|

|

THE SPECIAL ECONOMIC ZONES REGULATIONS

ARRANGEMENT OF REGULATIONS

PART I – PRELIMINARY

PART II – ADMINISTRATION OF SPECIAL ECONOMIC ZONES AND INSTITUTIONS

| 3. |

Business regulatory environment

|

| 4. |

Measures by Authority to ease registration

|

| 5. |

Enforcement of the Act

|

| 7. |

Factors to guide determination of sanctions

|

| 8. |

Consultation with other stakeholders

|

| 9. |

Delegation by Authority

|

PART III – DESIGNATION AND GAZETTING OF SPECIAL ECONOMIC ZONES

| 10. |

Preliminary review by the Authority on designation of an area

|

| 11. |

Requirements for proposal to designate

|

| 12. |

Review by the Cabinet Secretary

|

| 13. |

Criteria for evaluation

|

| 14. |

Determination of types of zones

|

| 15. |

Addition of territory to an existing special economic zone

|

| 16. |

Revocation or expiry of a special economic zone designation

|

| 17. |

Conversion of export processing zones to special economic zones

|

| 18. |

Recognition by government entities

|

PART IV – LICENSING OF SPECIAL ECONOMIC ZONES DEVELOPERS AND OPERATORS

| 19. |

Development and operation of a special economic zone

|

| 20. |

Review of applications

|

| 21. |

Issue of licences to special economic zone developers and operators.

|

| 22. |

Exercise of rights and obligations of special economic zones developers and operators

|

| 23. |

Rules for special economic zones

|

| 24. |

Cooperation requirements

|

PART V – LICENSING OF SPECIAL ECONOMIC ZONE ENTERPRISES

| 25. |

Electronic methods of registration

|

| 26. |

Application and approval requirements

|

| 27. |

Requirements for issue of special economic zones enterprise licence

|

PART VI – INFORMATION REQUIREMENTS FROM SPECIAL ECONOMIC ZONES END USERS

| 29. |

Registration requirements for special economic zones end users

|

PART VII – ONE-STOP SHOP

| 32. |

One-stop shop services

|

| 33. |

Authority oversight of one-stop shops

|

PART VIII – INVESTMENT RULES FOR SPECIAL ECONOMIC ZONES

| 34. |

Obligations of special economic zone residents

|

| 37. |

Safeguards against speculation

|

PART IX – LAND USE RULES AND BUILDING AND UTILITY CONTROLS

| 38. |

Master plans and zoning orders

|

| 39. |

Maps, surveys, deeds and lease registry

|

| 40. |

Regulation of construction activity

|

| 41. |

Environmental Regulation

|

| 42. |

General environmental management and regulatory responsibility

|

| 43. |

Initial environmental management of special economic zones

|

| 44. |

Environmental and social management system

|

| 45. |

Impact assessment and mitigation plans

|

| 46. |

Issuance of special economic zones environmental permits

|

| 47. |

Enforcement activities

|

| 48. |

Dealing with noncompliance

|

| 50. |

Coordination with other ministries

|

PART IXA – CONDITIONS FOR ENTRY INTO SPECIAL ECONOMIC ZONES

| 50A. |

Entry of persons into Special Economic Zones

|

| 50B. |

Special Economic Zone Workers

|

| 50C. |

Special Economic Zone Residence Permits

|

| 50D. |

Special Economic Zone Residence Pass

|

| 50E. |

Special Economic Zone Visitor Pass

|

PART X – AUTHORITY FUND, SANCTIONS AND FEES

PART XI – IMPLEMENTATION OF THE REGULATIONS

| 53. |

Cooperation agreements with other government entities.

