|

Arrangement of Sections

|

-

THE INSURANCE REGULATIONS, 1986

-

Part I – PRELIMINARY

-

Part II – REGISTRATION OF INSURERS

-

Part III – ADMITTED ASSETS AND ADMITTED LIABILITIES

-

Part IV – ACCOUNTS, BALANCE SHEETS, AUDIT AND ACTUARIAL INVESTIGATIONS

-

Part V – MANAGEMENT AND EXPENSES

-

Part VI – POLICY TERMS

-

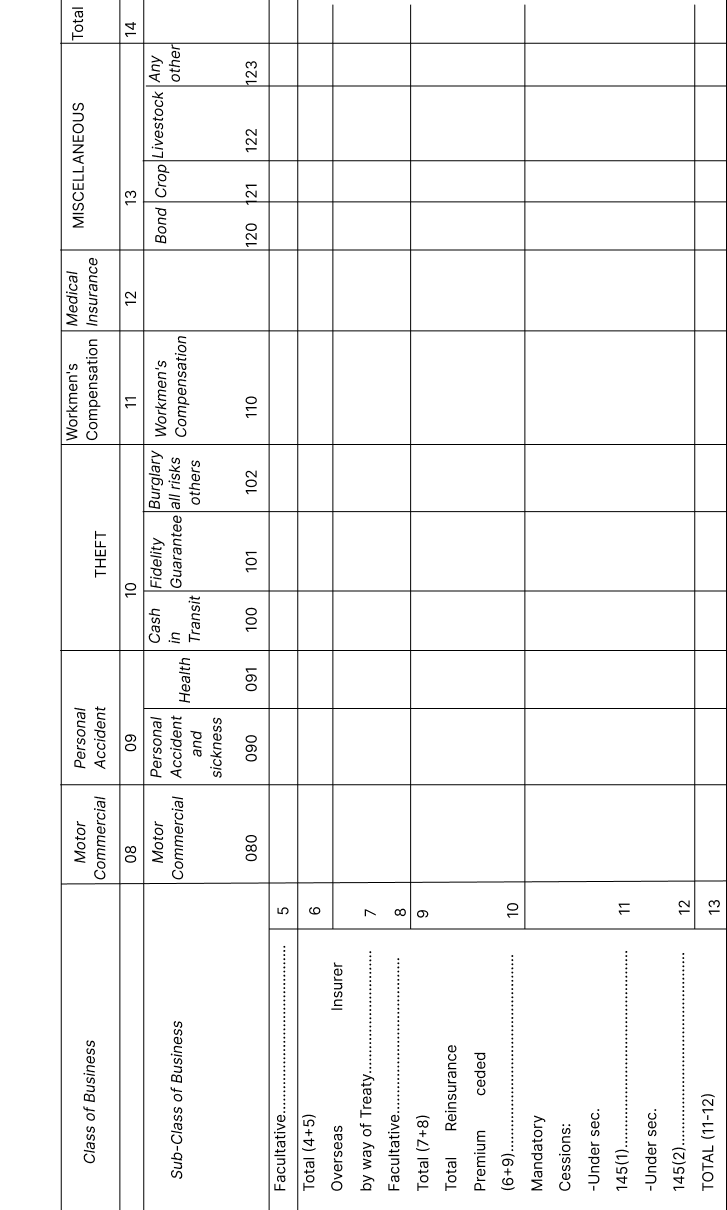

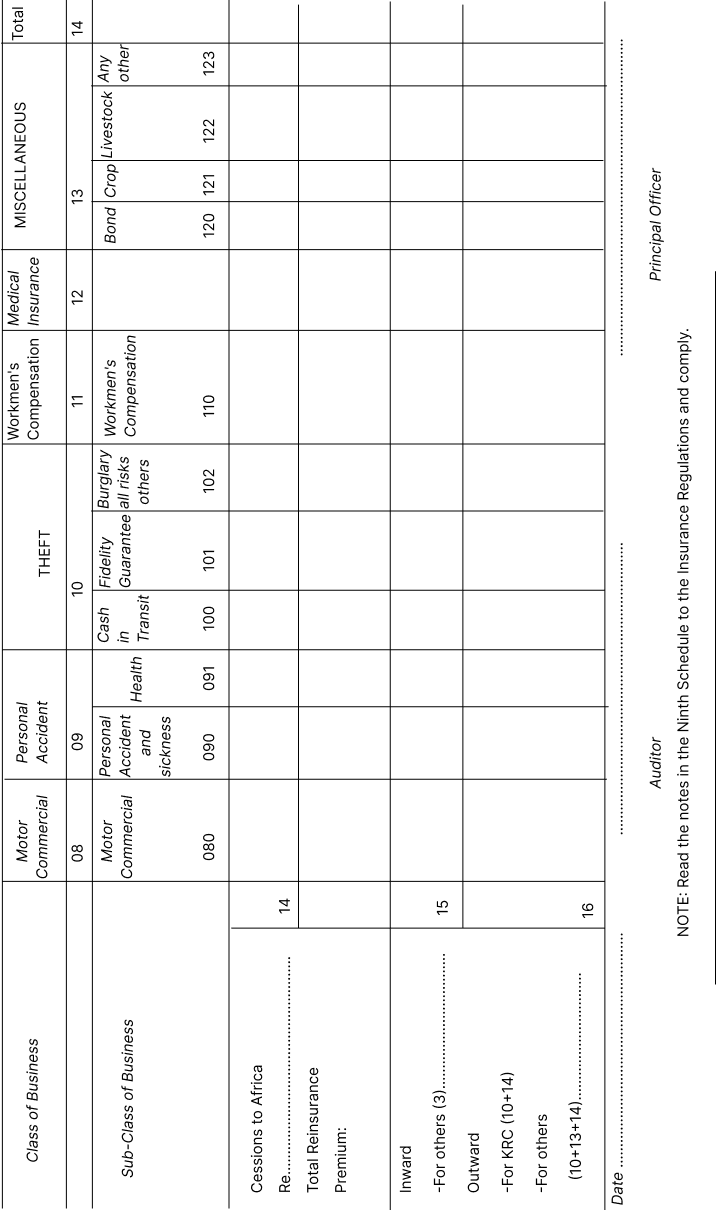

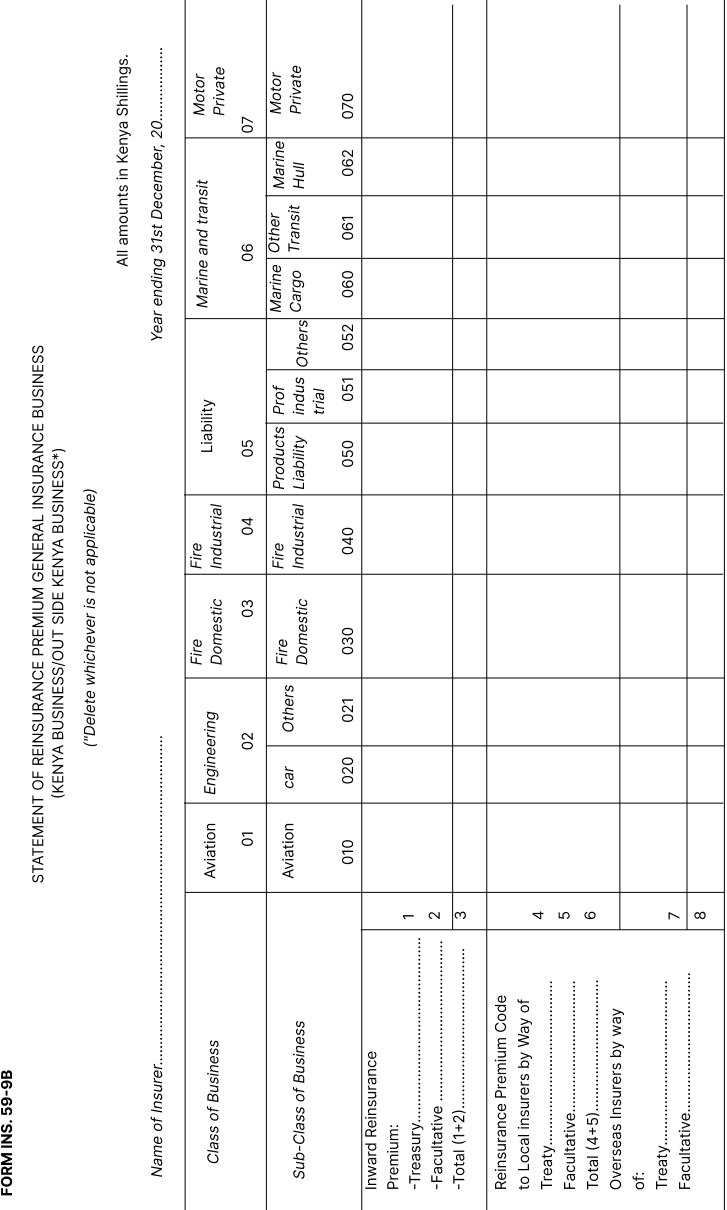

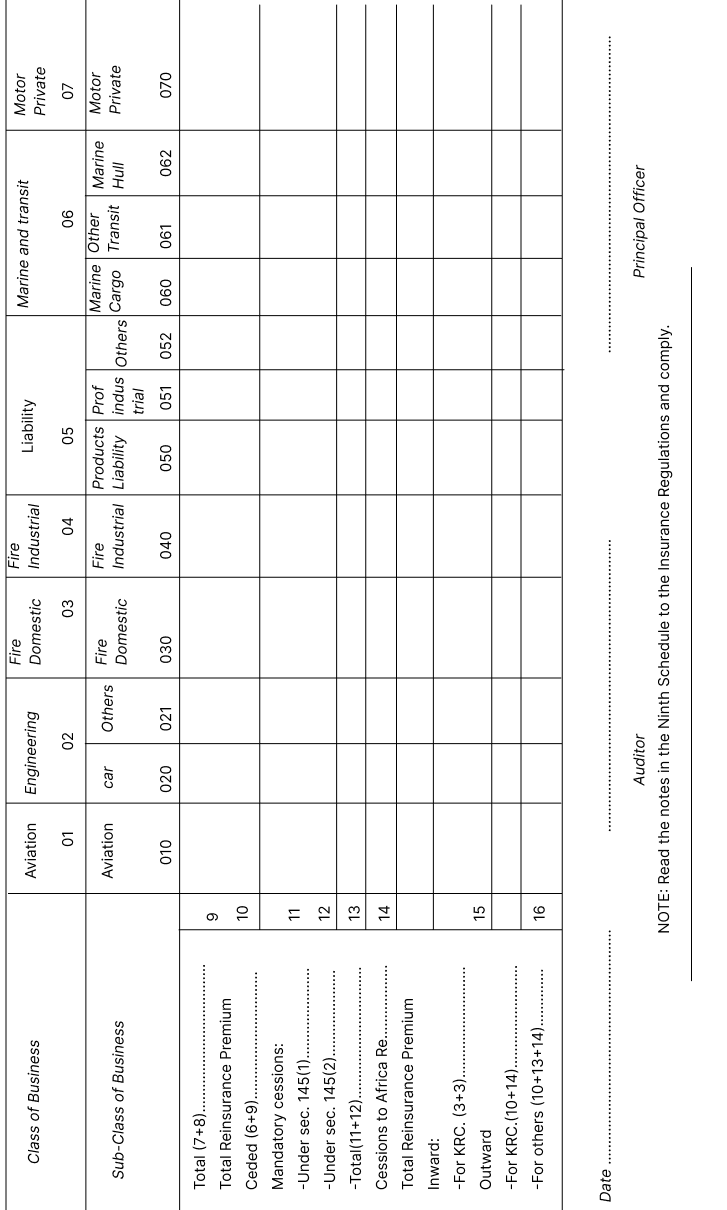

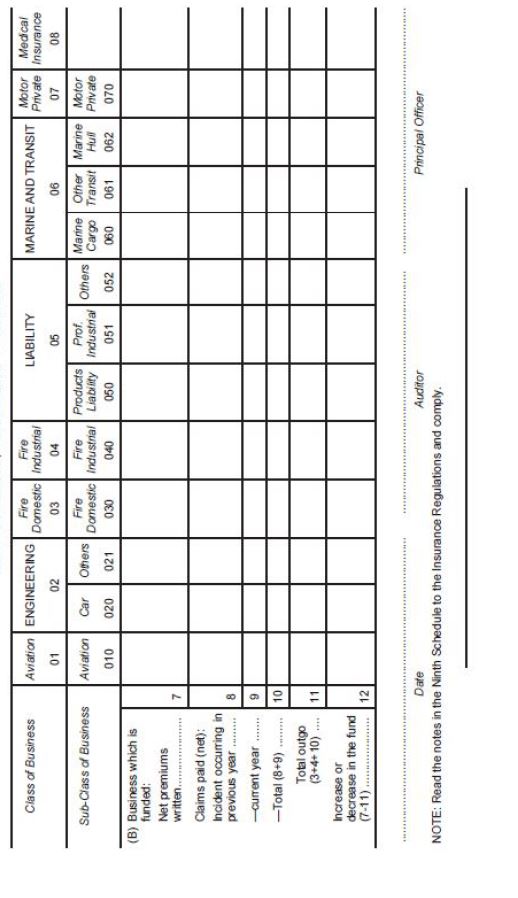

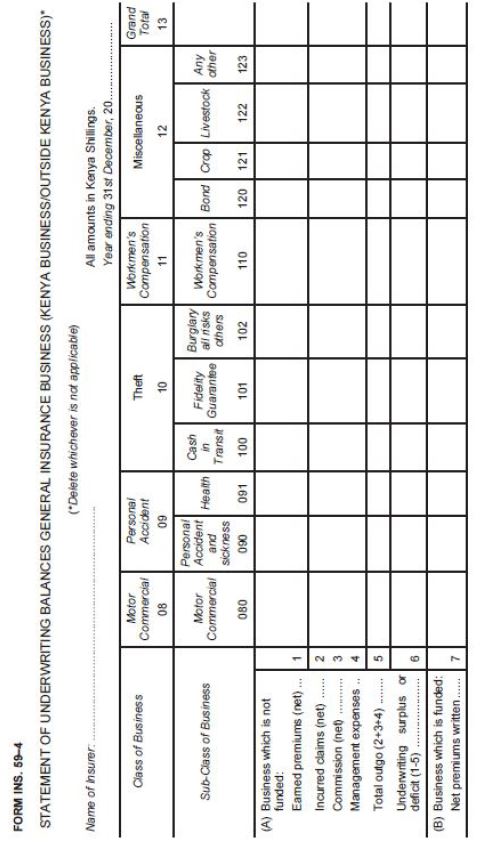

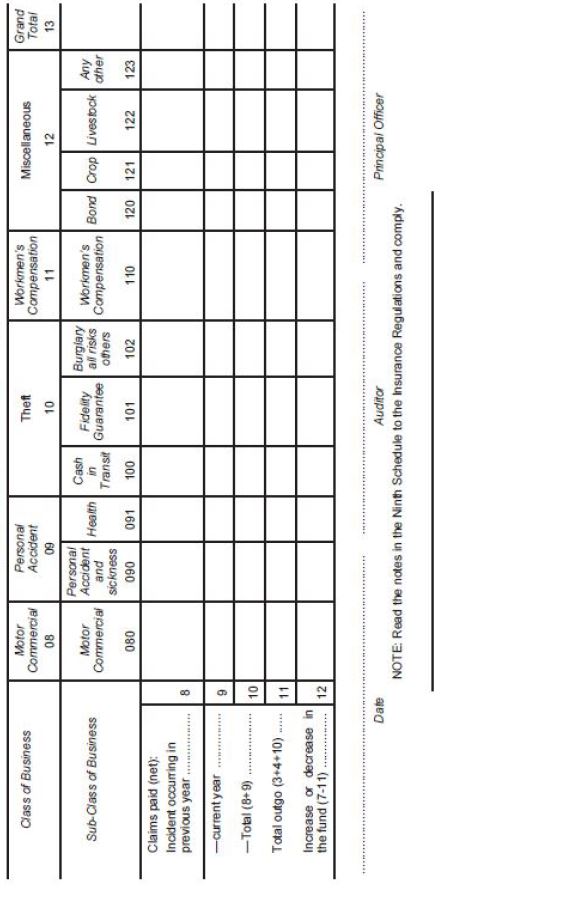

Part VII – NOMINATIONS

-

Part VIII – CLAIMS ON SMALL LIFE POLICIES

-

Part IX – MANDATORY REINSURANCE CESSIONS

-

Part X – INTERMEDIARIES, CLAIMS SETTLING AGENTS, INSURANCE SURVEYORS, MEDICAL INSURANCE PROVIDERS, LOSS ADJUSTERS, MOTOR ASSESSORS, INSURANCE INVESTIGATORS AND RISK MANAGERS

-

Part XI – ADVANCE PAYMENT OF PREMIUM

-

Part XII – GENERAL PROVISIONS

-

Part XIII – SUPPLEMENTARY PROVISIONS

-

FIRST SCHEDULE [s. 30 and 188(2) and r. 5 and 48.]

-

SECOND SCHEDULE

-

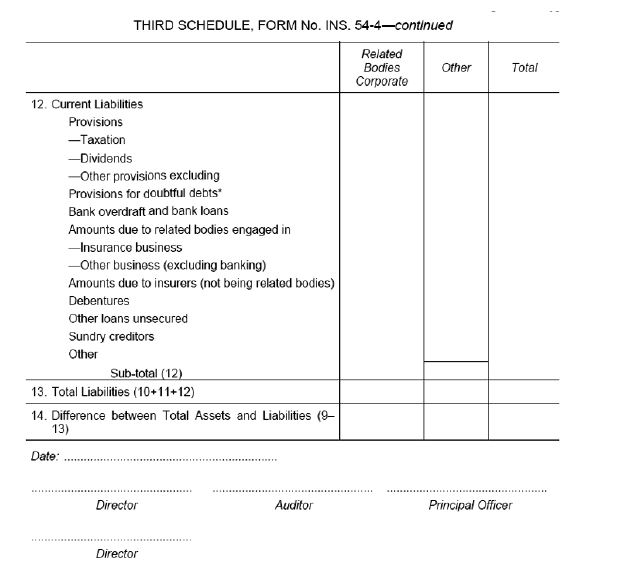

THIRD SCHEDULE[s. 52 and r. 10]

-

FOURTH SCHEDULE [s. 57(1)(b) and r. 12]

-

FIFTH SCHEDULE [s. 57(3) and r. 13]

-

SIXTH SCHEDULE [S. 57(5) and r. 14]

-

SEVENTH SCHEDULE [s. 58(3) and r. 15]

-

EIGHTH SCHEDULE [Regulation 16]

-

NINTH SCHEDULE

-

TENTH SCHEDULE [s. 70 and r. 21]

-

ELEVENTH SCHEDULE [L.N. 108/2002, r. 7, L.N. 59/2011, r. 6, L.N. 57/2012, r. 18, s. 73(2) and r. 22.]

-

TWELFTH SCHEDULE [s. 88(1) and r. 24.]

-

THIRTEENTH SCHEDULE [s. 89(3) and r. 25]

-

FOURTEENTH SCHEDULE [s. 111(1) and Regulation 29]

-

FIFTEENTH SCHEDULE [r. 32 and 33]

-

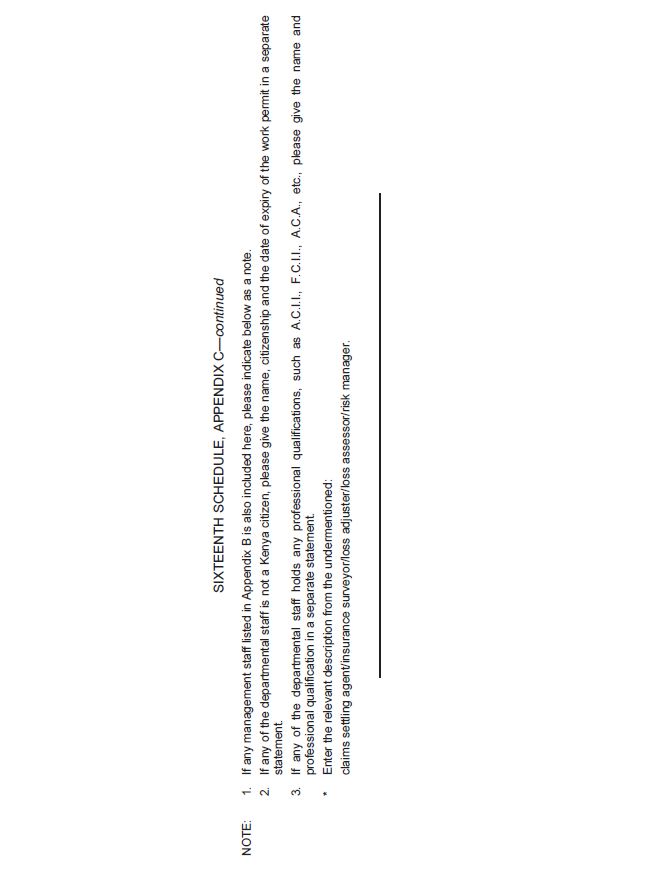

SIXTEENTH SCHEDULE

-

SEVENTEENTH SCHEDULE [L.N. 108/2002, r. 8, s. 151(1)(a) and r. 35.]

-

EIGHTEENTH SCHEDULE

-

NINETEENTH SCHEDULE [s. 39]

-

TWENTIETH SCHEDULE

-

TWENTY-FIRST SCHEDULE [L.N.51/201, r.8]

-

TWENTY-SECOND SCHEDULE [r. 34(2)]

-

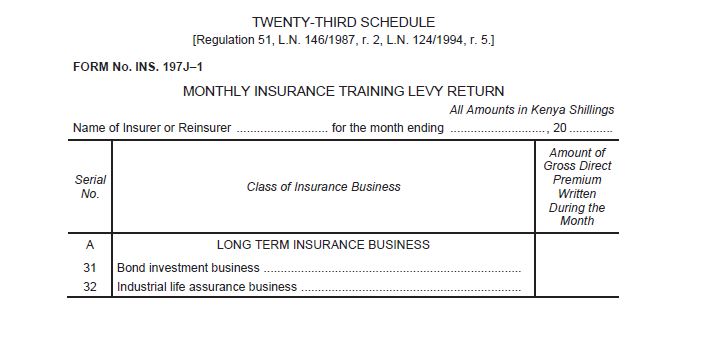

TWENTY-THIRD SCHEDULE

-

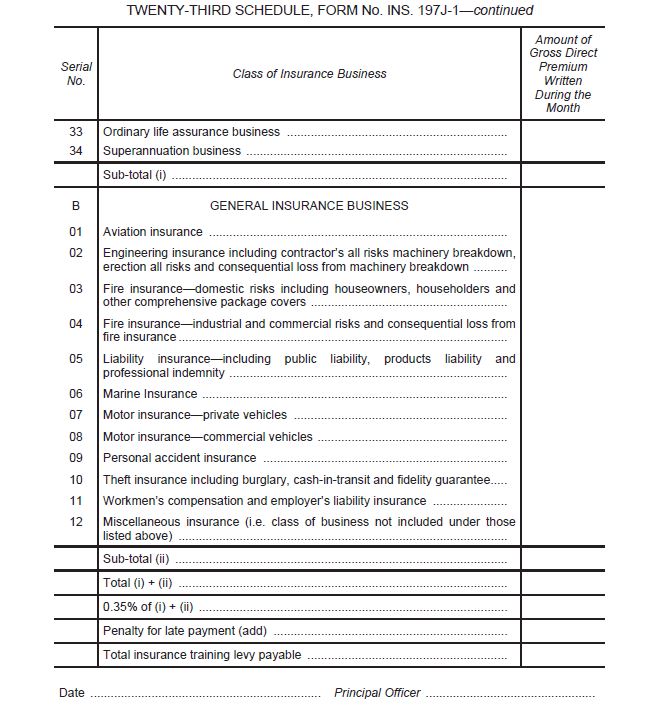

TWENTY-FOURTH SCHEDULE SCHEDULE

-

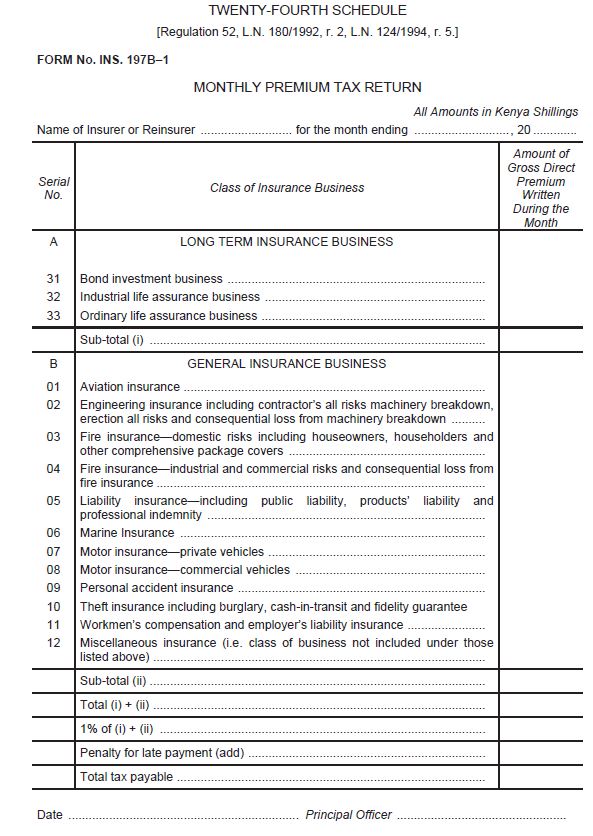

TWENTY-FIFTH SCHEDULE

-

TWENTY-SIXTH SCHEDULE

-

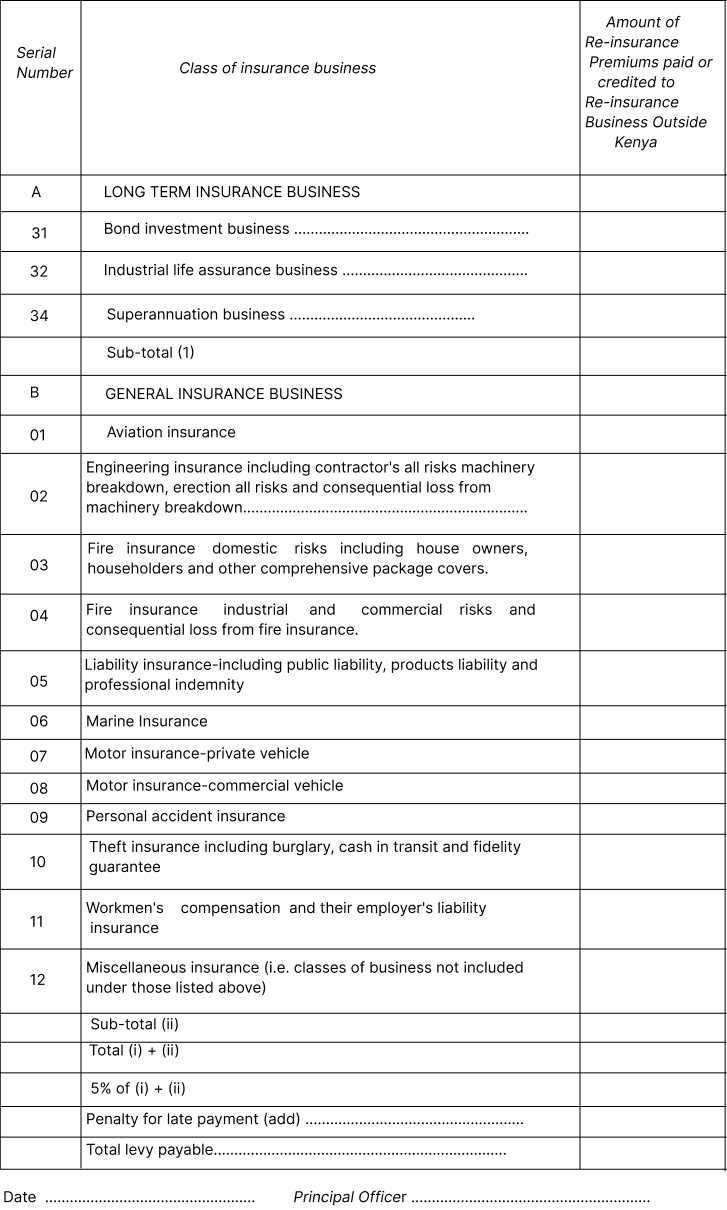

TWENTY-SEVENTH SCHEDULE [L.N. 124/1994, r. 6, L.N. 87/1996, r. 2, L.N. 135/2007.]

-

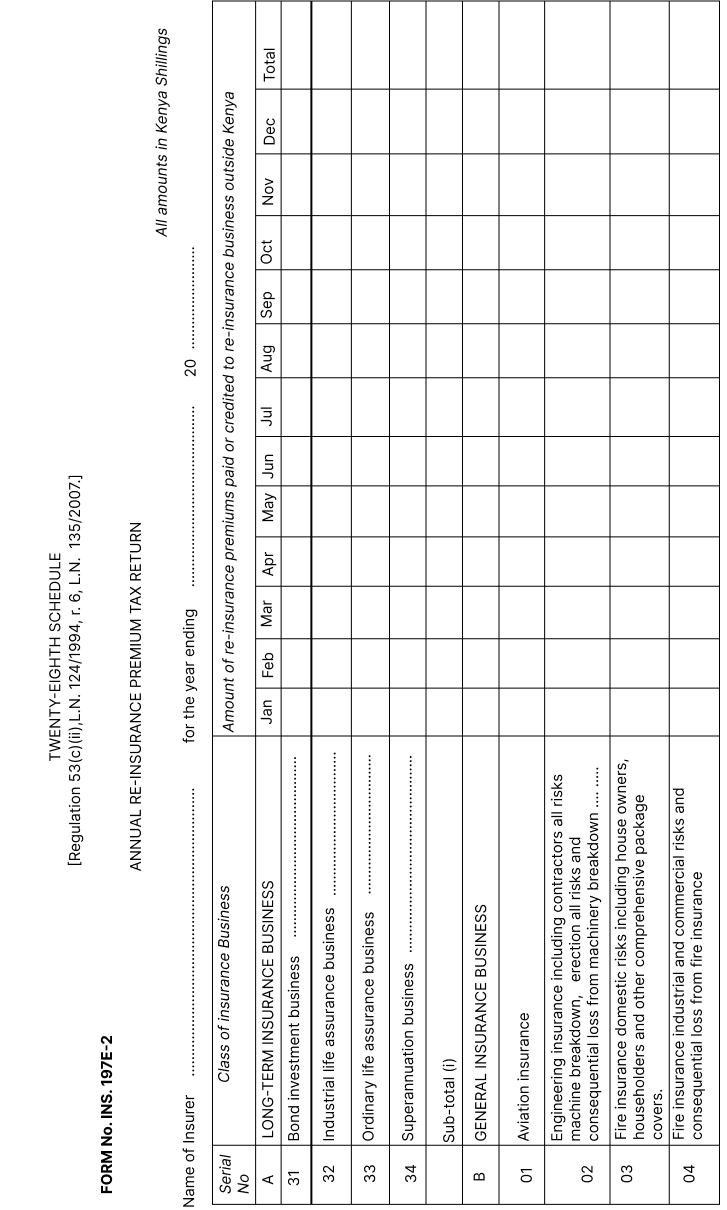

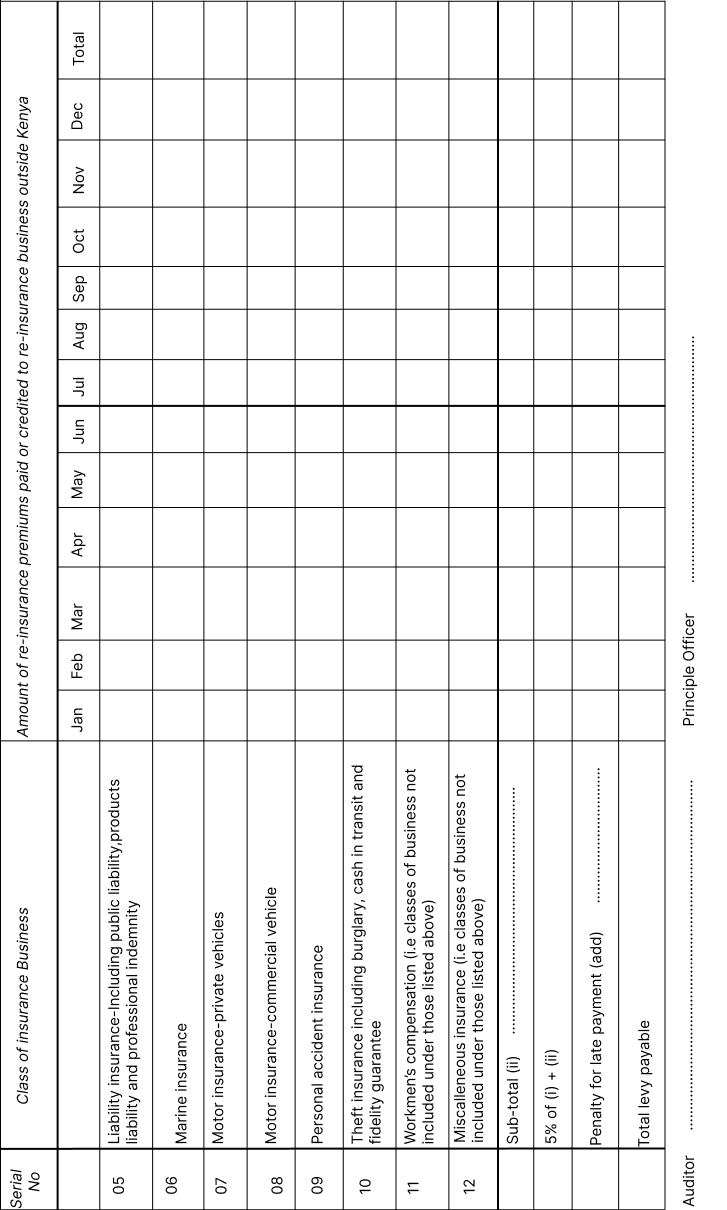

TWENTY-EIGHTH SCHEDULE

-

TWENTY-NINTH SCHEDULE

-

THE INSURANCE REGULATIONS

-

Part I – PRELIMINARY

-

Part II – REGISTRATION OF INSURERS

-

Part III – ADMITTED ASSETS AND ADMITTED LIABILITIES

-

Part IV – ACCOUNTS, BALANCE SHEETS, AUDIT AND ACTUARIAL INVESTIGATIONS

-

Part V – MANAGEMENT AND EXPENSES

-

Part VI – POLICY TERMS

-

Part VII – NOMINATIONS

-

Part VIII – CLAIMS ON SMALL LIFE POLICIES

-

Part IX – MANDATORY REINSURANCE CESSIONS

-

Part X – INTERMEDIARIES, CLAIMS SETTLING AGENTS, INSURANCE SURVEYORS, MEDICAL INSURANCE PROVIDERS, LOSS ADJUSTERS, MOTOR ASSESSORS, INSURANCE INVESTIGATORS AND RISK MANAGERS

-

Part XI – ADVANCE PAYMENT OF PREMIUM

-

Part XII – GENERAL PROVISIONS

-

Part XIII – SUPPLEMENTARY PROVISIONS

-

FIRST SCHEDULE

-

SECOND SCHEDULE

-

THIRD SCHEDULE [r. 52, r. 10]

-

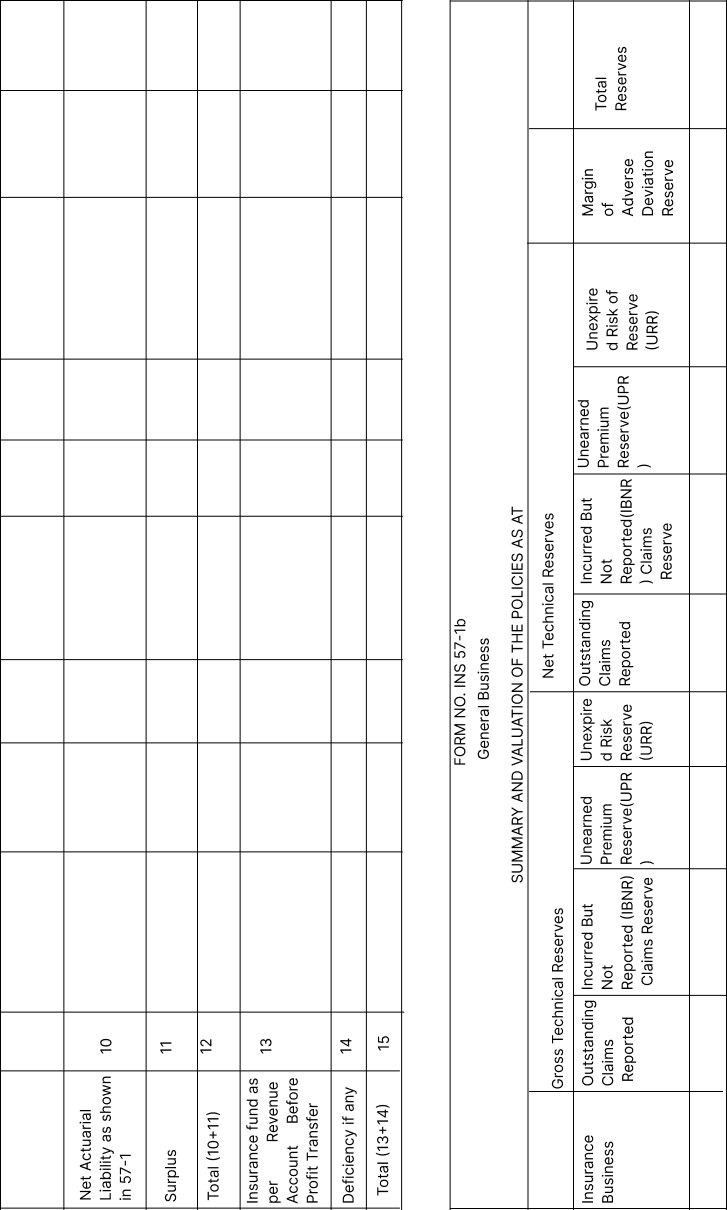

FOURTH SCHEDULE [s. 57(1)(b), r. 12]

-

FIFTH SCHEDULE [s. 57(3), r. 13]

-

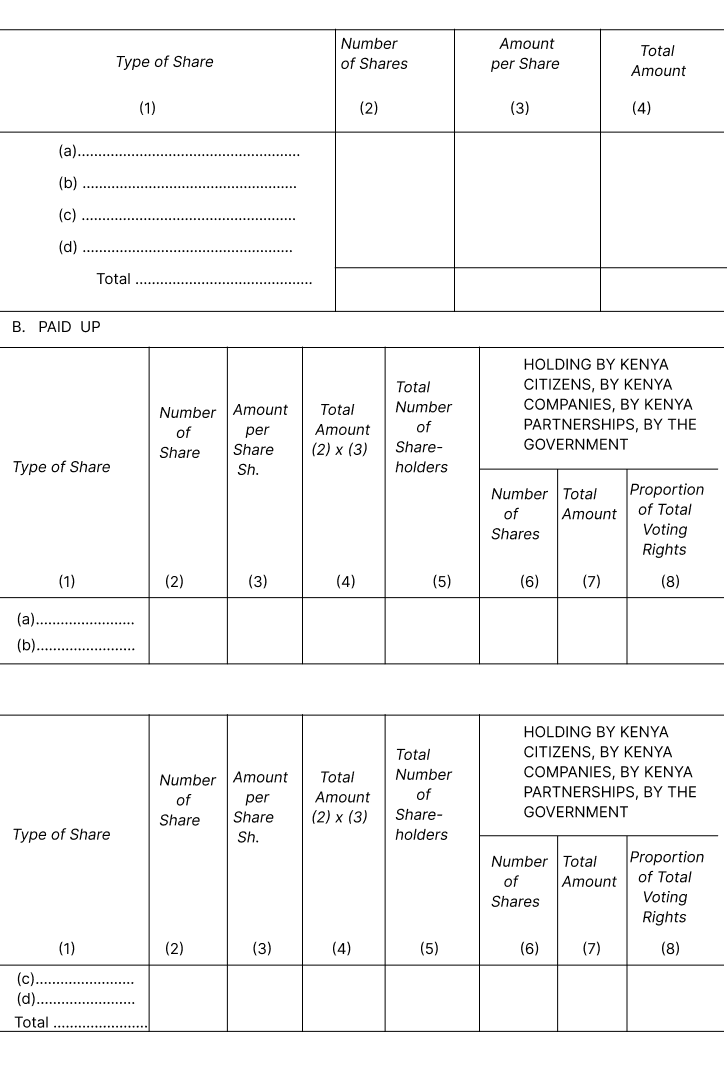

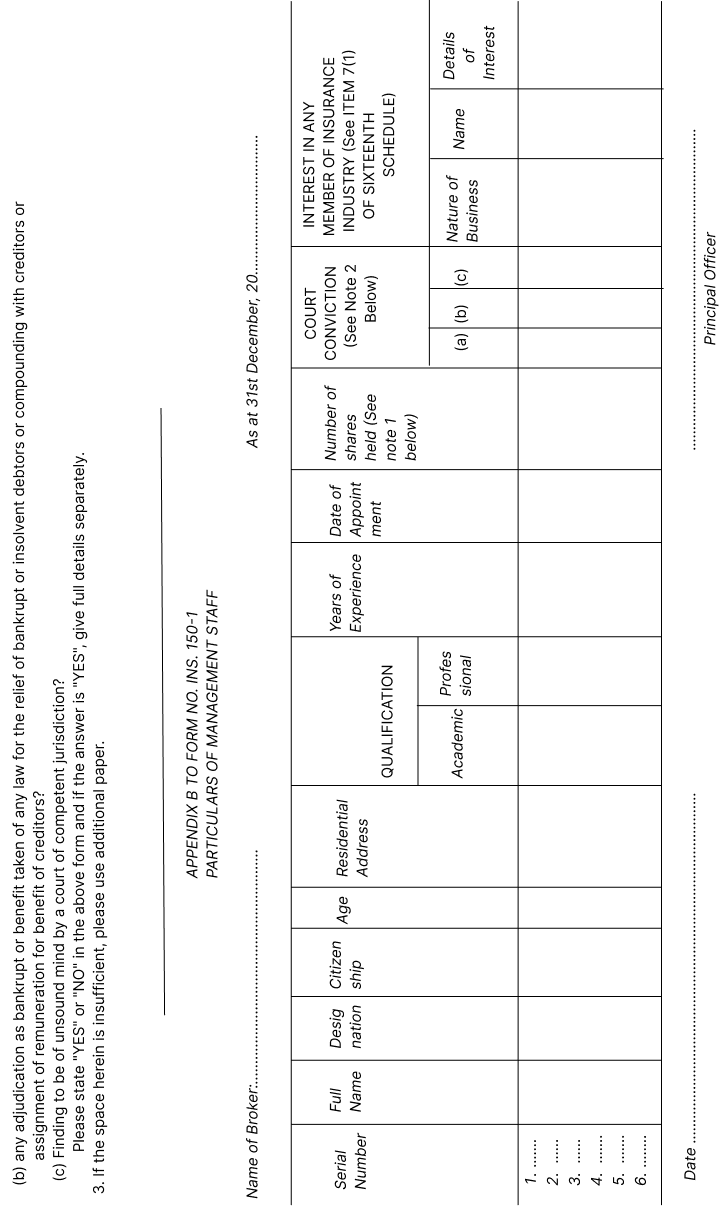

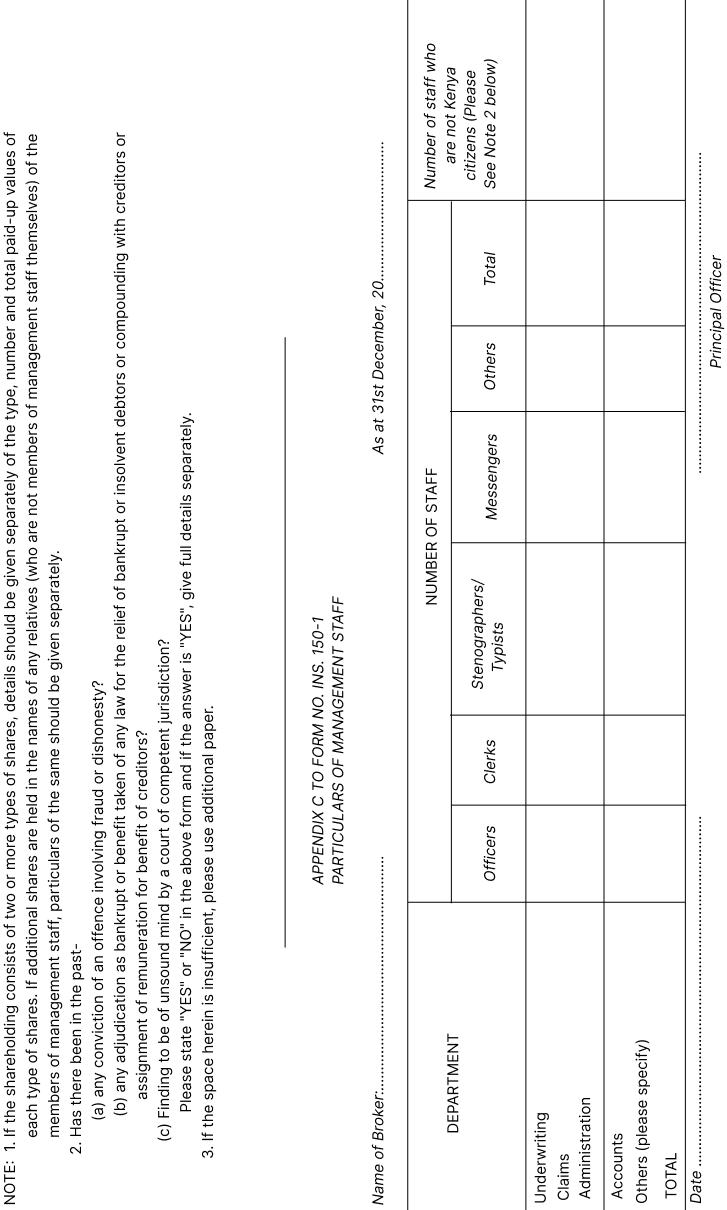

SIXTH SCHEDULE [S. 57(5), r. 14]

-

SEVENTH SCHEDULE [s. 58(3), r. 15]

-

EIGHTH SCHEDULE [r. 16]

-

NINTH SCHEDULE

-

TENTH SCHEDULE [s. 70, r. 21]

-

ELEVENTH SCHEDULE [s. 73(2), r. 22]

-

TWELFTH SCHEDULE [s. 88(1), r. 24]

-

THIRTEENTH SCHEDULE [s. 89(3), r. 25]

-

FOURTEENTH SCHEDULE [s. 111(1), r. 29]

-

FIFTEENTH SCHEDULE [r. 32, 33]

-

SIXTEENTH SCHEDULE [r. 34]

-

SEVENTEENTH SCHEDULE [s. 151(1)(a), r. 35.]

-

EIGHTEENTH SCHEDULE [s. 151(1)(e), r. 36]

-

NINETEENTH SCHEDULE [s. 39]

-

TWENTIETH SCHEDULE [r. 47]

-

TWENTY-FIRST SCHEDULE

-

TWENTY-SECOND SCHEDULE [r. 34(2)]

-

TWENTY-THIRD SCHEDULE [r. 51]

-

TWENTY-FOURTH SCHEDULE [r. 52]

-

TWENTY-FIFTH SCHEDULE

-

TWENTY-SIXTH SCHEDULE

-

TWENTY-SEVENTH SCHEDULE

-

TWENTY-EIGHTH SCHEDULE

-

TWENTY-NINTH SCHEDULE

-

THE INSURANCE (STATISTICS) REGULATIONS

-

THE INSURANCE (STATISTICS) REGULATIONS

-

THE INSURANCE (POLICYHOLDERS' COMPENSATION FUND) REGULATIONS

-

THE INSURANCE (POLICYHOLDERS' COMPENSATION FUND) REGULATIONS

-

THE INSURANCE (POLICYHOLDERS' COMPENSATION FUND) REGULATIONS

-

THE INSURANCE (POLICYHOLDERS' COMPENSATION FUND) REGULATIONS

-

THE INSURANCE (POLICYHOLDERS' COMPENSATION FUND) REGULATIONS

-

THE INSURANCE (INSURANCE APPEALS TRIBUNAL) RULES, 2013

-

THE INSURANCE (INSURANCE APPEALS TRIBUNAL) RULES

-

INSURANCE ACT (PRUDENTIAL PLC IN SHIELD COMPANY LIMITED) EXEMPTION, 2014

-

INSURANCE ACT (PRUDENTIAL PLC IN SHIELD COMPANY LIMITED) EXEMPTION, 2014

-

THE INSURANCE ACT - EXEMPTION

-

THE INSURANCE ACT - EXEMPTION

-

EXEMPTION

-

THE INSURANCE ACT - EXEMPTION

-

THE INSURANCE ACT - EXEMPTION

-

EXEMPTION

-

THE INSURANCE (CAPITAL ADEQUACY) GUIDELINES, 2017

-

THE INSURANCE (VALUATION OF TECHNICAL PROVISIONS FOR GENERAL INSURANCE BUSINESS) GUIDELINES, 2017

-

THE INSURANCE (VALUATION OF TECHNICAL PROVISIONS FOR LIFE INSURANCE BUSINESS) GUIDELINES, 2017

-

THE INSURANCE (CAPITAL ADEQUACY) GUIDELINES, 2017

-

THE INSURANCE (VALUATION OF TECHNICAL PROVISIONS FOR LIFE INSURANCE BUSINESS) GUIDELINES, 2017

-

THE INSURANCE (CAPITAL ADEQUACY) GUIDELINES

-

THE INSURANCE (VALUATION OF TECHNICAL PROVISIONS FOR GENERAL INSURANCE BUSINESS) GUIDELINES

-

THE INSURANCE (VALUATION OF TECHNICAL PROVISIONS FOR LIFE INSURANCE BUSINESS) GUIDELINES

-

THE INSURANCE (INVESTMENTS MANAGEMENT) GUIDELINES, 2017

-

THE INSURANCE (INVESTMENTS MANAGEMENT) GUIDELINES

-

INSURANCE (BANCASSURANCE) REGULATIONS, 2020

-

THE INSURANCE (ANTI-MONEY LAUNDERING AND COMBATING FINANCING OF TERRORISM) GUIDELINES, 2020

-

THE INSURANCE (GROUP-WIDE SUPERVISION) REGULATIONS

-

THE INSURANCE (MICROINSURANCE) REGULATIONS

-

INSURANCE (BANCASSURANCE) REGULATIONS, 2020

-

THE INSURANCE (ANTI-MONEY LAUNDERING AND COMBATING FINANCING OF TERRORISM) GUIDELINES

-

THE INSURANCE (GROUP-WIDE SUPERVISION) REGULATIONS

-

THE INSURANCE (MICROINSURANCE) REGULATIONS

-

THE INSURANCE ACT - EXEMPTION, 2021

-

EXEMPTION

-

THE INSURANCE ACT - EXEMPTION, 2021

-

EXEMPTION

-

INSURANCE ACT EXEMPTION, 2021

-

INSURANCE ACT EXEMPTION, 2021

-

THE INSURANCE (SUITABILITY OF KEY PERSONS) REGULATIONS, 2021

-

THE INSURANCE (SUITABILITY OF KEY PERSONS) REGULATIONS

-

THE INSURANCE ACT - EXEMPTION

-

EXEMPTION

-

THE INSURANCE ACT—EXEMPTION

|

|

THE INSURANCE REGULATIONS

ARRANGEMENT OF REGULATIONS

PART I – PRELIMINARY

PART II – REGISTRATION OF INSURERS

| 5. |

Insurer’s application for registration

|

| 6. |

Registration and annual fees

|

| 7. |

Statements to be submitted under section 30(k) of the Act

|

| 7A. |

Deposits for Insurers Registration

|

PART III – ADMITTED ASSETS AND ADMITTED LIABILITIES

PART IV – ACCOUNTS, BALANCE SHEETS, AUDIT AND ACTUARIAL INVESTIGATIONS

| 9. |

Classes of insurance business in respect of which separate accounts to be maintained

|

INSURANCE BUSINESS — CLASSES OF BUSINESS

| 10. |

Classes of general insurance business in respect of which separate accounts to be maintained

|

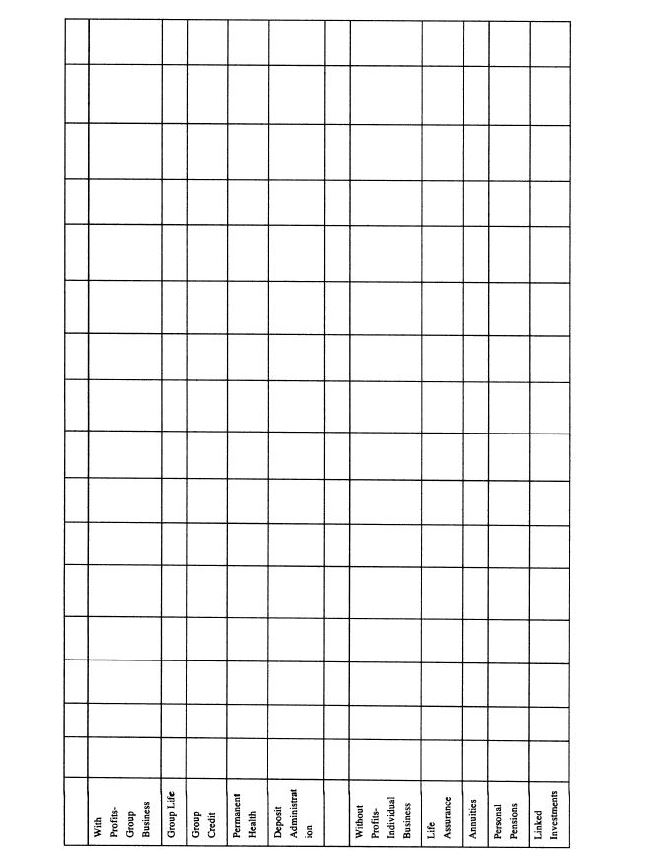

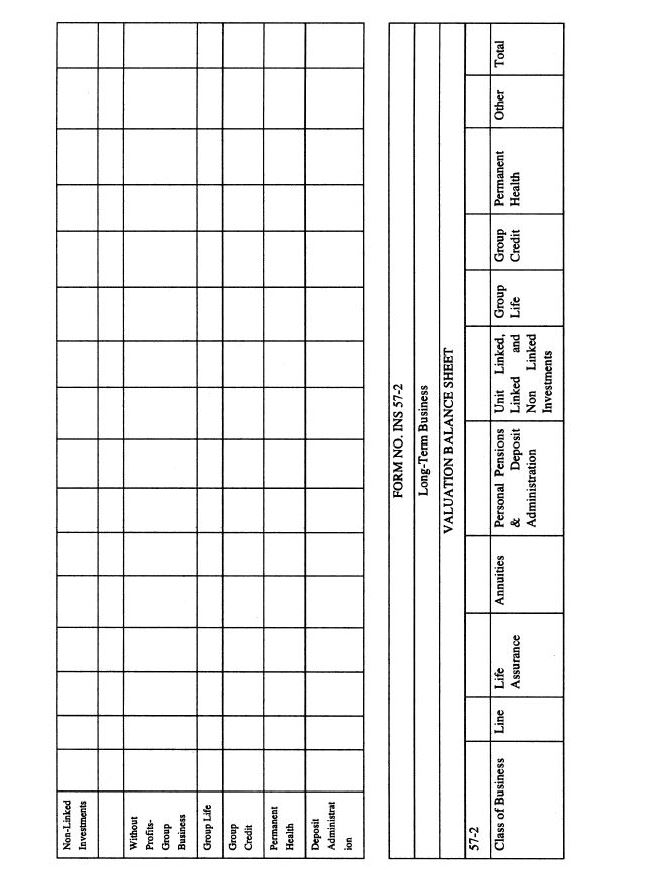

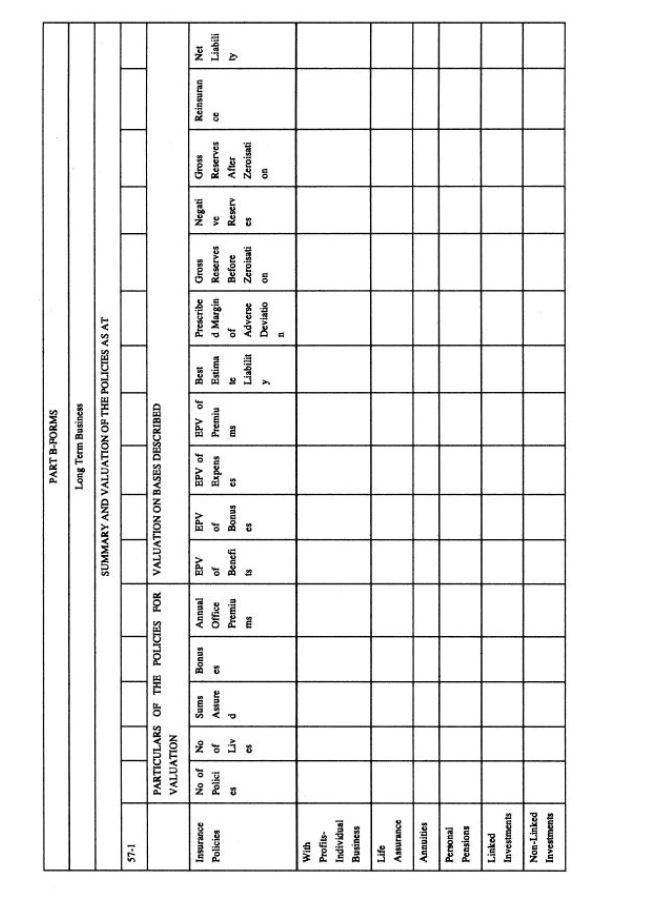

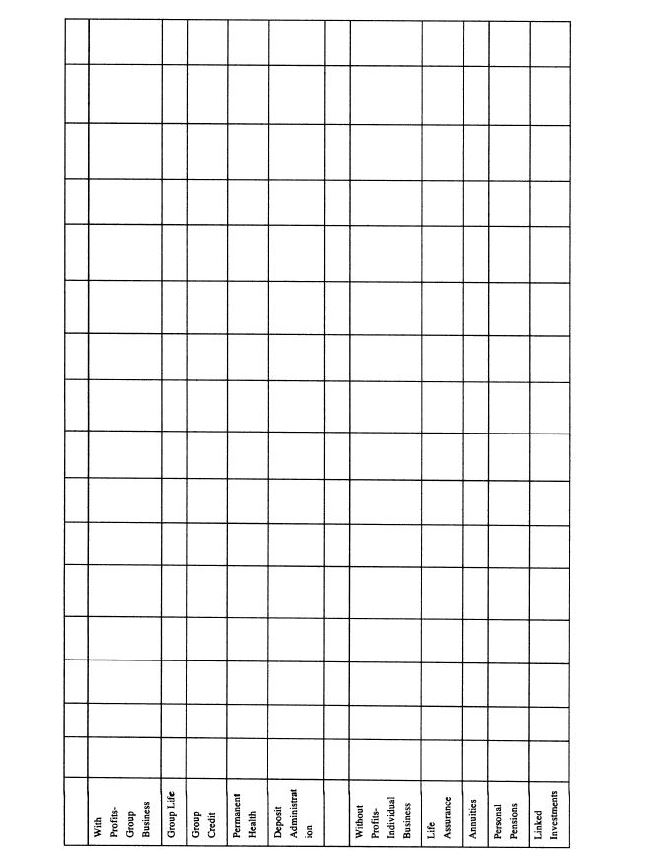

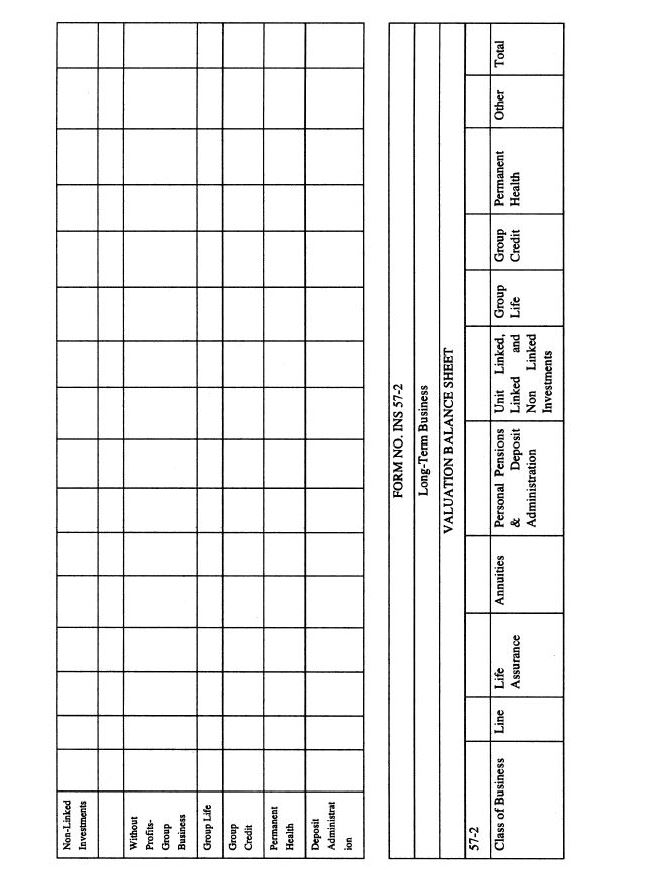

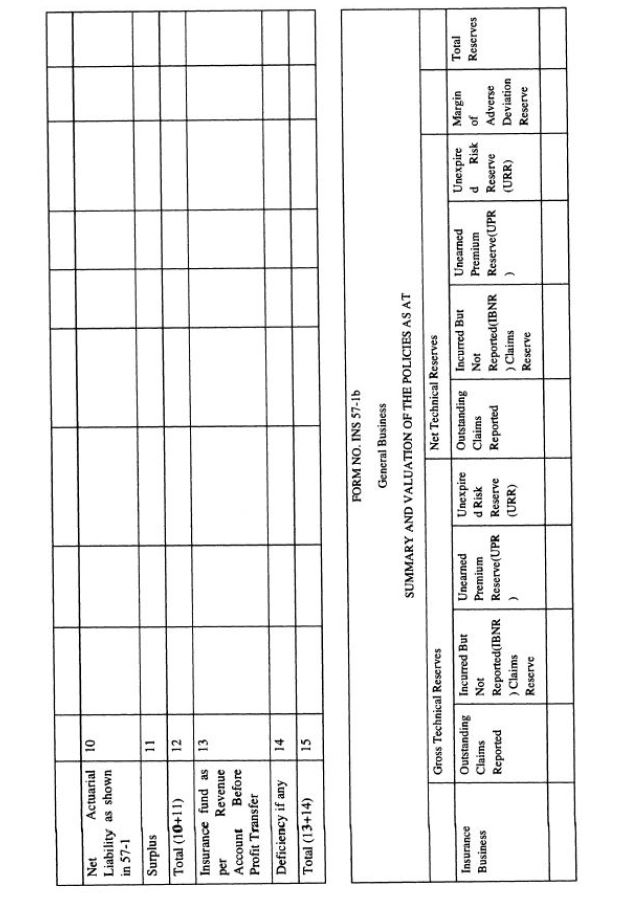

| 13. |

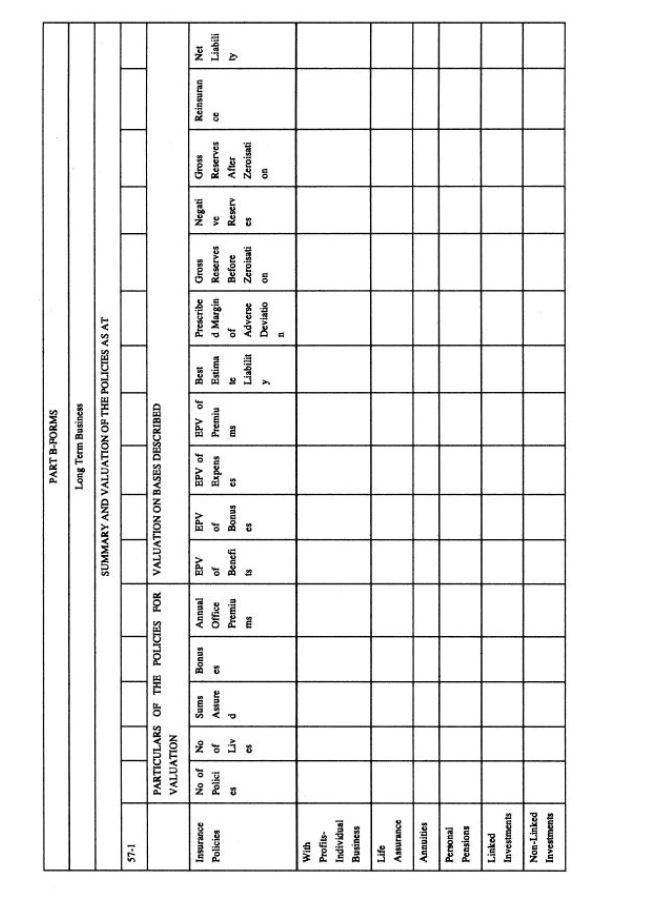

Statements of long-term insurance business

|

| 14. |

Actuarial valuation of liabilities

|

| 16. |

Actuary’s certificate

|

| 17. |

Annual returns: long term insurance business

|

| 18. |

Annual returns: general insurance business

|

| 19. |

Annual returns: supplementary provisions

|

| 20. |

Authentication and certification of accounts and statements

|

PART V – MANAGEMENT AND EXPENSES

| 22. |

Restriction on commission

|

PART VI – POLICY TERMS

| 23. |

Exemption from the provision regarding avoidance of contracts of unlimited amounts

|

| 26. |

Payment of interest on overdue premiums

|

| 27. |

Paid up industrial life policies

|

| 28. |

Certain policies to which sections 88-92 do not apply

|

PART VII – NOMINATIONS

| 30. |

Fee for registering, cancelling or changing a nomination

|

PART VIII – CLAIMS ON SMALL LIFE POLICIES

PART IX – MANDATORY REINSURANCE CESSIONS

| 33. |

Payment of re-insurance cessions

|

PART X – INTERMEDIARIES, CLAIMS SETTLING AGENTS, INSURANCE SURVEYORS, MEDICAL INSURANCE PROVIDERS, LOSS ADJUSTERS, MOTOR ASSESSORS, INSURANCE INVESTIGATORS AND RISK MANAGERS

| 34. |

Forms of application for registration and renewal of registration of intermediaries, etc

