the responsibilities provided in these regulations, the Money Laundering Reporting Officer shall ensure that—

| (a) |

he is informed of all suspicious activities available to the reporting institution and take action on suspicious disclosures from officers and employees of the reporting institution as soon as practical so as not to delay the reporting of such disclosures;

|

| (b) |

where a disclosure is made, he applies internal risk-management procedures on a suspicious transaction;

|

| (c) |

he reports disclosures deemed suspicious to the Centre in a manner provided for under paragraph (b);

|

| (d) |

officers and employees of the reporting institution are made aware of the Act as well as the audit systems adopted by the reporting institution; and

|

| (e) |

in liaison with the reporting institution’s human resource department, persons are screened before being hired as employees.

|

|

| (7) |

The appointment or removal of the Money Laundering Reporting Officer shall be communicated to the Centre and the reporting institution’s supervisory body within fourteen days of the appointment or removal.

|

| (8) |

An Internal Auditor and a Chief Executive shall not qualify to be appointed as a Money Laundering Reporting Officer except in the circumstances where the Chief Executive is a sole proprietor.

|

|

| 11. |

Anonymous or fictitious accounts

| (1) |

No person shall, in the course of his conduct of business as a reporting institution, open or maintain an anonymous or fictitious account.

|

| (2) |

A reporting institution shall, at the time of establishing a business relationship, take reasonable measures to determine whether the applicant for business is acting on his own behalf or on behalf of a third party.

|

| (3) |

In determining what constitutes reasonable measures for the purpose of sub-regulation (2), all the circumstances of the case shall be taken into account and in particular, regard shall be given to any guideline or code applicable to the reporting institution and, in the absence of any guideline or code, to best practice which, for the time being, is followed in the relevant field of business and which is applicable to those circumstances.

|

| (4) |

A reporting institution shall not knowingly establish or maintain a business relationship or conduct any transaction with a customer who is entering into a business relationship or conducting any transaction under a false name.

|

|

PART IV – DUE DILIGENCE REQUIREMENTS

| 12. |

Customer Due Diligence

| (1) |

Customer due diligence measures are to be undertaken by a reporting institution to enable it achieve the following objectives—

| (a) |

identify the customer and verify that customer’s identity using reliable, independent source documents, data or information;

|

| (b) |

identify the beneficial owner, and take reasonable measures to verify the identity of the beneficial owner, such that the reporting institution is satisfied that it knows who the beneficial owners is and it understands the ownership and control structure of the customer in case of legal persons and arrangements;

|

| (c) |

understand and, as appropriate, obtain information on the purpose and nature of the business relationship; and

|

| (d) |

conduct on going due diligence on the business relationship and scrutiny of transactions undertaken throughout the course of that relationship to ensure that the transactions being conducted are consistent with the reporting institution’s knowledge of the customer, their business and risk profile, including where necessary the source of funds.

|

|

| (2) |

A reporting institution shall take measures to satisfy itself as to the true identity of any applicant seeking to enter into a business relationship with it, or to carry out a transaction or series of transactions with it, by requiring the applicant to produce an official record for the purposes of establishing the true identity of the applicant and for the purpose of verifying that identity.

|

| (3) |

Every reporting institution shall, in the circumstances set out in subregulation (2), establish and verify in accordance with these Regulations, the following particulars regarding the applicant for business—

| (b) |

the purpose and nature of his business or principal activity;

|

| (c) |

his financial status; and

|

| (d) |

the capacity in which he is entering into the business relationship with the reporting institution.

|

|

| (4) |

The circumstances under subregulation (2) shall be carried out—

| (a) |

when establishing initial business relations;

|

| (b) |

when undertaking occasional or one-off transactions;

|

| (c) |

when there is cause to be suspicious; and

|

| (d) |

when there is doubt about veracity or adequacy of previously obtained customer information.

|

|

|

| 13. |

Information on natural persons

| (1) |

For the purposes of complying with the Act and these Regulations, where a reporting institution seeks to establish the identity of a natural person, it shall in addition to the requirements set out in section 45(1)(a) of the Act, request the following in relation to such person—

| (a) |

full names of the person; and

|

| (b) |

such other particulars as the Centre may prescribe.

|

|

| (2) |

Additional measures that may be used to identify and verify the identity of the customer include—

| (b) |

current physical or residential address;

|

| (c) |

utility bill including among others an electricity or a water bill;

|

| (d) |

occupation or employment details;

|

| (f) |

nature and location of business activity;

|

| (g) |

income tax personal identification number (PIN) issued by Kenya Revenue Authority if such a number has been issued to the customer;

|

| (h) |

where applicable, written references from acknowledged persons attesting to the customer’s identity; and

|

| (i) |

for accounts with more than one party and where one of the parties has identified the others, written confirmation shall be obtained to the effect that the first party has known the other(s) personally for at least twelve months.

|

|

|

| 14. |

Information on legal persons

| (1) |

For the purposes of complying with the Act and these Regulations, where a reporting institution seeks to establish the identity of a legal person or other body corporate, it shall in addition to the requirements set out in section 45(1)(b) of the Act, request the following in relation to such person—

| (b) |

evidence of registration or incorporation such as a certified copy of Certificate of Registration or Certificate of Incorporation, or Memorandum and Articles of Association or other similar documentation evidencing the legal status of the legal person or body corporate;

|

| (c) |

certified copy of board resolution stating authority to open an account or transact business with the reporting institution, and designating persons having signatory authority thereof;

|

| (d) |

the full names, date of birth, identity or passport number and address of the natural persons managing, controlling or owning the body corporate or legal entity;

|

| (e) |