|

| 54. |

Maintenance of an Electronic Register

|

SCHEDULES

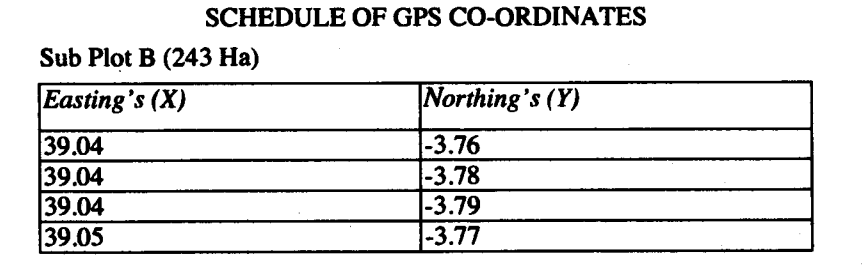

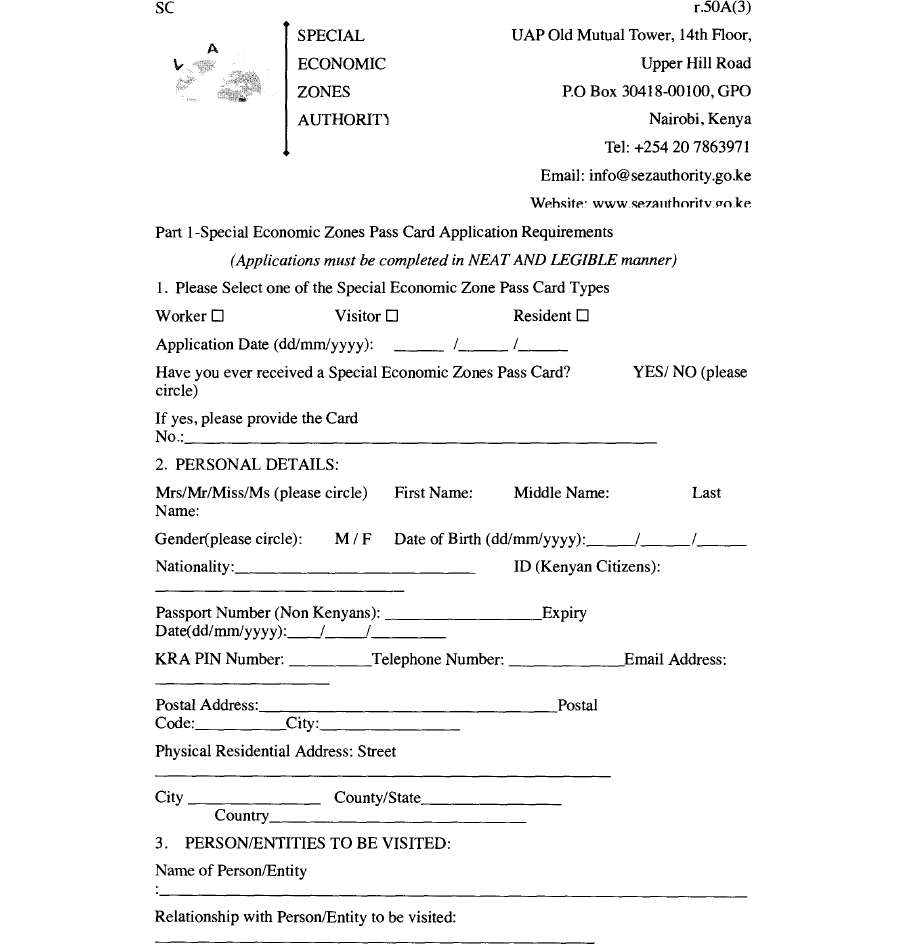

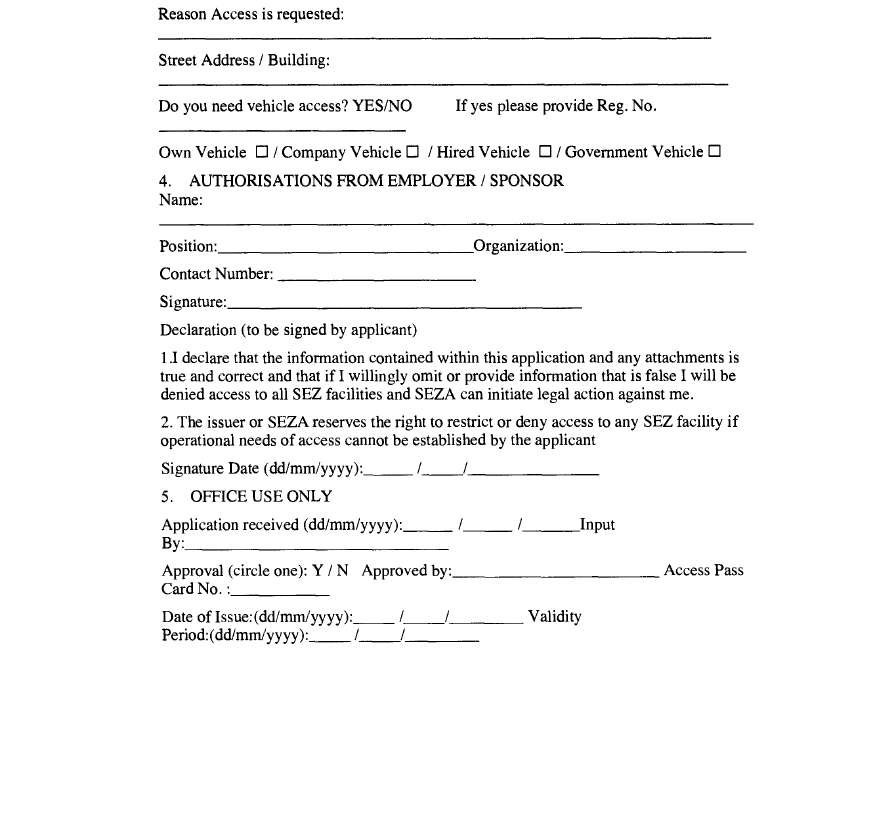

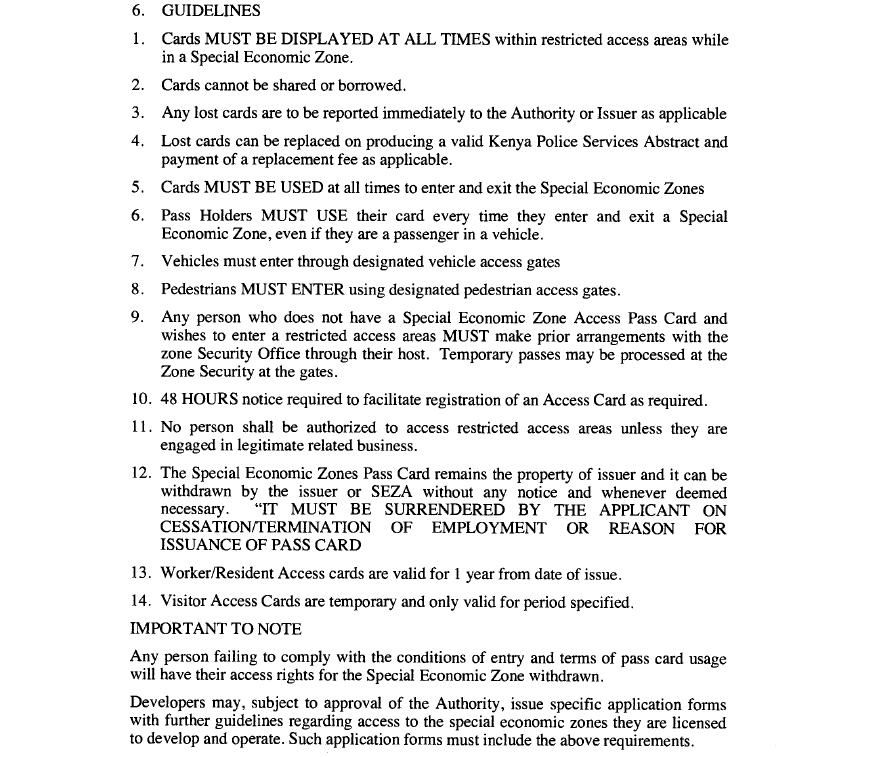

| SCHEDULE [s. 50A(3)] — |

PASS CARD APPLICATION

|

THE SPECIAL ECONOMIC ZONES REGULATIONS, 2016

PART I – PRELIMINARY

| 1. |

Citation

These Regulations may be cited as the Special Economic Zones Regulations 2016.

|

| 2. |

Interpretation

In these Regulations unless the context otherwise requires —

"business activity" means any activity regularly carried on for the production of income from the sale of goods or the performance of services within a special economic zone;

"Chief Executive Officer" means the chief executive officer appointed under section 16 of the Act;

"environmental performance" means measurable results of the Authority or special economic zones end user environmental practices, policies, safeguards, and procedures, based on established environmental quality standards;

"facility" means any location in a special economic zones in which business activities are carried out;

"interest" when used in relation to land and related assets, means any legal right to such assets, including, but not limited to, a freehold interest, leasehold interest, concessionary interest, license, franchise, easement, right of way, security interest, future interest, or any other right of occupancy, use, or development;

"maximum load capacity" means the maximum amount of a pollutant that an environmental media, such as air, land or water, can absorb without exceeding environmental quality standards;

"one-stop shop" means the service of the Authority fully authorised to define, perform, facilitate or mediate all regulatory requirements under applicable law, including those by all relevant government entities, for all special economic zones end users as provided in the Regulations;

"outside party" means a party not within the Authority, but includes all other government, private-sector, foreign governmental and non-governmental entities;

"service level agreement" means a legally binding agreement among government entities defining the operational framework among them in implementation of the special economic zones programme;

"special economic zones end user" means —

| (a) |

a holder of a special economic zones expatriate entry authorisation as defined in these Regulations;

|

| (b) |

a special economic zones enterprise;

|

| (c) |

a special economic zones investor;

|

| (d) |

a special economic zones worker; or

|

| (e) |

a special economic zones visitor; and

|

"special economic zones land" means land and other immovable assets within a special economic zone, including infrastructure, buildings, and other facilities.

|

PART II – ADMINISTRATION OF SPECIAL ECONOMIC ZONES AND INSTITUTIONS

| 3. |

Business regulatory environment

The Authority shall in accordance with the principles of openness and competitiveness under section 3(b) of the Act, maintain an open investment environment within the special economic zones to facilitate and encourage business activity:

Provided that the business activity does not raise any public interest concerns relating to health, safety, environment, national security, consumer protection, culture or financial stability.

|

| 4. |

Measures by Authority to ease registration

The Authority shall take the appropriate measures to establish simple, flexible and transparent procedures for the registration of special economic end users.

|

| 5. |

Enforcement of the Act

| (1) |

Pursuant to its functions under section 11 of the Act, the Authority shall have the powers to administer, investigate, enforce and sanction any activity in order to ensure compliance with the Act.

|

| (2) |

Notwithstanding the generality of paragraph (1), the Authority may —

| (a) |

monitor and conduct inspections of the facilities and activities of all persons registered under the Act; and

|

| (b) |

seize property and close facilities in accordance with the provisions of the Fair Administrative Action Act (No. 4 of 2015) and upon the order of the court.

|

|

| (3) |

The special economic zones developers and operators shall cooperate and provide assistance to the Authority when the Authority undertakes any enforcement action under the Act.

|

| (4) |

The Authority shall give a notice of twenty four hours to a special economic zone end user before an inspection is carried out and the Authority may grant any reasonable request by the special economic zones end user to avoid undue interruption to the business activities of the special economic zones end user.

|

| (5) |

Notwithstanding paragraph (4), the Authority may without notice and at any hour conduct an inspection if it has reasonable cause to believe the relevant laws have been breached.

|

| (6) |

The Authority shall coordinate its investigations with all relevant agencies and provide the necessary information in a timely manner to relevant agencies.

|

| (7) |

The Authority on the order of a court shall have the right to be reimbursed for any expenses incurred to investigate or remedy an offence under the Act.

|

|

| 6. |

Sanctions

| (1) |

Where a special economic zones end user fails to comply with any directives of the Authority or with any provisions of the Act or these Regulations, the Authority shall recommend to the Cabinet Secretary the imposition of an appropriate sanction.