|

| 35. |

Policy of professional indemnity for a broker

|

| 36. |

Statement of business

|

| 39. |

Bank guarantee for broker’s registration

|

| 40. |

Returns by corporate persons under the Act

|

PART XI – ADVANCE PAYMENT OF PREMIUM

| 41. |

Advance payment of premium

|

PART XII – GENERAL PROVISIONS

| 46. |

Fees for duplicate certificates

|

PART XIII – SUPPLEMENTARY PROVISIONS

| 47. |

Application for remittance

|

| 49. |

Manner of payment of fees

|

| 50. |

Reference to schedules

|

| 51. |

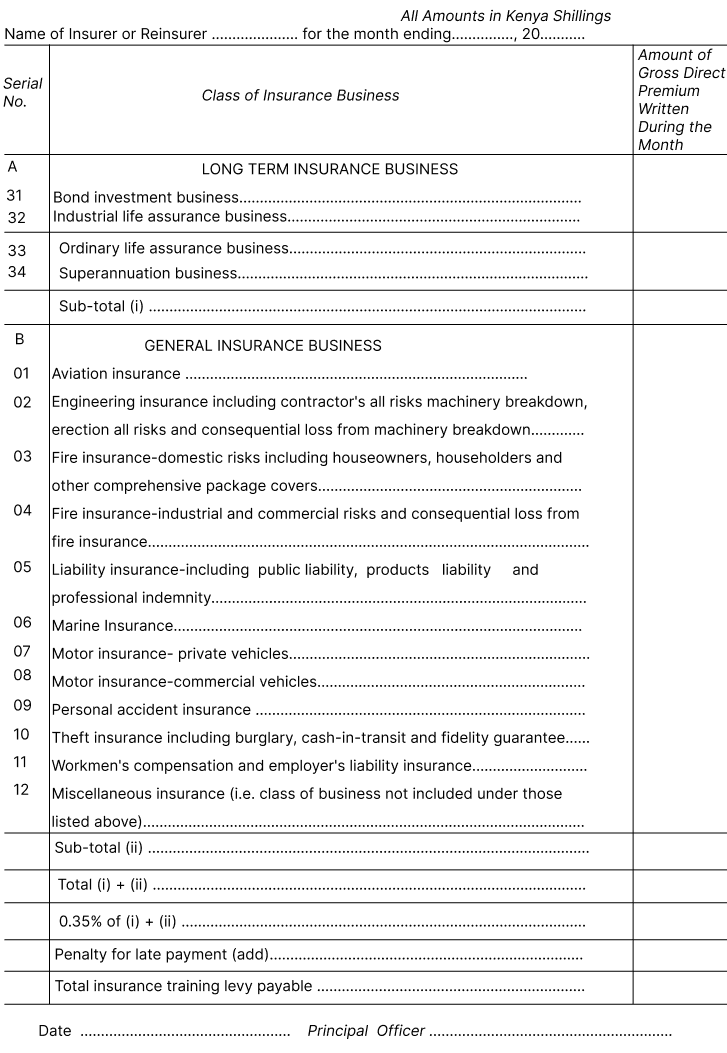

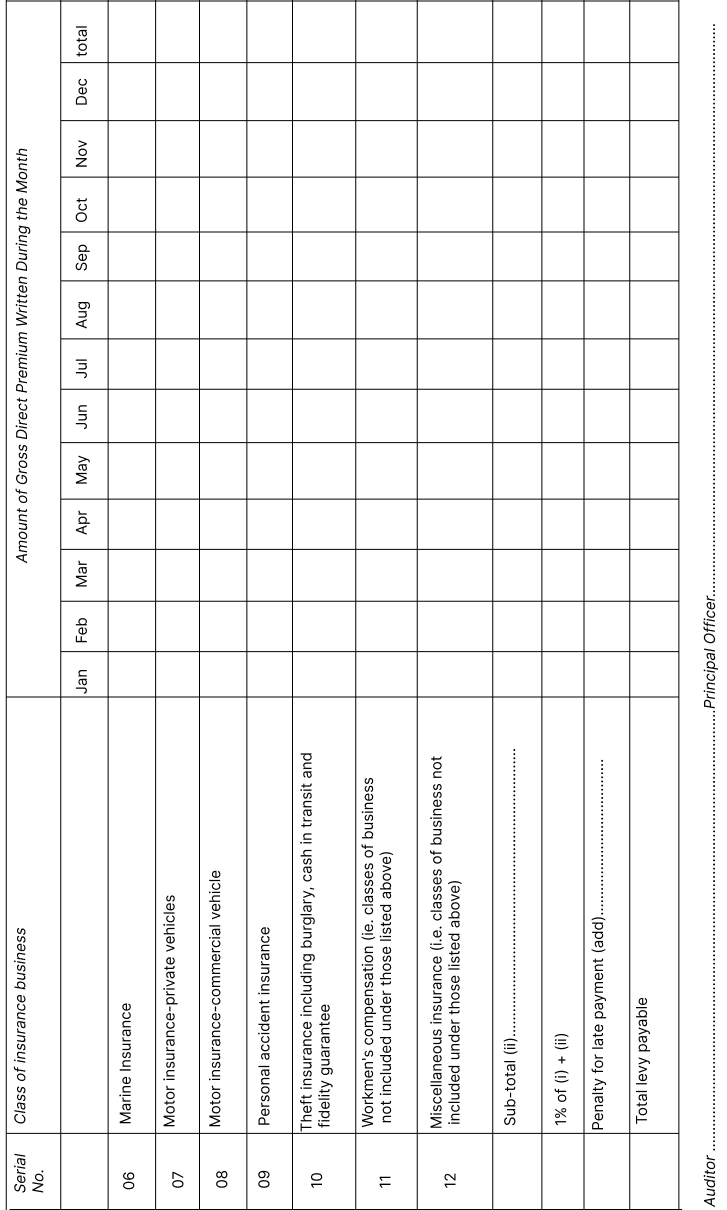

Monthly insurance training levy return

|

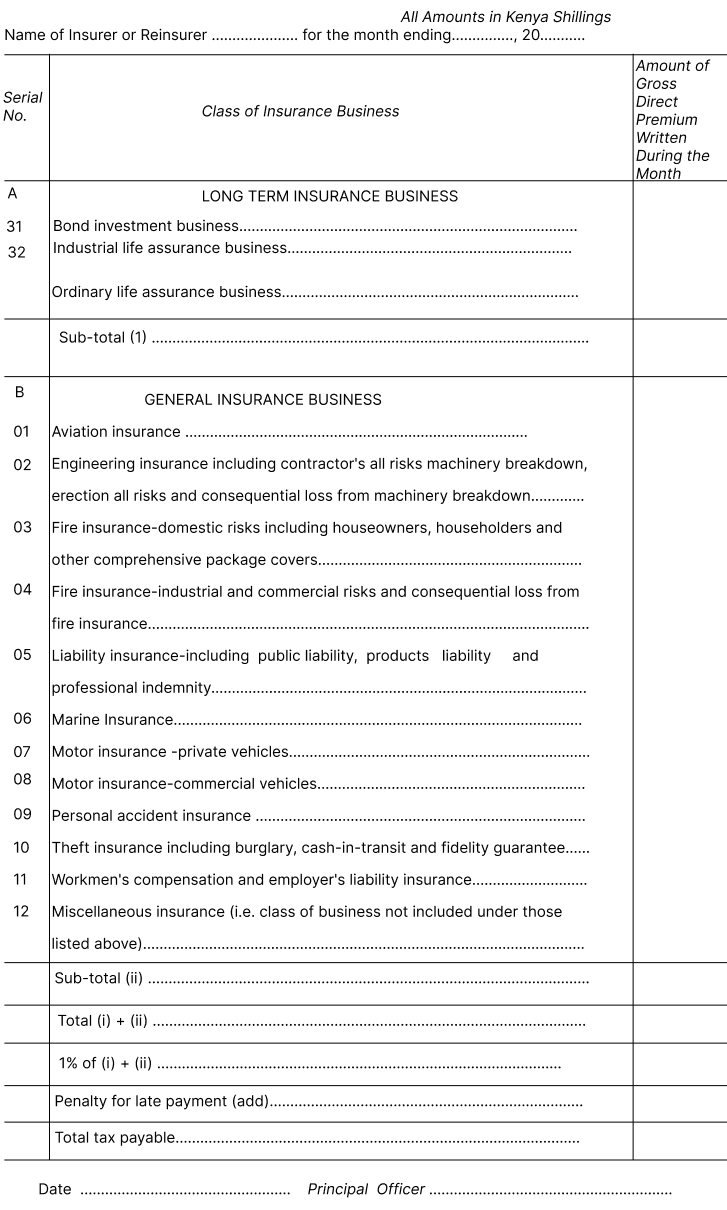

| 52. |

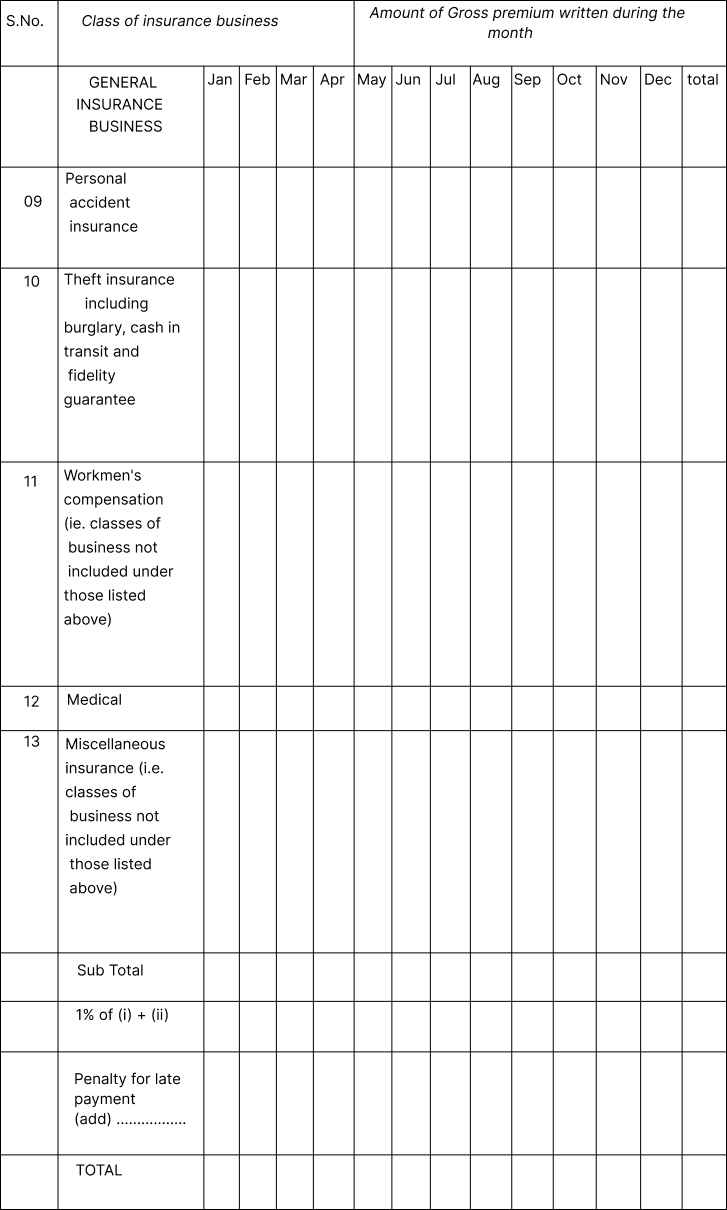

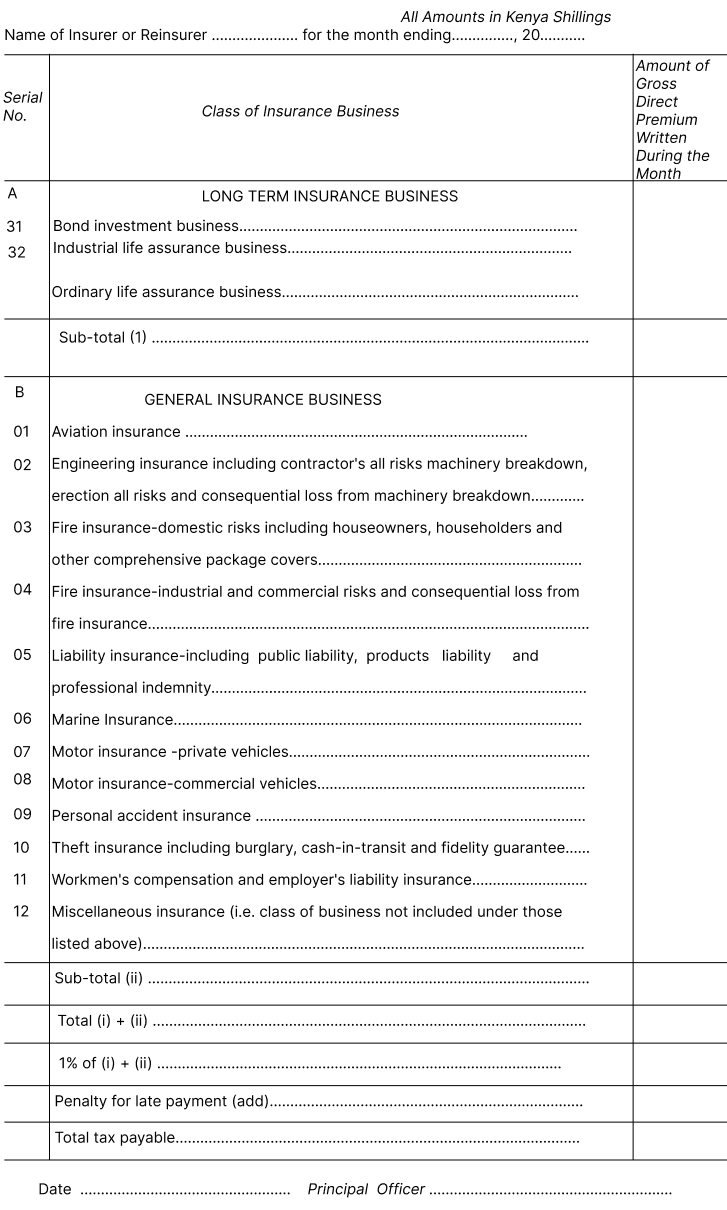

Monthly premium tax return

|

| 53. |

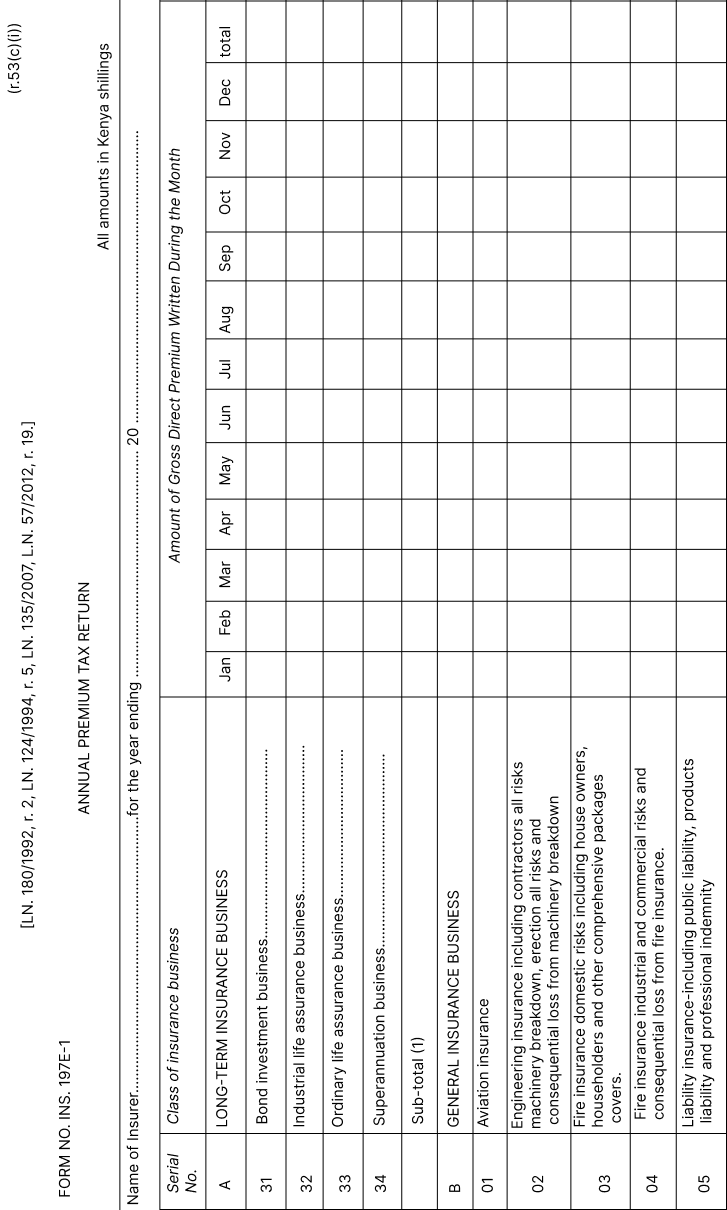

Annual premium tax return

|

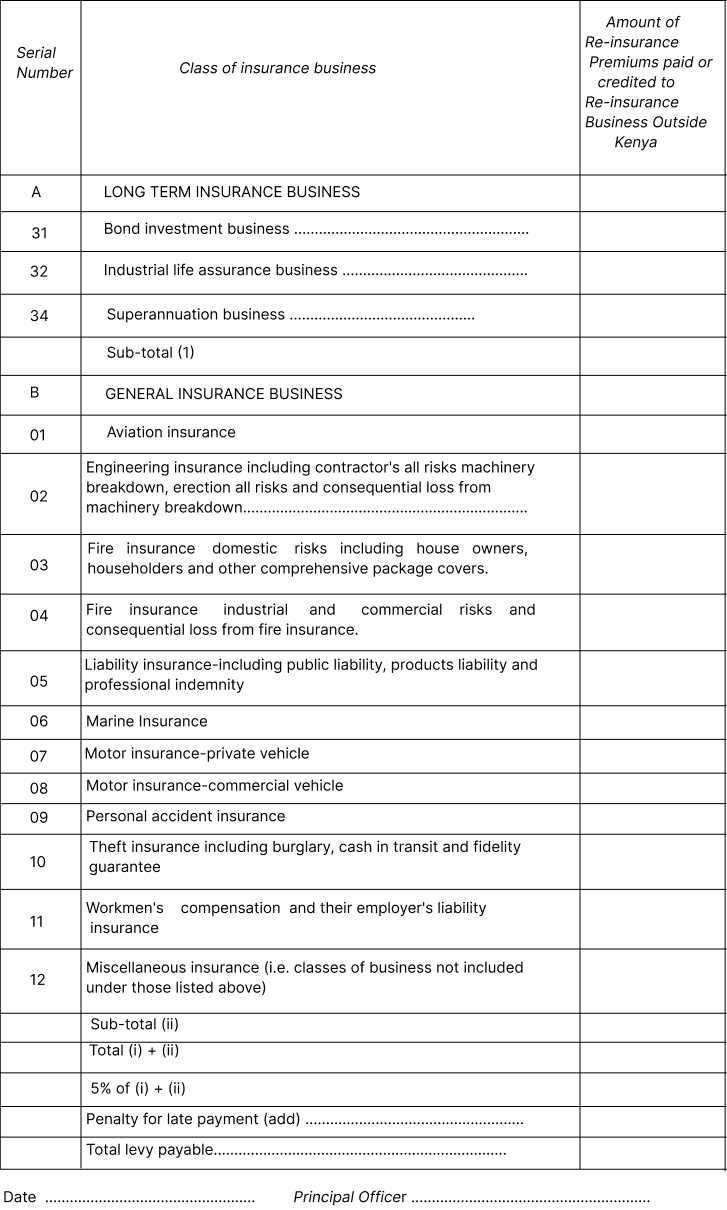

| 54. |

Monthly re-insurance premium tax return

|

| 55. |

Annual premium tax return

|

| 56. |

Annual Insurance Training Levy return

|

| 57. |

Payment of Insurance Training Levy

|

| 58. |

Monies Payable to Fund

|

SCHEDULES

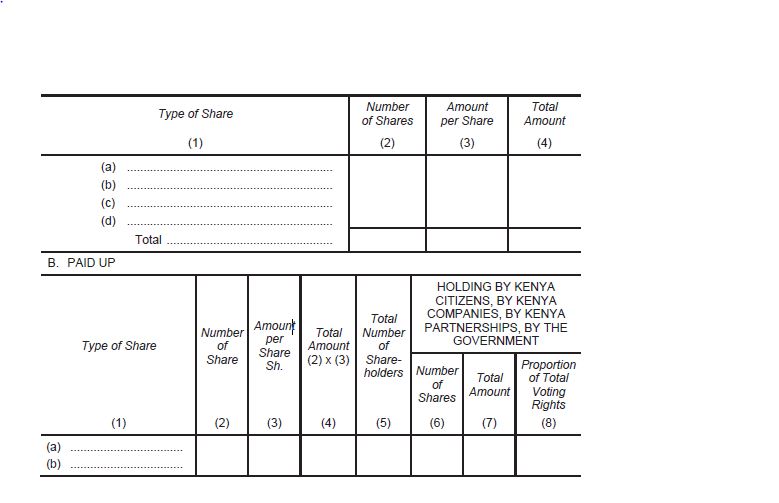

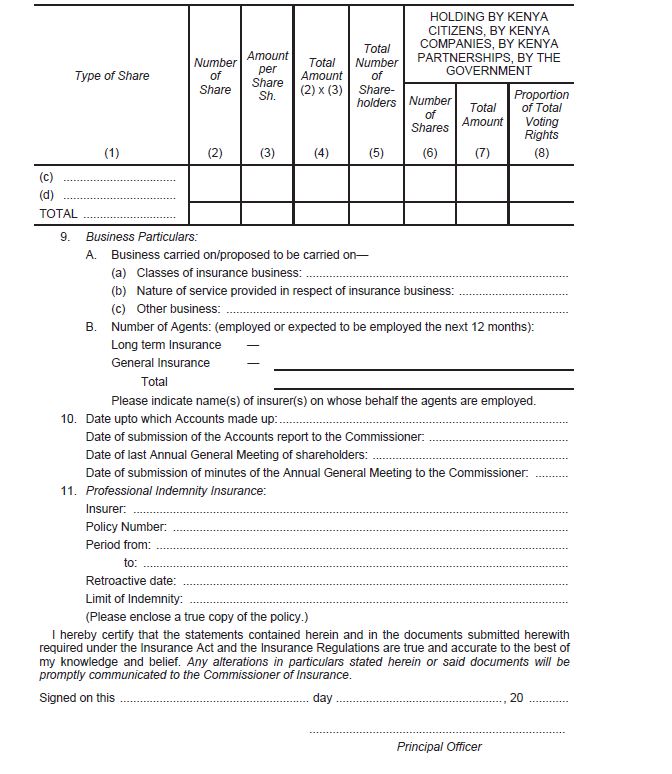

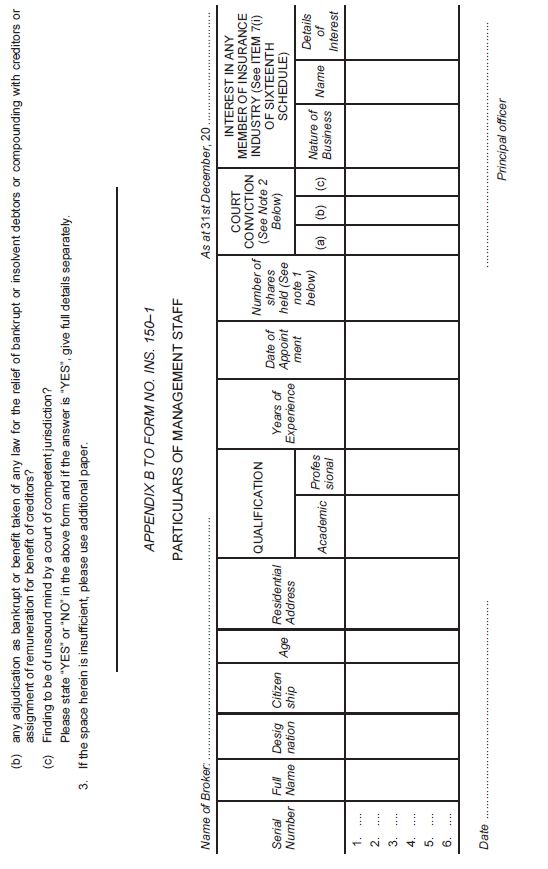

| FIRST SCHEDULE — |

APPLICATION FOR REGISTRATION AS AN INSURER

|

| SECOND SCHEDULE — |

DELETED

|

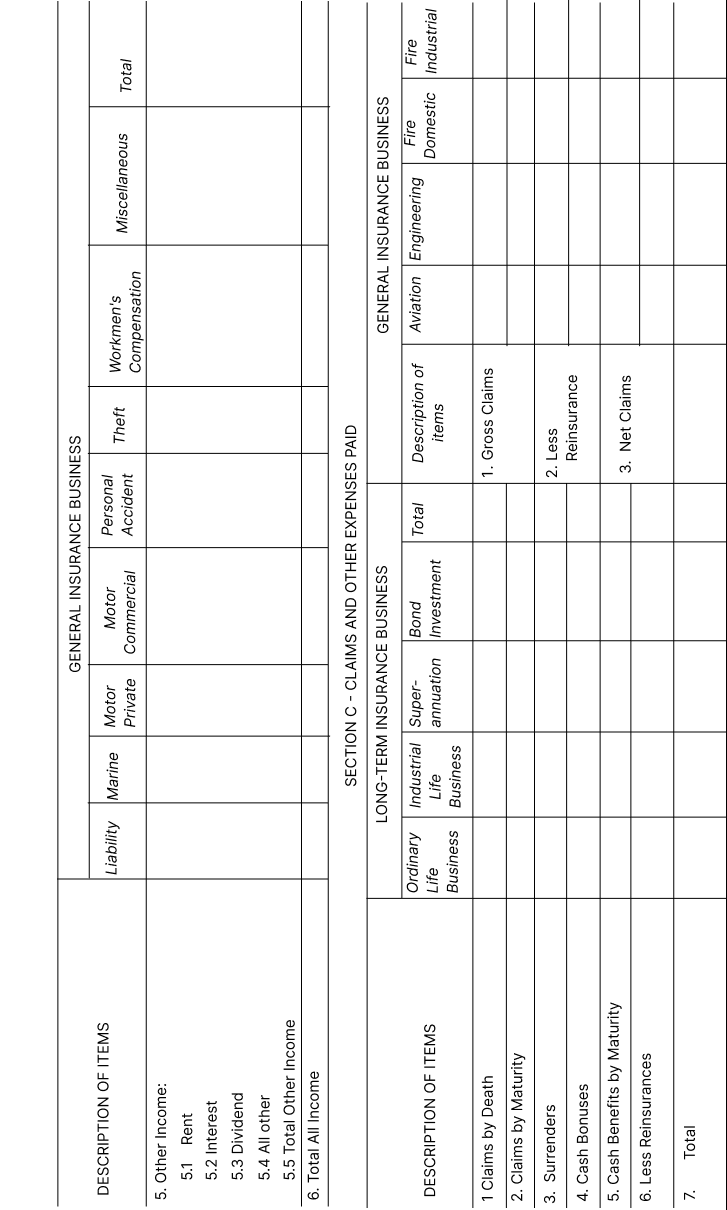

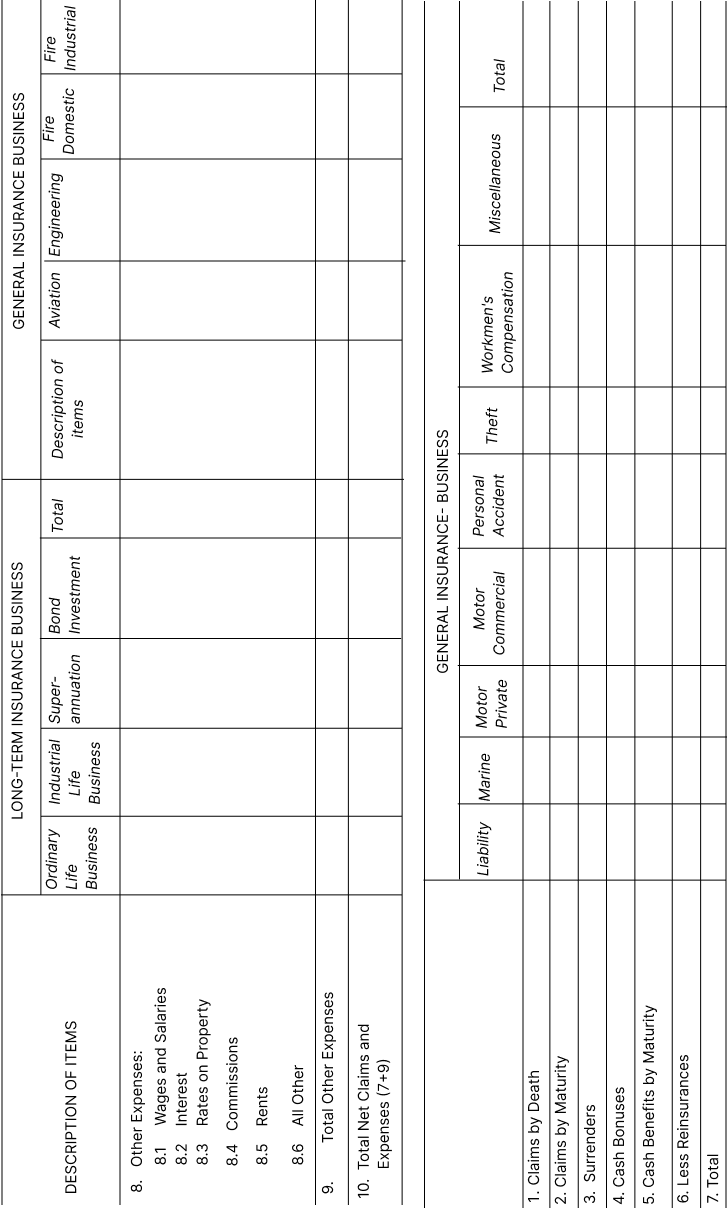

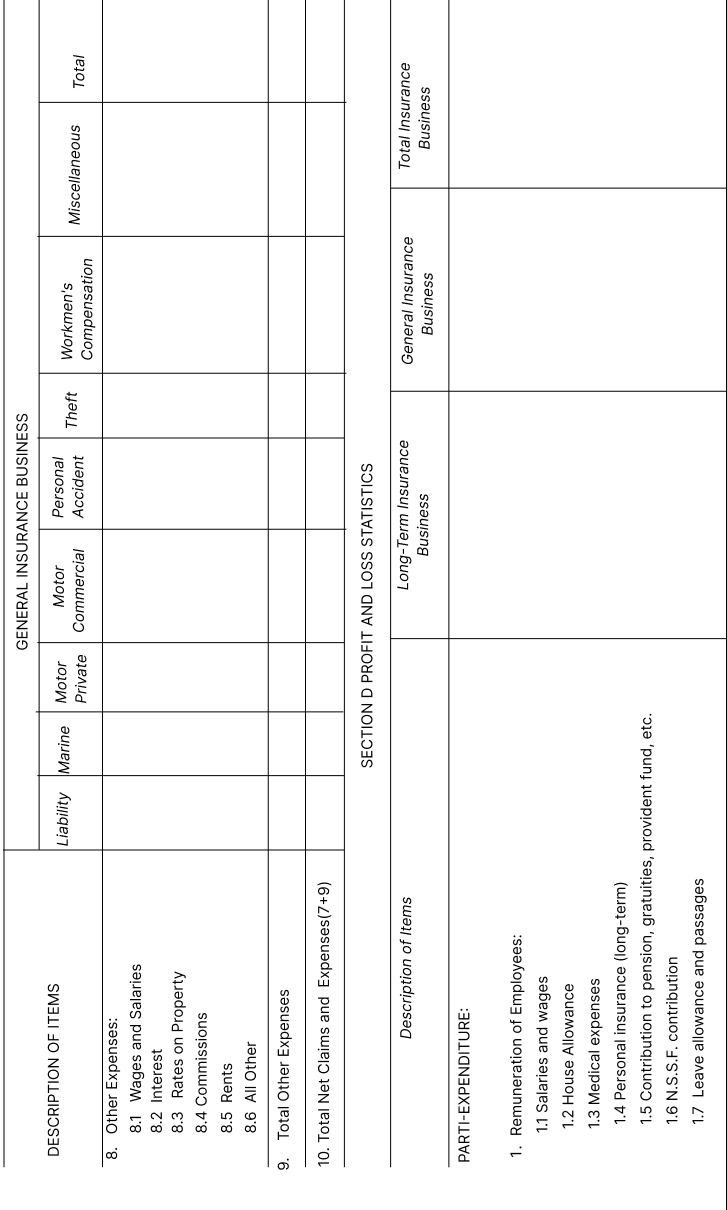

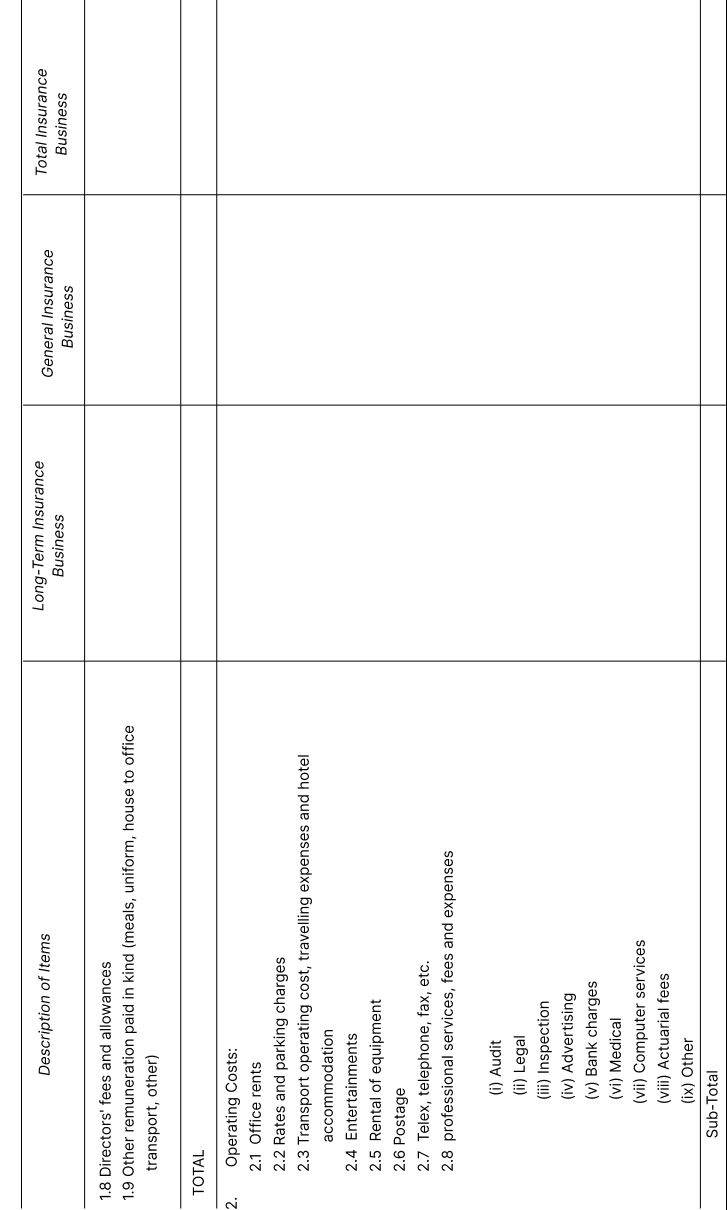

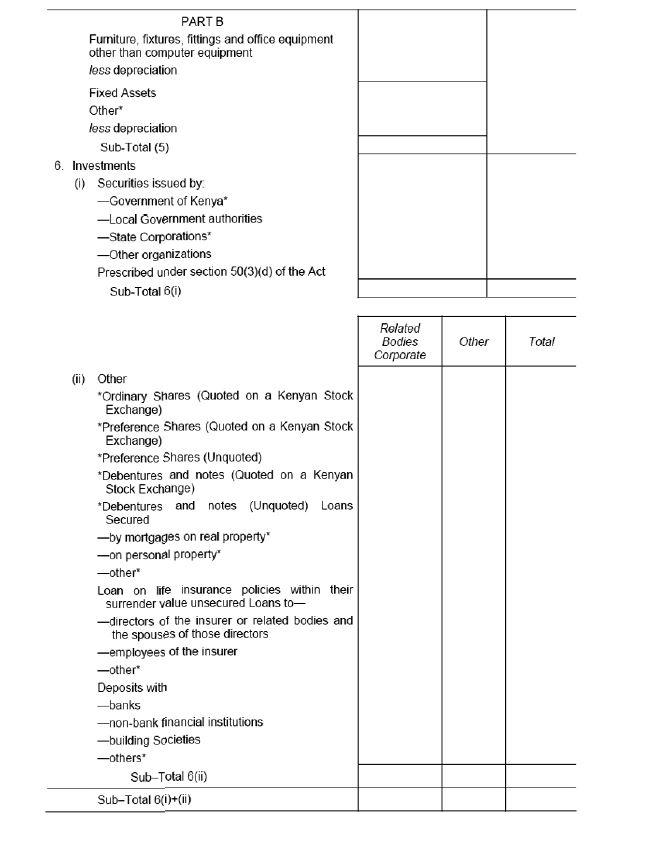

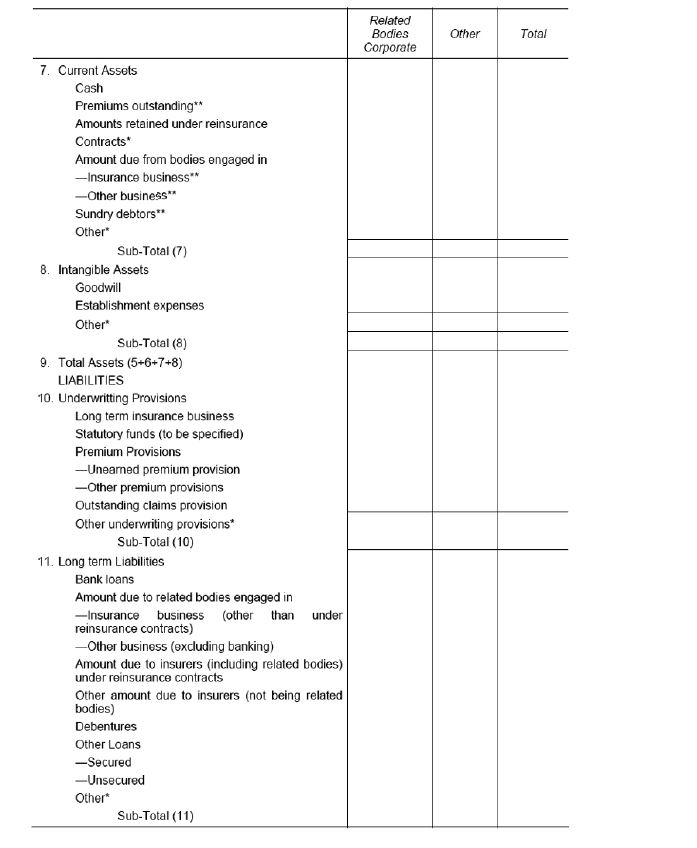

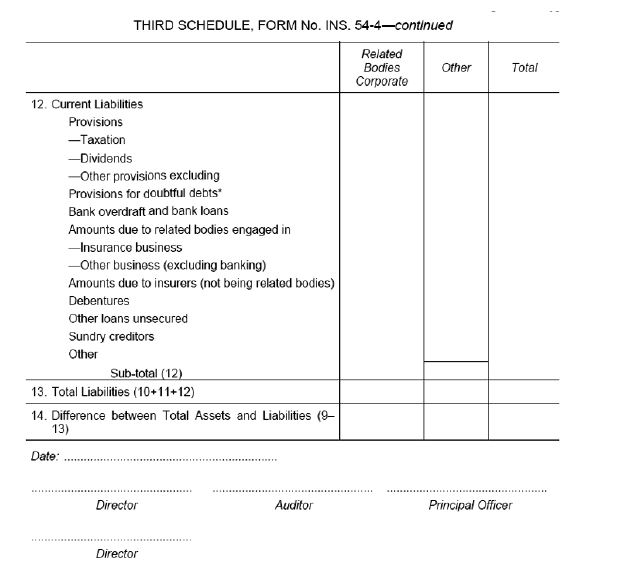

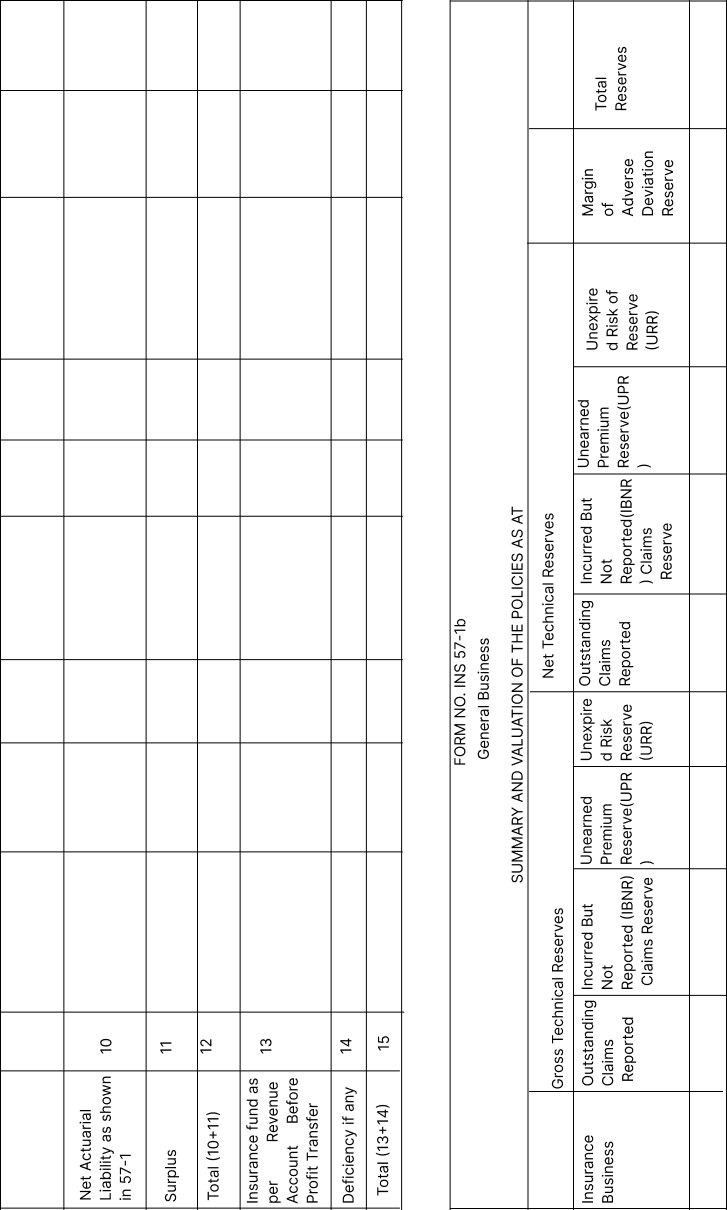

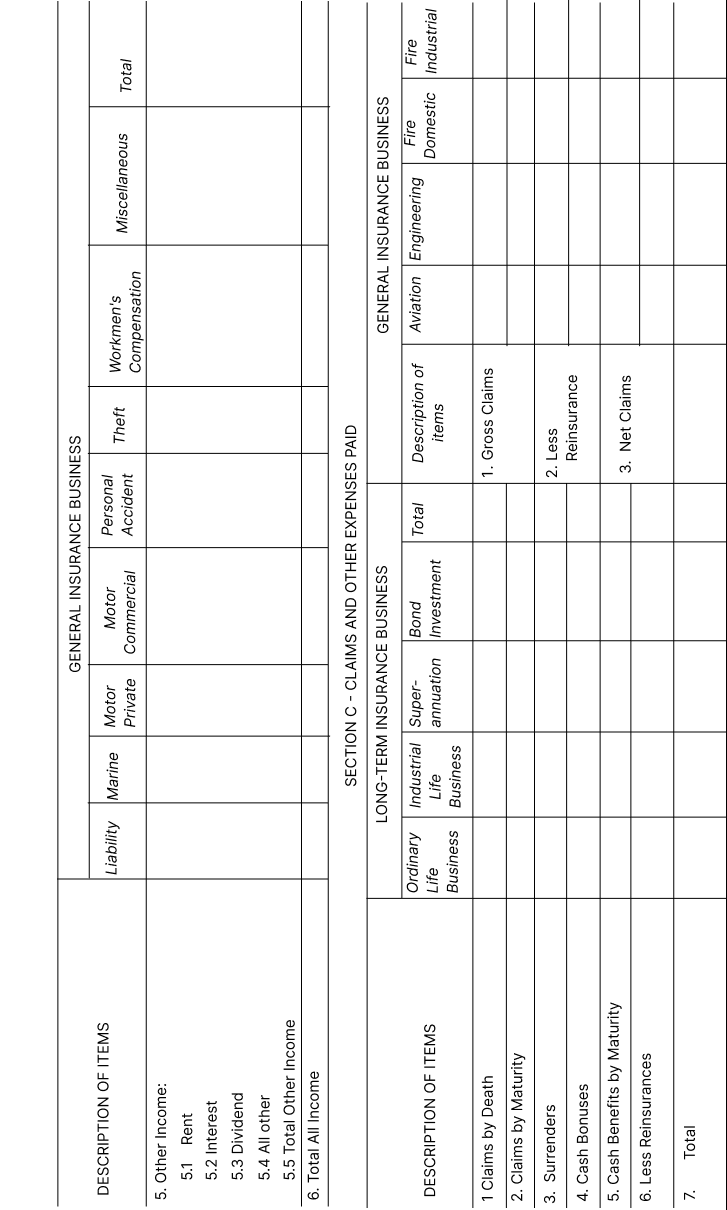

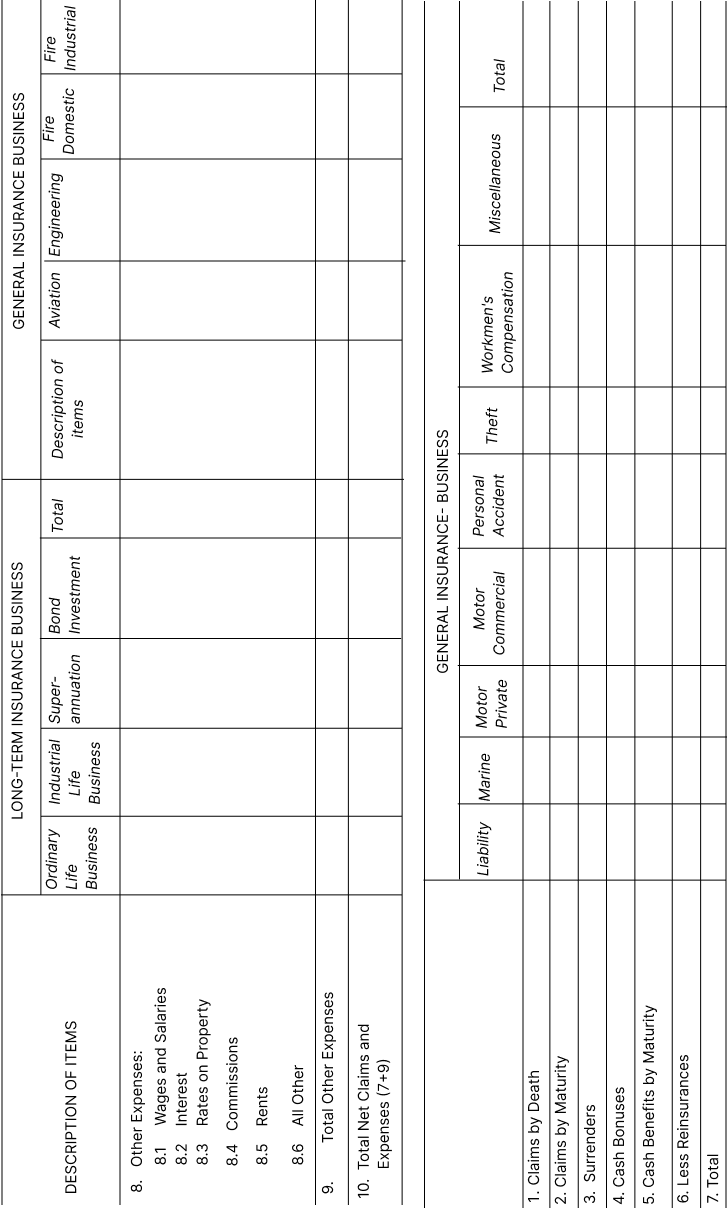

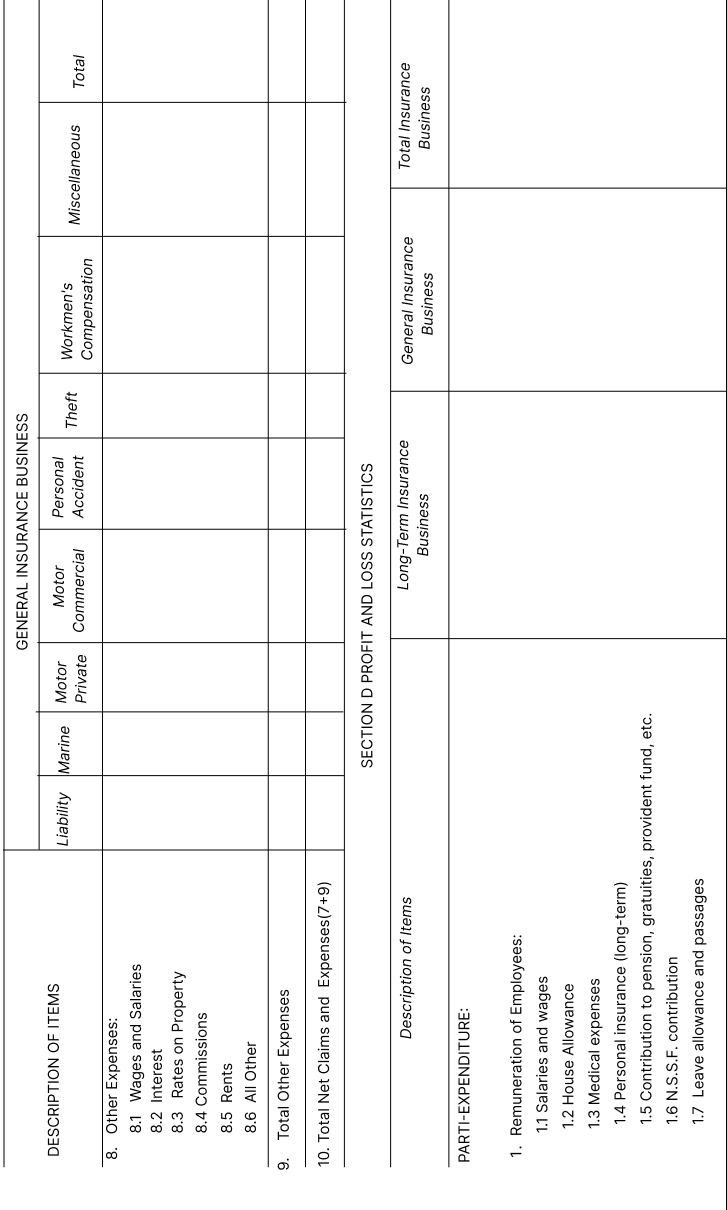

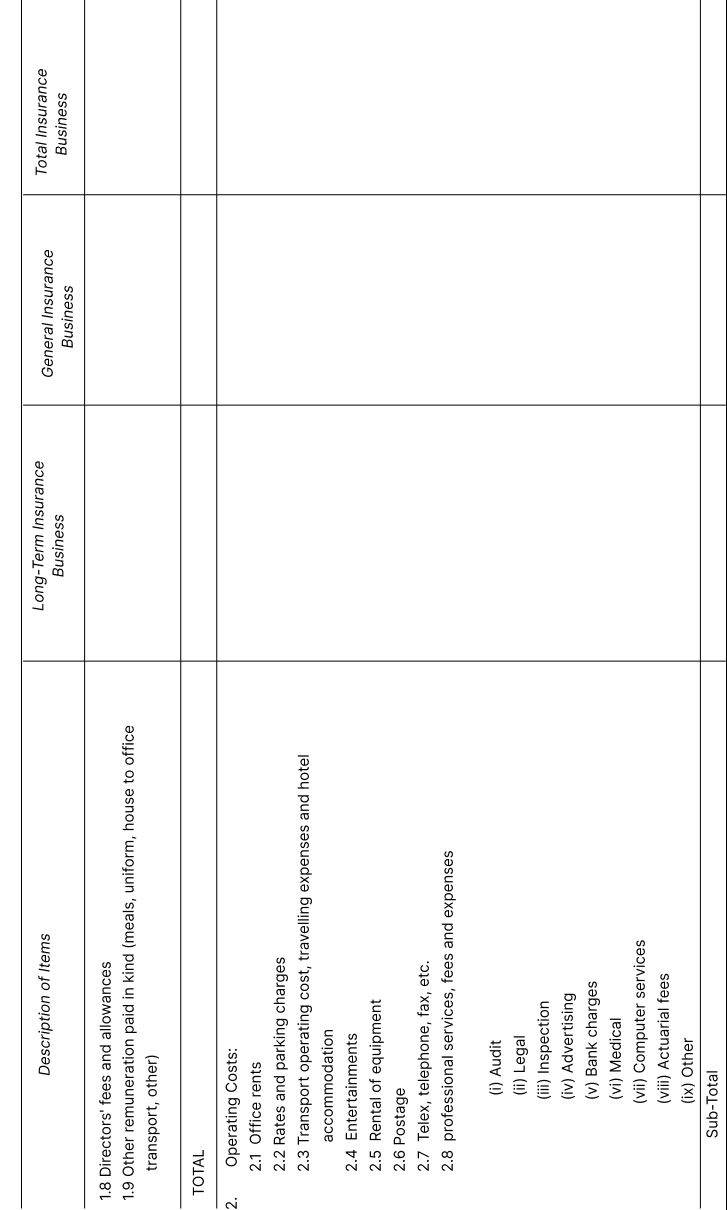

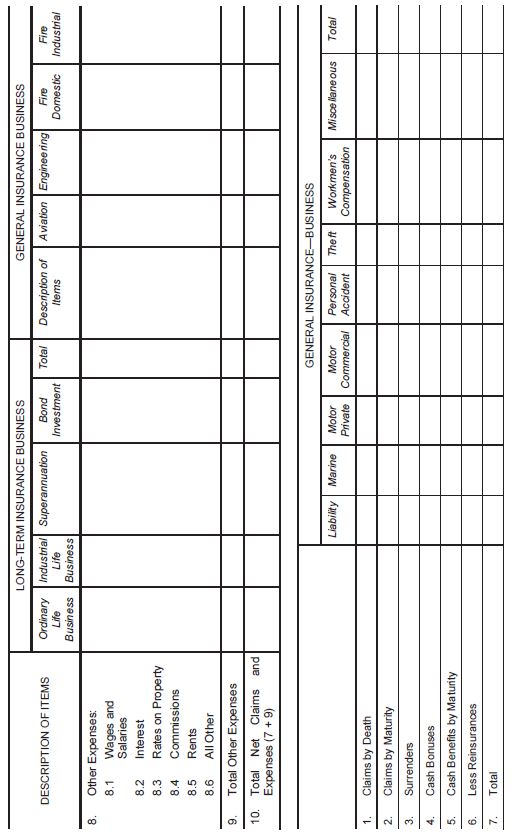

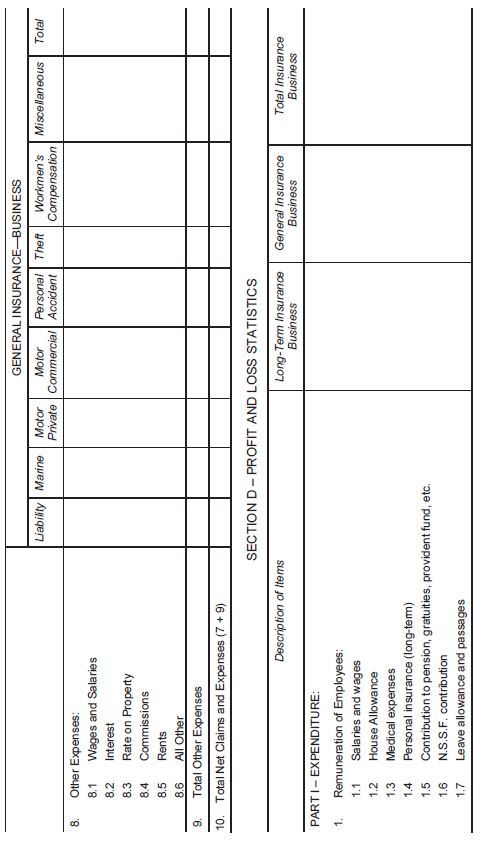

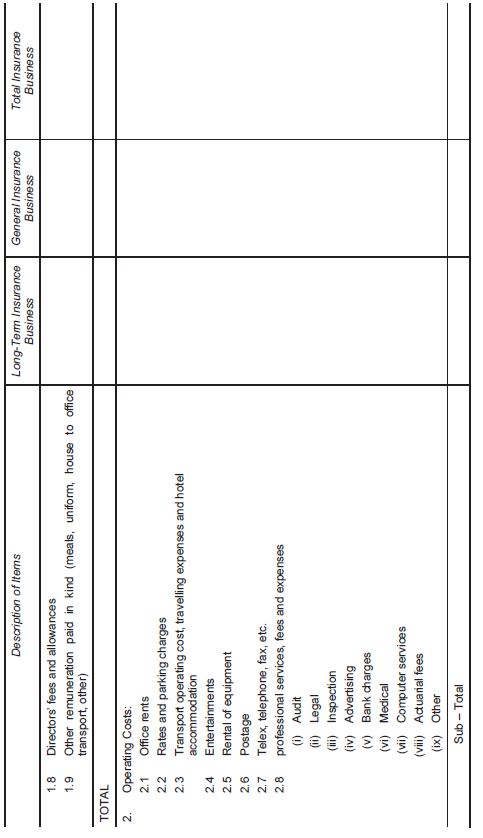

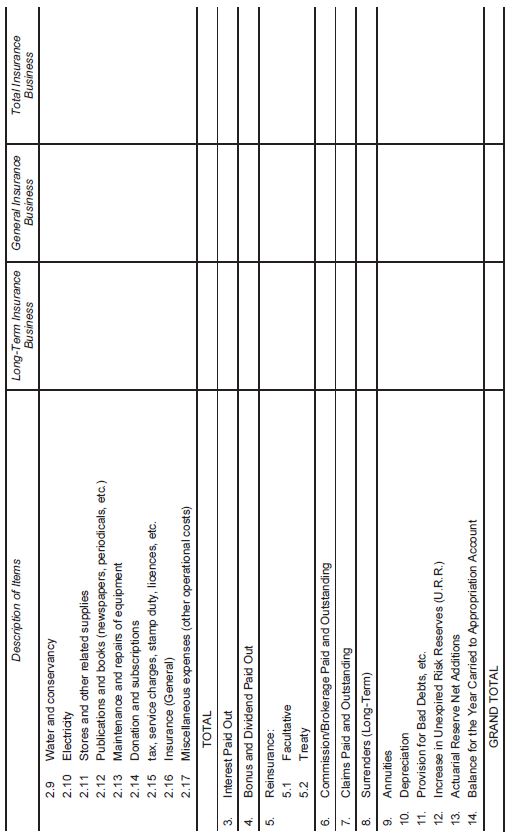

| THIRD SCHEDULE [r. 52, r. 10] — |

GENERAL INSURANCE BUSINESS

|

| FOURTH SCHEDULE [s. 57(1)(b), r. 12] — |

PROVISIONS RELATING TO THE PREPARATION OF ABSTRACTS OF ACTUARY’S REPORTS

|

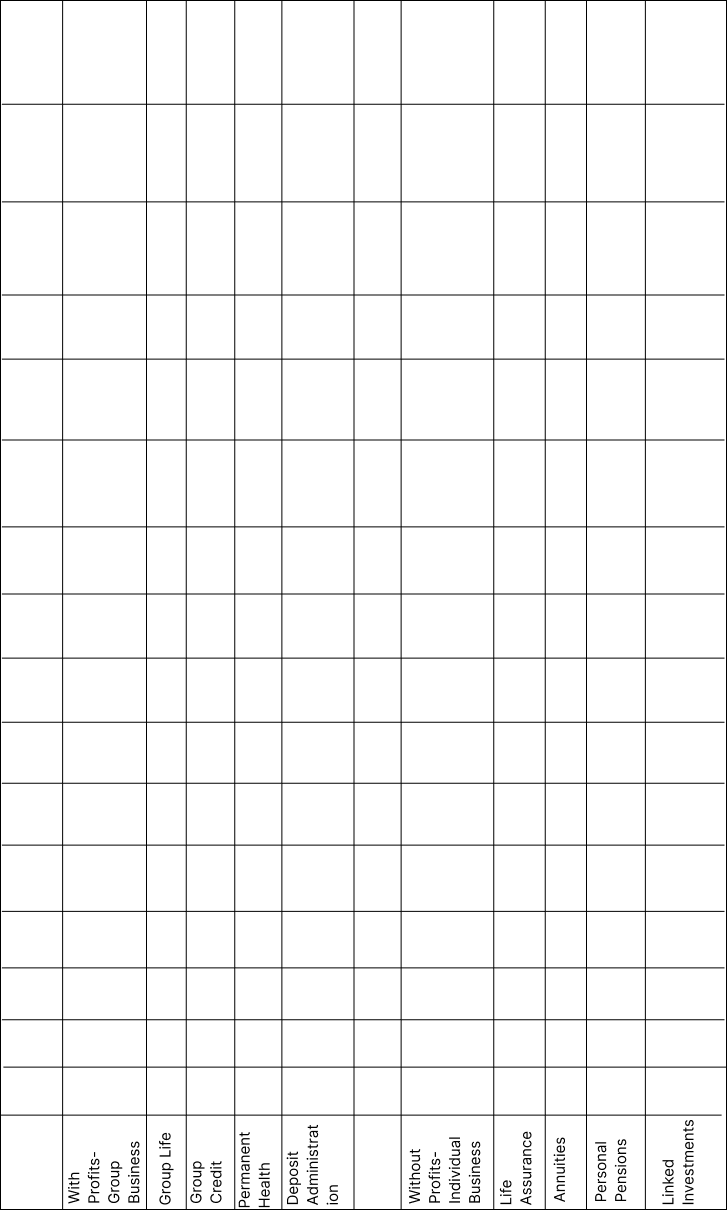

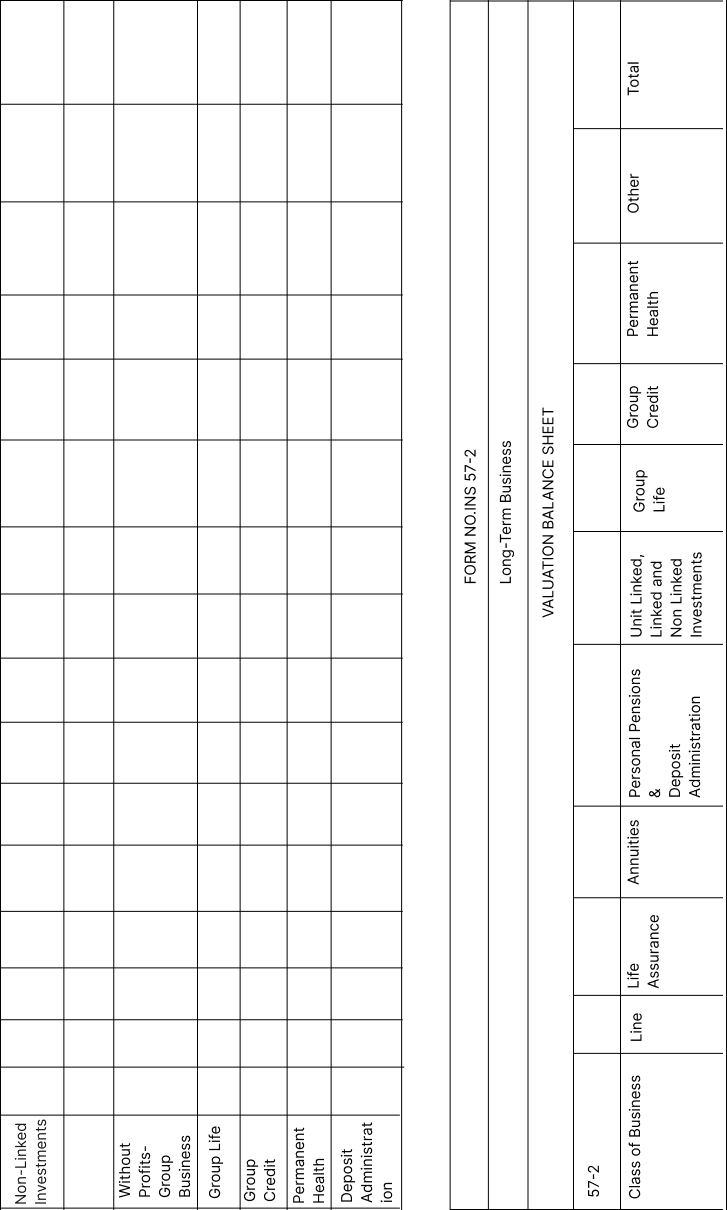

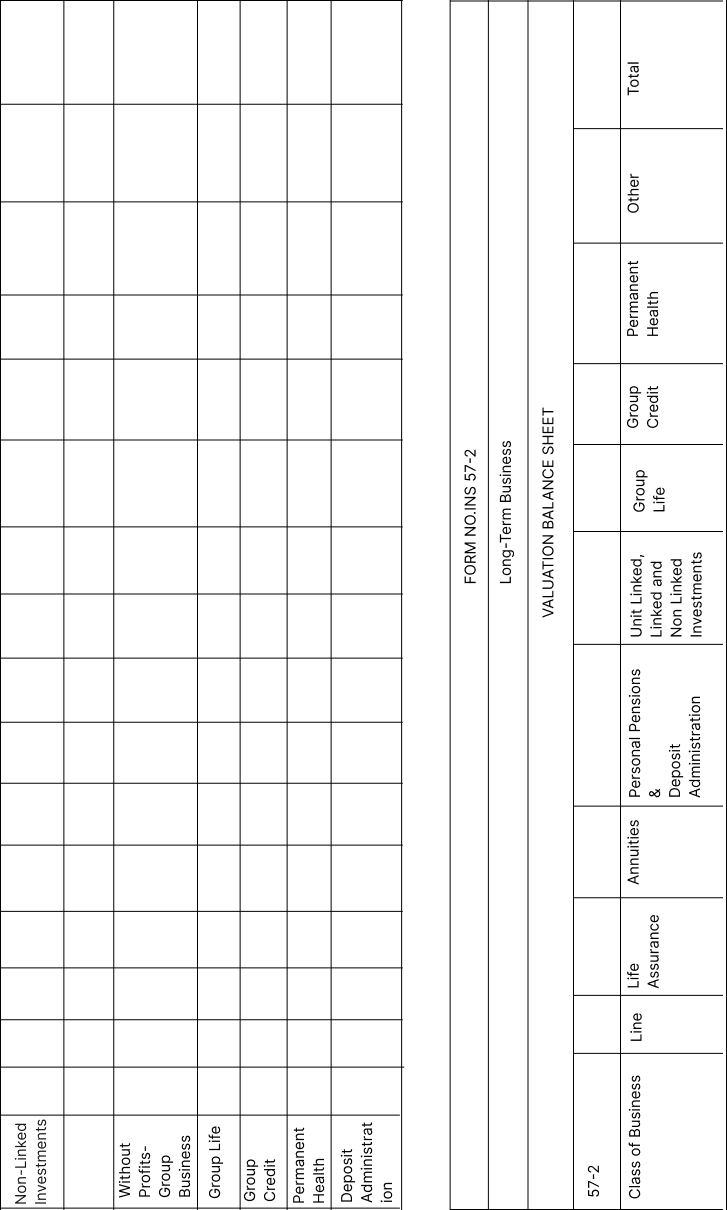

| FIFTH SCHEDULE [s. 57(3), r. 13] — |

PROVISIONS RELATING TO THE PREPARATION OF STATEMENTS OF LONG —TERM INSURANCE BUSINESS

|

| SIXTH SCHEDULE [S. 57(5), r. 14] — |

REGULATIONS RELATING TO ACTUARIAL VALUATION OF LIABILITIES

|

| SEVENTH SCHEDULE [s. 58(3), r. 15] — |

RULES FOR THE CALCULATION OF THE VALUE OF LIABILITIES ON THE PRESCRIBED BASIS

|

| EIGHTH SCHEDULE [r. 16] — |

ACTUARY’S CERTIFICATE

|

| NINTH SCHEDULE — |

NOTES TO FORM NOS. INS. 59-1 TO 59-12

|

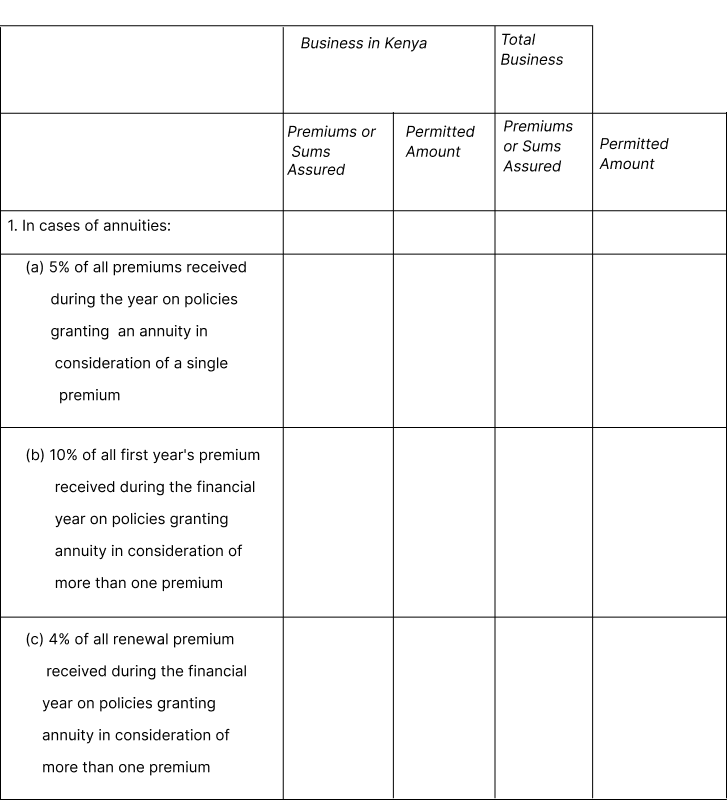

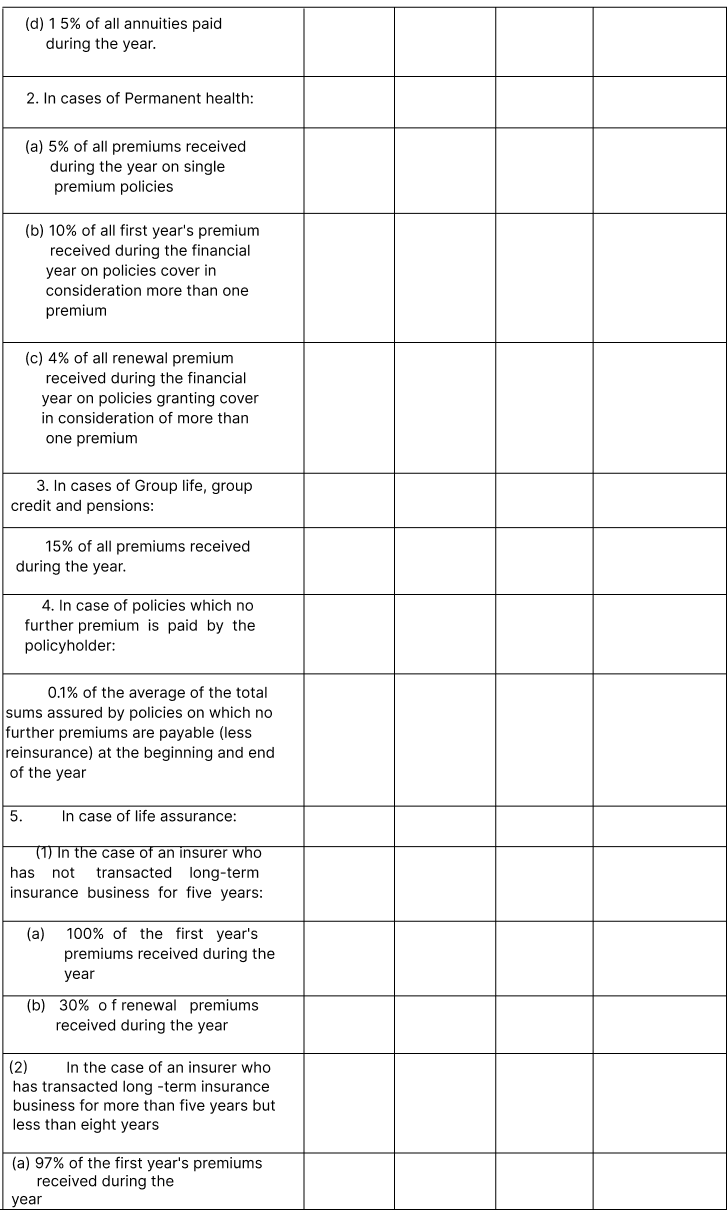

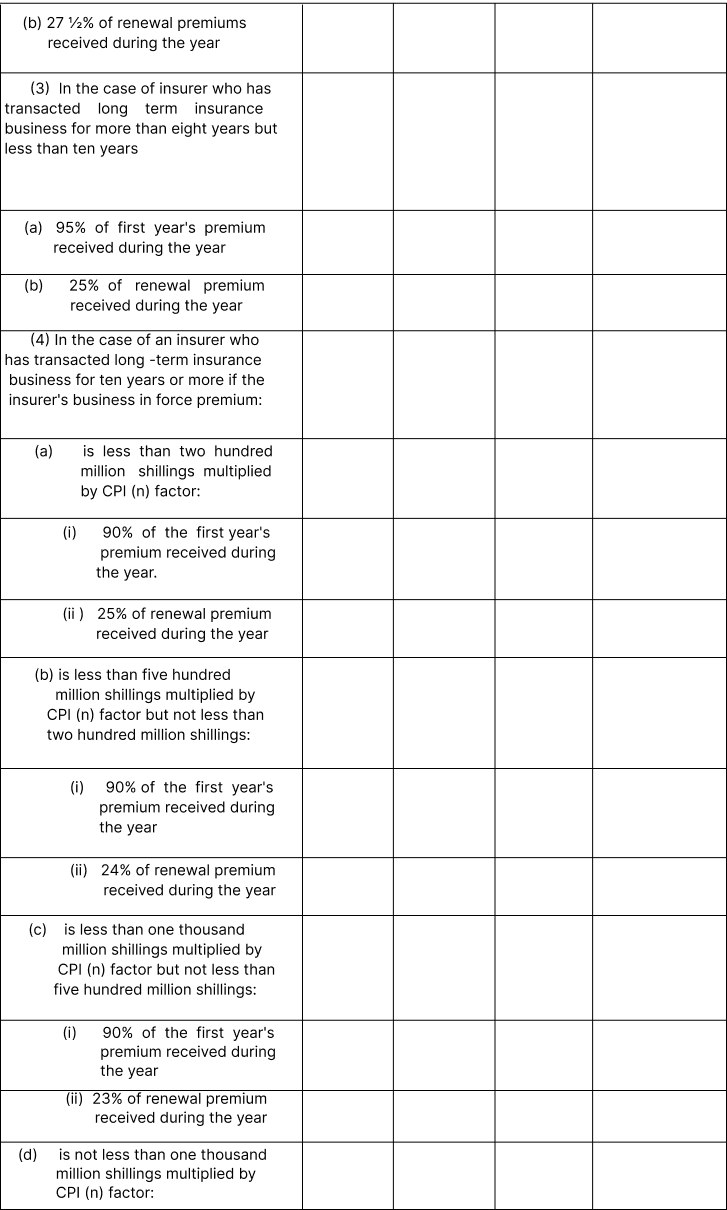

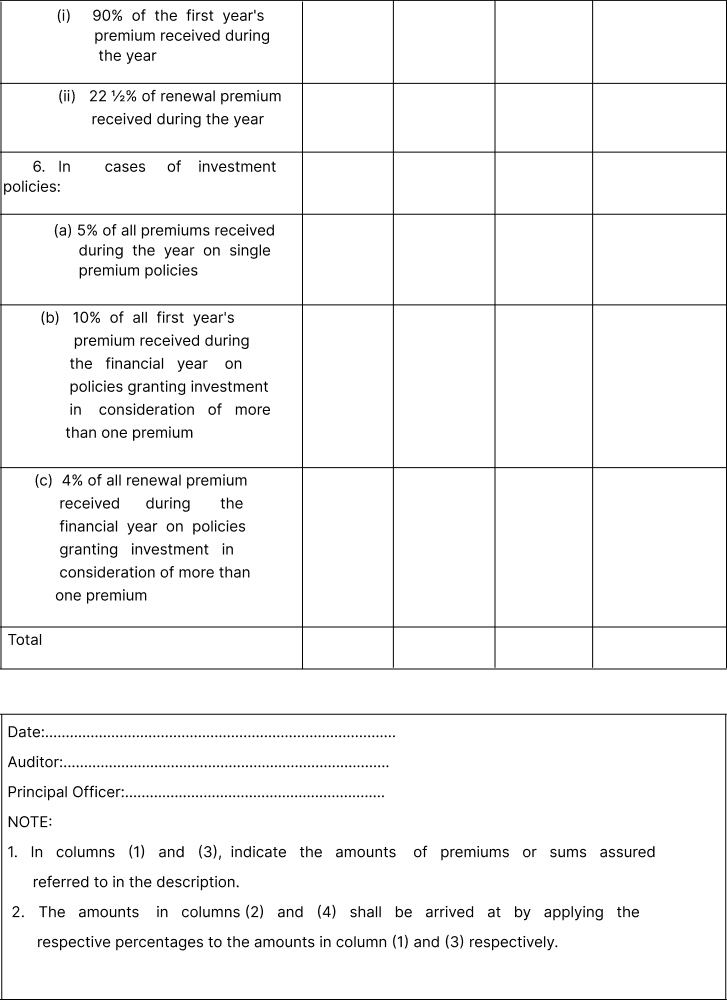

| TENTH SCHEDULE [s. 70, r. 21] — |

LIMITATION OF EXPENSES OF MANAGEMENT TERM INSURANCE BUSINESS OTHER THAN INDUSTRIAL LIFE ASSURANCE BUSINESS

|

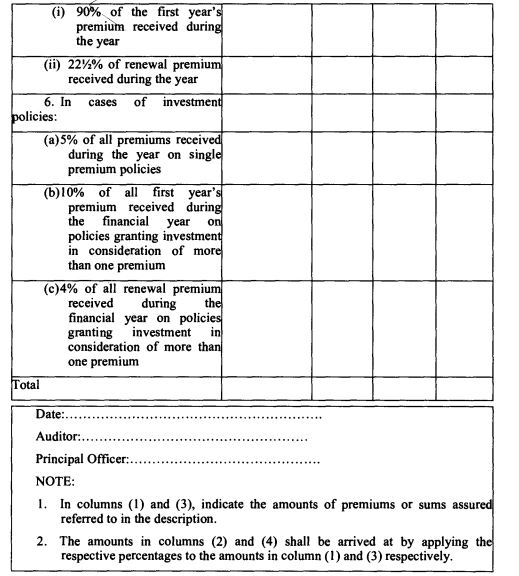

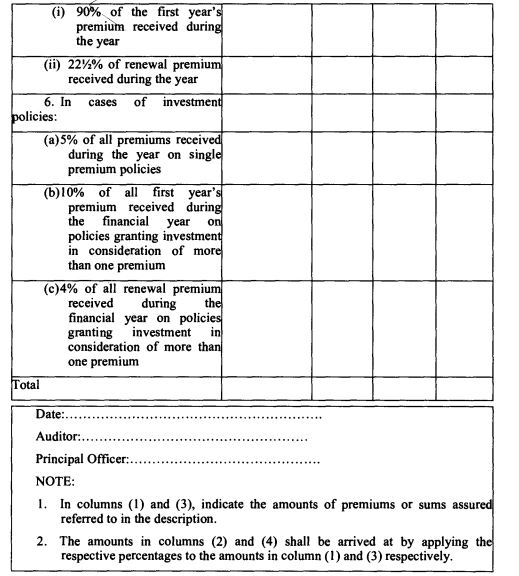

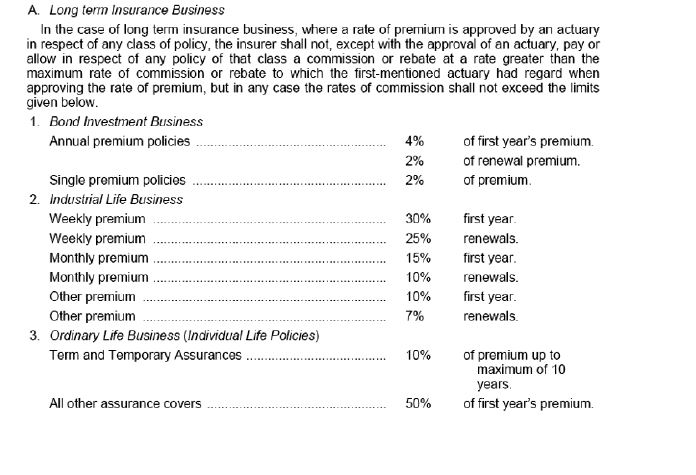

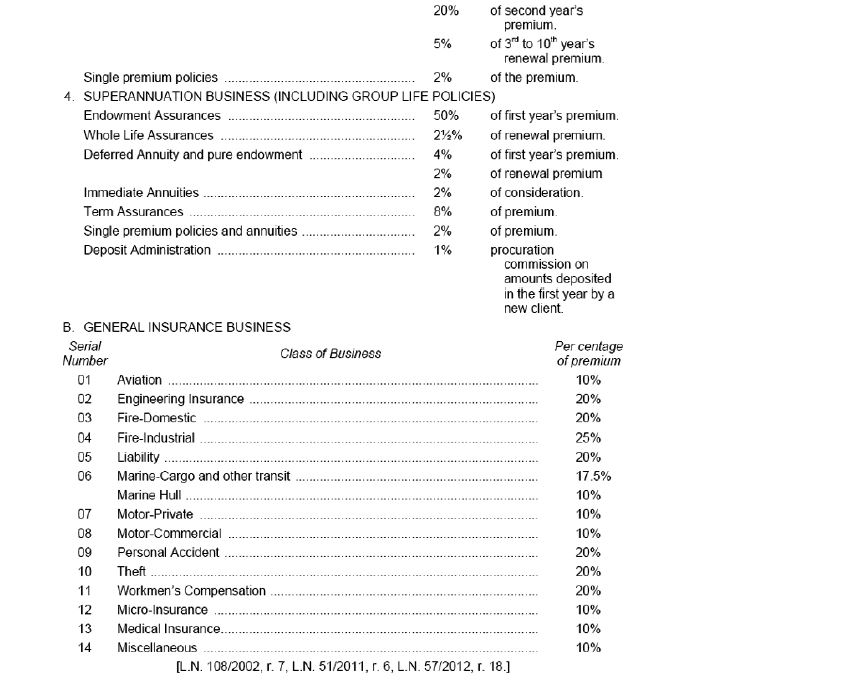

| ELEVENTH SCHEDULE [s. 73(2), r. 22] — |

MAXIMUM BROKERAGE, COMMISSION OR OTHER INTERMEDIARY PROCURATION FEES PAYABLE

|

| TWELFTH SCHEDULE [s. 88(1), r. 24] — |

RULES FOR ASCERTAINING THE AMOUNT OF A PAID UP POLICY

|

| THIRTEENTH SCHEDULE [s. 89(3), r. 25] — |

RULES FOR ASCERTAINING THE SURRENDER VALUE OF A POLICY

|

| FOURTEENTH SCHEDULE [s. 111(1), r. 29] — |

FORMS

|

| FIFTEENTH SCHEDULE [r. 32, 33] — |

MANDATORY REINSURANCE CESSIONS

|

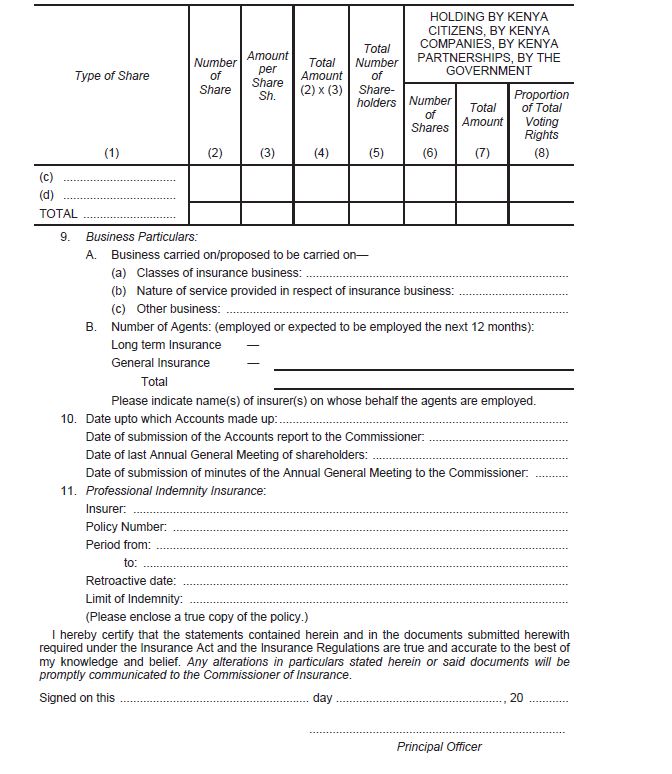

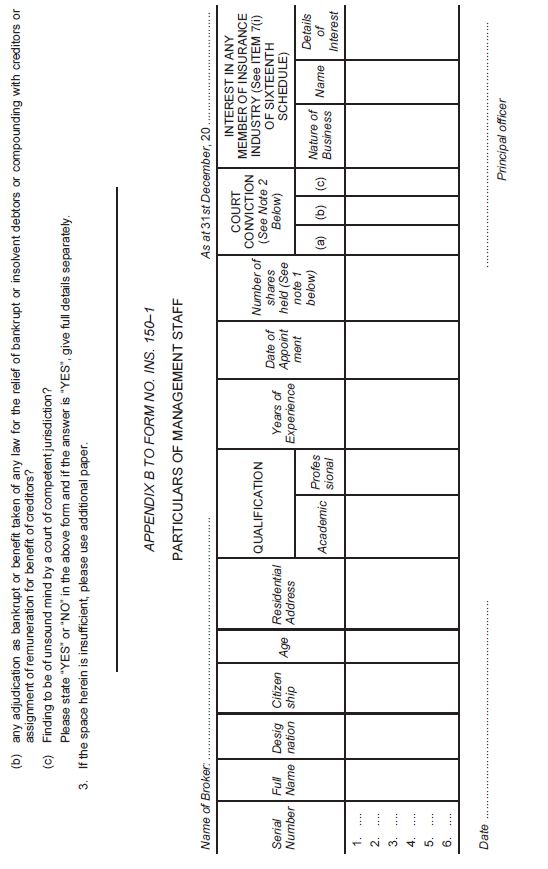

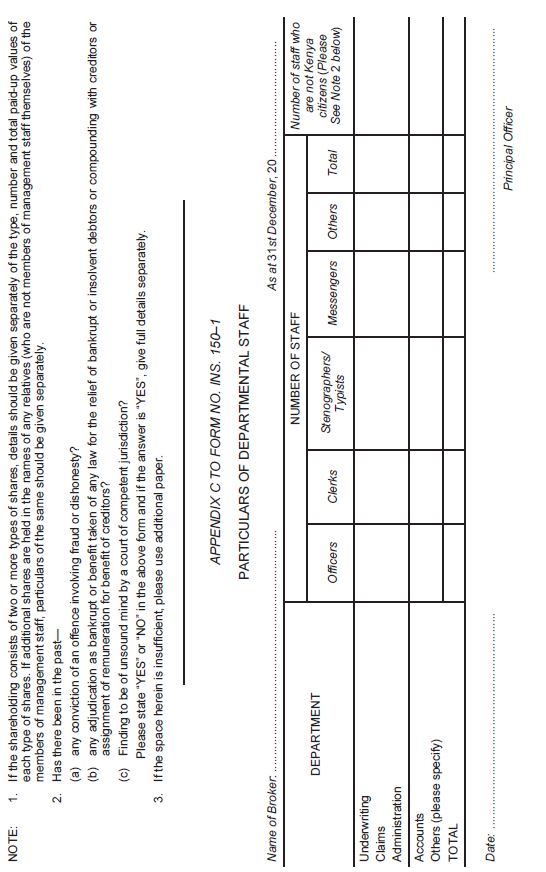

| SIXTEENTH SCHEDULE [r. 34] — |

APPLICATIONS

|

| SEVENTEENTH SCHEDULE [s. 151(1)(a), r. 35.] — |

PROFESSIONAL INDEMNITY POLICY

|

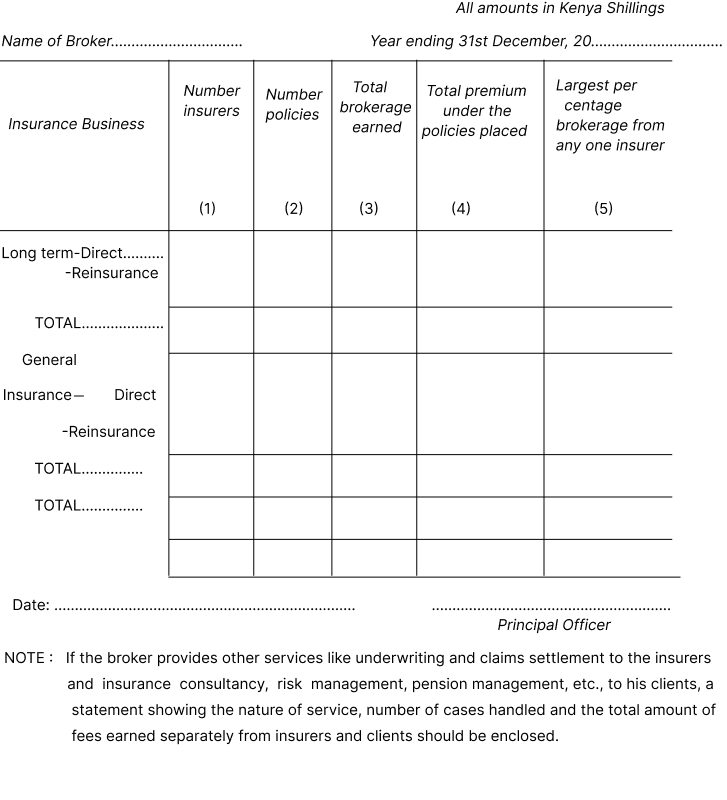

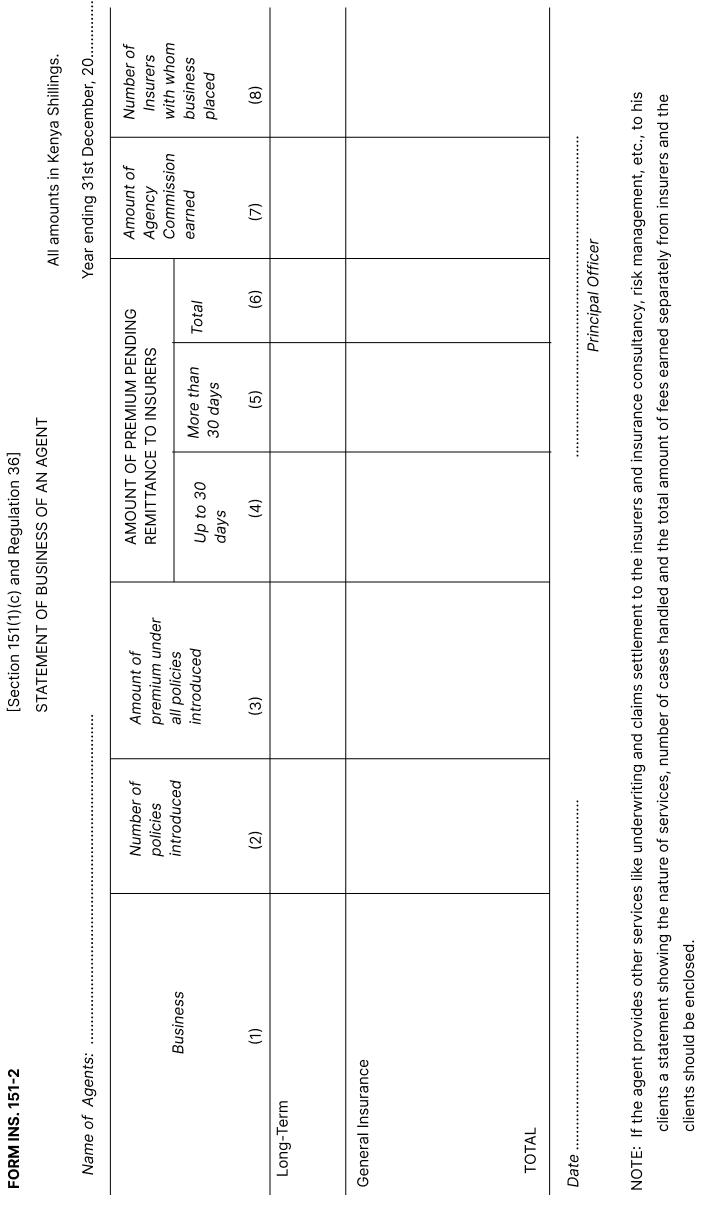

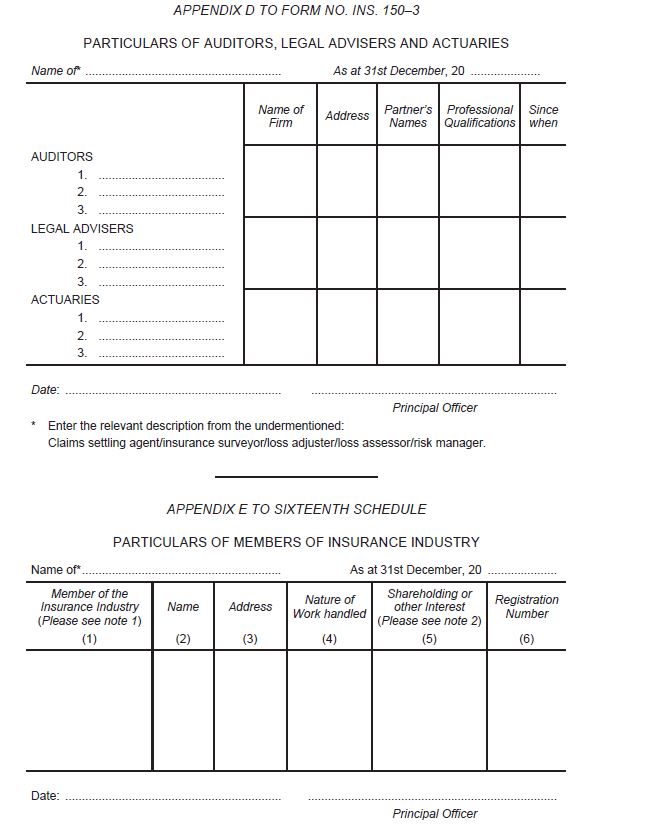

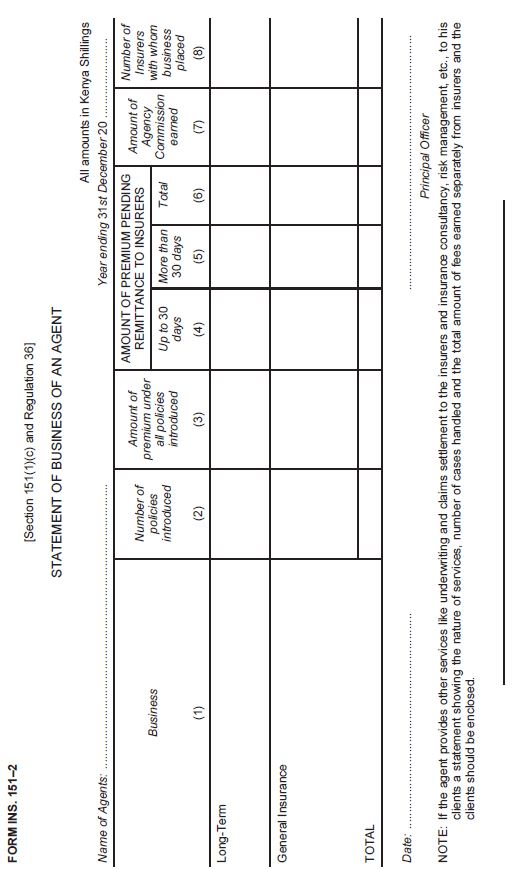

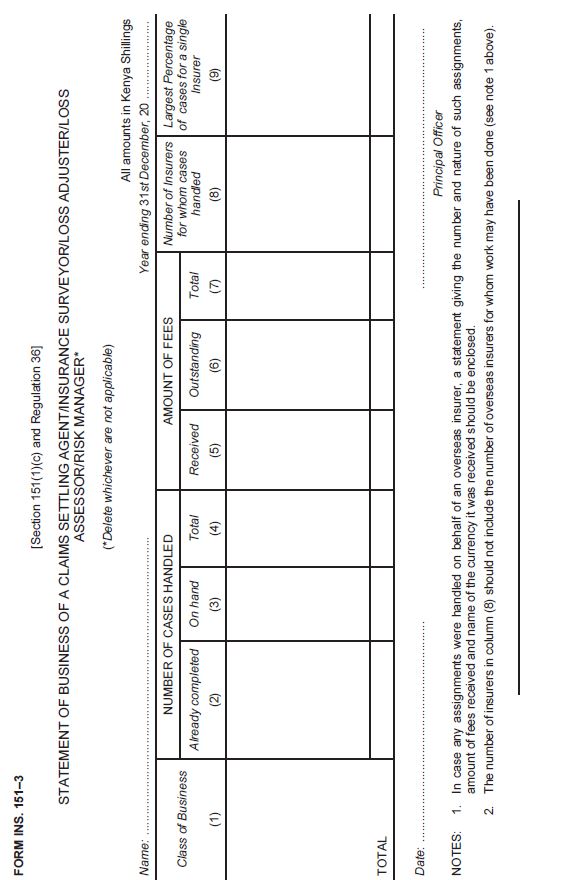

| EIGHTEENTH SCHEDULE [s. 151(1)(e), r. 36] — |

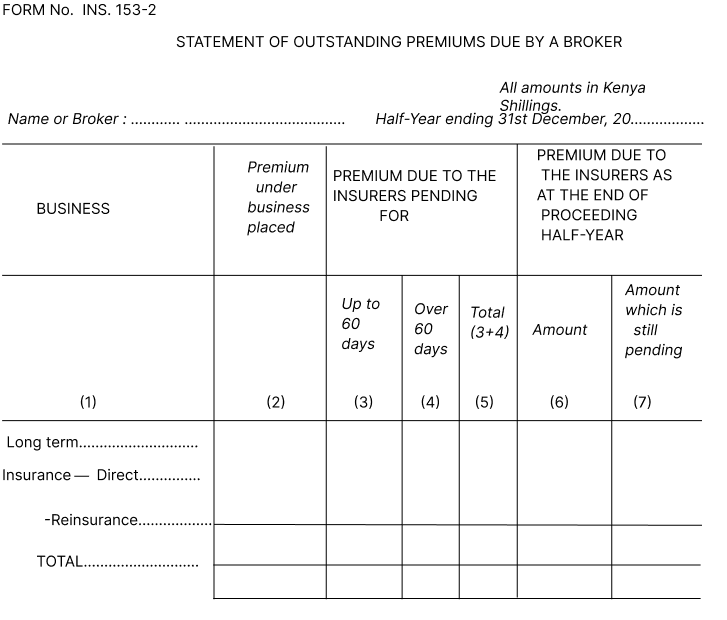

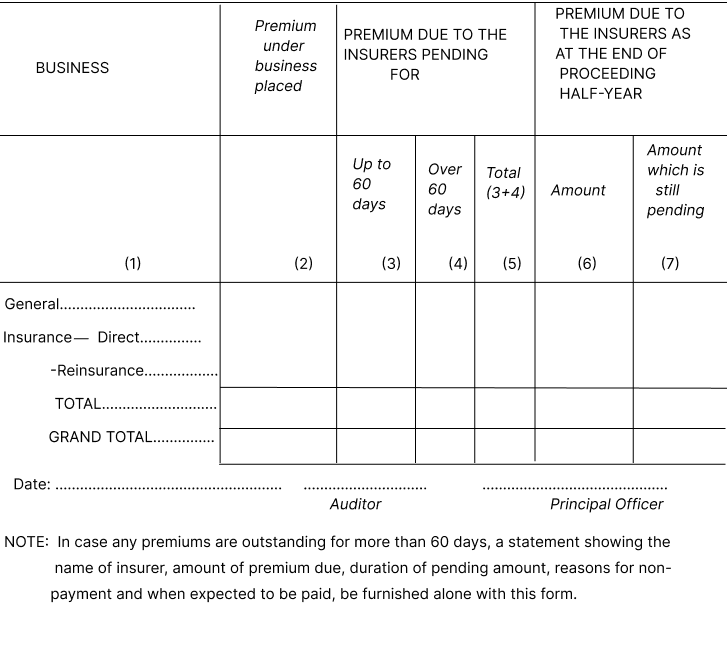

STATEMENT OF BUSINESS OF A BROKER

|

| NINETEENTH SCHEDULE [s. 39] — |

FORM OF GUARANTEE

|

| TWENTIETH SCHEDULE [r. 47] — |

APPLICATION TO REMIT FUNDS OVERSEAS

|

| TWENTY-FIRST SCHEDULE — |

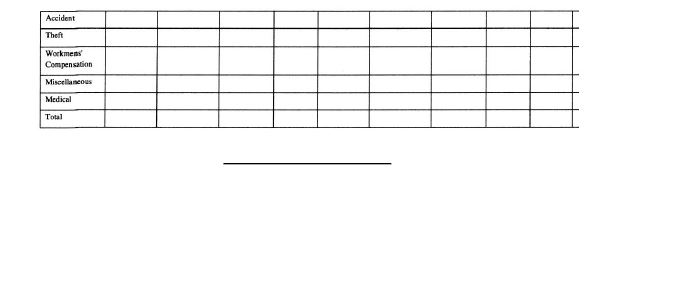

SUMMARY OF CLAIMS

|

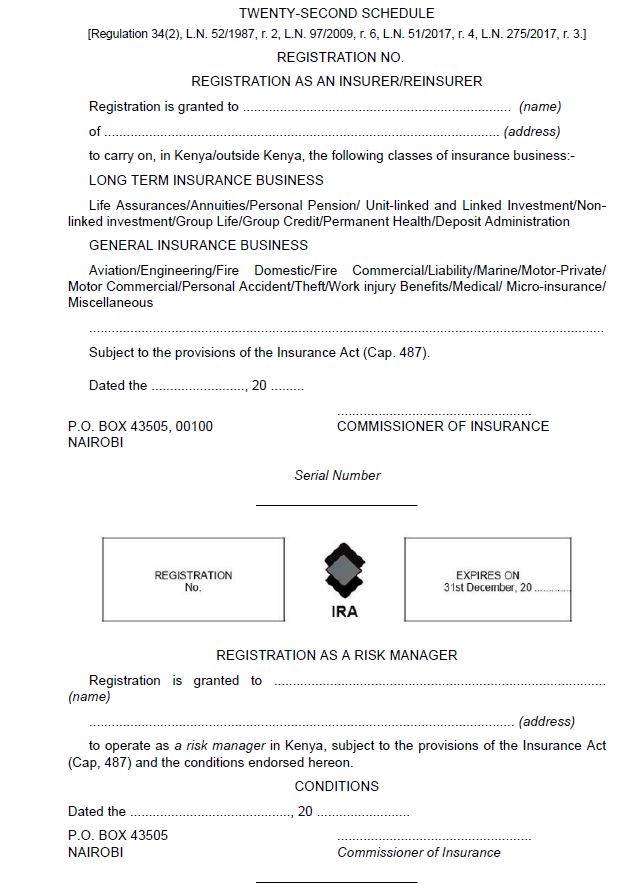

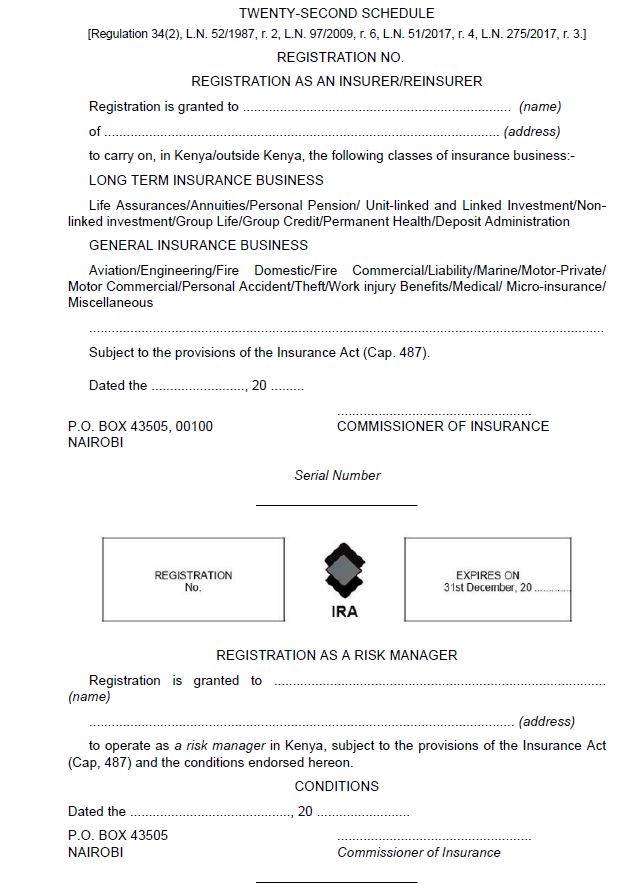

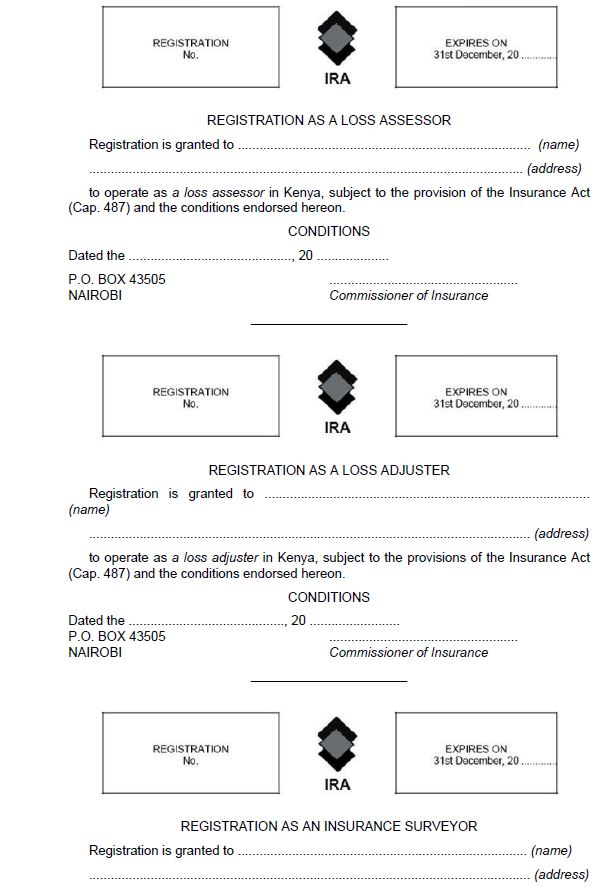

| TWENTY-SECOND SCHEDULE [r. 34(2)] — |

REGISTRATION AS AN INSURANCE/REINSURER

|

| TWENTY-THIRD SCHEDULE [r. 51] — |

MONTHLY INSURANCE PREMIUM LEVY RETURN

|

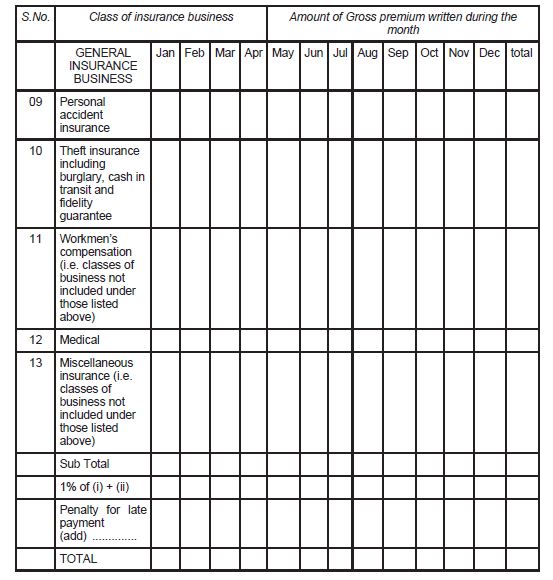

| TWENTY-FOURTH SCHEDULE [r. 52] — |

MONTHLY PREMIUM TAX RETURN

|

| TWENTY-FIFTH SCHEDULE — |

ANNUAL PREMIUM TAX RETURN

|

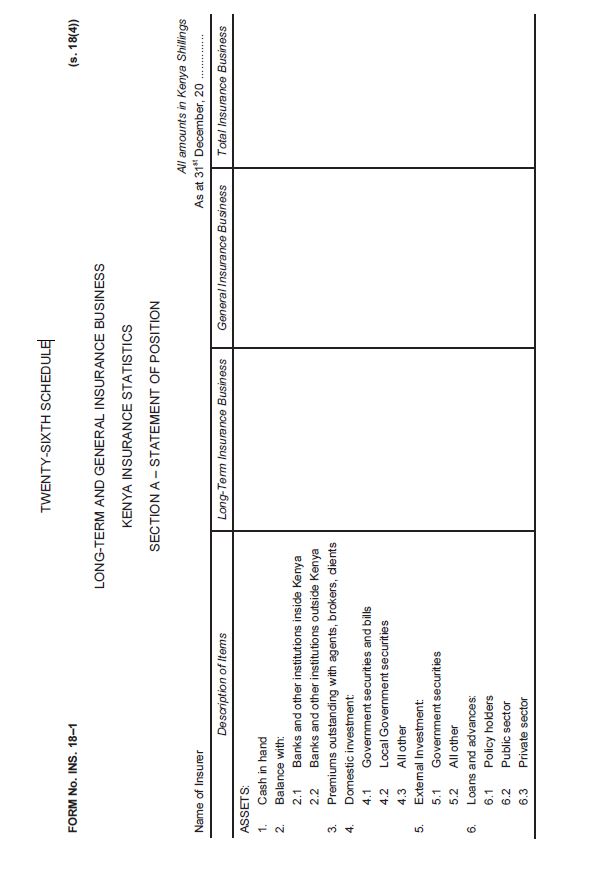

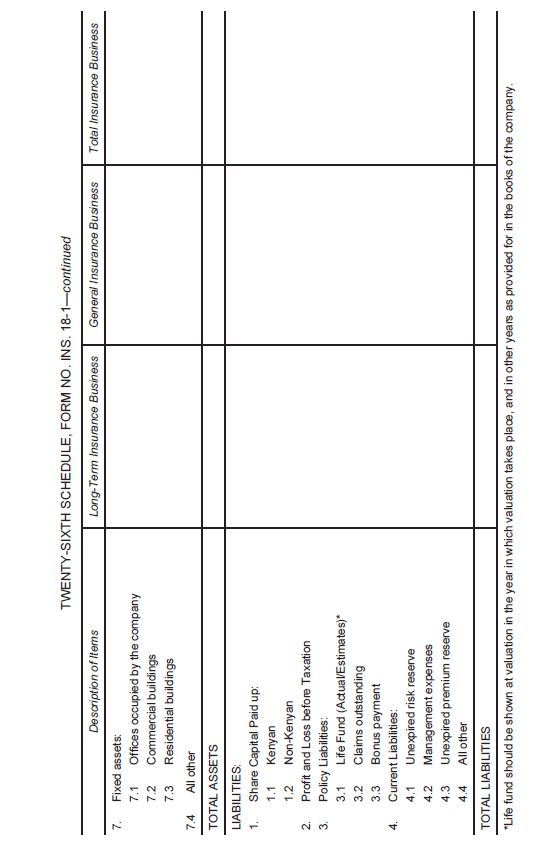

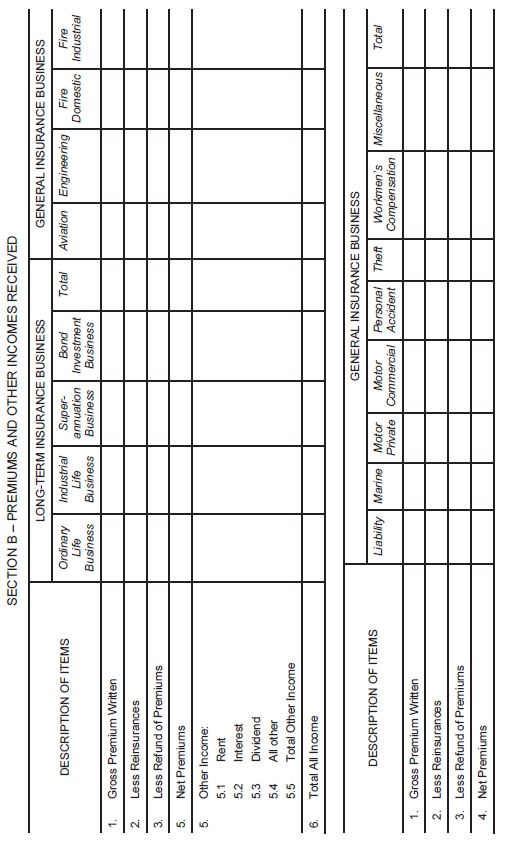

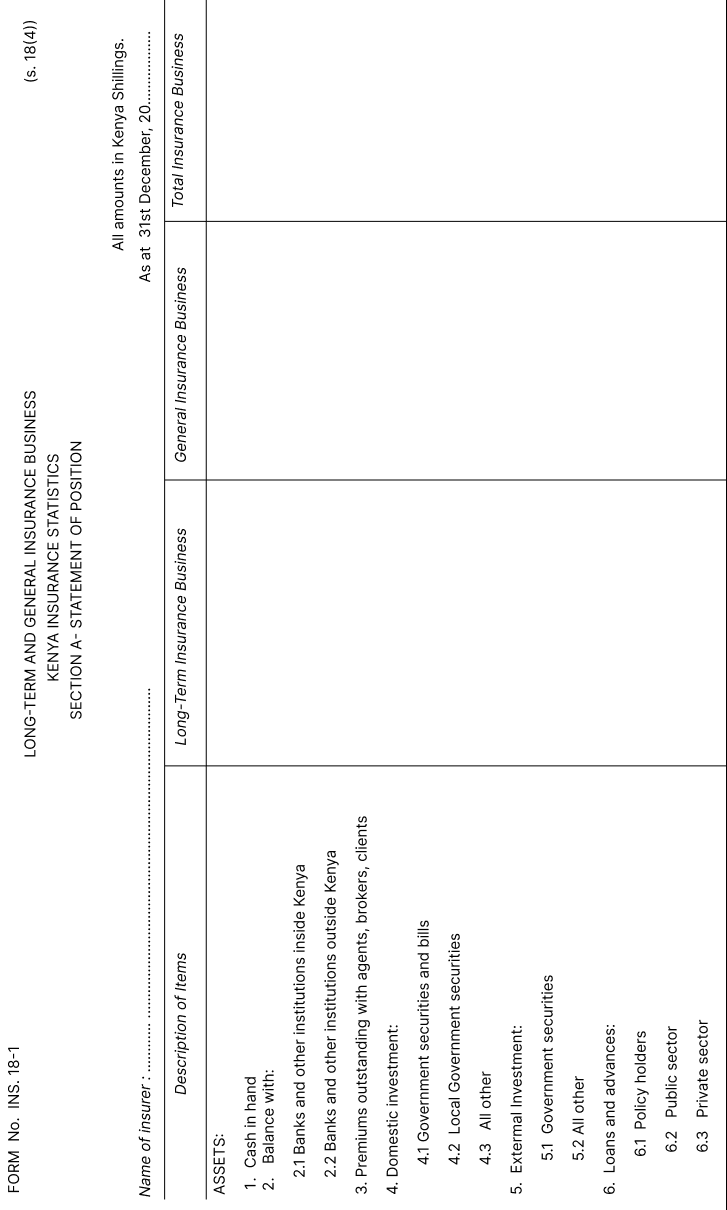

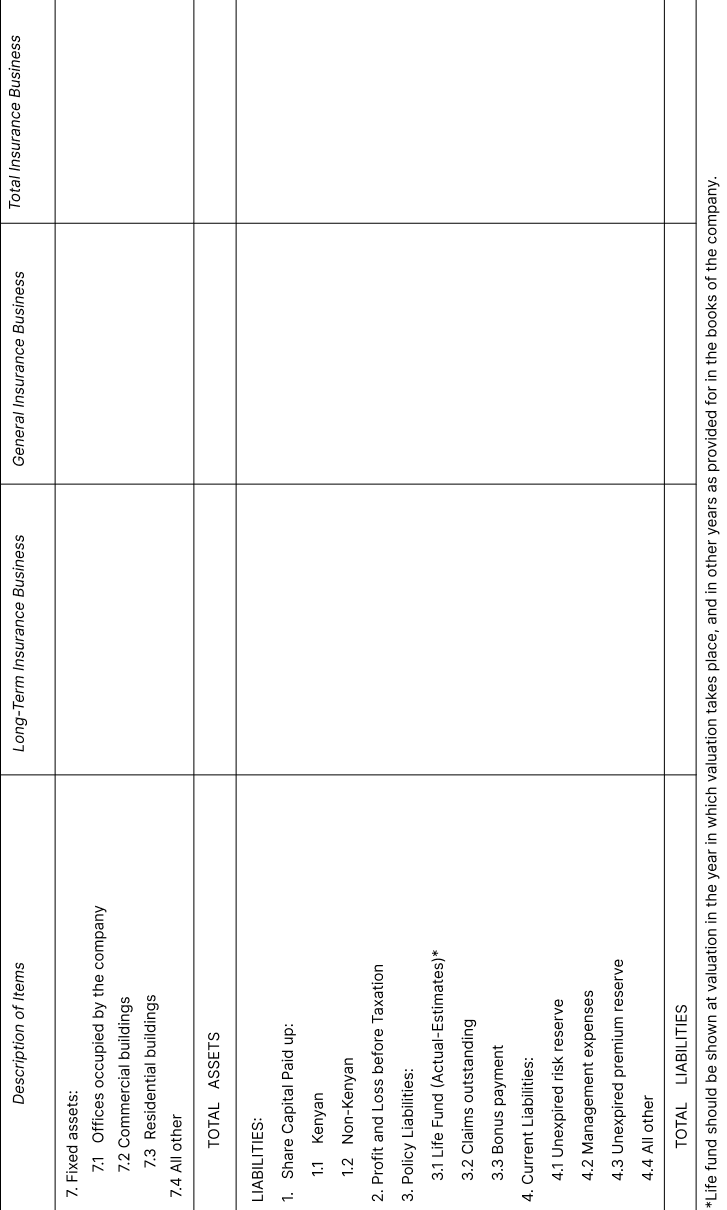

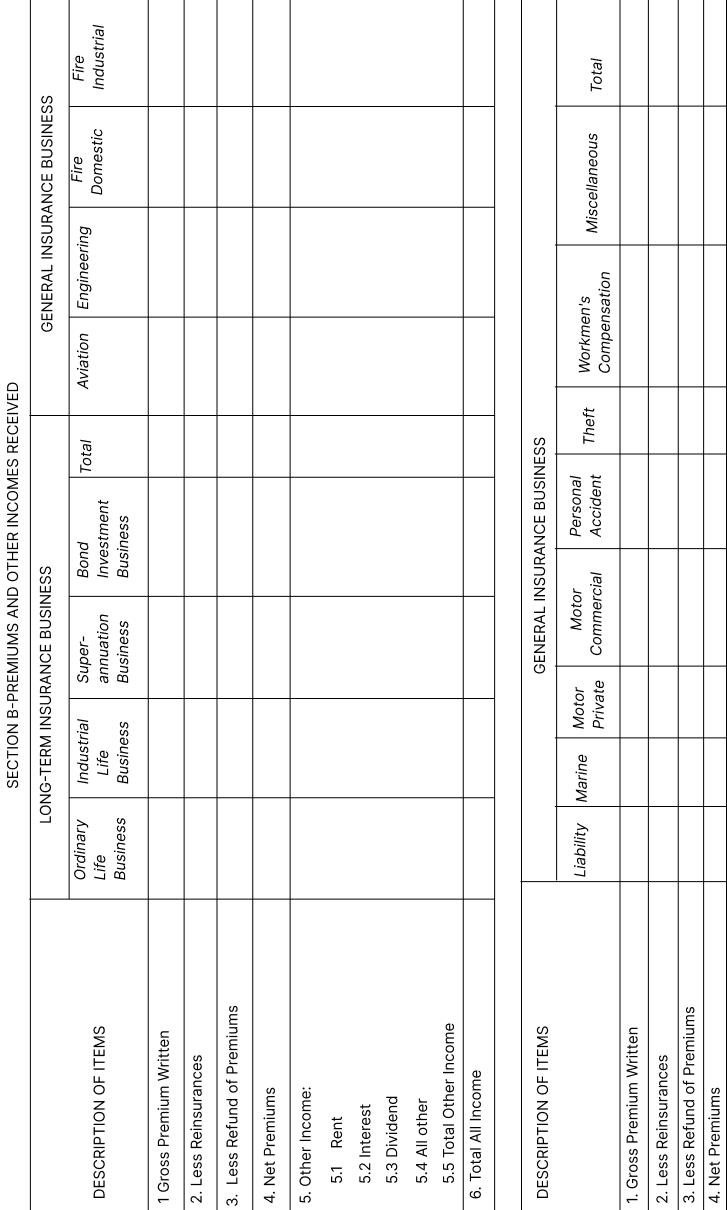

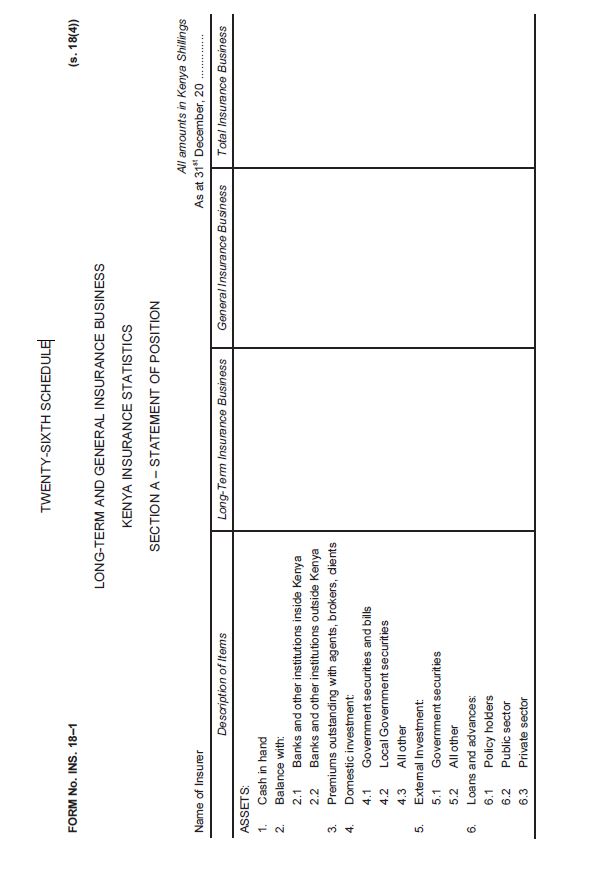

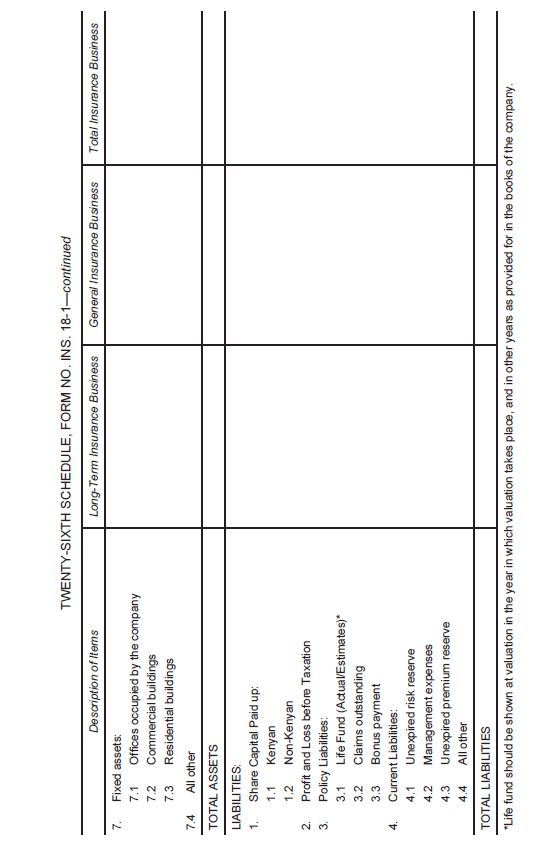

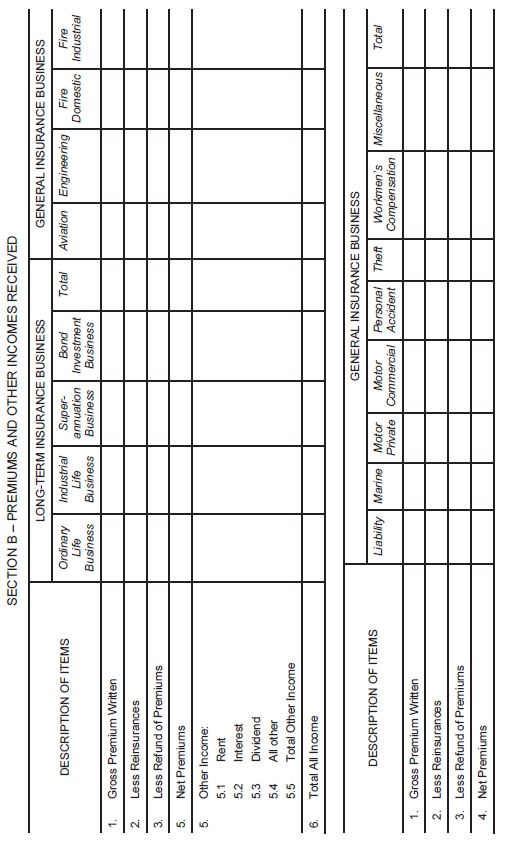

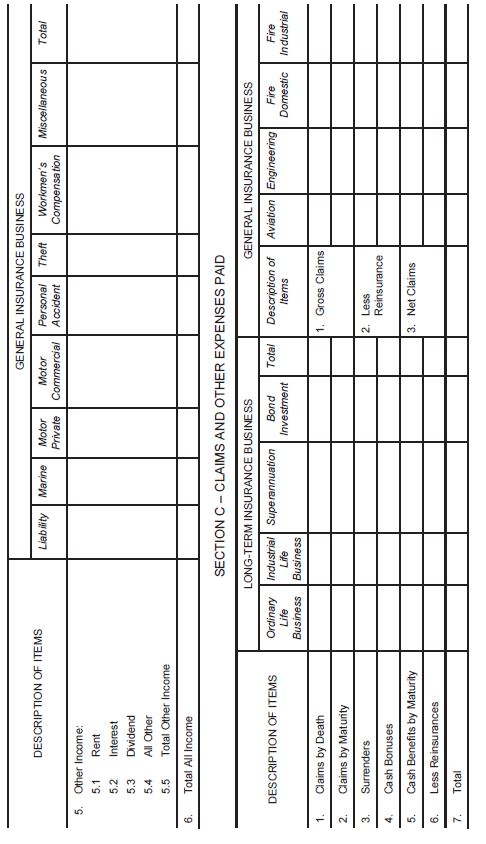

| TWENTY-SIXTH SCHEDULE — |

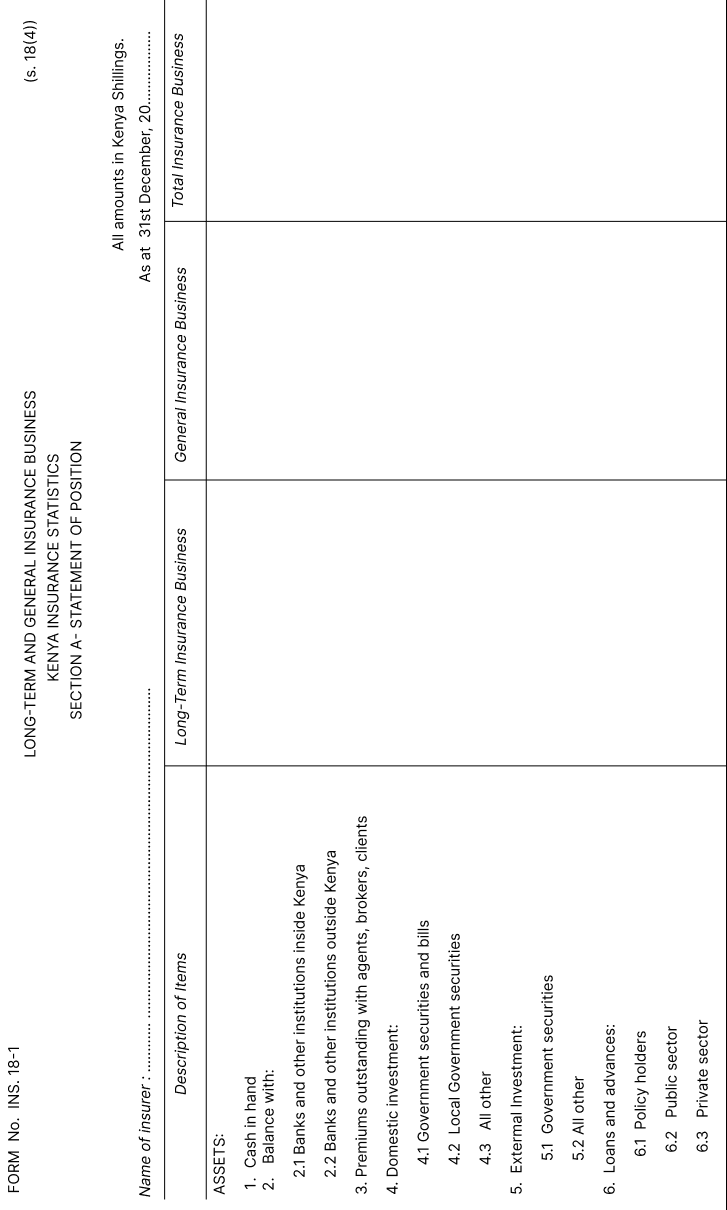

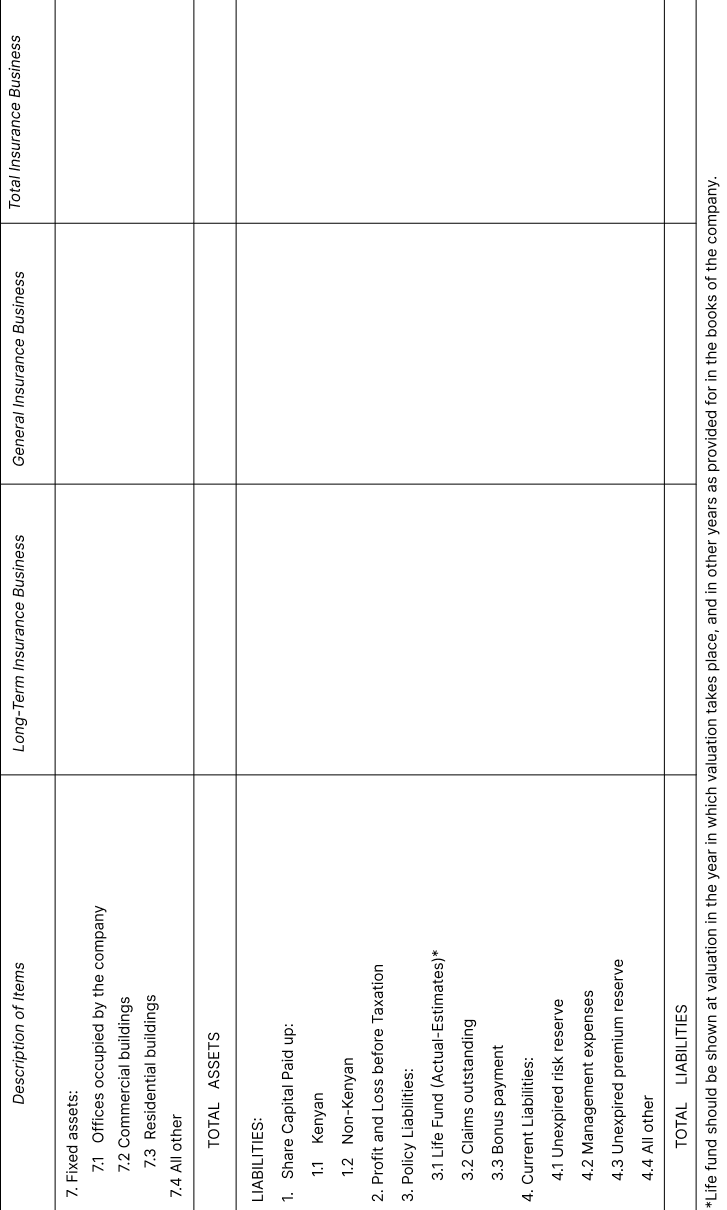

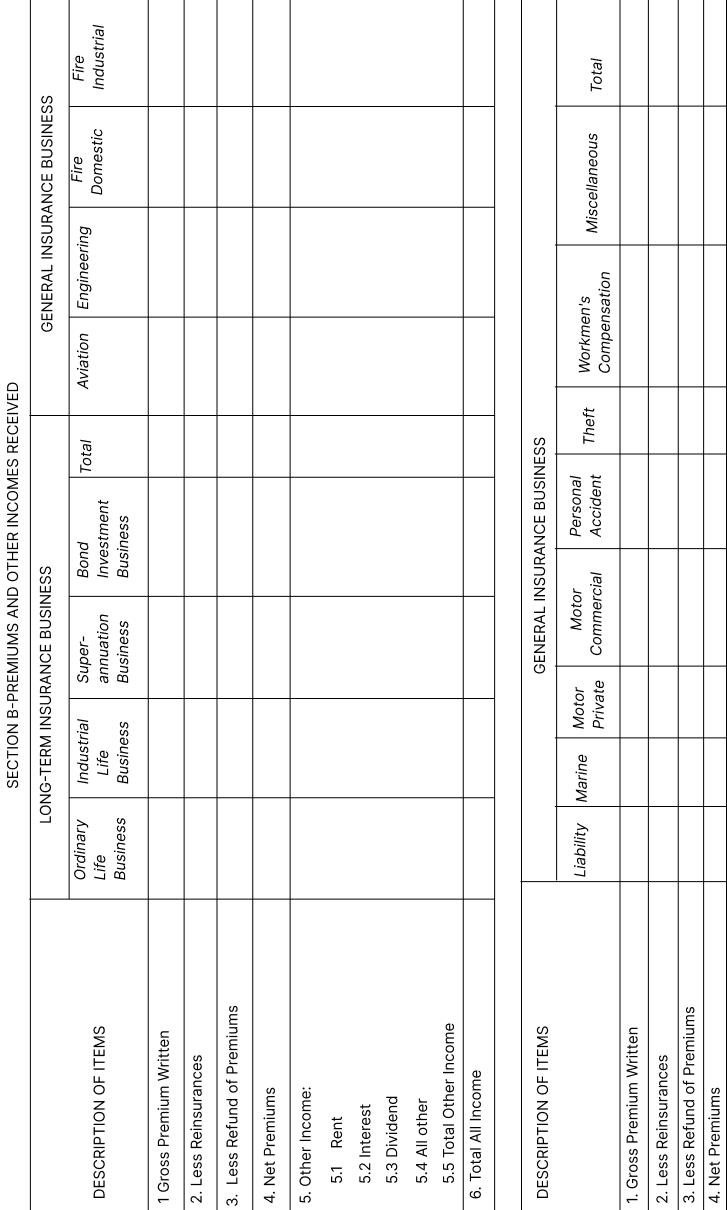

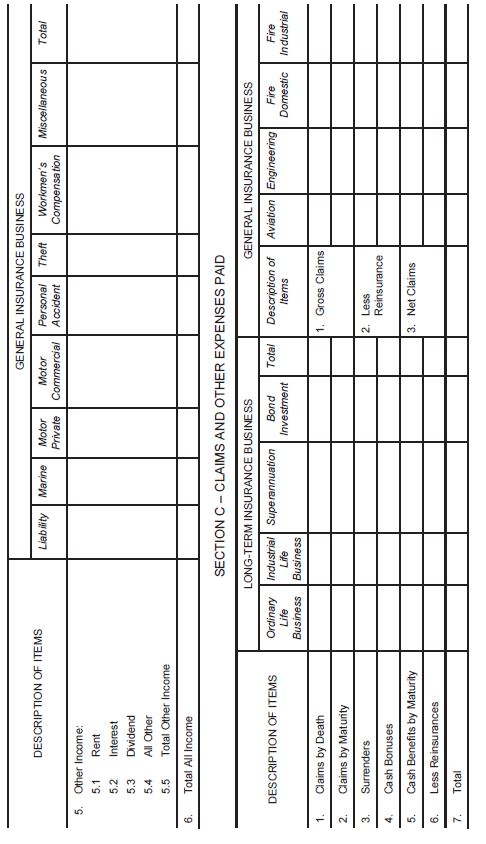

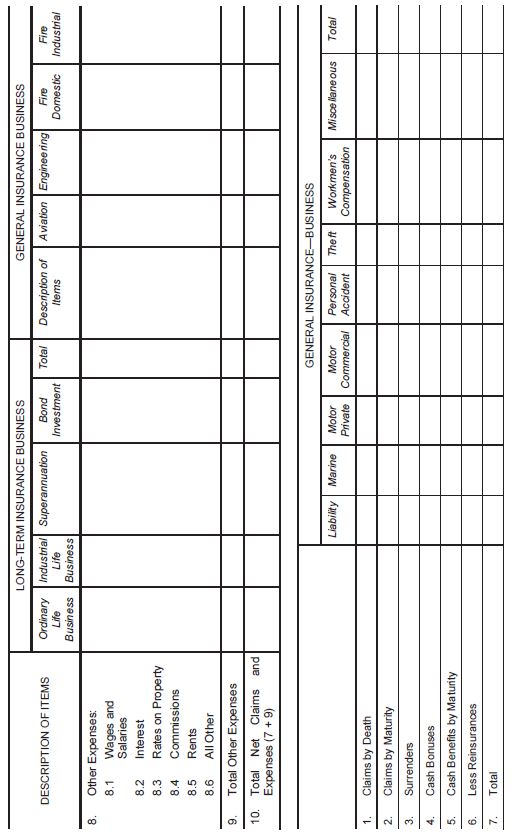

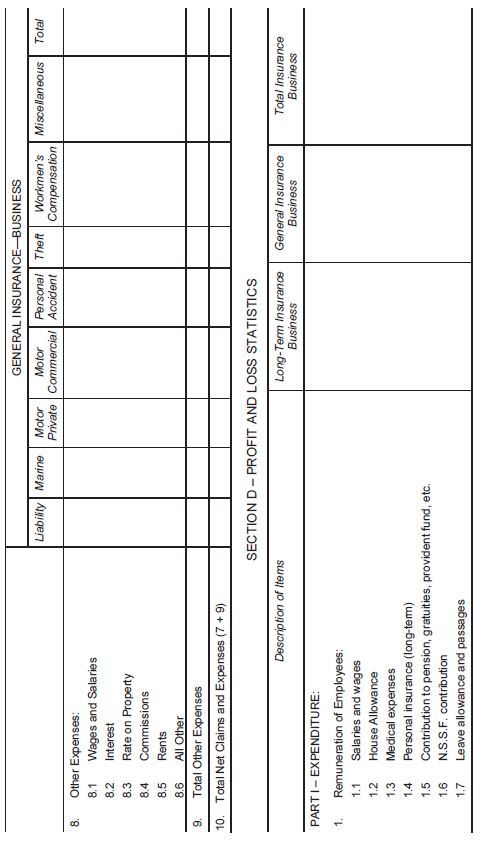

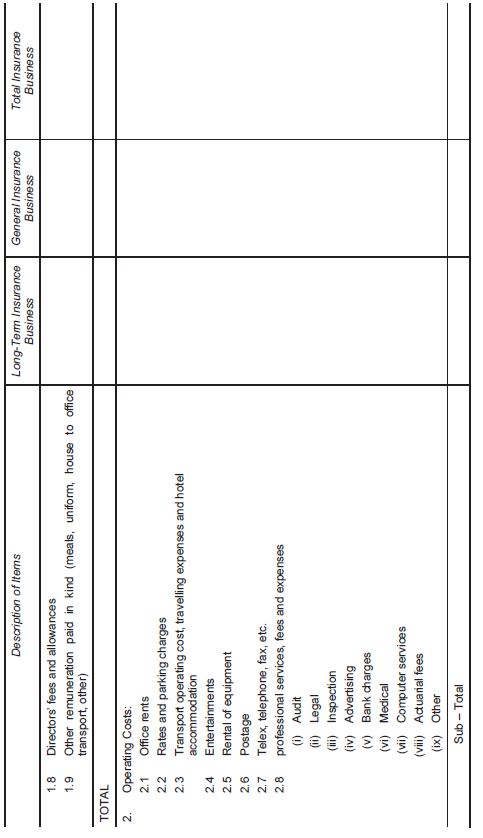

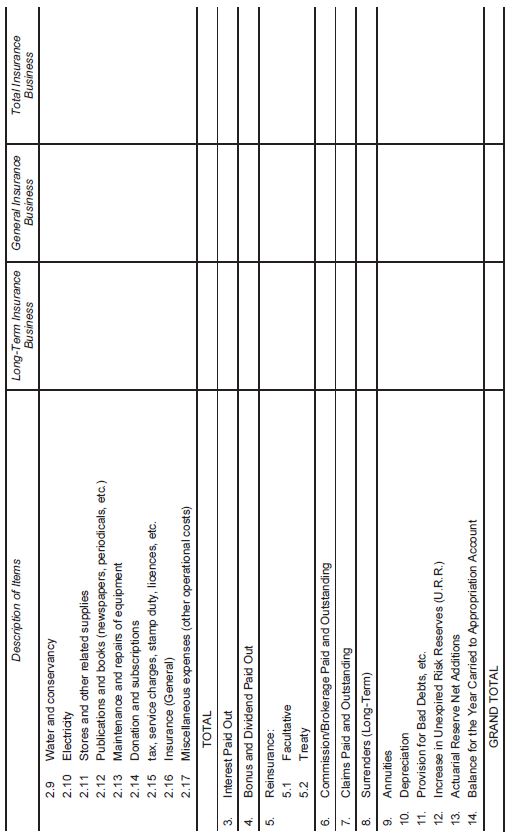

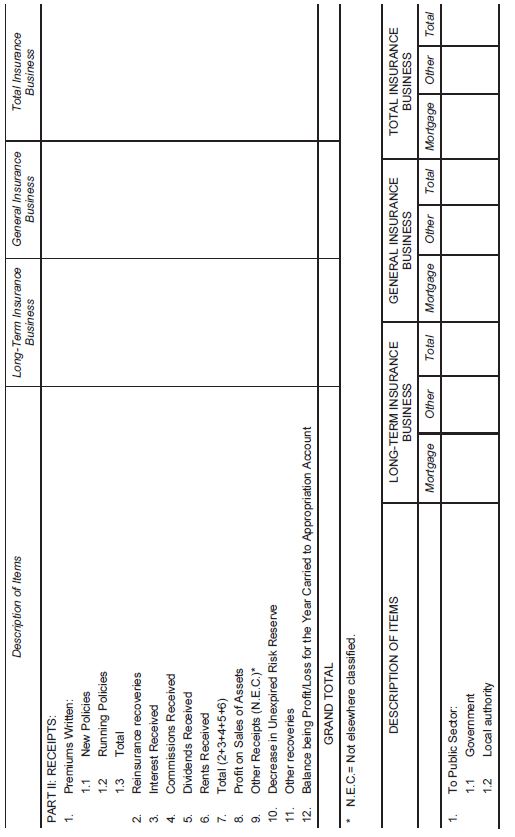

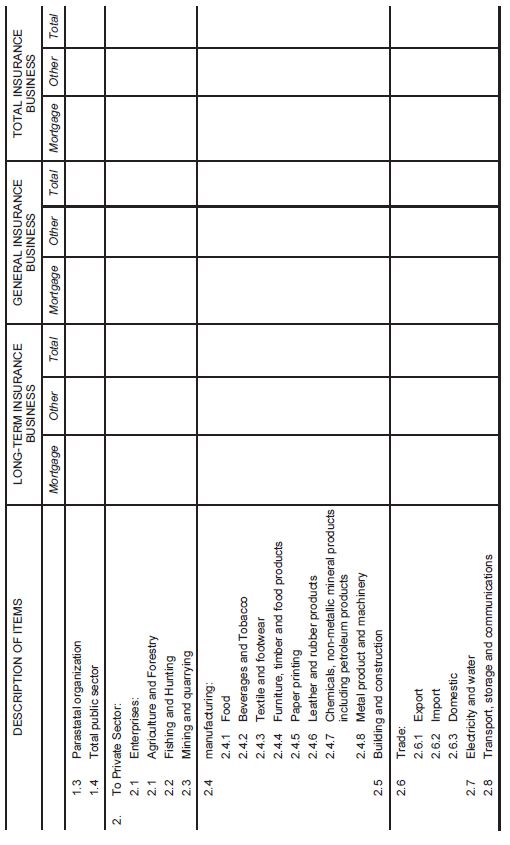

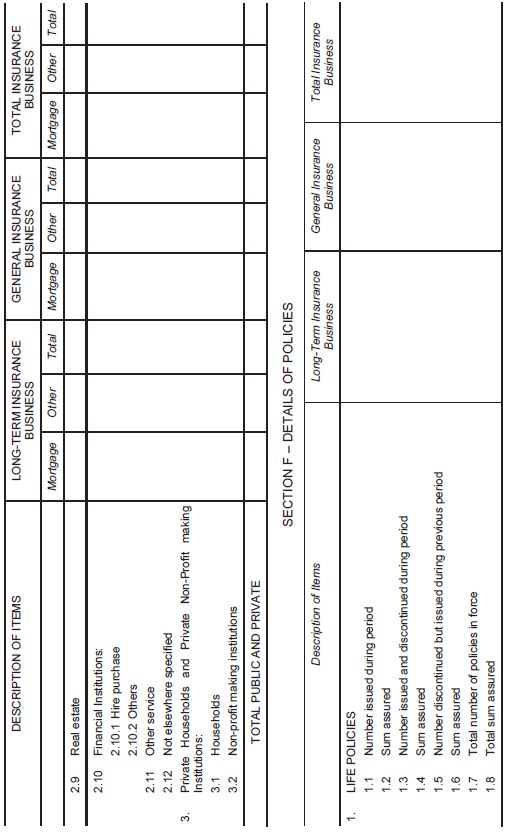

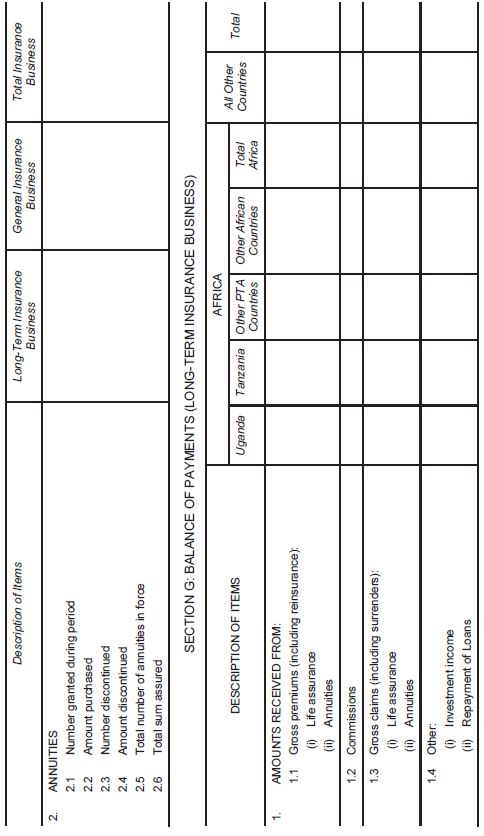

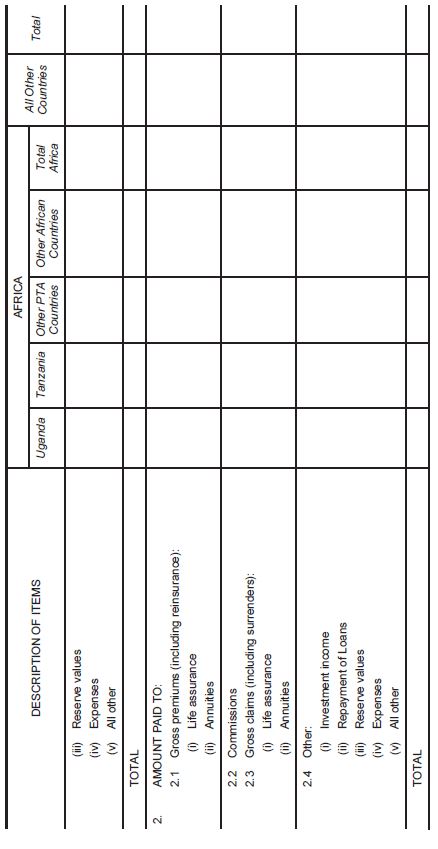

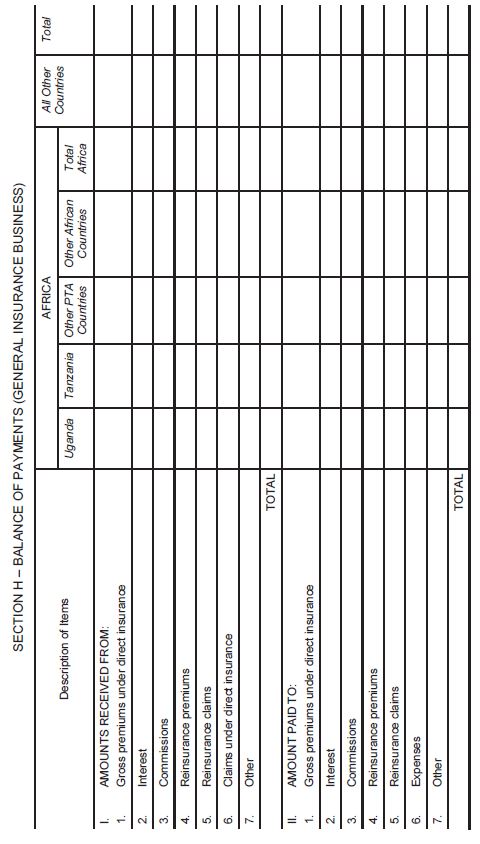

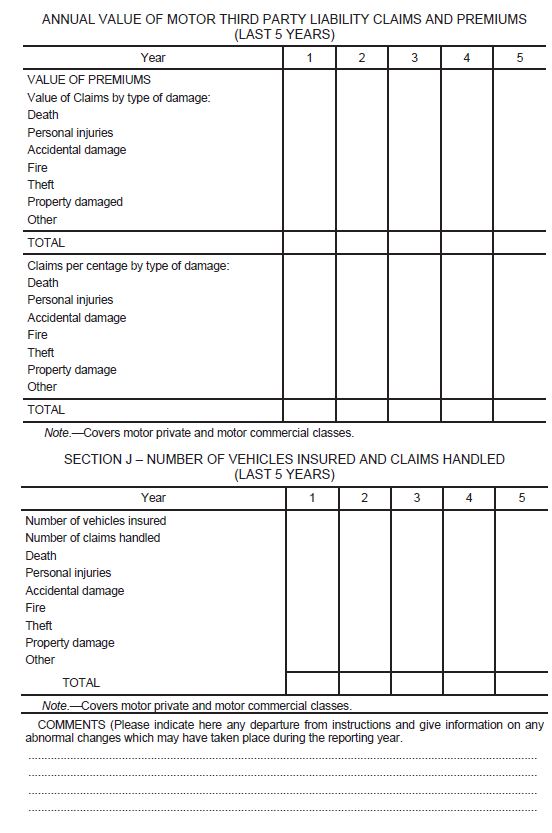

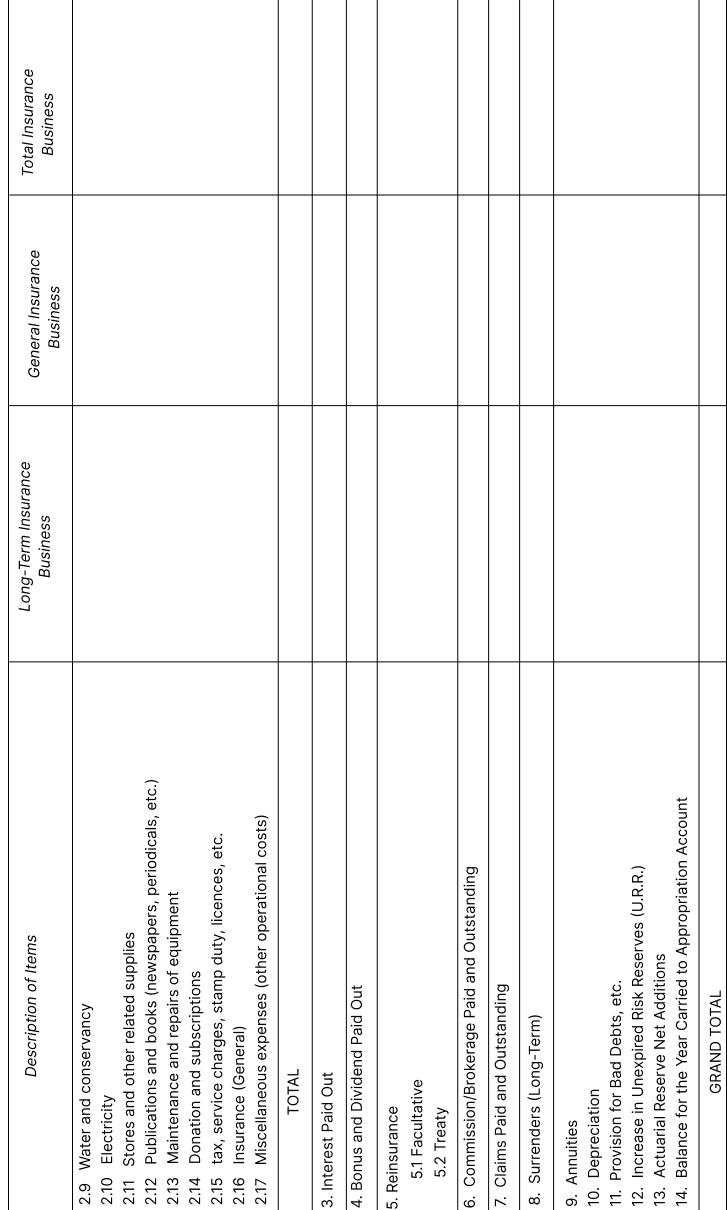

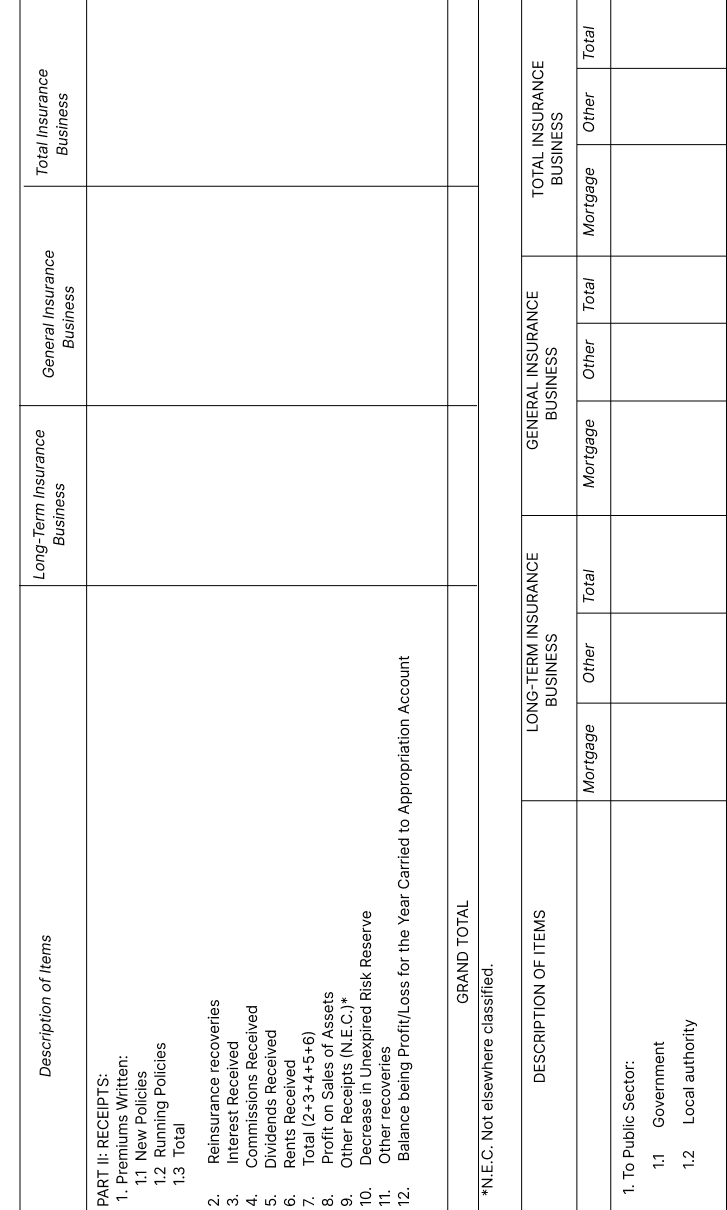

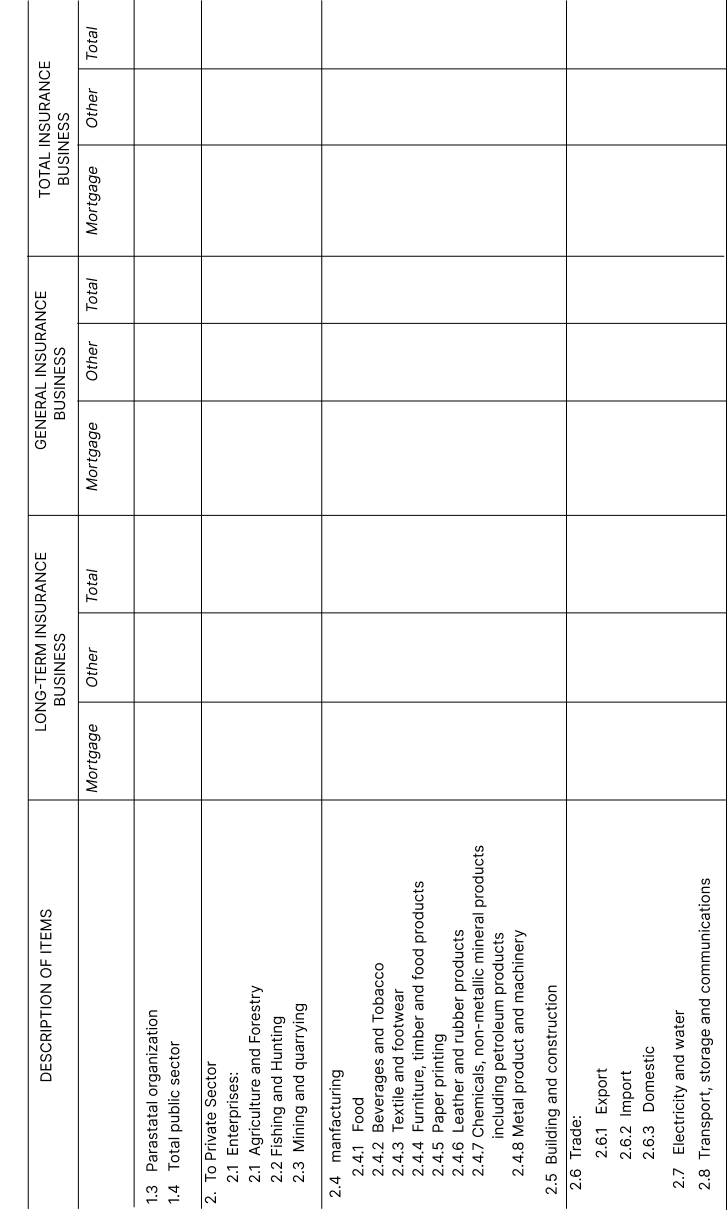

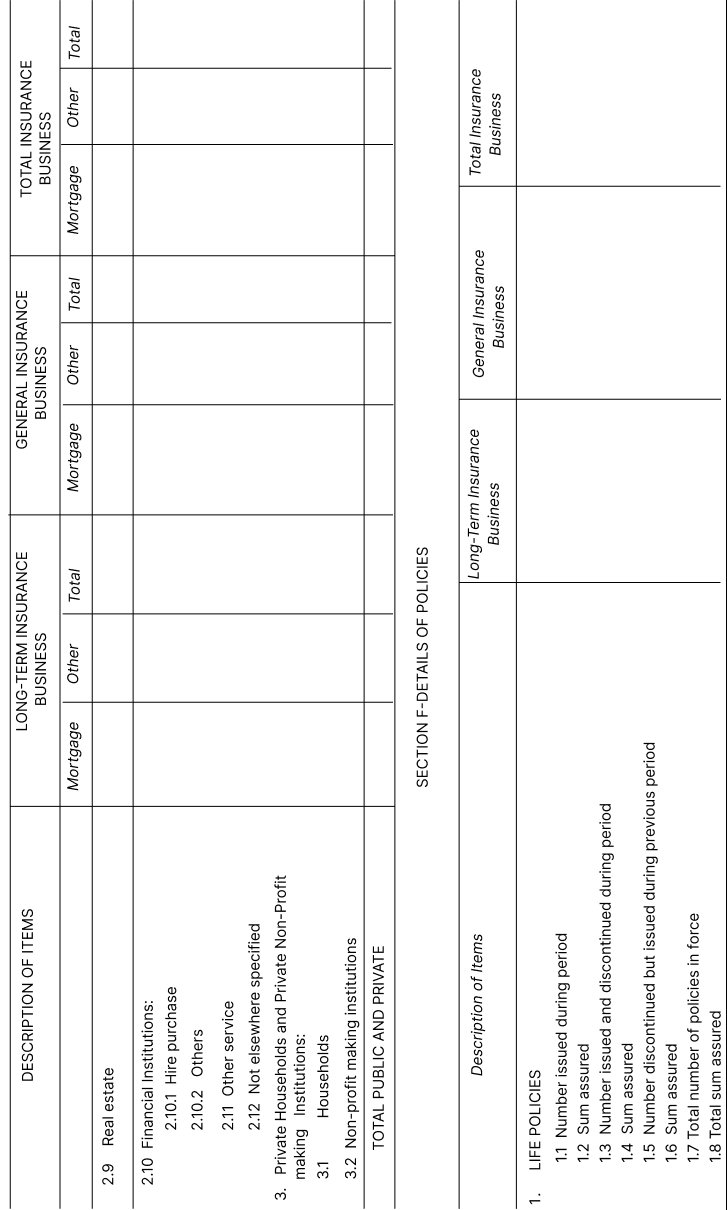

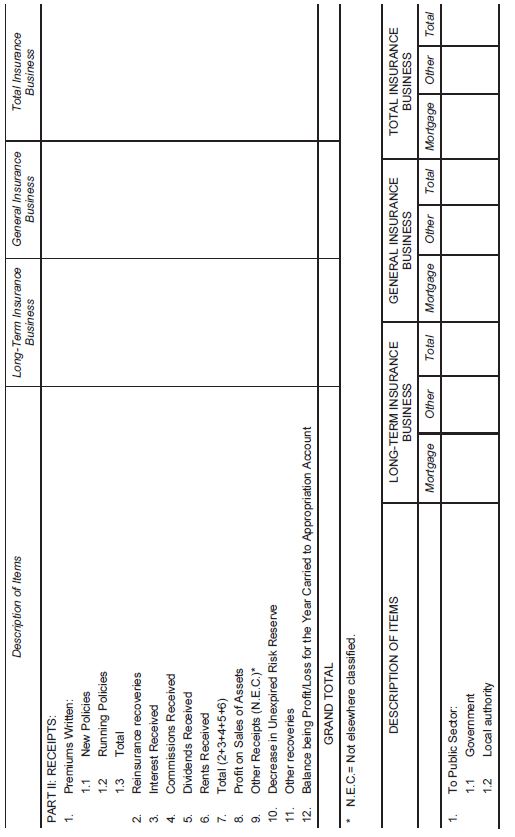

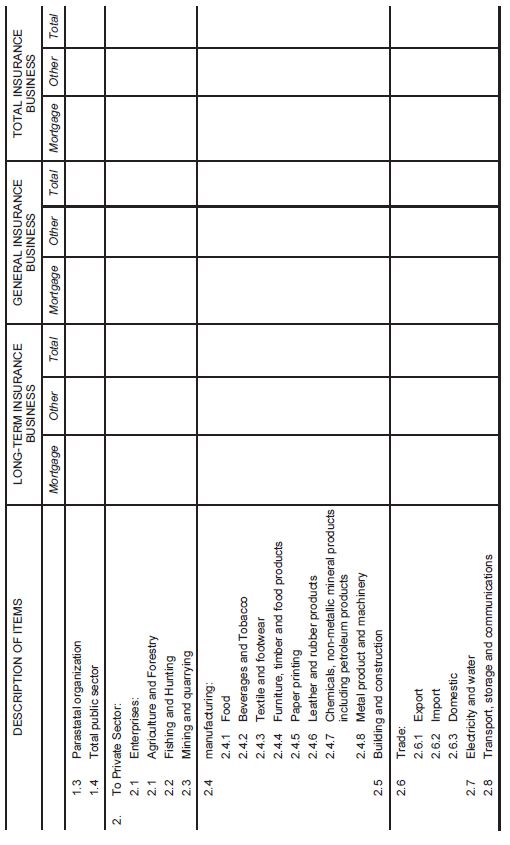

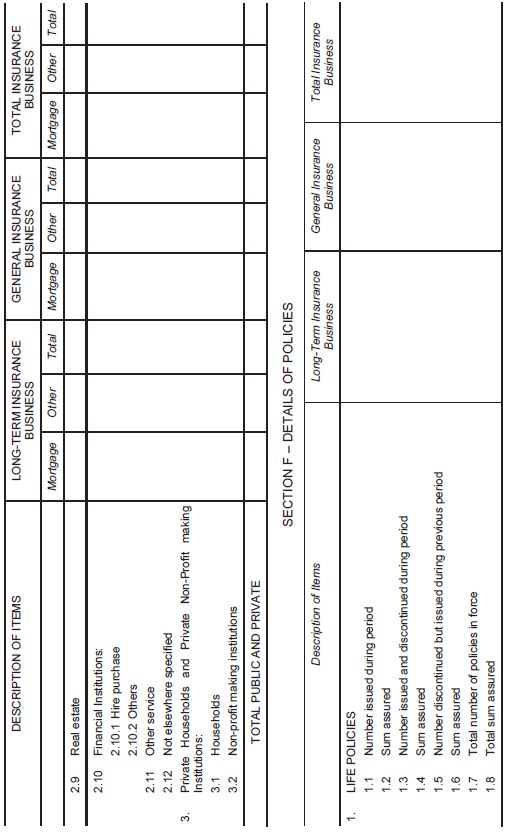

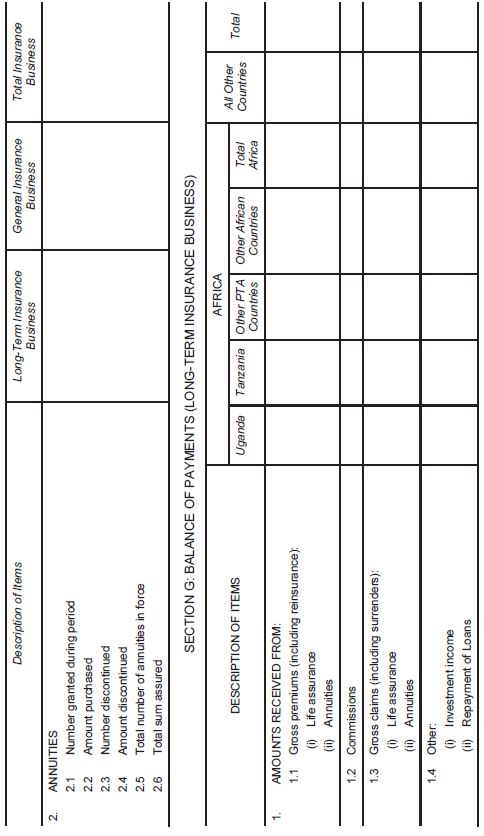

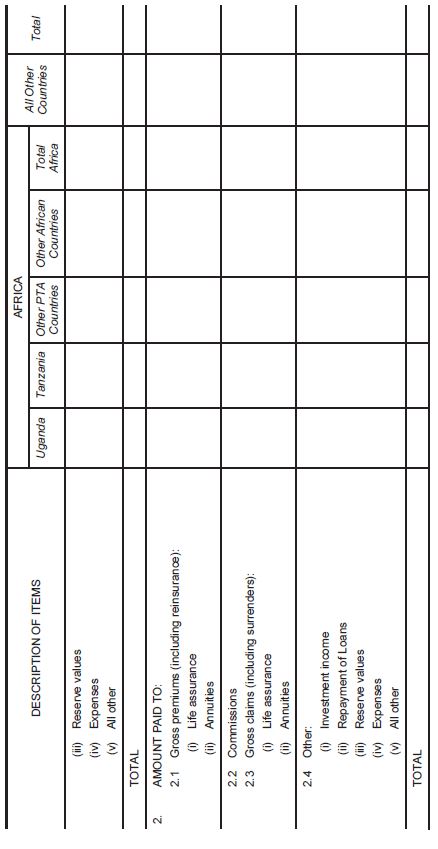

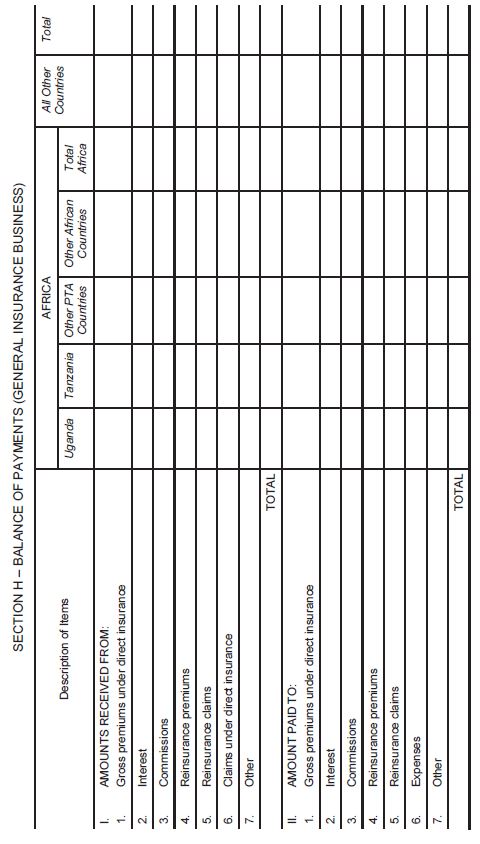

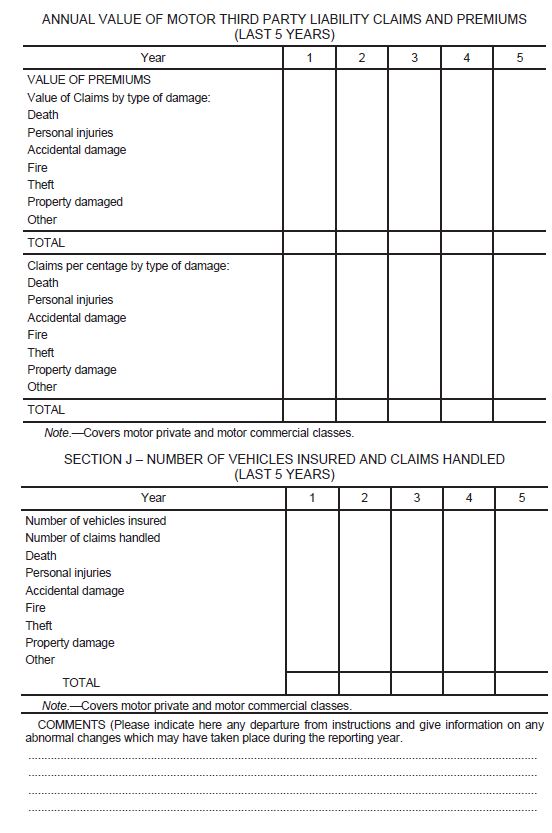

LONG TERM AND GENERAL INSURANCE BUSINESS

|

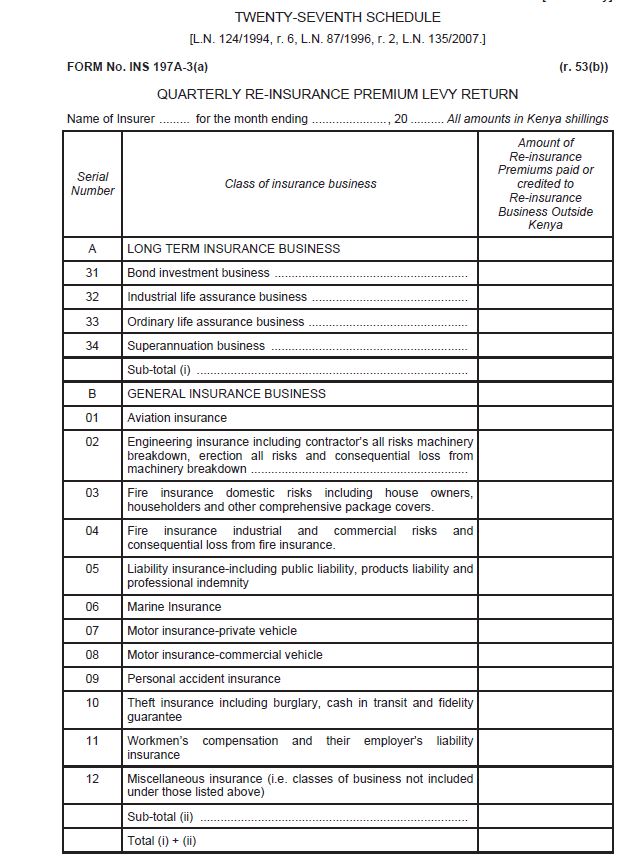

| TWENTY-SEVENTH SCHEDULE — |

QUARTERLY RE-INSURANCE PREMIUM LEVY RETURN

|

| TWENTY-EIGHTH SCHEDULE — |

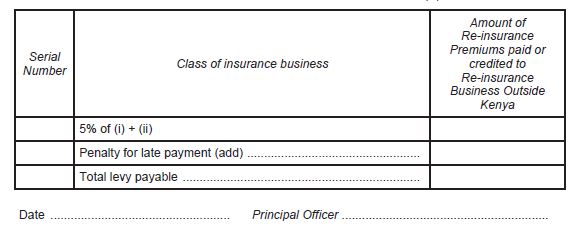

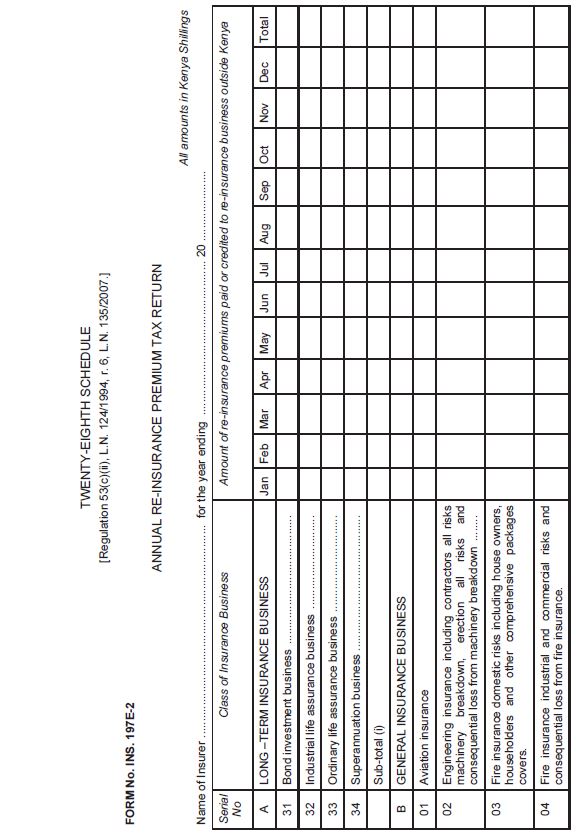

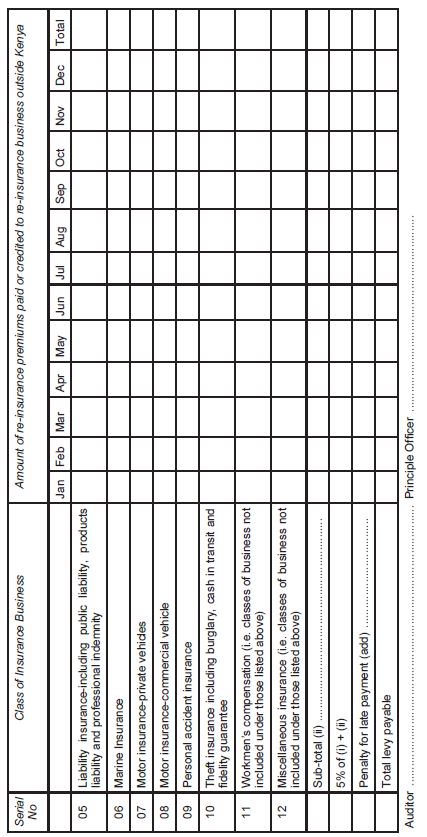

ANNUAL RE-INSURANCE PREMIUM TAX RETURN

|

| TWENTY-NINTH SCHEDULE — |

ANNUAL INSURANCE TRAINING LEVY RETURN

|

THE INSURANCE (STATISTICS) REGULATIONS

| 1. |

These Regulations may be cited as the Insurance (Statistics) Regulations, 1993, and shall be deemed to have come into operation on the 1st January, 1992.

|

| 2. |

Every insurer registered or authorized to carry on insurance business in Kenya shall prepare the statistics in accordance with the Twenty-sixth Schedule and four copies thereof duly authenticated and certified in the manner shall be deposited with the Commissioner within six months, after the end of the period to which they relate.

|

THE INSURANCE REGULATIONS, 1986

[ Legal Notice 312 of 1986, Legal Notice 52 of 1987, Legal Notice 349 of 1987, Legal Notice 180 of 1992, Legal Notice 189 of 1994, Legal Notice 372 of 1995, Legal Notice 87 of 1996, Legal Notice 169 of 1998, Legal Notice 75 of 1999, Legal Notice 172 of 1999, Legal Notice 108 of 2002, Legal Notice 91 of 2003, Legal Notice 40 of 2004, Legal Notice 65 of 2006, Legal Notice 99 of 2006, Legal Notice 2 of 2007, Legal Notice 135 of 2007, Legal Notice 97 of 2009, Legal Notice 85 of 2010, Legal Notice 154 of 2010, Legal Notice 51 of 2011, Legal Notice 57 of 2012, Legal Notice 178 of 2014, Legal Notice 104 of 2015, Legal Notice 108 of 2016, Legal Notice 51 of 2017, Legal Notice 275 of 2017, Legal Notice 93 of 2019, Legal Notice 217 of 2020, Legal Notice 167 of 2021, Legal Notice 69 of 2022]

PART I – PRELIMINARY

| 1. |

Citation

These Regulations may be cited as the Insurance Regulations, 1986.

|

| 2. |

Applicability

These Regulations shall apply to all members of the insurance industry, mutatis mutandis, unless otherwise specified.

|

| 3. |

Interpretation

| (1) |

In these Regulations—

“Kenya citizen” means an individual, being a natural person, who is a citizen of Kenya;

“Kenya company” means a company, incorporated under the Companies Act (Cap. 486) whose shares are wholly owned by Kenya citizens;

“Kenya partnership” means a partnership whose partners are all Kenya citizens.

|

| (2) |

For the purposes of these Regulations and the management of the insurance industry the classes and sub-classes of insurance business shall be serialized according to the serial numbers specified in these Regulations.