|

| (2) |

Notwithstanding paragraph (1), the Authority may —

| (a) |

delay sanctions for a limited time if the action giving rise to the sanctions is under investigation or is being prosecuted and the imposition of the sanction may be excessive; or

|

| (b) |

waive sanctions if the action giving rise to the sanctions has been adequately punished or redressed by the national or county authorities.

|

|

| (3) |

The Cabinet Secretary may impose the following sanctions against special economic zones end users —

| (a) |

issue a written directive to remedy the breach, omission or violation;

|

| (b) |

restrict the special economic zones end user from engaging in specified activities, despite the existence of a valid licence;

|

| (c) |

suspend the registration;

|

| (d) |

cancel or revoke the registration;

|

| (e) |

seek appropriate redress in a court of law; or

|

| (f) |

apply any other type of sanction, the Authority is authorised to impose under any relevant law.

|

|

| (4) |

Sanctions may not be imposed for an action or omission that was beyond the control of any party or that was not reasonably foreseeable by any party.

|

| (5) |

The Cabinet Secretary may impose one or more of the sanctions under paragraph (3) in addition and without prejudice to any sanction, judgment, order, fine, penalty or punishment imposed by any other relevant government entity as long as the rules of natural justice and the rule of law is observed.

|

|

| 7. |

Factors to guide determination of sanctions

The following factors shall guide a determination of sanctions against a special economic zones end user —

| (a) |

the damage directly or proximately caused by the violation, action or omission, including any harm to —

| (i) |

other special economic zones end users; |

| (ii) |

the Authority or other relevant government entities; |

| (iii) |

persons outside the special economic zones; and |

| (iv) |

the environment, animals or natural resources inside or outside the special economic zones; |

|

| (b) |

the appropriate sanction to deter similar conduct by the person or other persons in similar circumstances, taking into account —

| (i) |

the risk of similar violations, omissions or breaches under similar circumstances going undiscovered or undetected or of the person otherwise not suffering loss for having committed the violation, omission or breach except that the person's purchase of insurance to cover the loss shall not be considered in the determination of sanctions; |

| (ii) |

the potential benefit the person stood to gain from committing a violation, omission or breach or from not taking adequate precautions to avoid a violation, omission or breach; and |

| (iii) |

the ease with which precautions could have been taken to prevent or reduce the risk of committing the violation, omission or breach. |

|

|

| 8. |

Consultation with other stakeholders

In the performance of its functions and exercise of its powers, the Authority shall, where appropriate, consult with the relevant government agencies and the users of the facilities and services of the Authority.

|

| 9. |

Delegation by Authority

| (1) |

The Authority shall in writing, delegate as much responsibility as is practically feasible for the provision of non-regulatory functions conferred to it under any relevant laws to the special economic zones developer, special economic zones operator or any other contracted private-sector services providers.

|

| (2) |

The Authority may delegate the administrative or regulatory functions assigned to it under the relevant laws to a government agency or other service provider by a service level agreement, provided that delegating such functions —

| (a) |

would improve the quality or effectiveness of the function;

|

| (b) |

would not diminish the cost-efficiency with which such functions are carried out;

|

| (c) |

would not impose undue burden on the entities being regulated or interfere with the performance of such a function;

|

| (d) |

would not result in a conflict of interest; and

|

| (e) |

would not be contrary to the public interest or in any way impact the environment, national security, morality, human or animal health in a negative manner.

|

|

|

PART III – DESIGNATION AND GAZETTING OF SPECIAL ECONOMIC ZONES

| 10. |

Preliminary review by the Authority on designation of an area

| (1) |

A proposal for the designation of an area as a special economic zone may be submitted by any person to the Authority.

|

| (2) |

| (a) |

no later than thirty days after receipt of the proposal, inform the person whether the proposal is complete in accordance with the considerations set out under section 5 of the Act and regulation 11; and

|

| (b) |

no later than ninety days after receipt of a complete proposal, consider and determine whether to recommend to the Cabinet Secretary, that an area be designated as a special economic zone.

|

|

|

| 11. |

Requirements for proposal to designate

| (1) |

A proposal under regulation 10 shall be considered complete if it is accompanied by a feasibility study report containing the following —

| (a) |

a market-demand analysis;

|

| (c) |

an economic impact assessment;

|

| (d) |

a strategic environmental and social-impact assessment in accordance with these Regulations; and

|

| (e) |

any other information necessary for the Authority to evaluate the project under each of the criteria set out in section 5 of the Act.

|

|

| (2) |

Notwithstanding paragraph (1), where applicable, any additional requirements under the Public Private Partnerships Act, (No. 15 of 2013) and the law relating to procurement shall be complied with.

|

| (3) |

If an outside party submits a proposal to the Authority under regulation 10, the outside party shall in addition submit, with regard to the same territory —

| (a) |

a special economic zones developer application;

|

| (b) |

a special economic zones operator application, if the area is already developed and no additional development activity is planned; or

|

| (c) |

a special economic zones developer and operator application.

|

|

|

| 12. |

Review by the Cabinet Secretary

| (1) |

The Cabinet Secretary shall review a proposal and recommendation to designate within thirty days of the recommendation by the Authority and —

| (a) |

approve the recommendation; or

|

| (b) |

reject the recommendation;

|

|

| (2) |

Where the Cabinet Secretary rejects a recommendation, the Cabinet Secretary shall —

| (a) |

set out the reasons for the decision in writing; or

|

| (b) |

recommend that the proposal is modified so that it may comply with the Act or these Regulations before it is approved ; and

|

| (c) |

retain a copy of the proposal and recommendation and protect the confidentiality of the contents of the proposal.

|

|

| (3) |

Where a designation is likely to raise public interest concerns, the Cabinet Secretary shall publish a preliminary notice, which shall —

| (a) |

provide the geographical location, boundary specifications, map coordinates, property registration information, and proposed economic activities of the planned special economic zones; and

|

| (b) |

invite any person that may be affected by the designation to submit written comments to the Cabinet Secretary no later than thirty days of the publication date of the notice.

|

|

| (4) |

No later than sixty days after publication of the notice under paragraph (3), the Cabinet Secretary shall evaluate the comments, data and any other information based on the evaluation criteria under regulation 13 and the criteria in section 5 of the Act and approve or reject the proposal to designate the area as a special economic zone.

|

| (5) |

Where the Cabinet Secretary recommends modifications to the proposal to designate under paragraph (2), he or she shall consult with the Authority and, if the proposal was submitted by an outside party, the respective outside party and if the Authority and the applicant agree in writing to the proposed modifications, the Cabinet Secretary shall, no later than twenty days of receiving communication from the Authority to this effect, publish the declaration of the special economic zone in the Gazette.

|

| (6) |

Where the Authority makes a negative determination regarding a proposal to designate by an outside party, the outside party may appeal to the Cabinet Secretary.

|

|

| 13. |

Criteria for evaluation

| (1) |

The Cabinet Secretary shall designate an area as a special economic zone if it meets the following conditions —

| (a) |

land availability, including —

| (i) |

sufficient dimension of the proposed special economic zone to support a diverse and competitive business environment; |

| (ii) |

ease of identifying interests in the land of the proposed special economic zones and ease of resolving any potential disputes and claims; and |

| (iii) |

ability to expand the capacity of the land in the proposed special economic zones in the event of positive special economic zones investment uptake and economic impact; |

|

| (b) |

industrial economics and dynamics criteria including the presence of business activity and multiple enterprises engaged in formal, registered economic activity within proximity of the boundaries of the proposed special economic zone which could be potential partners of or anchor tenants in the special economic zones;

|

| (c) |

accessibility and connectivity criteria including —

| (i) |

access roads within proximity of the boundaries of the proposed special economic zone; |

| (ii) |

reasonable access to an airport, railway, dry-port, seaport or border post within proximity of the boundaries of the proposed special economic zone; |

| (iii) |

reasonable access to adequate labour and consumption markets within proximity of the boundaries of the proposed special economic zone; |

| (iv) |

upstream raw materials or distribution centres for semi-finished inputs within proximity of the boundaries of the proposed special economic zone; or |

| (v) |

downstream processing or distribution points for special economic zones' exports within proximity of the boundaries of the proposed special economic zone; |

|

| (d) |

infrastructure criteria including —

| (i) |

fresh surface water, aquifers, or water-distribution networks within proximity of the boundaries of the proposed special economic zone; |

| (ii) |

existing or reliably planned access to waste water treatment and sewerage within reasonable proximity of the proposed special economic zone; |

| (iii) |

roads inside or outside the proposed special economic zone within proximity of the boundaries of the proposed special economic zones; |

| (iv) |

social infrastructure, including schools, hospitals, hotels, retail business, and places of worship within proximity of the boundaries of the proposed special economic zone; |

| (v) |

structures within the boundaries of the proposed special economic zone that may be converted for special economic zone use; or |

| (vi) |

suitable distance of proposed special economic zones assets from dangerous infrastructure; |

|

| (e) |

socio-environmental criteria including —

| (i) |

compliance with socio-environmental requirements under any relevant laws; |

| (ii) |

suitable climate for the expected activities in the proposed special economic zone; |

| (iii) |

absence of significant flooding risk to the proposed special economic zone site; |

| (iv) |

suitability of the proposed site in light of its cultural context and the perspectives and rights of local communities; |

| (v) |

adequate security conditions in the area; |

| (vi) |

presence of significant religious, cultural, or similar assets that can be properly integrated into the special economic zones planning framework; |

| (vii) |

absence of any significant health risks within the area of the proposed special economic zone; and |

| (viii) |

ability to relocate population in a socio-economically acceptable manner if the proposed special economic zone would involve population displacement as well as to relocate agricultural, commercial or other industrial activities in a cost-effective manner; |

|

| (f) |

topographical and construction constraints, including —

| (ii) |

soil and subsidence conditions; |

| (iii) |

erosion conditions; |

| (iv) |

soil contamination; and |

| (v) |

other construction constraints; |

|

| (g) |

development impact potential, including the likelihood of —

| (i) |

raising the quality of life and expanding opportunities for lower-income populations; |

| (ii) |

producing positive social and economic spillover effects outside the proposed special economic zones; |

| (iii) |

positively influencing regional or national infrastructure planning; |

| (iv) |

coherence with other development projects in the area; |

| (v) |

coherence with land-use master plans; |

| (vi) |

skills-development and training of workforce; |

| (vii) |

increased economic diversification; |

| (viii) |

national employment generation; |

| (ix) |

increased wages and working standards; and |

| (x) |

reliable testing and catalysing of beneficial reforms for nation-wide implementation. |

|

|

| (2) |

The Cabinet Secretary shall, publish in the Gazette, the appropriate distance dimensions of the special economic zones from the proximity-based criteria set out in paragraph (1).

|

|

| 14. |

Determination of types of zones

| (1) |

The Cabinet Secretary may designate a special economic zone on public or private land.

|

| (2) |

The Cabinet Secretary may classify a special economic zone as one or more of the types of zones specified in section 4(6) of the Act if the information submitted in support of designation demonstrates that —

| (a) |

there is strong market demand for the specialisation indicated by the classification;

|

| (b) |

the specialisation advances the identified development goals of Kenya;

|

| (c) |

the location to be designated is well suited for the specialisation; and

|

| (d) |

the designation has been requested by the special economic zone developer or special economic zone operator.

|

|

| (3) |

The Authority shall by notice in the Gazette prescribe the descriptions and standards for classifying special economic zones under section 4(6) of the Act and the applicable services, infrastructure and policies applicable to these classifications.

|

| (4) |

All special economic zones, regardless of their type, shall be open to all business activities eligible for special economic zone enterprise licenses under these Regulations.

|

|

| 15. |

Addition of territory to an existing special economic zone

| (1) |

A special economic zones developer or operator may apply to the Cabinet Secretary to add land to an existing special economic zone in accordance with these Regulations.

|

| (2) |

The procedures and requirements for the designation of an additional special economic zone shall apply when evaluating an application under paragraph (1) except that any relevant information that may have been submitted shall be taken into account by the Authority in order to expedite the evaluation.

|

|

| 16. |

Revocation or expiry of a special economic zone designation

| (1) |

The Cabinet Secretary may revoke a declaration under section 4(2) of the Act from any portion or all of the territory of a special economic zone upon the recommendation of the Authority and where the Authority presents evidence establishing that —

| (a) |

the designation no longer serves the objectives of the Act;

|

| (b) |

the revocation would not amount to discrimination; and

|

| (c) |

the revocation will be carried out in accordance with due process of the law and ensure the protection of private property and guarantees against expropriation as are provided for under any relevant laws.

|

|

| (2) |

Unless otherwise stated in the final designation of the special economic zone, a special economic zone designation shall expire if after three years after the designation, the Authority has not licensed a special economic zones developer in accordance with the Act and these Regulations.

|

|

| 17. |

Conversion of export processing zones to special economic zones

Any export processing zones developer, export processing zones operator or export processing zones enterprise may apply for designation as a special economic zones developer or special economic zones operator or special economic zones enterprise subject to the provisions of the Act and these Regulations.

|

| 18. |

Recognition by government entities

All relevant government entities, including national and county governments, shall recognize and comply with the Cabinet Secretary's designation of special economic zones under the Act and these Regulations.

|

PART IV – LICENSING OF SPECIAL ECONOMIC ZONES DEVELOPERS AND OPERATORS

| 19. |

Development and operation of a special economic zone

| (1) |

For the development of a designated public or private public private partnership based special economic zone, the Authority shall select and conclude an agreement with a special economic zones developer for the development of a special economic zone.

|

| (2) |

The Authority shall permit the special economic zones developer selected under paragraph (1) to —

| (a) |

operate the special economic zone provided that the developer has been licensed as a special economic zones operator under the Act; or

|

| (b) |

select one or more special economic zones operators to operate the special economic zone.

|

|

| (3) |

Where a special economic zones developer selects a special economic zones operator, the special economic zones developer shall conclude an operator agreement with the special economic zones operator and —

| (a) |

the Authority shall not be party to the operator agreement and shall only regulate the special economic zones operator to the same extent as special economic zones enterprises:

|

| (i) |

the special economic zones developer maintains legal responsibility and liability for all actions of the special economic zones operator and all sub-contractors of the special economic zones operator; and |

| (ii) |

the provisions of the operator agreement are consistent with the developer agreement; |

| (b) |

the Authority shall issue a license to the special economic zones operator in accordance with the Act and these Regulations. |

|

| (4) |

Where the special economic zones developer declines to select a special economic zones operator, the Authority shall, following the provisions of the developer agreement, select one or more special economic zones operators and conclude operator agreements with them for the operation, management and provision of services for the special economic zones.

|

| (5) |

The Authority shall publish in the Gazette, the selection criteria and procedures for the operator agreement.

|

| (6) |

Where there is an existing special economic zone, the Authority may select a special economic zones operator in accordance with the criteria and procedures set out in the notice under paragraph (5).

|

| (7) |

Where a special economic zones operator of an existing special economic zones intends to expand the project, the Authority may —

| (a) |

allow the special economic zones operator to develop the land itself, provided the operator has been licensed as a special economic zones developer;

|

| (b) |

allow the special economic zones operator to select one or more special economic zones developers; or

|

| (c) |

select one or more special economic zones developers in accordance with these Regulations.

|

|

| (8) |

Where the special economic zones operator selects a special economic zones developer, the special economic zones operator shall conclude a developer agreement with the special economic zones developer and —

| (a) |

the Authority shall not be party to the special economic zones developer agreement and shall regulate the special economic zones developer to the same extent as other special economic zones enterprises:

|

| (i) |

the special economic zones operator maintains legal responsibility and liability for all actions of the special economic zones developer and all sub contractors of the special economic zones developer; and |

| (ii) |

all the provisions of the developer agreement are consistent with the operator agreement; |

| (a) |

the Authority shall issue a license to the special economic zones developer in accordance with the Act and these Regulations. |

|

|

| 20. |

Review of applications

The Authority shall, by notice in the Gazette provide the procedures and criteria for the review of applications for licences for special economic zone developers and operators.

|

| 21. |

Issue of licences to special economic zone developers and operators.