|

|

| 4. |

Excluded business

For the purposes of the definition of “insurance business” in section 2 of the Act the following are declared not to be insurance businesses for the purposes of the Act—

| (a) |

business undertaken by a person being a carrier, carrier’s agent, forwarding agent, wharfinger, warehouse man or shipping agent, relating only to his liability in respect of goods belonging to another person and in his possession or under his possession or under his control for the purpose of carriage, storage or sale of those goods;

|

| (b) |

business undertaken by a person, being an inn-keeper or lodging, housekeeper relating only to his liability in respect of goods belonging to another person and in the possession or under the control of a guest at the inn or lodging house of which the first-mentioned person is the inn-keeper or lodging-housekeeper for safe custody.

|

|

PART II – REGISTRATION OF INSURERS

| 5. |

Insurer’s application for registration

The application for registration as an insurer under section 30 of the Act, shall be submitted in Form No. INS. 30–1 in the First Schedule together with all the information required to be submitted in the appendices to that form specified in that Schedule.

|

| 6. |

Registration and annual fees

| (1) |

The registration fees for an insurer that is registered under section 31 shall be—

| (a) |

in the case of an insurer, one hundred and fifty thousand shillings; and

|

| (b) |

in the case of a reinsurer, two hundred and fifty thousand shillings.

|

|

| (2) |

The annual fees for an insurer that is registered under section 31 shall be—

| (a) |

in the case of an insurer, one hundred and fifty thousand shillings; and

|

| (b) |

in the case of a reinsurer, two hundred and fifty thousand shillings.

|

|

| (3) |

The fees specified in paragraph (2) shall be payable annually on or before the 30th September in each year.

|

| (4) |

The Authority may, with respect to an insurer that fails to pay the annual fees on the date specified in paragraph (3)—

| (a) |

impose a penalty of twenty thousand shillings for each day the fees remain unpaid; and

|

| (b) |

cancel the insurer's licence.

|

|

|

| 7. |

Statements to be submitted under section 30(k) of the Act

For the purpose of section 30(k) of the Act, every insurer shall, at the time of first making application for registration under one or more of the classes of insurance business prescribed under regulations 9 and 10, lodge with the Commissioner the following statements:

| (a) |

a photocopy of the certificate of incorporation;

|

| (b) |

in the case of an insurer who has not transacted insurance business prior to making the application or where authorization is sought to transact a class of business not transacted before, a copy of the feasibility study report carried out in this regard, showing estimates of premium, expenses and claims for each of the first three financial years following the year in which the application is made, separately on a year by year basis and separately for each such year on both optimistic and pessimistic bases and such feasibility study report shall contain the following information—

| (i) |

estimates relating to— |

| (ii) |

a forecast balance sheet; |

| (iii) |

estimates relating to the financial resources to cover underwriting liabilities and the margin of solvency; |

| (iv) |

in the case of long term insurance business, the number of contracts, and the total sums assured or amounts of annuity per annum expected to be issued; |

|

| (c) |

the sources of business (for example, insurance brokers, agents, own employees or direct selling) and the approximate per centage expected from each source;

|

| (d) |

a summary (that is to say a treaty slip) of reinsurance treaties arranged for each class of business containing all the terms and conditions;

|

| (e) |

copies or drafts of any agreements with persons (other than employees of the insurer) who will manage the business of the insurer;

|

| (f) |

copies or drafts of any standard agreements which the insurer may have with brokers or agents;

|

| (g) |

in the case of long term insurance business, a certificate by an actuary, supported by calculations or projections by the actuary, that he considers the financing of the insurer to be sufficient to cover both technical reserves and the required margin of solvency during the first three financial years following the financial year in which application is made;

|

| (h) |

in the case of an insurer who has not transacted insurance business prior to making the application or where authorization is sought to transact a class of business not transacted before, the estimated costs of installing the administrative services and organization for securing business, and the financial resources intended to cover those costs;

|

| (i) |

accounts, statements and reports laid before the shareholders at the last three annual general meetings or, if less than three annual general meetings have been held, the accounts, statements and reports laid before the annual general meetings which have been held and the minutes of the annual general meetings shall also be lodged;

|

| (j) |

in the case of an insurer who was carrying on or transacting long term insurance business immediately prior to the date of commencement of the Act, copies of the last three valuation reports of the actuary.

|

|

| 7A. |

Deposits for Insurers Registration

For the purposes of section 32 of the Act, deposits required to be kept with the Central Bank of Kenya shall be under lien in favour of the Insurance Regulatory Authority.

|

PART III – ADMITTED ASSETS AND ADMITTED LIABILITIES

PART IV – ACCOUNTS, BALANCE SHEETS, AUDIT AND ACTUARIAL INVESTIGATIONS

| 9. |

Classes of insurance business in respect of which separate accounts to be maintained

| (1) |

Classes of insurance business in respect of which separate accounts to be maintained (1) An insurer carrying on insurance business, shall maintain separate accounts in respect of the following classes of insurance business—

|

|

Serial No. of classes

|

Brief Description of classes

|

|

31

|

Life Assurance

|

|

32

|

Annuities

|

|

33

|

Pensions(a) Personal pension(b) Deposit Administration

|

|

34

|

Group life

|

|

35

|

Group Credit

|

|

36

|

Permanent Health

|

|

37

|

Investment(a) Unit link and Linked Investment(b) Non-linked investments

|

| (2) |

For the purposes of this regulation—

| (a) |

"annuity" means an insurance contract that provides for a series of guaranteed payments, either for a specified period of time or for the lifetime of one or more individuals;

|

| (b) |

“deposit administration” means an insurance plan for retaining retirement contributions made by employers in a special fund held by an insurer which shall be applied towards the purchase of annuities as employees retire;

|

| (c) |

“group credit insurance” means insurance purchased by a creditor on the life or health of debtors to pay off the creditor's debt in the case of the creditor's disability or death:

|

| (d) |

“permanent health insurance” means a long term insurance contract designed to provide a replacement income to a policyholder if the policyholder is unable to work due to illness or injury:

|

| (e) |

“personal pension” means a long term savings product where an individual shall contribute voluntarily and a lump sum shall be available upon that individuals retirement: and

|

| (f) |

"unit link and linked investment" means an insurance product that offers the benefit of insurance and investment in an integrated plan".

|

|

|

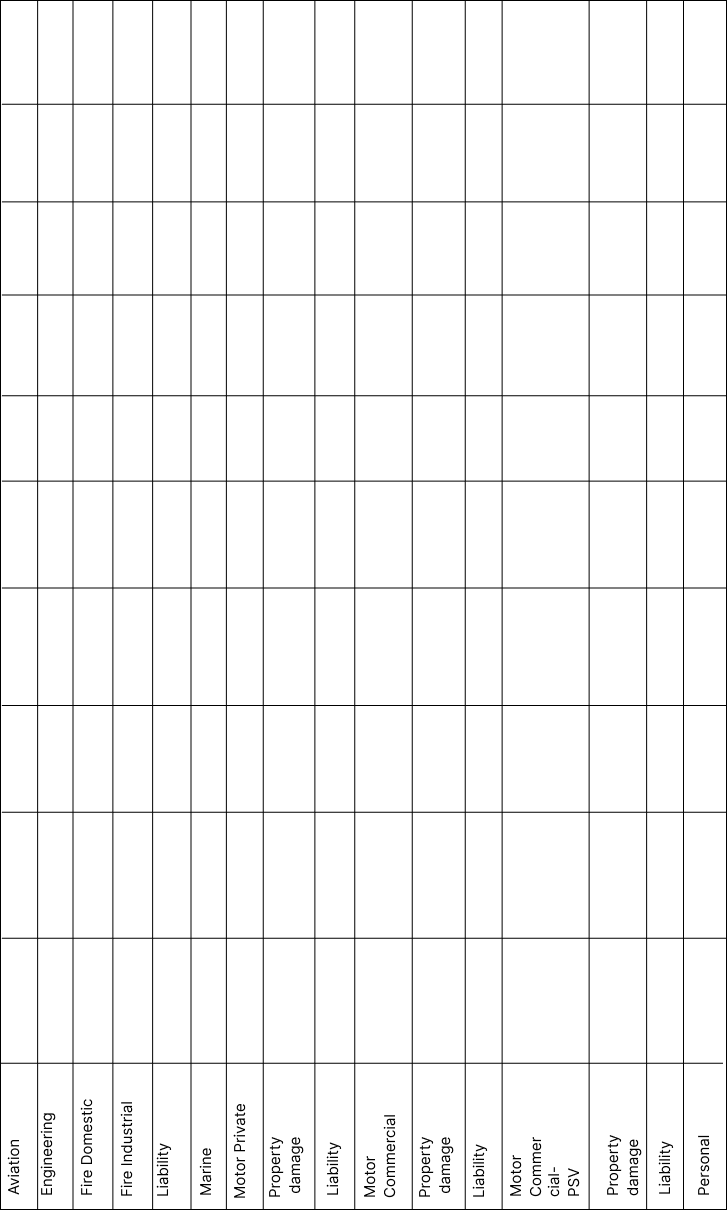

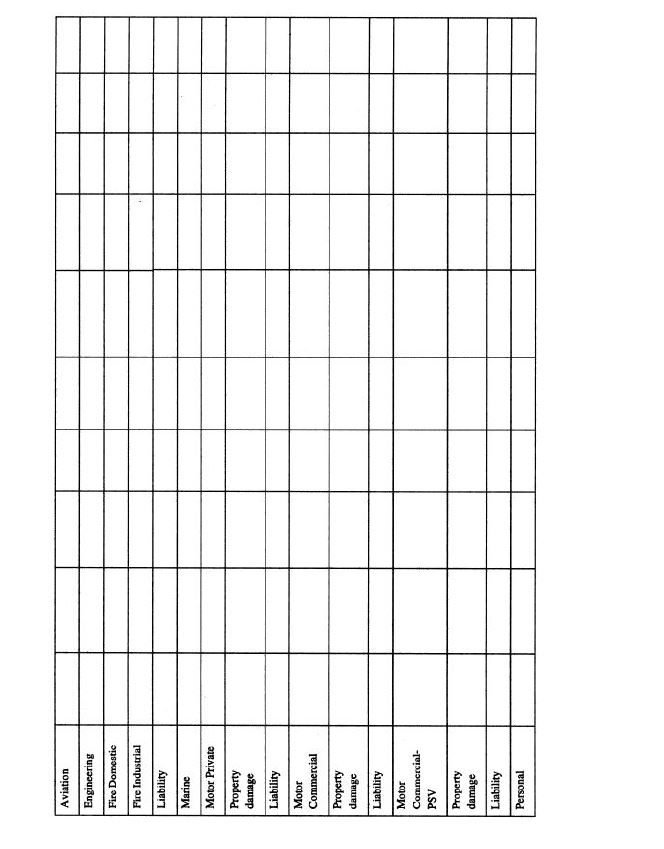

| 10. |

Classes of general insurance business in respect of which separate accounts to be maintained

An insurer carrying on general insurance business shall maintain separate accounts in respect of the classes of business listed in Part A of the Third Schedule and defined for the purposes of these Regulations in Part B of that Schedule.

|

| 11. |

Forms of accounts

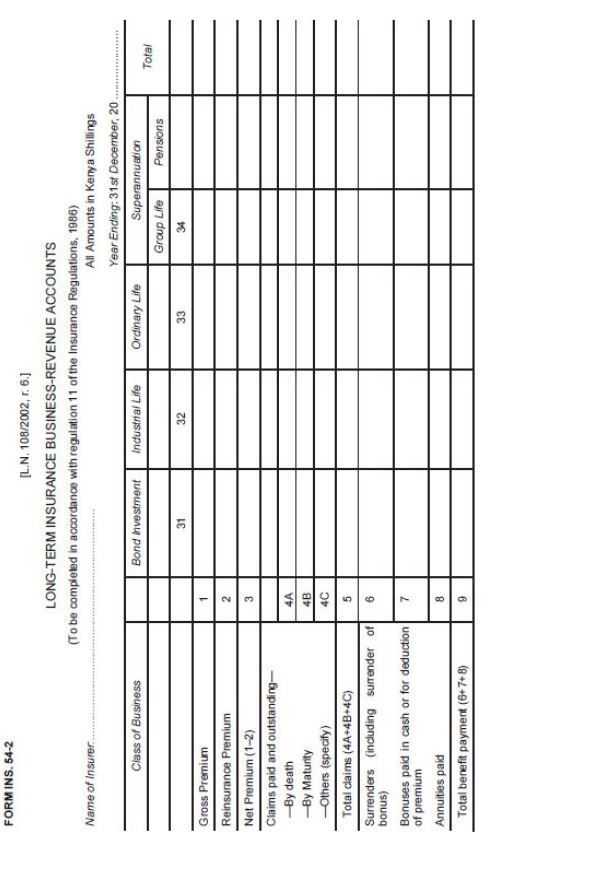

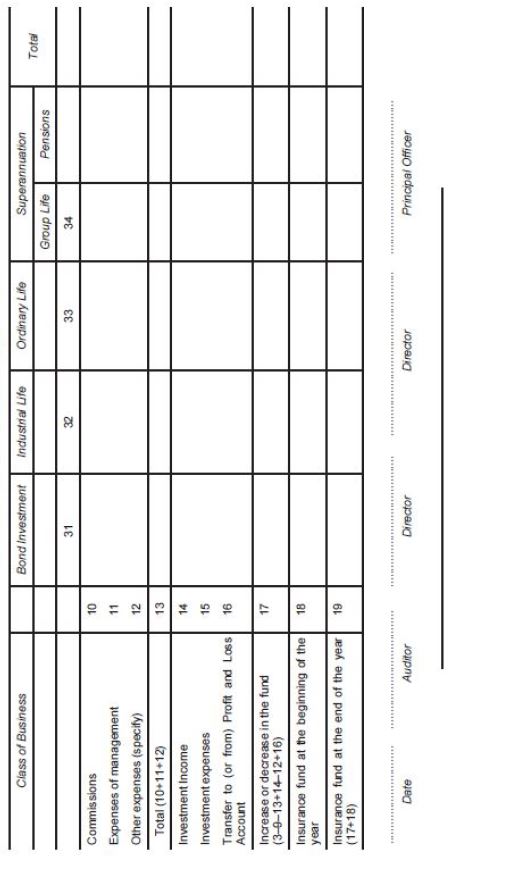

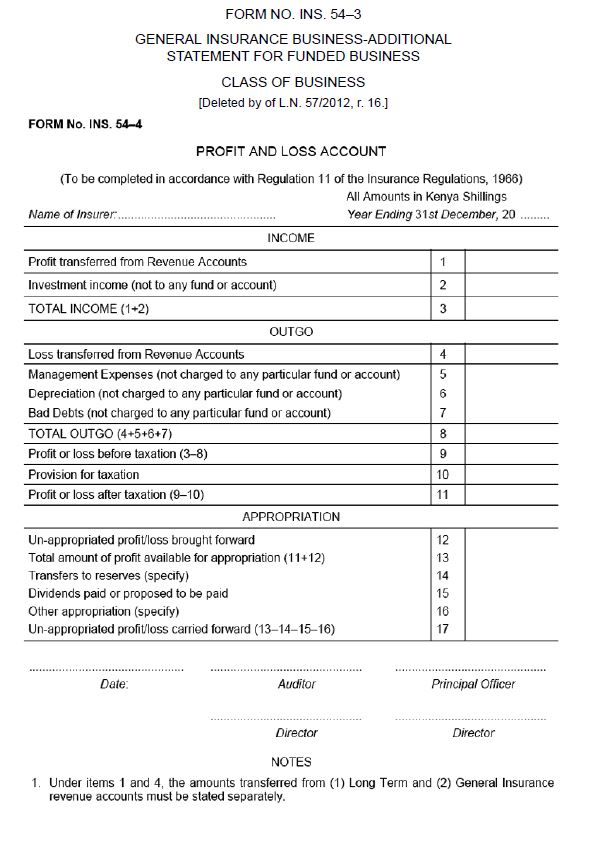

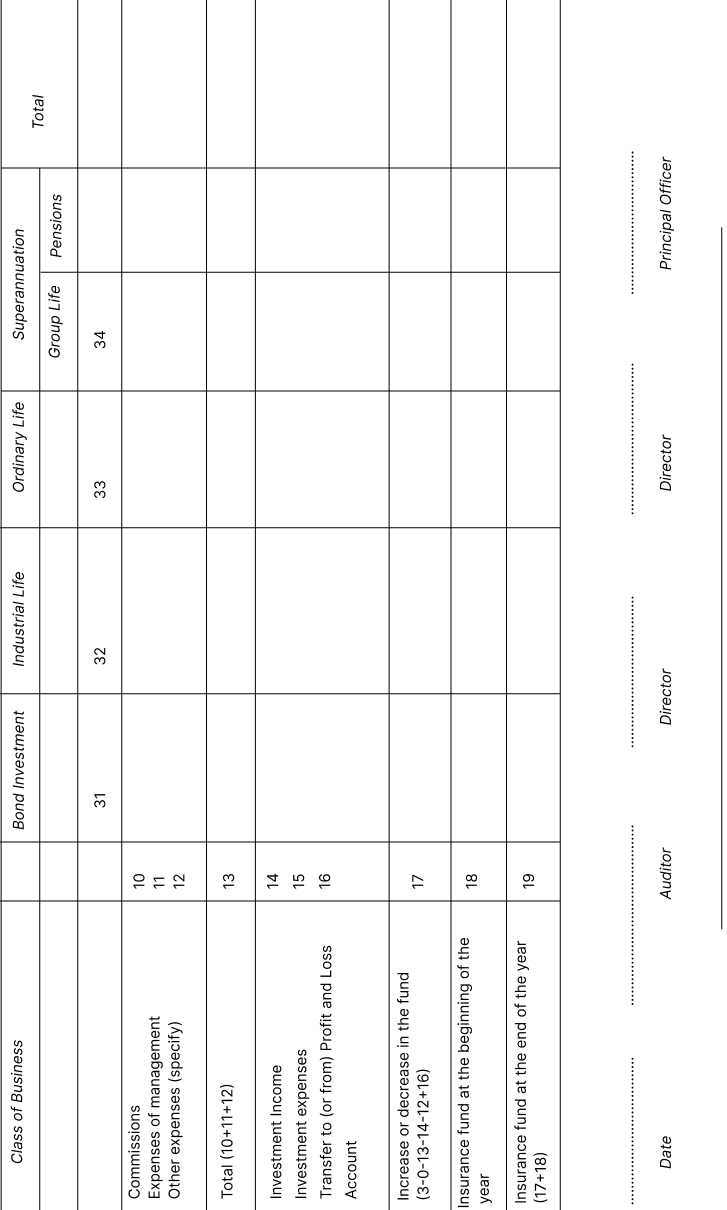

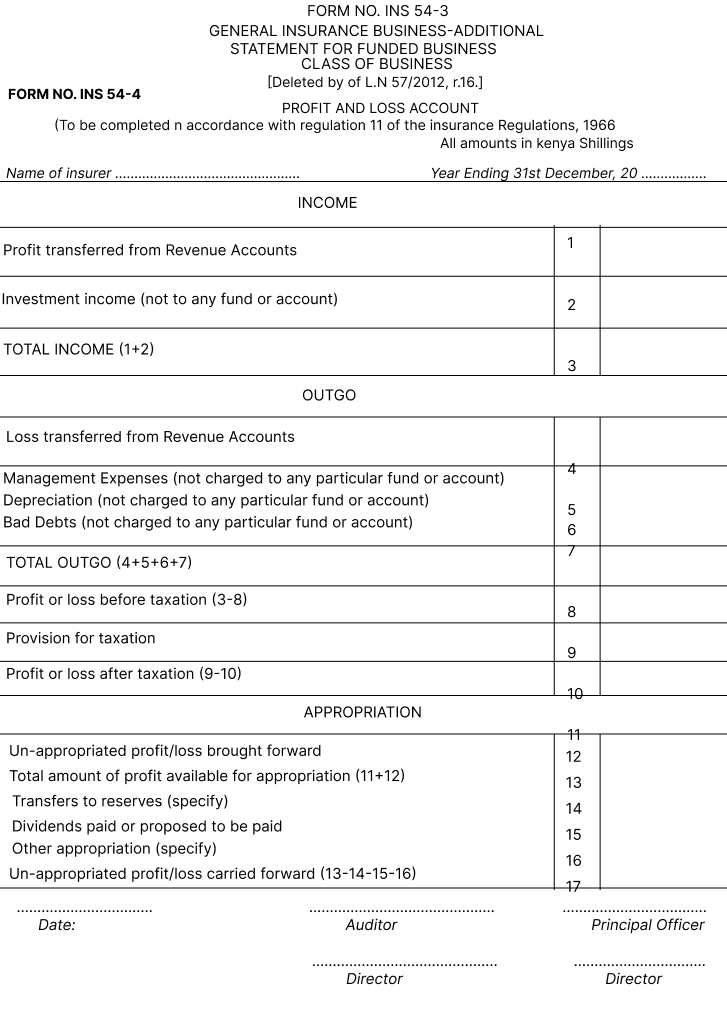

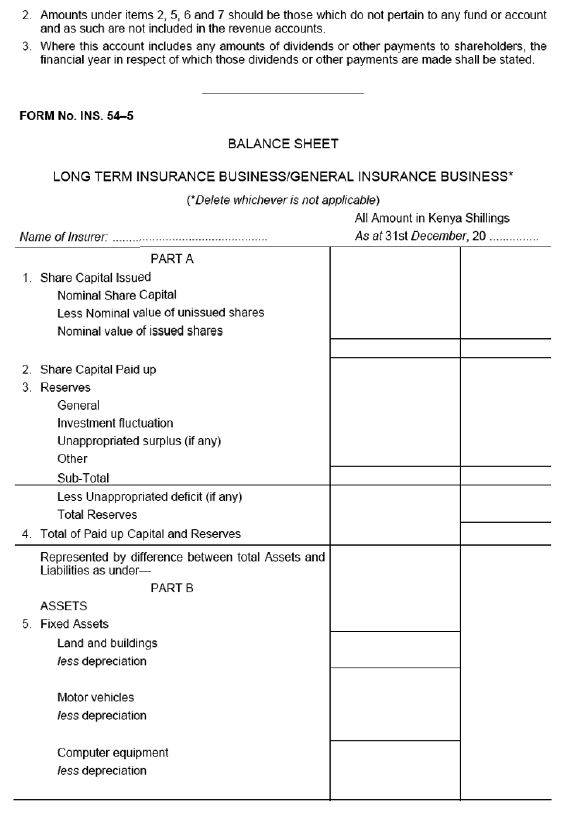

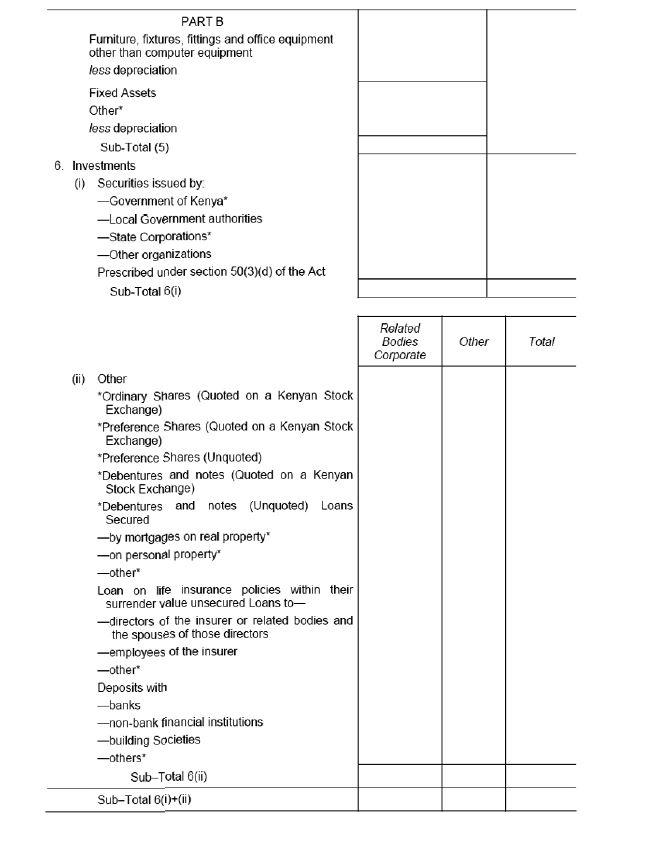

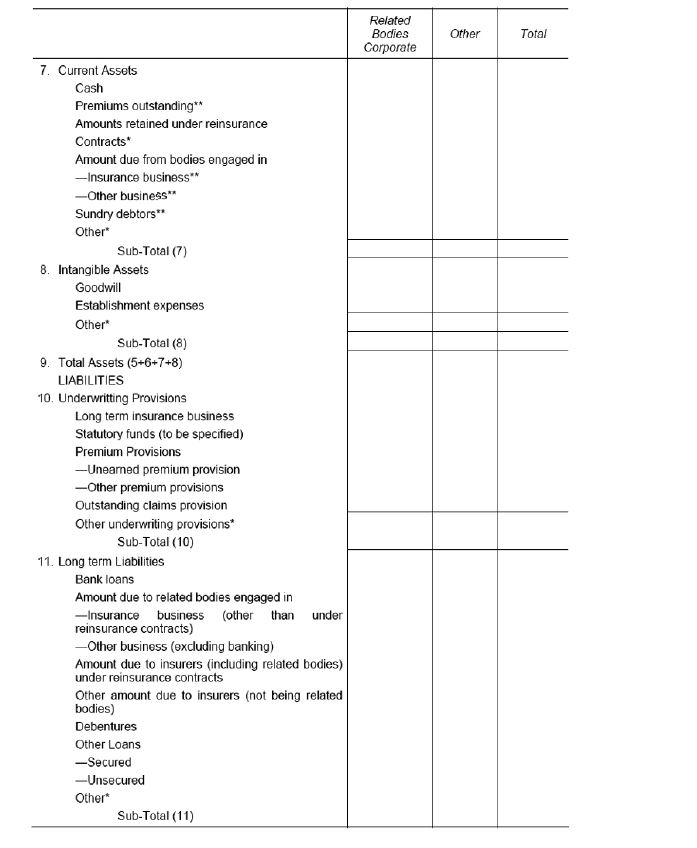

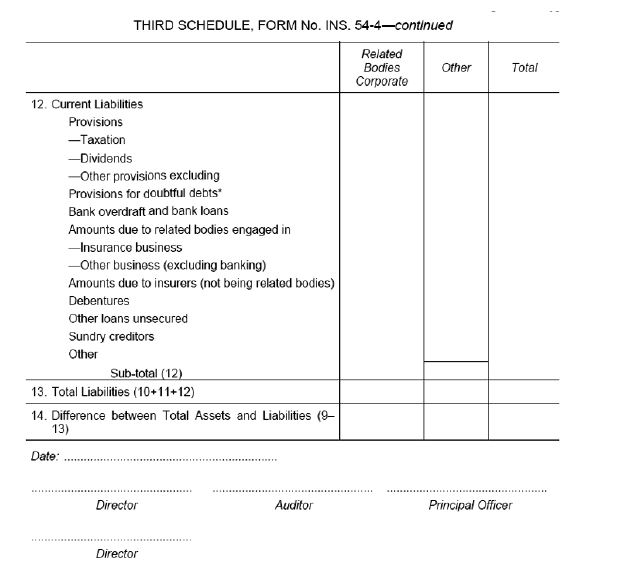

| (1) |

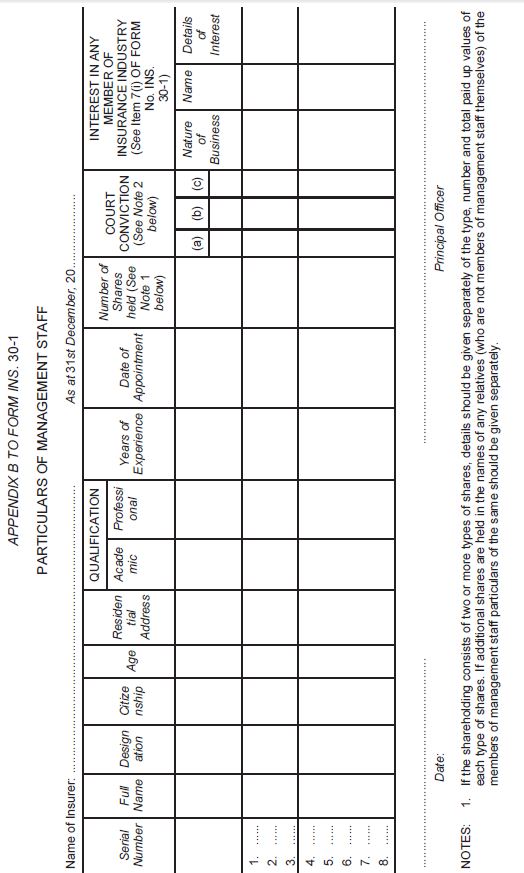

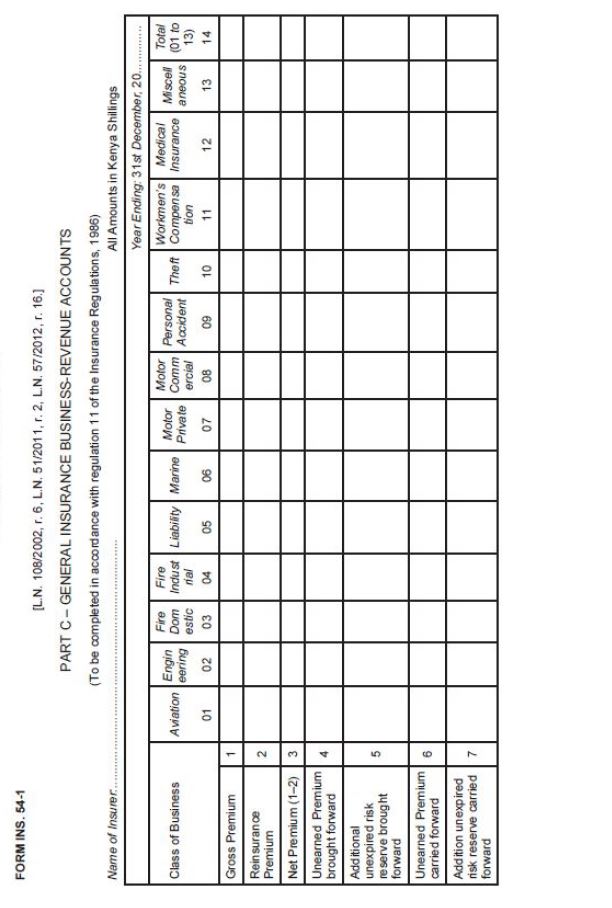

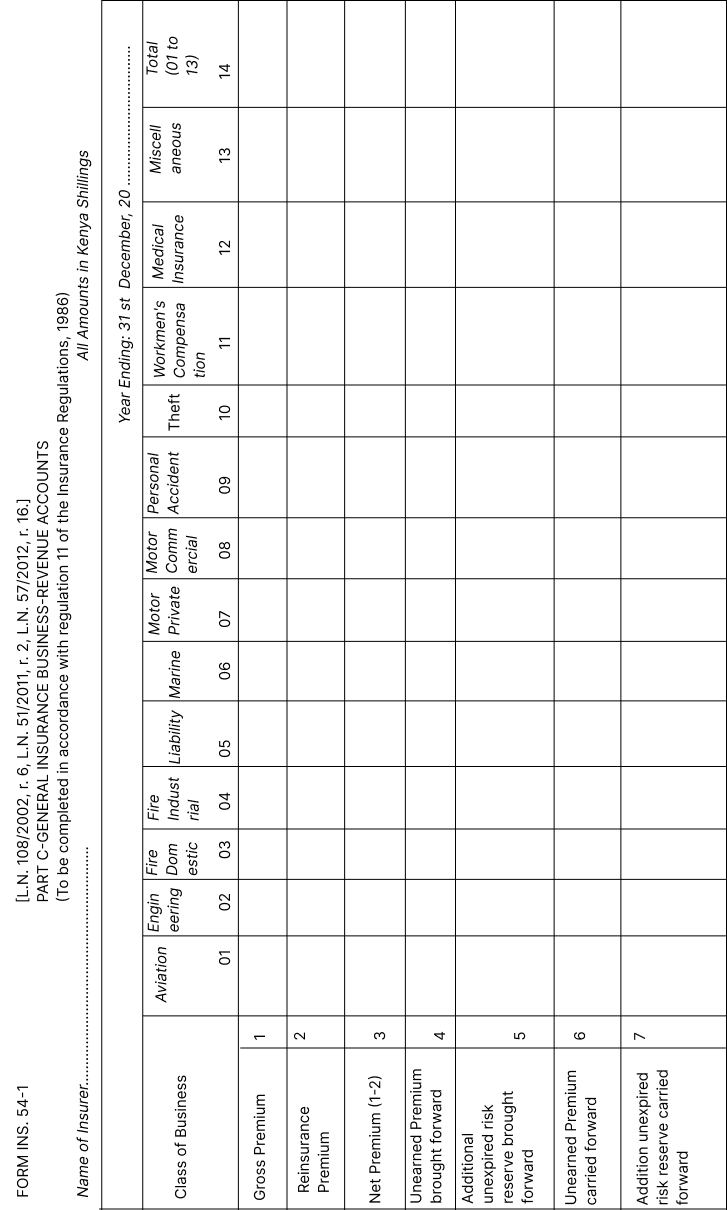

For the purposes of section 54 of the Act, the forms of accounts shall be the following forms set out in Part C of the Third Schedule—

| (a) |

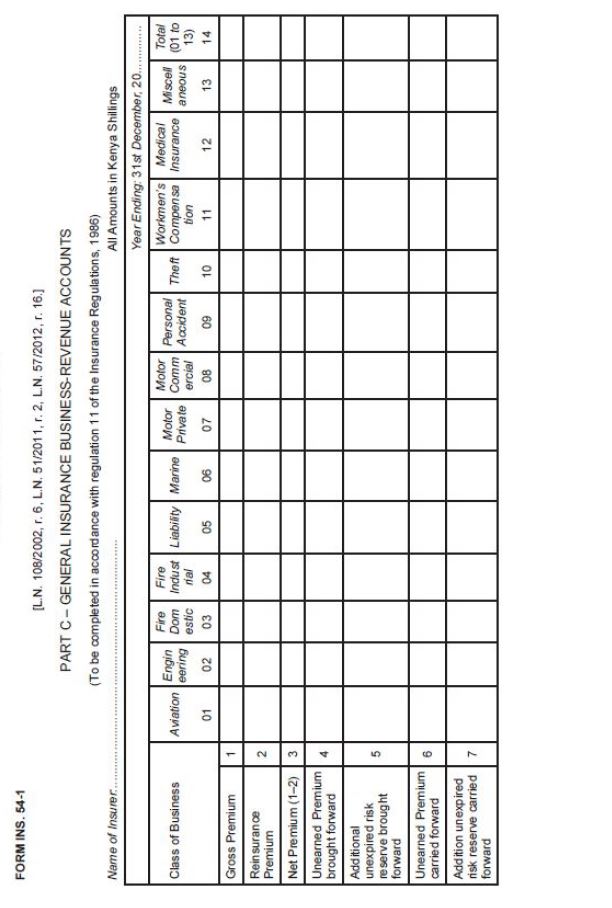

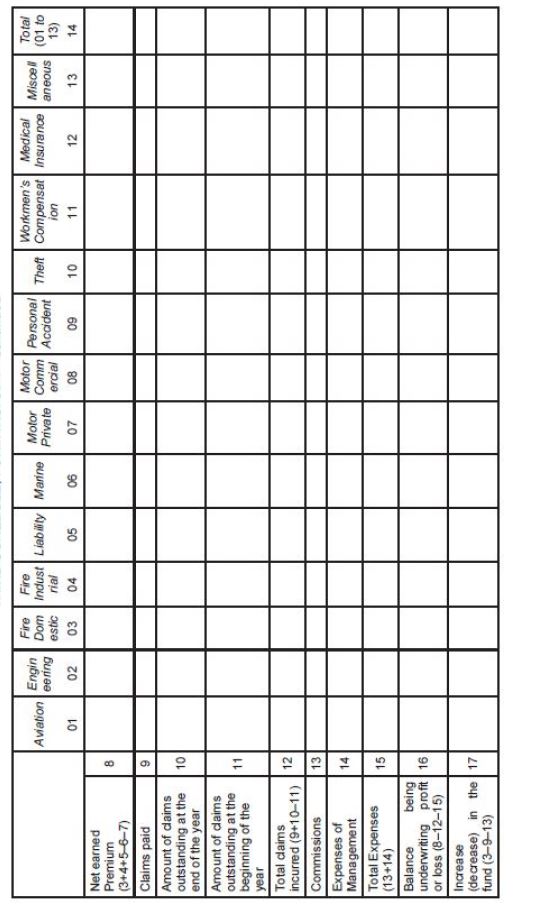

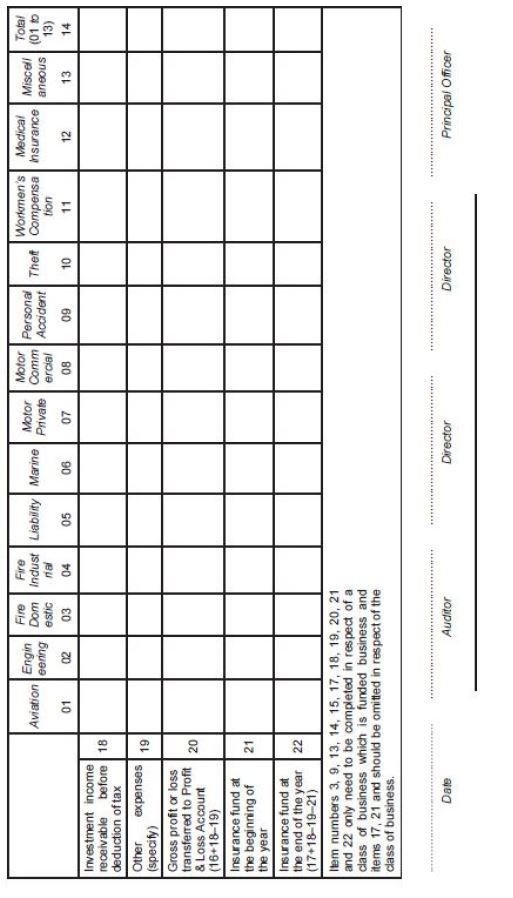

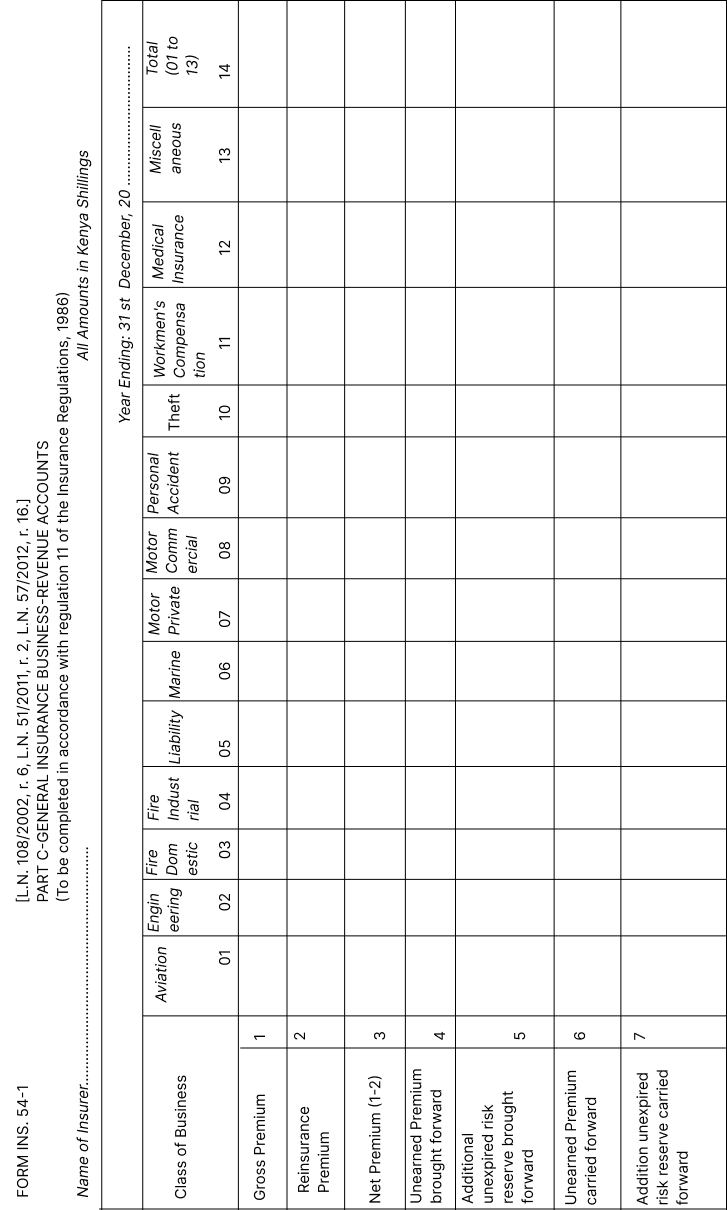

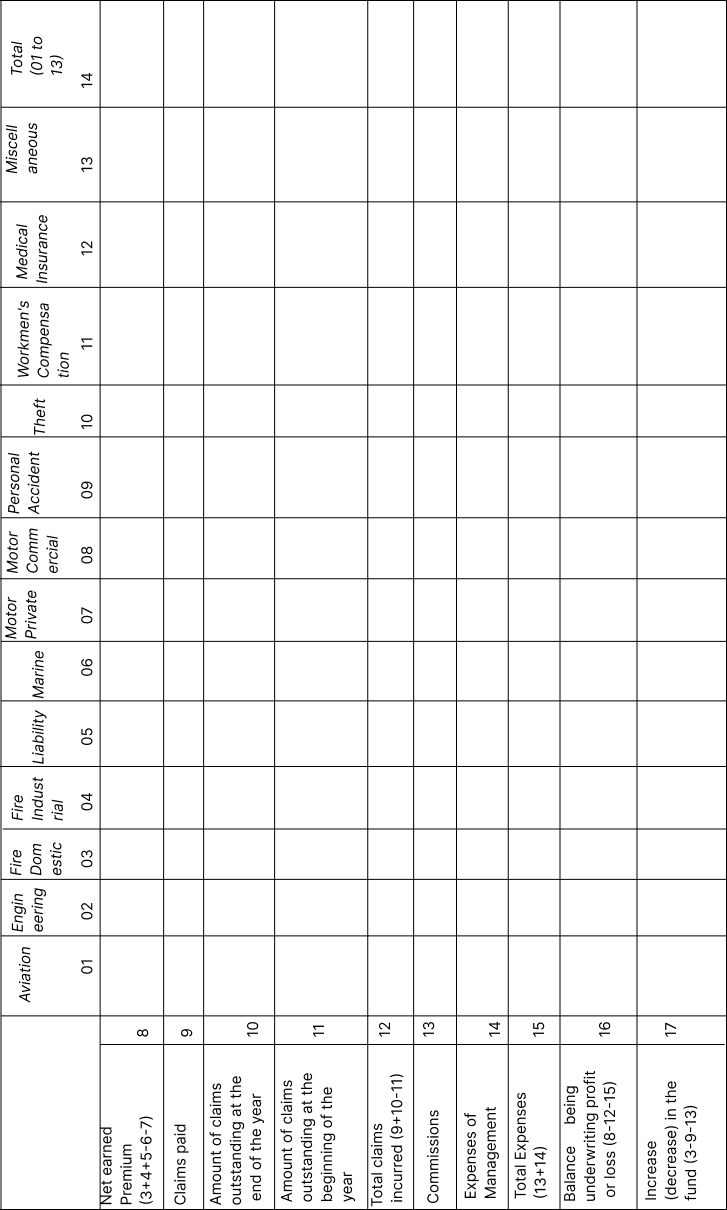

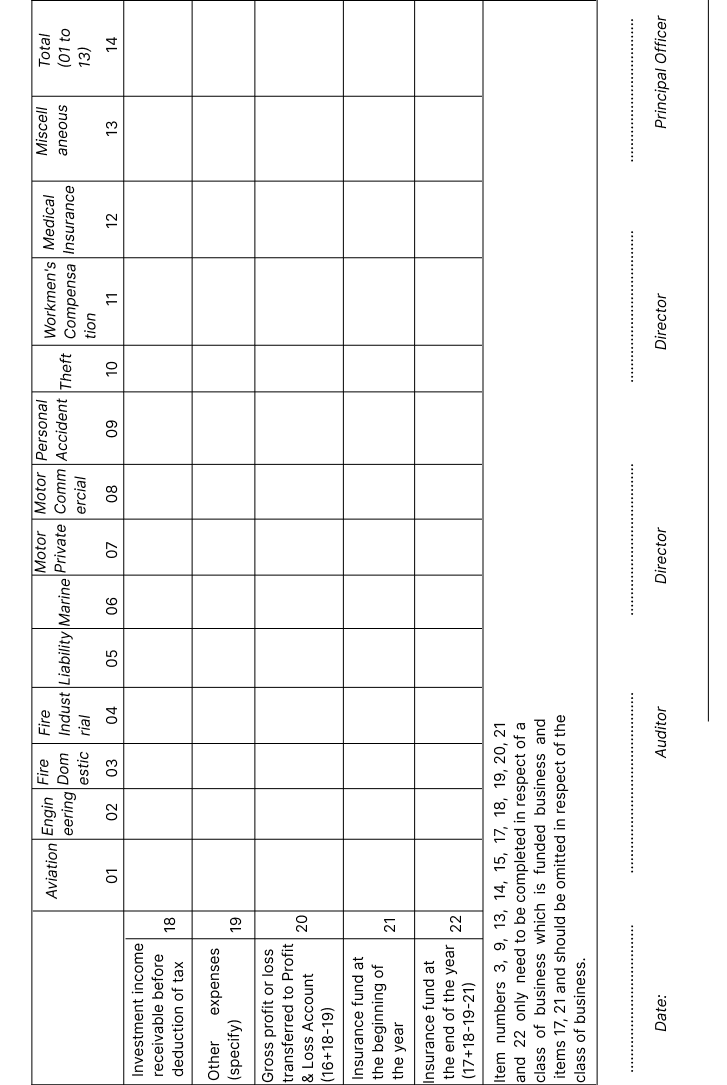

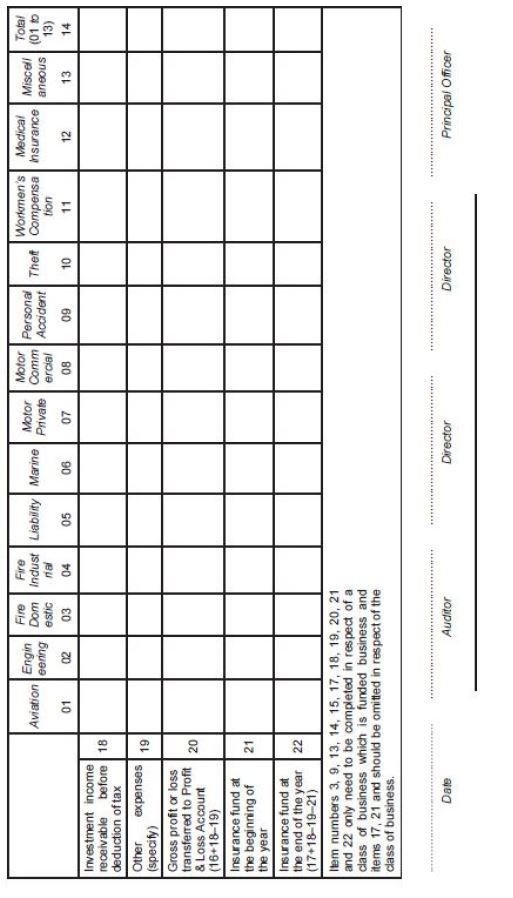

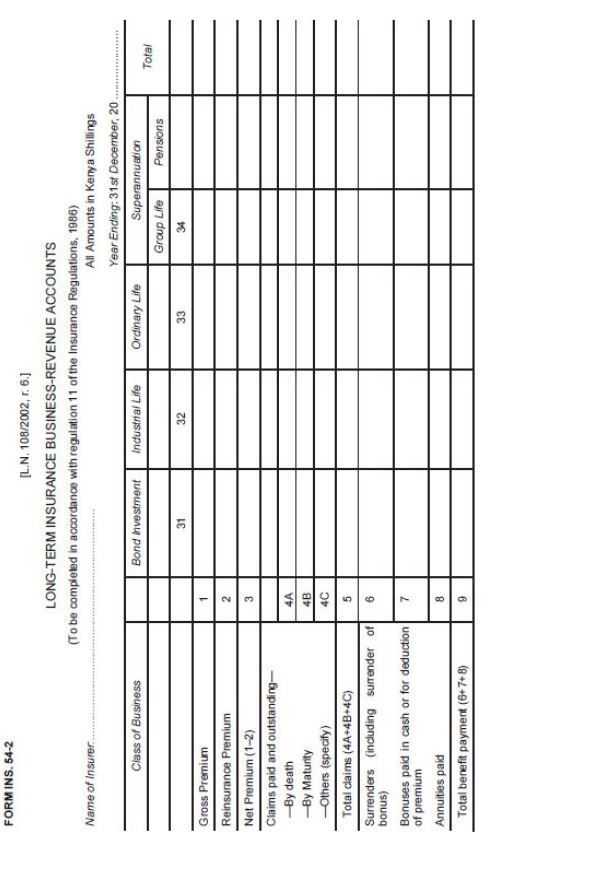

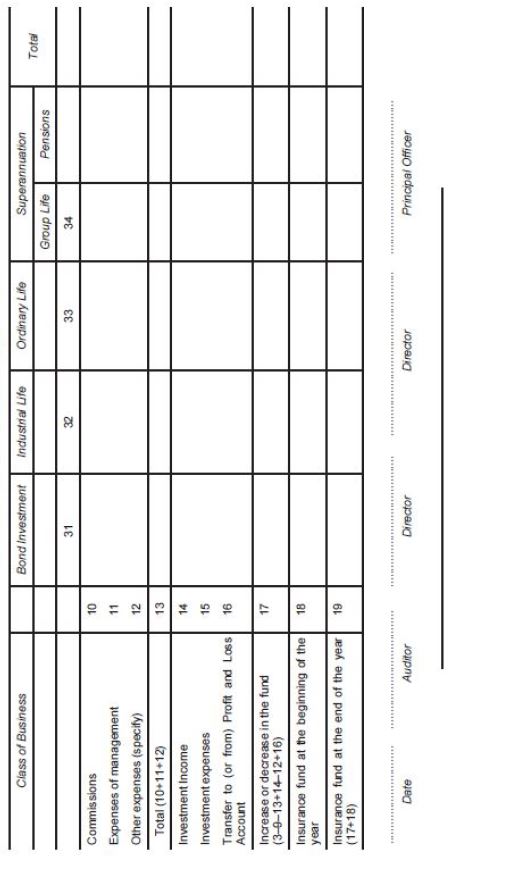

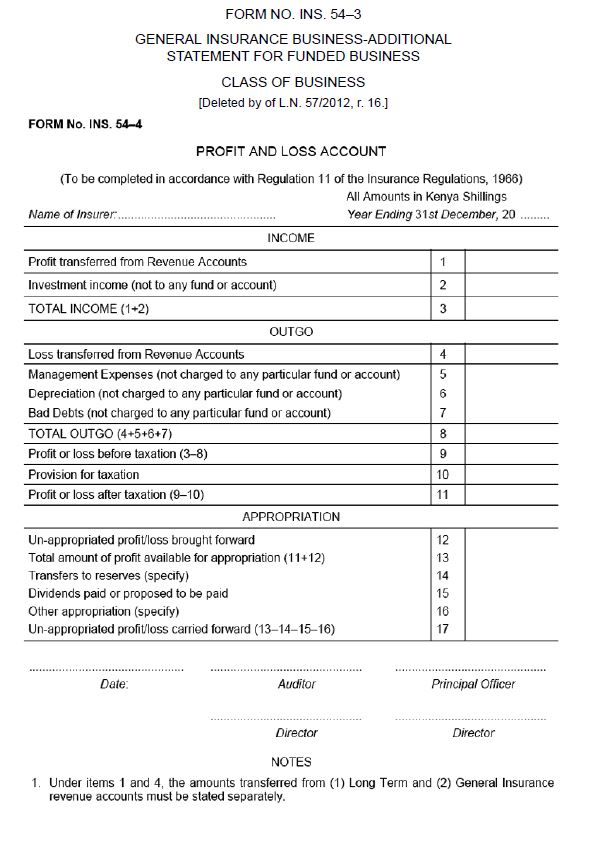

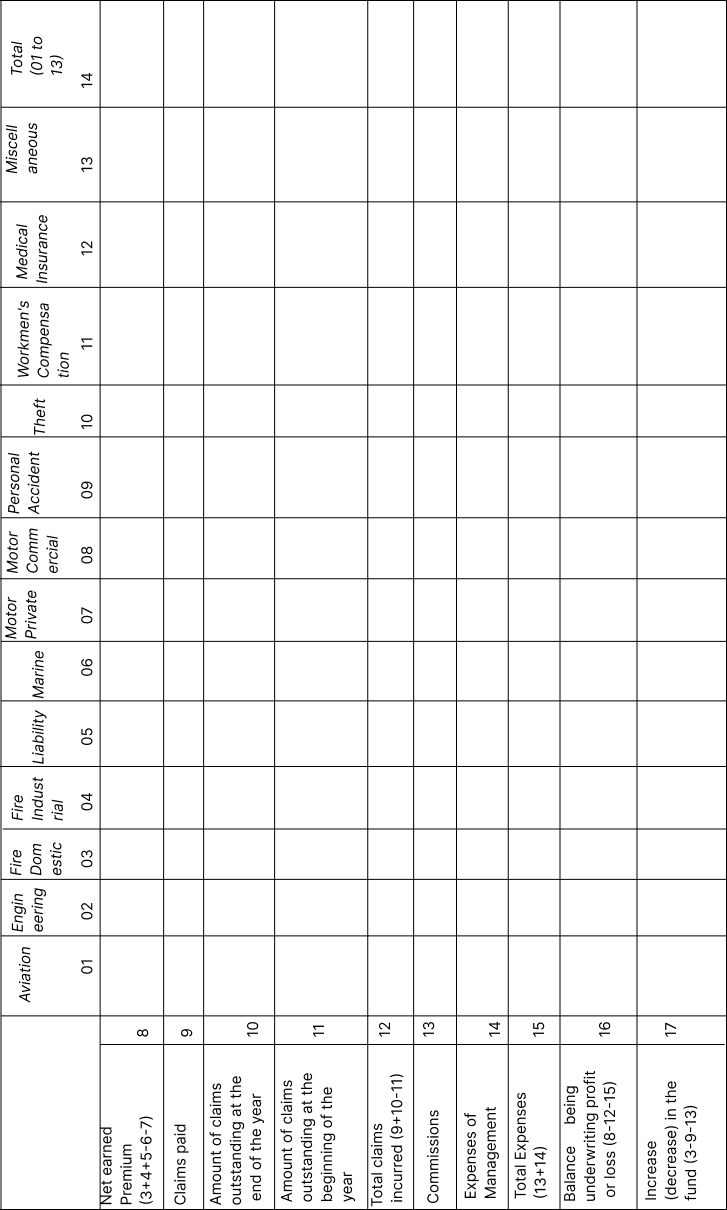

the general insurance business revenue account, Form No. INS. 54-1;

|

| (b) |

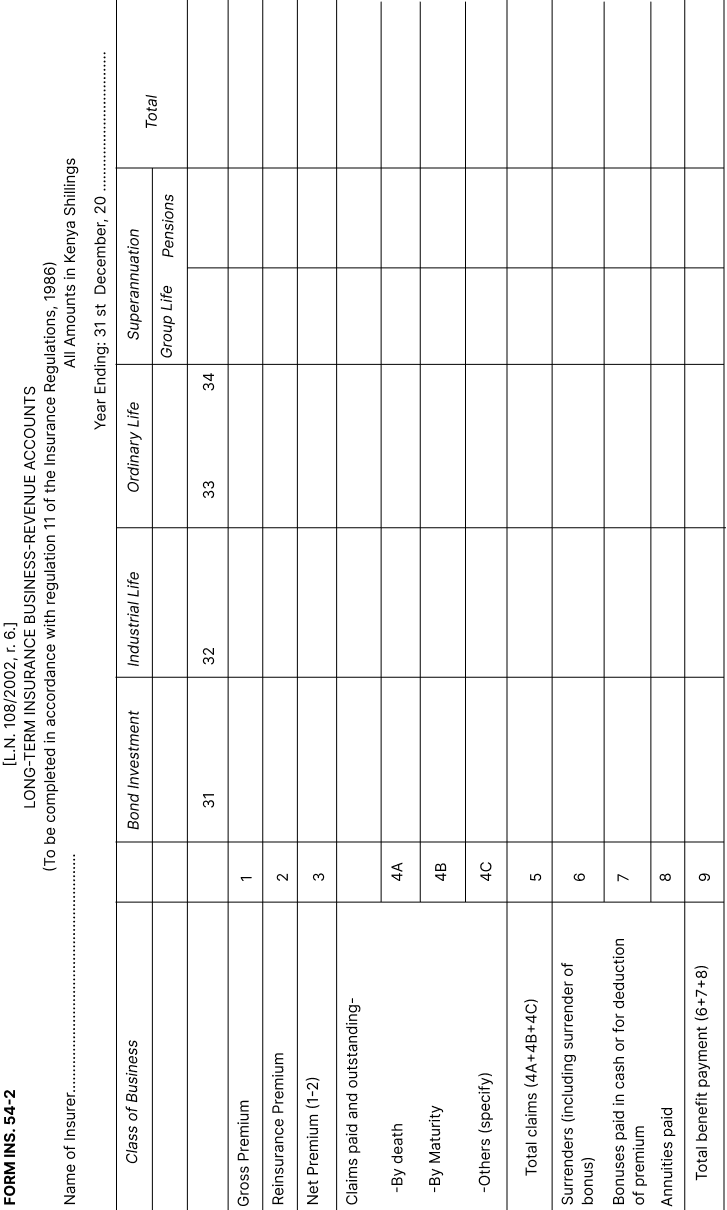

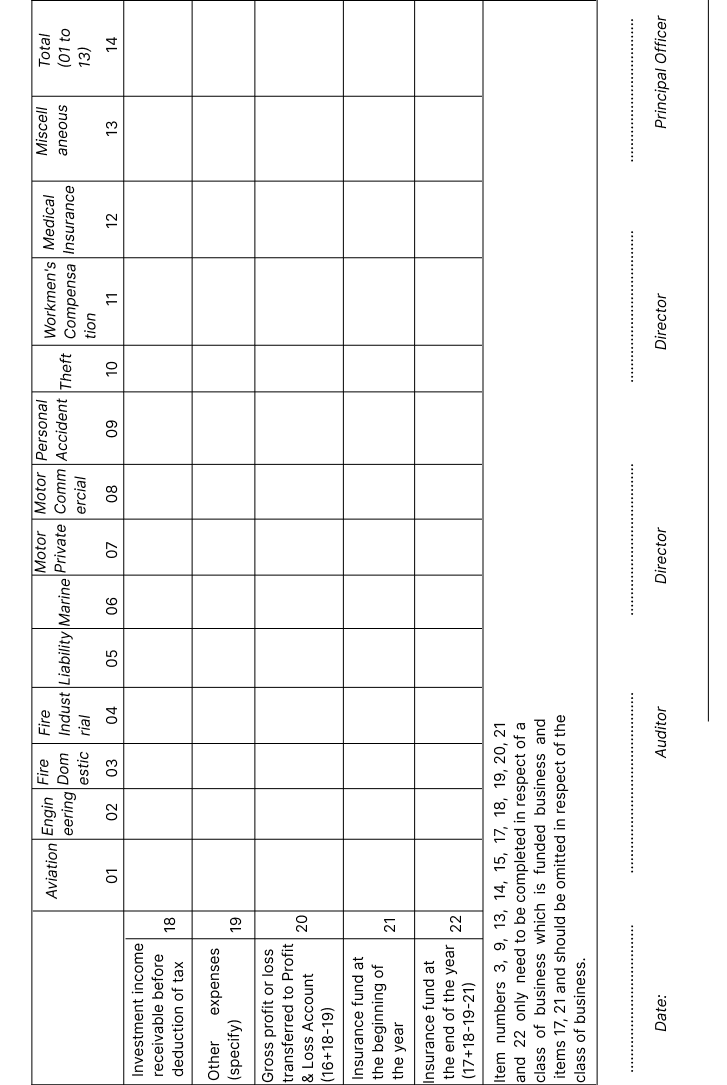

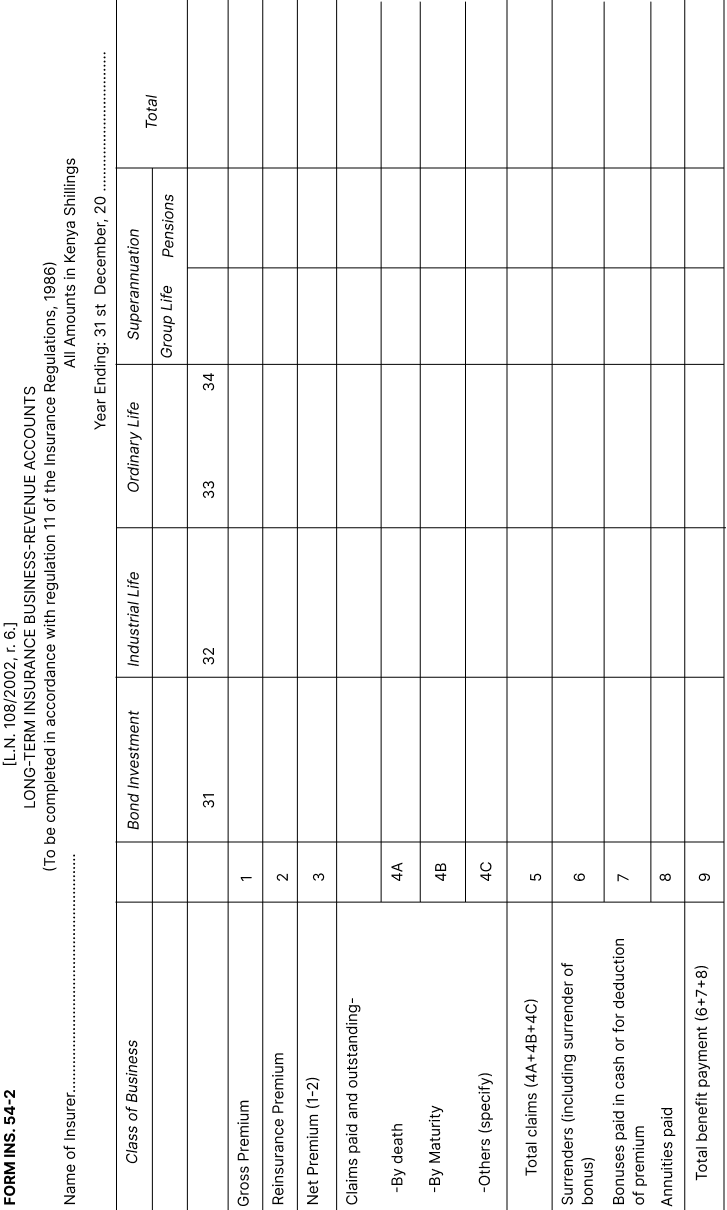

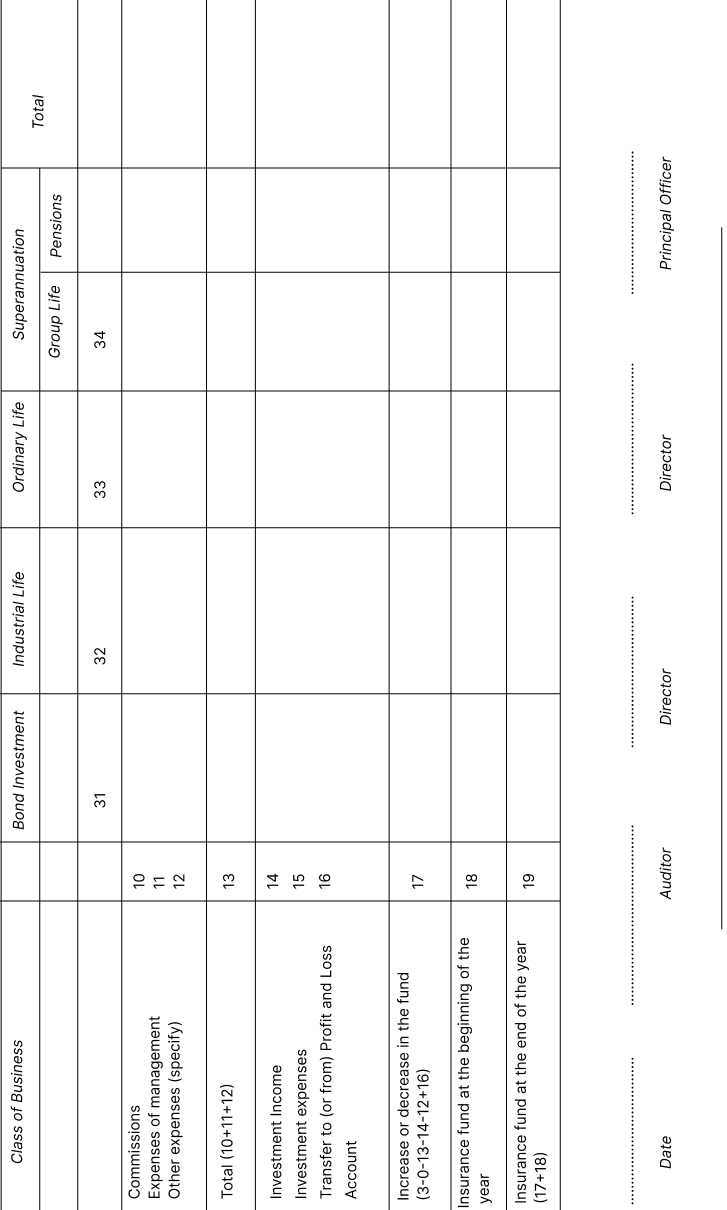

the long term insurance business revenue account, Form No. INS. 54-2;

|

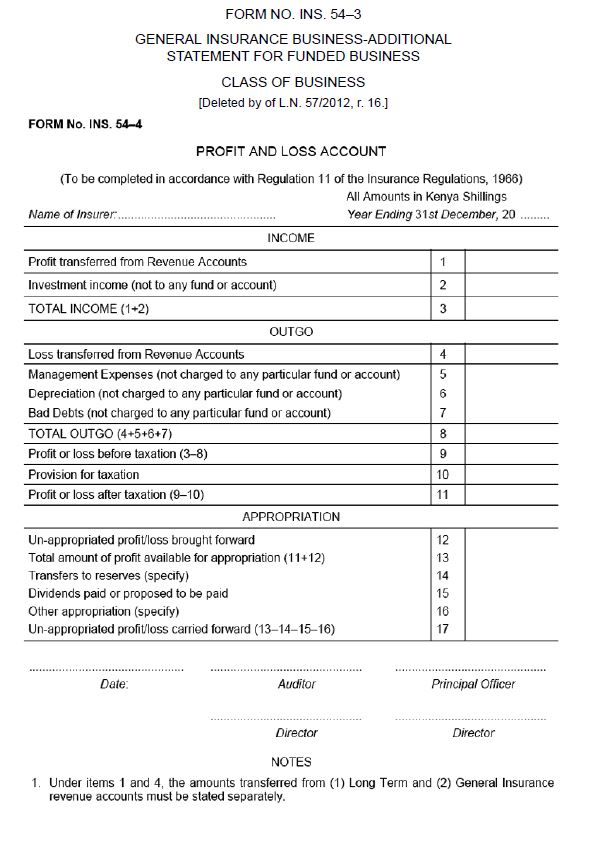

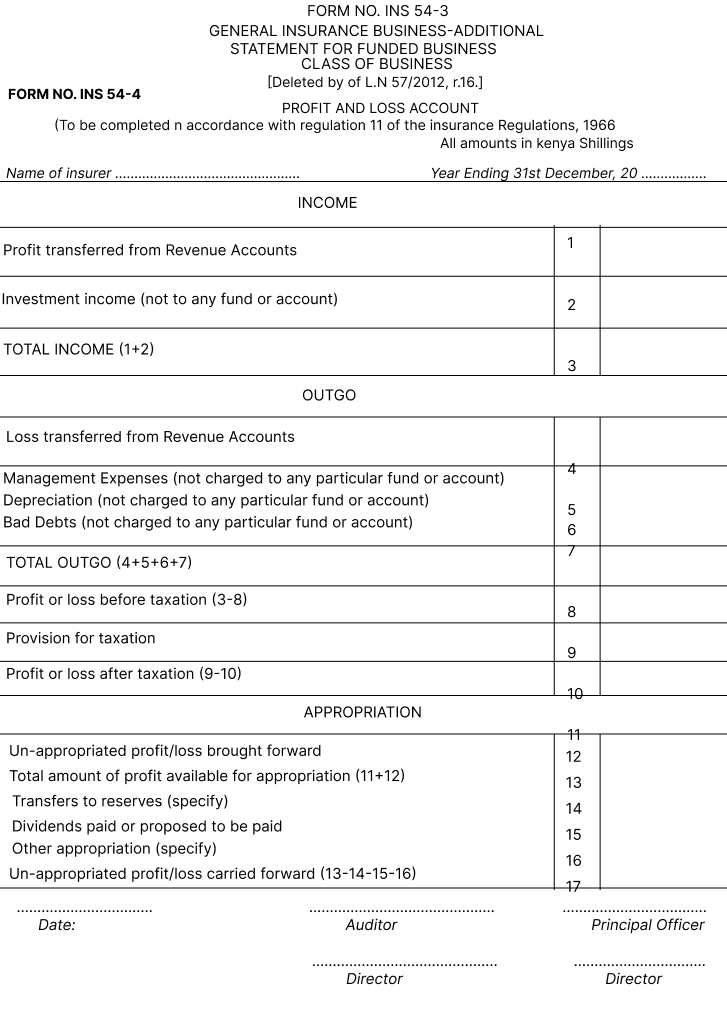

| (d) |

the profit and loss account, Form No. INS. 54-4;

|

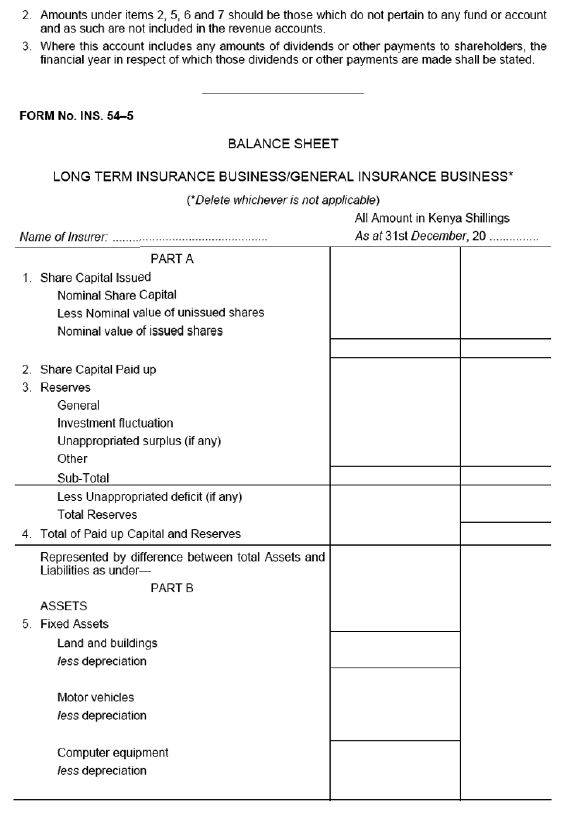

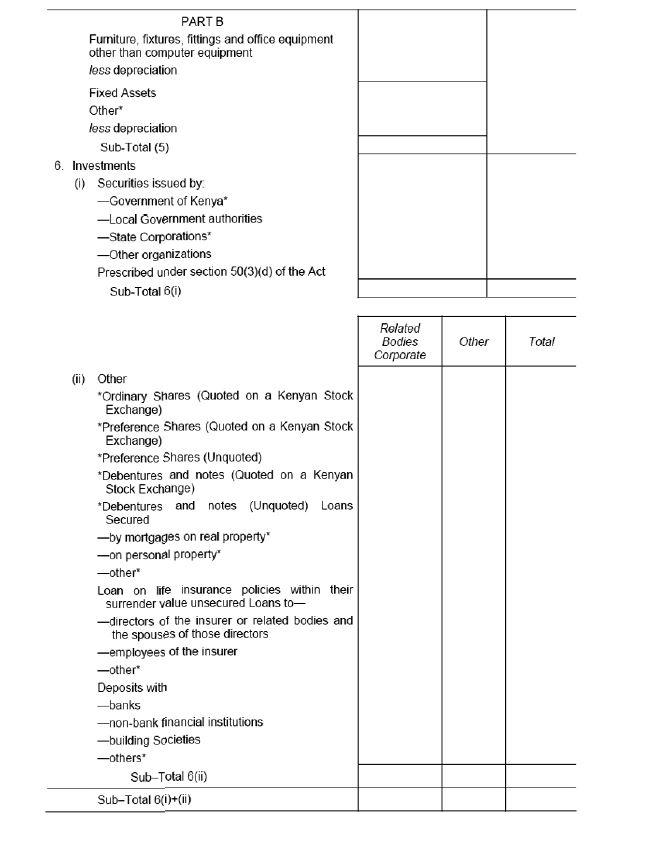

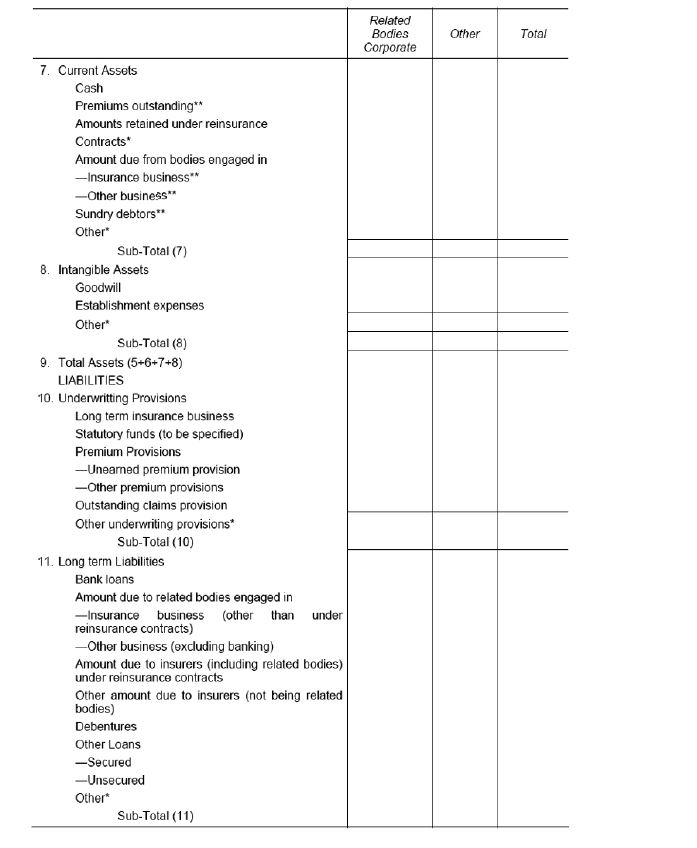

| (e) |

the balance sheet, Form No. INS. 54-5.

|

|

| (2) |

The forms shall be prepared in accordance with the directions specified in Part D of the Third Schedule and such other directions as the Commissioner may from time to time in writing issue to members of the insurance industry.

[L.N. 57/2012, r. 2.]

|

|

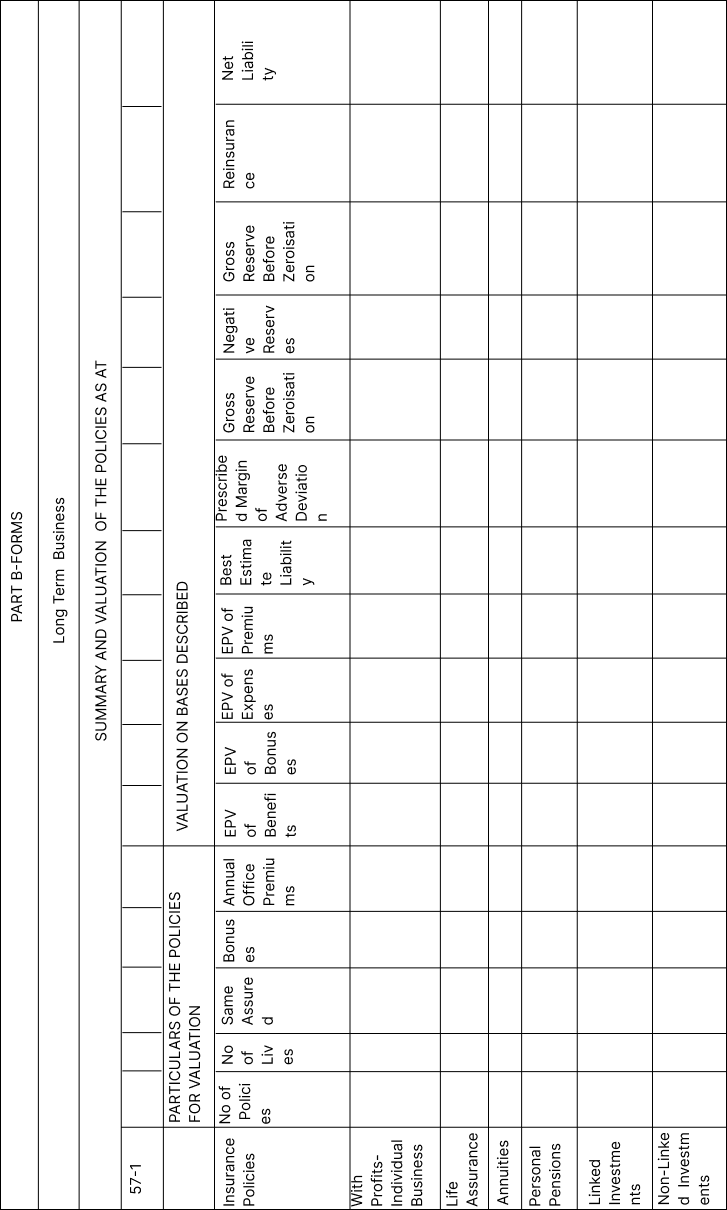

| 12. |

Actuarial abstracts

For the purposes of section 57(1) of the Act, the actuarial abstracts and statements in respect of long term insurance business shall be prepared in accordance with the provisions of the Fourth Schedule.

|

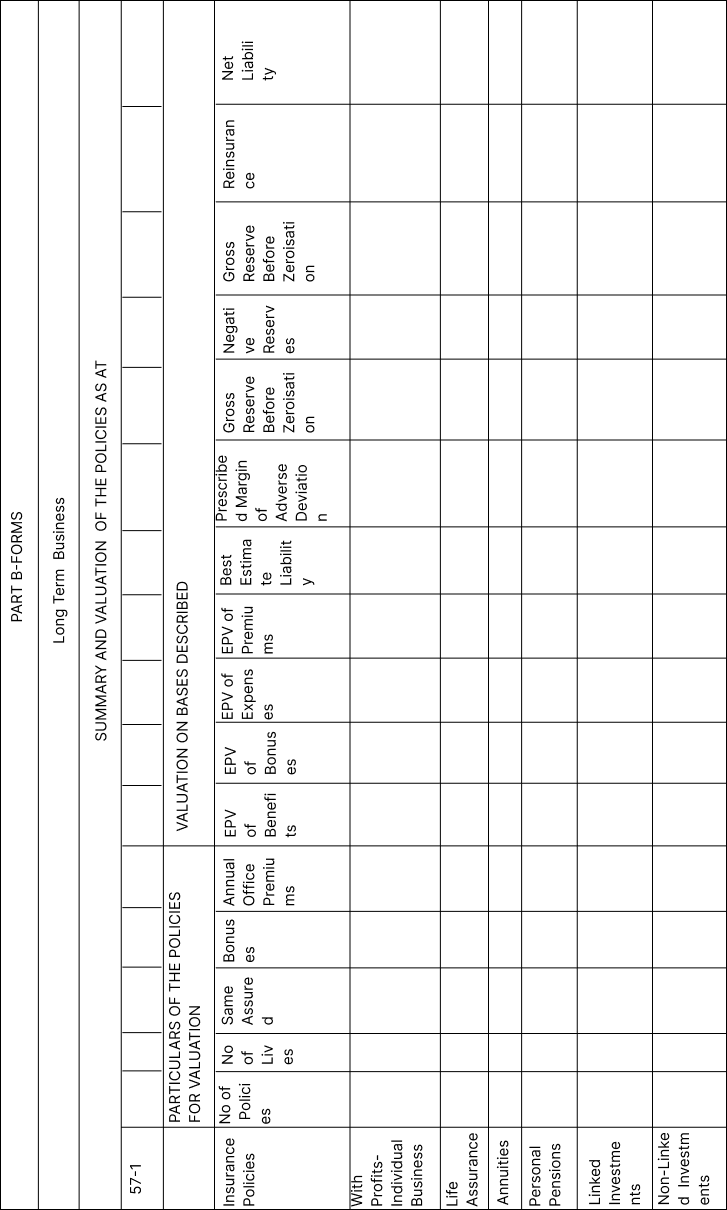

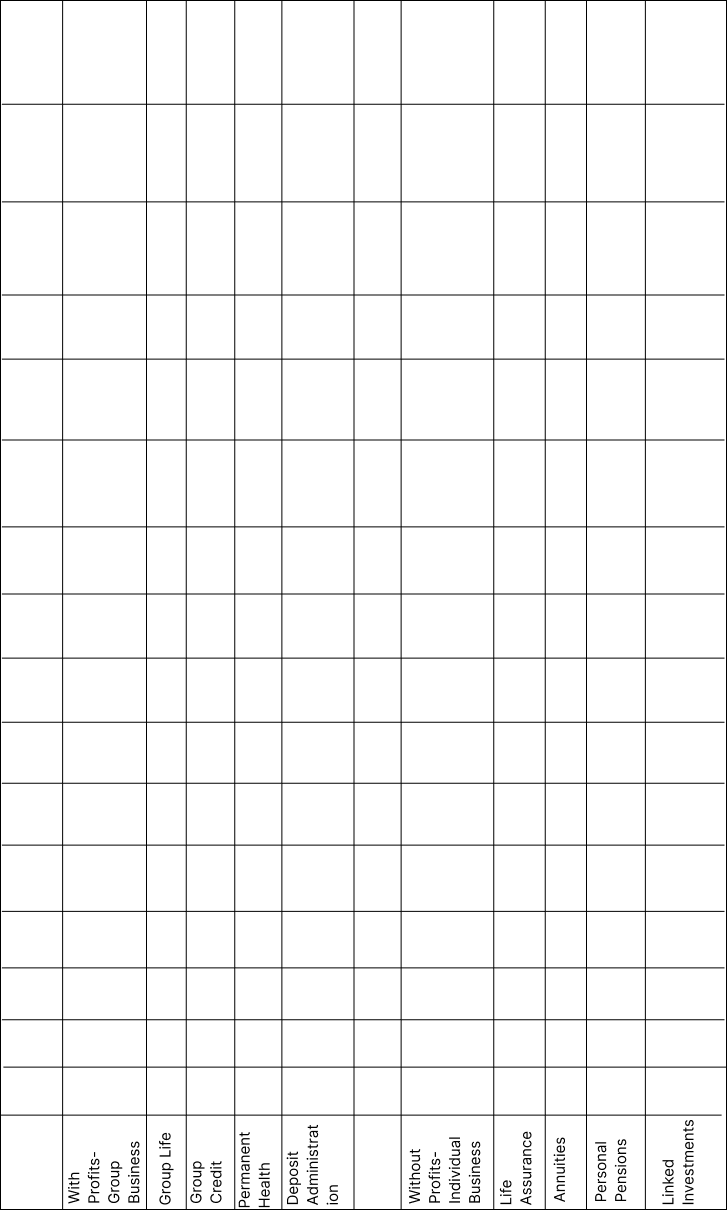

| 13. |

Statements of long-term insurance business

For the purposes of section 57(3) of the Act, the statement required of an insurer following an investigation under section 57(1) of the Act shall be prepared in accordance with the provisions of the Fifth Schedule.

|

| 14. |

Actuarial valuation of liabilities

For the purposes of section 57(5) of the Act, the value of assets and the amount of liabilities for purposes of an actuarial investigation shall, subject to section 58 of the Act, be determined in accordance with the provisions of the Sixth Schedule.

|

| 15. |

Prescribed basis

For the purposes of section 58(3) of the Act, the calculation on the prescribed basis of the value of liability of a statutory fund in respect of its policies, shall be according to the provisions of the Seventh Schedule.

[L.N. 108 of 2016, r. 3.]

|

| 16. |

Actuary’s certificate

For the purposes of section 58(5)(c) of the Act, an actuary’s certificate shall be in form set out in the Eighth Schedule.

|

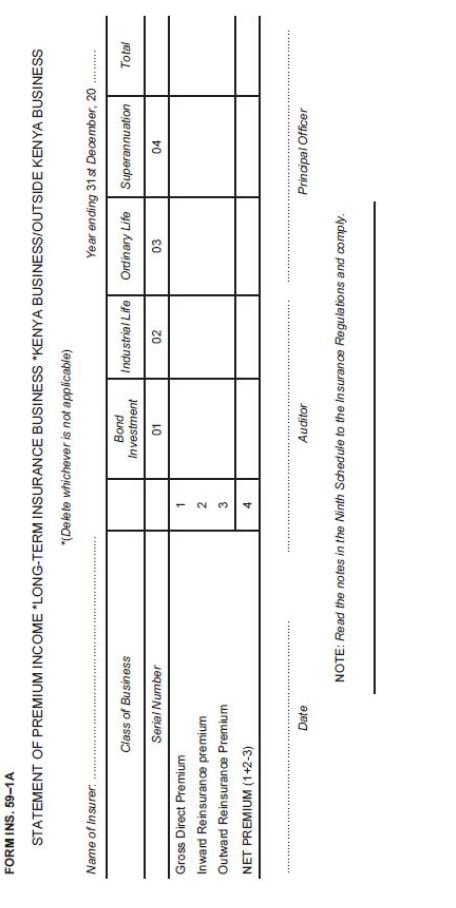

| 17. |

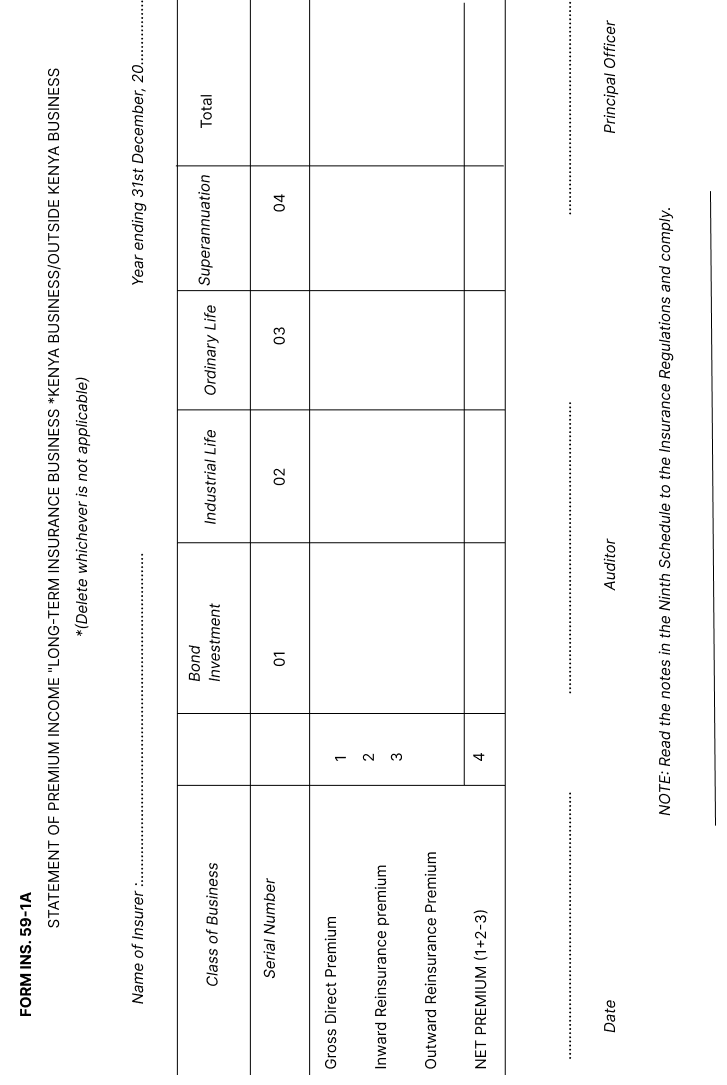

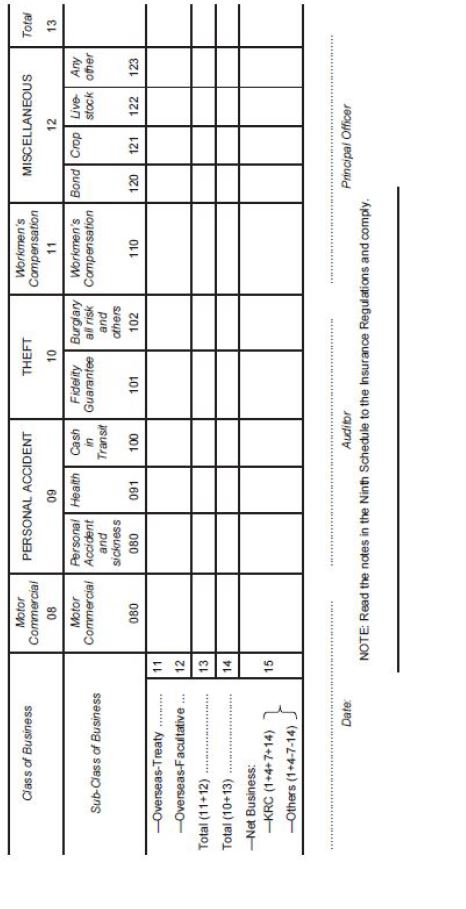

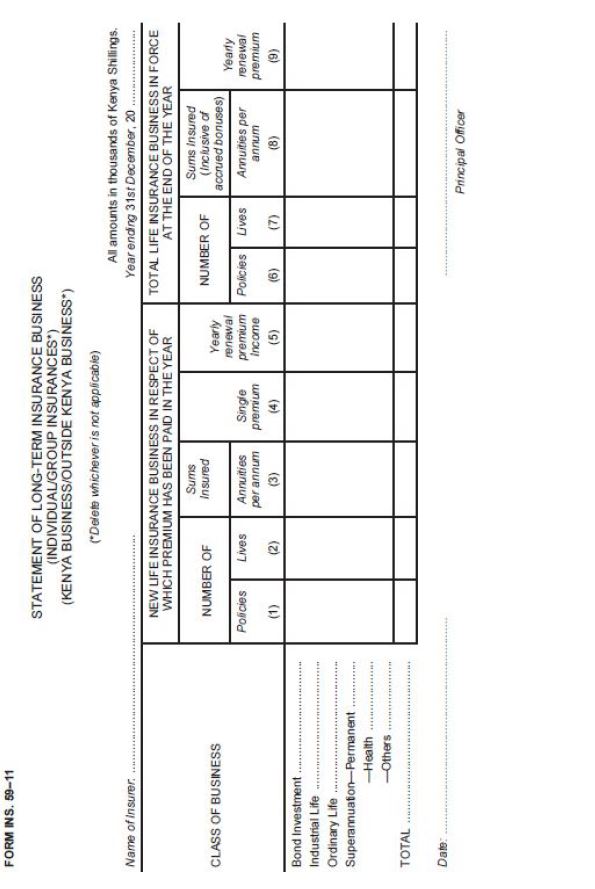

Annual returns: long term insurance business

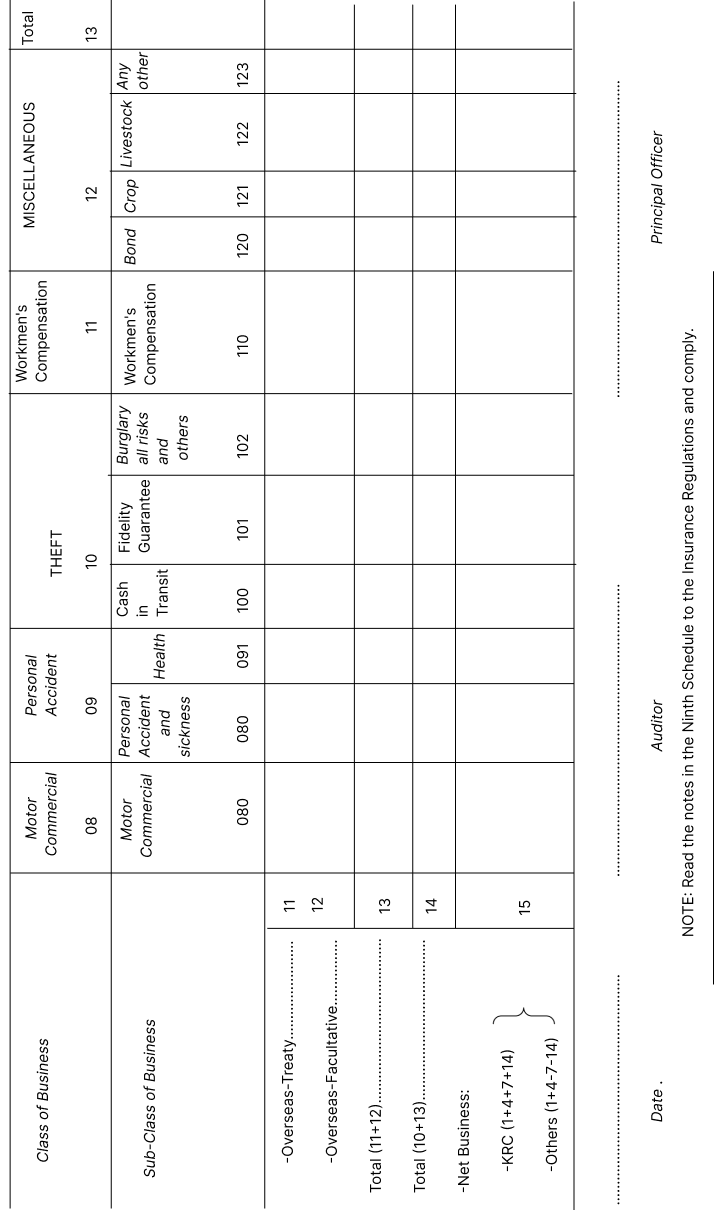

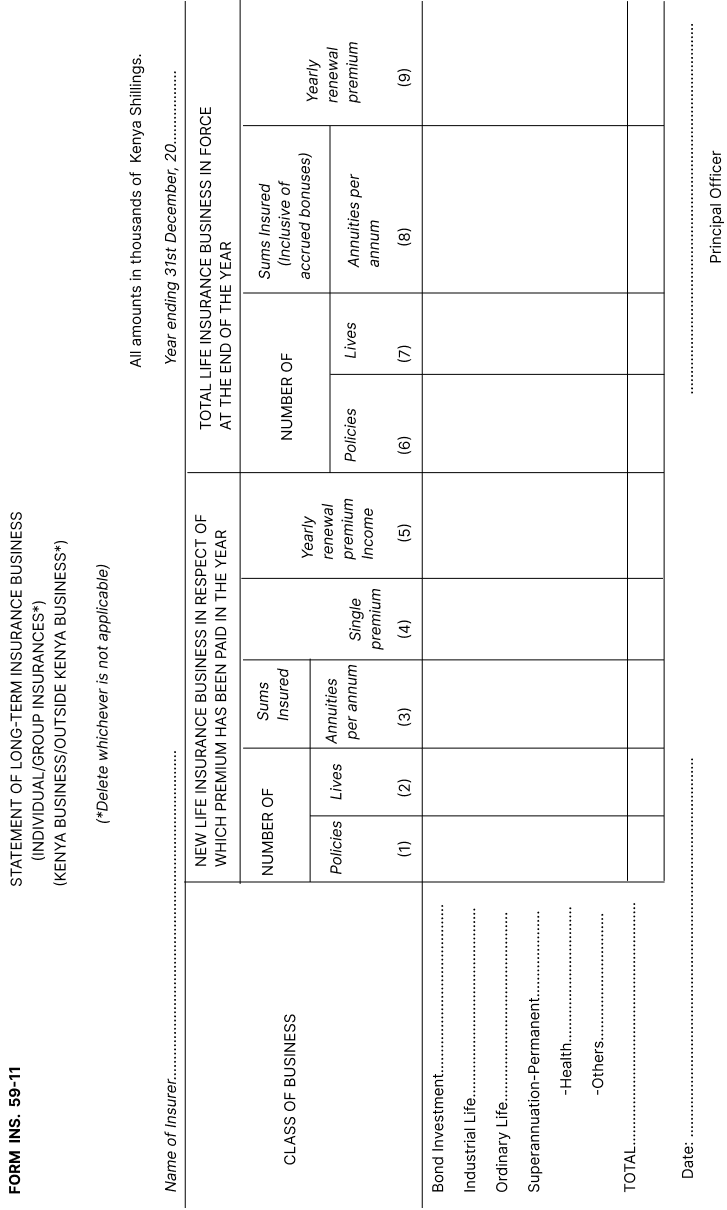

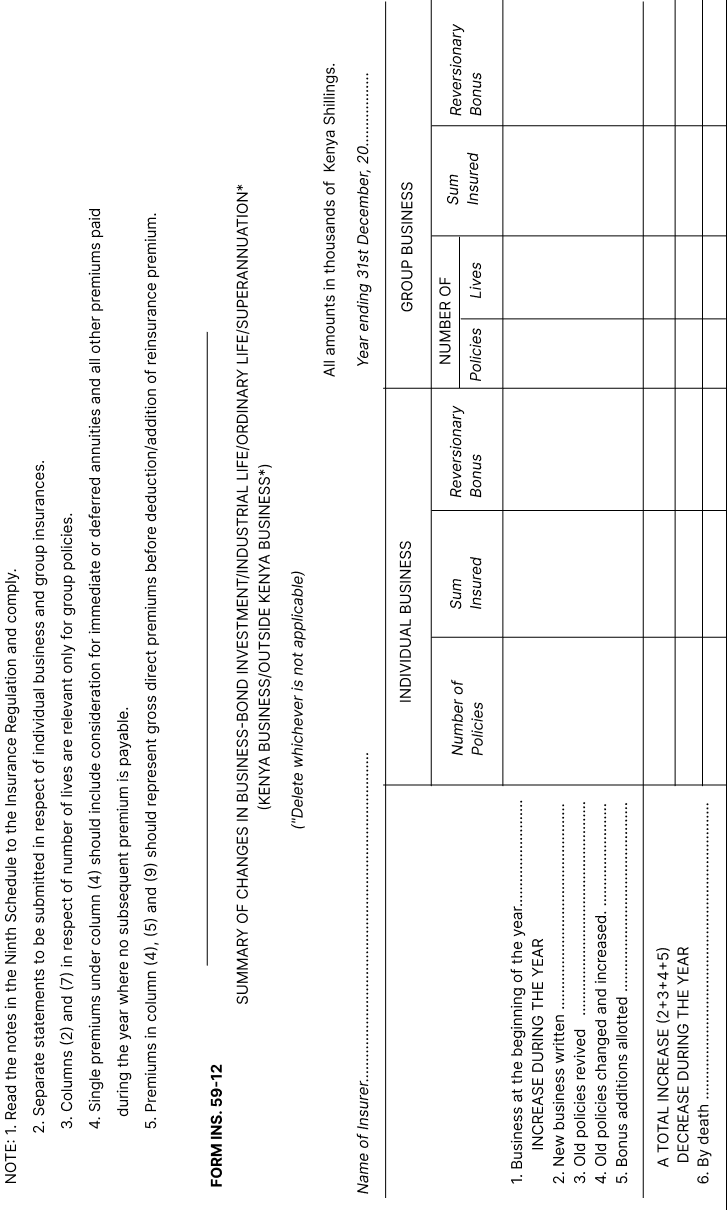

For the purposes of section 59 of the Act, every insurer carrying on long term insurance business shall, within three months after the end of the period to which they relate, lodge with the Commissioner, in respect of every financial year—

| (a) |

deleted by L.N. 93/2019 r. 4;

|

| (b) |

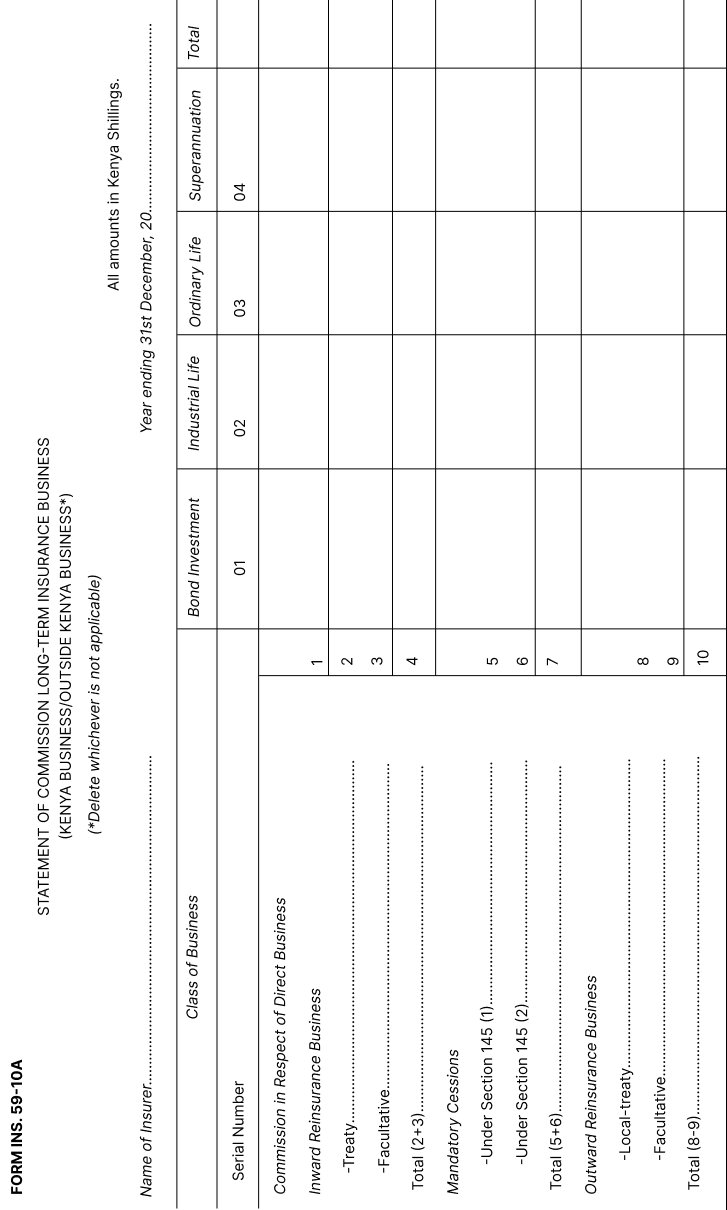

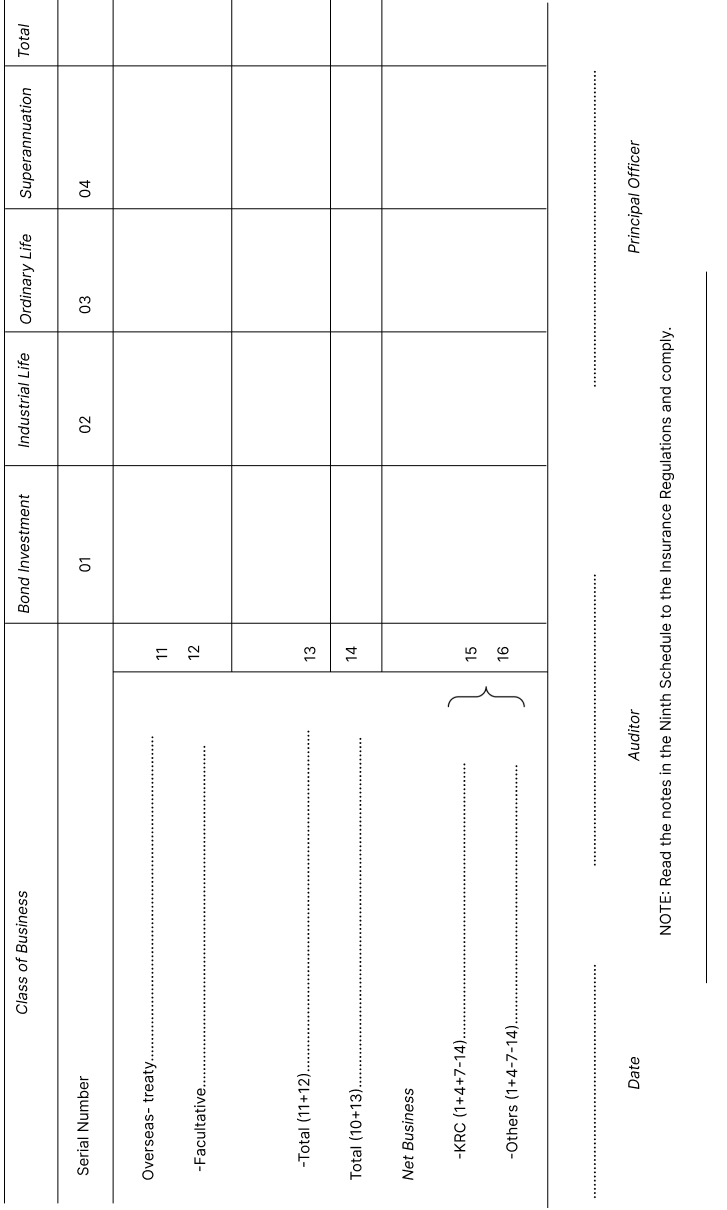

the following statements in the forms set out in the Ninth Schedule signed by the principal officer and also by an auditor in the case of those under (i), (ii), (iii), (iv) and (v)—