| (1) |

Upon conclusion of an agreement under these Regulations and the payment of such licensing fees as shall be specified by the Authority, the Authority shall issue the special economic zones developer or operator with a special economic zones developer's or operator's license.

|

| (2) |

The special economic zones developer's or operator's license shall authorise the developer or operator as the case may be to conduct the activities described in the agreement.

|

| (3) |

The special economic zones developer's or operator's licenses shall remain valid for an indefinite period of time unless the —

| (a) |

special economic zones developer's or operator's land lease or concession term expires;

|

| (b) |

special economic zones developer's or operator's agreement term expires; or

|

| (c) |

licence is revoked by the Authority.

|

|

| (4) |

The Authority shall publish in the Gazette, the standards and procedures for suspension, revocation and reinstatement of the licences.

|

|

| 22. |

Exercise of rights and obligations of special economic zones developers and operators

The special economic zones developers and operators licensed under the Act shall —

| (a) |

develop and operate their respective special economic zones —

| (i) |

in a commercial manner; |

| (ii) |

in conformity with international good practices and applicable laws; and |

| (iii) |

in consistence with the long-term sustainable economic and human development goals of Kenya; |

|

| (b) |

comply with the conditions in their respective agreements;

|

| (c) |

not sell or lease special economic zones land to any person other than a special economic zones developer, operator or resident unless authorised by the Authority;

|

| (d) |

develop and implement an effective environmental and social management system approved by the Authority in accordance with the Regulations;

|

| (e) |

ensure equal treatment and avoidance of discrimination in the delivery of services to special economic zones end users;

|

| (f) |

monitor and supervise activities in the special economic zones for compliance with the Act and these Regulations;

|

| (g) |

notify the Authority immediately upon becoming aware of any violation or non-compliance with the Act and these Regulations within their respective areas of operation; and

|

| (h) |

comply with all of the obligations imposed on special economic zones enterprises under the Act and these Regulations.

|

|

| 23. |

Rules for special economic zones

| (1) |

Special economic zones developers and operators shall coordinate with the Authority to develop, deliver services and maintain facilities used by the Authority including the one-stop centre headquarters and other one-stop shops established in the respective special economic zones.

|

| (2) |

The Authority may delegate to a special economic zones developer or operator the responsibility for establishing and enforcing special economic zones rules on the following matters —

| (a) |

building structure design, aesthetics, density, and height;

|

| (b) |

obstructions of public areas;

|

| (c) |

vehicle movement and parking;

|

| (d) |

use of hazardous or flammable materials;

|

| (h) |

maintenance requirements;

|

| (k) |

public billing and signage; and

|

| (l) |

any other matter approved by the Authority and is compatible with the relevant laws.

|

|

| (3) |

Notwithstanding paragraph (2), the Authority may only delegate the responsibility for making the rules if a developer or operator has the capacity to monitor compliance with the rules.

|

| (4) |

The special economic zones developers and operators may recommend sanctions or other measures to the Authority against special economic zones end users for violations, breaches or omissions of rules made pursuant to these Regulations.

|

| (5) |

The special economic zones developers and special economic zones operators may enforce sanctions to ensure compliance with the rules.

|

|

| 24. |

Cooperation requirements

Government entities, including national and county governments, shall —

| (a) |

recognise the rights and obligations vested on the special economic zones developers or operators and other service providers for special economic zones, under the Act and the relevant developer or operator agreements;

|

| (b) |

allow and provide reasonable access to areas around designated special economic zones for the development of supporting infrastructure for the special economic zones and the Authority shall allow and provide reasonable access to areas inside special economic zones; and

|

| (c) |

conclude service level agreements as are necessary, to coordinate the required capacity and time frame of infrastructure and utilities delivery.

|

|

PART V – LICENSING OF SPECIAL ECONOMIC ZONE ENTERPRISES

| 25. |

Electronic methods of registration

| (1) |

The Authority shall design an electronic system to facilitate the registration process and other administrative matters under the Act or these Regulations.

|

| (2) |

An electronic signature shall be valid for any registration or licensing requirement under the Act or these Regulations.

|

| (3) |

An applicant may make an application for registration through the one-stop shop.

|

| (4) |

Notwithstanding paragraphs (1) and (2), the Authority may require an applicant or their agent to appear in person, or to participate in a telephone, video or voice over internet protocol conference, for an interview.

|

|

| 26. |

Application and approval requirements

| (1) |

The Authority shall by notice in the Gazette specify the required information for registration, license and permit applications for special economic zones enterprises and residents and the procedures for approving such applications.

|

| (2) |

There shall be no limit or quota on the number of special economic zone enterprises or residents registered or on the number of licenses issued for special economic zone enterprises, provided that all applicants secure an approval from their relevant special economic zone operators in accordance with the procedures set out in the Gazette and the requirements of the specific special economic zone master plan and zoning plans.

|

| (3) |

A licence for a special economic zone enterprise may be issued —

| (a) |

to investments of a prescribed minimum size as may be determined by the Authority;

|

| (b) |

regardless of whether the applicants are new businesses, expansions of existing businesses or relocations of existing businesses; and

|

| (c) |

regardless of whether the special economic zone is the business's primary place of business.

|

|

| (4) |

The Authority shall enter into service level agreements with county and the relevant national government entities, in order to—

| (a) |

co-ordinate information sharing;

|

| (b) |

consolidate and streamline procedures; and

|

| (c) |

support the regulatory functions of relevant government entities with respect to the activities of special economic zone enterprises and residents:

|

Provided that the service level agreements shall, to the extent possible, not impose of any additional burdens on the special economic zone enterprises and residents.

|

|

| 27. |

Requirements for issue of special economic zones enterprise licence

When evaluating an application for a special economic zone enterprise licence, the Authority shall ensure the following requirements are met —

| (a) |

technical health or safety requirements as prescribed by the Authority in accordance with international standards, except that different or more stringent standards may be imposed where the Authority is certain, for reasons relating to the special economic zone's specific physical, social, economic, or cultural characteristics or context, that such standards do not fulfil the required level of protection;

|

| (b) |

policy requirements for the protection of public health, national or public security, labour, safety, consumer protection or general financial matters for instance financial institutions, commercial banks, and insurance companies;

|

| (c) |

environmental protection requirements, which may incorporate measures included in the applicant's environmental impact statement as provided in these Regulations and the relevant laws; and

|

| (d) |

requirements directly related to mitigating potential threats to consumer protection, culture and financial stability.

|

|

| 28. |

Negative list

| (1) |

The Cabinet Secretary shall, on receiving a recommendation from the Authority, publish a negative list of activities that are prohibited or restricted from being undertaken within the special economic zones.

|

| (2) |

The restricted activities under paragraph (1), shall include, any activity likely to pose a substantial threat to health, safety, environment, national security, consumer rights, culture and financial stability.

|

| (3) |

The Authority may approve the conduct of any restricted activity provided the applicant demonstrates that it can adequately mitigate or avoid the risks set out under paragraph (2).

|

| (4) |

The Authority shall provide the necessary assistance to any person intending to make an application for the conduct of restricted activity including providing a description of the information and documents necessary to support an application for each type of restricted activity.

|

| (5) |

The prohibited activities under paragraph (1) shall include those activities that pose a threat to health, safety, environment, national security, consumer protection, culture and financial stability and for which there is no possibility of avoiding or mitigating the threat.

|

| (6) |

The Cabinet Secretary shall regularly review the negative list of activities.

|

| (7) |

A special economic zones licensee seeking to expand its activities and undertake an activity that is not in the negative list, may notify the Authority of this intention but the licensee need not apply for a new licence to conduct the new activity.

|

| (8) |

A special economic zones licensee seeking to expand its activities and undertake a restricted activity shall apply for a separate permit for that activity.

|

|

PART VI – INFORMATION REQUIREMENTS FROM SPECIAL ECONOMIC ZONES END USERS

| 29. |

Registration requirements for special economic zones end users

| (1) |

The Authority shall specify the information to be provided by a person applying for a special economic zones end user licence.