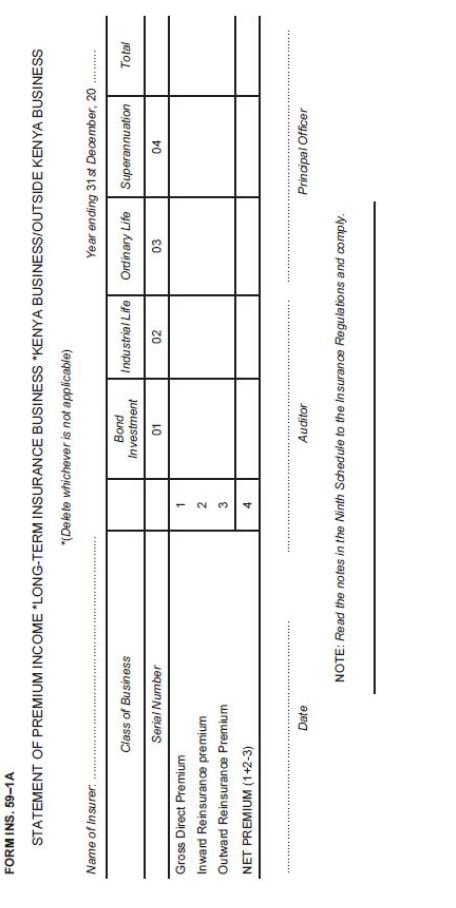

| (i) |

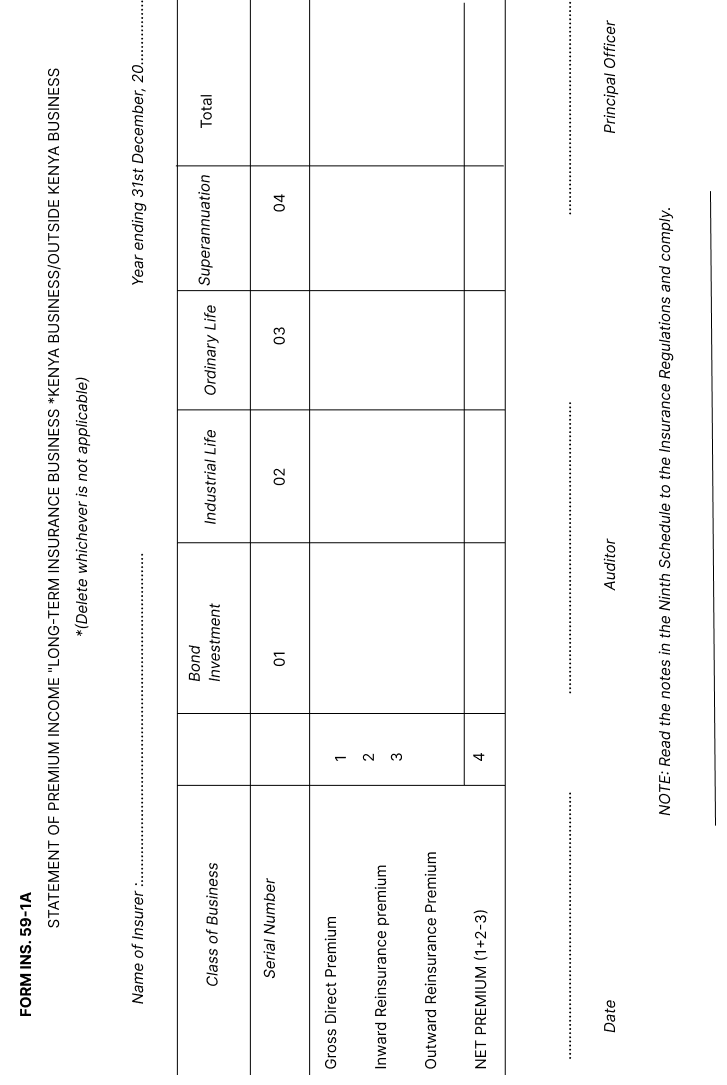

statement of premium income, Form No. INS 59-14; |

| (ii) |

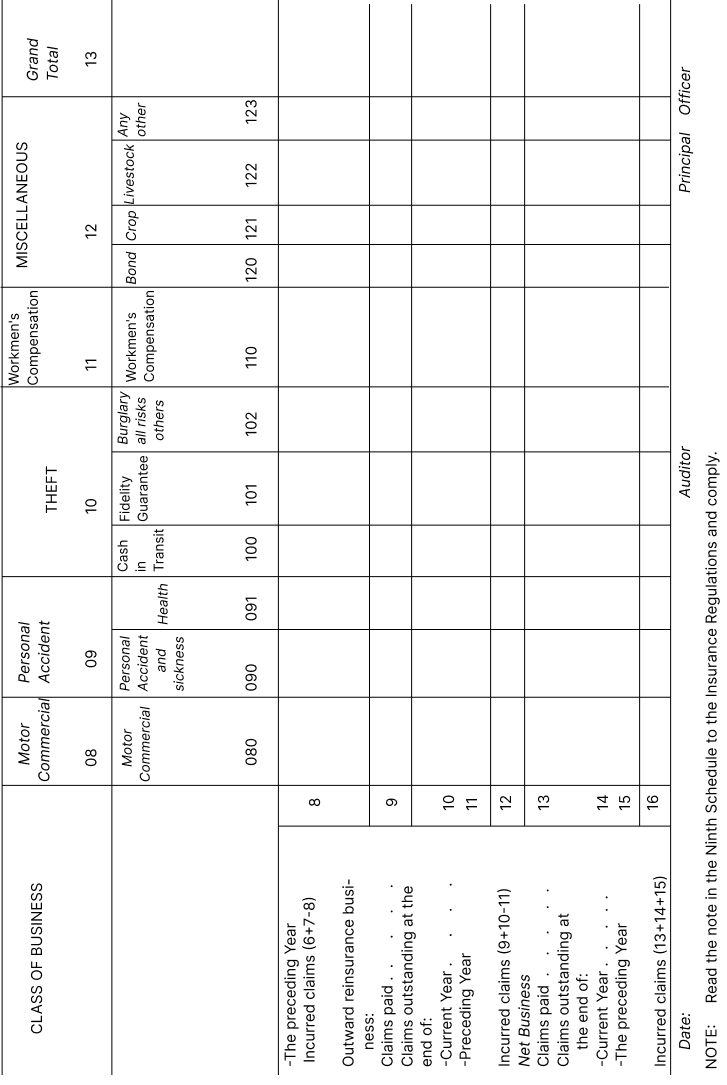

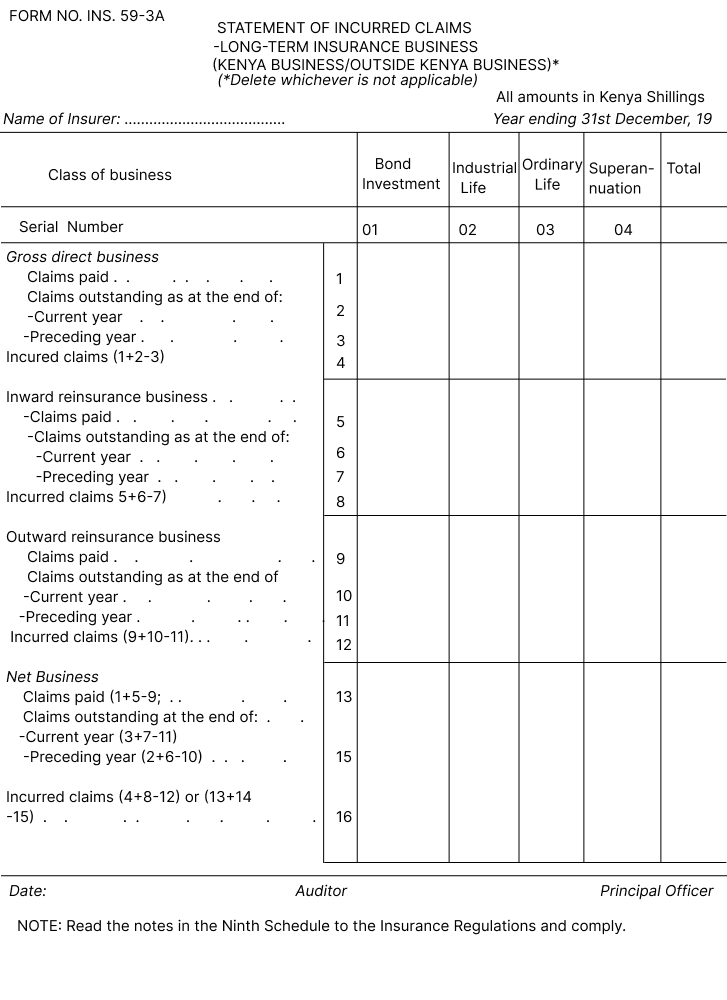

statement of incurred claims, Form No. INS 59-3A; |

| (iii) |

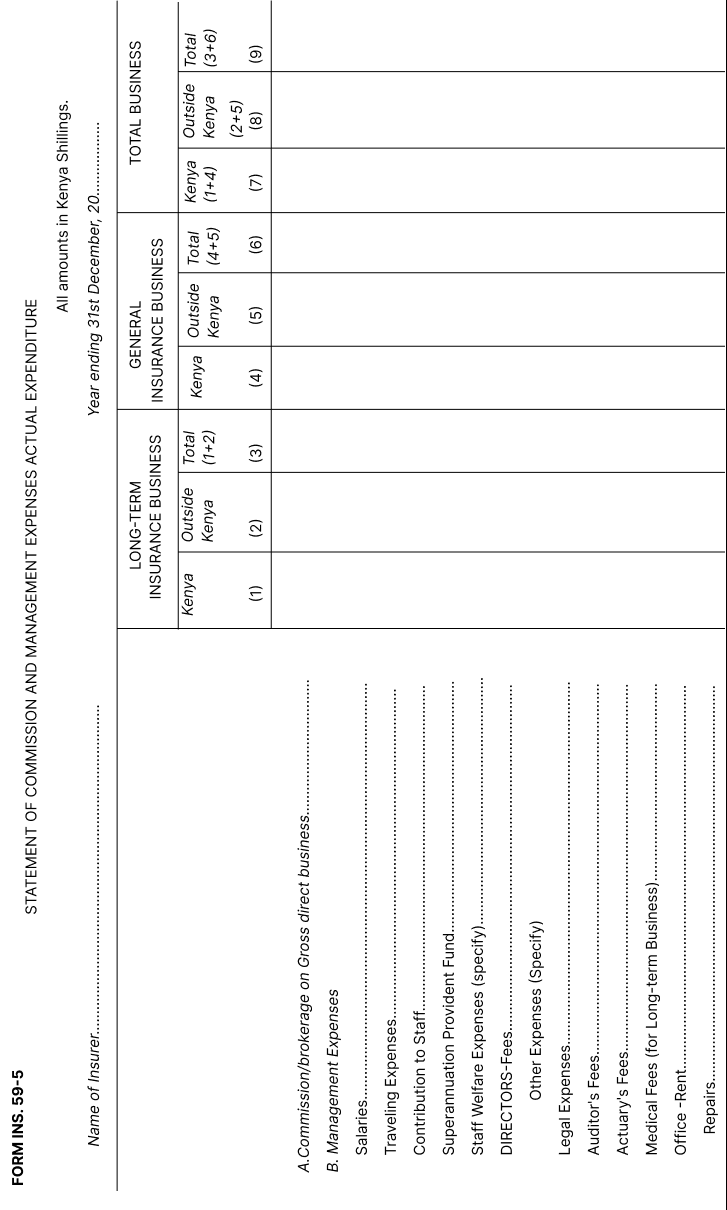

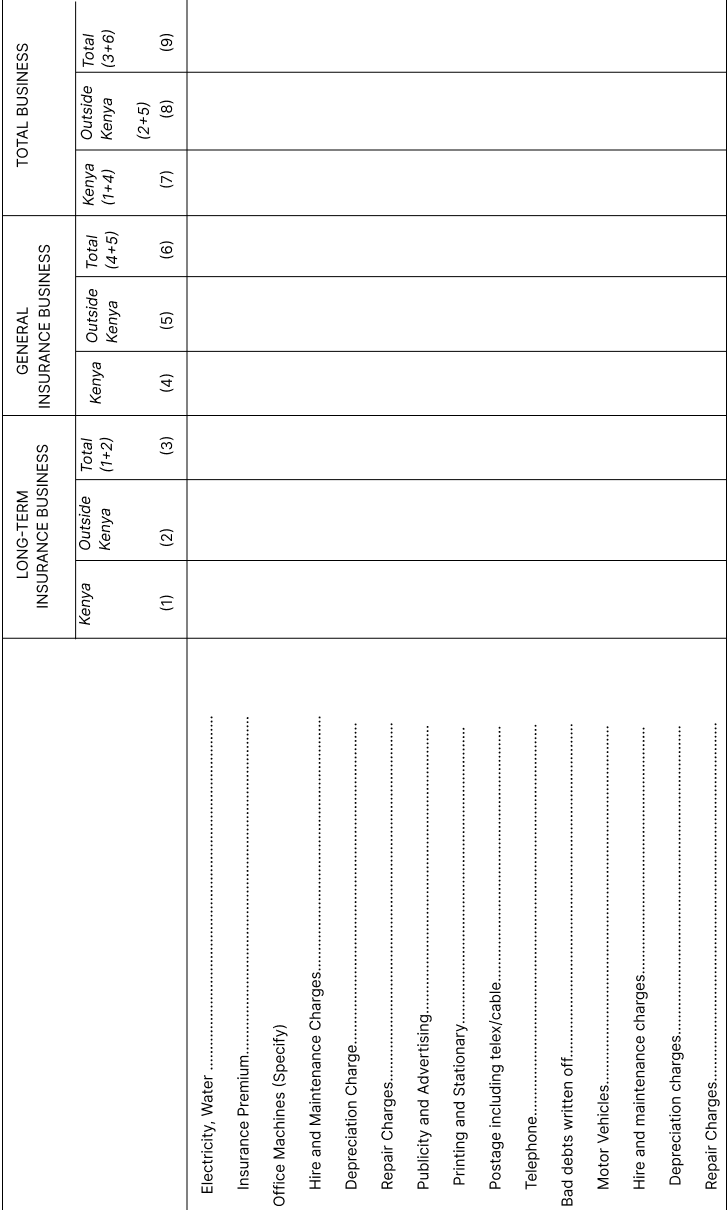

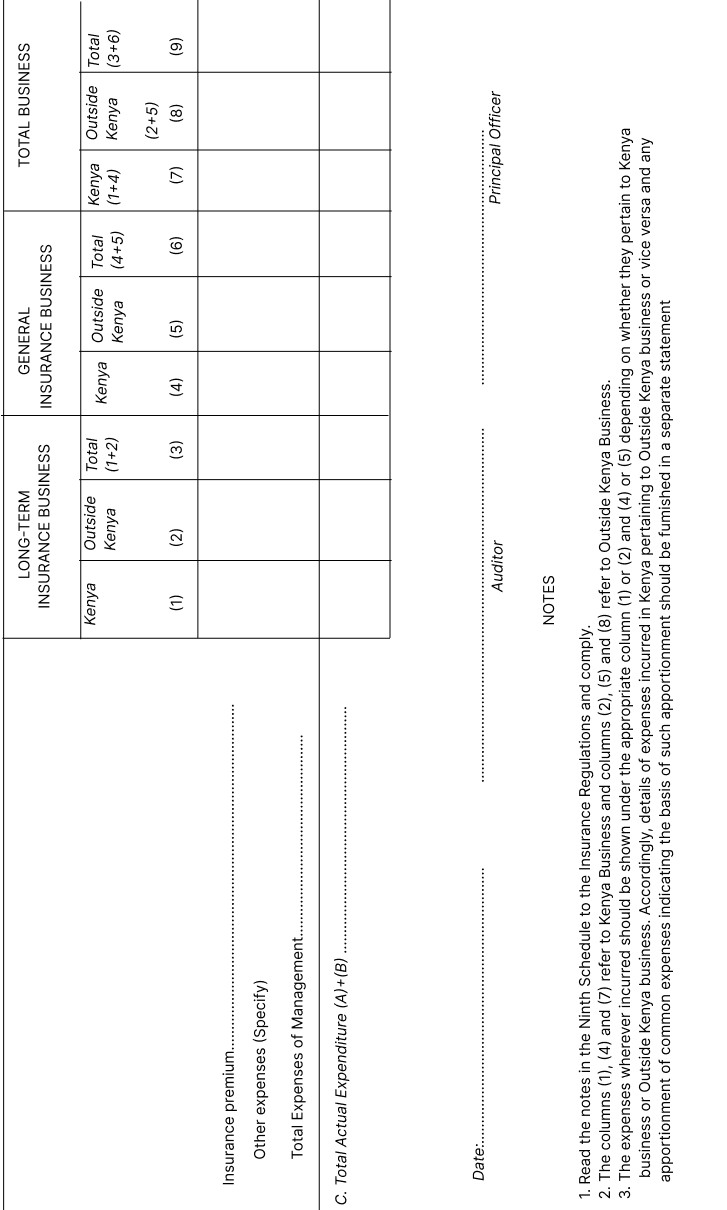

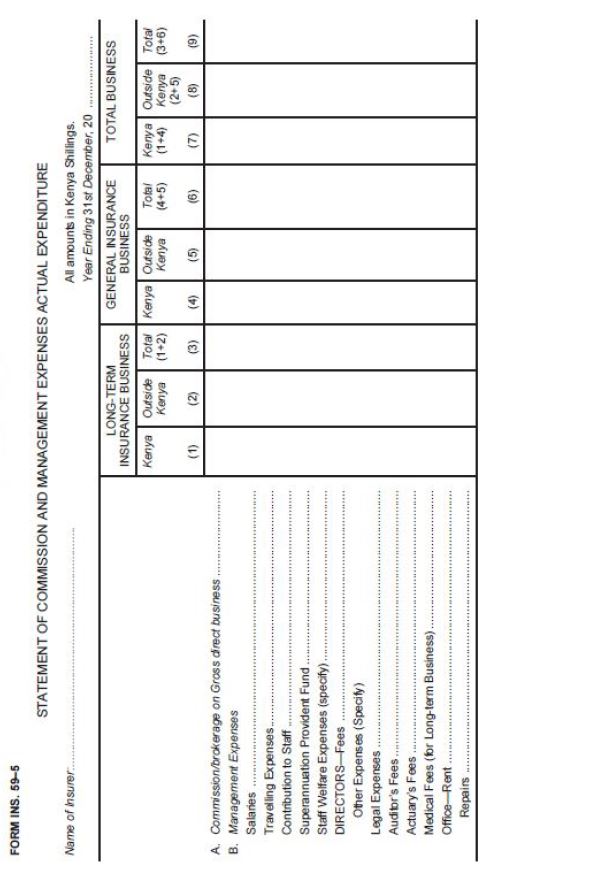

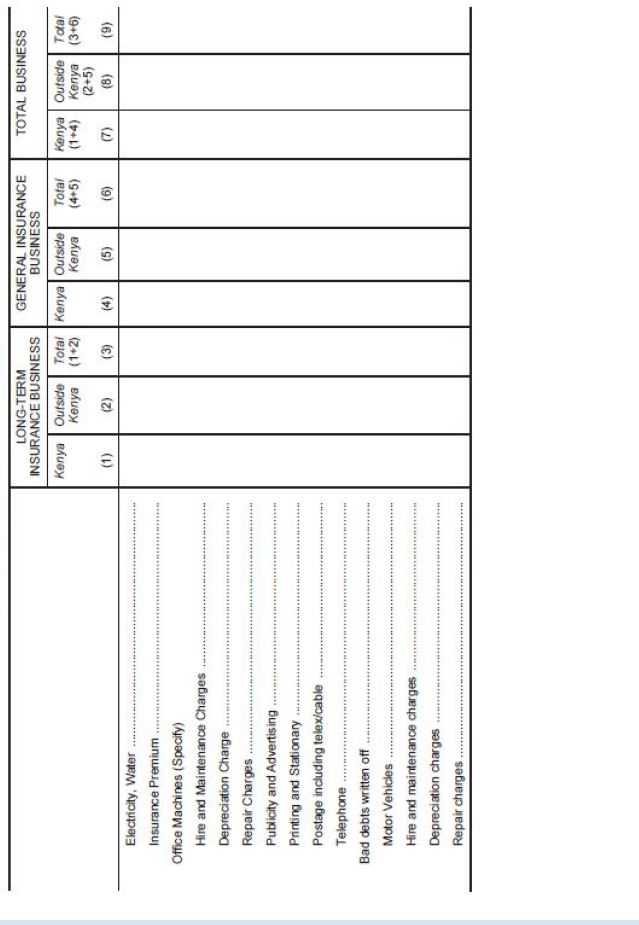

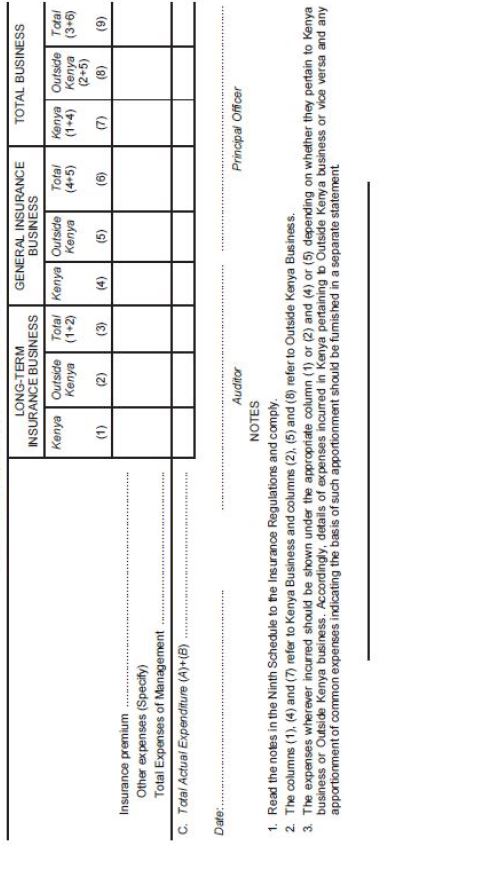

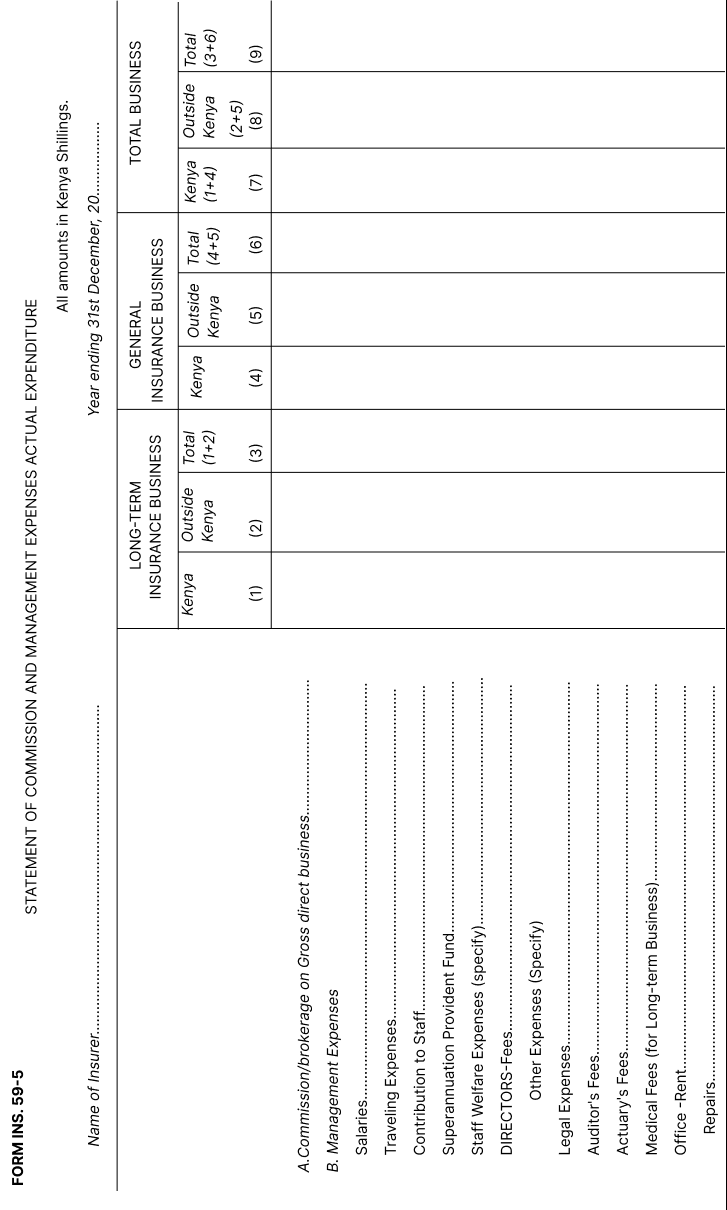

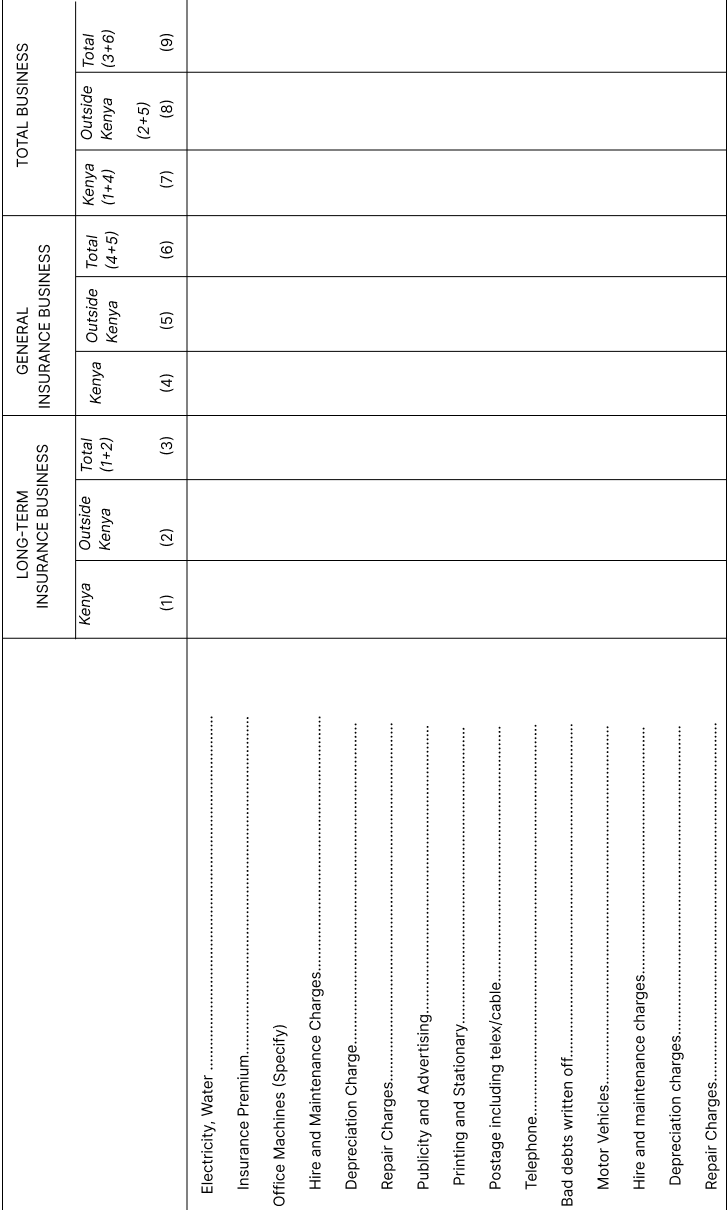

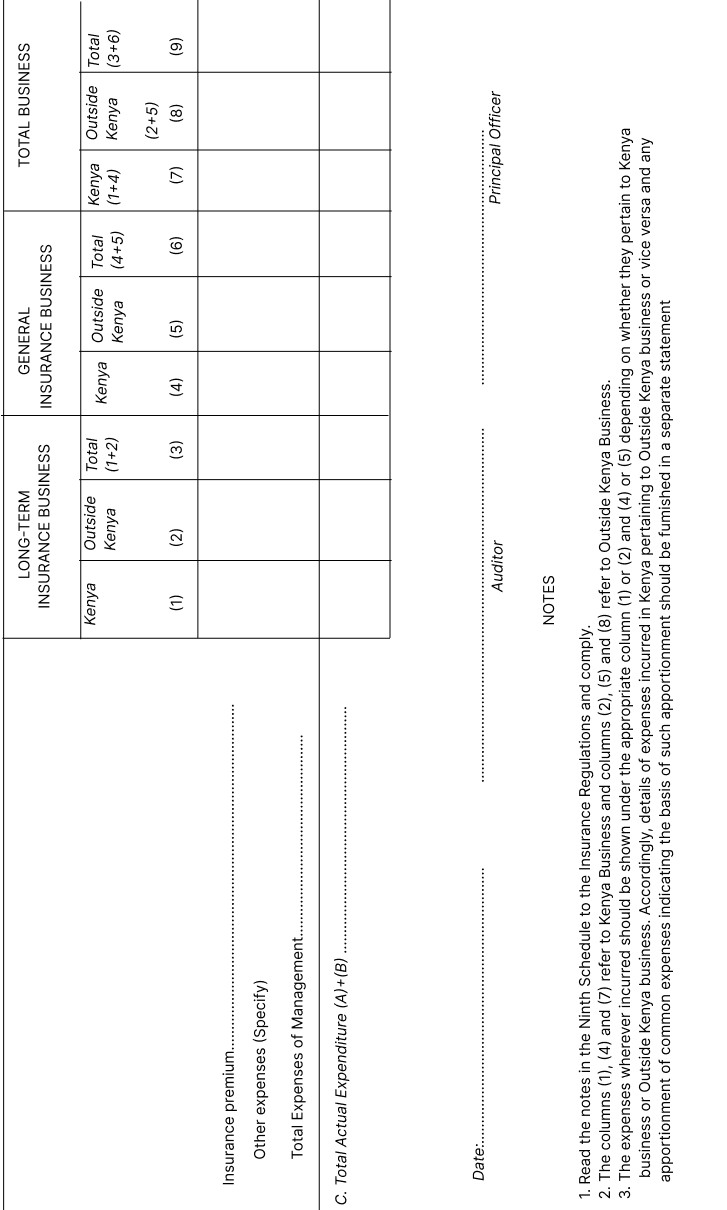

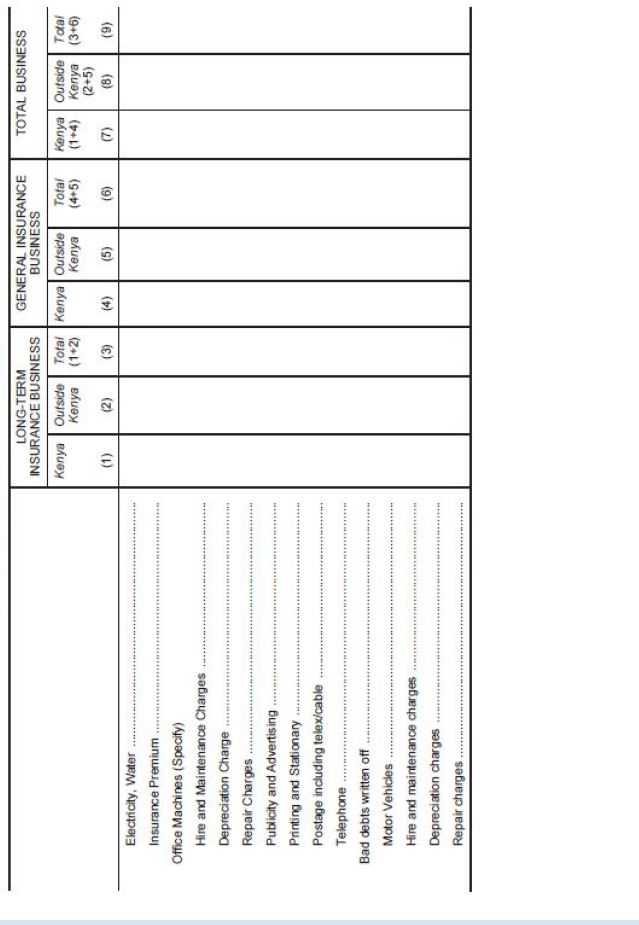

statement of commission and management expenses, Form No. INS 59-5; |

| (iv) |

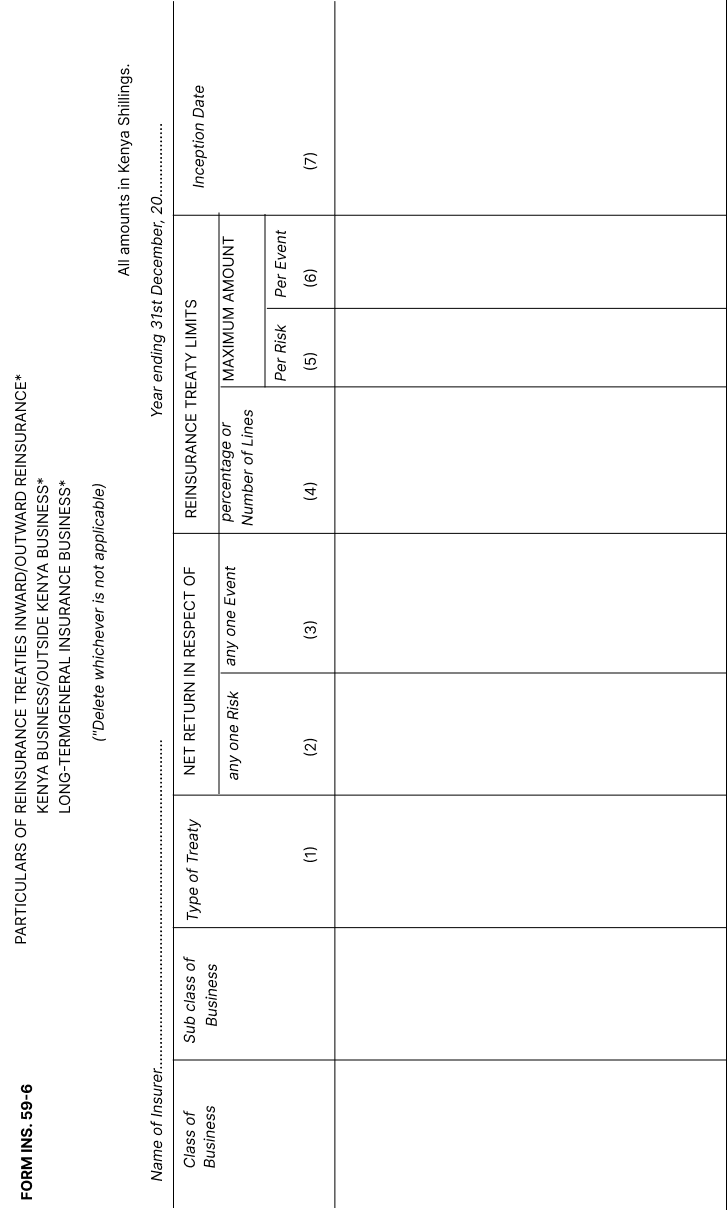

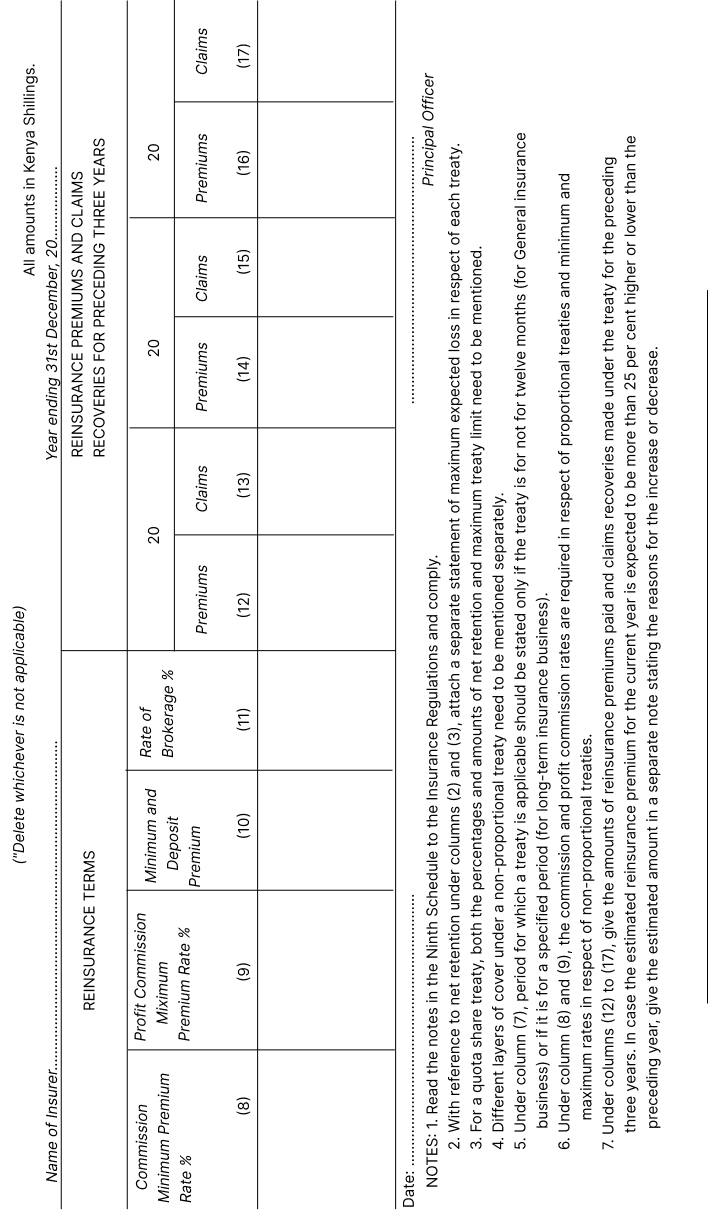

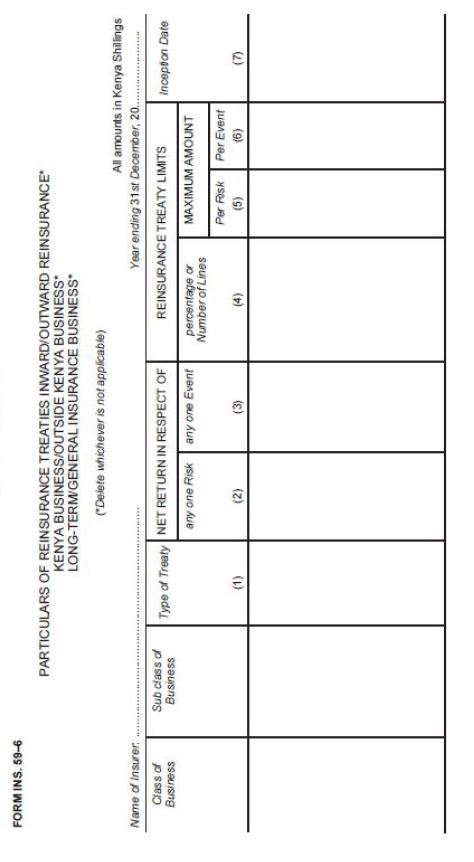

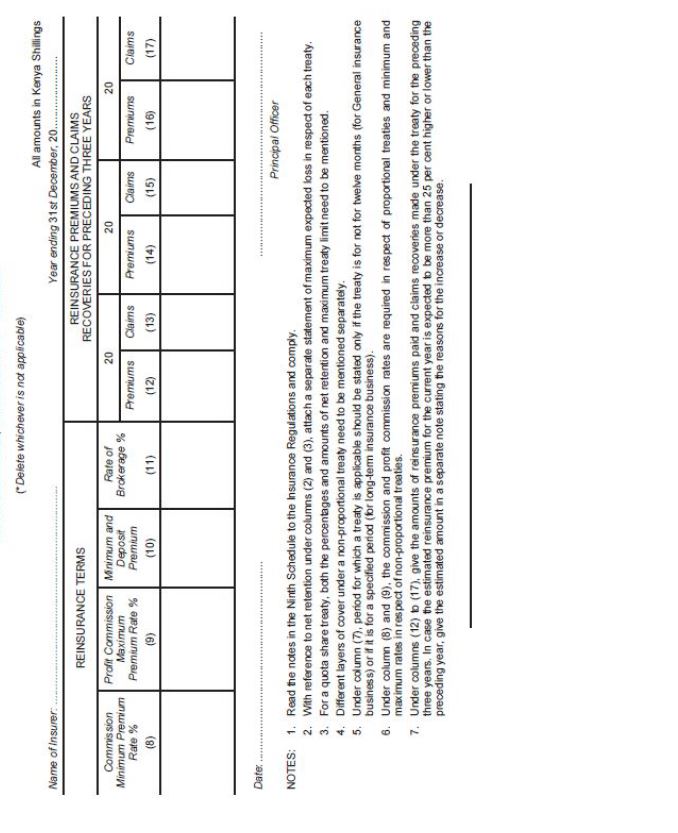

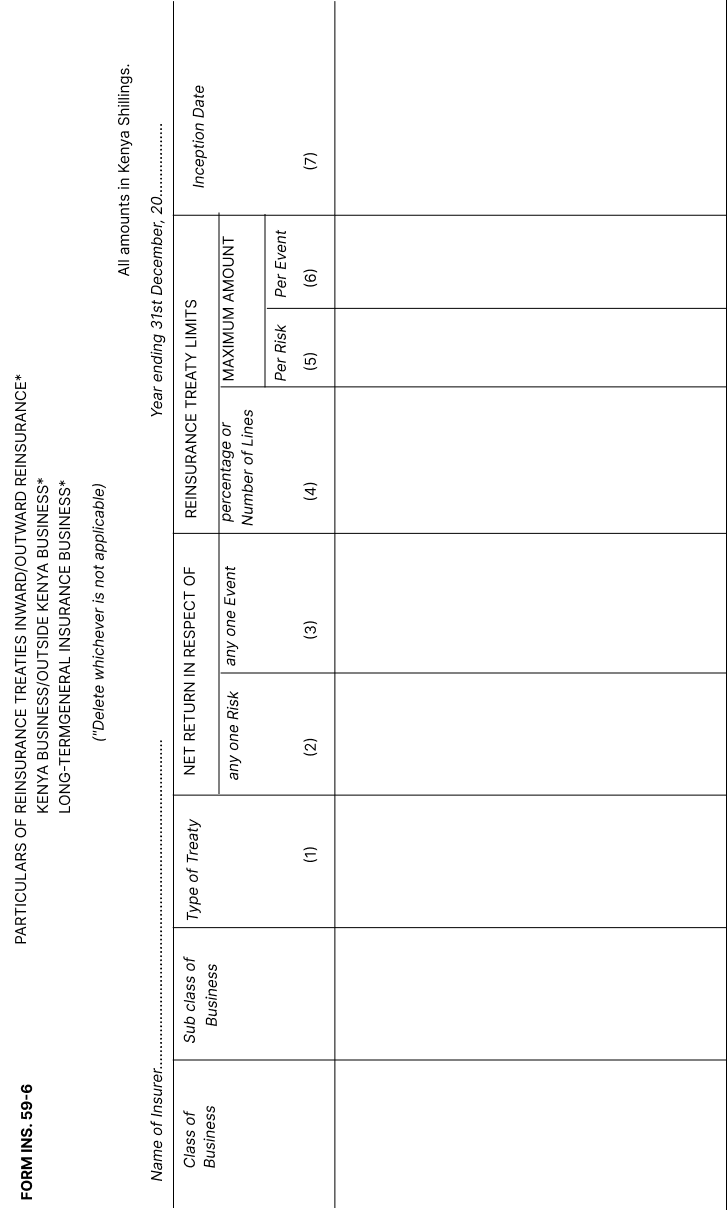

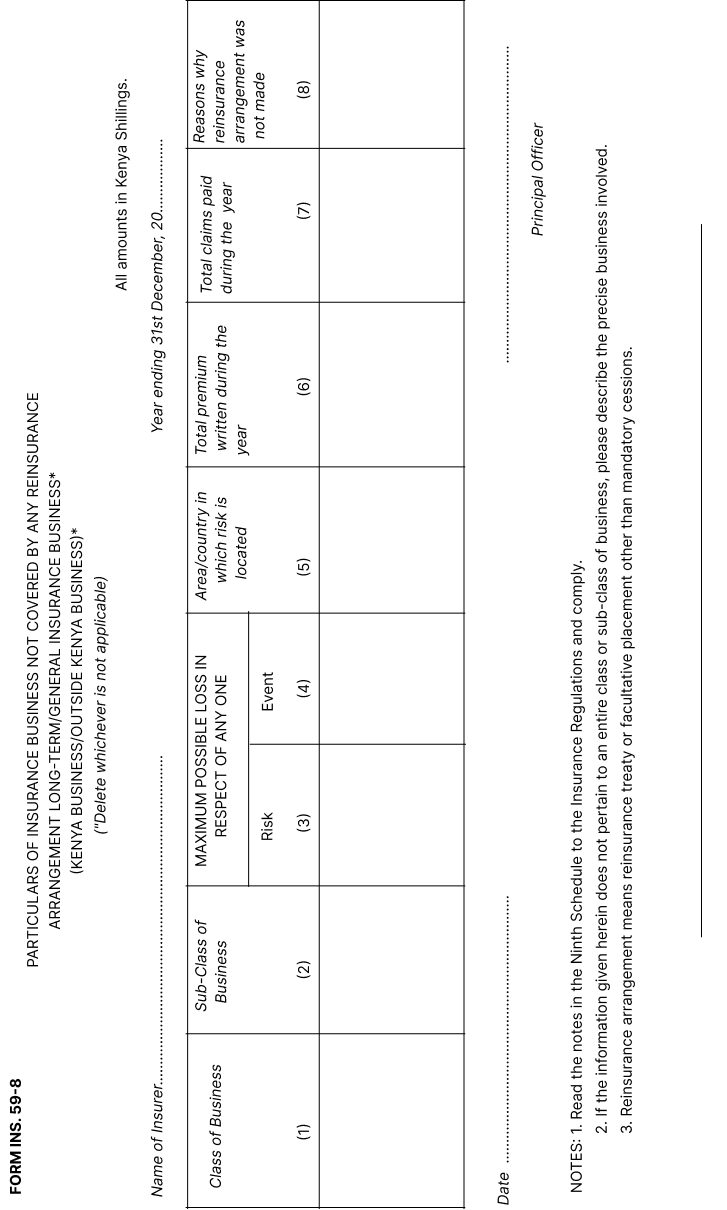

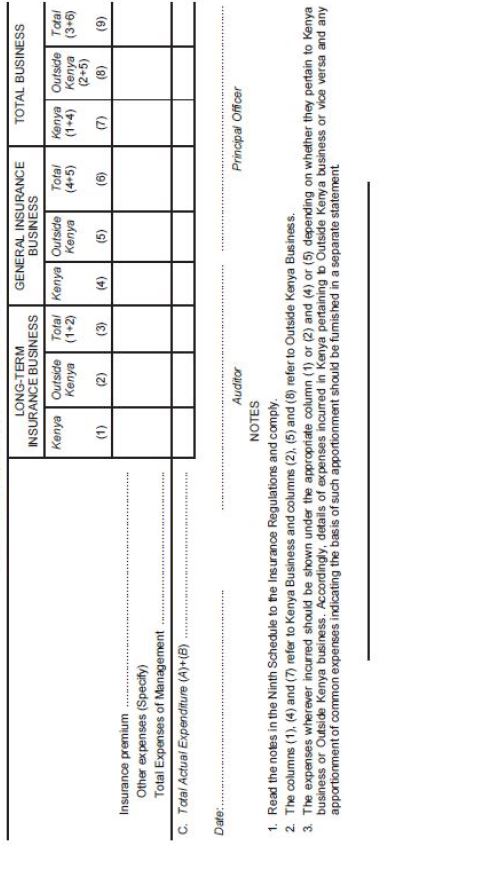

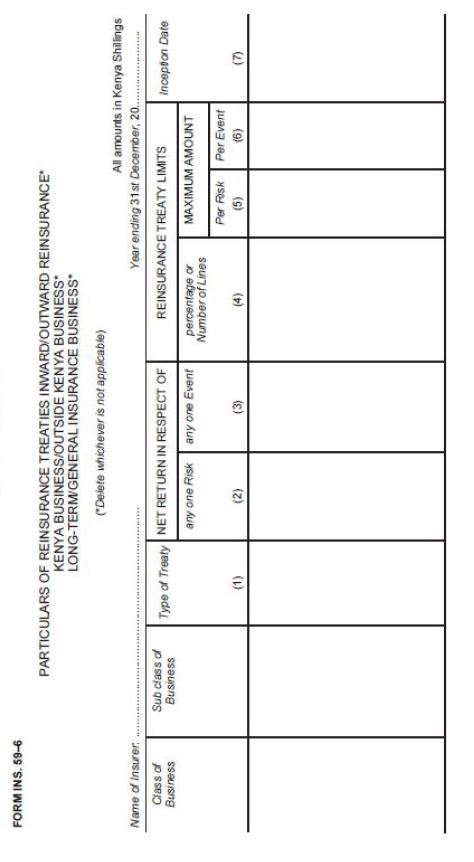

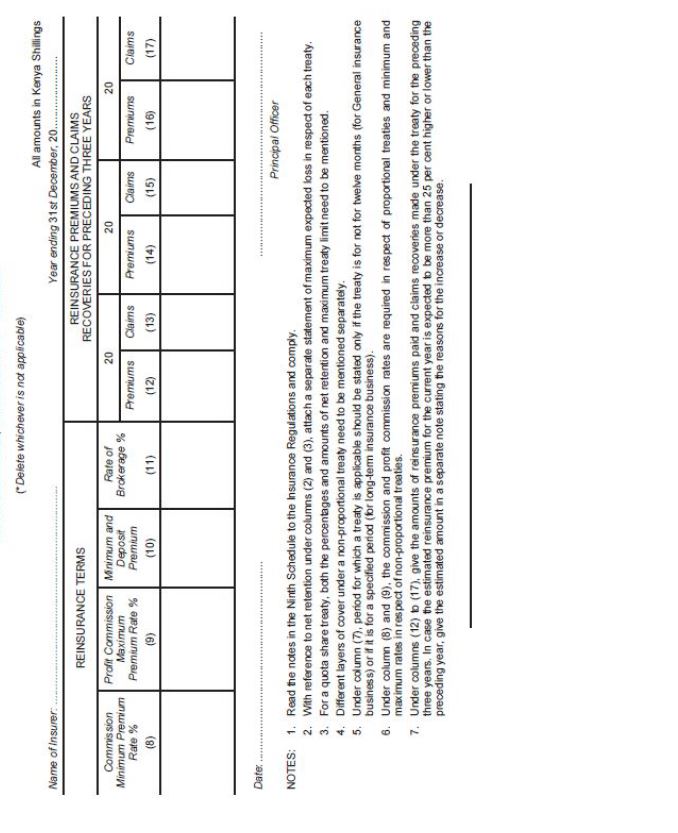

particulars of inward and outward re-insurance treaties, Form No. INS 59-6; |

| (v) |

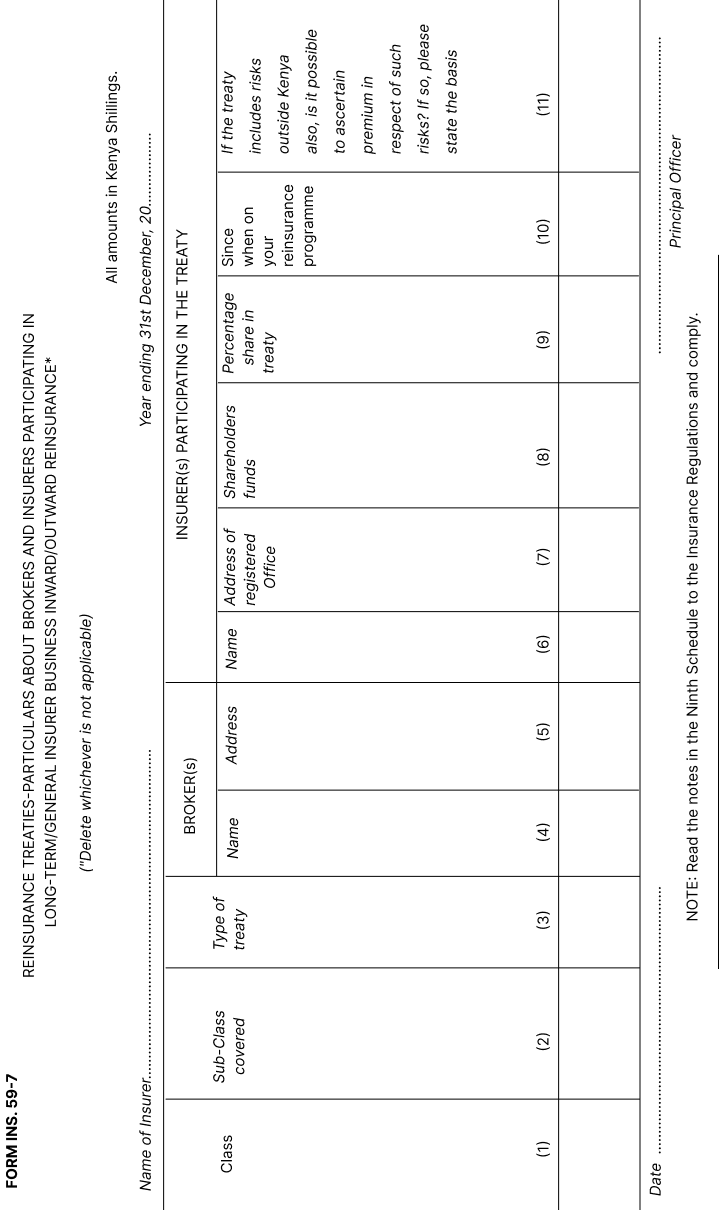

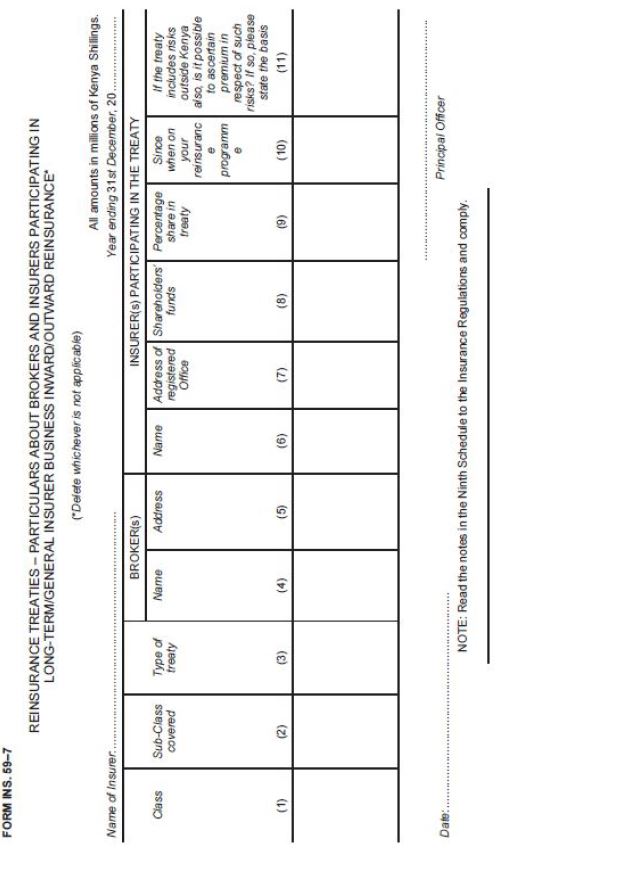

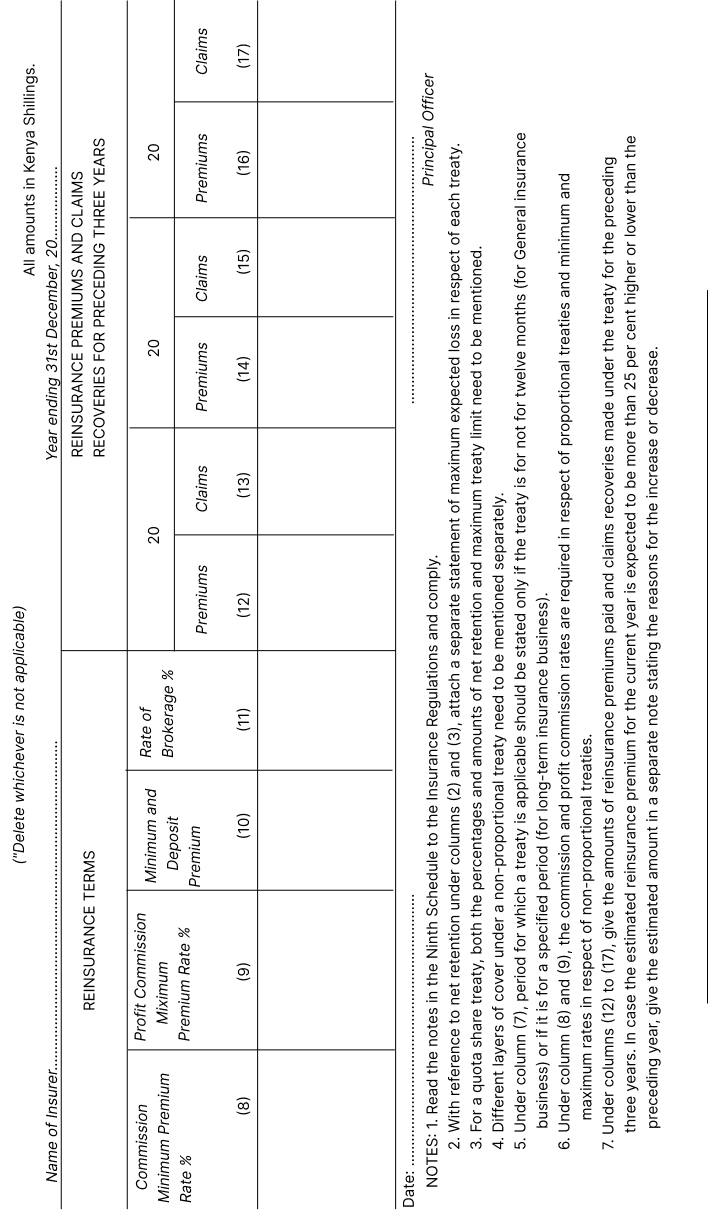

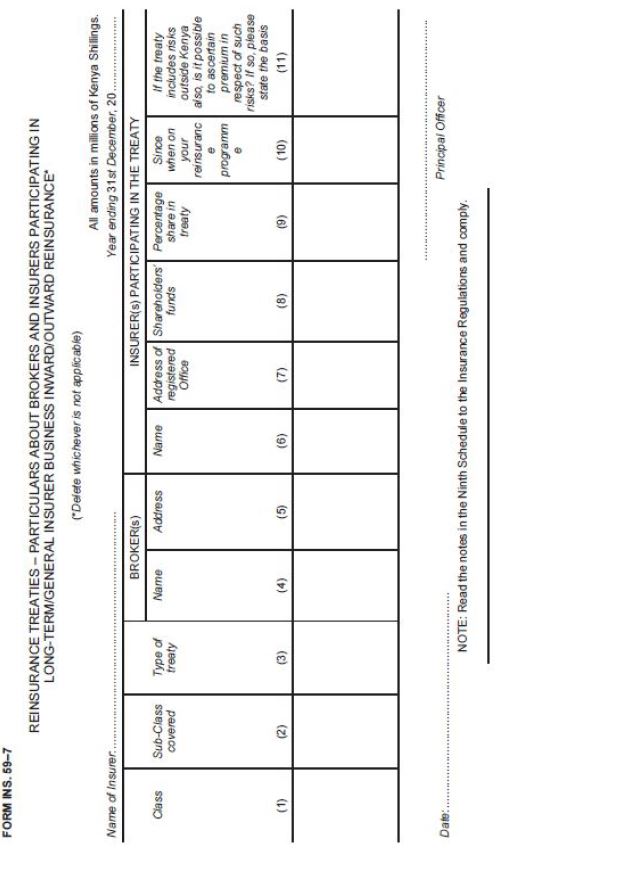

particulars of brokers, reinsurers and re-insured under inward and outward reinsurance treaties, Form No. INS 59-7; |

| (vi) |

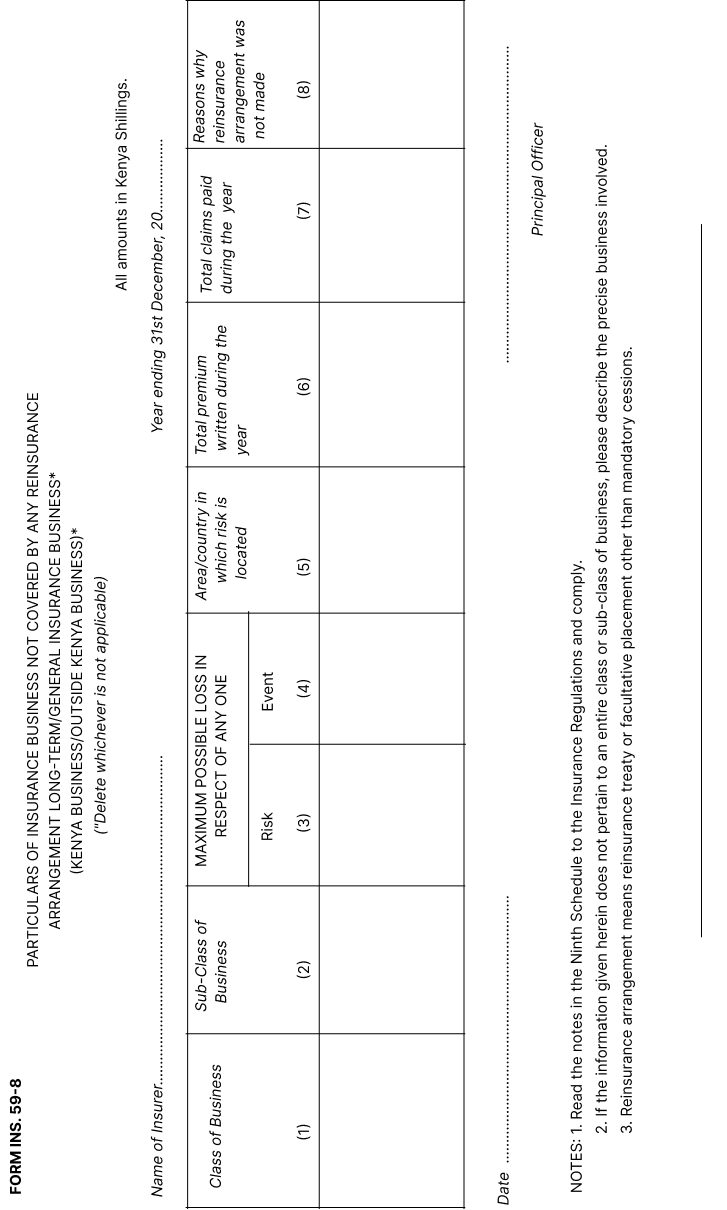

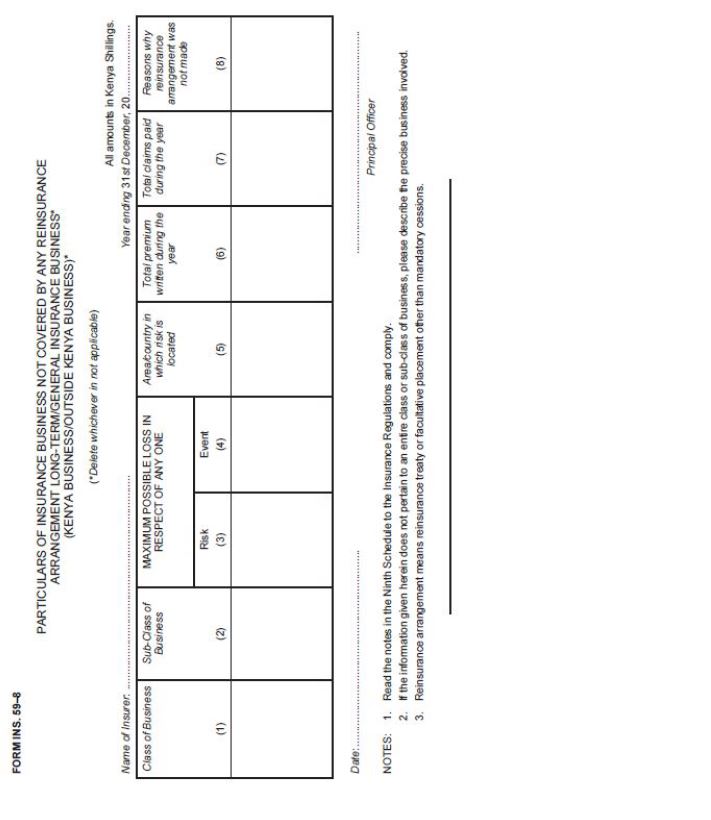

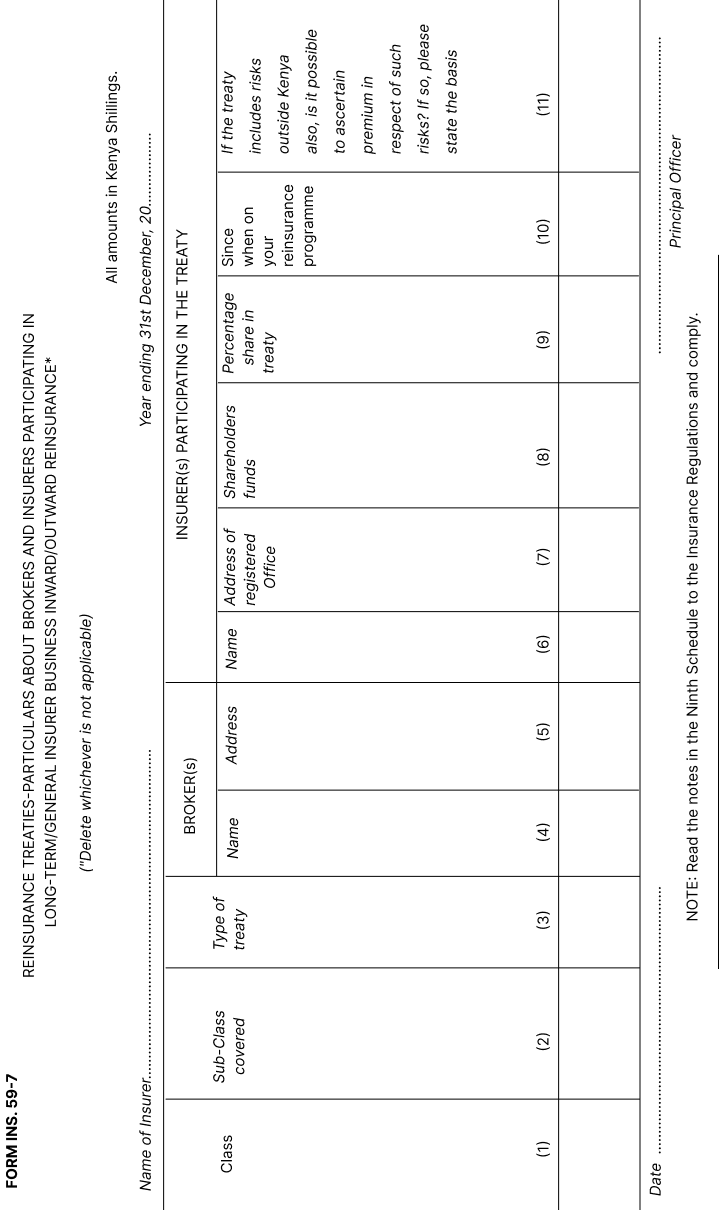

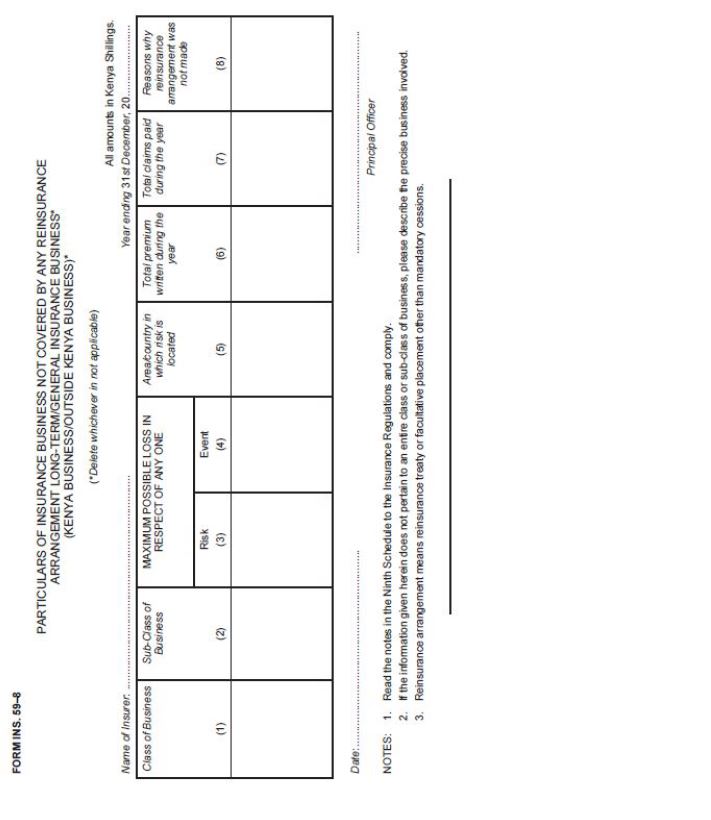

particulars of insurance business not covered by any reinsurance arrangement, Form INS. 59-8; |

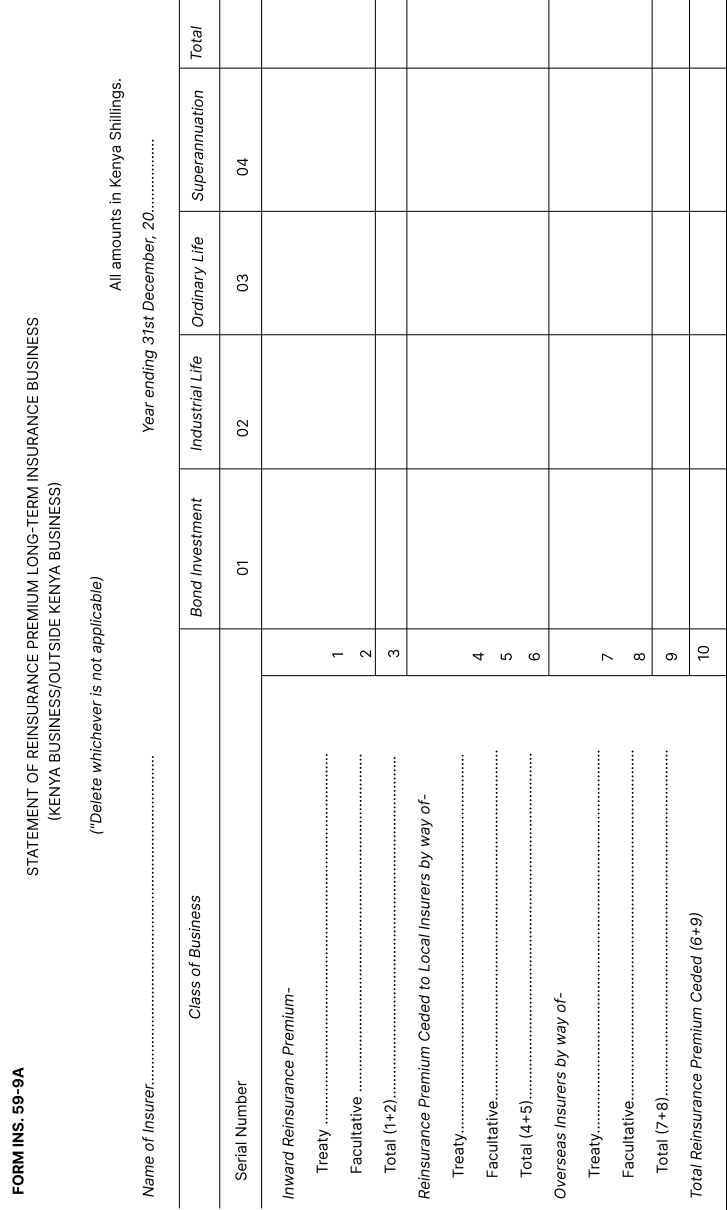

| (vii) |

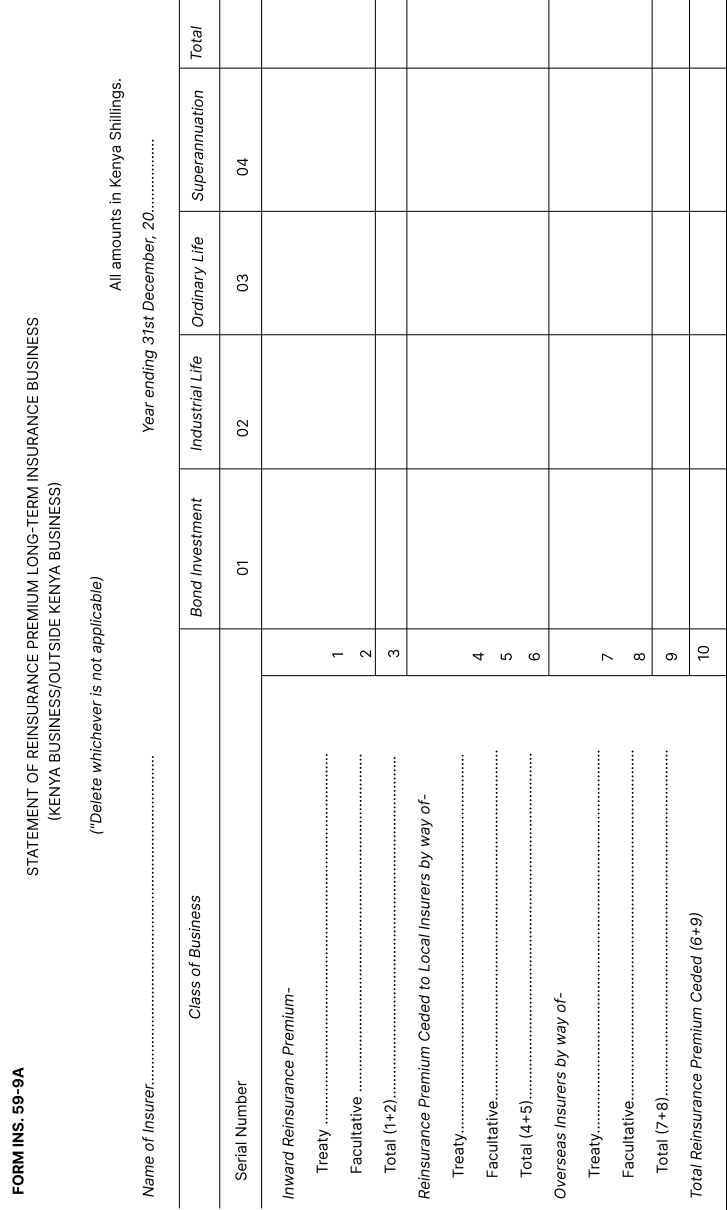

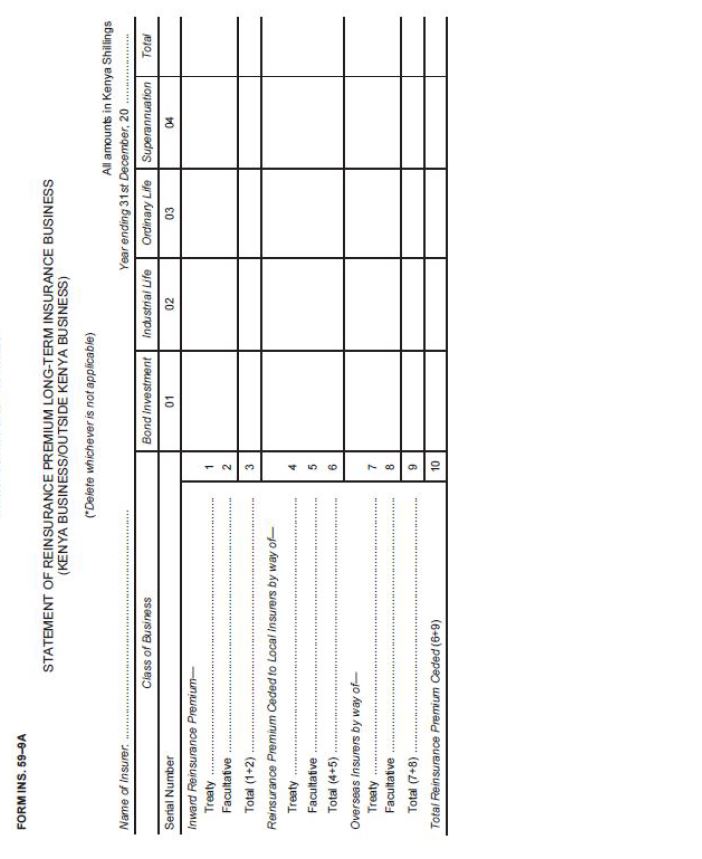

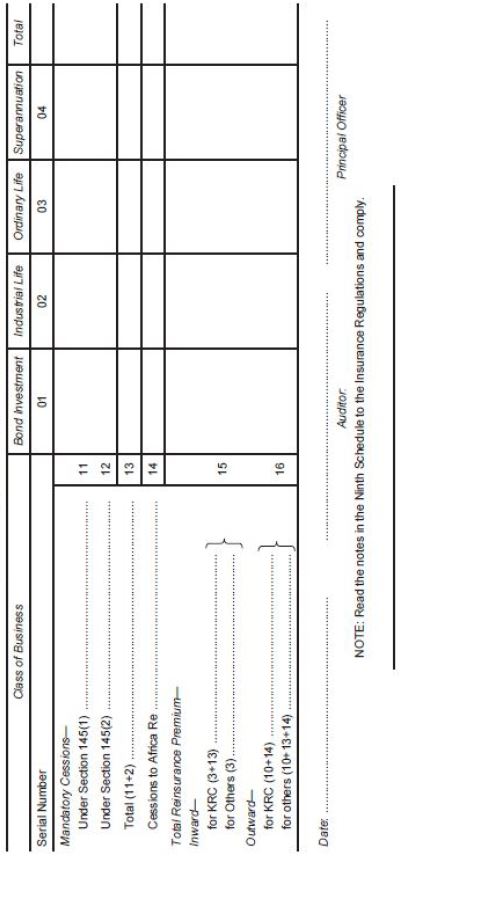

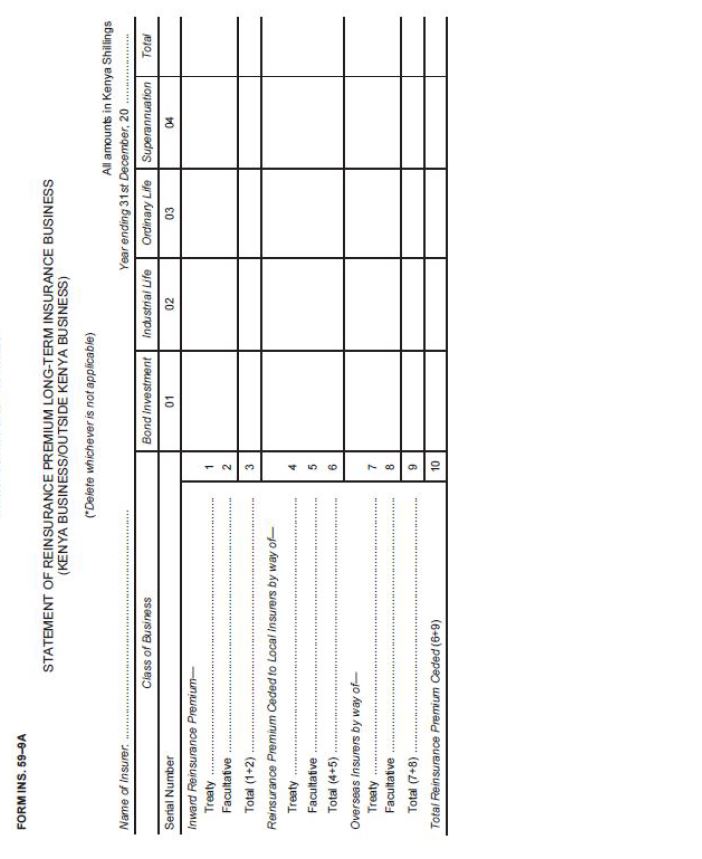

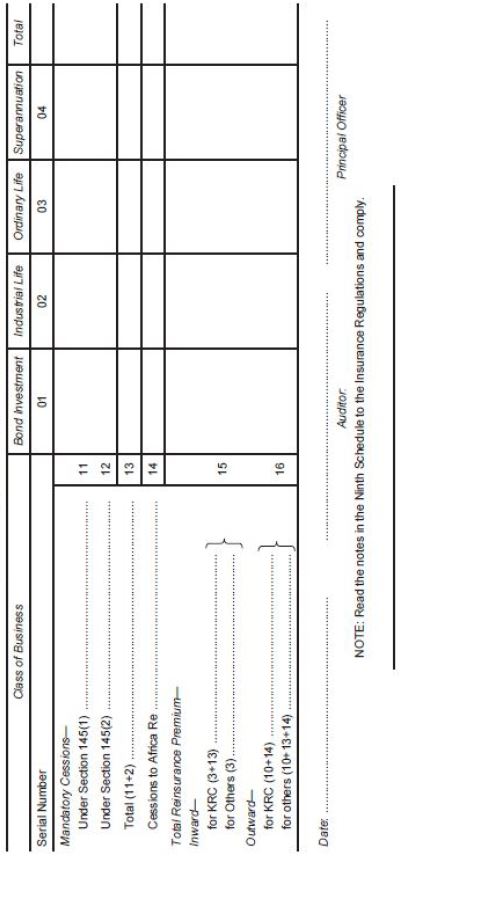

statement of reinsurance premiums on long term business, Form No. INS 59-9A |

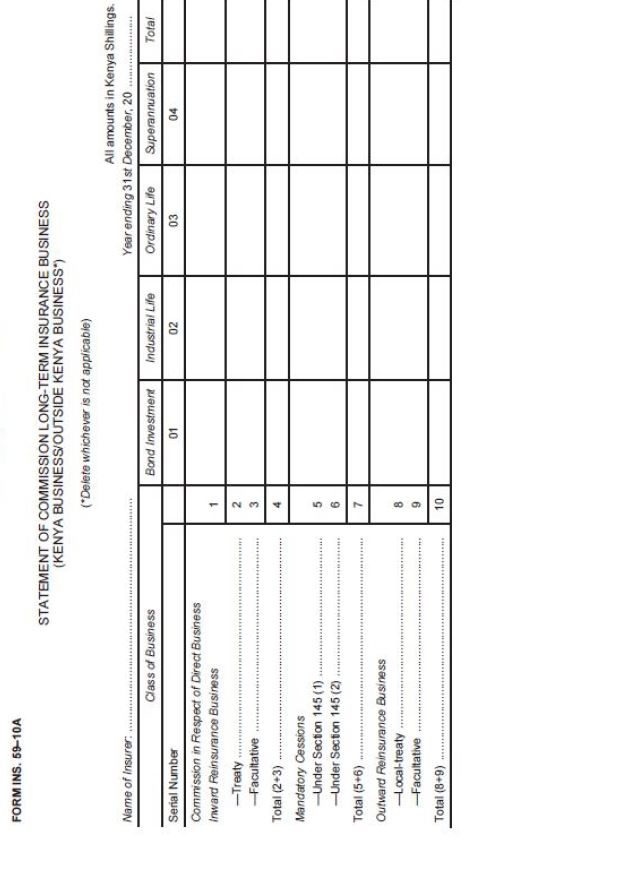

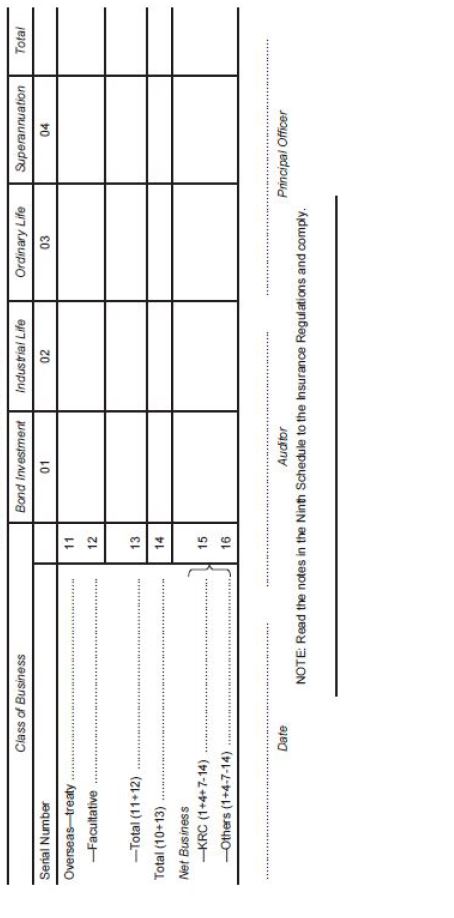

| (viii) |

particulars of inward and outward reinsurance treaties; |

| (ix) |

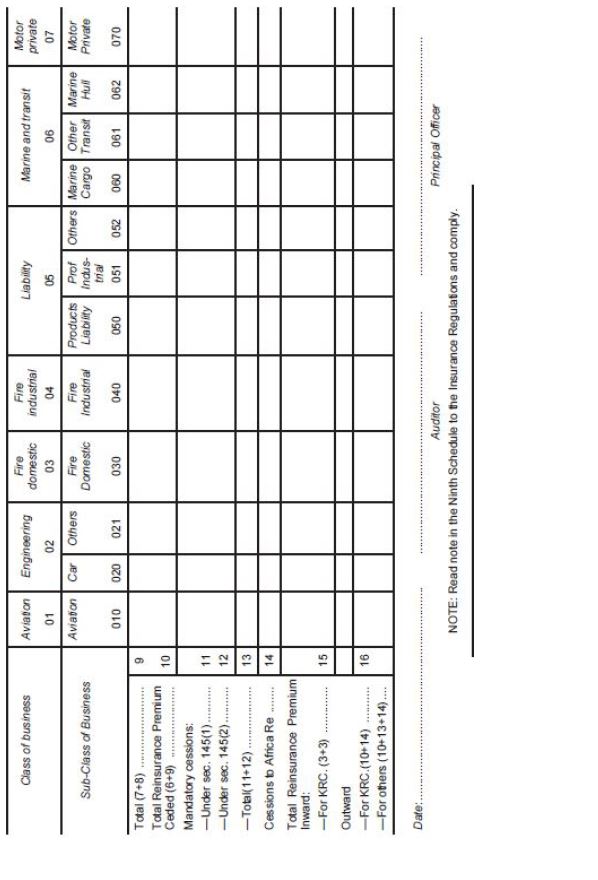

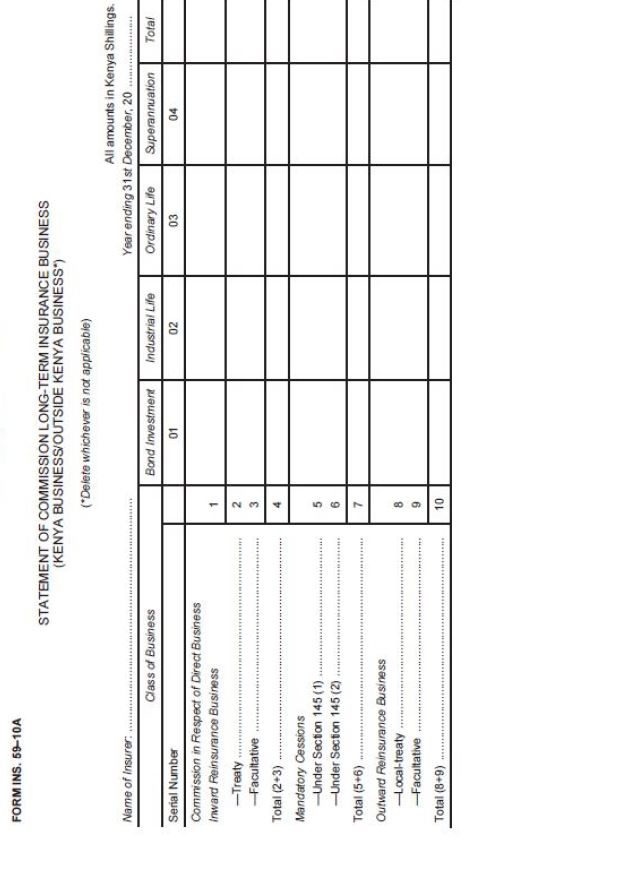

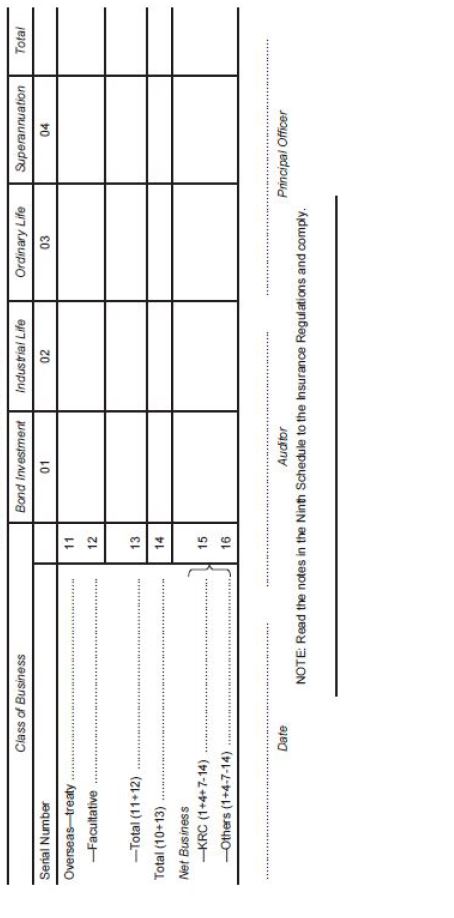

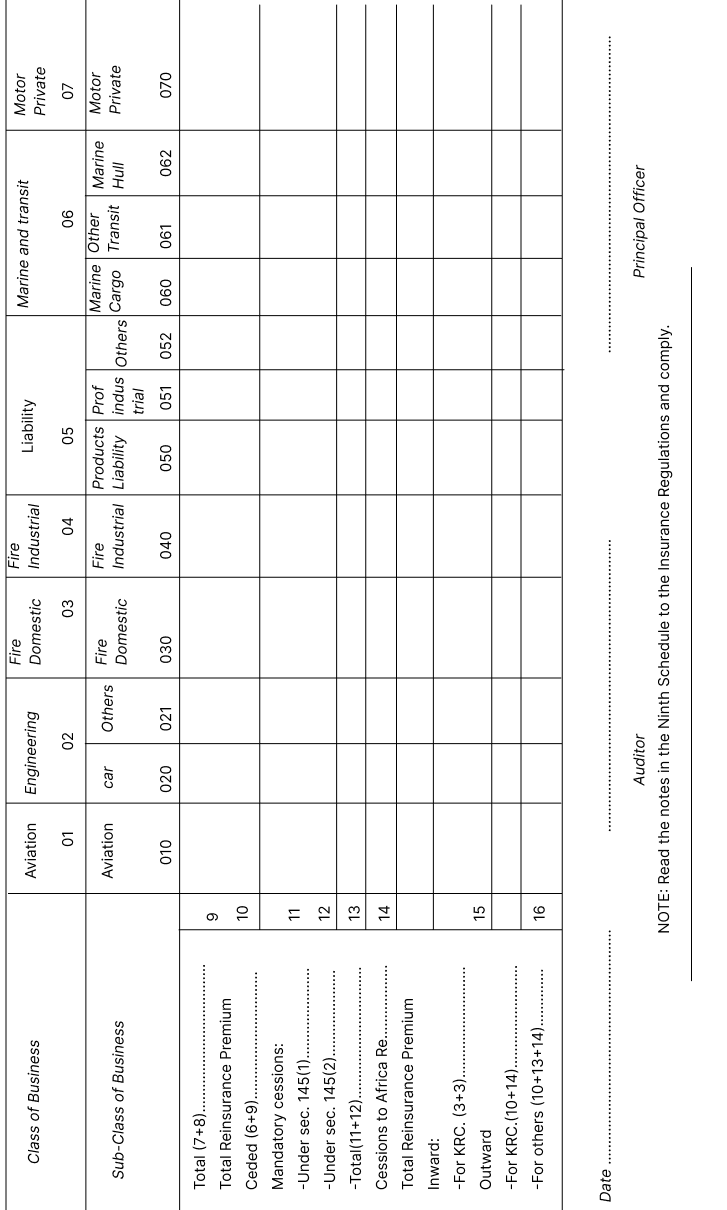

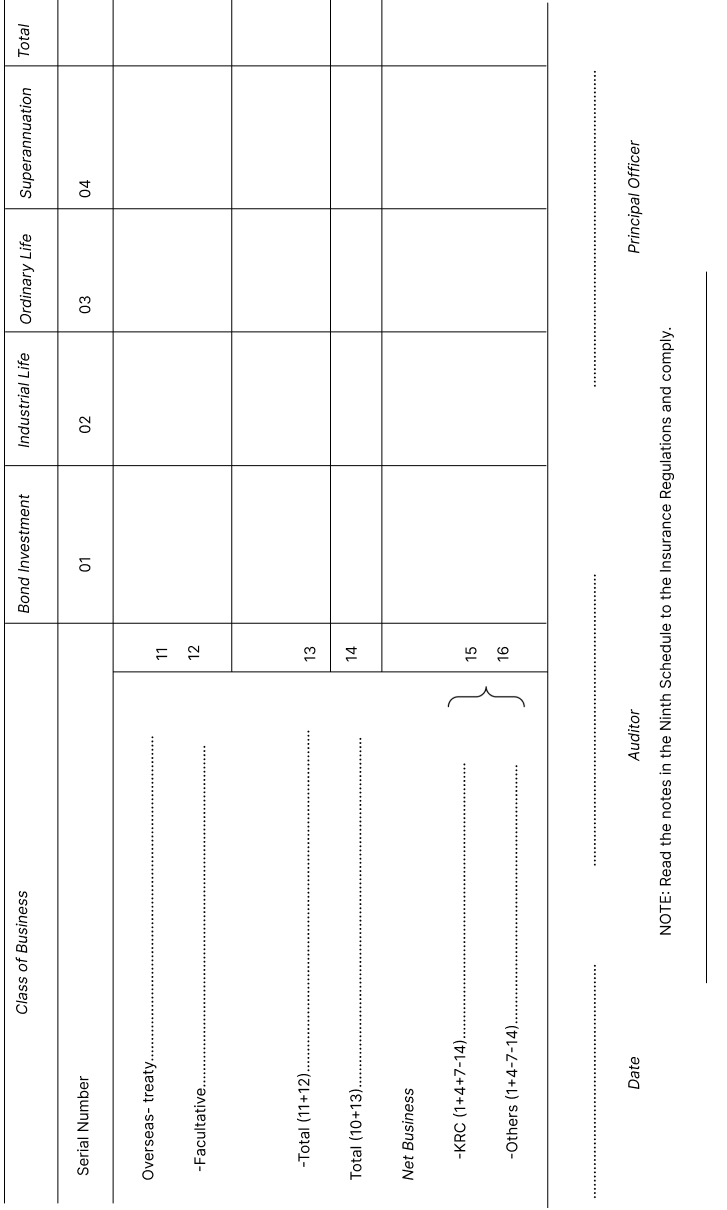

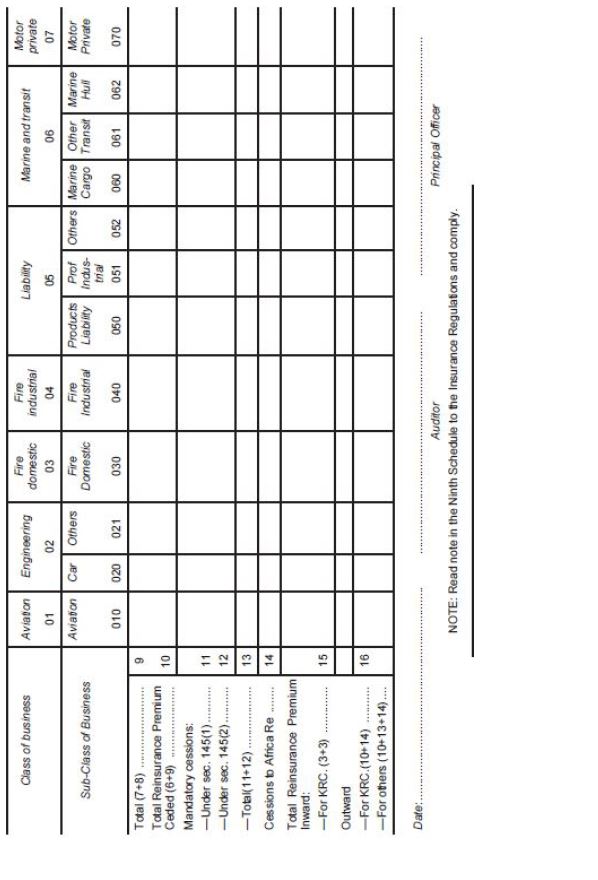

statement of commission Form No. INS. 59-10A; |

| (x) |

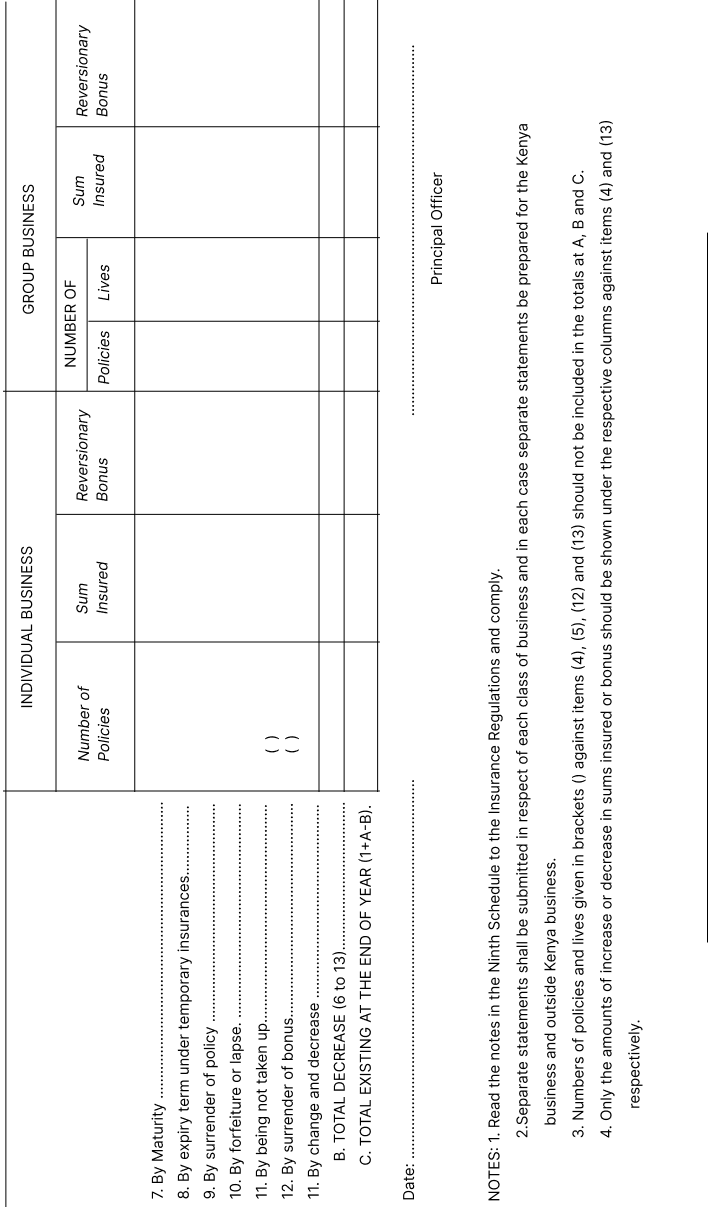

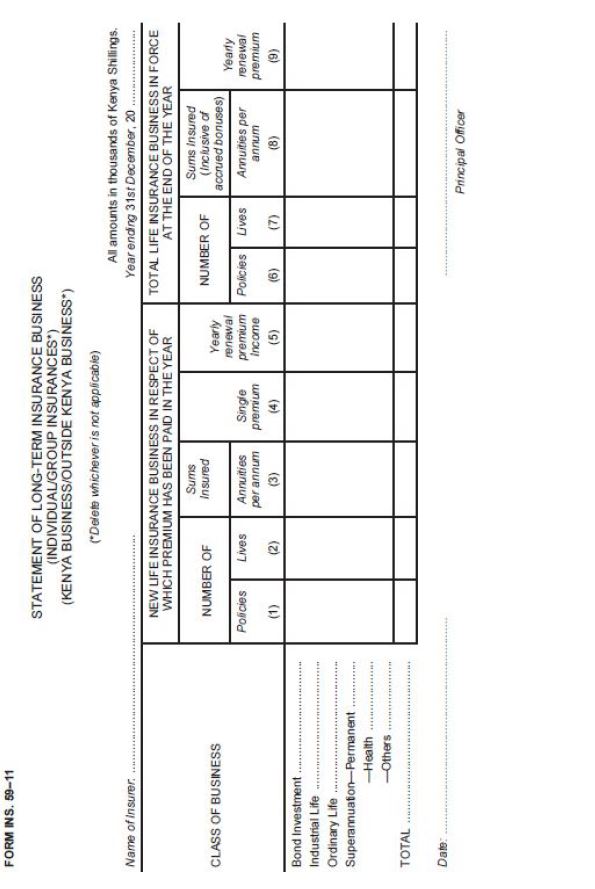

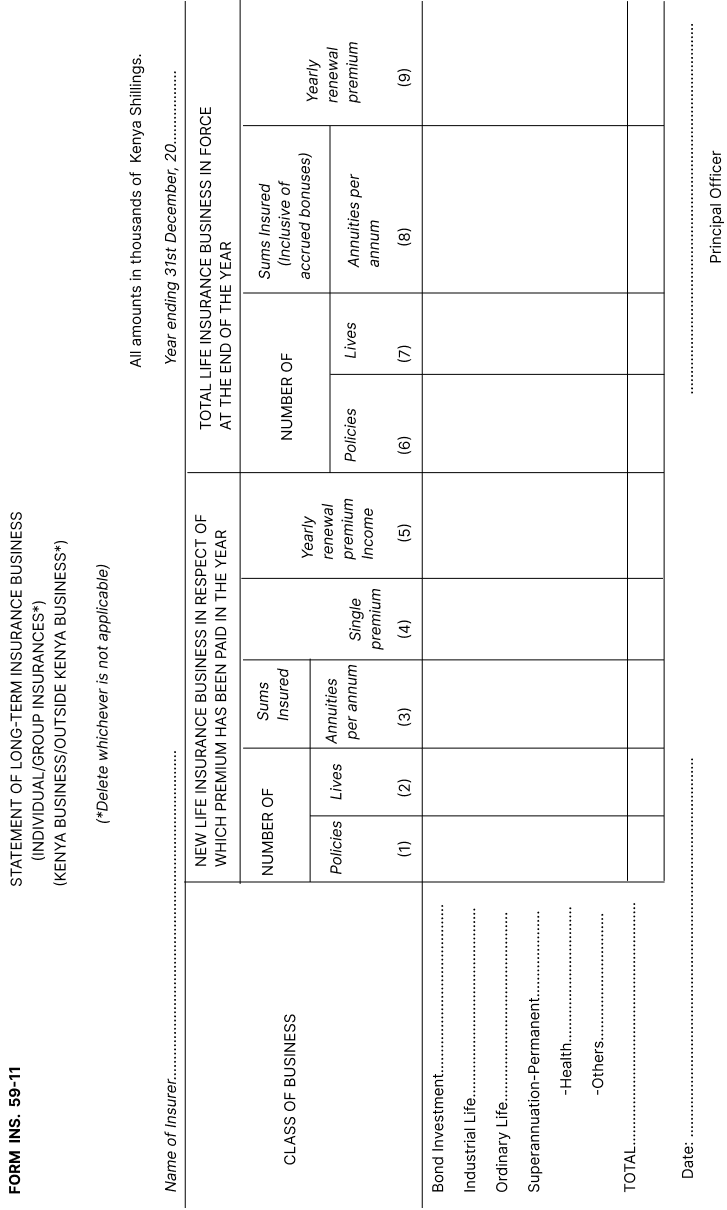

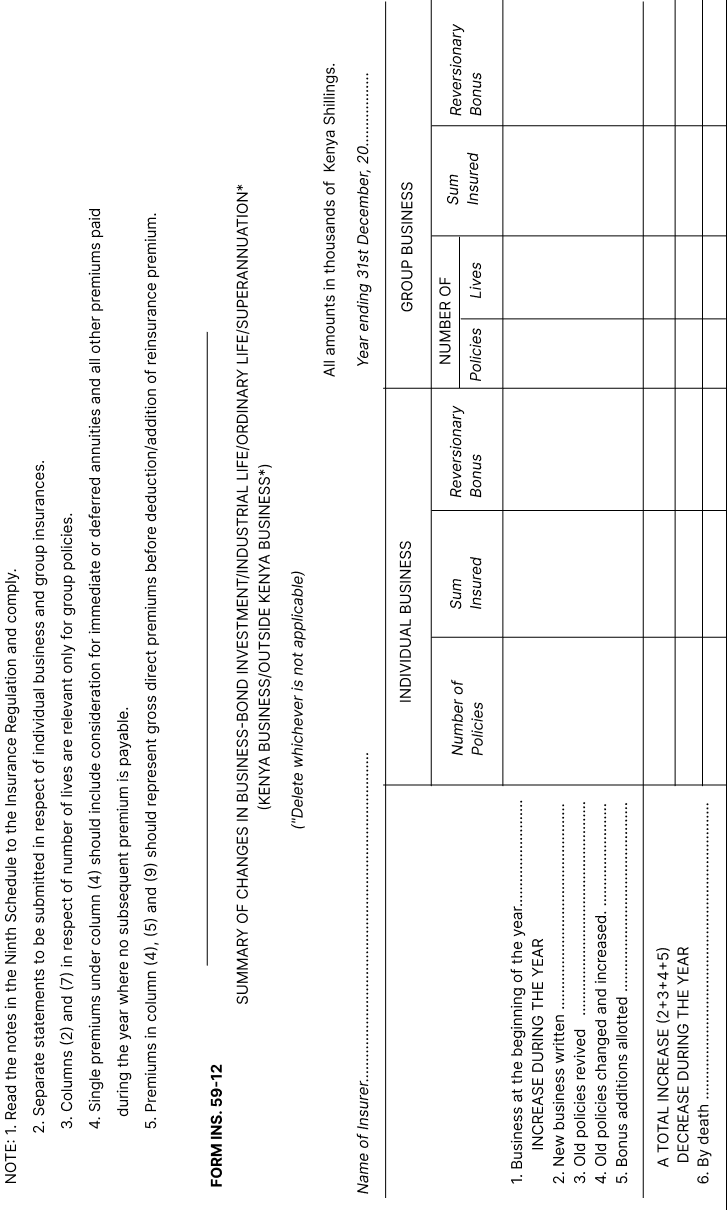

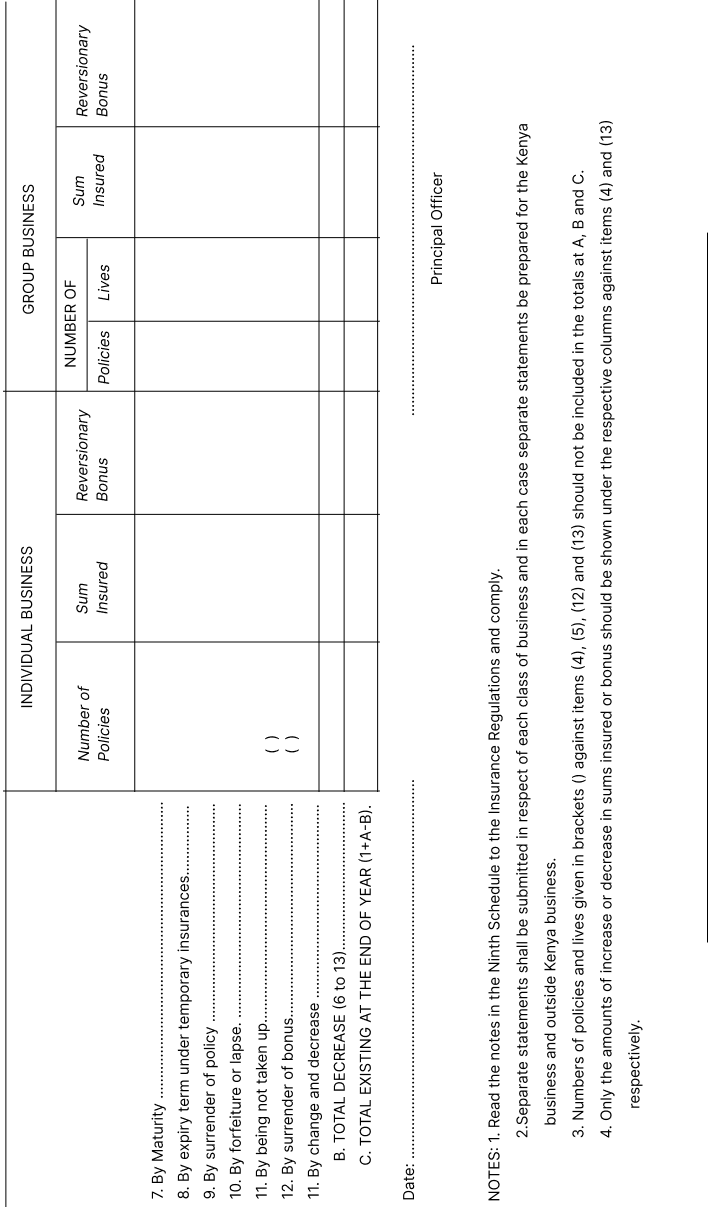

statement of long term insurance business, Form No. INS. 59-11; |

| (xi) |

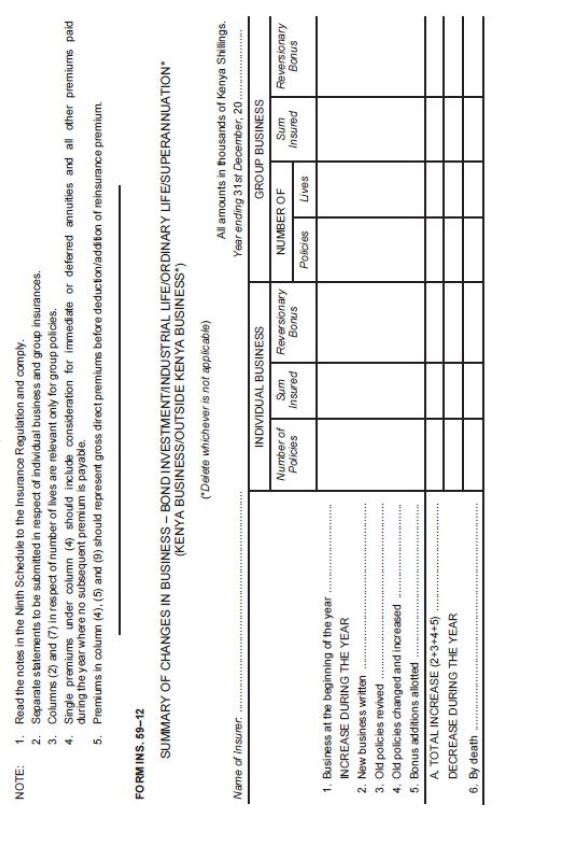

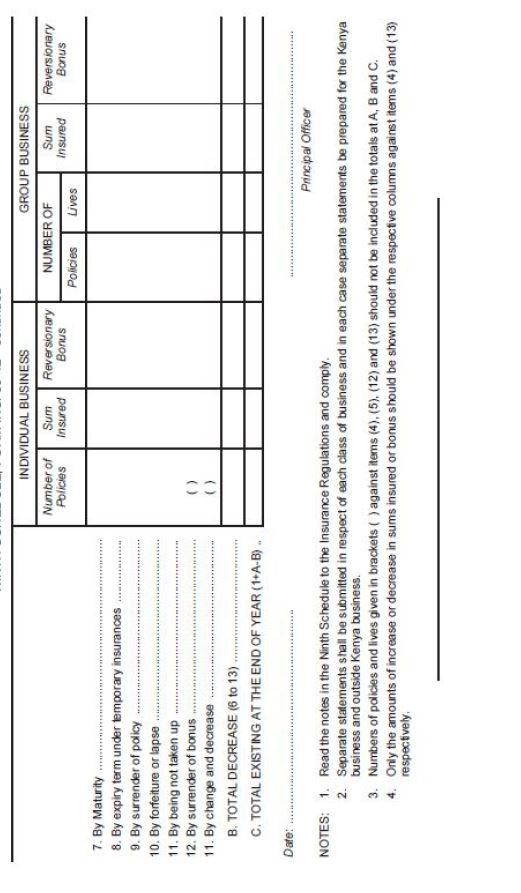

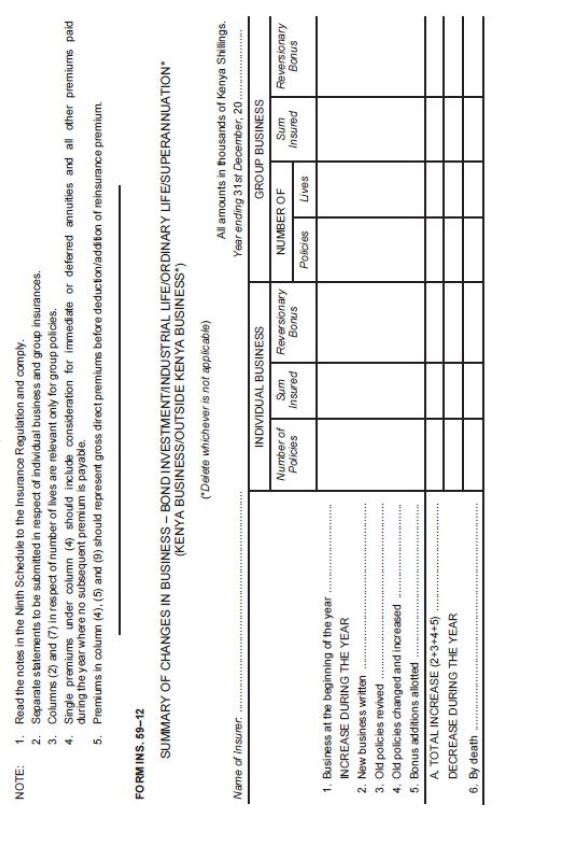

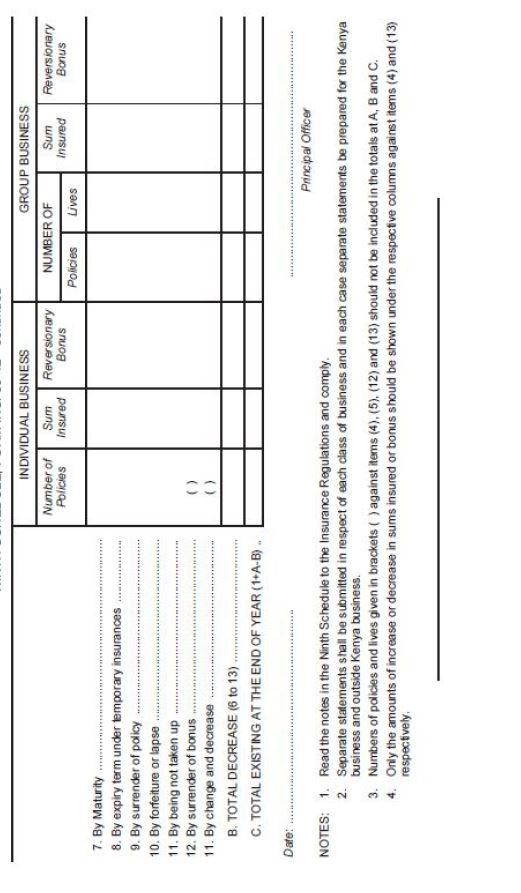

statement of movement in long term insurance business, Form No. INS 59-12. |

|

[L.N. 108/2002, r. 2, L.N. 57/2012, r. 3, L.N. 108/2016, r. 4, L.N. 93/2019, r. 4.]

|

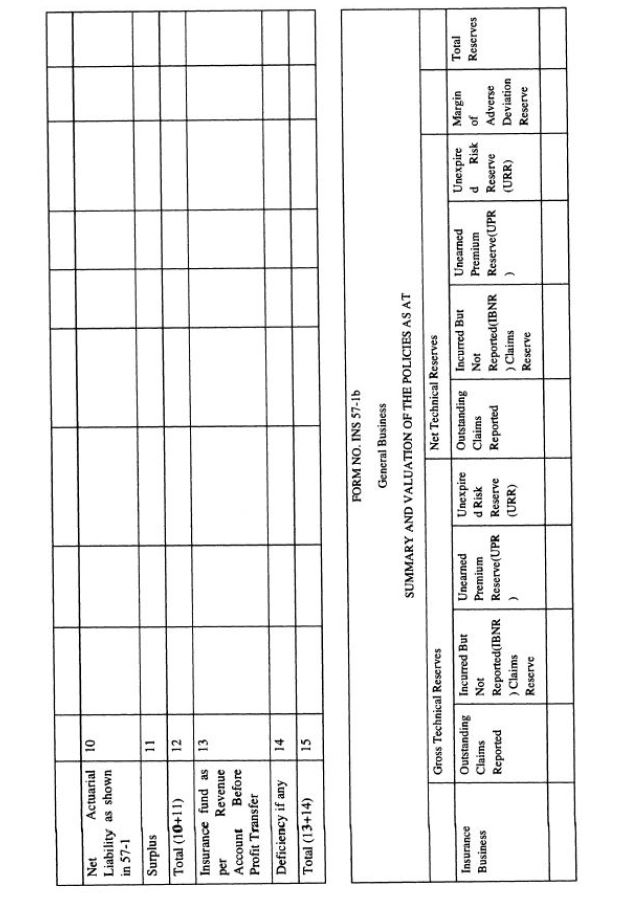

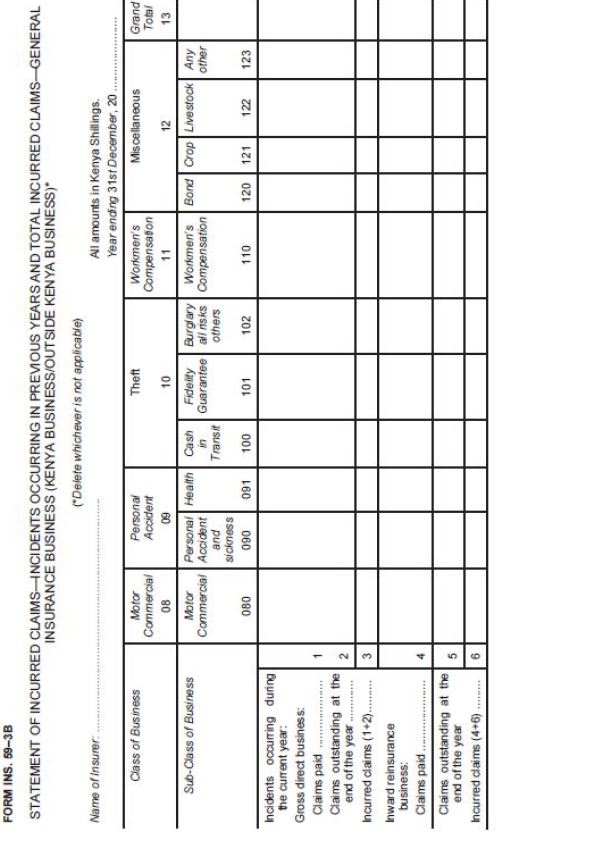

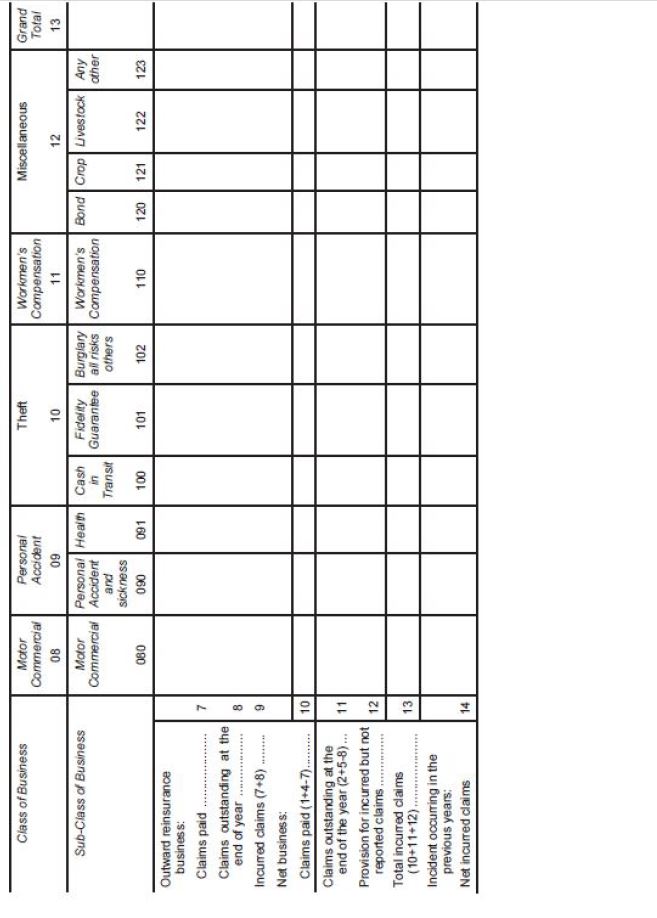

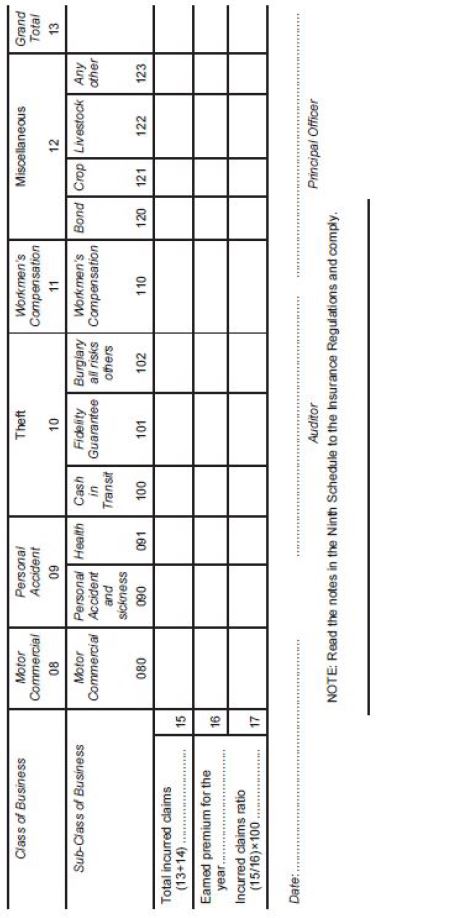

| 18. |

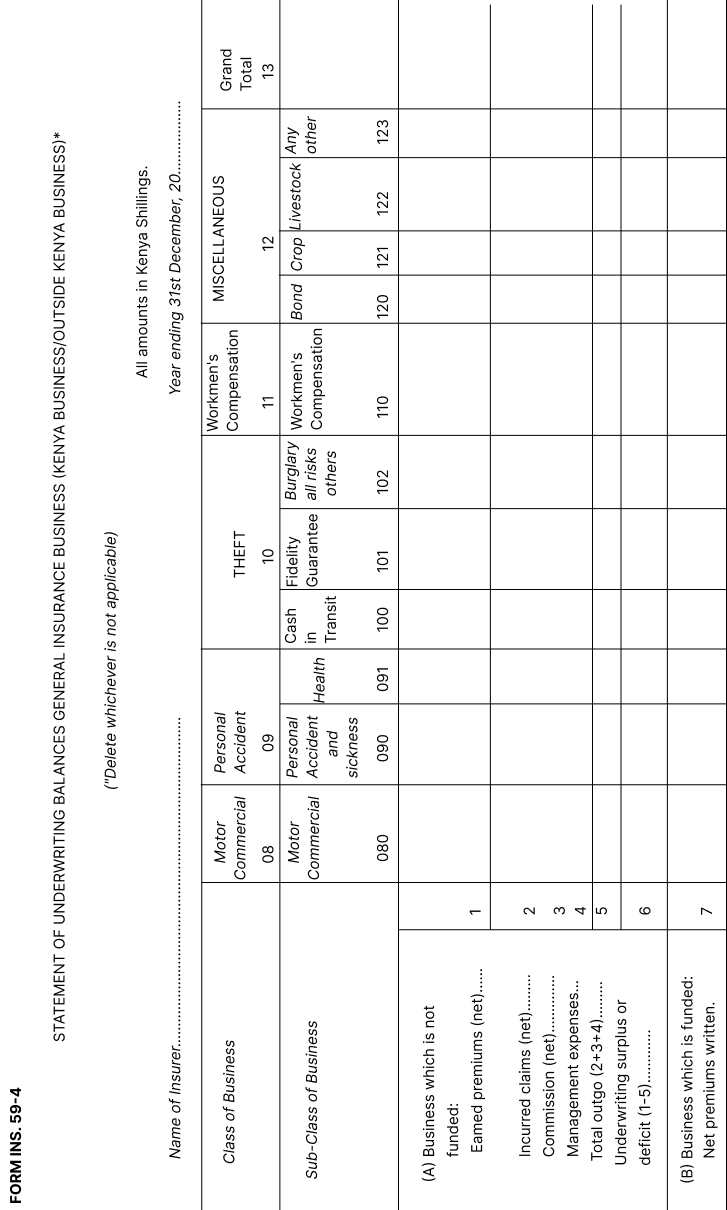

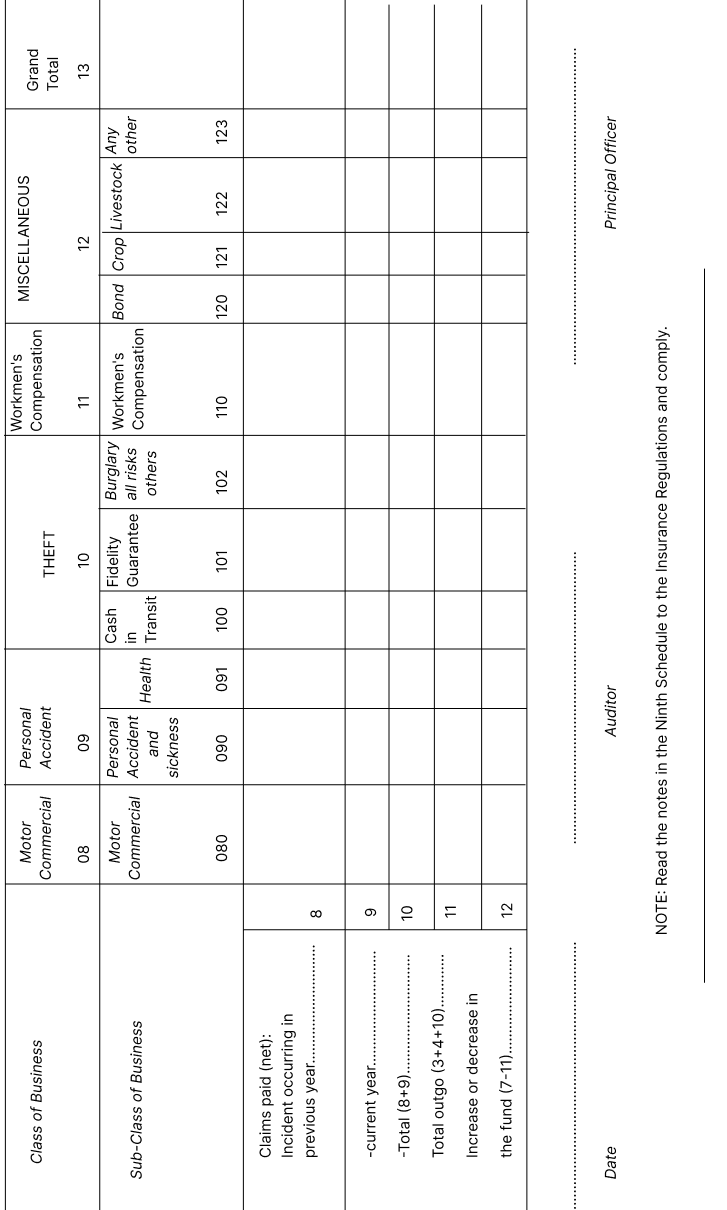

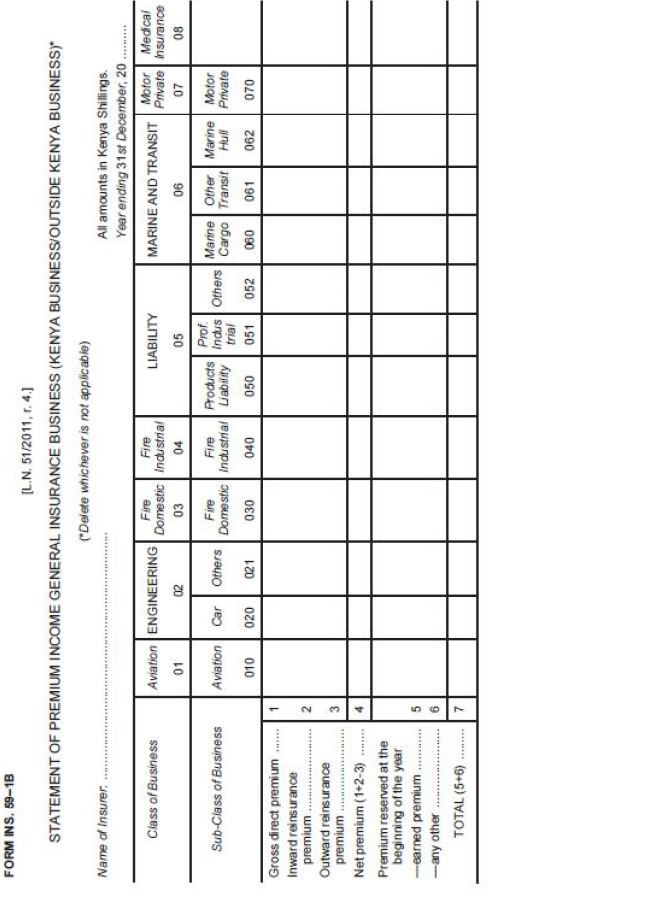

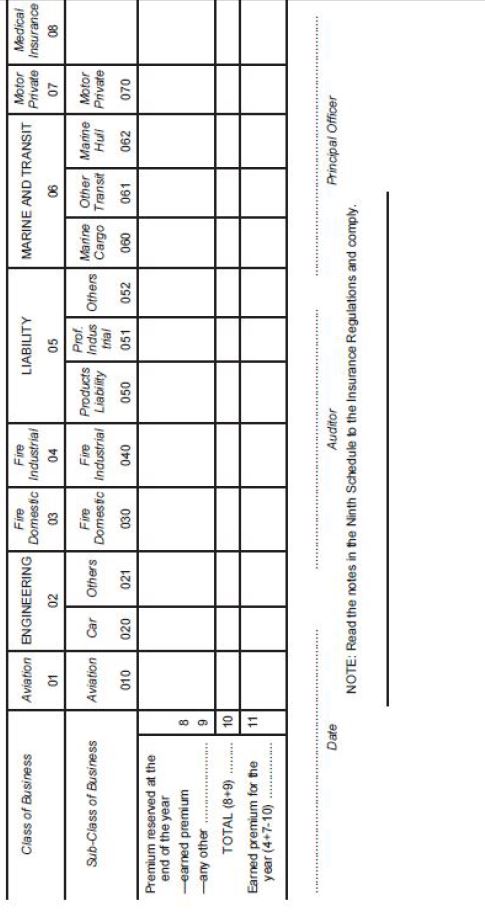

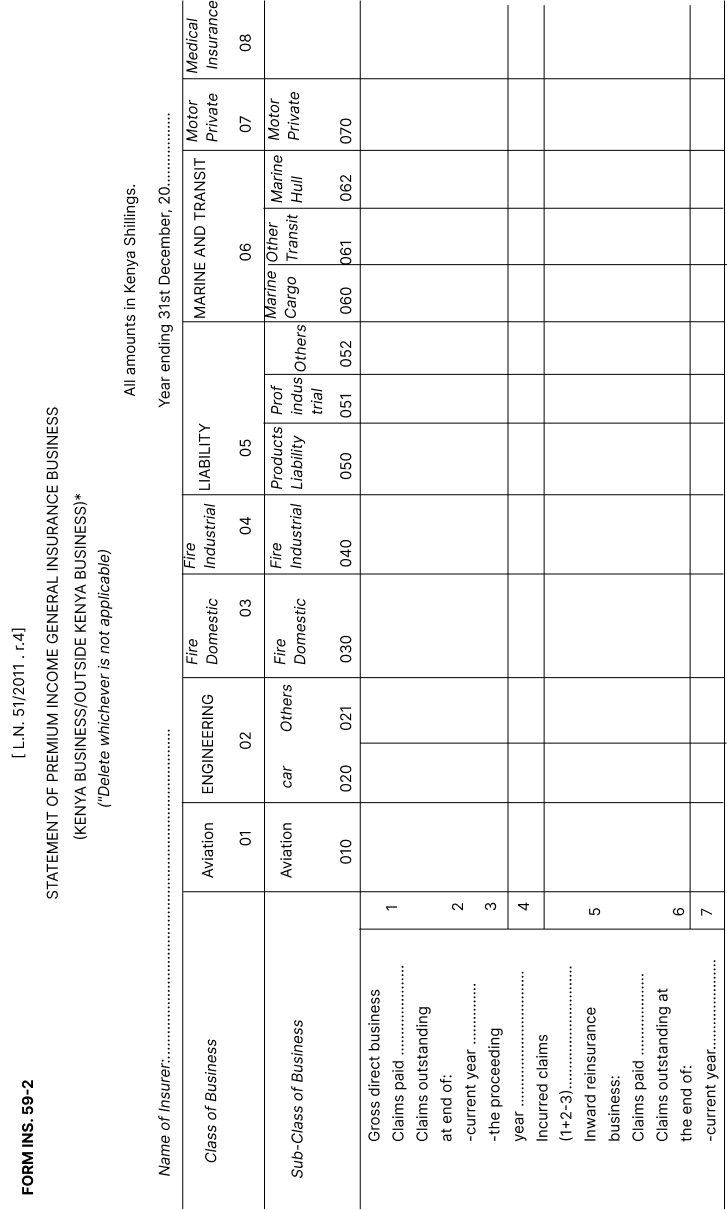

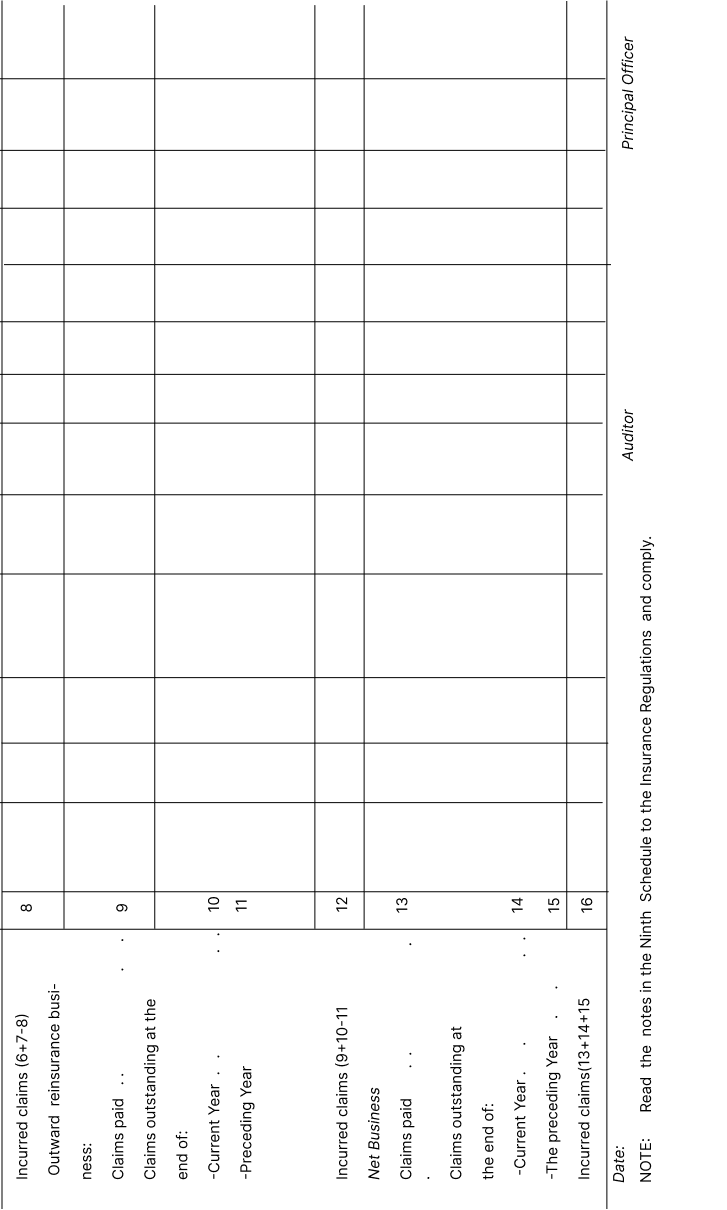

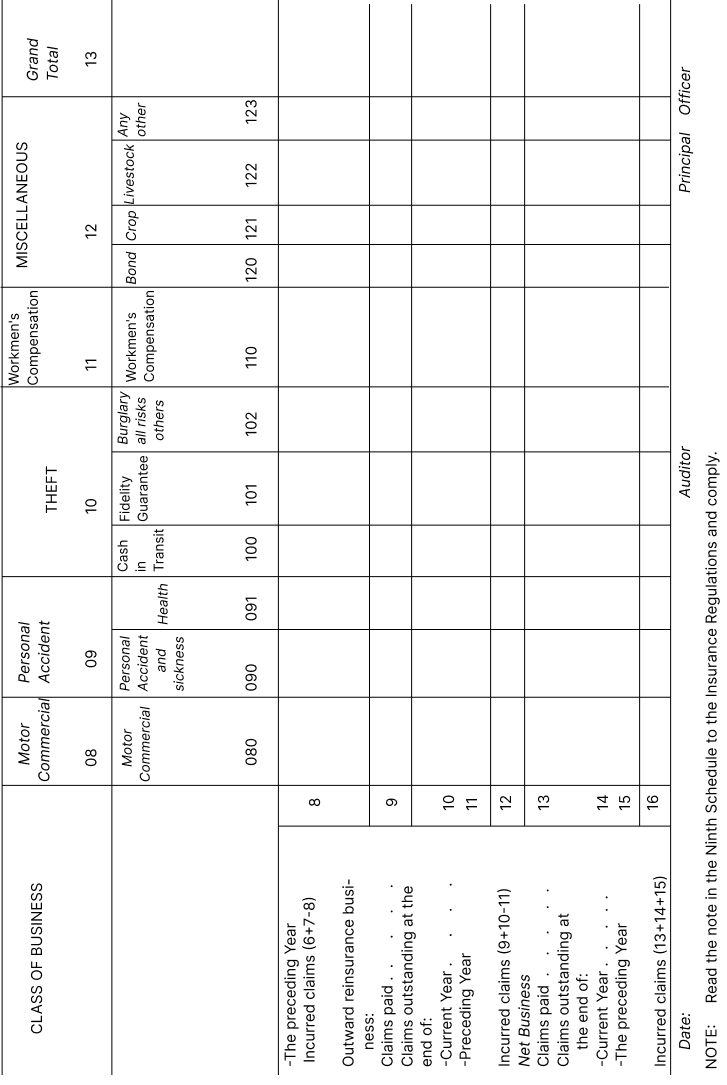

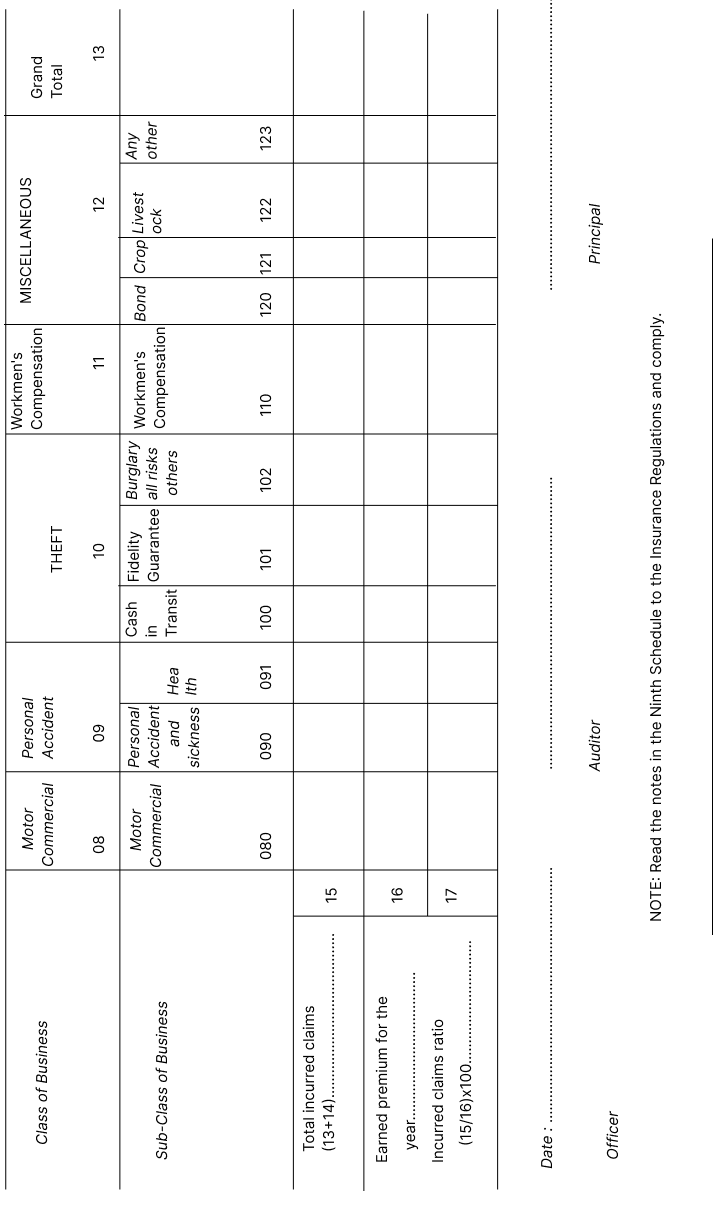

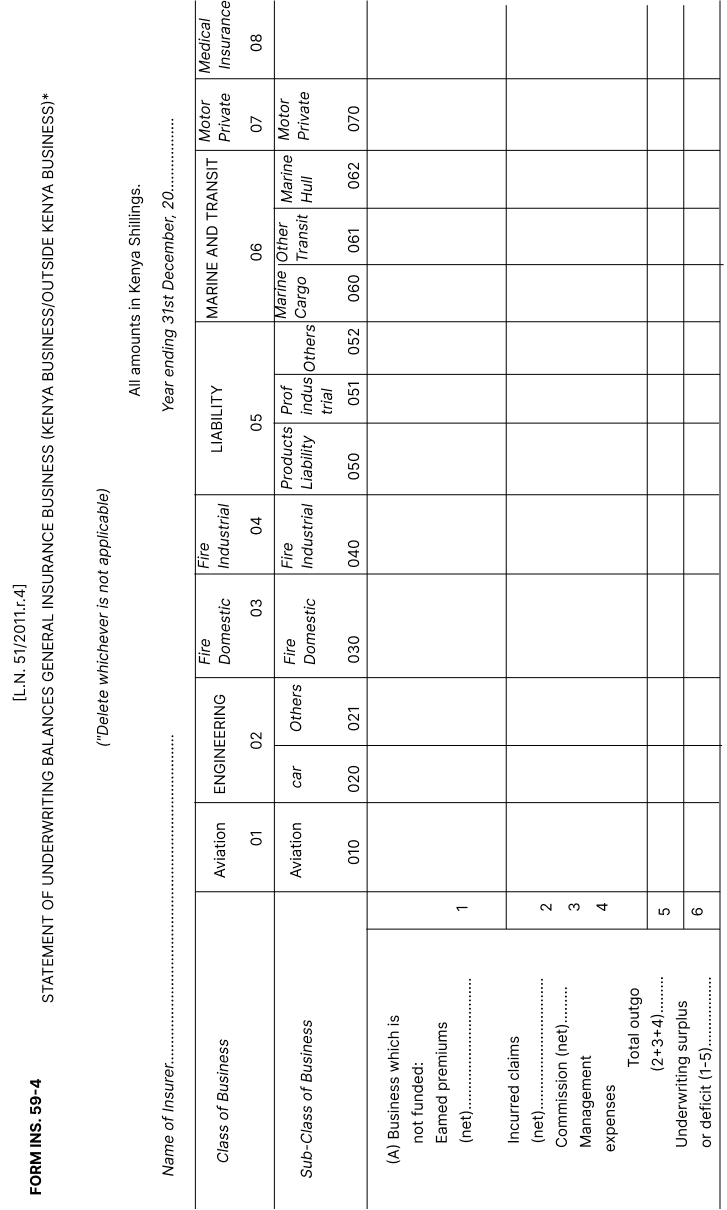

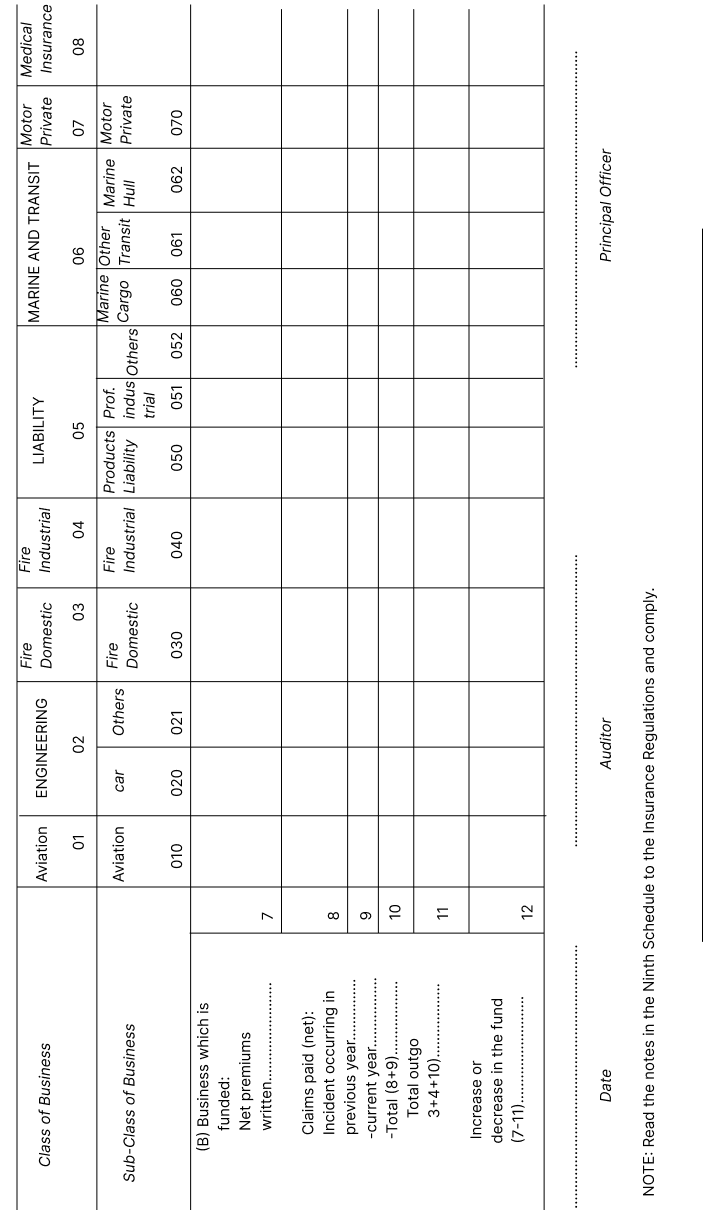

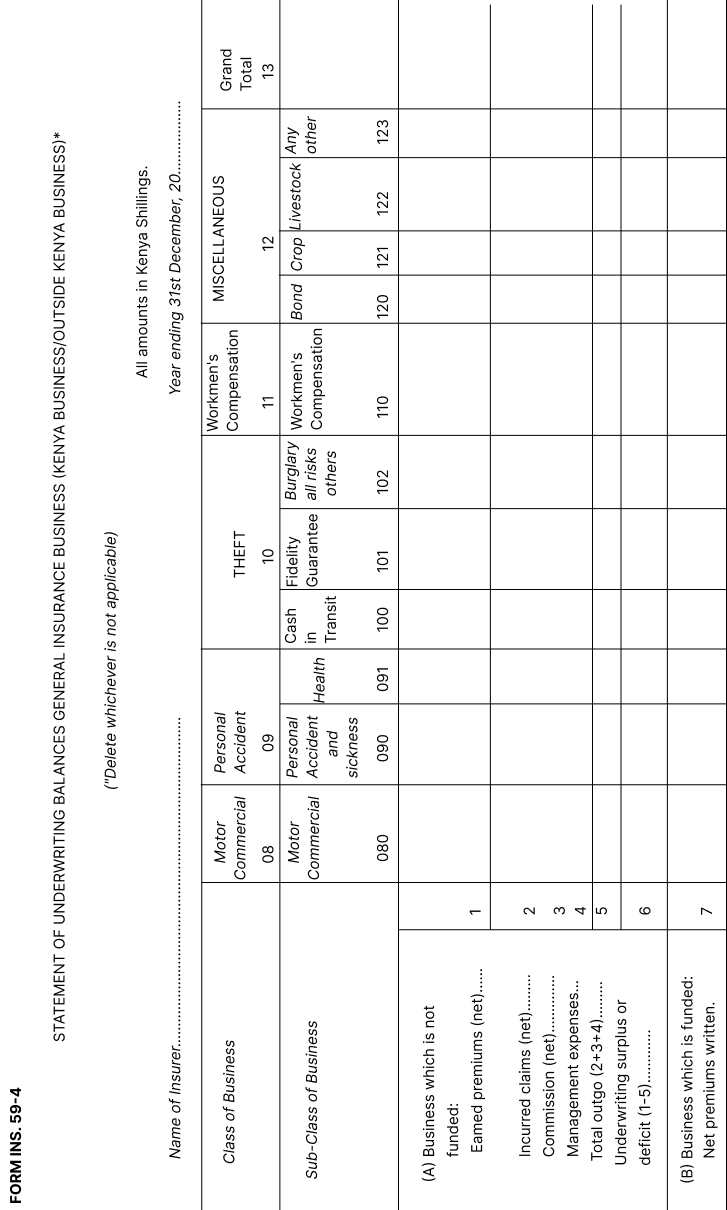

Annual returns: general insurance business

For the purposes of section 59 of the Act, every insurer carrying on general insurance business shall, within six months after the end of the period to which they relate, lodge with the Commissioner, in respect of every financial year—