|

| (2) |

A person applying for a permit to engage in business activities within the special economic zone shall provide similar information to that required for approval for a licence under the Act except that the Authority may waive certain requirements based on the nature of activity to be carried out.

|

| (3) |

The Authority shall from time to time publish in the Gazette, the fees to be paid by an applicant.

|

| (4) |

An applicant for special economic zone resident status, shall file and annually update this information as shall be specified by the Authority.

|

| (5) |

Every special economic zone enterprise shall be required to provide such information as is required to help the Authority monitor and evaluate the performance of the special economic zone programme and the Authority shall protect the confidentiality of this information.

|

| (6) |

The Authority shall prescribe the information required in paragraph (5).

|

|

| 30. |

Annual Returns

All special economic zone developers, operators and enterprises shall annually submit to the Authority the following information with regard to the relevant special economic zone-

| (a) |

special economic zone investments undertaken during the preceding calendar year and the investments projected for the forthcoming calendar year, including number, size, employment, investment level, and business activities of all special economic zone enterprises;

|

| (b) |

total area of special economic zone land, buildings and infrastructure under development, and the projects being constructed thereon;

|

| (c) |

all performance indicators specified in the special economic zone developer agreement or special economic zone operator agreement, and required by the Authority for monitoring and evaluation purposes;

|

| (d) |

letters of continued financial good standing from the special economic zone developer's or special economic zone operators' financial institutions; and

|

| (e) |

any other information that the Authority may require.

|

|

PART VII – ONE-STOP SHOP

| 31. |

One-stop shop

| (1) |

Pursuant to section 11 (h) of the Act, the Authority shall administer a one-stop shop for each special economic zone and a central coordinating one-stop shop at the headquarters of the Authority to facilitate performance of all the functions, powers, and responsibilities assigned to the Authority.

|

| (2) |

| (a) |

deploy such number of staff; and

|

| (b) |

request the relevant government entities deploy such number of staff as may be required for the performance of the functions of the one-stop shops.

|

|

| (3) |

Each special economic zone developer or special economic zone operator shall provide sufficient space for the one-stop shop at no cost within the special economic zone they operate and comply with the requirements of the Authority with regards to the one-stop shops.

|

|

| 32. |

One-stop shop services

| (1) |

Notwithstanding regulation 32, the one-stop centre and one-stop shops shall offer the following services —

| (a) |

process special economic zone resident registration and business licensing documents and related reporting information required of special economic zone end users, and issue related licenses or certifications;

|

| (b) |

process and issue work visas and permits for expatriates operating within the special economic zones;

|

| (c) |

process and issue development and construction permits and certificates of occupancy;

|

| (d) |

process and issue environmental permits in accordance with the Regulations and the requirements of the Authority;

|

| (e) |

evaluate proposals to designate areas as special economic zones;

|

| (f) |

evaluate registration applications for special economic zone developers and operators;

|

| (g) |

facilitate tax and customs administration requirements for special economic zone end users on behalf of the Kenya Revenue Authority;

|

| (h) |

facilitate labour reporting obligations;

|

| (i) |

perform inspections and other enforcement activities or coordinate enforcement activities with the relevant government entities;

|

| (j) |

provide prompt answers to all questions regarding all government requirements or services;

|

| (k) |

receive payments, applications, and requests on behalf of the Authority or other relevant government entities; and

|

| (l) |

respond to complaints by special economic zone end users in relation to special economic zones.

|

| (m) |

assistance with start-up, operation, and closing of economic activities within the special economic zones;

|

| (n) |

technical assistance programmes for new and young entrepreneurs;

|

| (o) |

business training, general assistance, and counselling;

|

| (p) |

feasibility studies and markets research;

|

| (q) |

financial advisory services and grant assistance;

|

| (r) |

information on production, marketing, operating plans, finance, export opportunities, recruitment, and training; and

|

| (s) |

financial support for domestic small businesses.

|

|

|

| 33. |

Authority oversight of one-stop shops

To develop and maintain the capacity of the one-stop shops to fulfil its purposes, the Authority shall —

| (a) |

have the powers and oversight responsibilities necessary to effectively manage staff deployed to the one-stop shops;

|

| (b) |

issue and enforce internal rules and regulations, standard operating procedures, and codes of conduct for staff deployed to the one-stop shop; and

|

| (c) |

charge user fees and charges for the services offered at the one-stop shop.

|

|

PART VIII – INVESTMENT RULES FOR SPECIAL ECONOMIC ZONES

| 34. |

Obligations of special economic zone residents

Special economic zone residents shall —

| (a) |

provide updated information to the one-stop shops on any change in the particulars submitted for registration or licensing, no later than fifteen days after the change;

|

| (b) |

upon request by the Authority or any relevant government entity provide proof of registration;

|

| (c) |

notify the Authority prior to any change in activities that relate to the conditions upon which the licence was issued;

|

| (d) |

acquire and take possession of real estate within the relevant special economic zones no later than sixty days after the date the licence is issued,

|

unless otherwise stated in the licence;

| (e) |

commence construction or business activities authorised by the licence no later than one year after the date the licence is issued unless otherwise stated in the licence, failing which the license shall expire;

|

| (f) |

manage any waste produced as a result of its activities;

|

| (g) |

maintain company books, records, accounts, and financial statements in accordance with the International Financial Reporting Standards and such books, records, accounts, and financial statements shall be subject to independent audits as required under the relevant laws;

|

| (h) |

record, in an automated inventory-control and record keeping system, any information required under the laws relating to customs;

|

| (i) |

promptly notify the Authority of any actual or potential discrepancy discovered between its records and those of the Kenya Revenue Authority;

|

| (j) |

maintain separate records for activities within special economic zones and activities outside special economic zones, if the special economic zones enterprise conducts simultaneous economic activities within and outside the special economic zones;

|

| (k) |

assume full responsibility, as well as tax and penal liability, for all goods that cannot be accounted for, including such liability as may result from a presumption that such goods were leaked from a special economic zone into the customs territory;

|

| (l) |

cooperate with the Authority and all other relevant government entities by granting such entities access to its premises and records to inspect and verify compliance with the relevant laws; and

|

| (m) |

comply with the laws relating to tax.

|

|

| 35. |

National treatment

| (1) |

The Authority and all other relevant government entities shall accord to special economic zones end users of foreign nationality, treatment equal to that accorded to nationals with respect to all business activities, in accordance with the Constitution and the relevant laws.

|

| (2) |

All special economic zones enterprises, including special economic zones developers and operators shall —

| (a) |

be entitled to freely exercise any business activity open to similar domestic or foreign businesses as approved by the Authority;

|

| (b) |

not be subject to any minimum capital requirements when reinvesting profits in new or existing projects; and

|

| (c) |

not be subject to any foreign ownership limits or domestic ownership requirements.

|

|

|

| 36. |

Expropriation

| (1) |

The Government may only appropriate an interest in land where the expropriation —

| (a) |

serves a significant public purpose;

|

| (b) |

has not been carried out in a discriminatory manner;

|

| (c) |

has been carried out in accordance with the due process of law; and

|

| (d) |

complies with all other principles of applicable law, including the principles of full protection, security and fair and equitable treatment.

|

|

| (2) |

Where possible, the property shall be returned when the seizure is no longer necessary.

|

| (3) |

For the purposes of this section, a "public purpose" includes seizures made out of necessity in response to war, grave disturbance of public order or urgent social interest.

|

|

| 37. |

Safeguards against speculation

| (1) |

A special economic zone developer shall not sell or lease land within the special economic zone to any person other than a special economic zone enterprise or resident without authorisation by the Authority and may only sell or lease subject to the applicable master plans and zoning requirements.

|

| (2) |

Any construction or development activity on land leased or purchased under paragraph (1) shall commence within two years of the date of purchase or in accordance with the terms specified in applicable agreements between the parties or whichever is the lesser.

|

| (3) |

If the Authority establishes that any action under paragraph (1) was committed to encourage speculative investment in special economic zone land, the Authority shall take one or more of the following actions as may be considered appropriate for the determination of sanctions under these Regulations —

| (a) |

impose on the purchaser the payment of the fair market value of the transferred title or lease less the inflation adjusted cost if the transfer was on a freehold basis;

|

| (b) |

void and rescind the applicable initial lease or sale agreement;

|

| (c) |

seize the purchaser's interest in the special economic zone land and convey it to the party that validly transferred the interest to the purchaser initially; and

|

| (d) |

impose on the purchaser the payment of rent on the transferred special economic zone land for six months until another special economic zone enterprise or resident purchases or leases the land:

|

Provided that the rent shall be paid to the benefit of the party that validly transferred the interest to the special economic zone land initially.

|

| (4) |

For purposes of implementing these Regulations, the Authority shall keep track of the annual fair market value of special economic zone lands.

|

|

PART IX – LAND USE RULES AND BUILDING AND UTILITY CONTROLS

| 38. |

Master plans and zoning orders

| (1) |

The Authority shall consider proposed land use master plans submitted by applicants for a special economic zone developer or operator licence as well as any proposed master plans emanating from the Authority itself, and shall collaborate with the county government officer responsible for planning and selected special economic zone developers and operators to finalise the master plan and the zoning orders for each special economic zone.

|

| (2) |

The Authority shall ensure that all master plans and zoning plans within the special economic zones do not conflict with existing land use controls for the areas surrounding the special economic zones or related development objectives of the neighbouring county governments.

|

| (3) |

For any land within a designated special economic zone, any master plan and zoning order made by the Authority shall supersede any previous conflicting land use controls for the same land.

|

| (4) |

The Authority shall, by notice in the Gazette, prescribe the procedures and criteria for approving or rejecting land use master plans and zoning criteria developed by special economic zone developers or operators.

|

|

| 39. |

Maps, surveys, deeds and lease registry

| (1) |

The Authority shall establish and maintain a registry of special economic zones maps, surveys, deeds and leases within one year of its operationalization.

|

| (2) |

The registry established under paragraph (1) shall Include a comprehensive map containing data on all real property in the special economic zones and the registered interests in those properties.

|

| (3) |

The Authority shall publish in the Gazette, the information required under paragraph (2).

|

| (4) |

The registry established under paragraph (1) shall be accessible to the public.

|

| (5) |

The Authority shall enter into service level agreements with the Ministry responsible for matters relating to lands or the relevant county government in order to address any inter-governmental technical matters required for the implementation of these Regulations.

|

|

| 40. |

Regulation of construction activity

| (1) |

The Authority shall by notice in the Gazette prescribe a Building Code, development and construction permits, certificates of occupancy, procedures and criteria for the approval of development and construction works for special economic zones.

|

| (2) |

The one-stop shops shall facilitate the manner in which all the permits under paragraph (1) can be obtained from the respective authorized entities by an applicant.

|

| (3) |

All the relevant government entities, including the county governments, shall cooperate with the Authority in any matter related to land use planning, development and regulation of construction in order to give effect to the Act.

|

|

| 41. |

Environmental Regulation

| (1) |

The Authority or the relevant government entity shall not permit the following within the special economic zones —

| (a) |

the emission of any substance beyond specified thresholds into water, air, or land;

|

| (b) |

noise above the specified decibel limits set by the Authority for particular areas;

|

| (c) |

intensive exploitation of natural resources over de minimis levels prescribed by the Authority for particular resources;

|

| (d) |

nuisance affecting the ability of special economic zone end users or persons outside the special economic zones to enjoy or use their property; and

|

| (e) |

contributions to ozone depletion or global warming over de minimis levels prescribed by the Authority.

|

|

| (2) |

The enforcement of this regulation including permits, waivers, monitoring, inspections, audits and enforcement shall be the responsibility of —

| (a) |

the National Environment Management Authority with regards to the operations of special economic zone developers and operators; and

|

| (b) |

the Authority with regards to special economic zone enterprises.

|

|

| (3) |

Notwithstanding paragraph (2), the Authority and the National Environment Management Authority shall conclude a service level agreement to facilitate the execution of their respective roles and responsibilities under the Act and the application of all applicable standards, procedures, fees and charges within the special economic zones.

|

|

| 42. |

General environmental management and regulatory responsibility

| (1) |

The National Environment Management Authority or the Authority shall issue environmental permits to authorize certain activities under the Act and may publish a list of activities that do not require special economic zone environmental permits.

|

| (2) |

The list of activities that do not require special economic zone environmental permits shall include the activities that are not reasonably predicted to have a significant impact on the environment, either because of their nature or because of the scale under which they will be performed.

|

| (3) |

A special economic zone developer or operator shall not undertake any activity that requires environmental permits without the environmental permit.

|

| (4) |

Notwithstanding the generality of paragraph (1) the activities that require an environmental permit shall include, but not be limited to —

| (a) |

the construction, installation, operation, modification, or extension of sewage works;

|

| (b) |

the construction, installation, operation, modification, or extension of any new transmission or release outlet for the release of pollutants;

|

| (c) |

the construction, installation, operation, modification, or extension of any infrastructure projects or industrial or commercial facilities where such activities will cause an increase in the release of pollutants or otherwise alter the physical, chemical, or biological properties of land, air, or water in any manner not already authorised under applicable law; and

|

| (d) |

any increase in volume of released pollutants in excess of the permitted volume specified under any existing permit.

|

|

| (5) |

The Authority and the National Environment Management Authority, as the case may be, shall only issue special economic zone environmental permits upon approval of an environmental impact assessment.

|

| (6) |

For the avoidance of doubt, the special economic zone environmental permit issued under these Regulations shall comply with the requirements of the Environment Management and Coordination Act, (No. 5 of 2015.)

|

|

| 43. |

Initial environmental management of special economic zones

| (1) |

Prior to the operationalisation of a special economic zone, on the basis of a baseline environmental survey of the land, air, and water in the special economic zone submitted by the special economic zone developer, the Authority, in consultation with the National Environment Management Authority, shall establish special economic zones environmental quality standards and maximum load capacities for specified pollutants, applicable to a specific special economic zone project site.

|

| (2) |

The standards and load capacities developed under paragraph (1) shall form the basis for the volume of pollutants and wastes permitted to be released.

|

| (3) |

The National Environment Management Authority shall in consultation with the Authority, review the special economic zones environmental quality standards at least once every three years to determine their adequacy in light of current national environmental priorities and revise them as appropriate.

|

| (4) |

The standards determined under paragraph (1) shall not be below the prescribed national levels, but may be set at a higher or stricter level.

|

| (5) |

Upon completion of the baseline environmental survey and establishment of the environmental quality standards, the National Environment Management Authority shall identify and establish procedures for addressing the existing environmental challenges and concerns in collaboration with the relevant special economic zones developer or operator and the Authority.

|

| (6) |

The National Environment Management Authority, in consultation with the Authority, shall have the power to designate protected areas within special economic zones to protect water supplies, bio diversity or other environmental resources.

|

| (7) |

The Authority in consultation with the National Environment Management Authority, shall, by notice in the Gazette, provide further procedures and standards for environmental management consistent with these Regulations.

|

|

| 44. |

Environmental and social management system

| (1) |

Prior to commencing any works or extension works on the land within a special economic zone, the special economic zones developer, in coordination with the relevant special economic zones operator, shall develop an environmental and social management system for the special economic zones.

|

| (2) |

The environmental and social management system shall be appropriate to the nature and scale of the proposed development, operational activities and the level of foreseen social and environmental impacts.

|

| (3) |

The social and environmental management system, including all environmental and social audit reports and hazard or risk assessment reports, shall be prepared in accordance with the relevant laws and accepted international practice.

|

| (4) |

Notwithstanding paragraph (3), the standards shall comply with the IS014001 Environmental Management Systems, Occupational Health and Safety Standards 18001, Social Accountability (humane workplace and worker human rights) SA8000 standards and the United Nations Convention on the Rights of Persons with Disabilities.

|

| (5) |

The Authority shall, in consultation with the National Environment Management Authority, by notice in the Gazette, provide further requirements for special economic zonessocial and environmental management systems.