| (a) |

deleted by L.N. 93/2019, r. 5;

|

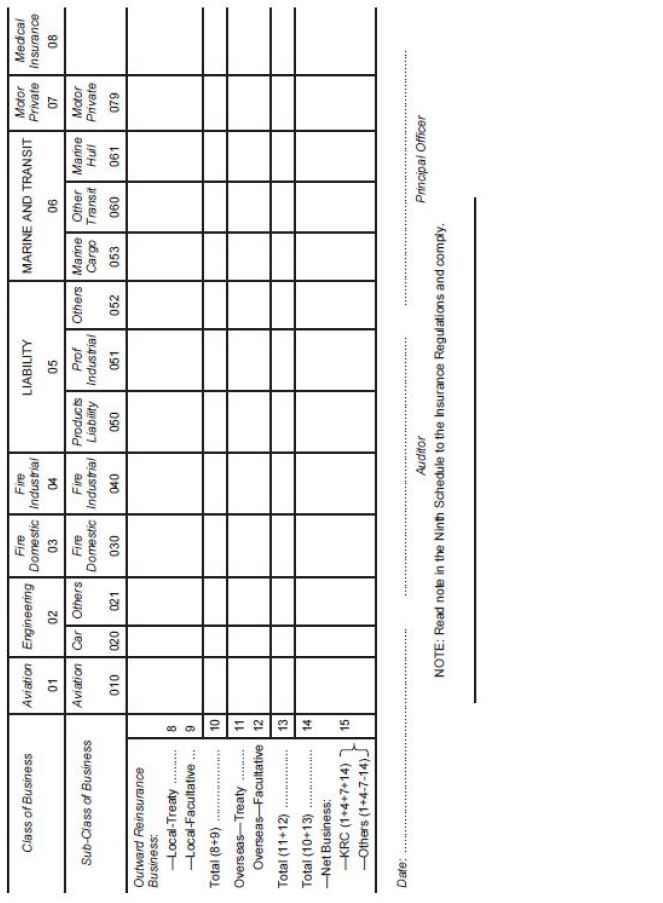

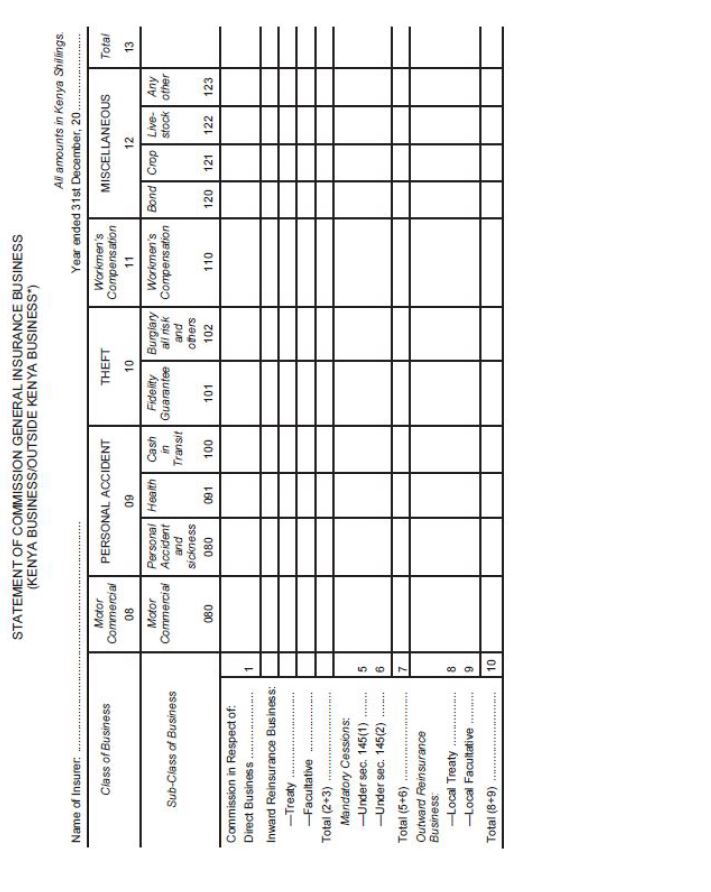

| (b) |

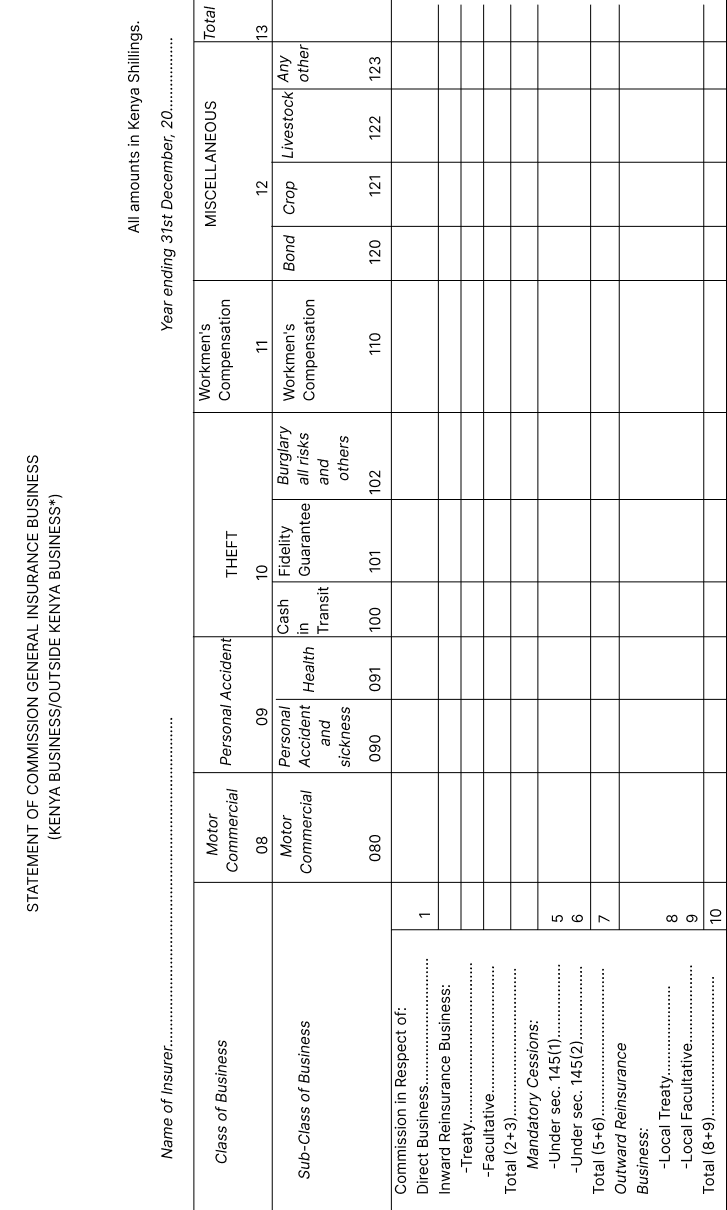

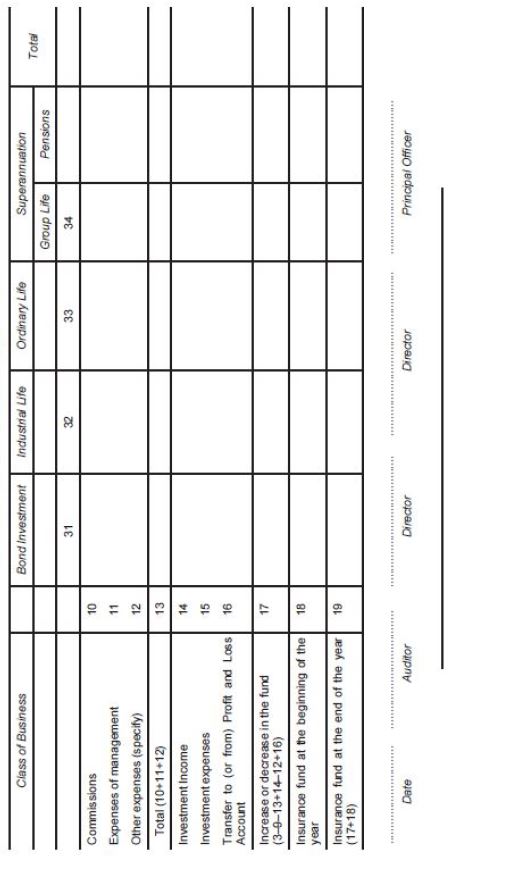

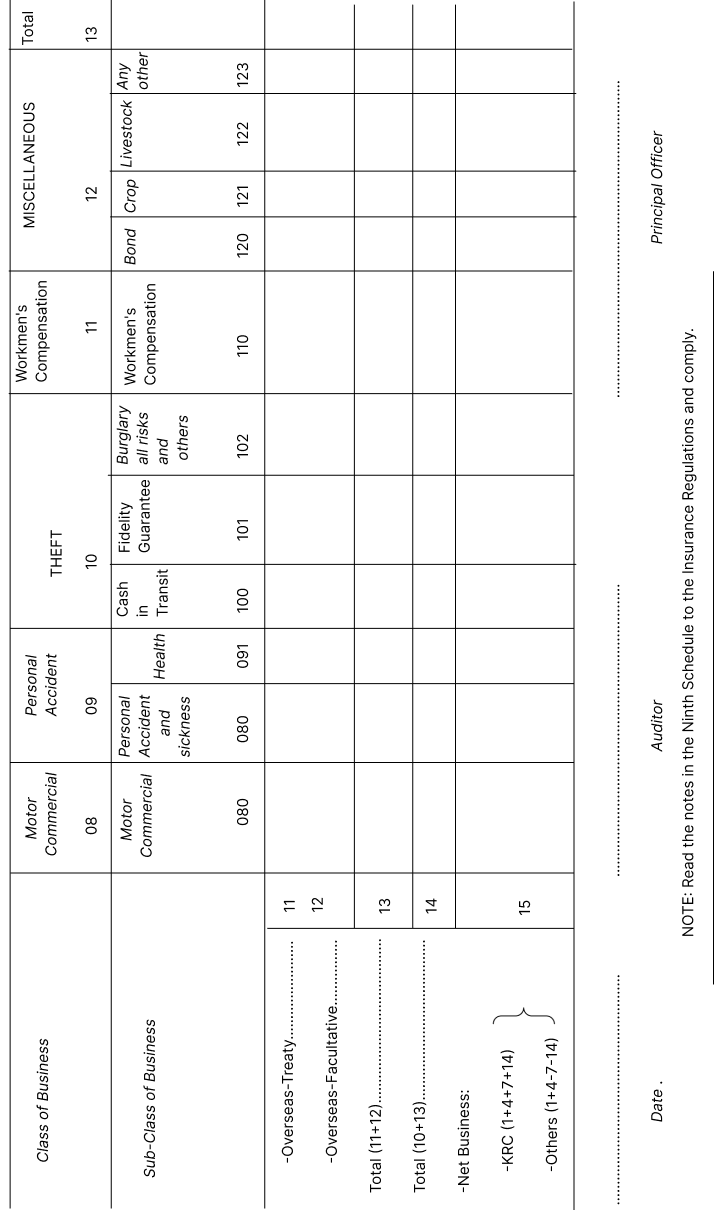

the following statements in the forms set out in the Ninth Schedule, signed by the principal officer and also by an auditor in the case of the statements under (i), (ii), (iii), (iv), (v), (vi) and (vii)—

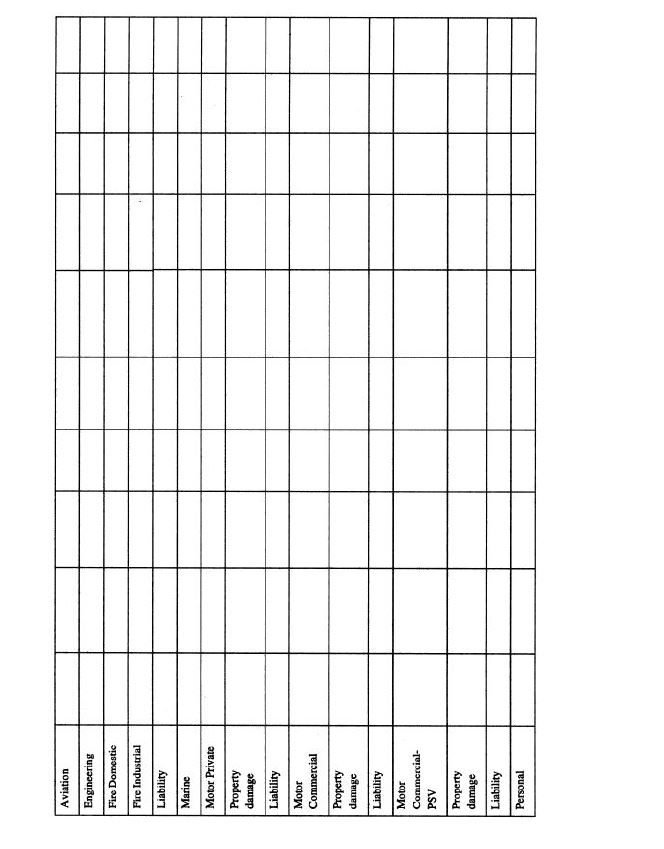

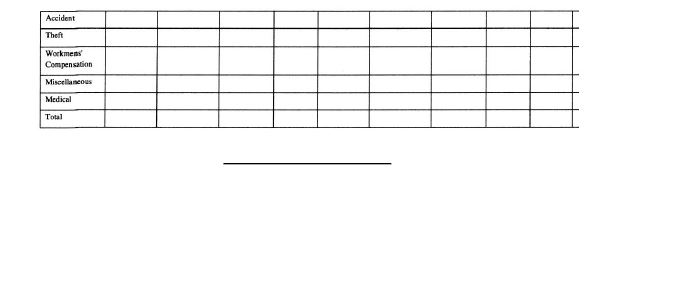

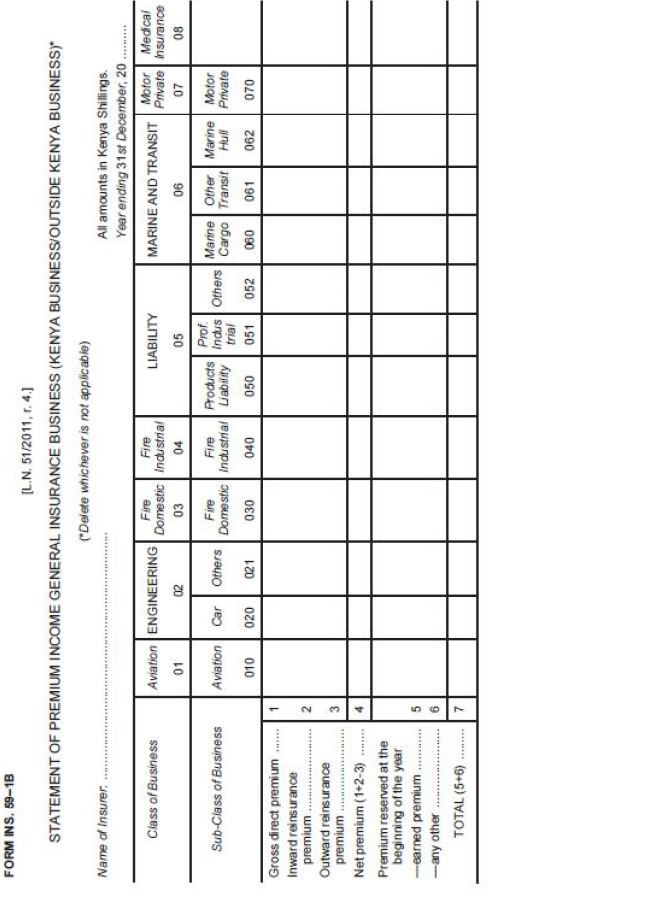

| (i) |

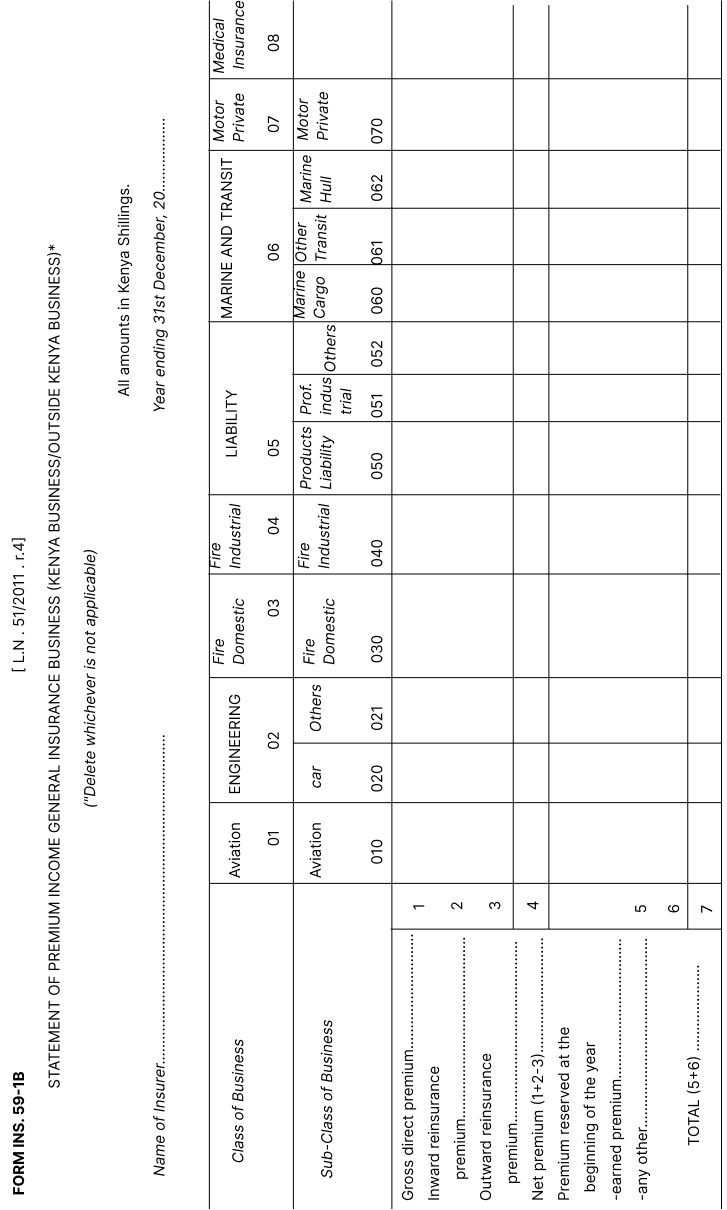

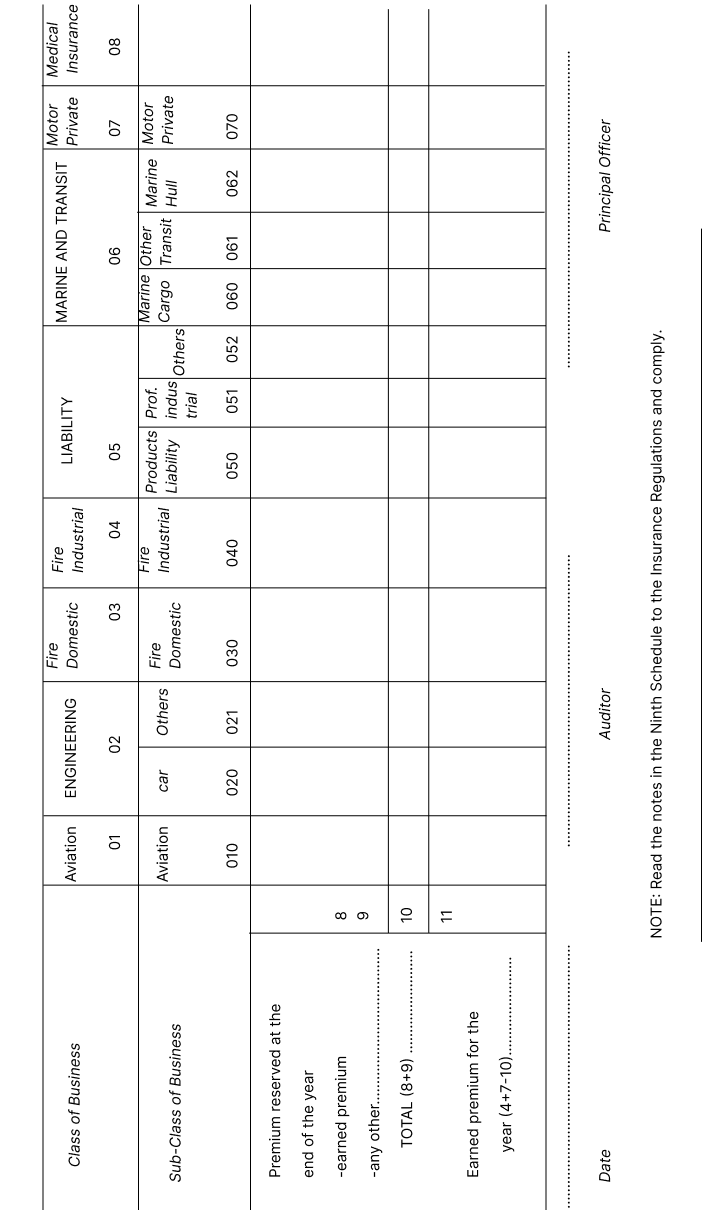

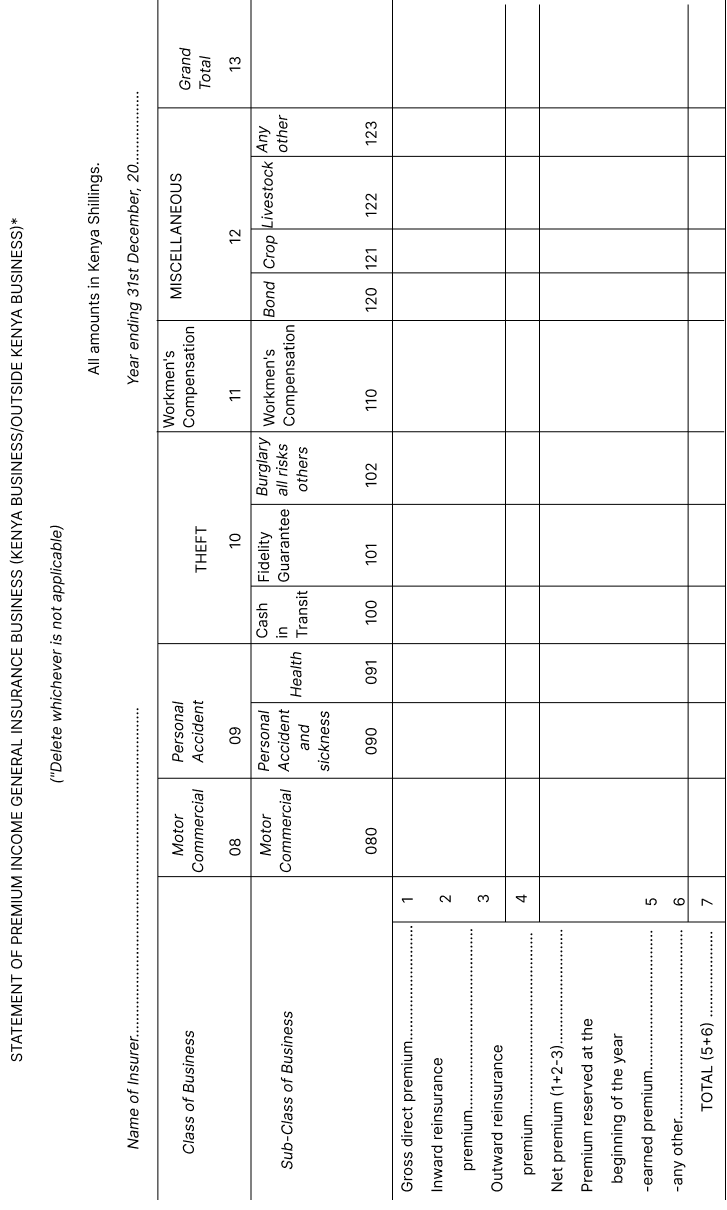

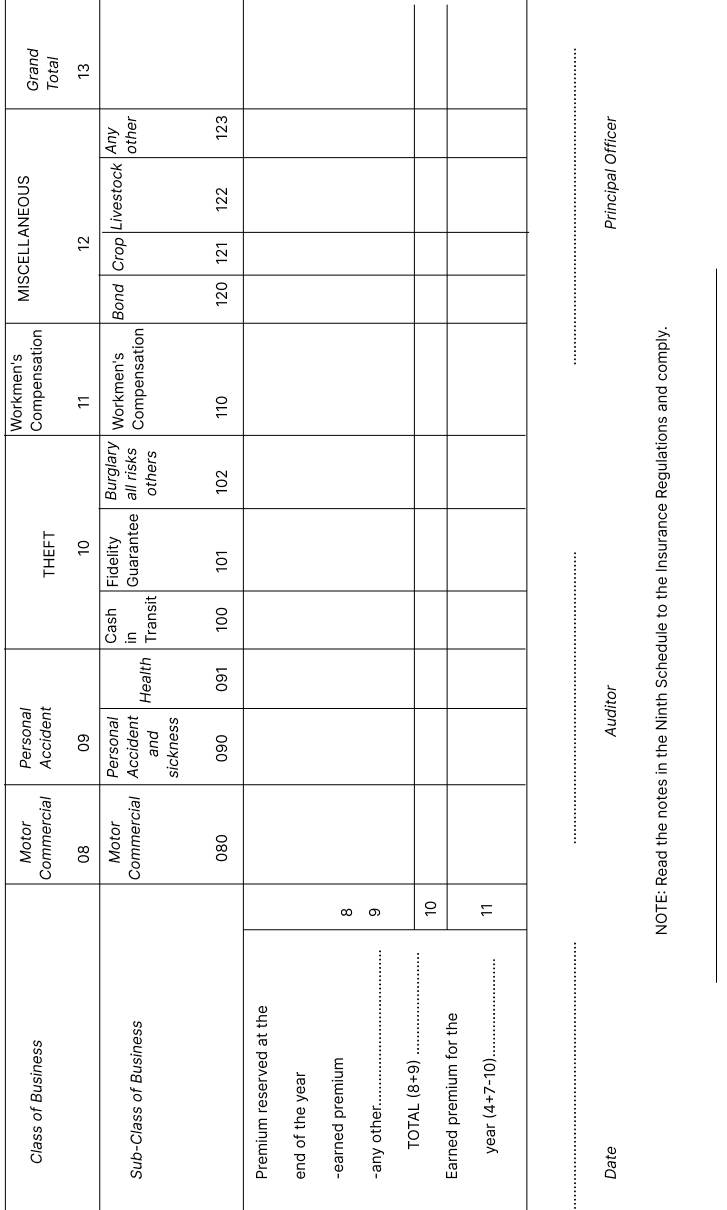

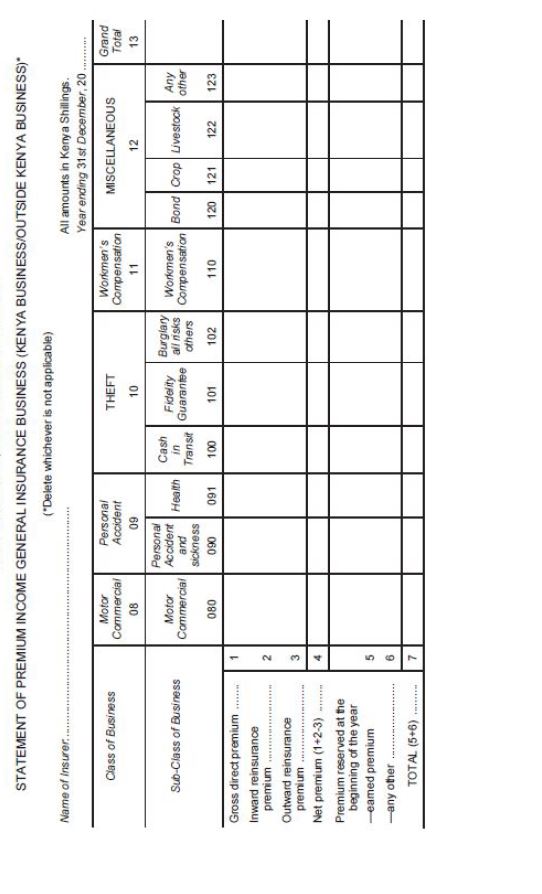

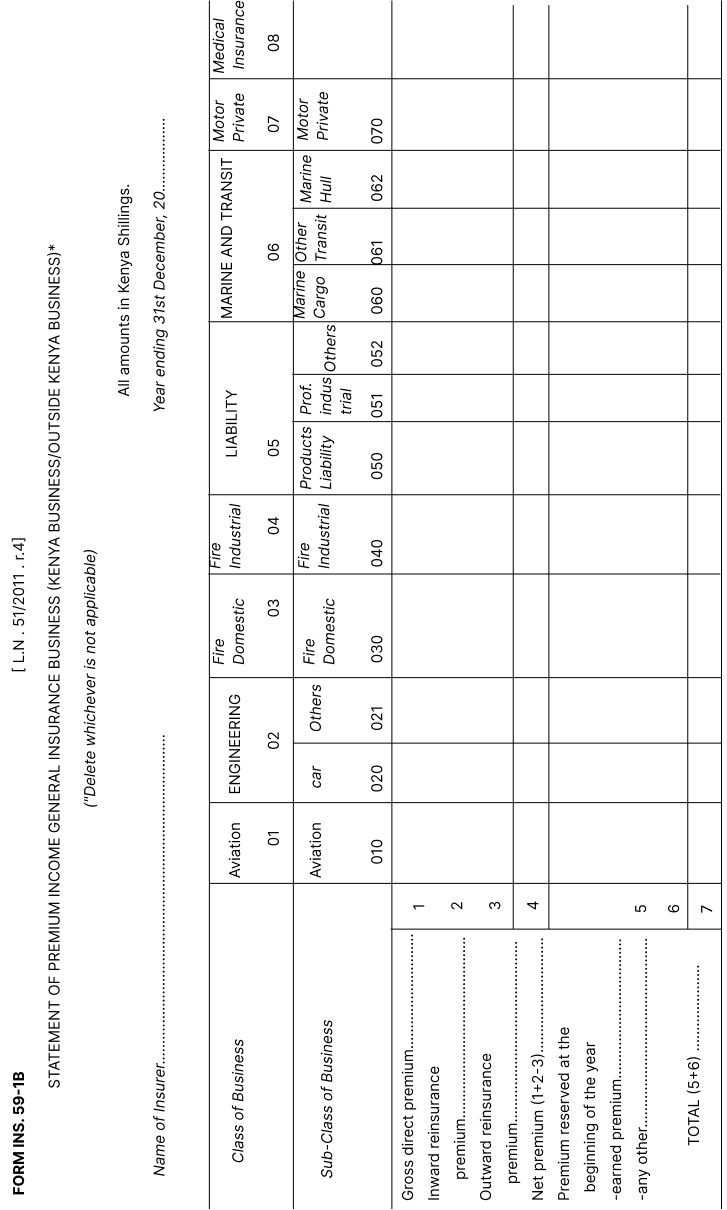

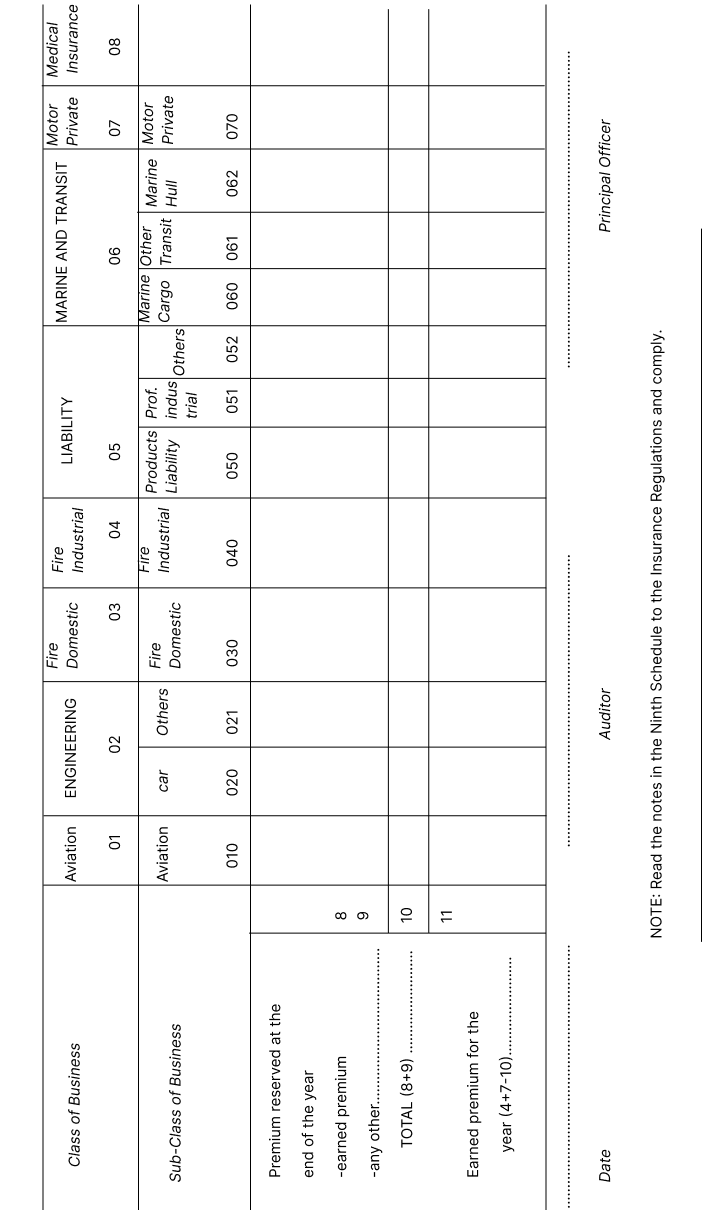

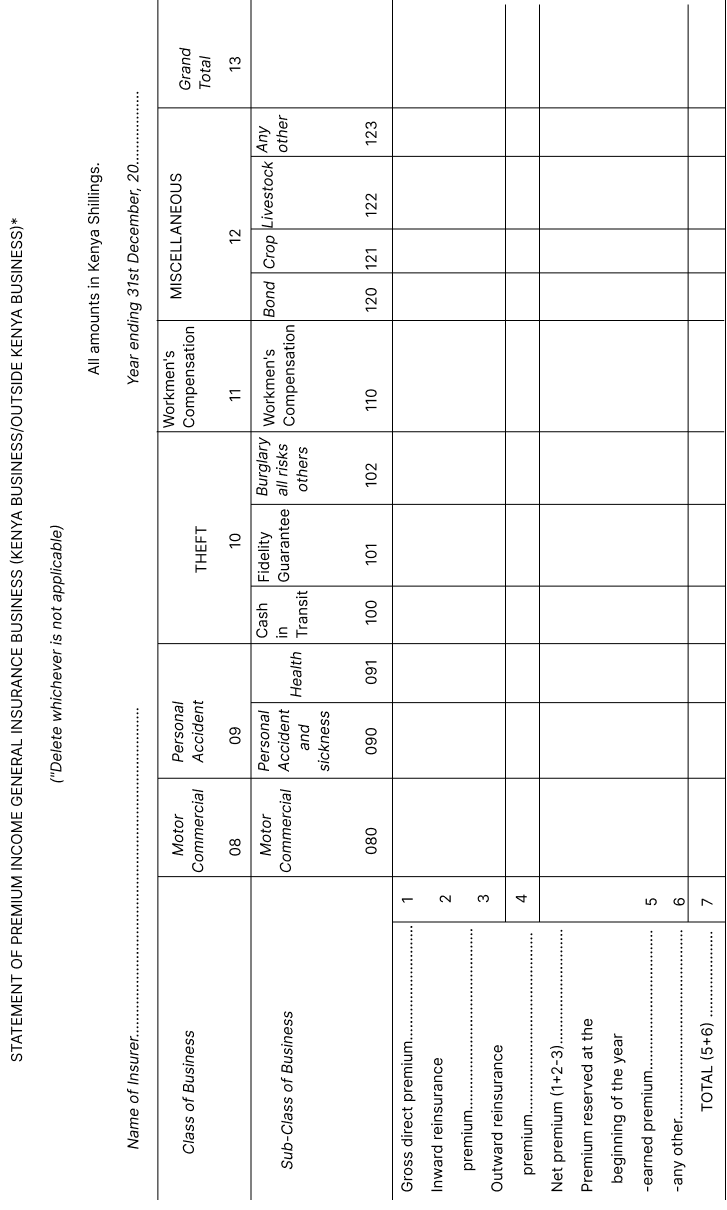

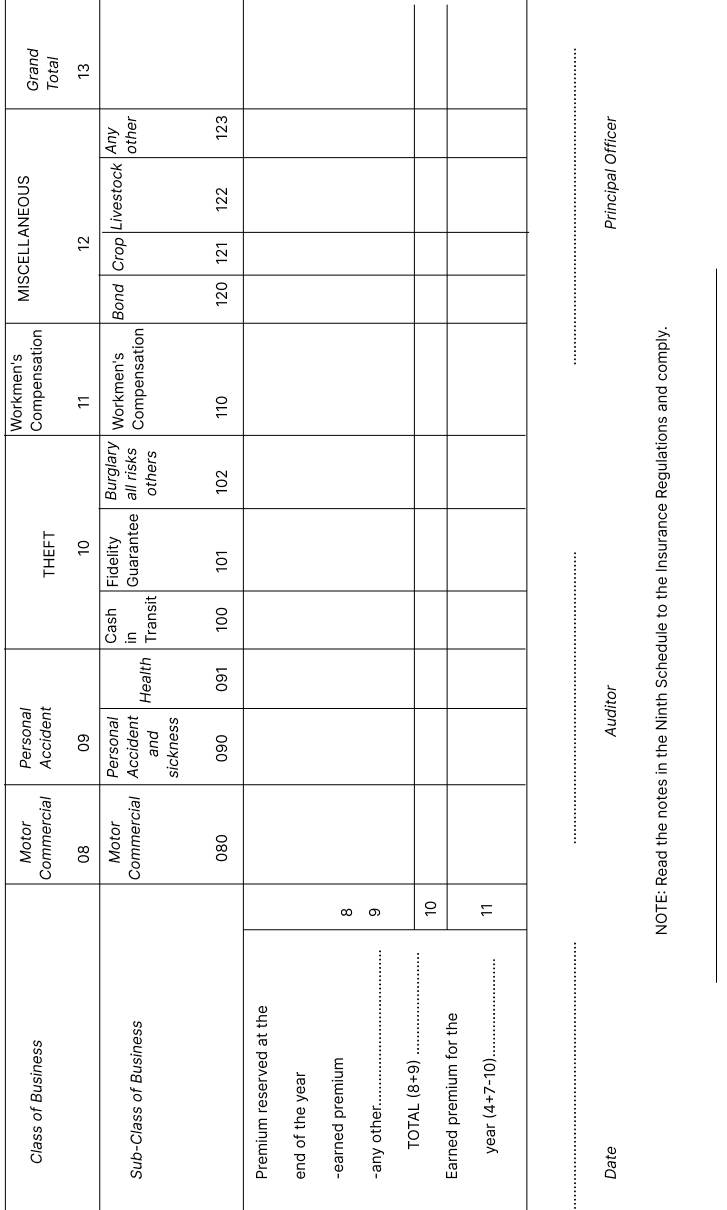

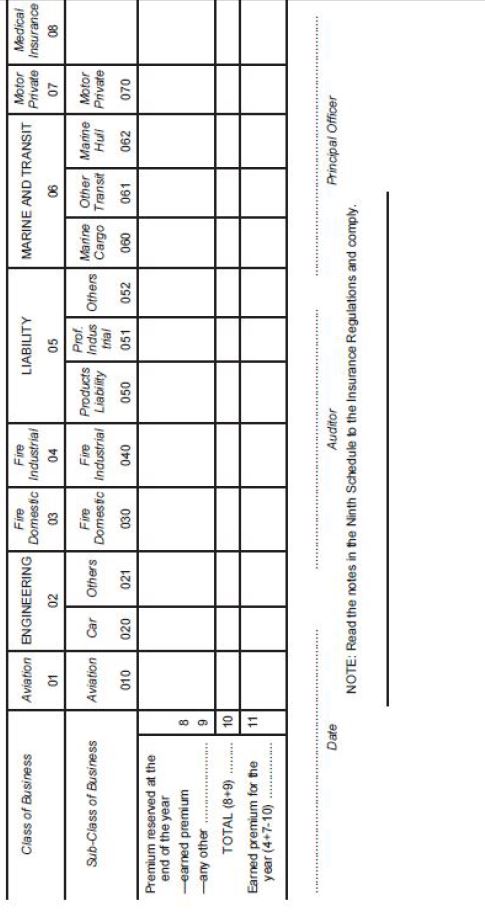

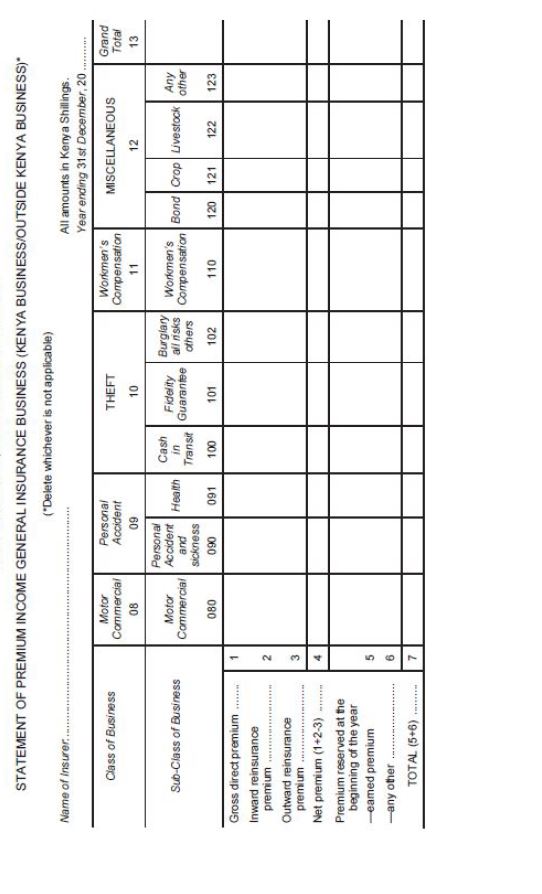

statement of premium income, Form No. INS. 59-1B; |

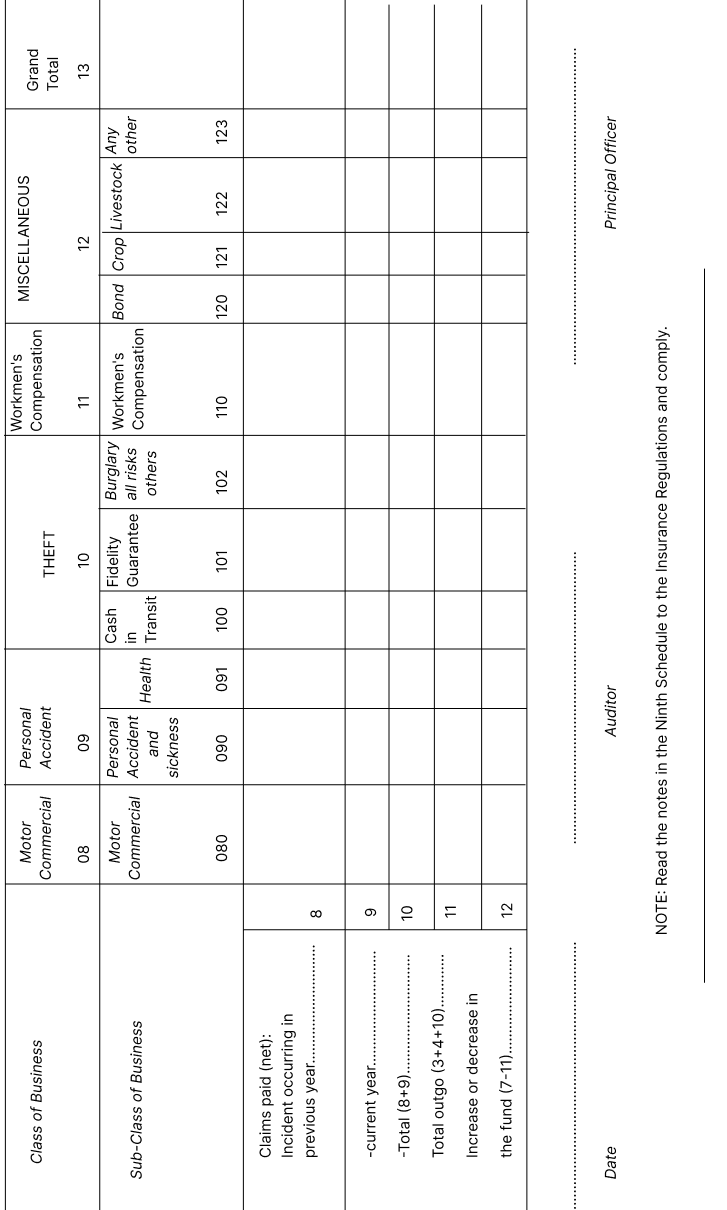

| (ii) |

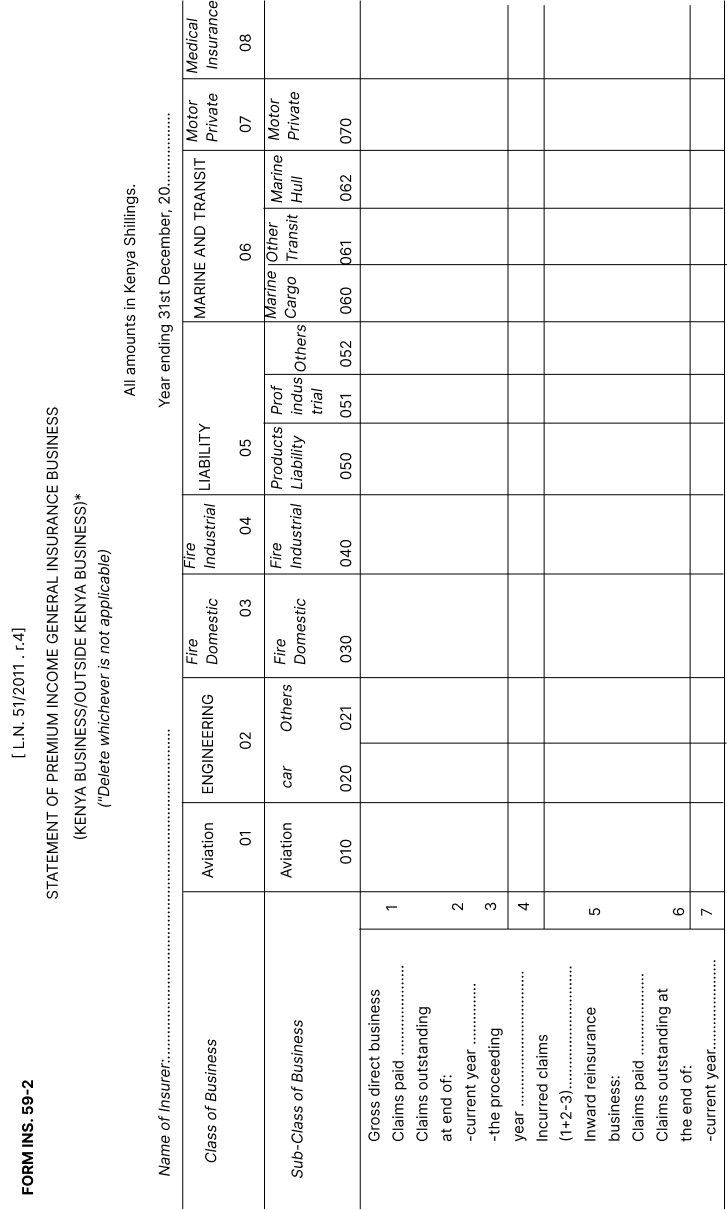

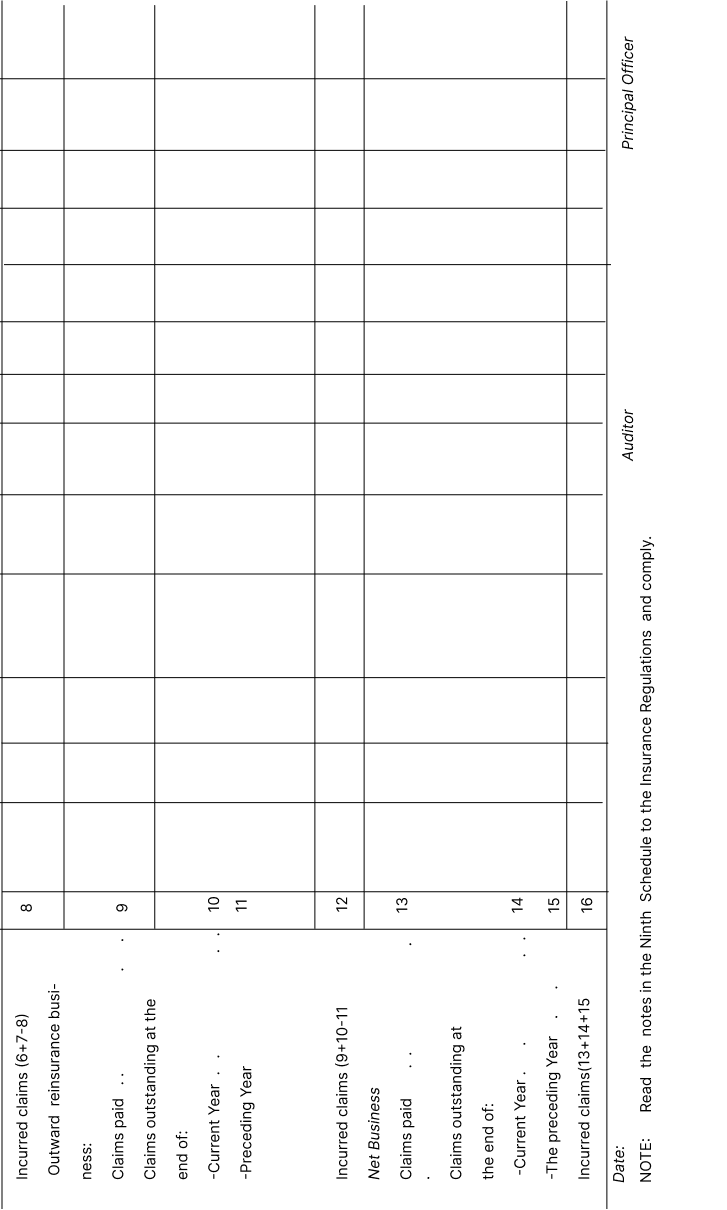

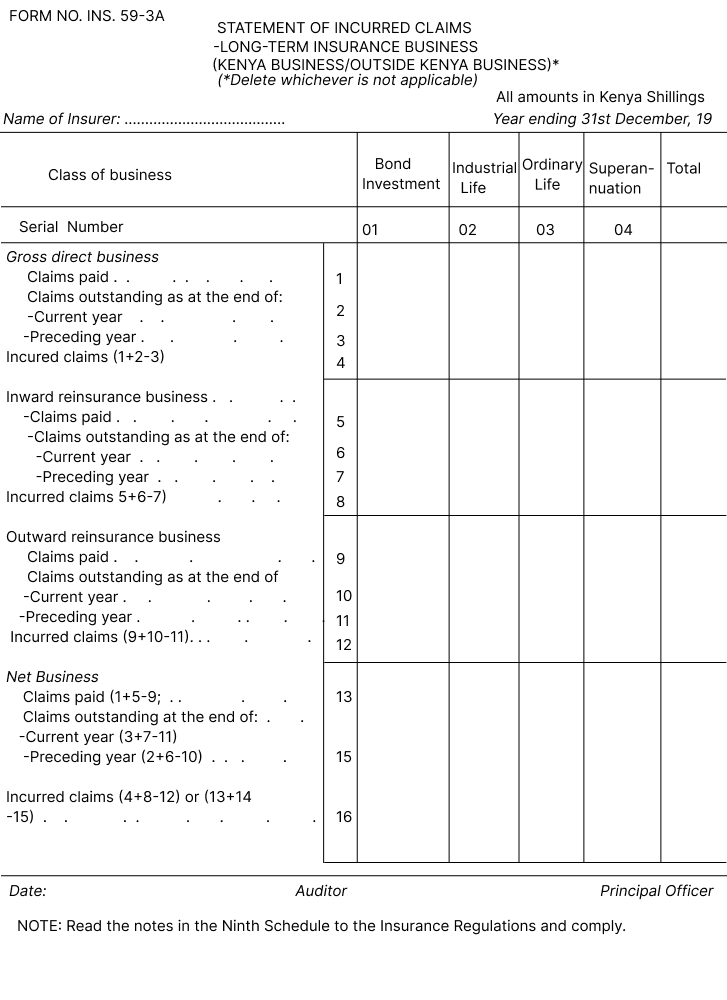

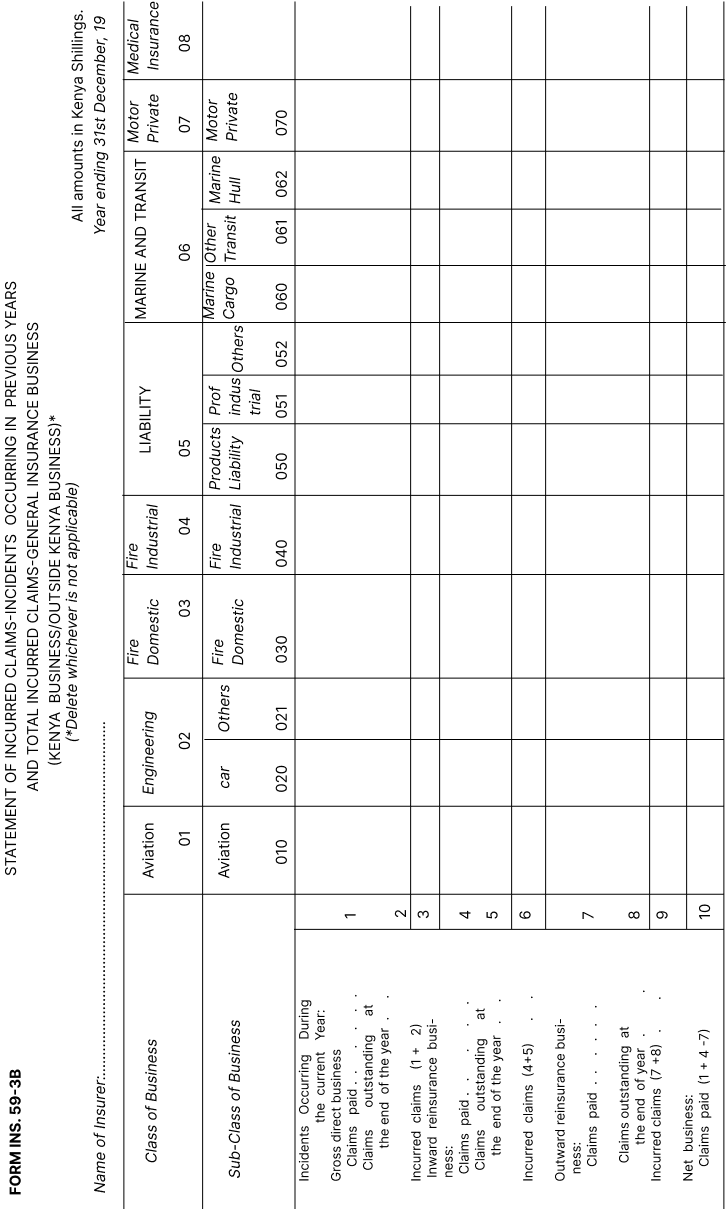

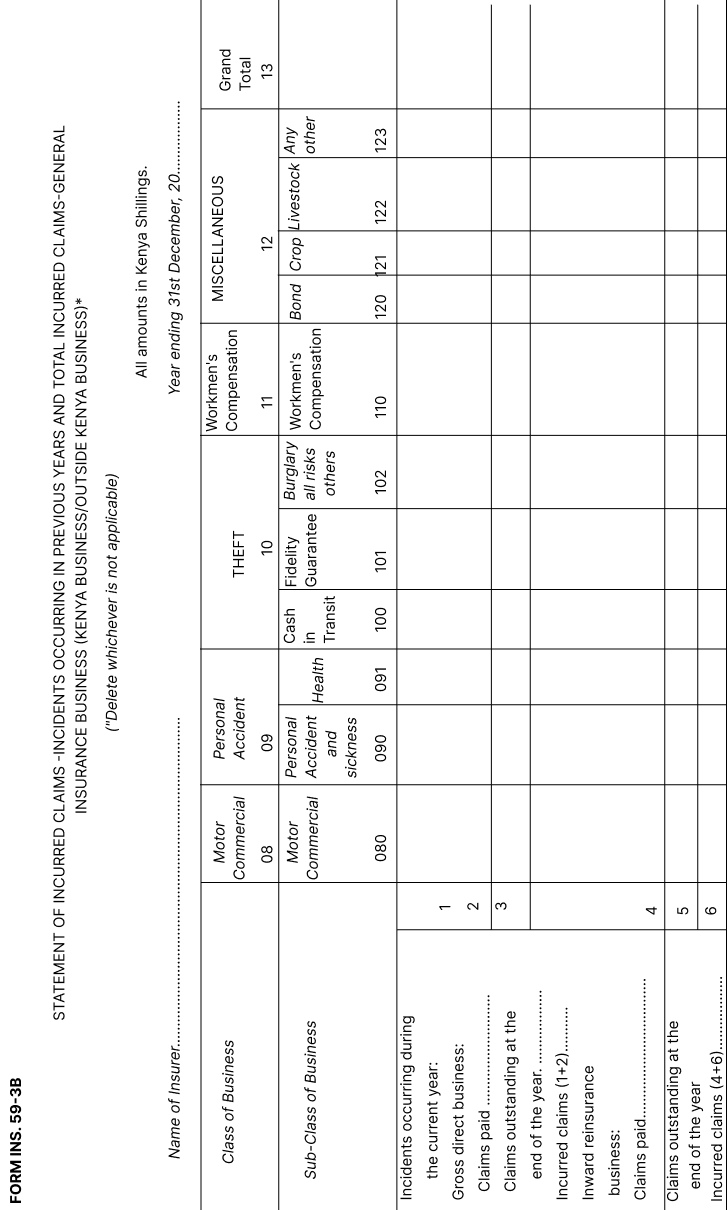

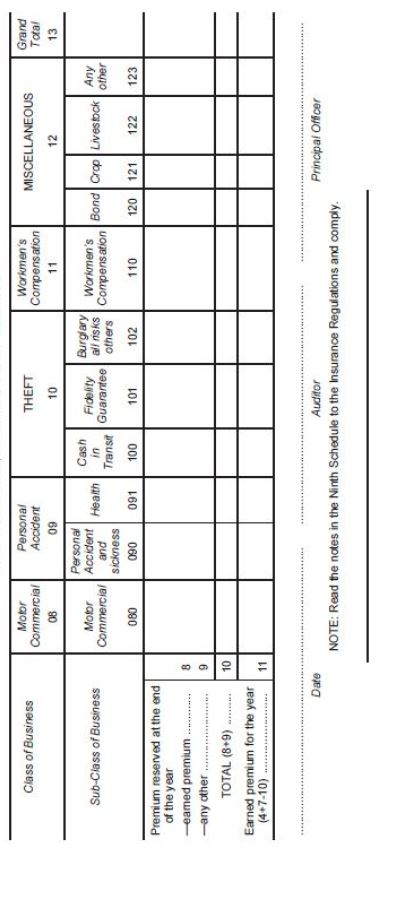

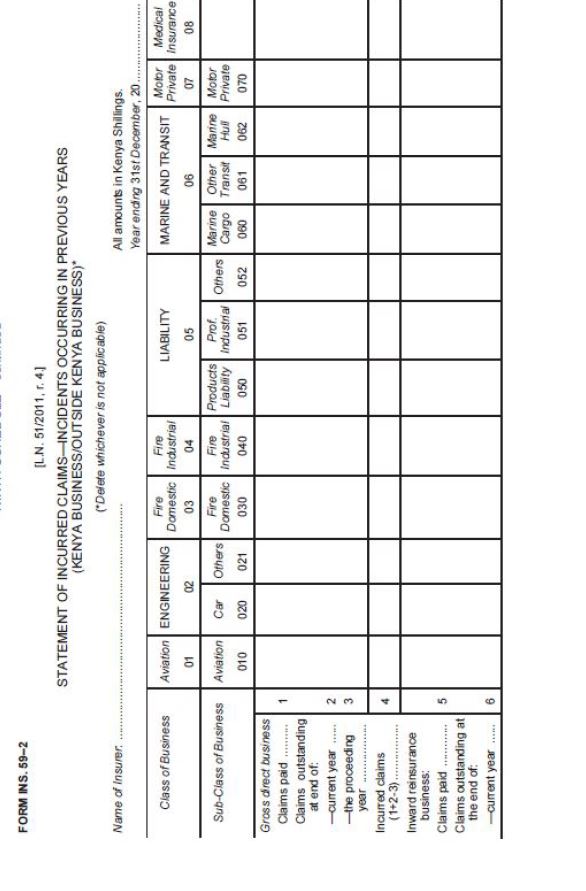

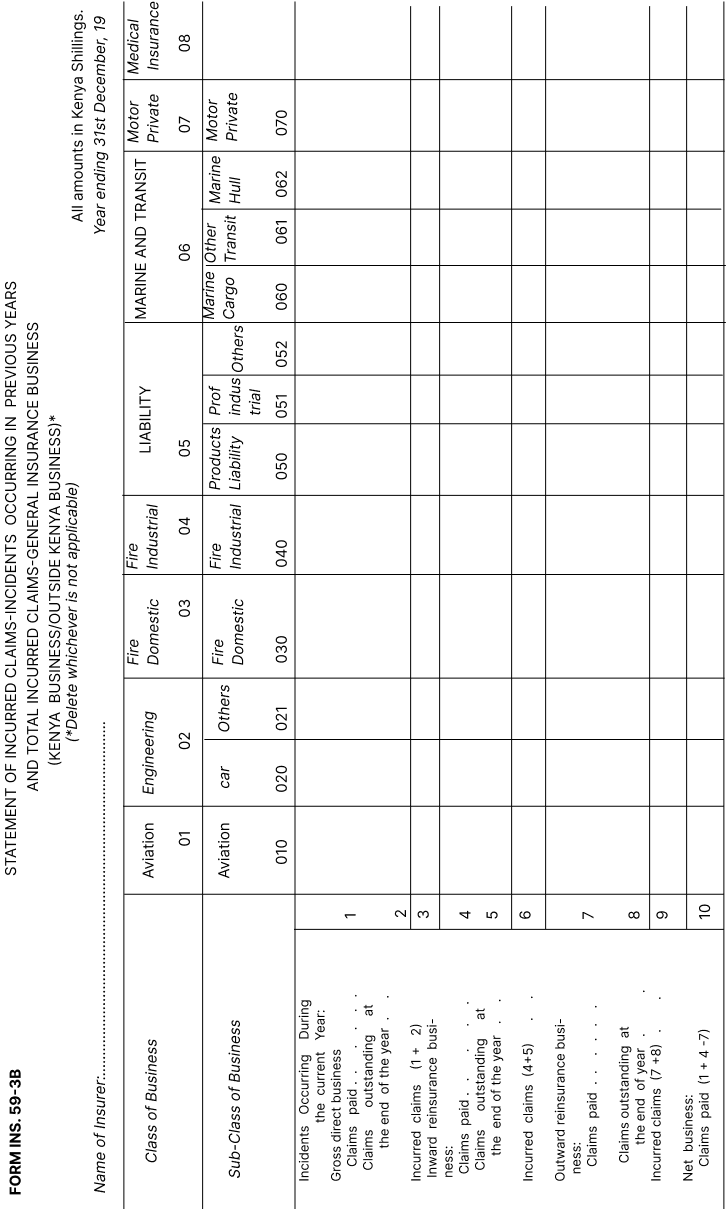

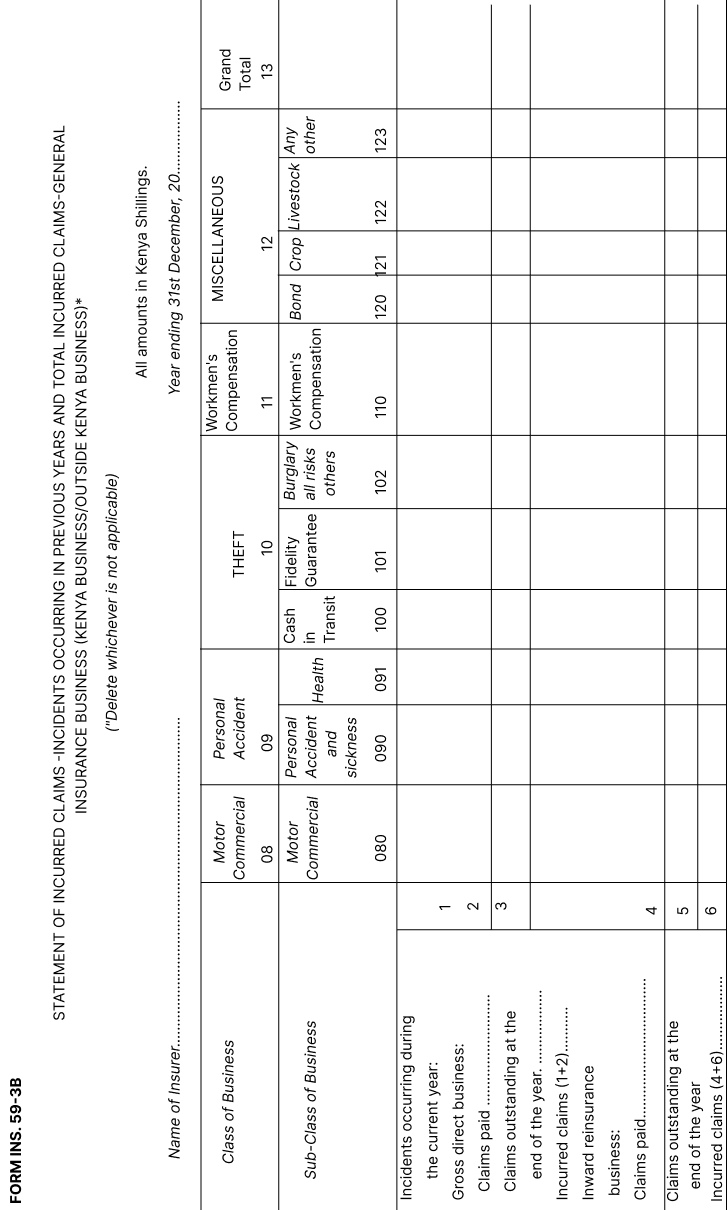

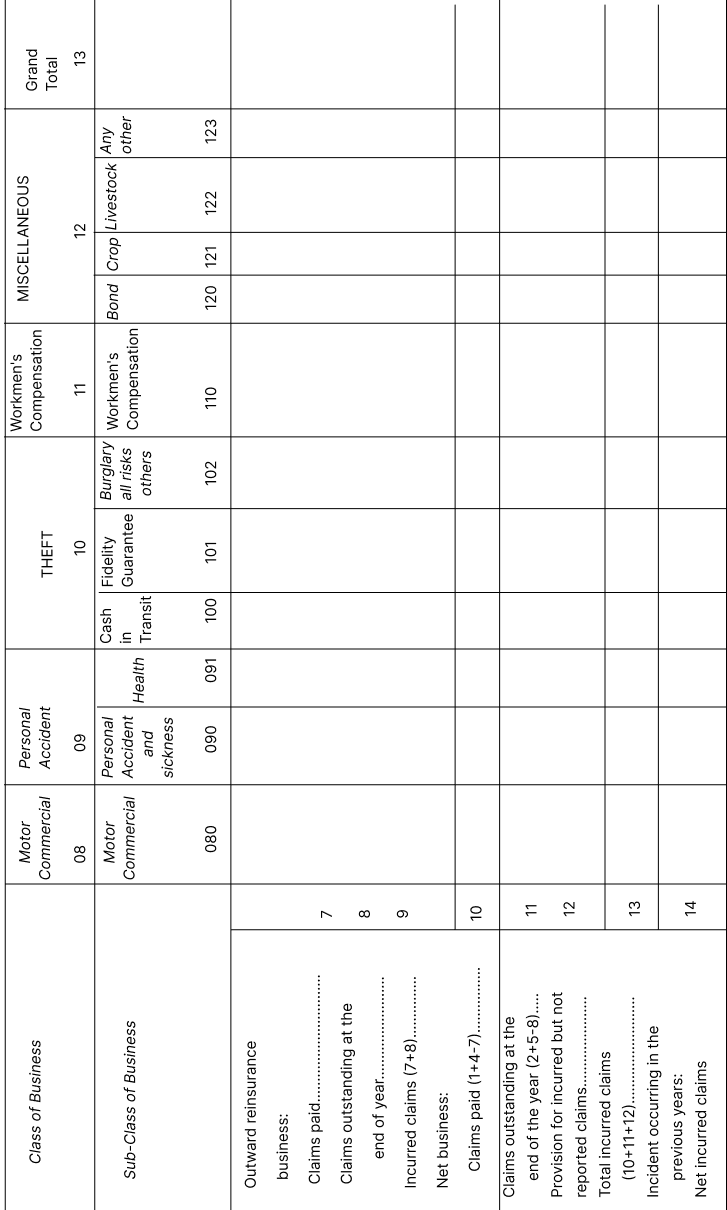

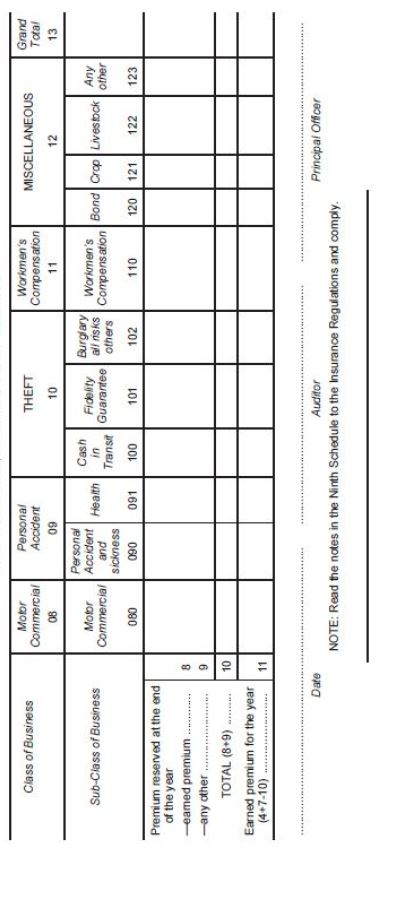

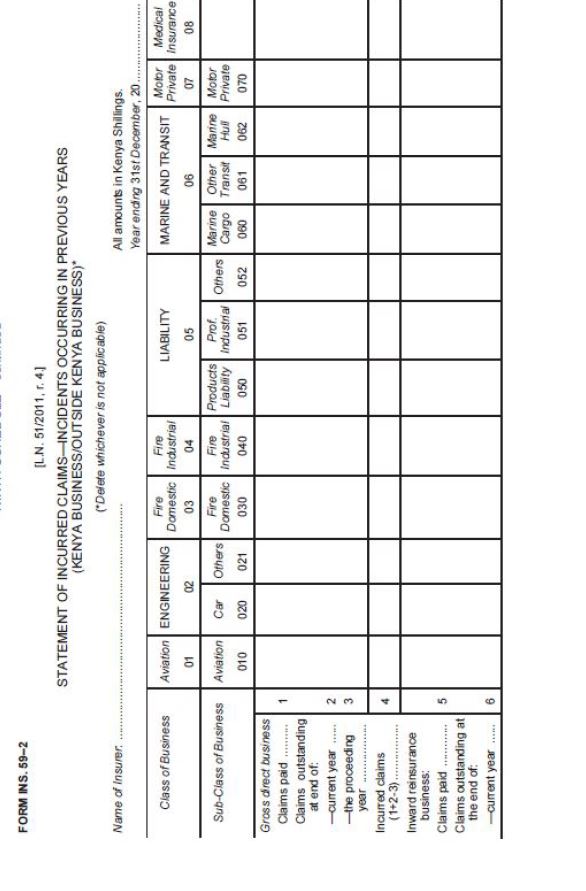

statement of incurred claims in respect of incidents occurring in previous years, Form No. INS. 59-2; |

| (iii) |

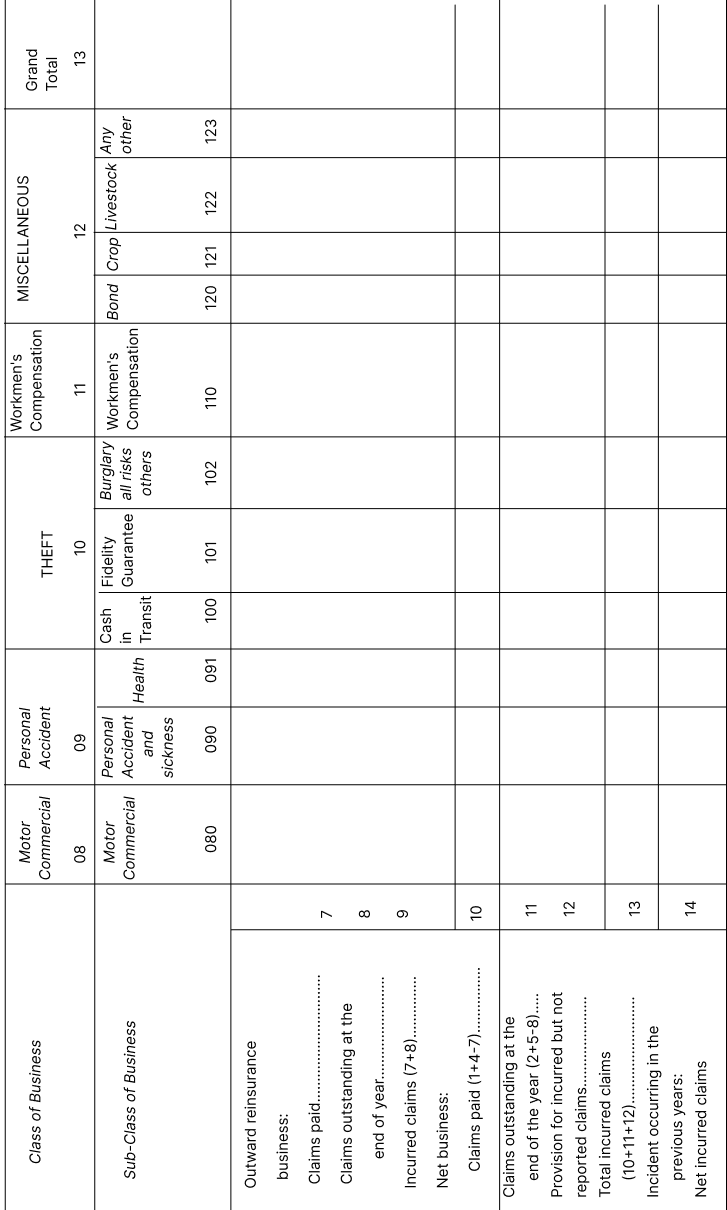

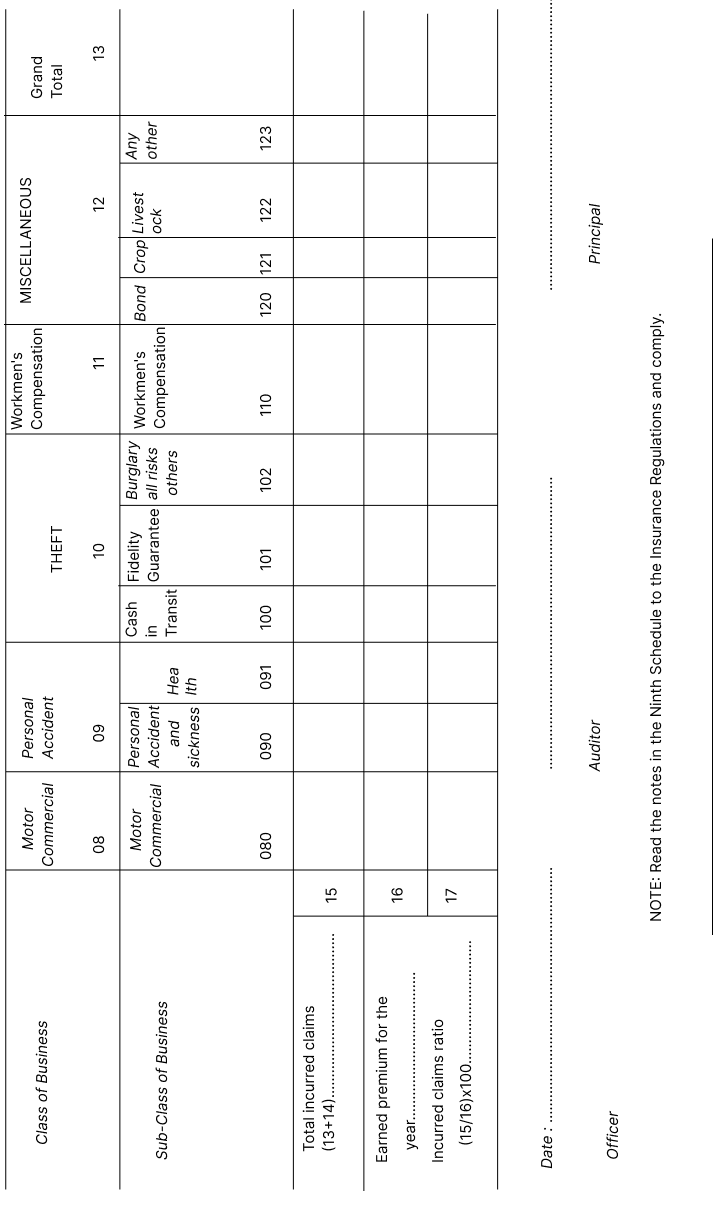

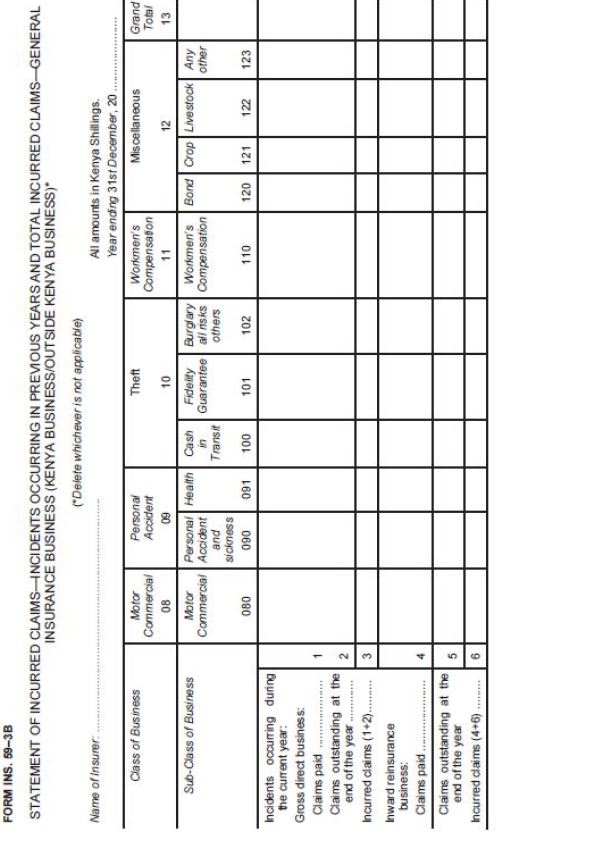

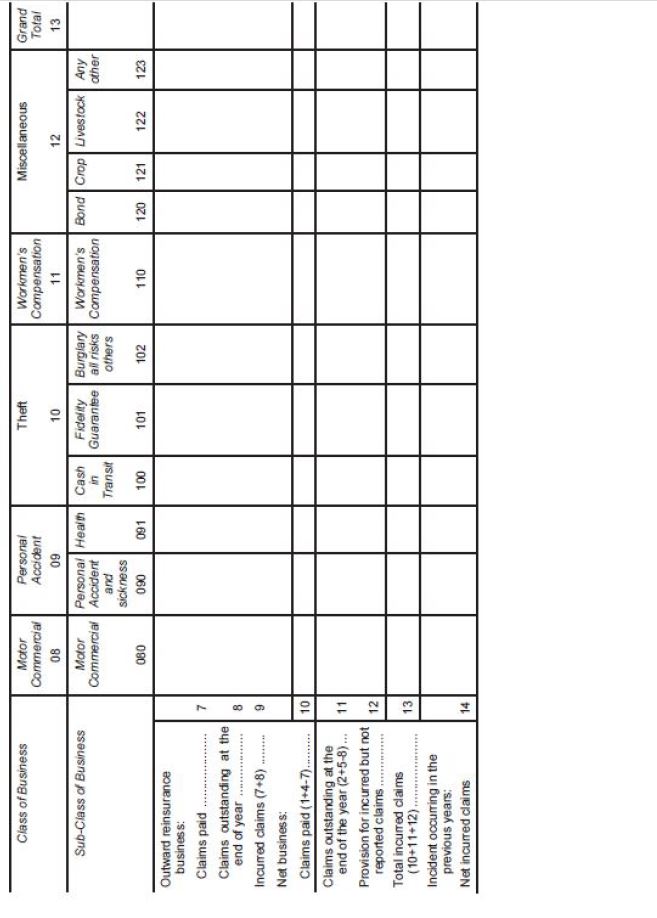

statement of incurred claims in respect of incidents occurring in the current year and total incurred claims, Form No. INS. 59-3B; |

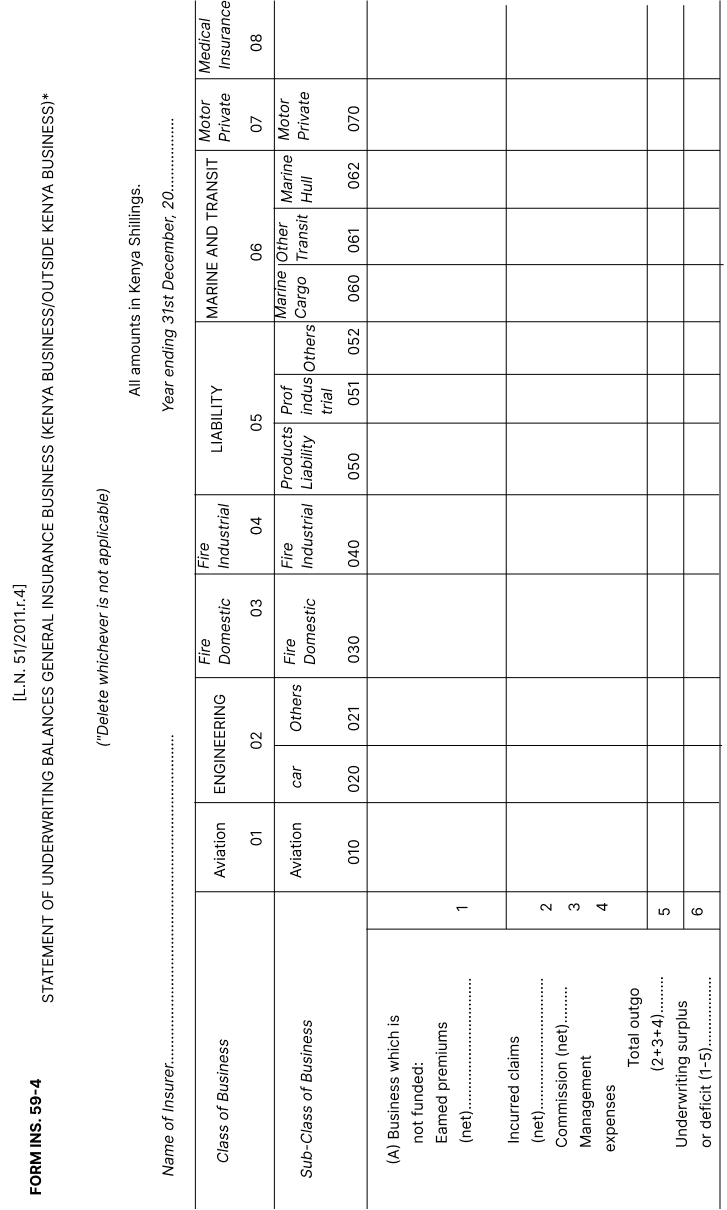

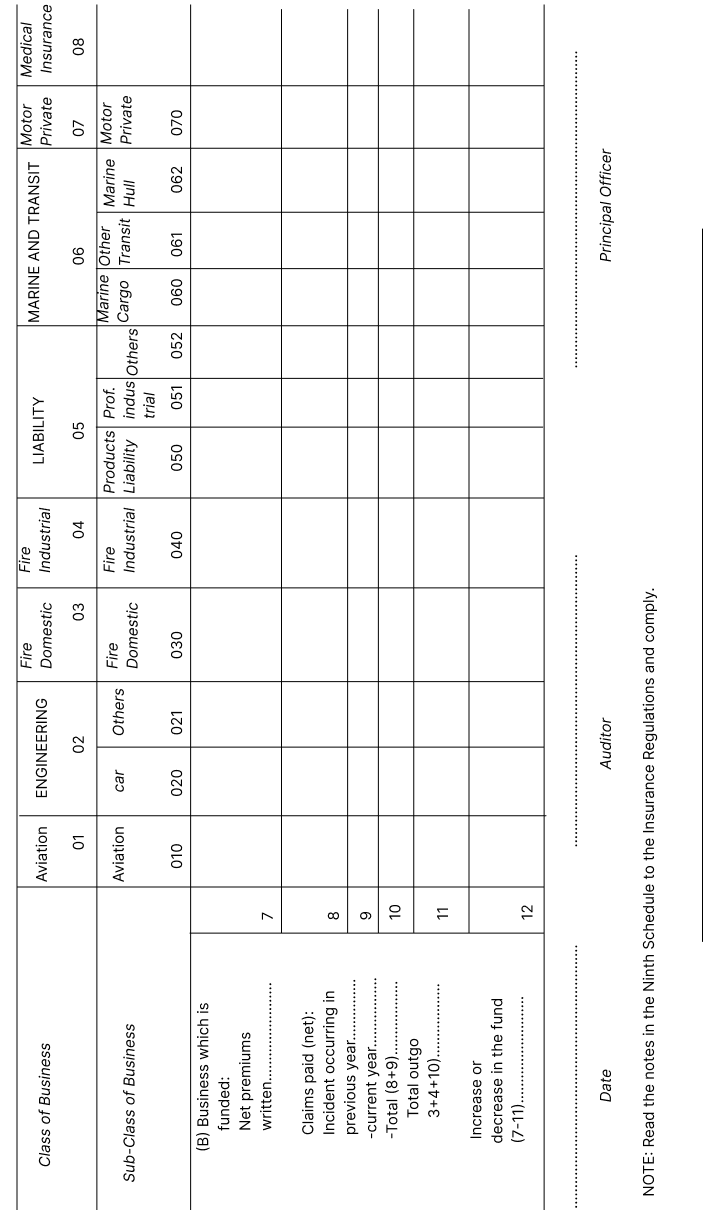

| (iv) |

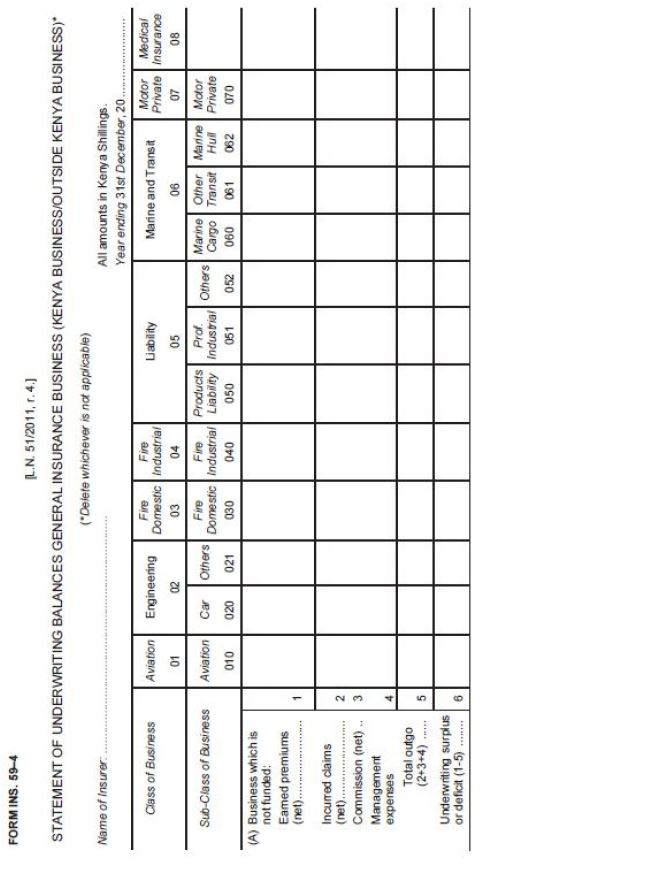

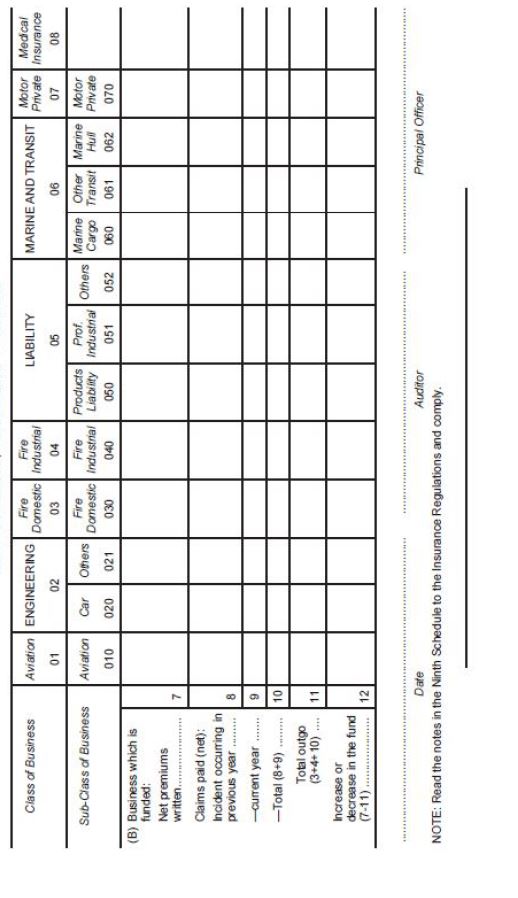

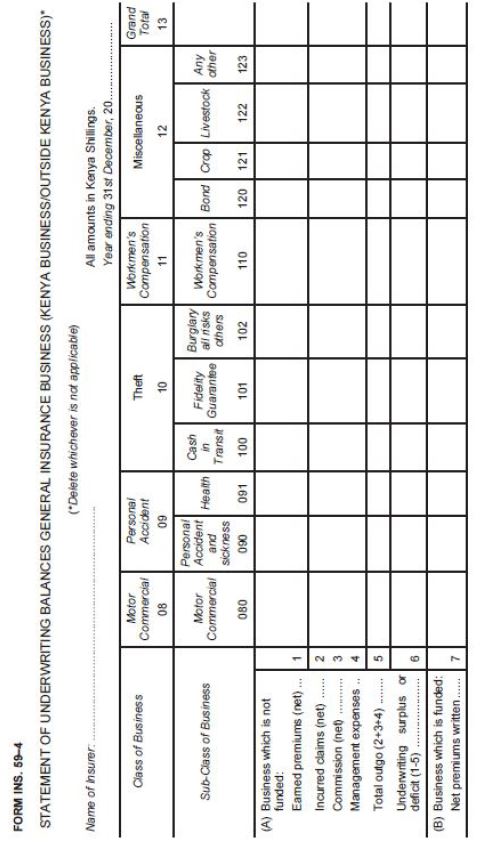

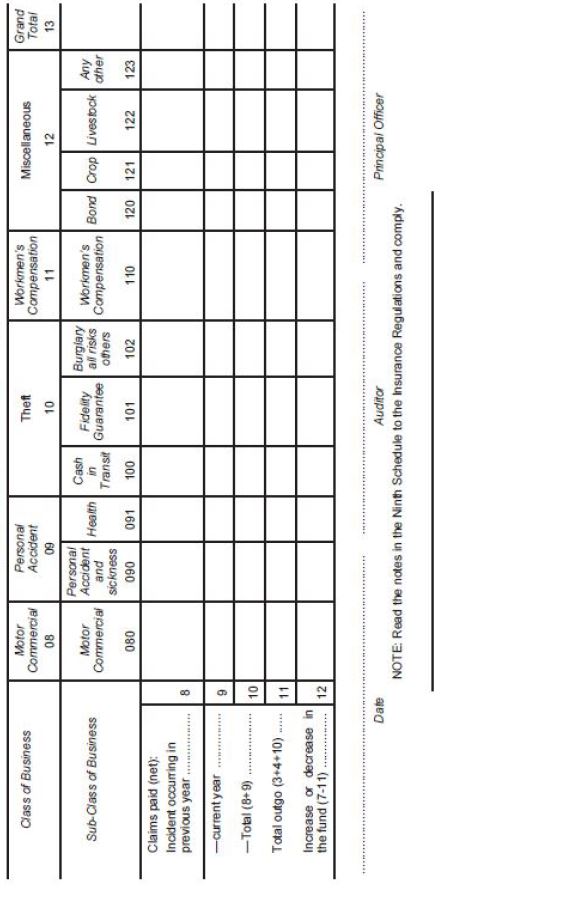

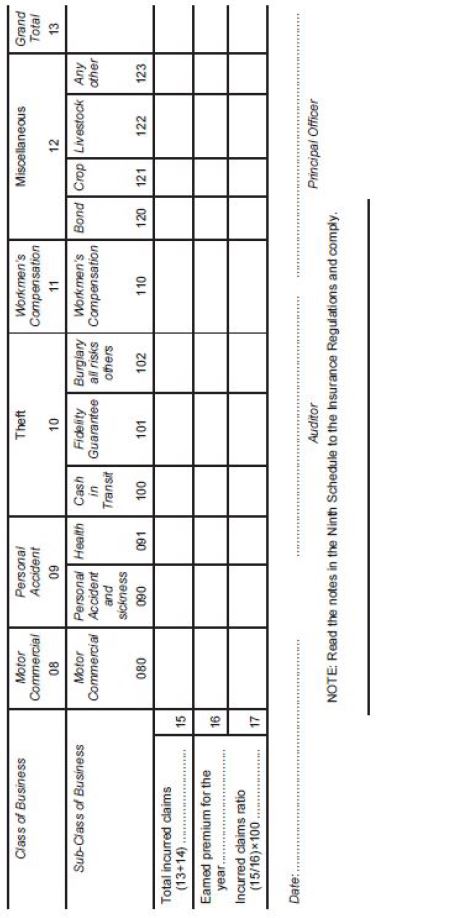

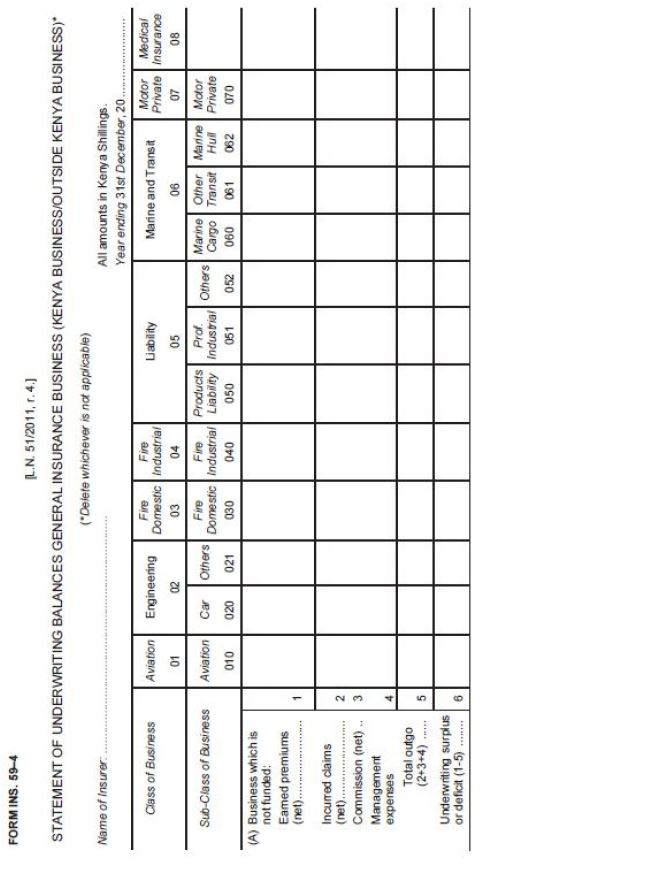

statement of underwriting balances, Form No. INS. 59-4; |

| (v) |

statement of commission and management expenses, Form No. INS. 59-5; |

| (vi) |

particulars of inward and outward reinsurance treaties, Form No. INS 59-6; |

| (vii) |

particulars of brokers, reinsurers and re-insured under inward and outward reinsurance treaties, Form No. INS. 59-7; |

| (viii) |

particulars of insurance business not covered by any reinsurance arrangement, Form No. INS. 59-8; |