|

|

| 45. |

Impact assessment and mitigation plans

| (1) |

In order to ensure that the environmental burdens resulting from development or other activities are reduced as much as possible —

| (a) |

every special economic zone developer shall submit an environmental and social impact assessment; and

|

| (b) |

all other persons applying for a special economic zone environmental permit shall submit an environmental impact assessment to the National Environment Management Authority and a copy to the Authority in accordance with this regulation.

|

|

| (2) |

Once all significant impacts have been identified, the applicants shall develop a mitigation action that contains the strategies for addressing the identified environmental social risks and impacts.

|

| (3) |

Upon completion of the impact assessment and mitigation action plan, special economic zones' developers and operators shall prepare an environmental and social impact statement and the other applicants shall prepare an environmental impact statement.

|

| (4) |

The Authority, in consultation with the National Environment Management Authority, shall by notice in the Gazette specify the required elements for impact assessments, mitigation action plans, impact statements, the criteria and procedures for approving the assessments, plans, and guidelines for implementing them.

|

|

| 46. |

Issuance of special economic zones environmental permits

| (1) |

If the National Environment Management Authority or the Authority approves an impact statement, the Authority shall issue a special economic zone environmental permit, which shall allow the applicant to conduct the activities specified in the impact statement, subject to all specified mitigation action plans and permit conditions.

|

| (2) |

The Authority may impose conditions on the special economic zones environmental permits to limit the permit to certain procedures, releases or other activities based on the impact statement.

|

| (3) |

The National Environment Management Authority or the Authority, as the case may be, shall ensure that the conditions imposed under paragraph (2), limit the amount of permitted releases by assigning each relevant permit holder, a load allocation and the load allocation shall be determined based on —

| (a) |

the maximum load capacities such that the sum total of each pollutant, waste or other substance allowed to be released into air, land, or water under the permits does not exceed any maximum load capacity;

|

| (b) |

the amount of releases reasonably necessary for the type of industry applying for the permit as demonstrated in the impact statement; and

|

| (c) |

the expected number of industries that will need similar permits in and around the special economic zone in the future.

|

|

|

| 47. |

Enforcement activities

| (1) |

The Authority based on information collected from the special economic zone end users, shall compile a special economic zone environmental database and conduct annual inventories, which shall be shared with the National Environmental Management Authority and be used to monitor special economic zone permit holders' compliance with environmental obligations.

|

| (2) |

A special economic zone environmental permit holder shall every six months, report compliance with all permit conditions in the manner specified in the impact statement and submit the report to the Authority and a copy to the National Environment Management Authority.

|

| (3) |

The Authority may inspect any special economic zone facility at any time, with or without notice, to gather information on the environmental performance of the special economic zone end users or on all environmental aspects to their activities for the purpose of monitoring and enforcing compliance with the relevant laws.

|

| (4) |

The Authority may, at reasonable time of day, access and copy records retained by the operator of the facility, inspect any monitoring equipment or methods to determine accuracy, and acquire environmental samples.

|

| (5) |

The National Environment Management Authority may conduct related inspections provided that these inspections are coordinated through the one-stop shops so as to minimise disruption and avoid unnecessary duplication.

|

| (6) |

In order to ensure compliance with the relevant laws, —

| (a) |

the Authority may conduct environmental audits of facilities within the special economic zones; and

|

| (b) |

the National Environment Management Authority may conduct environmental audits of facilities within the special economic zones and any area surrounding the special economic zones.

|

|

| (7) |

The audits under paragraph (6), shall be prioritised for areas or facilities that —

| (a) |

engage in activities that have potentially serious negative environmental impacts;

|

| (b) |

have had previous poor environmental performances;

|

| (c) |

have been subjected to or caused, or are suspected to have been subjected to or caused, serious environmental harm; or

|

| (d) |

are in environmentally sensitive locations or near vulnerable communities based on the data obtained from baseline assessments and environmental and social impact assessments.

|

|

|

| 48. |

Dealing with noncompliance

| (1) |

If the Authority or the National Environment Management Authority as the case may be, discovers non-compliance with the relevant laws, including any permit condition, it shall notify the special economic zones end user and the relevant special economic zone developer or operator, if different from the special economic zones end user concerned.

|

| (2) |

The National Environment Management Authority in coordination with the Authority shall make rules to enforce paragraph (1).

|

|

| 49. |

Public Health

| (1) |

The Authority shall, in coordination with the relevant government entities responsible for public health ensure the protection of human, animal and plant life from diseases and any other harm in accordance with the relevant laws.

|

| (2) |

The Authority in consultation with the relevant government entities responsible for public health, shall issue the applicable procedures for the inspection and control of persons, baggage, carriers and merchandise entering the special economic zones that may pose a threat to human, animal, or plant health and the inspections and controls shall be conducted by the personnel of the relevant government entities.

|

|

| 50. |

Coordination with other ministries

| (1) |

The Authority and the ministries responsible for environment, water and natural resources shall share any information requested by either party and shall attach, second or deploy staff and provide technical assistance and training to each other as requested.

|

| (2) |

The Authority may conclude service level agreements with the Ministries responsible for environment, water and natural resources for the conduct of any of the functions under these Regulations.

|

|

PART X – AUTHORITY FUND, SANCTIONS AND FEES

| 51. |

Fees

| (1) |

The Authority shall publish a schedule of the fees that the Authority may charge for any of the authorised activities under the Act, including any fees for registration, permitting, and licensing.

|

| (2) |

The Authority shall regularly update the fee schedule as necessary to comply with the Regulations and to facilitate an effective regulatory system.

|

|

| 52. |

Collection of fees

| (1) |

The Authority shall publish a schedule of all the fees, levies and charges owed to the relevant government entities in connection with the establishment and operation of a business within a special economic zone, including any registration, permitting, and licensing fees.

|

| (2) |

The fees under paragraph (1) shall include the following —

| (a) |

incorporation or registration of companies charges;

|

| (b) |

fees for legal and professional services related to the company operations;

|

| (c) |

socio-environmental impact assessment and mitigation plan filing and evaluation fees and the annual information update fees;

|

| (d) |

land rates and land rent;

|

| (e) |

public utility connection charges;

|

| (g) |

national social security fund levies;

|

| (h) |

national hospital insurance fund levies;

|

| (j) |

any other statutory fee applicable for activities authorised under the Act.

|

|

| (3) |

The Authority may consolidate the fees, levies or charges imposed on special economic zone enterprises as may be required under the relevant laws.

|

| (4) |

The fees under this Regulation may be paid through the one stop shop and the Authority shall remit the fees to the relevant government entities in accordance with the terms of service level agreements entered into by the Authority and the relevant government entities.

|

| (5) |

The Authority shall regularly update the fee schedule to comply with the Regulations and facilitate an effective regulatory system.

|

|

PART XI – IMPLEMENTATION OF THE REGULATIONS

| 53. |

Cooperation agreements with other government entities.

| (1) |

All relevant government entities shall cooperate with the Authority in the implementation of the Act and these Regulations by entering into service level agreements with the Authority to —

| (a) |

facilitate the processing of permits, licenses, registrations, and other approvals;

|

| (b) |

facilitate the collection of any fees, fines or penalties;

|

| (c) |

coordinate, monitor, inspect or otherwise enforce any provision of the Act;

|

| (d) |

undertake any activity that may be lawfully undertaken jointly by them

|

| (e) |

facilitate the training of the one-stop centre staff to perform their functions effectively;

|

| (f) |

share information with the Authority through shared electronic databases and other means as necessary;

|

| (g) |

hold regular meetings to coordinate activities and facilitate communication as often as necessary;

|

| (h) |

regulate the attachment, secondment or deployment of staff to the special economic zones; and

|

| (i) |

coordinate inspections or investigations so as to avoid unnecessary disruption or interference with the normal and lawful activities of special economic zones end users.

|

|

| (2) |

The Authority may take measures with regard to any of the matters provided for under the Act and the Regulations if —

| (a) |

the relevant government entities do not form a service level agreement or other agreement adequately addressing all needs, constraints, or special economic zones end user demands within one financial year after the date of operational effectiveness of the Authority; or

|

| (b) |