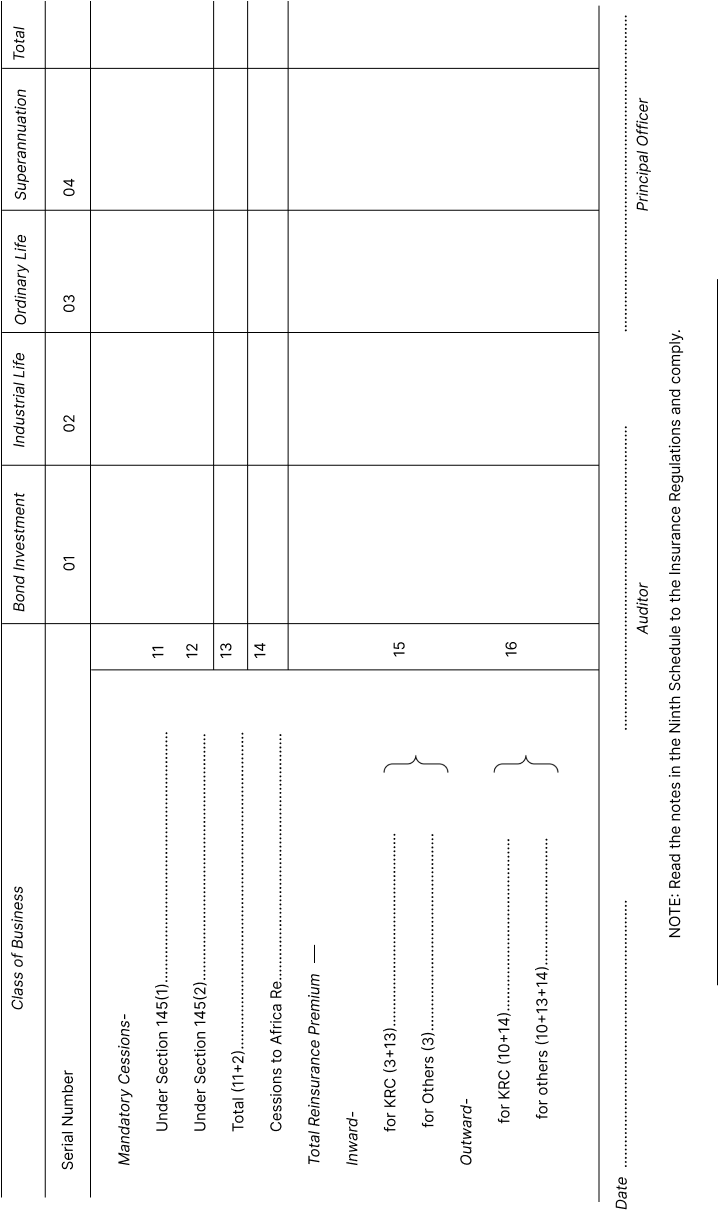

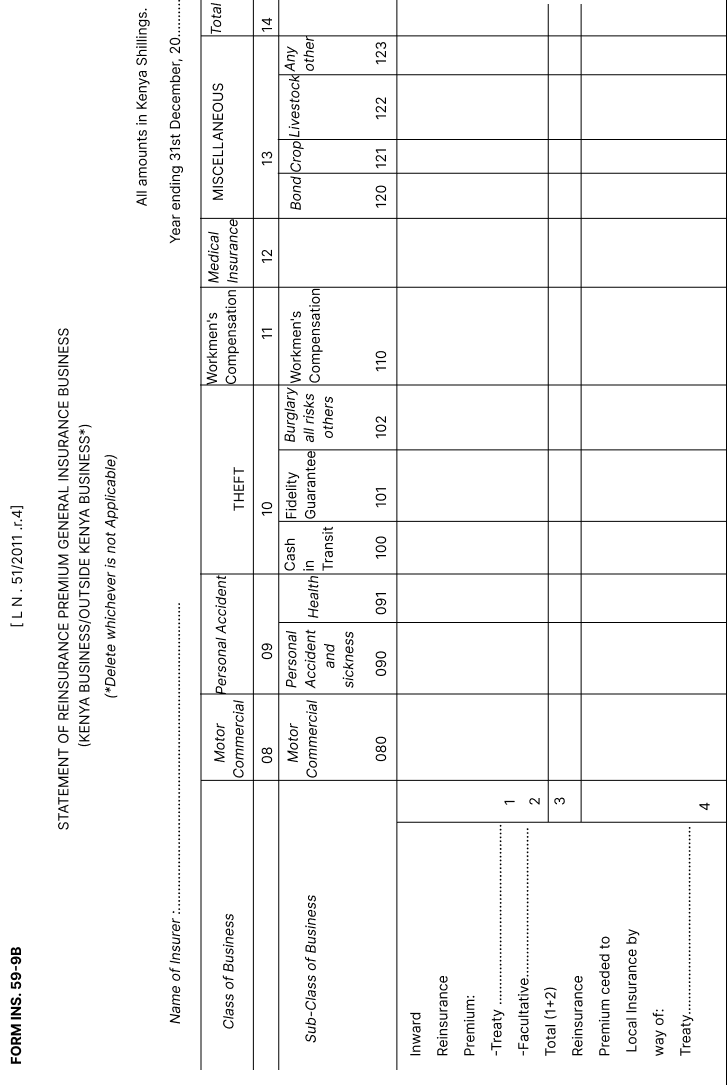

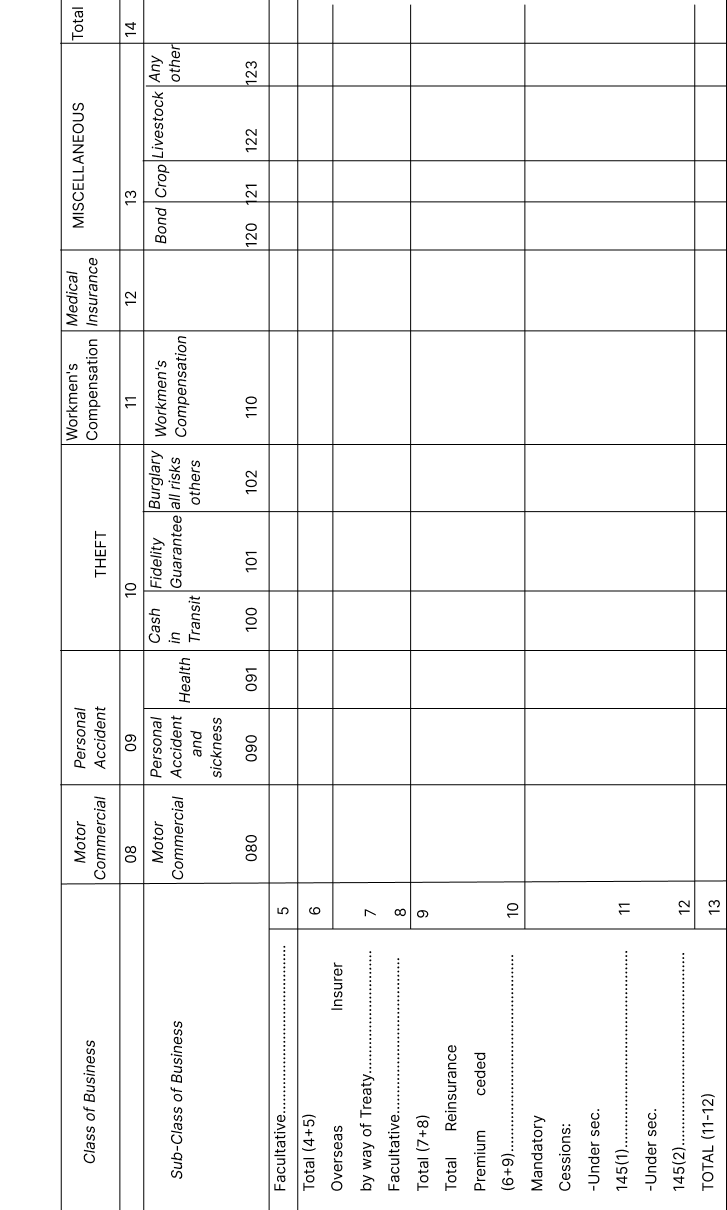

| (ix) |

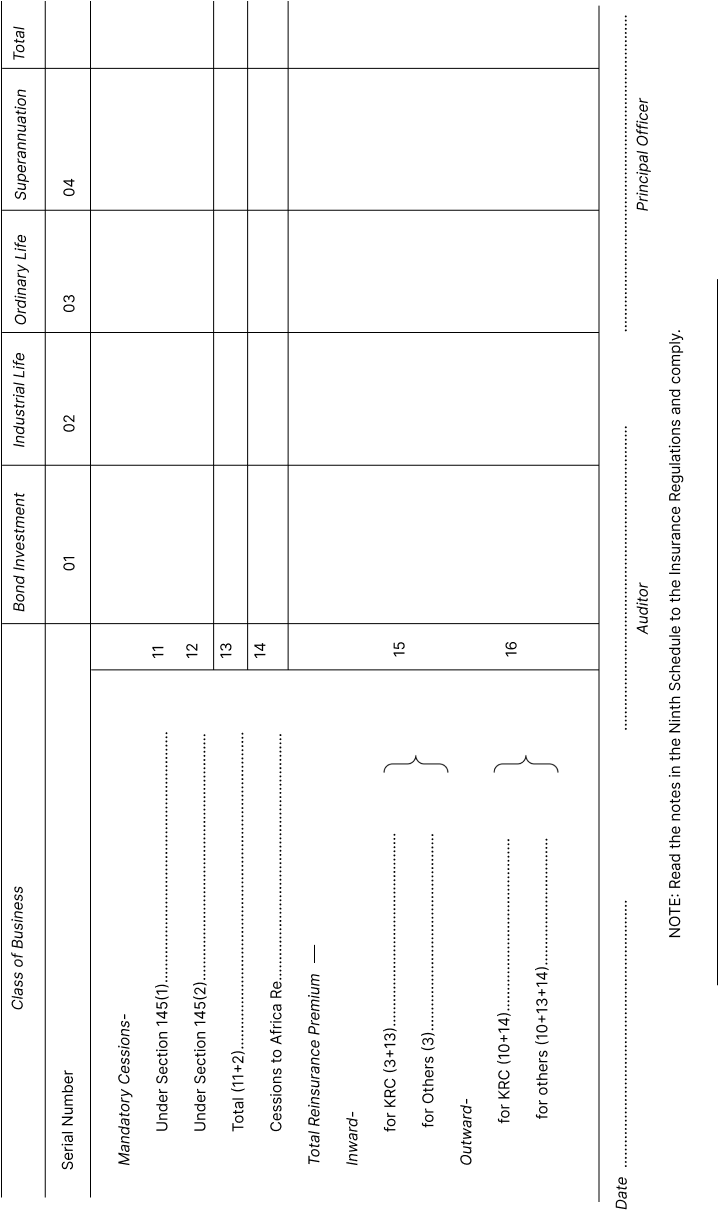

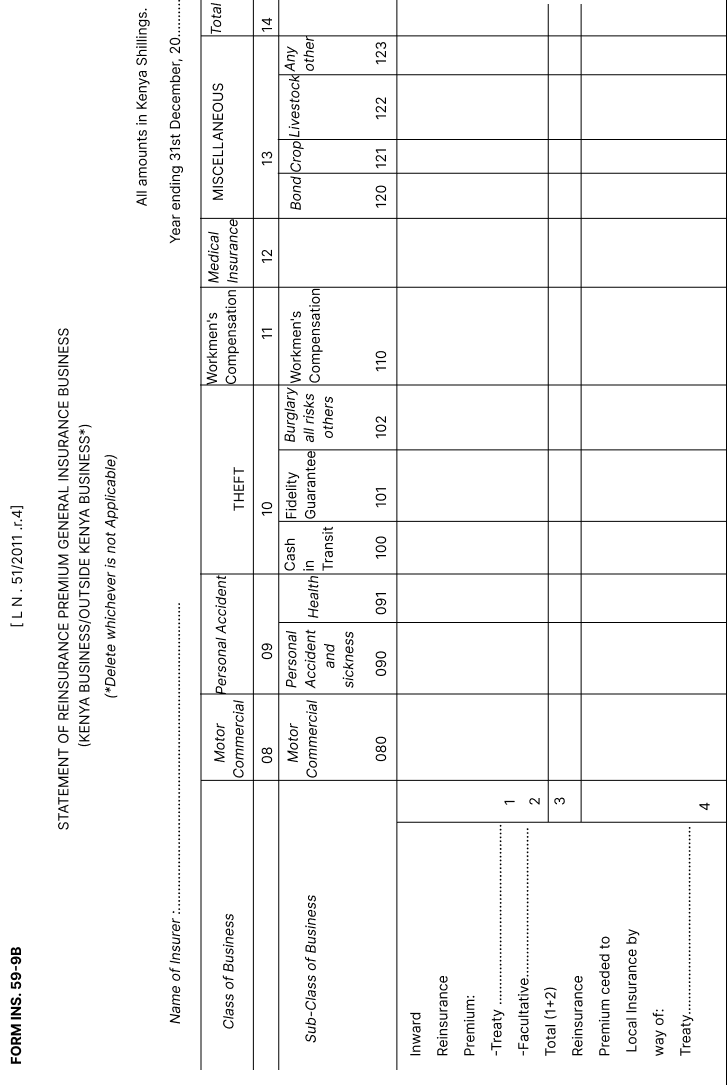

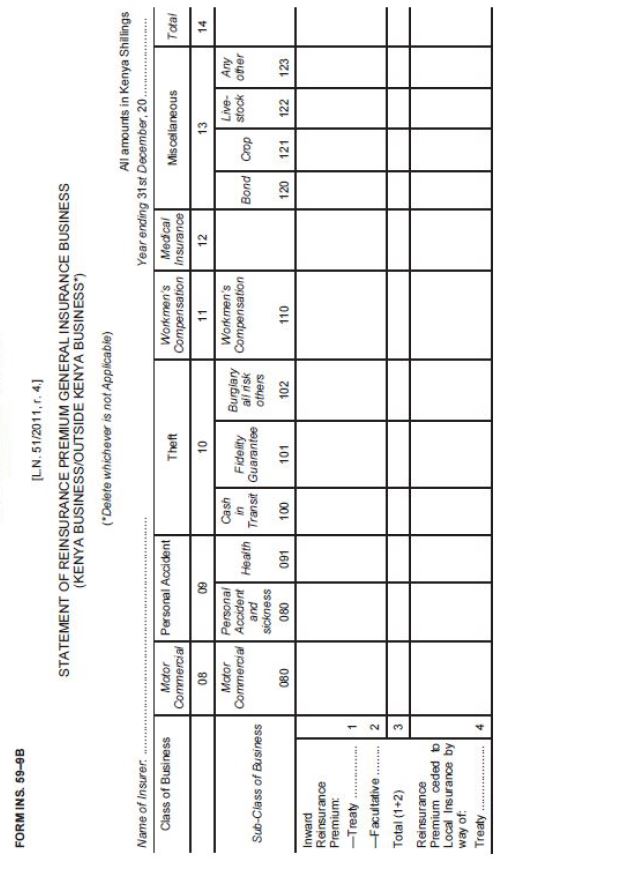

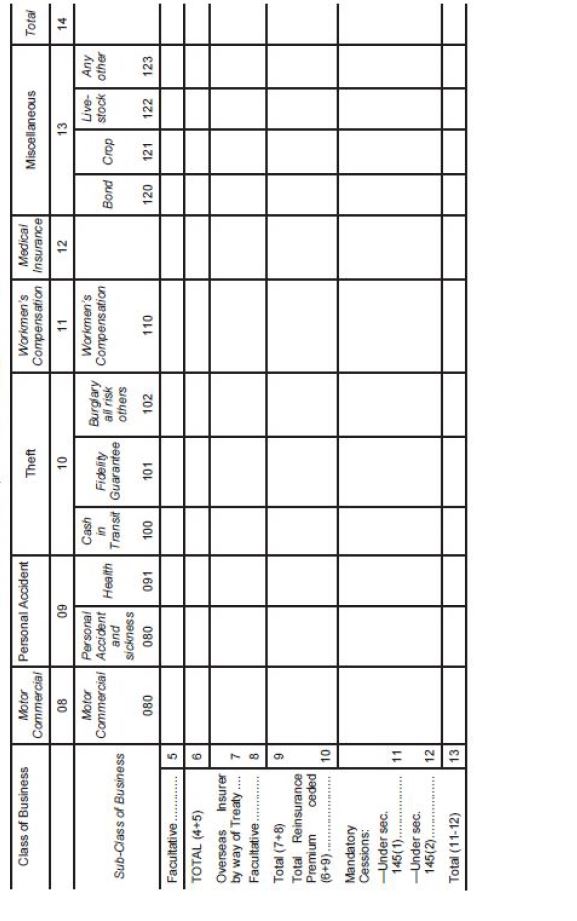

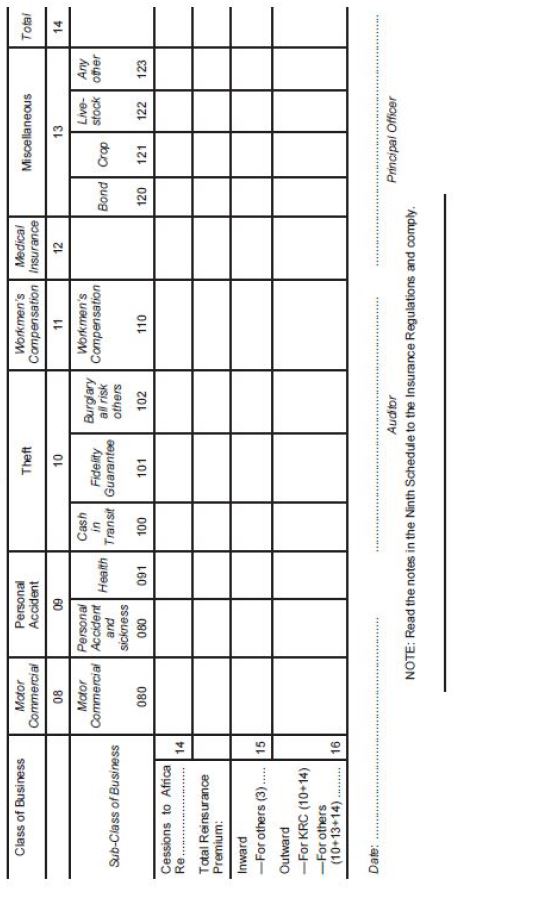

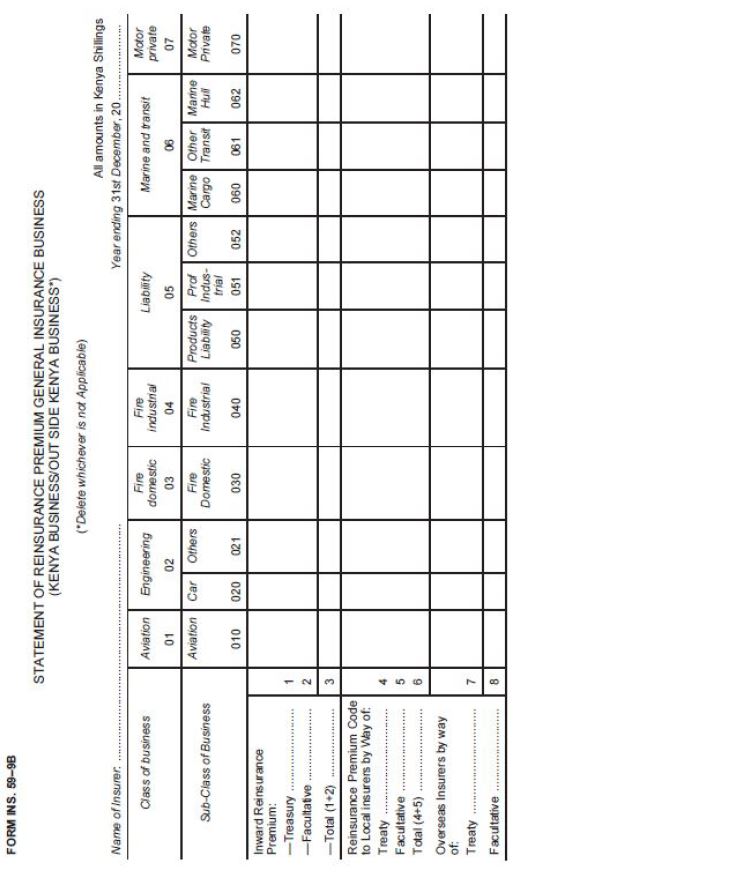

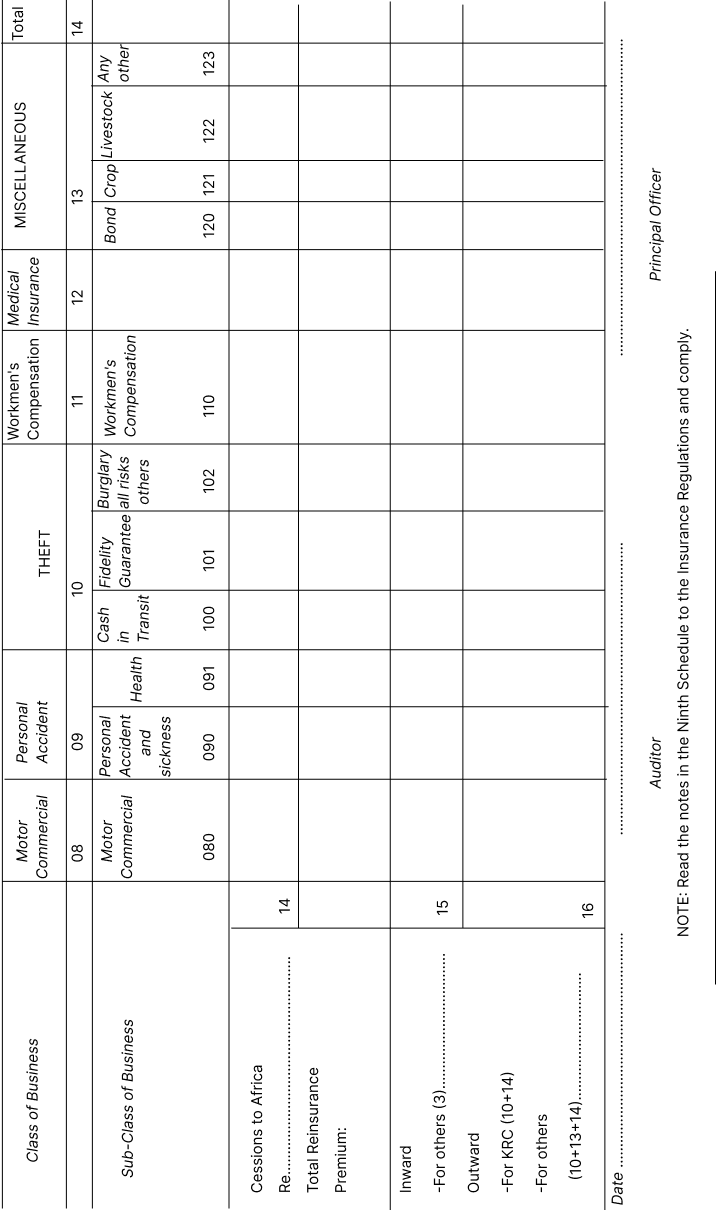

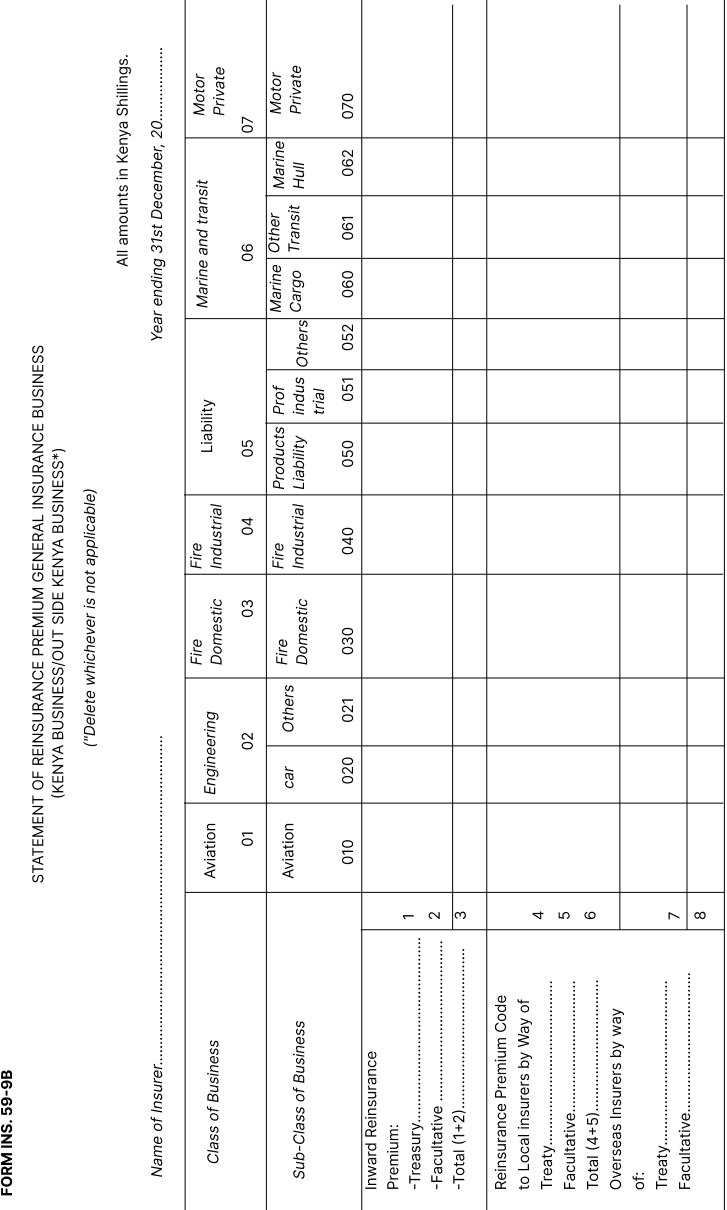

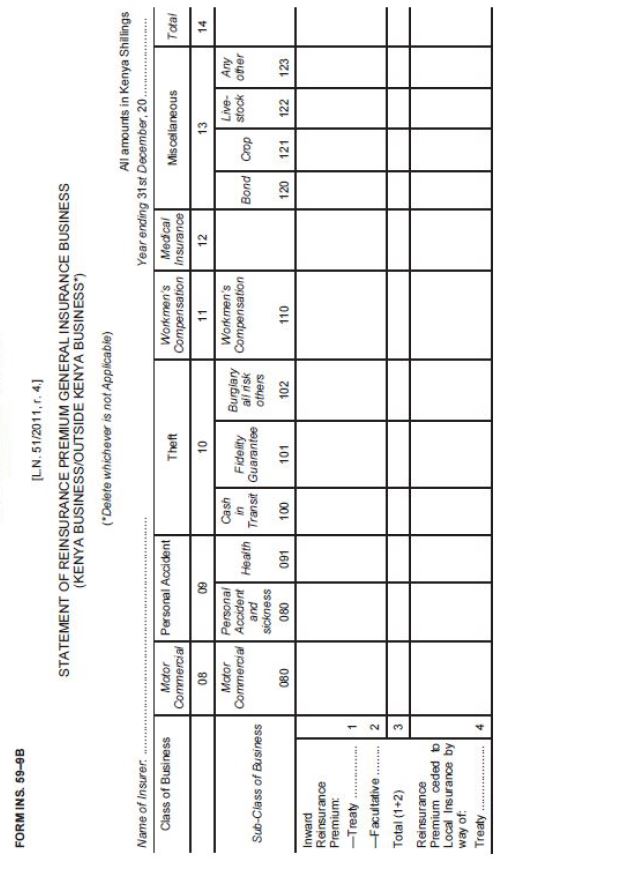

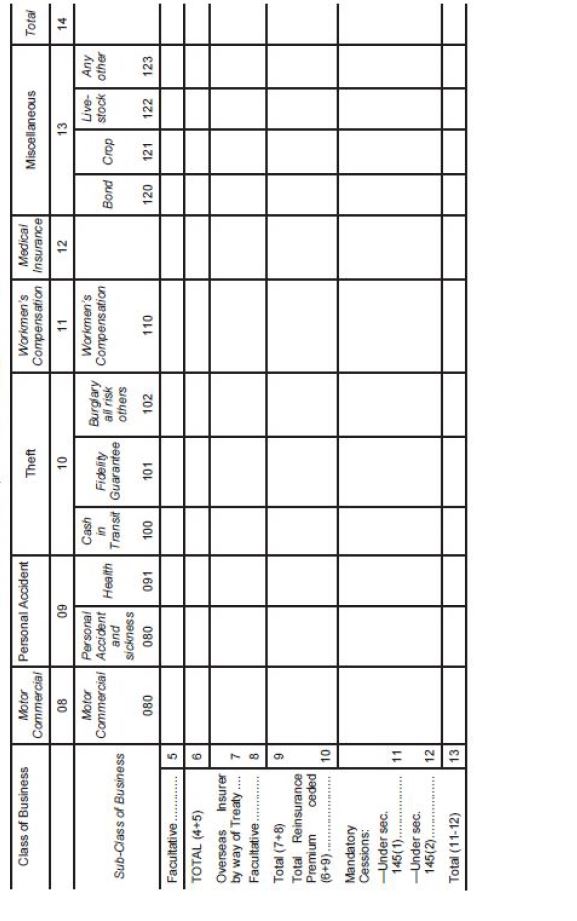

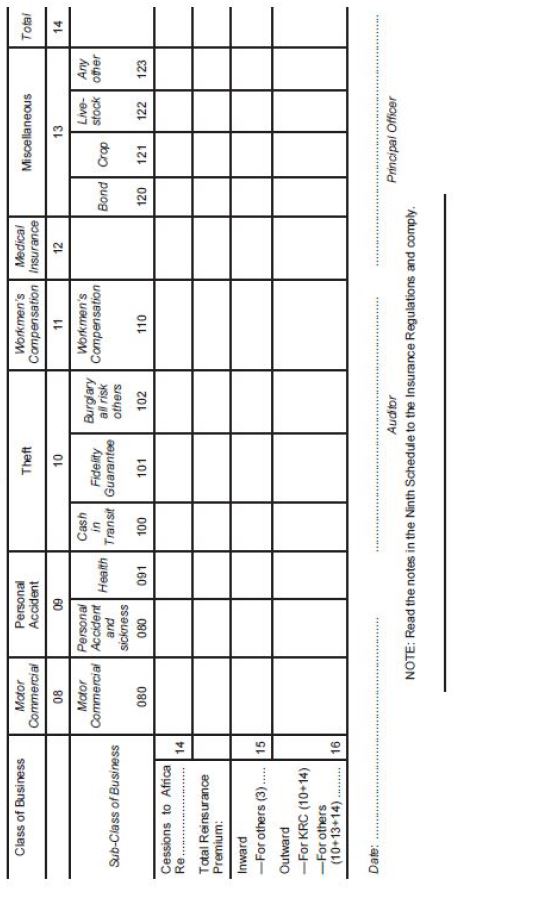

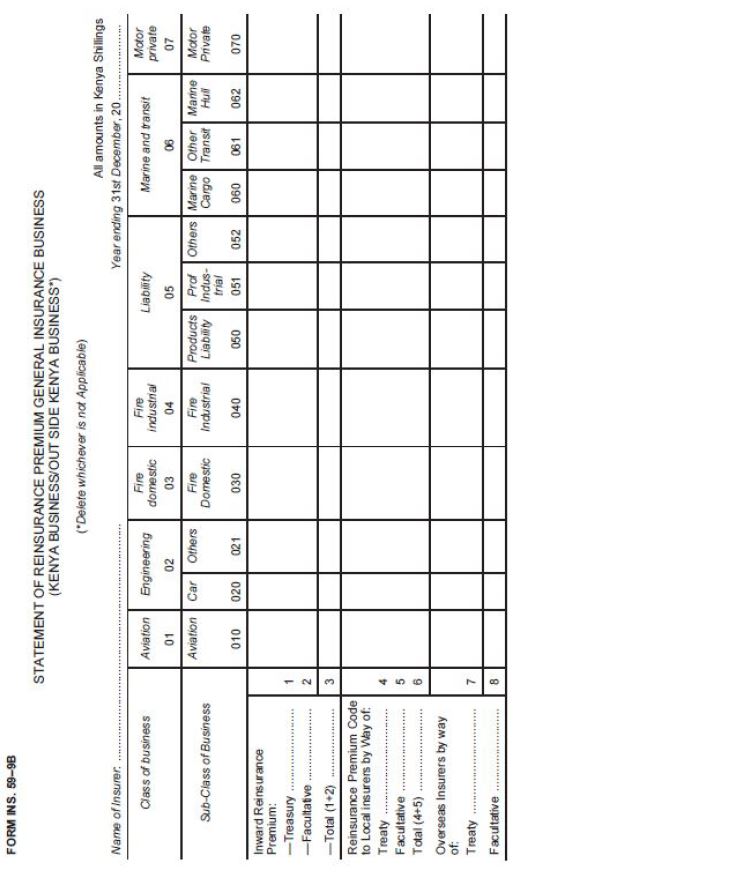

statement of premium, Form No. INS. 59-9B; |

| (x) |

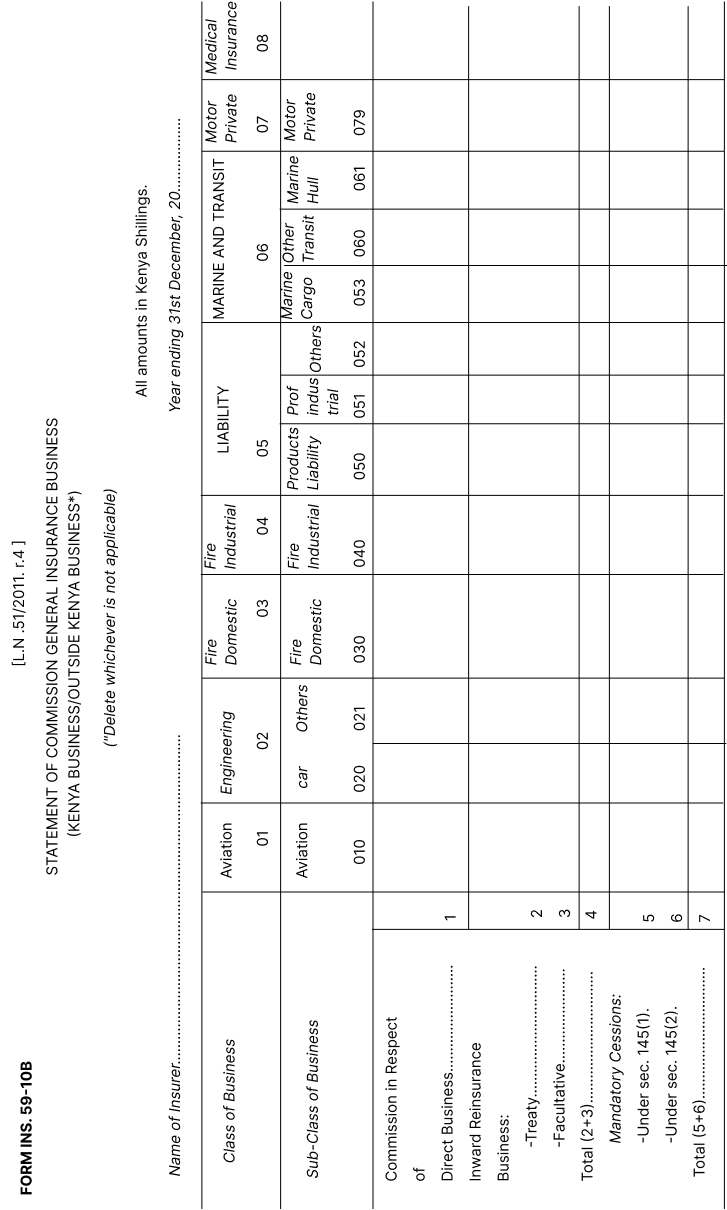

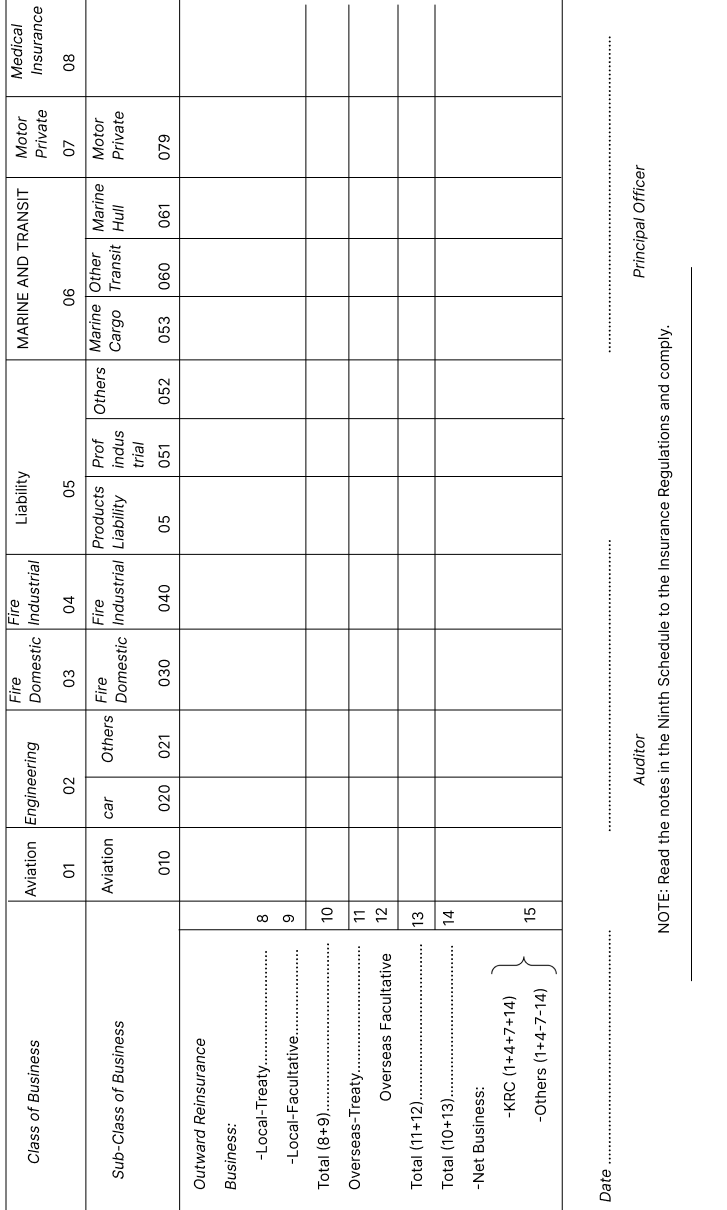

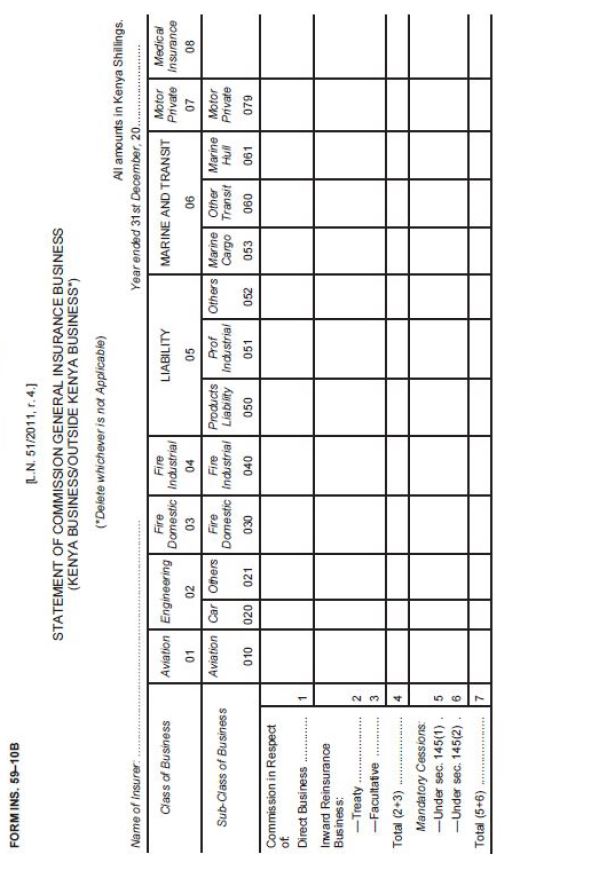

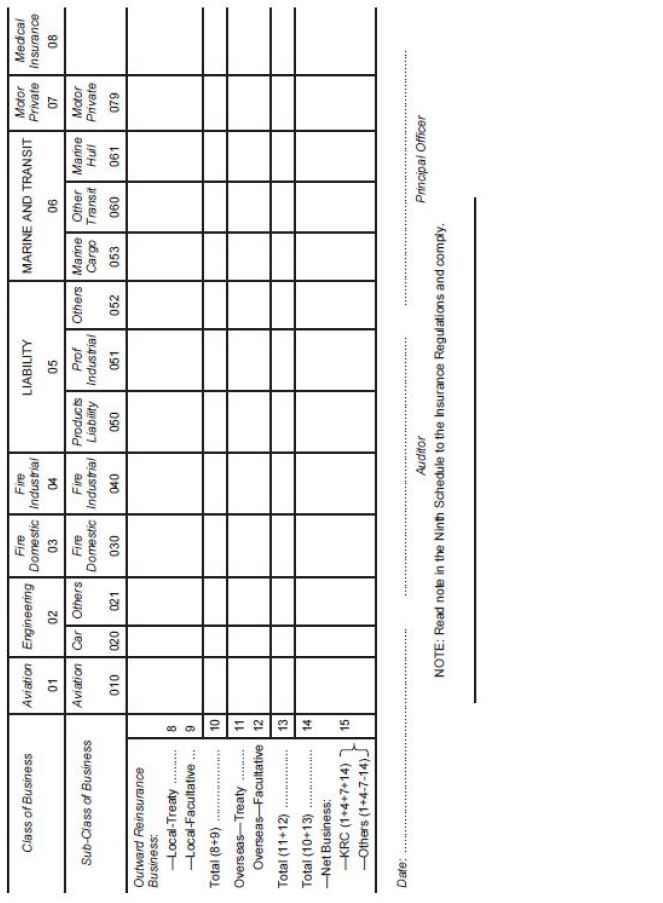

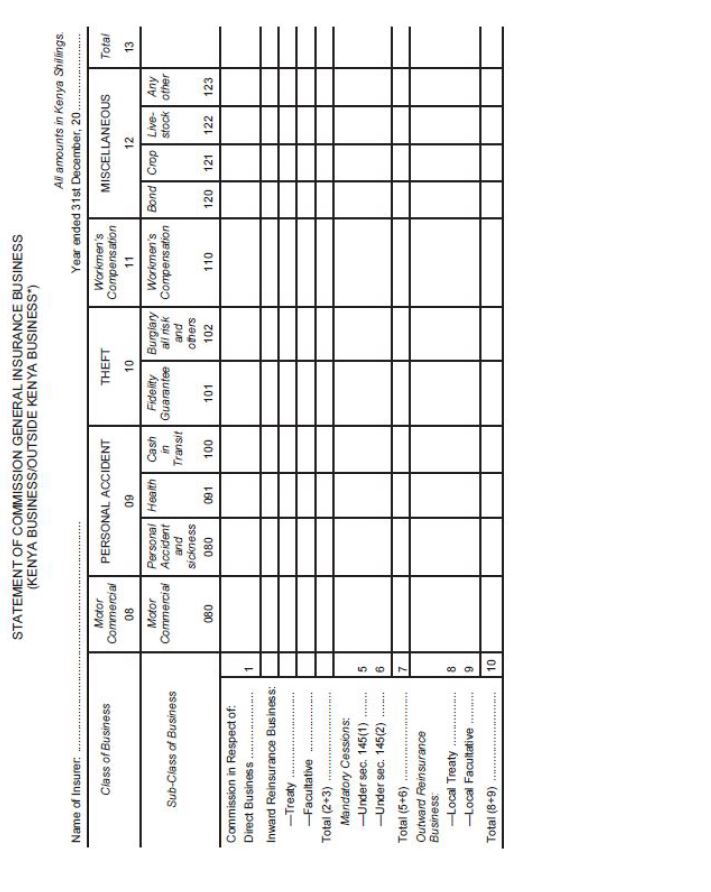

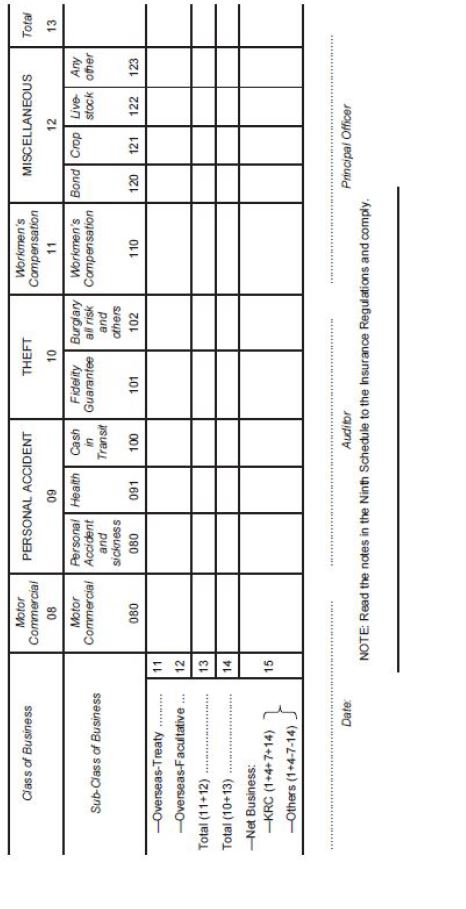

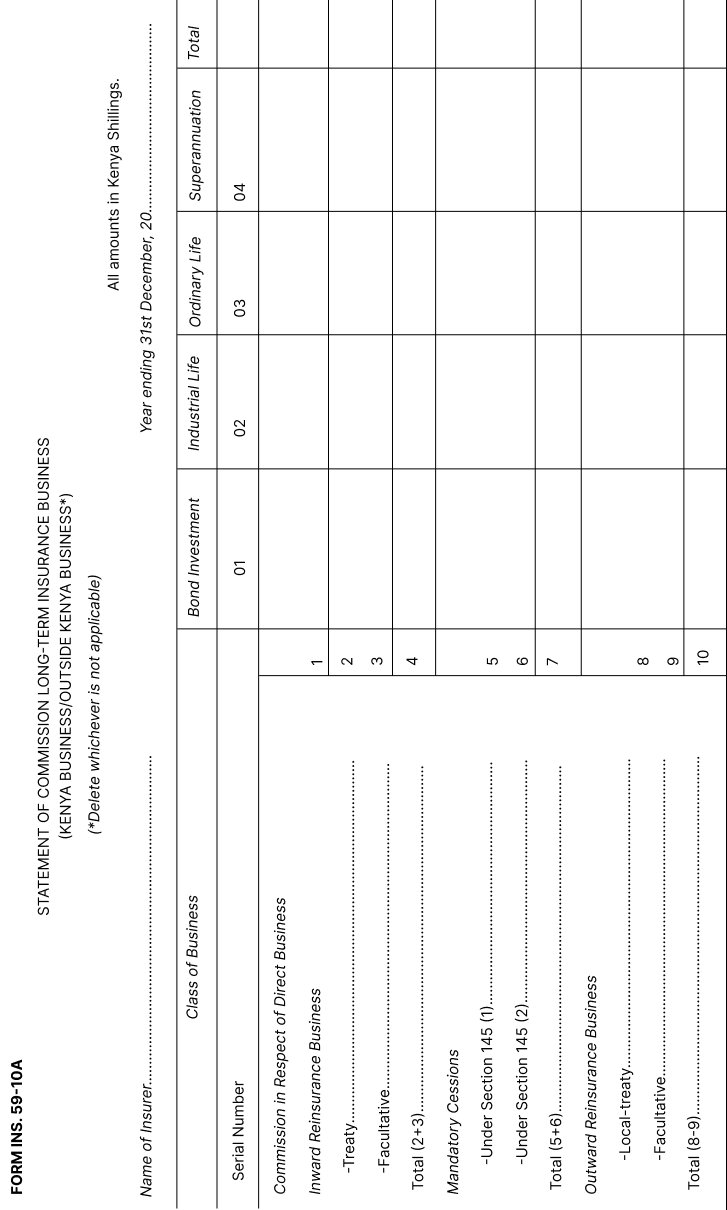

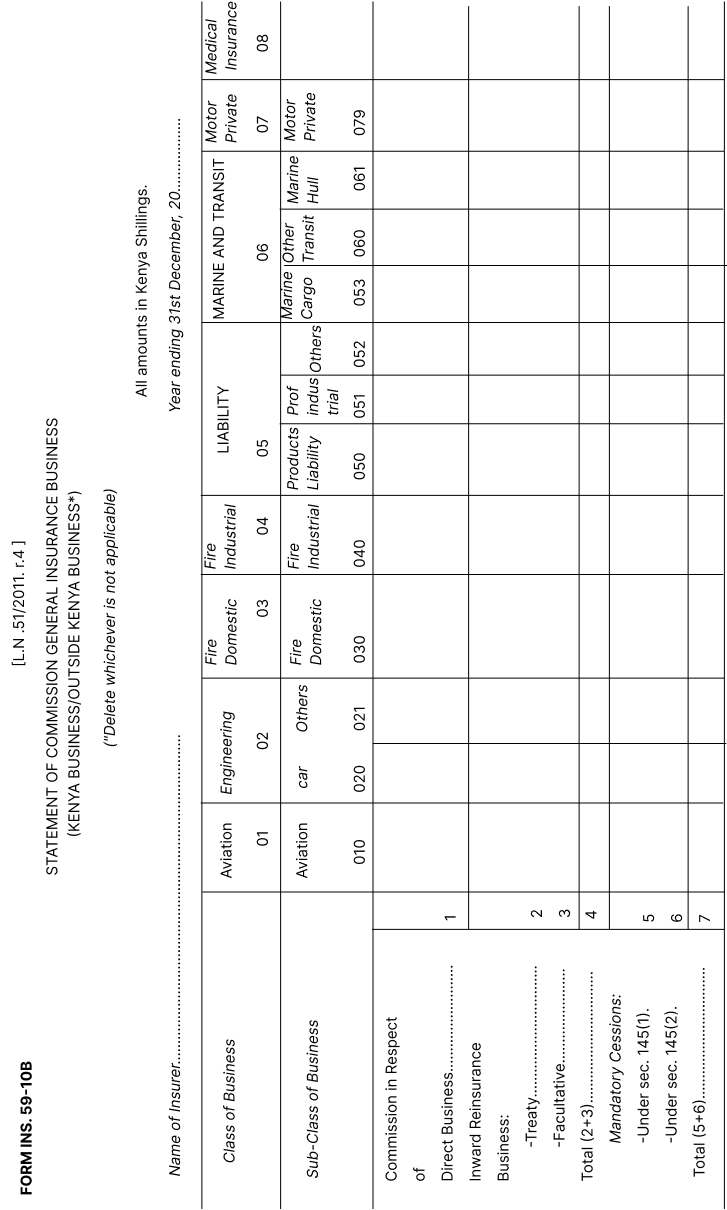

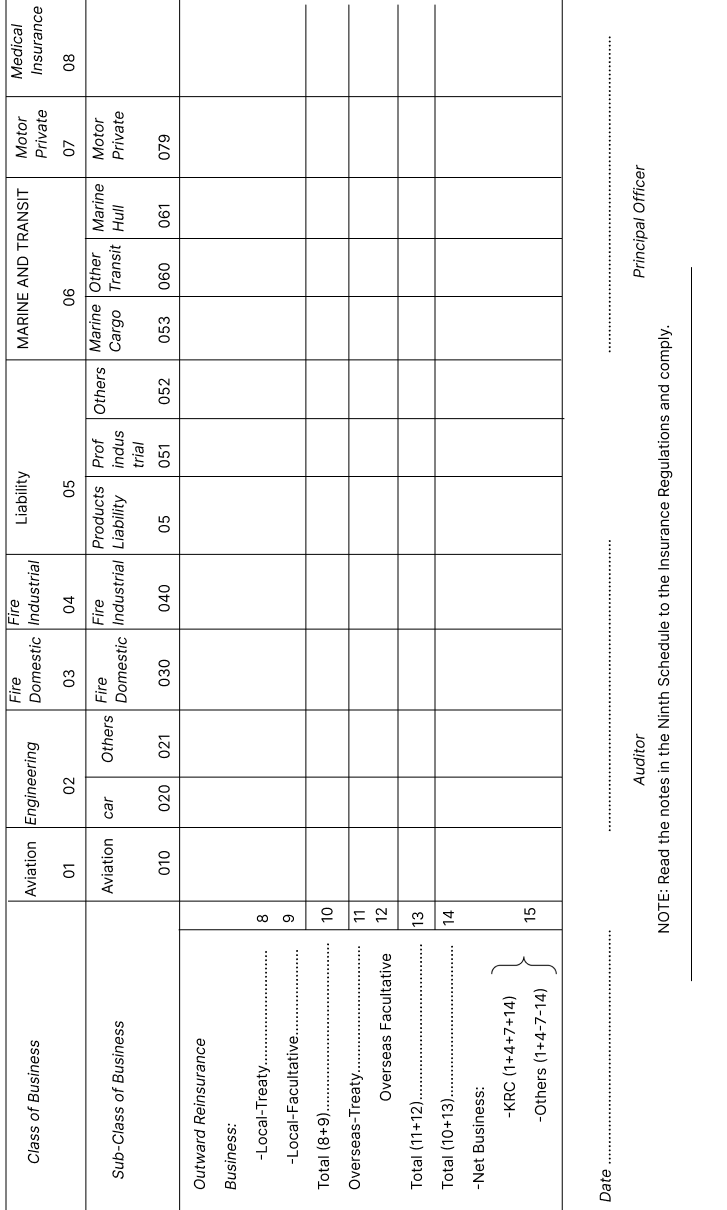

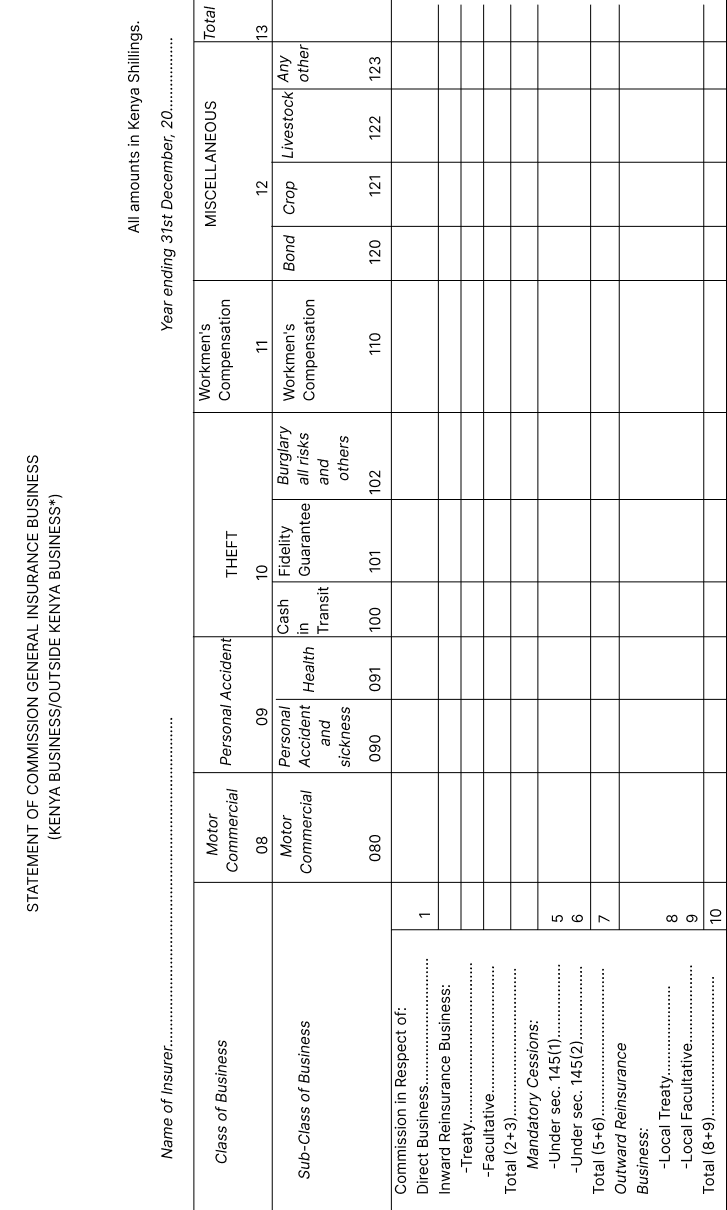

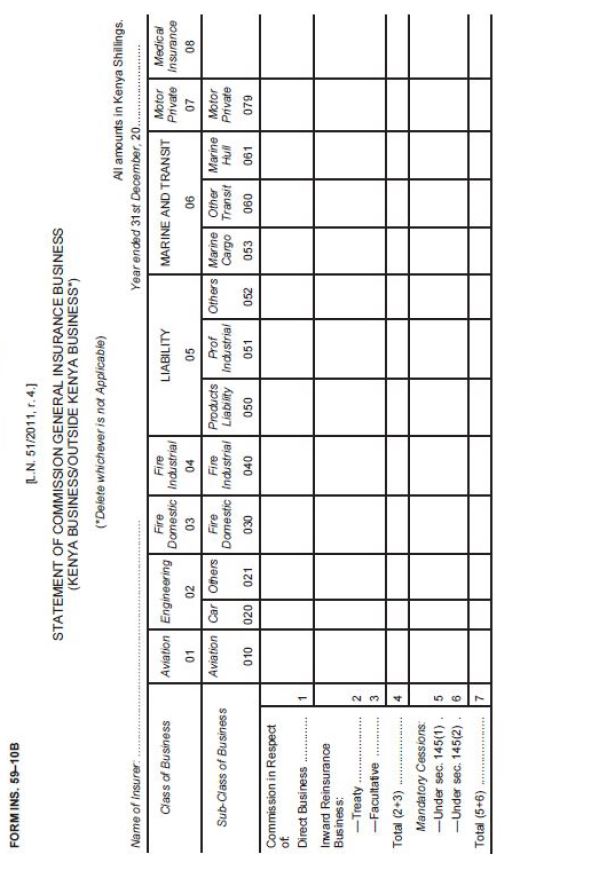

statement of commission, Form No. INS. 59-10B. |

|

[L.N. 108/2002, r. 3, L.N. 57/2012, r. 4, L.N. 93/2019, r. 5.]

|

| 19. |

Annual returns: supplementary provisions

| (1) |

The statements required under regulations 17 and 18 shall be submitted separately in respect of Kenya business and outside Kenya business.

|

| (2) |

In case an insurer does not have any information to submit in respect of any of the classes of business under regulations 17 and 18 the statements required shall be submitted indicating that the insurer has no information to submit.

|

| (3) |

“Class of business” and “sub-class of business” wherever shown in the statements required to be furnished under regulations 17 and 18 are those specified in regulation 9 in respect of long term insurance business and in Part A of the Third Schedule in respect of general insurance business.

|

|

| 20. |

Authentication and certification of accounts and statements

| (1) |

The copies of the accounts, balance sheets, certificates, abstracts, returns or statements required to be deposited with the Commissioner under section 61(1) of the Act shall, in addition to the signatures required under section 60 of the Act, by the insurer a certificate of authentication signed by the principal officer and the person who prepared the account, balance sheet, certificate, abstract, return or statement in this form:

|

"CERTIFIED ON THE .................................... 20 .....TO BE AN AUTHENTIC COPY FOR THE PURPOSES OF SECTION 61 OF THE INSURANCE ACT, 1984.

|

|

...............................

|

................................

|

|

...............................

|

................................

|

|

| (2) |

The name of the person signing any statement, document, return, abstract, report, submitted to the Commissioner under the provisions of the Act or these Regulations shall be printed just below the signature and any one signing in the name of a firm shall print his own name and also that of his firm below the signature.

|

| (3) |

Subject to such conditions as the Commissioner may prescribe, insurance formalities or submission of documents under this regulation may be done through the use of information technology.

[L.N. 85/2010, r. 2, L.N. 57/2012, r. 5.]

|

|

PART V – MANAGEMENT AND EXPENSES

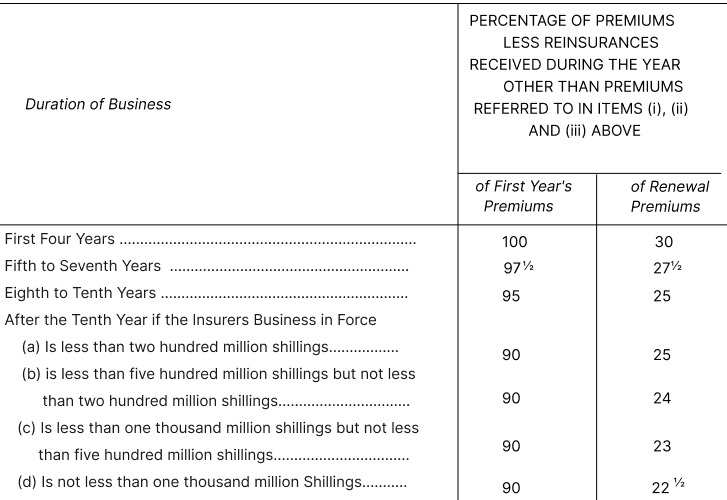

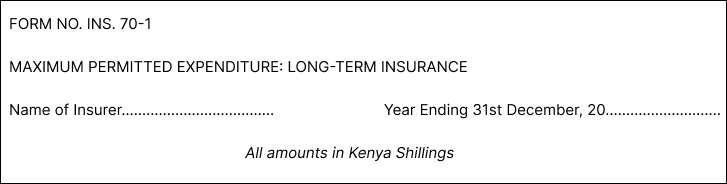

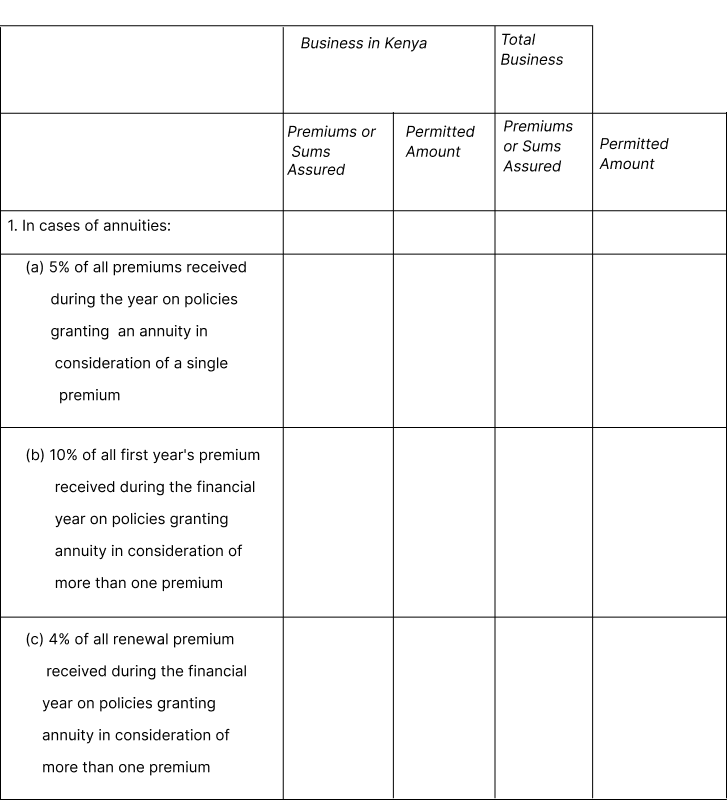

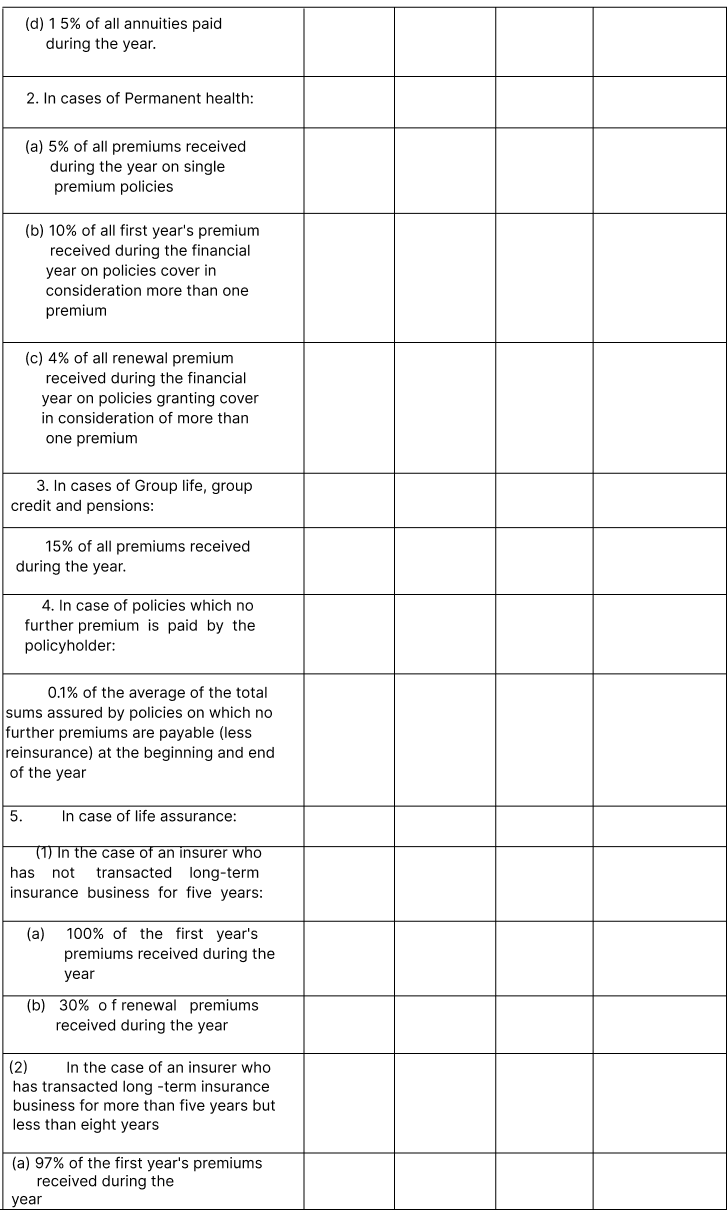

| 21. |

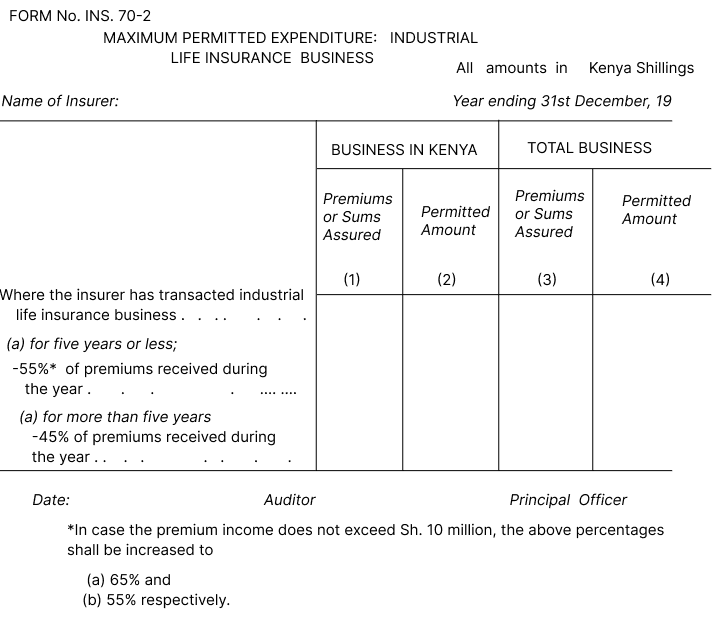

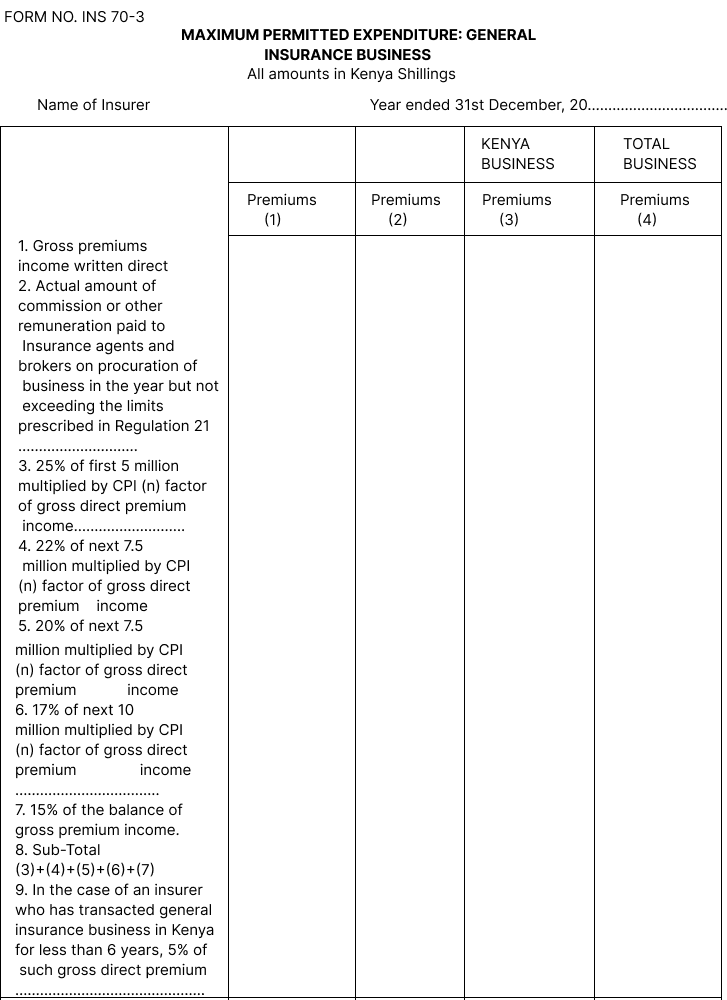

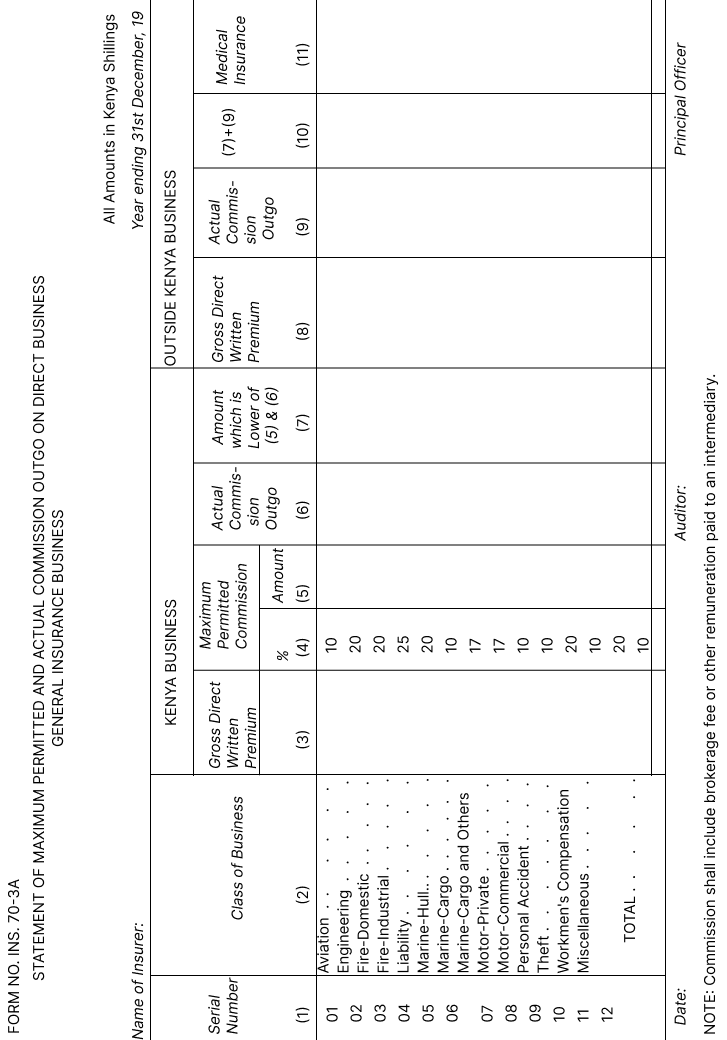

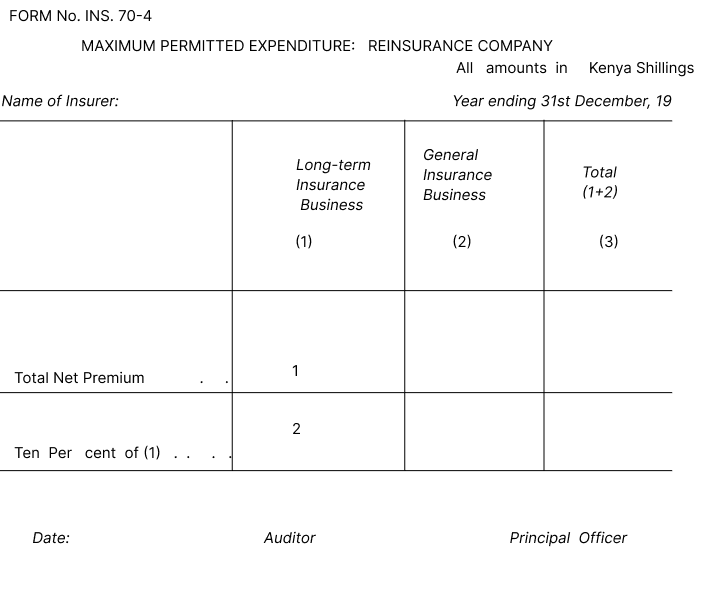

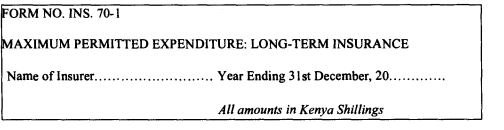

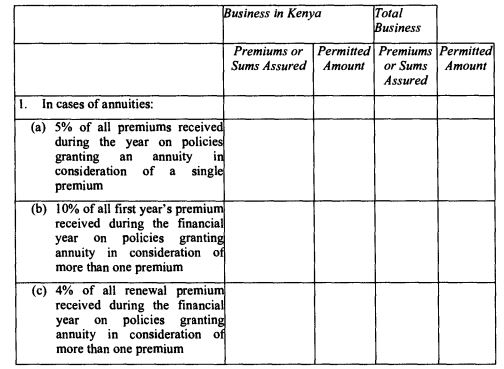

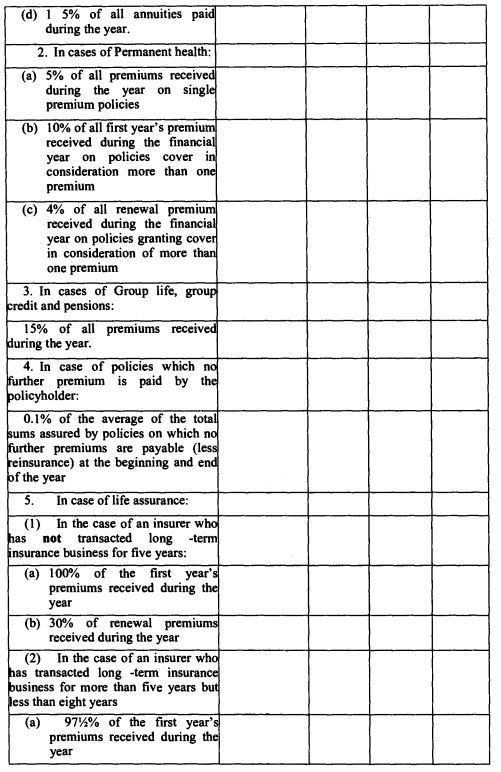

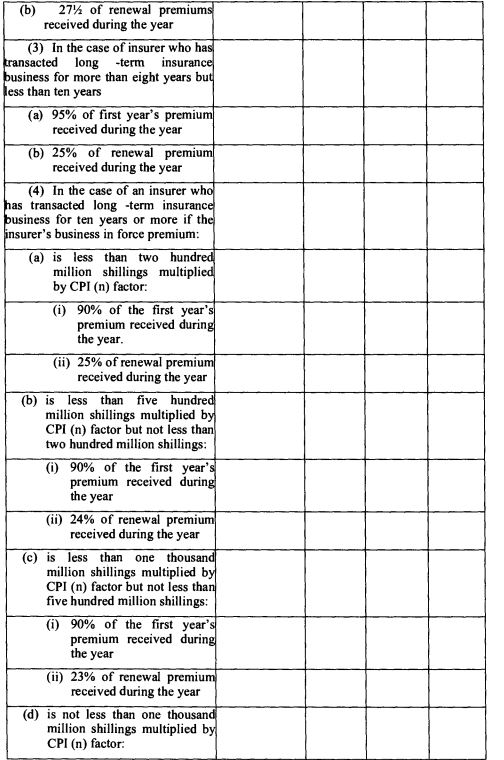

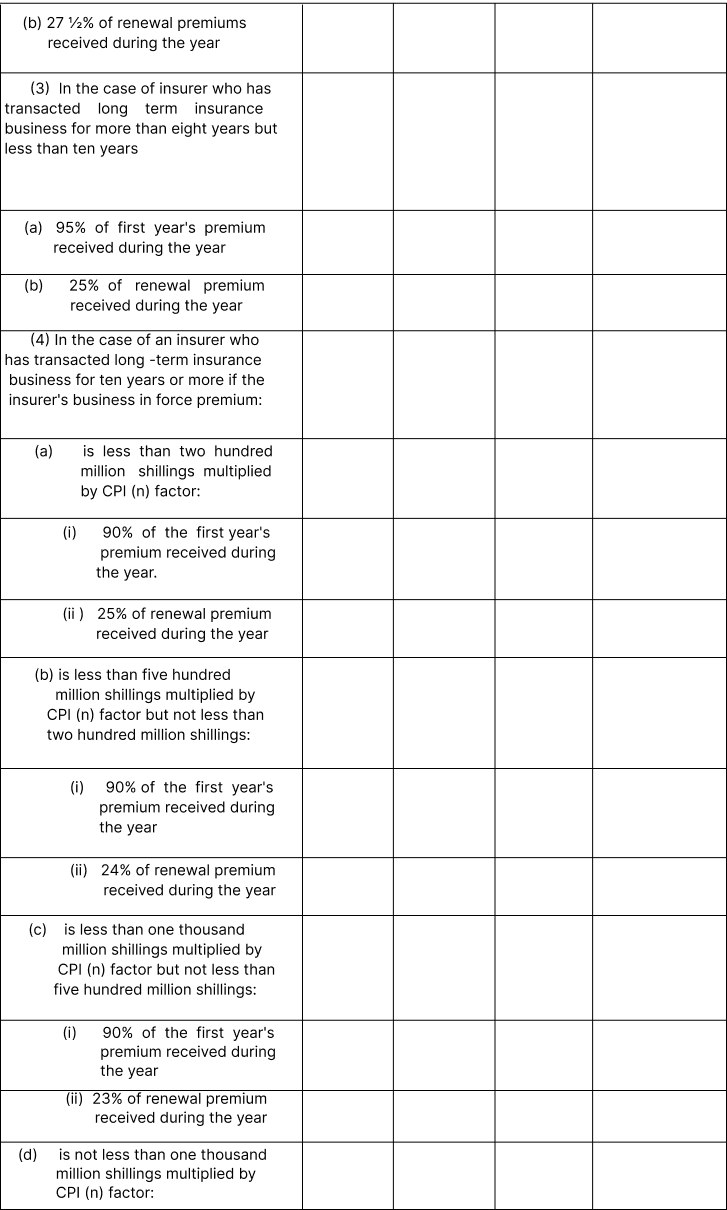

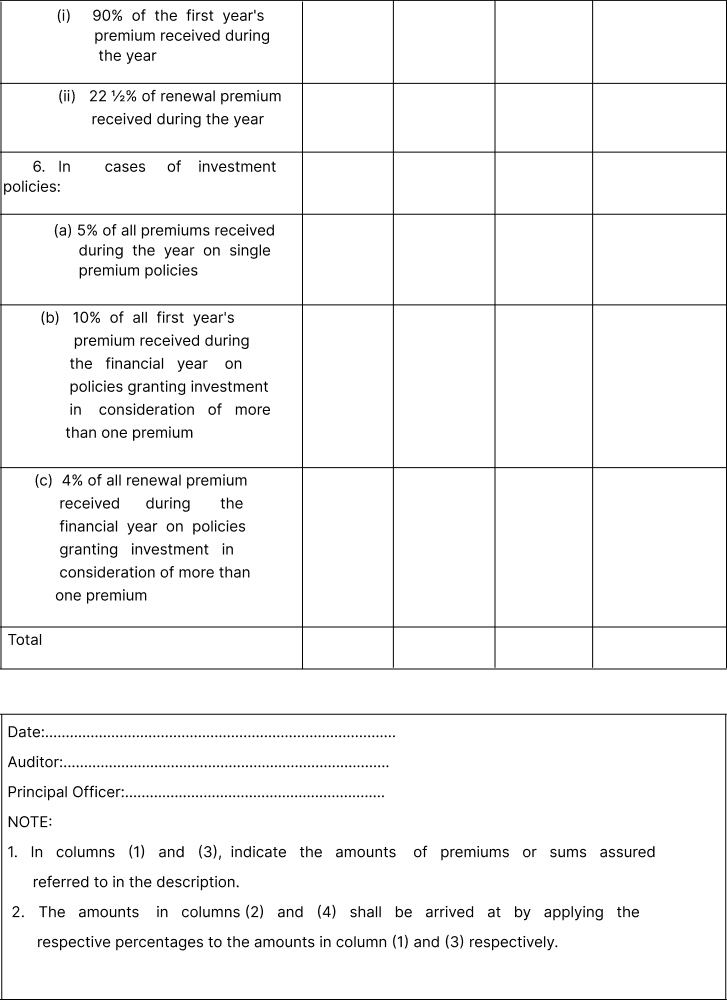

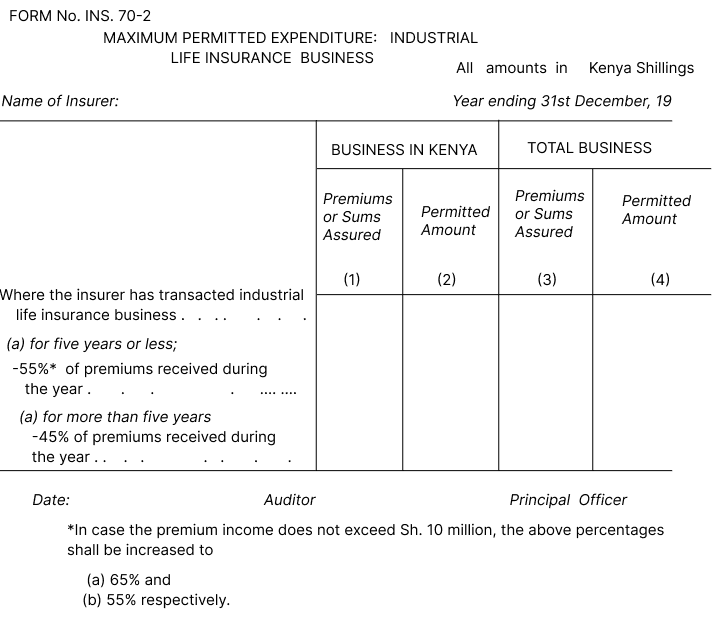

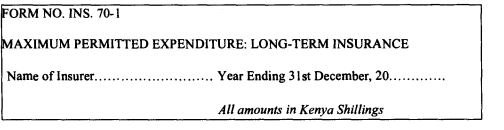

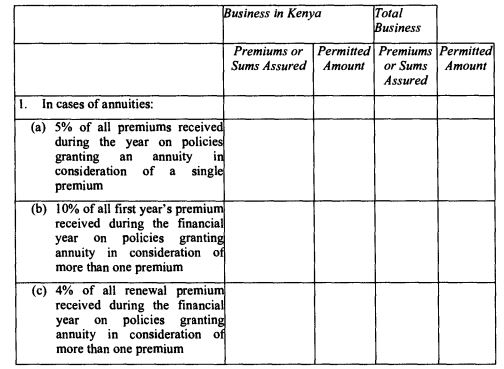

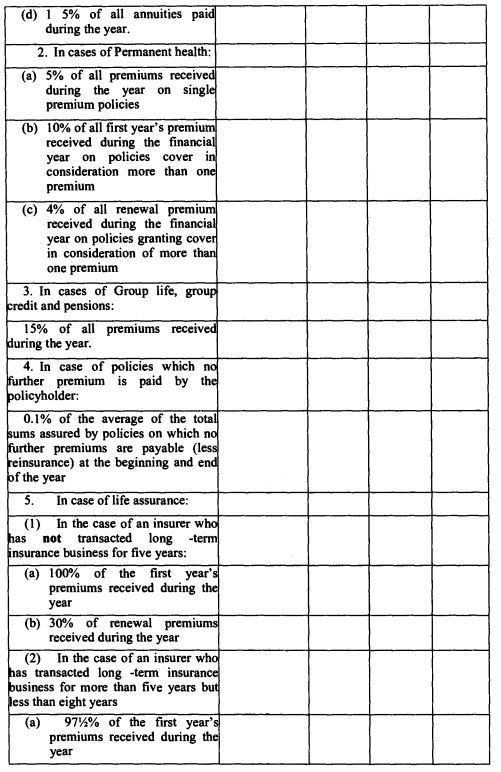

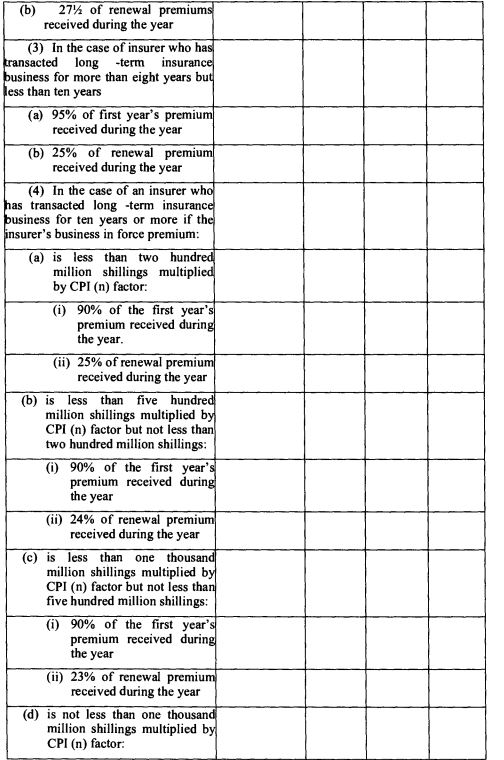

Management expenses

| (1) |

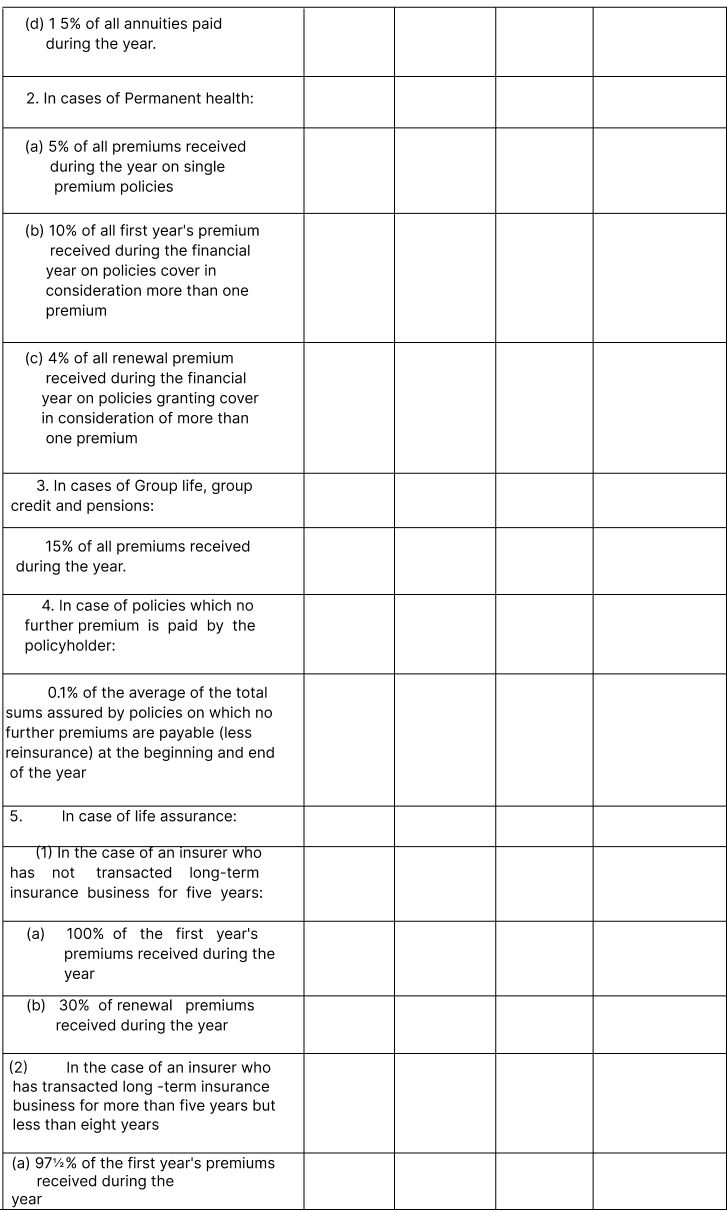

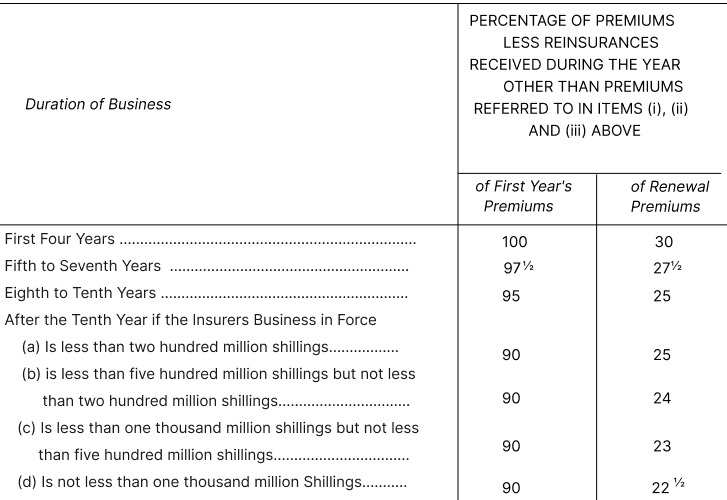

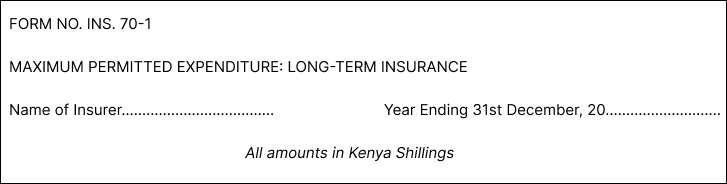

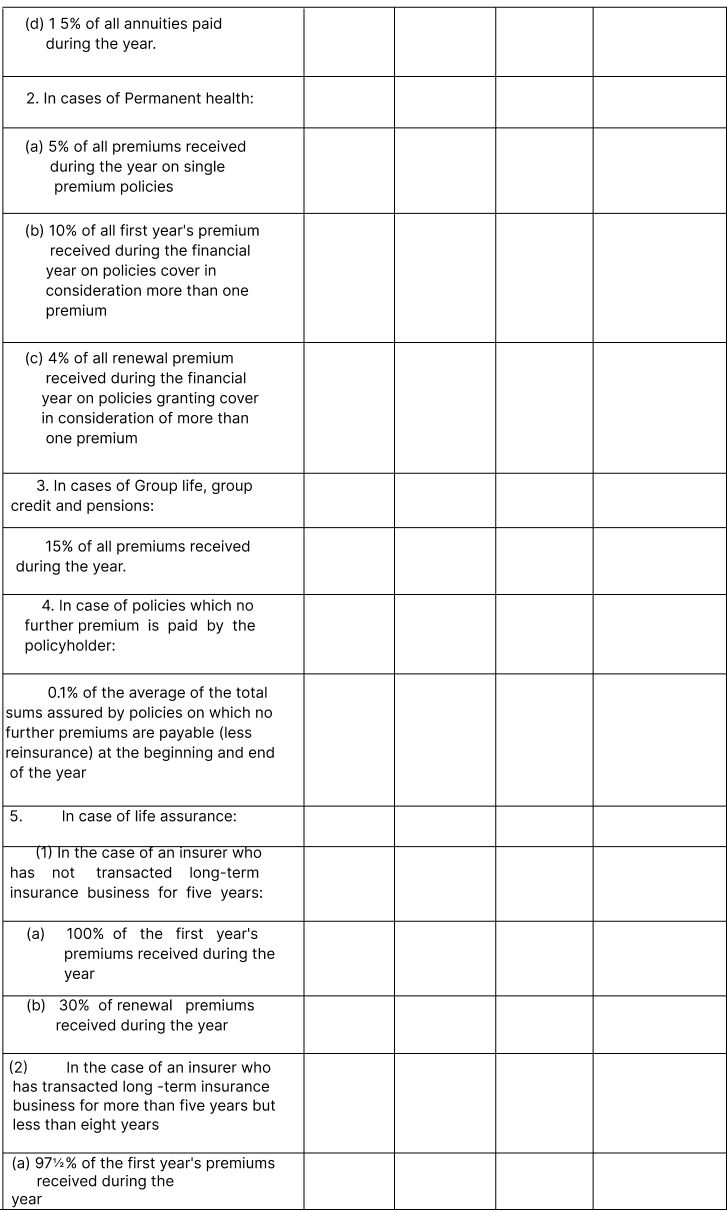

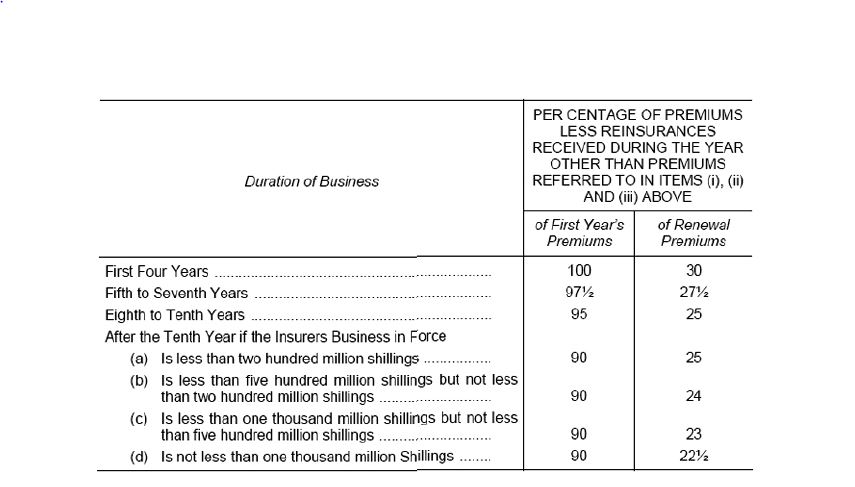

For the purposes of section 70(1) of the Act the limits of management expenses shall be as set out in Part A of the Tenth Schedule.

|

| (2) |

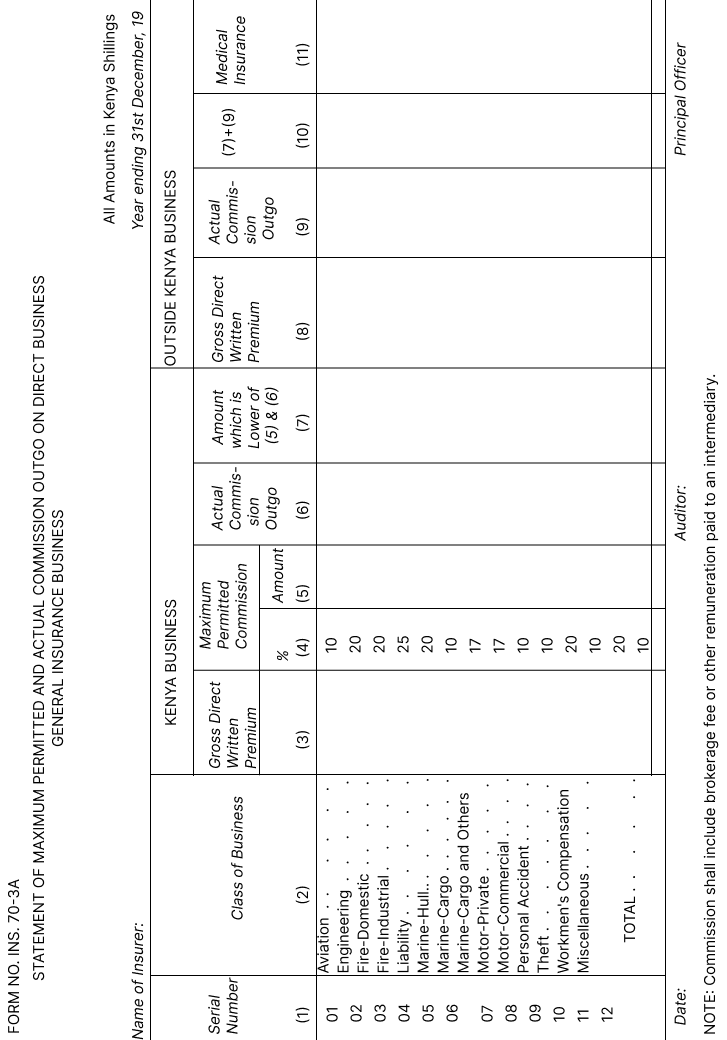

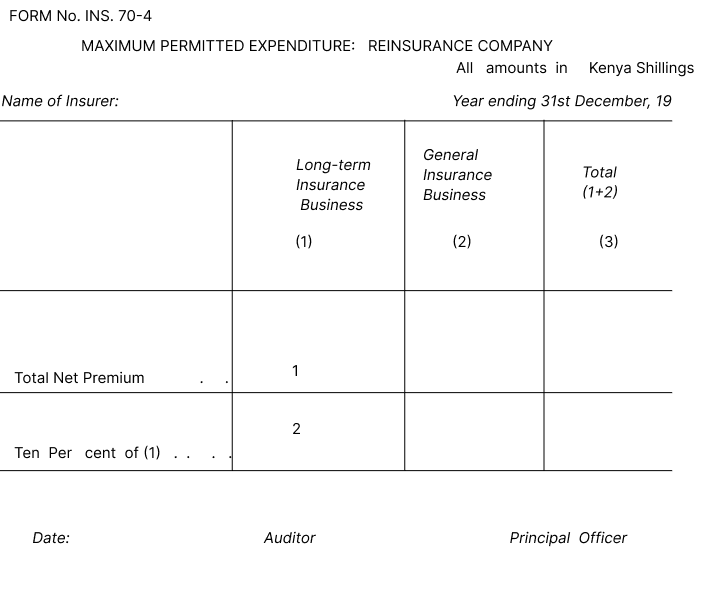

Every insurer shall submit statements in forms Nos. INS. 70-1, INS. 70-2, INS. 70-3, INS. 70-3A, INS. 70-4 set out in part B of the Tenth Schedule as may be applicable, within four months of the period to which they relate, duly certified by the principal officer.

[L.N. 57/2012, r. 6.]

|

|

| 22. |

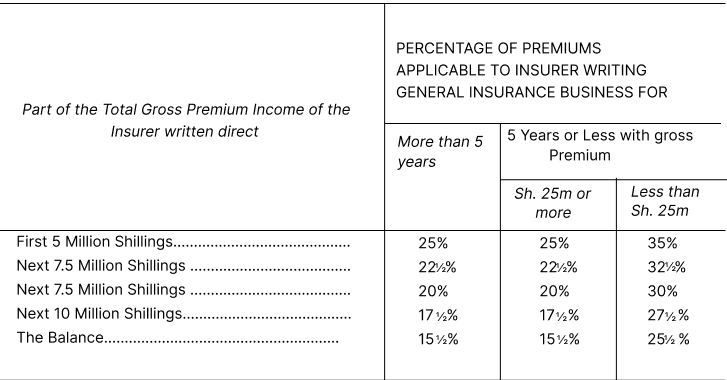

Restriction on commission

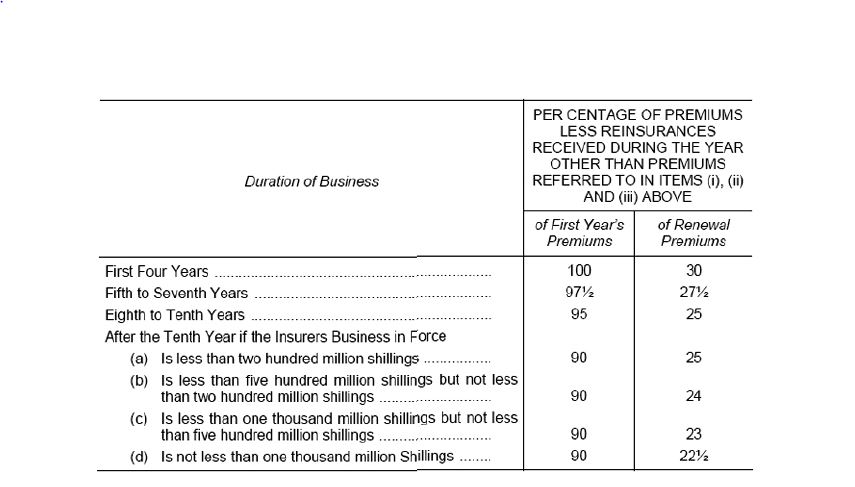

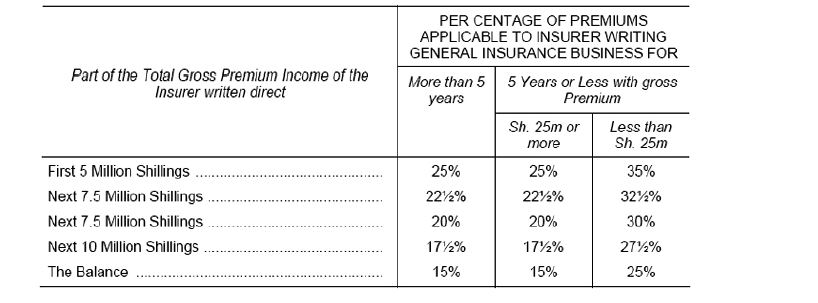

For the purposes of section 73(2) of the Act, the maximum rates of brokerage, commission, payable by an insurer shall be those specified in the Eleventh Schedule in respect of the classes of business specified in that schedule.

[L.N. 108 of 2002, r. 4.]

|

PART VI – POLICY TERMS

| 23. |

Exemption from the provision regarding avoidance of contracts of unlimited amounts

The following categories of contracts shall be exempt from the operation of section 78 of the Act, namely—

| (a) |

contracts of insurance covering the liability under the Insurance (Motor Vehicles Third Party Risks) Act (Cap. 405);

|

| (b) |

contracts of insurance covering the liability of an employer to the employee under common law.

|

|

| 24. |

Paid up policies

For the purposes of section 88(1) of the Act, the rules on paid up policies shall be those specified in the Twelfth Schedule.

|

| 25. |

Surrender values

For the purposes of section 89 of the Act, the surrender value of a policy shall be calculated in accordance with the rules set out in the Thirteenth Schedule.

|

| 26. |

Payment of interest on overdue premiums

For the purposes of section 90(2) of the Act the prescribed terms shall be terms under which the amount of interest chargeable in respect of an overdue premium would be an amount calculated at a rate of interest not exceeding ten percentum per annum on the overdue premium compounded annually.

|

| 27. |

Paid up industrial life policies

For the purposes of section 91(4) of the Act the prescribed rules shall be those set out in the Twelfth Schedule.

|

| 28. |

Certain policies to which sections 88-92 do not apply

In accordance with subsection (2) of section 93 of the Act, it is declared that the provisions of sections 88 to 92 (inclusive) of the Act shall apply in respect of each of the classes of policies specified in this regulation, subject to the modifications declared in the paragraph of this regulation in which that class is specified—

| (a) |

Family Income Policies and Policies which provide other additional benefits on death within a specified term—

If a policy provides income or other additional life insurance benefits so that the amount payable (exclusive of bonuses) in the event of death within a specified term dating from the commencement of the policy exceeds the amount payable (exclusive of bonuses) in the event of death or survival after the expiry of the specified term (which latter amount is hereinafter referred to as the basic sum insured), the paid up policy to which the policy owner is entitled shall be payable on the same contingencies as the basic sum insured only, and shall not carry such additional benefits.

|

| (b) |

Policies which include certain contingent additional benefits—

If a policy includes provision for a benefit payable in an event other than death or survival, or a benefit payable in the event of death by accident or in the event of a specified sickness only (either or both of which benefits are hereinafter referred to as additional benefits), the paid up policy to which the policy owner shall be entitled shall be calculated in accordance with the rules set out in the Twelfth Schedule; and for the purpose of that calculation the additional benefits shall be ignored, and the paid up policy shall not provide any part of the additional benefits.

|

| (c) |

Option Policies—

If a policy contains provision for the contract thereunder to be varied at the option of the owner of the policy on a specified date or on the happening of a specified event and the policy owner becomes entitled to a paid up policy before that option has been exercised, the paid up policy to which the policy owner shall be entitled shall be that to which he would be entitled if the policy did not include provision for that optional variation.

|

| (d) |

Altered Ordinary Life Policies—

In cases where, since the issue of any ordinary policy, the contract thereunder has been varied at the request of the policy owner in such a manner that either the date upon which the sum insured becomes payable, or the term during which premium payments are to be made, or both, have been altered, the paid up value of the policy shall be calculated according to the rules determined for the purpose by the insurer’s actuary.

|

| (e) |

Policies providing for endowment insurance payable in instalments depending on survival with level premiums until the last instalment is paid—

If an endowment insurance policy provides for payment of the sum assured by instalments depending on survival and full sum assured or any unpaid balance at death, premiums being payable at a level rate until the final balance of the sum insured has been paid, the paid up policy value of such a policy shall be calculated according to rule 2 instead of rule 1 of the rules set out in the Twelfth Schedule:

Provided that—

| (i) |

if, according to the practice of the insurer, on the policy being made paid up, the paid up amount is payable in one lumpsum on death or at maturity instead of instalments as provided in the original contract, this factor shall be allowed for in the calculation of the paid up value of the policy under rule 2 of the Twelfth Schedule; and |

| (ii) |

for the actual calculation of paid up values of policies referred to in this paragraph an insurer may use, with the approval of the Commissioner, working rules framed by the insurer’s actuary consistent with the provision of this paragraph. |

|

| (f) |

Paid up Policies—

Where a policy has been rendered paid up (whether by the grant of a paid up policy as required by the Insurance Act or otherwise) and a calculation of the surrender value of the policy is subsequently required to be made, the calculation shall be made according to the rules set out in the Thirteenth Schedule, and the amount of the paid up policy of which the present value is to be found in terms of rule 1 of those rules shall be the actual amount of the paid up policy.

|

|

PART VII – NOMINATIONS

| 29. |

Nomination of minors

For the purposes of the proviso to section 111(1) of the Act, the appointment of a person to receive the money secured by a policy in the event of the death of the holder of a policy during the minority of the nominee shall be in the form set out in the Fourteenth Schedule.

|

| 30. |

Fee for registering, cancelling or changing a nomination

An insurer may charge a policy-holder ten shillings for registering a nomination or its cancellation or change pursuant to section 111(3) of the Act.

|

PART VIII – CLAIMS ON SMALL LIFE POLICIES

| 31. |

Fee for adjudication

The fee to be charged and collected for an adjudication under section 112 of the Act shall be two percentum of the sum assured of the policy in dispute or one hundred shillings, whichever is the greater amount.

|

PART IX – MANDATORY REINSURANCE CESSIONS

| 32. |

Mandatory cessions

For the purposes of section 145 of the Act, the proportions of business which shall be ceded to the Corporation by insurers, the manner of cessions and the terms and conditions applicable shall be those set out in the Fifteenth Schedule for the various classes of insurance business specified in that schedule.

|

| 33. |

Payment of re-insurance cessions

Payment by insurers to the Corporation in respect of re-insurance effected under Part XIV of the Act shall made within the periods of payment specified in the Fifteenth Schedule.

|

PART X – INTERMEDIARIES, CLAIMS SETTLING AGENTS, INSURANCE SURVEYORS, MEDICAL INSURANCE PROVIDERS, LOSS ADJUSTERS, MOTOR ASSESSORS, INSURANCE INVESTIGATORS AND RISK MANAGERS

| 34. |

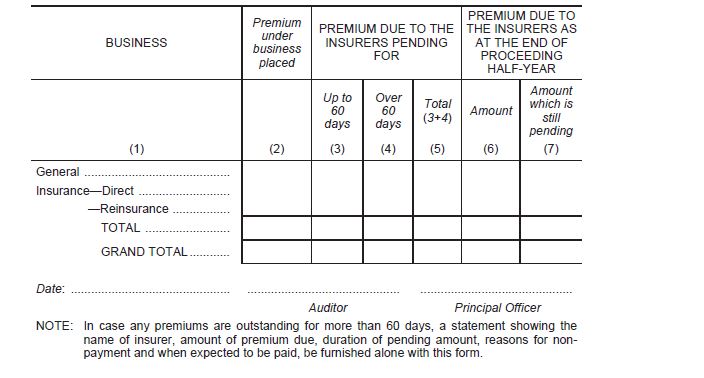

Forms of application for registration and renewal of registration of intermediaries, etc

| (1) |

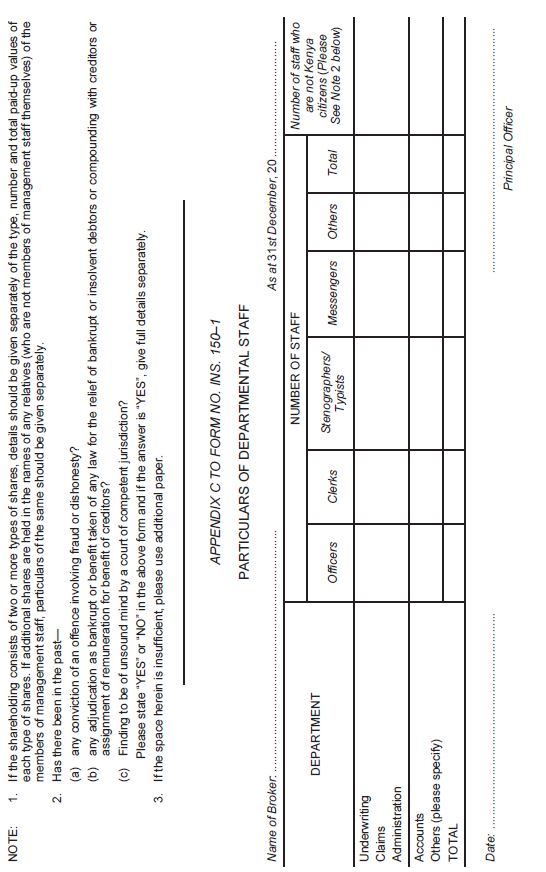

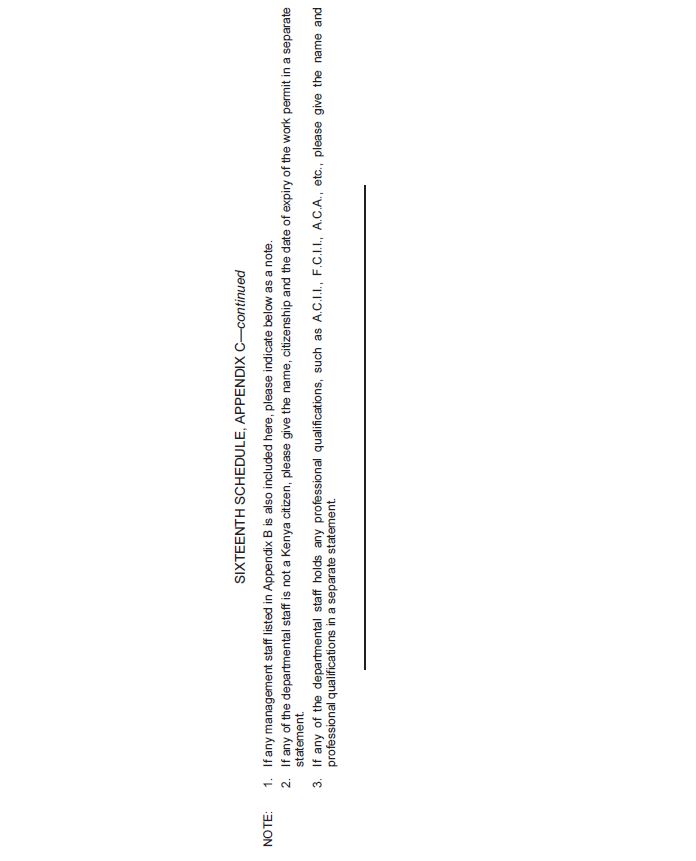

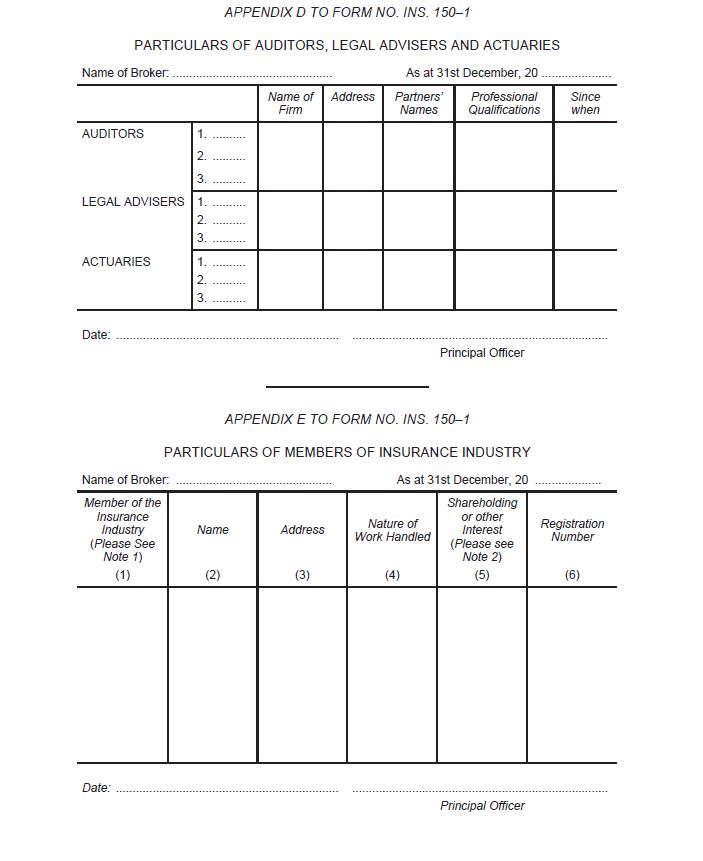

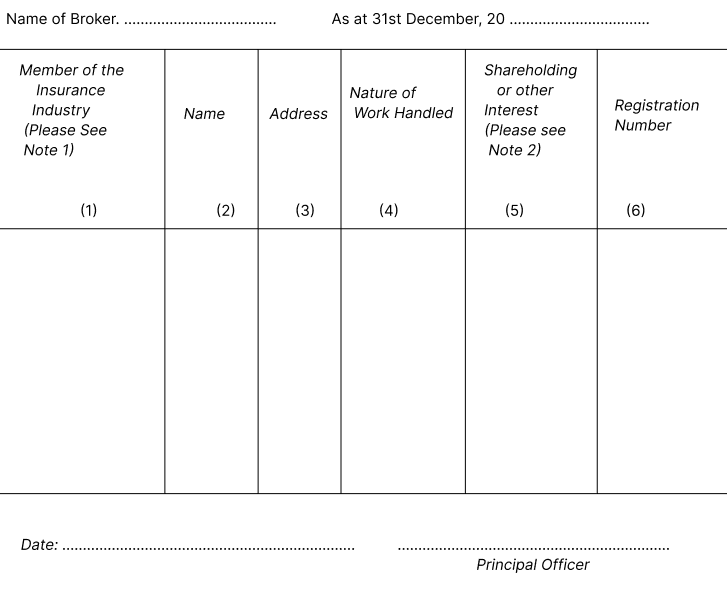

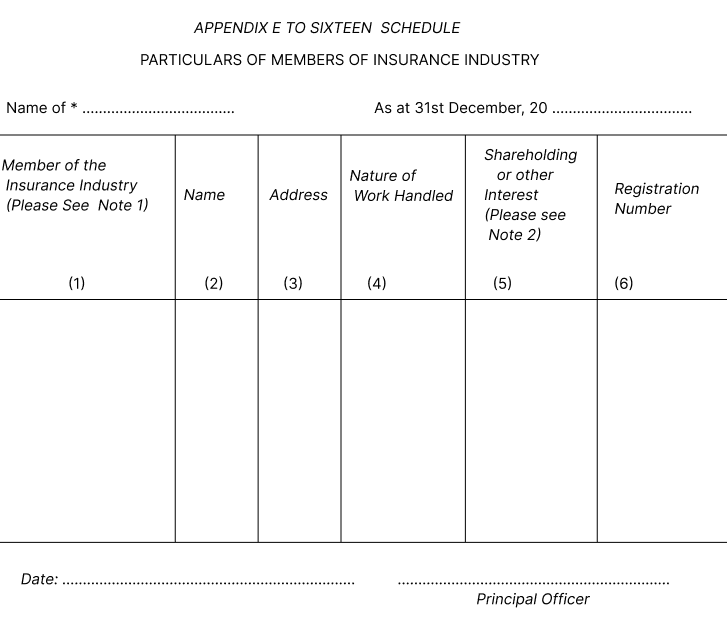

The forms set out in the Sixteenth Schedule shall be used by brokers, agents, risk managers, motor assessors, insurance investigators, loss adjusters, insurance surveyors, medical insurance providers, bank assurance intermediaries and claims settling agents when applying for registration underthe Act and shall be submitted together with the appendices thereto prescribed in that Schedule.

|

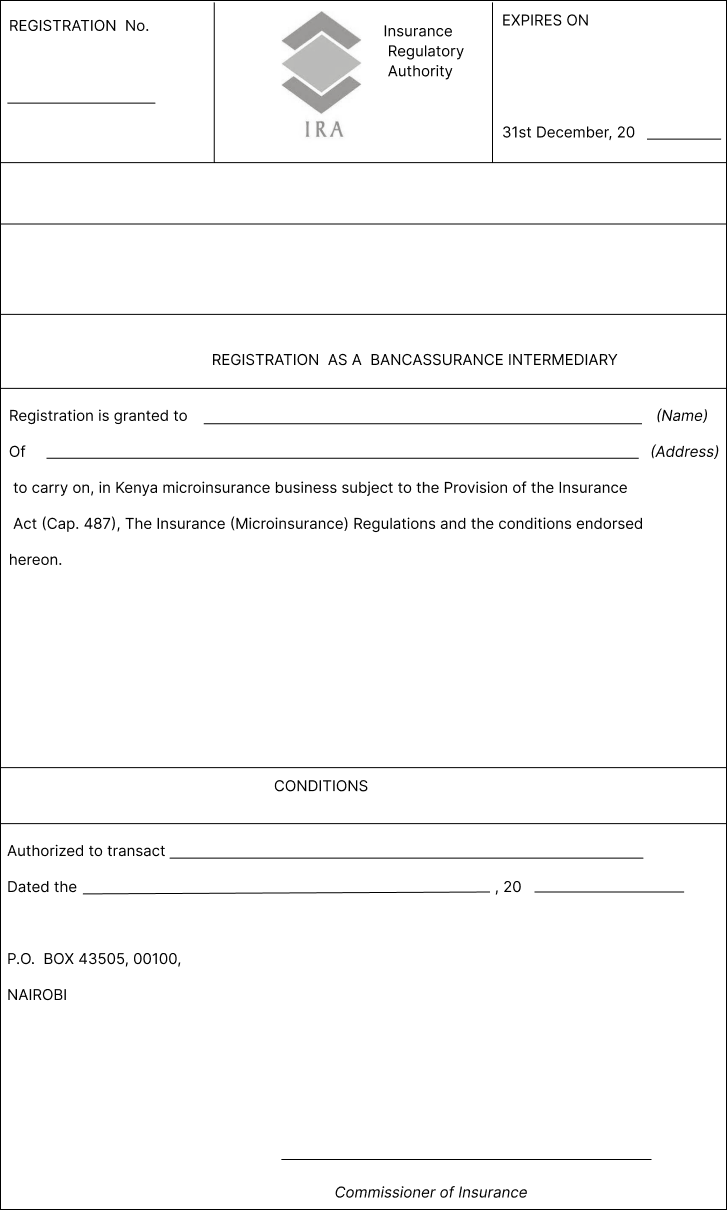

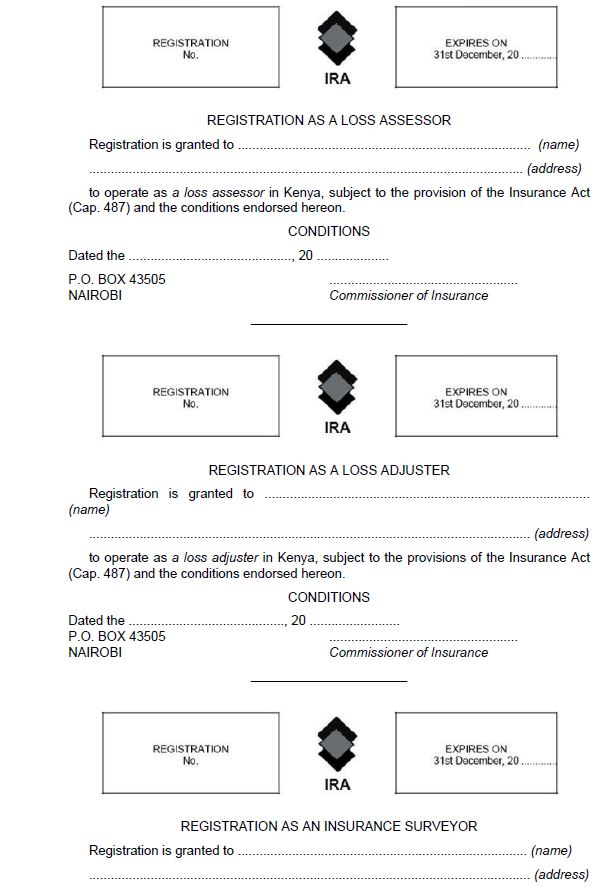

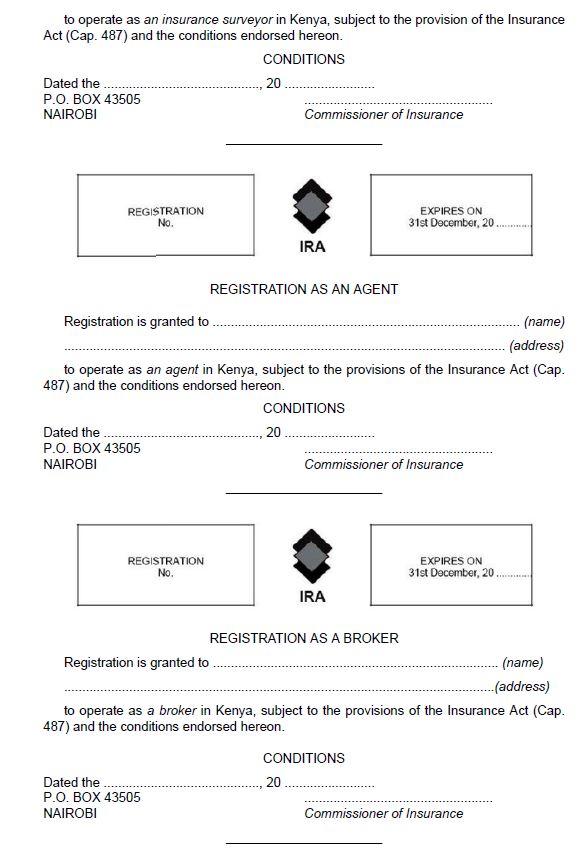

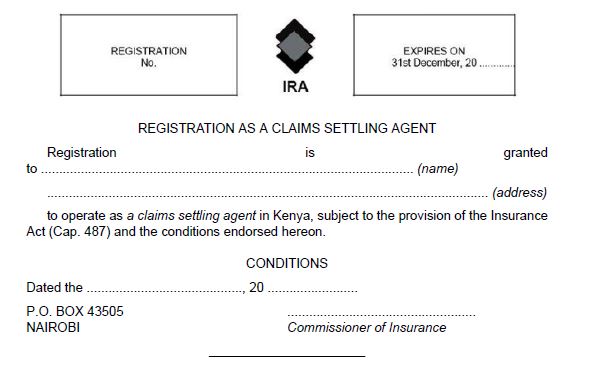

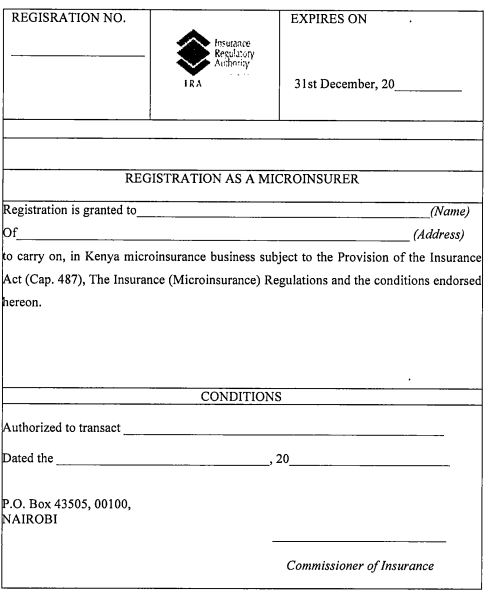

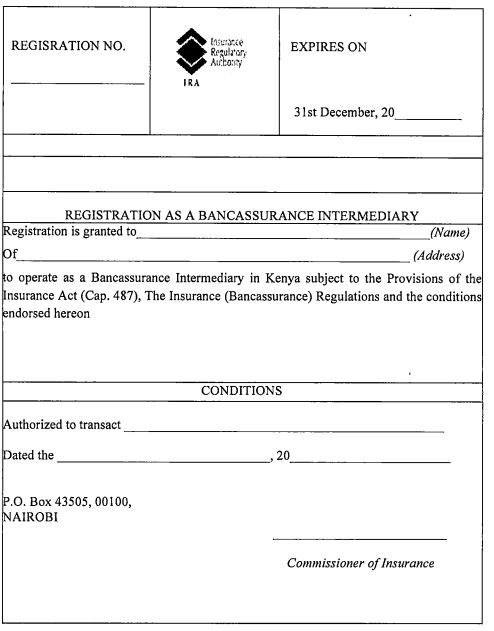

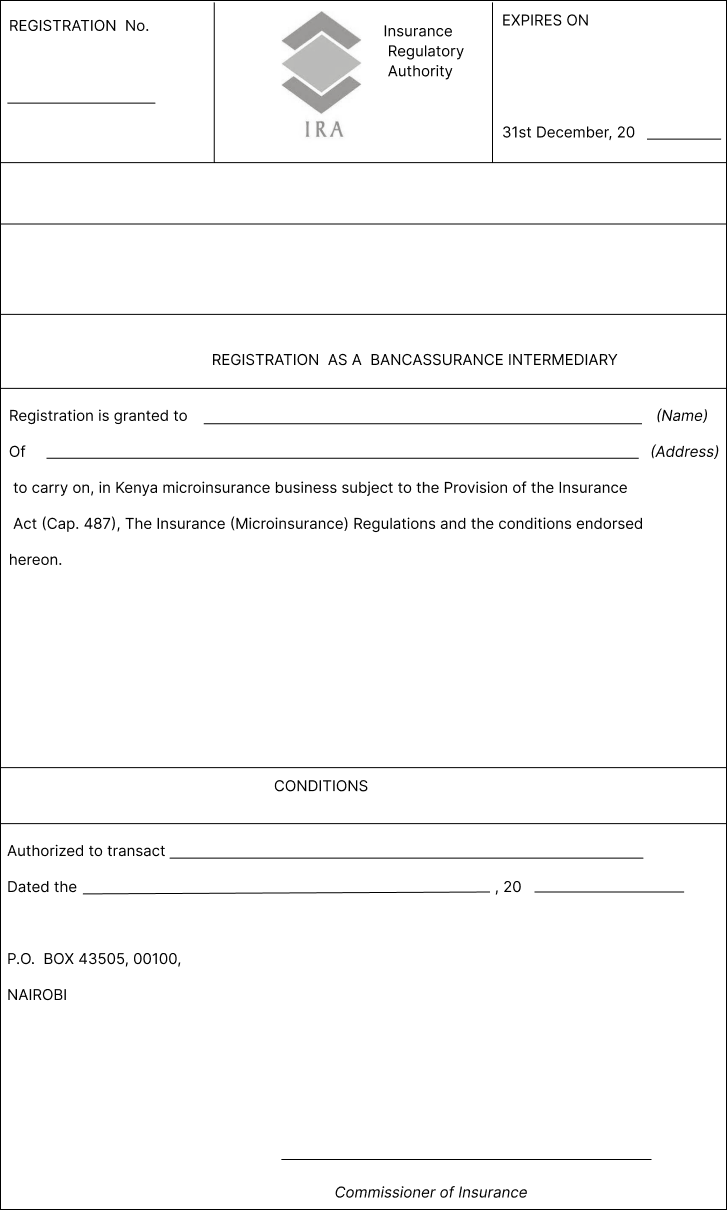

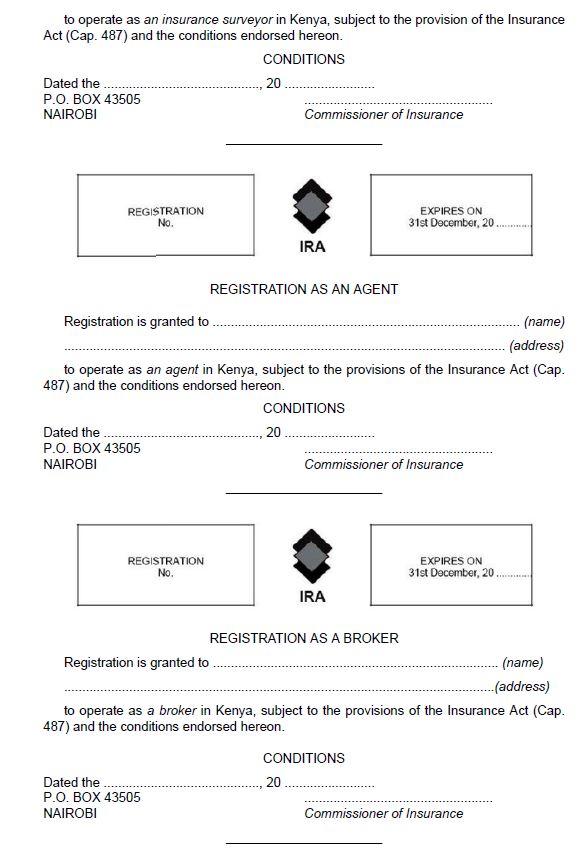

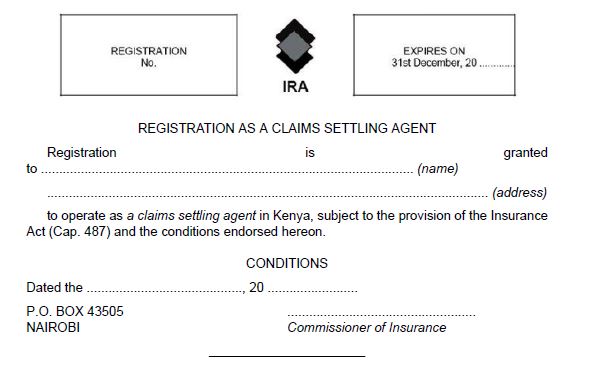

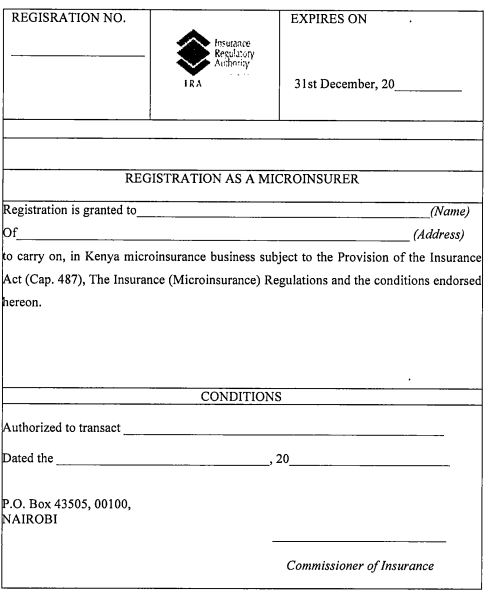

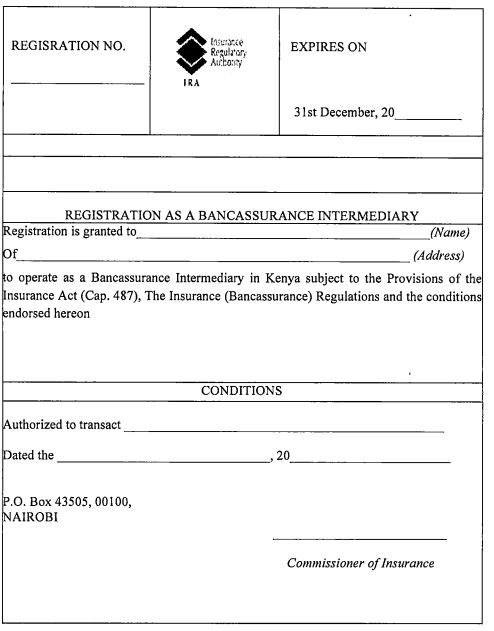

| (2) |

For purposes of registration of insurers registration and renewal of registration of micro-insurers agents, brokers, risk managers, motor assessors, insurance investigators, loss adjusters, insurance surveyors, medical insurance providers, bancassurance intermediaries and claims settling agents the registration certificates to be issued on registration shall be in the forms set out in the Twenty-Second Schedule.

[L.N. 52/1987, r. 2, L.N. 57/2012, r. 7, r. 8, L.N. 275/2017, r. 2, L.N. 69/2022, r. 2.]

|

|

| 35. |

Policy of professional indemnity for a broker

For the purposes of section 151(1)(a) of the Act, the policy of professional indemnity insurance to be taken out by a broker or medical insurance provider shall be as prescribed in the Seventeenth Schedule.

[L.N. 57/2012, r. 9.]

|

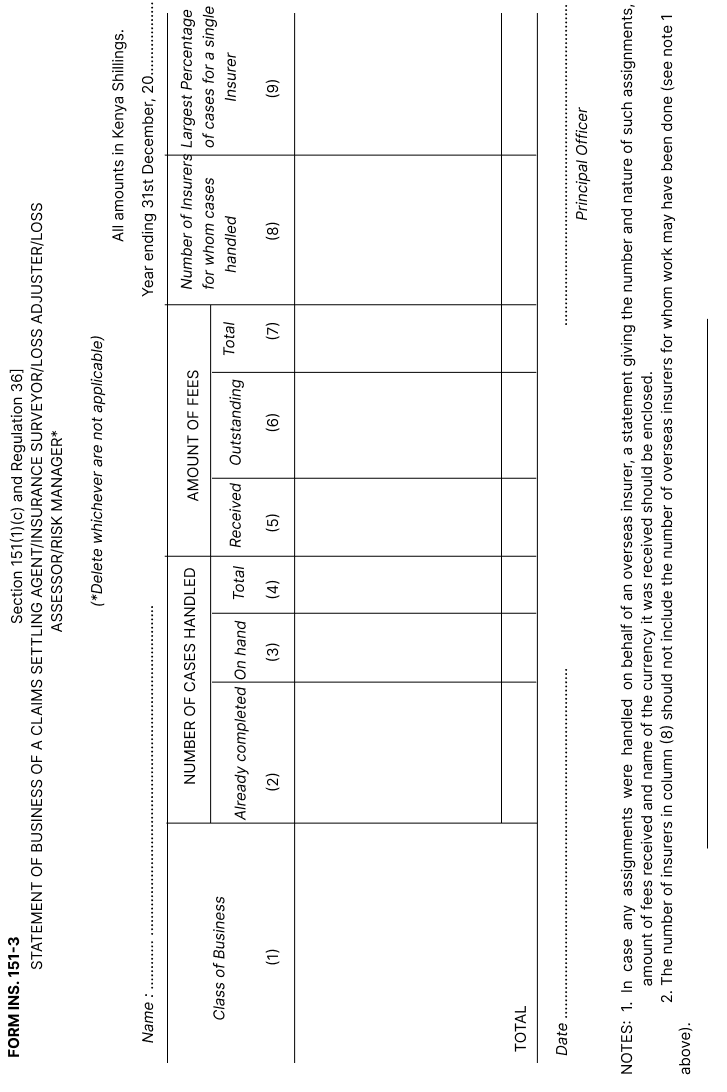

| 36. |

Statement of business

For the purposes of section 151(1)(c), every agent, broker, claims settling agent, insurance surveyor, medical insurance provider, loss adjuster, motor assessor, insurance investigator and risk manager, shall submit a statement of business in the appropriate form prescribed in the Eighteenth Schedule and in accordance with the notes thereto.

[L.N. 57/2012, r. 10.]

|

| 37. |

Fees payable

The fees for registration and renewal of registration under sections 151(1)(d) and 188(2) of the Act shall be as follows—

|

|

Ksh

|

|

Insurance broker

|

10,000

|

|

Risk manager

|

3,000

|

|

Motor assessor

|

3,000

|

|

Insurance investigator

|

3,000

|

|

Loss adjuster

|

3,000

|

|

Insurance surveyor

|

3,000

|

|

Medical insurance agent

|

10,000

|

|

Claims setting agent

|

3,000

|

|

Insurance Agent

|

1,000

|

|

Corporate insurance agent

|

1,000

|

[L.N. 189/1994, r. 2, L.N. 57/2012, r. 11.]

|

| 38. |

Other documents

For the purposes of section 151(1)(e) of the Act, a broker, an insurance provider who is already carrying on business on the appointed date shall, at the time of the application forthe first registration under the Act, submit—

| (a) |

an audited profit and loss account;

|

| (b) |

an audited balance sheet;

|

| (c) |

a report from an auditor as to whether—

| (i) |

proper accounting records have been kept; |

| (ii) |

proper returns adequate for audit have been received; |

| (iii) |

the balance sheet and profit and loss accounts are in accordance with the accounting records: |

| (i) |

if the auditor is unable to make a positive opinion in respect of the matters specified in this paragraph he shall state that fact in his report and shall qualify the report if he fails to obtain all the information and explanations which are necessary for the purposes of the audit; and |

| (ii) |

if the broker carries on any other business, he shall attach a supplementary statement— |

|

|

| 39. |

Bank guarantee for broker’s registration

For the purpose of section 153(1) of the Act the form of guarantee which may be required of a broker by the Authority shall be as set out in Form 153-1 in the Nineteenth Schedule or in the form of a two-year Government bond held by the Authority, and the minimum amount of the guarantee shall be, at the time of first registration of the broker and at the time of subsequent renewals, three million shillings.

Provided that a broker who is registered before the commencement of this provision shall provide the guarantee referred to herein within a period of eighteen months from the date of such commencement.

[L.N. 124/1994, r. 2, L.N. 75/1999, r. 2, L.N. 108/2002, r. 5, L.N. 65./2006, r. 2, L.N. 2/2007, r. 2, L.N. 97/2009, r. 3, L.N. 85/2010, r. 3.]

|

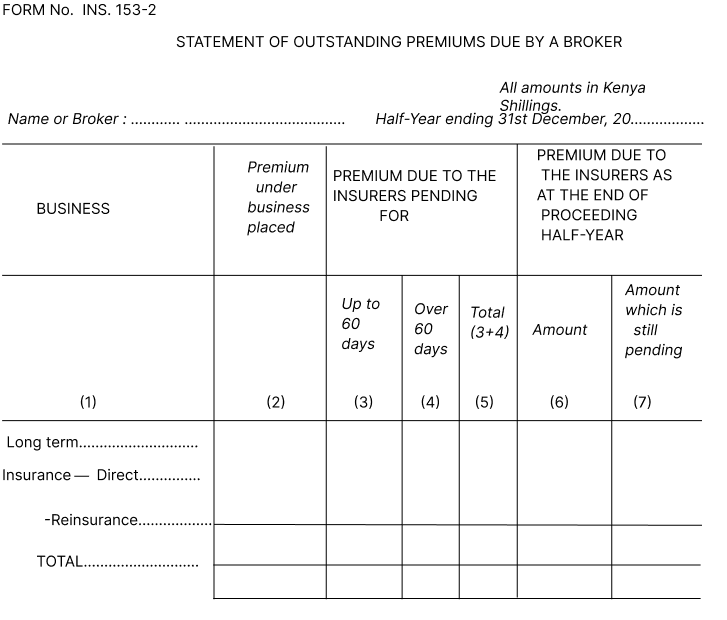

| 40. |

Returns by corporate persons under the Act

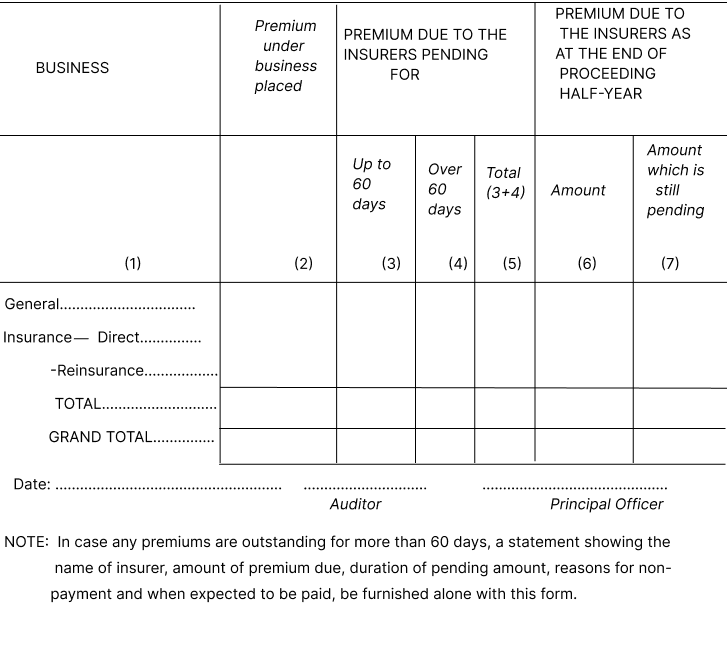

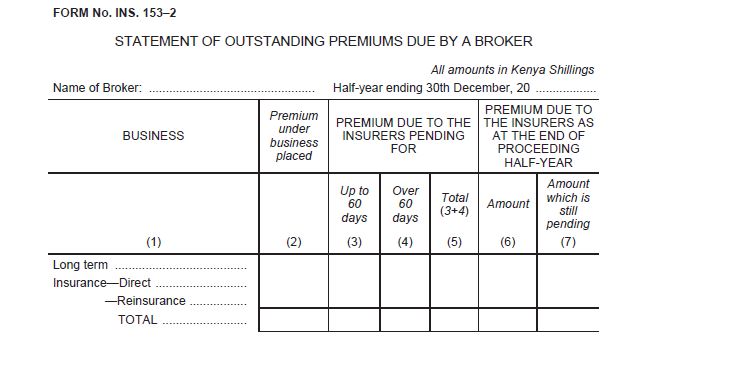

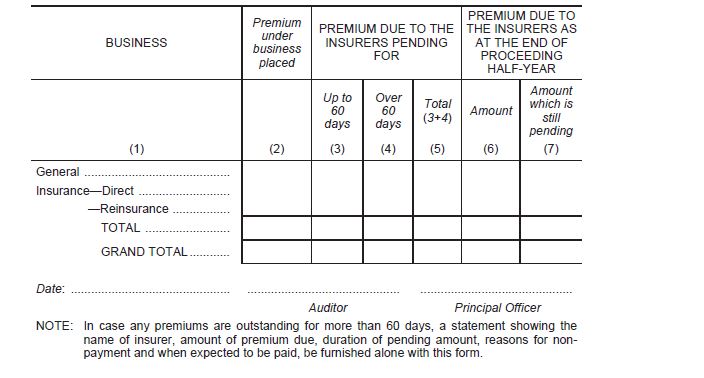

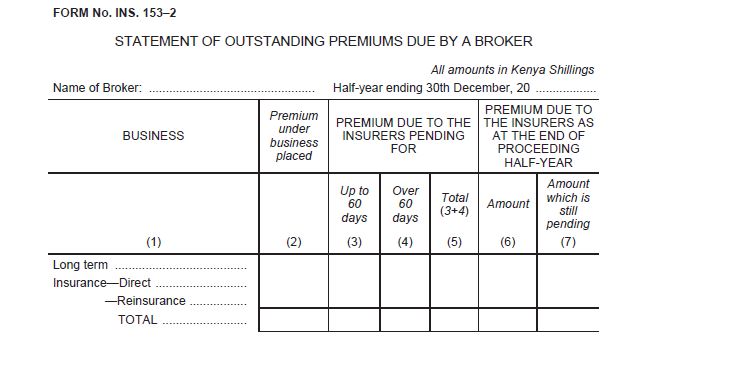

For the purposes of section 155 of the Act, every corporate person registered under Part XV - of the Act, shall furnish to the Commissioner, within four months after the end of the period to which they relate, such audited accounts and statements together with the auditors’ report as are required to be prepared as may be prescribed by the Authority, from time to time shall, in addition, furnish, within sixty days from the end of each half year, audited statements showing the total amount of premium due from the broker to all insurers in Kenya remaining outstanding as at 30th June and 31st December of every year in respect of risks placed with the insurers before the respective dates and also separately, in respect of risks placed with the insurers before the respective dates and also separately, in respect of risks placed more than sixty days prior to the respective dates, in Form No. INS. 153–1 in the Nineteenth Schedule.

[L.N. 85/2010, r. 4, L.N. 57/2012, r. 13.]

|

PART XI – ADVANCE PAYMENT OF PREMIUM

| 41. |

Advance payment of premium

For the purposes of section 156(1) of the Act, a risk in respect of a policy may be assumed before the premium payable in respect thereof is received—

| (a) |

if the entire amount of premium is guaranteed to be paid by a bank licensed under the Banking Act (Cap. 488);

|

| (b) |

if an advance deposit is made with the insurer to the credit of the insured sufficient to cover the payment of the entire amount of the premium together with the premium, if any, due from the insured in respect of any other risk already assumed against such deposit, such deposit being agreed to be adjusted towards the premium.

|

|

| 42. |

Despatch of premium

For the purposes of section 156(4) of the Act, the premium collected by an agent or a received by him shall be deposited with or despatched to the insurer immediately upon the receipt thereof.

[L.N. 91/2003, r. 3.]

|

| 43. |

Relaxations

For the purposes of section 156(5) of the Act, in respect of the categories of insurance policies mentioned hereunder the provisions of subsection (1) of section 156 of the Act and regulation 41 shall stand relaxed to the extent and in the manner mentioned in respect of each category of policy, subject to the conditions mentioned therein—

| (a) |

Policies under Sickness Insurance Scheme—

Premiums on such policies may be accepted in instalments provided that the instalment covering a particular period shall be received on or before the date of commencement of the period.

|

| (b) |

Declaration Policies—

Risks in respect of such policies may be insured if at least the premium calculated on 75 percentum of the sum insured has been received before assumption of the risk.

|

| (c) |

Policies issued on the basis of adjustable premiums—

Risk in respect of policies issued on the basis of adjustable premium such as workmen’s compensation, cash in transit, and others, may be assumed on receipt of provisional premiums based on a fair estimate.

|

| (d) |

Annual insurances connected with aircraft hulls and marine hulls—

Facilities for delayed payment of premium on such policies, or the payment of premiums by means of instalments not exceeding four in number and on the basis of an approved clause, may be allowed at the discretion of the insurer, provided that such clause is endorsed on the policy.

|

| (e) |

Short period covers in respect of insurance connected with aircraft hulls and marine hulls—

Short period covers may be granted on such risks on a held covered basis, subject to the condition that the premium or additional premium in respect of risks assumed in a calendar month shall be paid by the end of the next calendar month.

|

| (f) |

Policies issued for long term—

In the case of policies issued for long term, such as contract performance bonds or guarantees, contractors’ all risks policies, machinery erection policies and the like, the premium may be staggered as necessary according to custom, over the period of the cover, provided that the first instalment is higher than any other instalment by at least five percentum of the total premiums payable and each instalment is paid in advance, but where the premium is payable by declaration, it may be paid within fifteen days from the effective date of such declaration.

|

| (g) |

Schedule and Consequential Loss Policies—

In such cases a provisional amount towards the premium shall be collected before the date of inception or renewal of risk on the basis of the previous year’s premium.

|

| (h) |

Marine Covers other than hulls—

| (i) |

In the case of inland shipments and transit risks, risk may be assumed under open policies in respect of seasonal crops such as tea, on the payment of a provisional premium based on a fair estimate. |

| (ii) |

In the case of exports overseas, risk may be assumed subject to the condition that the premium shall be paid within fifteen days from the date of sailing of the overseas vessel; |

| (iii) |

In the case of imports, risk may be assumed subject to the condition that the premium shall be paid within fifteen days of the receipt of declaration in Kenya from the insurer’s or insured’s representative overseas: Provided that the relaxations under subparagraphs (ii) and (iii) shall apply to marine cover notes only and not to marine policies. |

|

| (i) |

Policies relating to co-insurances—

The premiums shall be deemed to have been duly paid if paid on the full insurance to any one of the co-insurers.

|

| (j) |

Policies of reinsurance—

Risks may be assumed without payment of premium in advance in insurances accepted under automatic re-insurance contracts.

|

|

PART XII – GENERAL PROVISIONS

| 44. |

Folio copies

For the purposes of section 177(2) of the Act the fee per page of a document deposited with the Commissioner copied and furnished shall be two shillings.

|

| 45. |

Inspection fees

The fee for inspection of a register under section 185 of the Act shall be ten shillings.

|

| 46. |

Fees for duplicate certificates

The fee for a duplicate certificate under section 189(2) of the Act shall be five hundred shillings.

|

PART XIII – SUPPLEMENTARY PROVISIONS

| 47. |

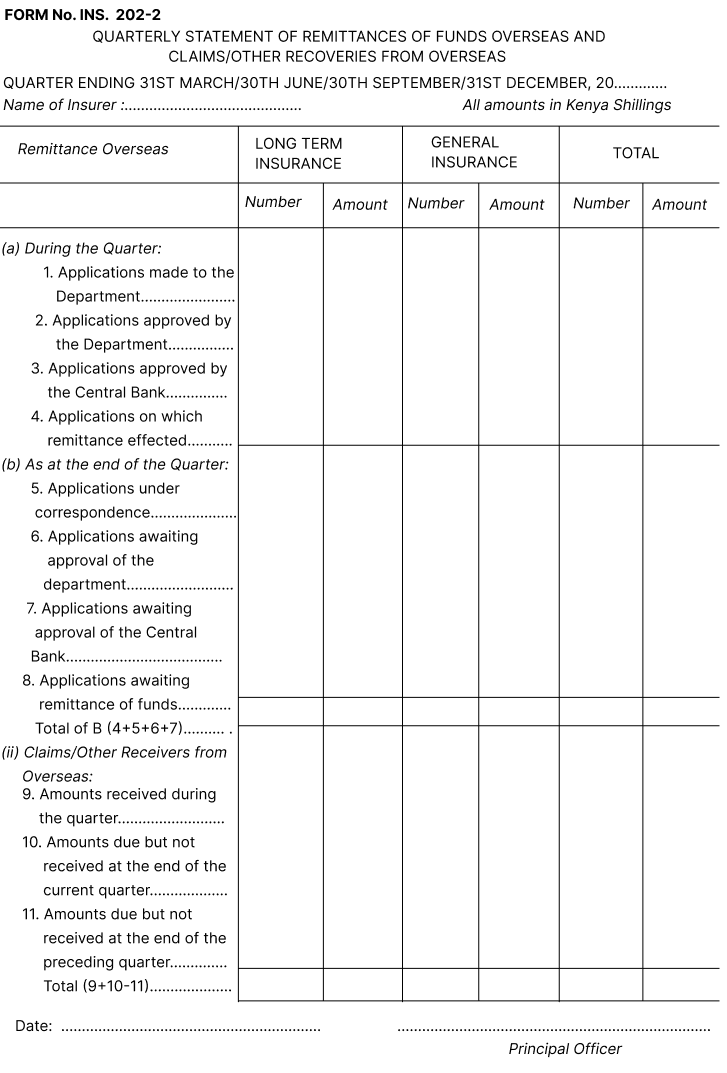

Application for remittance

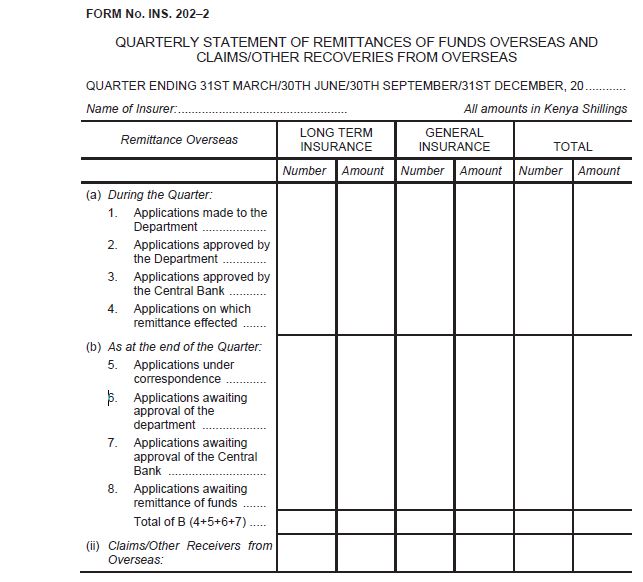

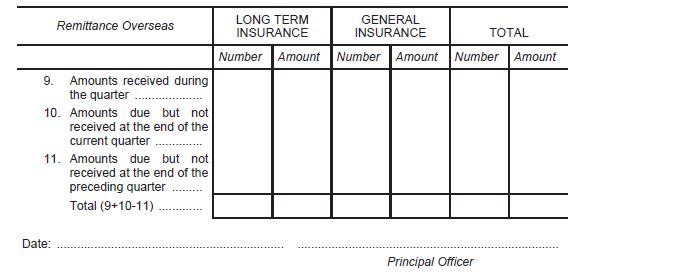

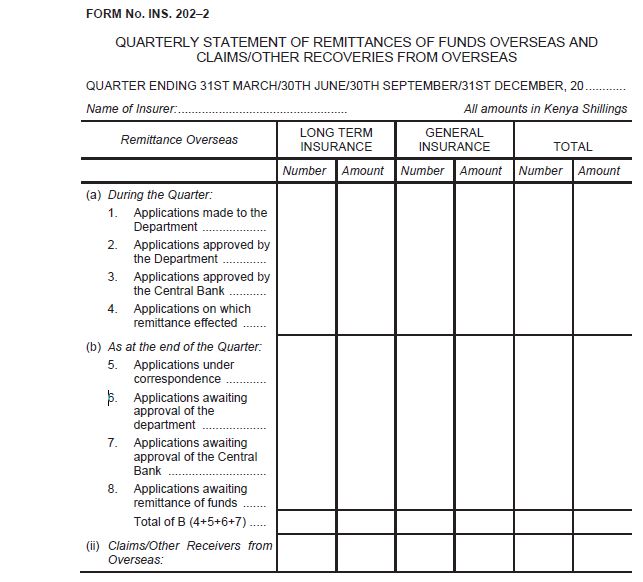

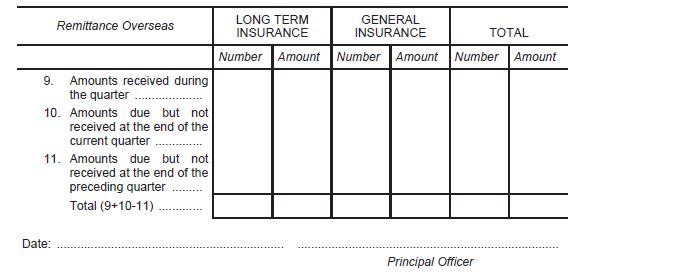

An application for the Commissioner’s approval under section 201 of the Act to remit money or securities out of Kenya shall be made in Form No. INS. 201–1 in the Twentieth Schedule and every insurer shall also furnish to the Commissioner a statement in respect of re-insurance business ceded abroad and re-insurance in Form No. INS. 201–2 in the Twentieth Schedule showing, separately business accepted from abroad and also separately in respect of long term insurance business re-insurance and general insurance business re-insurances, the total amount (in equivalent Kenya shillings remitted abroad and the total amount of recoveries (in equivalent Kenya shillings) made from foreign reinsurers and insurers during each of the quarters ending on the last day of March, June, September and December within one month from the close of the quarter to which it relates; and every such statement shall be signed by the principal officer of the insurer.

|

| 48. |

Claims

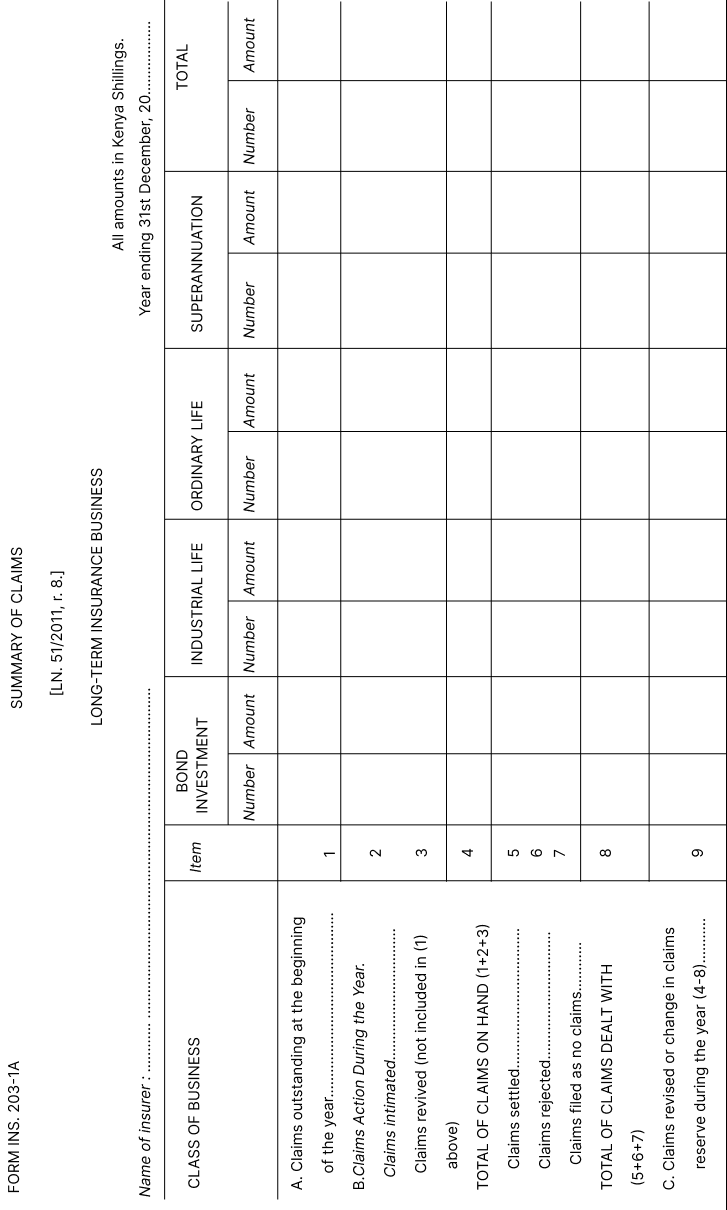

For the purposes of section 203 of the Act, an insurer shall furnish the following statements to the Commissioner duly certified by the principal officer—

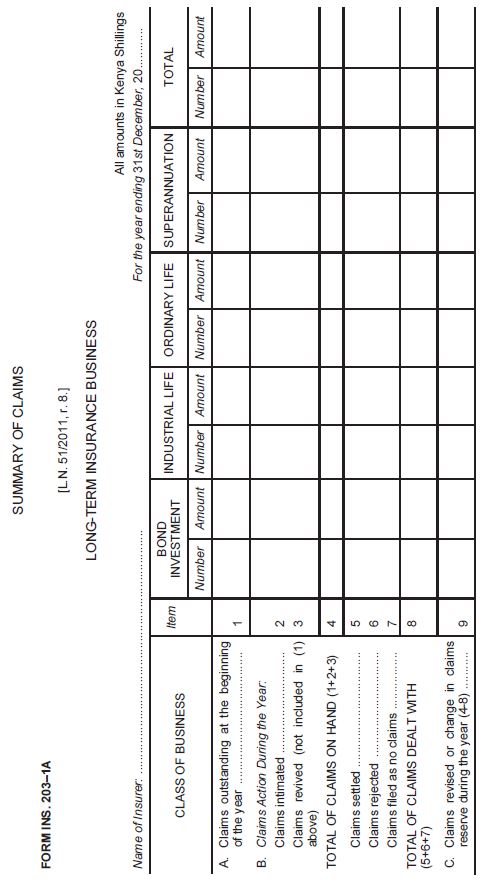

| (i) |

a statement in Form No. INS. 203–1A in the Twenty-First Schedule in respect of the long term insurance business within three months after the end of the period to which it relates; and |

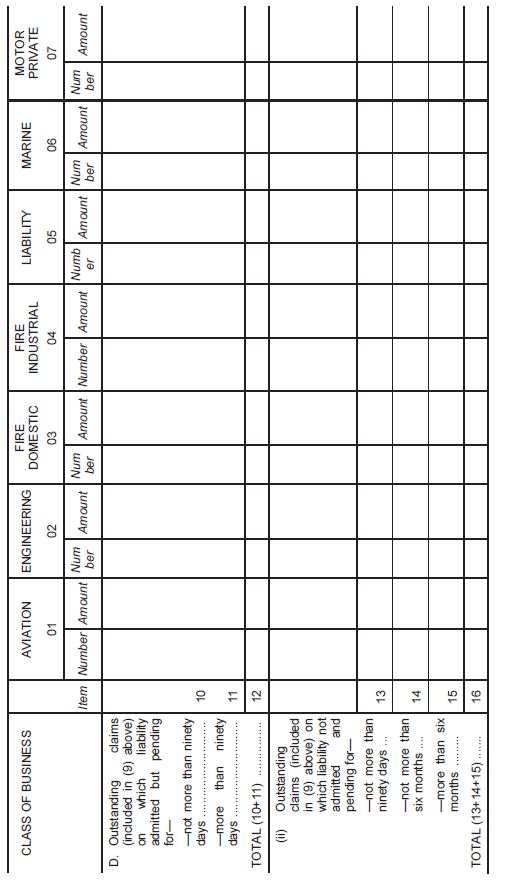

| (ii) |

a statement in Form No. INS. 203–1B in the Twenty-First Schedule in respect of the general insurance business within three months after the end of the period to which it relates; and |

| (iii) |

a statement in Form No. INS. 203–2 in the Twenty-First Schedule in respect of the long term and general insurance business within 15 days after the end of the period to which it relates. |

|

| 49. |

Manner of payment of fees

The fees payable by the members of the insurance industry for registration or renewal of registration under the Act and the Regulations shall be paid to “The Insurance Regulatory Authority”.

[L.N. 97/2009, r. 4, L.N. 85/2010, r. 5.]

|

| 50. |

Reference to schedules

A reference in these Regulations to a Schedule shall be a reference to the particular Schedule set out in the “Schedules to the Insurance Regulations, 1986” published by the Government Printer, which Schedules shall be construed as one with these Regulations.

[L.N. 312/1986.]

|

| 51. |

Monthly insurance training levy return

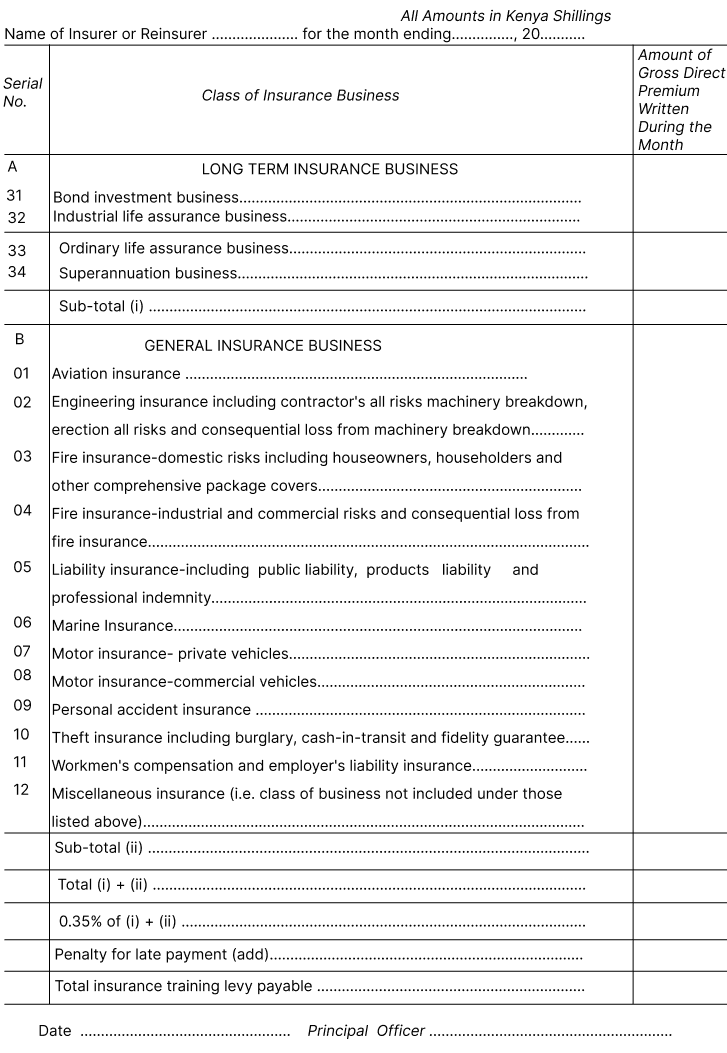

For the purposes of section 197A (2), the rates of Levy shall be—

| (a) |

in case of gross direct premiums written by such insurers, one per cent (1%); and

|

| (b) |

in case of reinsurance premiums paid or credited to a reinsurer outside of Kenya, five per cent (5%).

|

[L.N. 146/1987, r. 2, Corr. No. 43/1987, L.N. 180/1992, r. 2, L.N. 124/1994, r. 3, L.N. 135/2007, r. 2, L.N. 97/2009, r. 5.]

|

| 52. |

Monthly premium tax return

For purposes of section 197A(4), the levies payable under regulation 51 shall—

| (a) |

become payable at the end of each calendar month in case of the gross direct premiums;

|

| (b) |

become payable at the end of each quarter in case of the reinsurance premiums, in which the premiums were received or paid by the insurer and shall be payable by such insurer not later than the last day of the first month succeeding that in which the levies become due.

|

[L.N. 180/1992, r. 2, L.N. 124/1994, r. 3, L.N. 135/2007, r. 2.]

|

| 53. |

Annual premium tax return

For purposes of section 197E every insurer registered or authorized to carry on insurance business in Kenya shall—

| (a) |

at the end of each calendar month, prepare a monthly premium levy return, showing the total premiums due from the insurer for that particular month as set out in the Twenty Fourth Schedule;

|

| (b) |

at the end of each quarter, prepare a quarterly reinsurance levy return, showing the total insurance premiums due from the insurer for that particular quarter as set out in the Twenty Seventh Schedule; and

|

| (c) |

at the end of each calendar year and not later than the third month following the end of that year, prepare—

| (i) |

an annual premium levy return as set out in the Twenty Fifth Schedule; and |

| (ii) |

an annual reinsurance premium levy return as set out in the Twenty Eighth Schedule. |

|

[L.N. 180/1992, r. 2, L.N. 124/1994, r. 3, L.N. 135/2007, r. 2.]

|

| 54. |

Monthly re-insurance premium tax return

For the purposes of section 197B (2), the rates of the levy shall be calculated at the rate of zero point two per cent (0.2%) of the gross direct premiums written by the insurer in respect of general insurance business.

[L.N. 124/1994, r. 4, L.N. 135/2007, r. 2.]

|

| 55. |

Annual premium tax return

For the purposes of section 197B (3), the form set out in the Twenty Third Schedule shall be in the form for the monthly insurance training levy return.

[L.N. 124/1994, r. 4, L.N. 135/2007, r. 2.]

|

| 56. |

Annual Insurance Training Levy return

For the purposes of section 197E, an insurer carrying on general business in Kenya shall, at the end of each calendar year and not later than the third month following that year, prepare an annual insurance training levy return as set out in the Twenty Ninth Schedule.

[L.N. 135/2007, r. 3.]

|

| 57. |

Payment of Insurance Training Levy

For the purposes of section 197E, the levy payable under section 197B shall be paid to the Insurance Training and Education Trust in such manner as may be prescribed by the Authority from time to time.

[L.N. 135/2007, r. 3, L.N. 57/2012, r. 14.]

|

| 58. |

Monies Payable to Fund

For the purposes of section 4(2), all monies payable into the Fund shall be paid to the Insurance Regulatory Authority in such manner as may be prescribed by the Authority from time to time.

[L.N. 135/2007, r. 3, L.N. 57/2012, r. 15.]

|

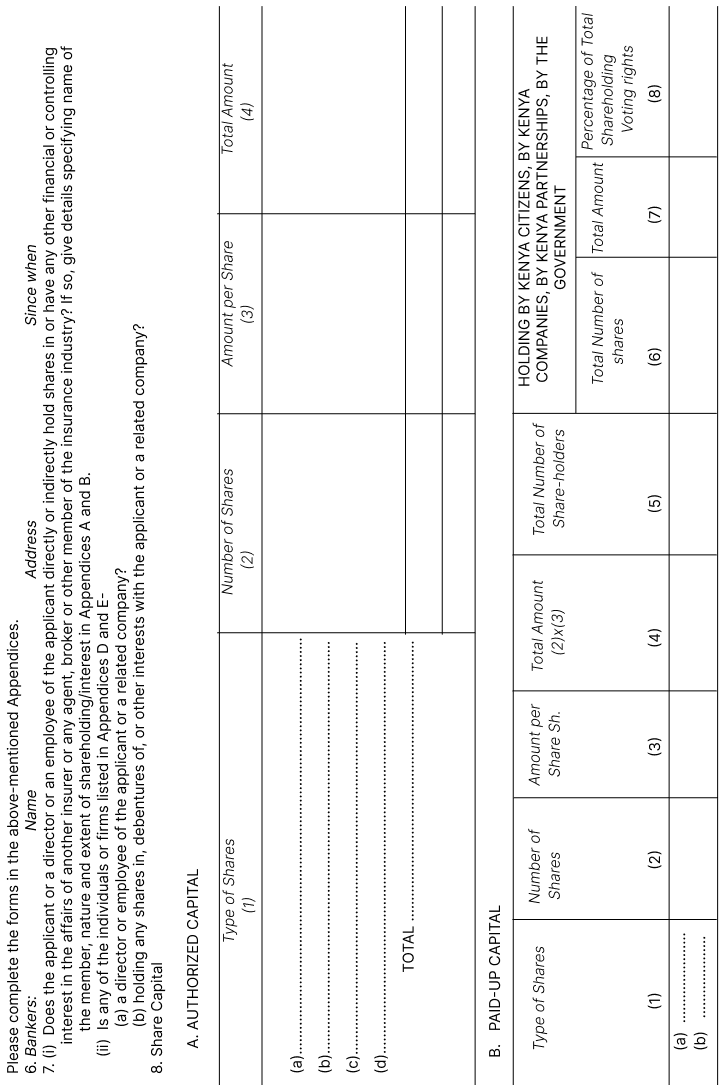

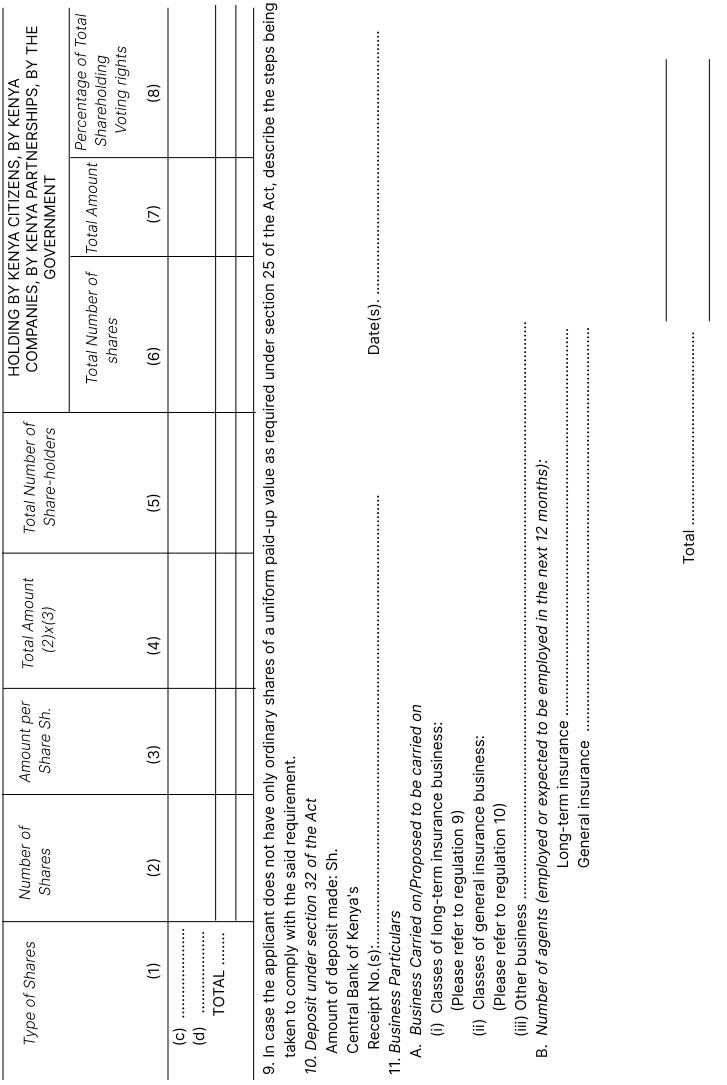

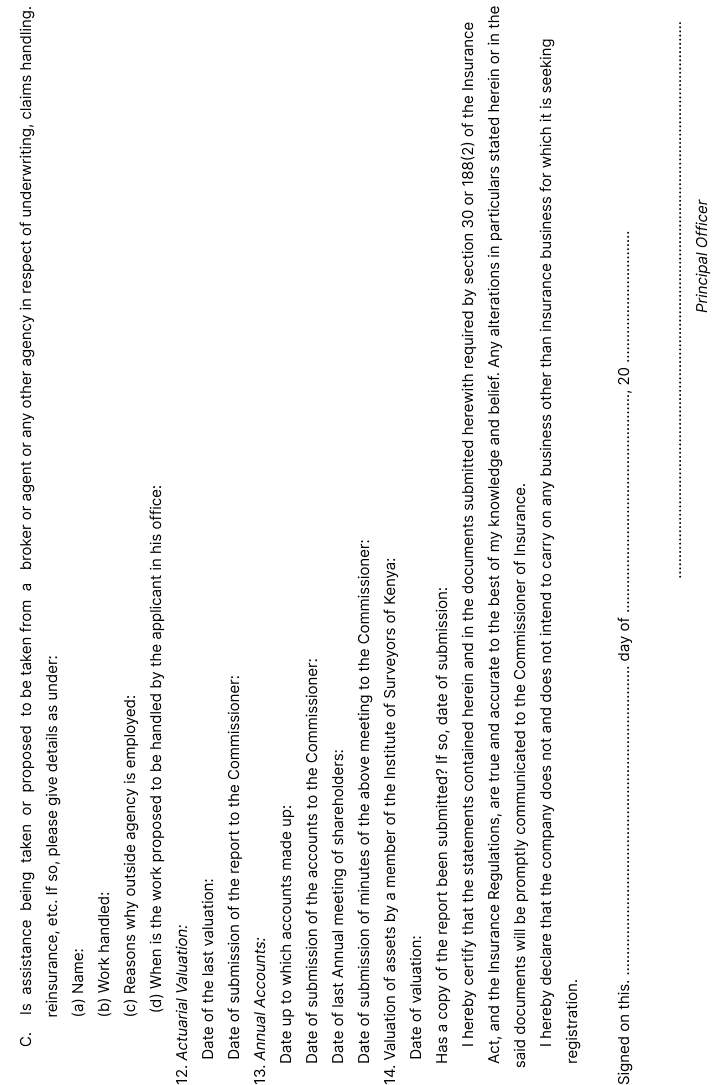

FIRST SCHEDULE [s. 30 and 188(2) and r. 5 and 48.]

APPLICATION FOR REGISTRATION OF AN INSURER

[L.N. 51/2017, r. 3.]

All amounts in Kenya shillings

Read the Notes in Appendix F to this Form carefully and comply

A. APPLICANT

| 2. |

Registered Office:

— Postal

Address:

— Telegraphic

Address:

—Telex —Telephone

|

| 3. |

Location of Offices:

—Principal:

(give address)

—Branches:

(give address)

|

| 4. |

Incorporation:

—Place: —Date:

Insurance Business:

—Date of first licence:

—Date of Commencement

|

| 5. |

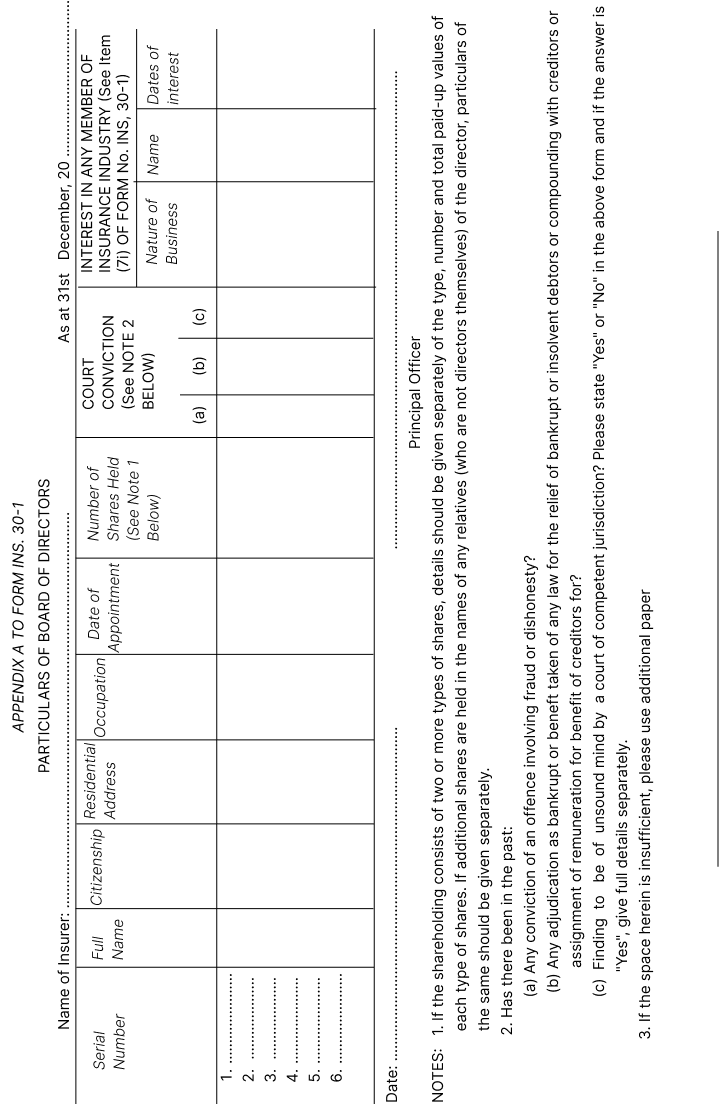

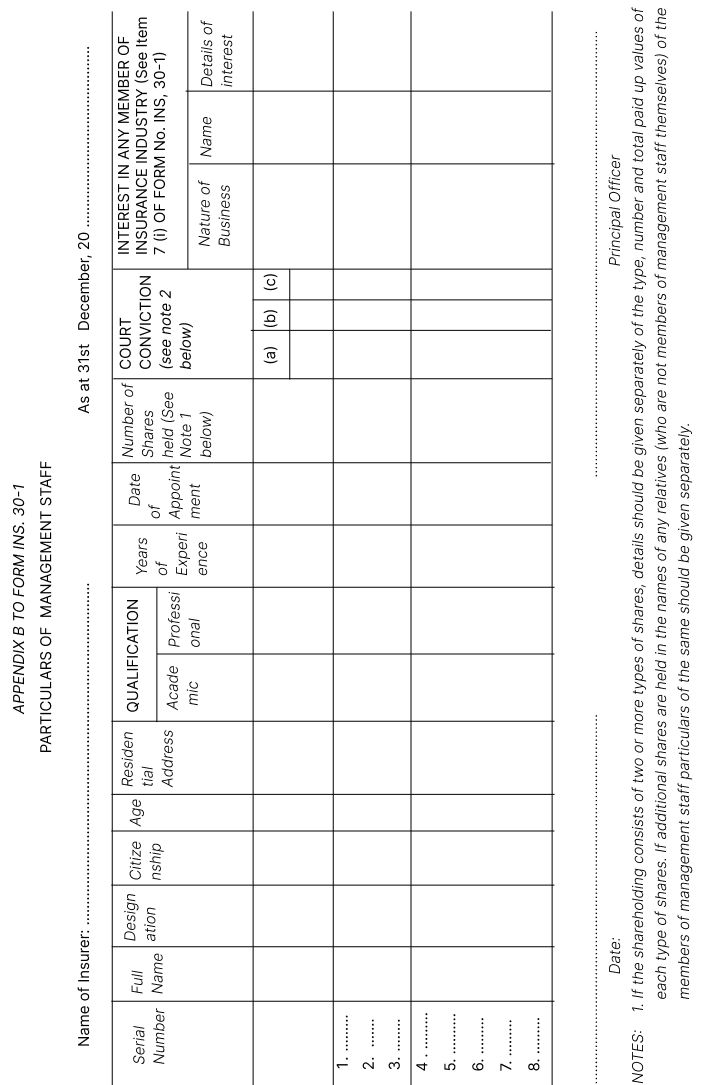

| (i) |

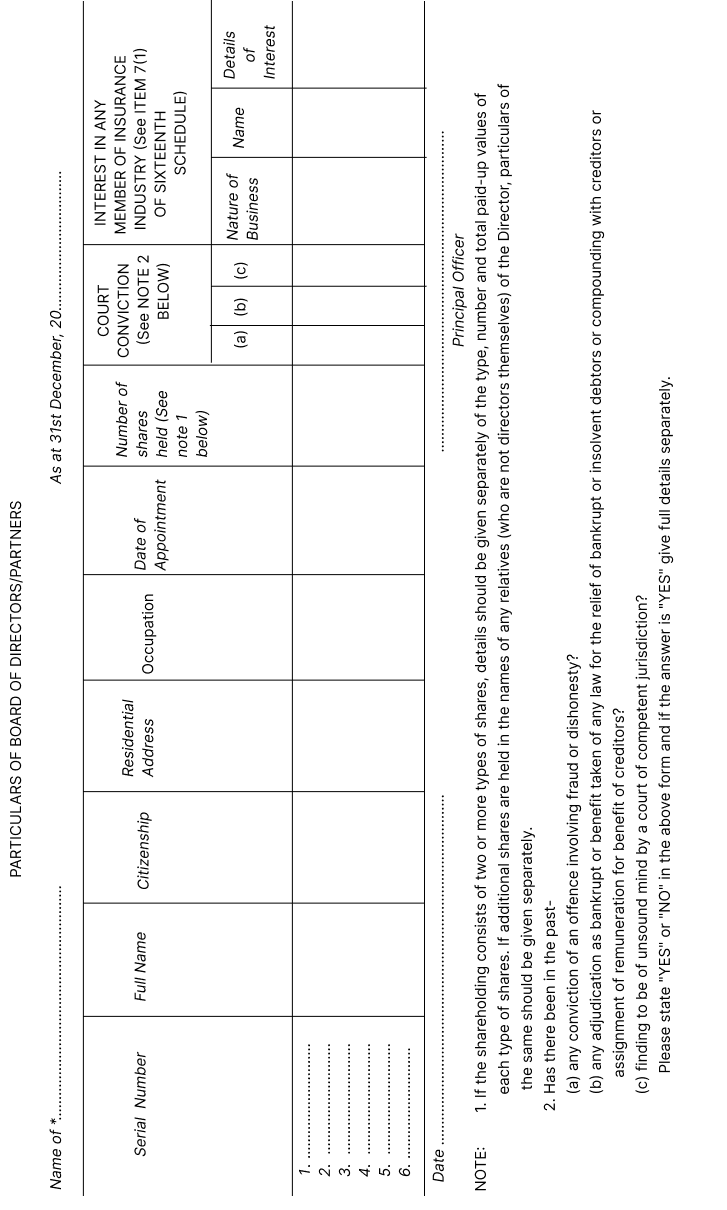

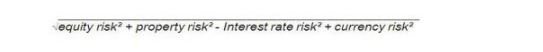

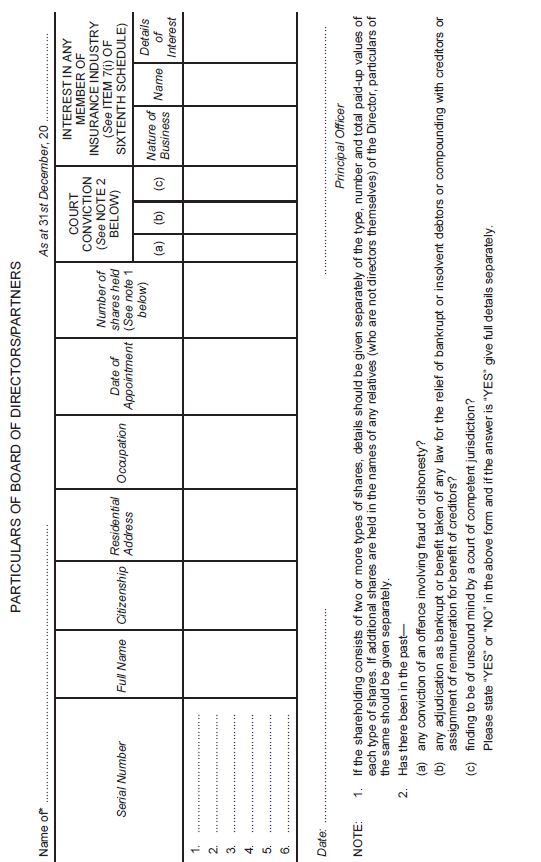

Members of Board of Directors (Appendix A) |

| (ii) |

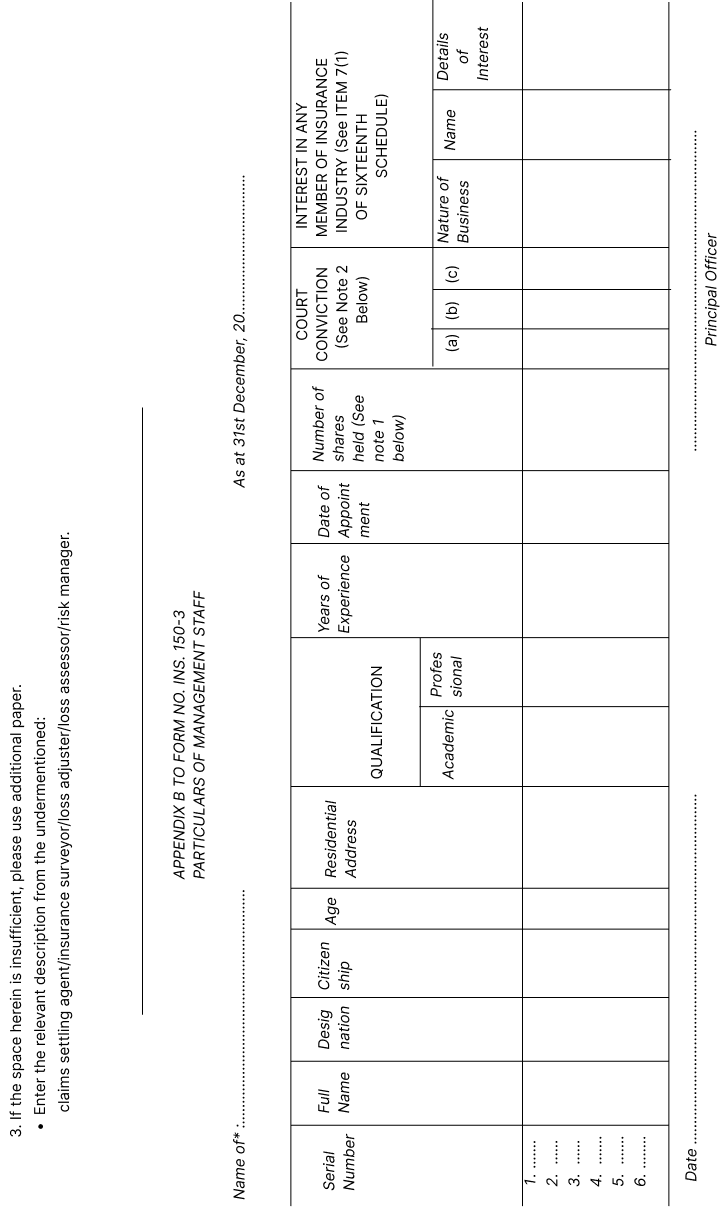

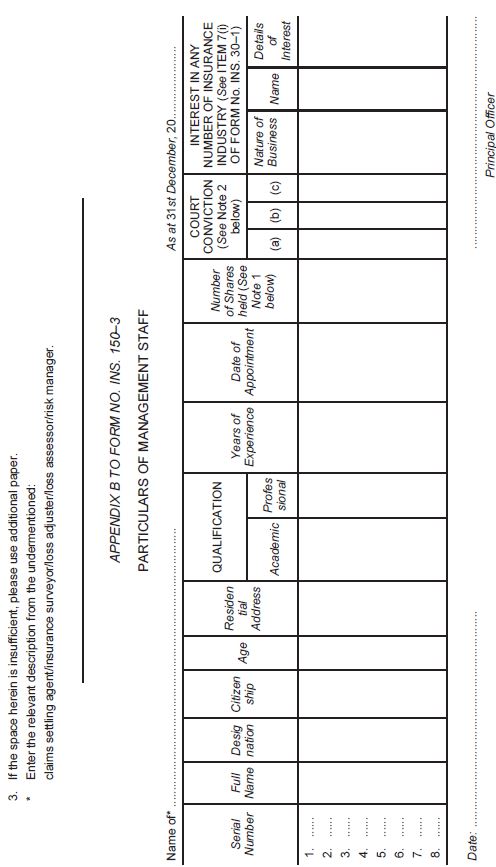

Principal Officer, Company Secretary and other senior management staff (Appendix B) |

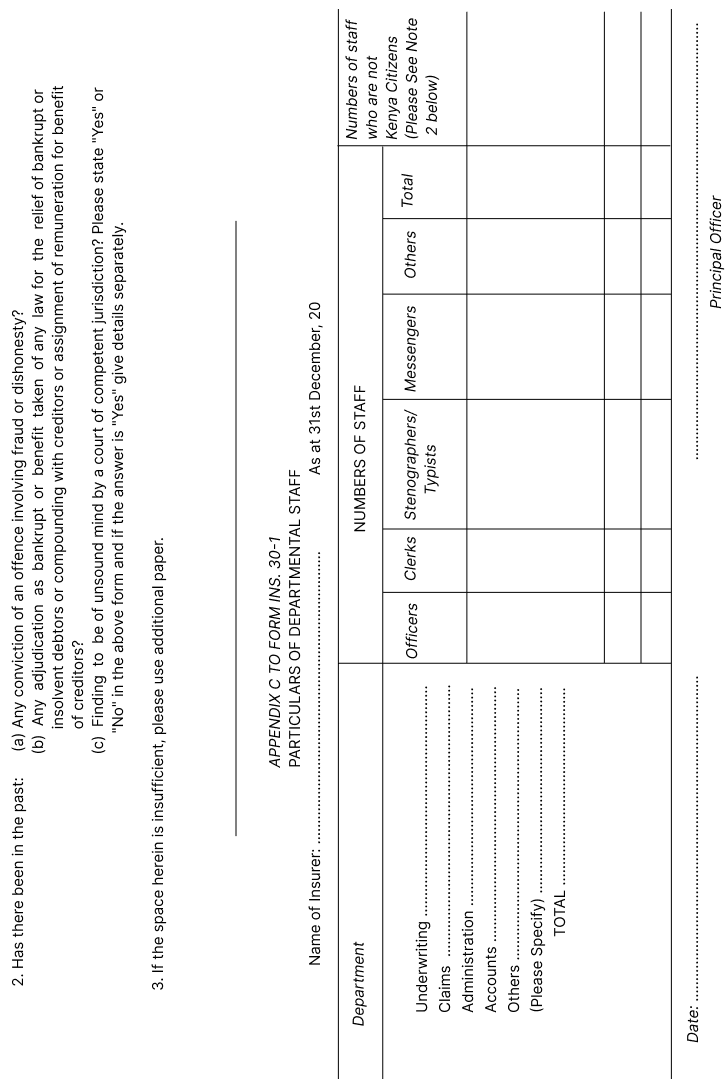

| (iii) |

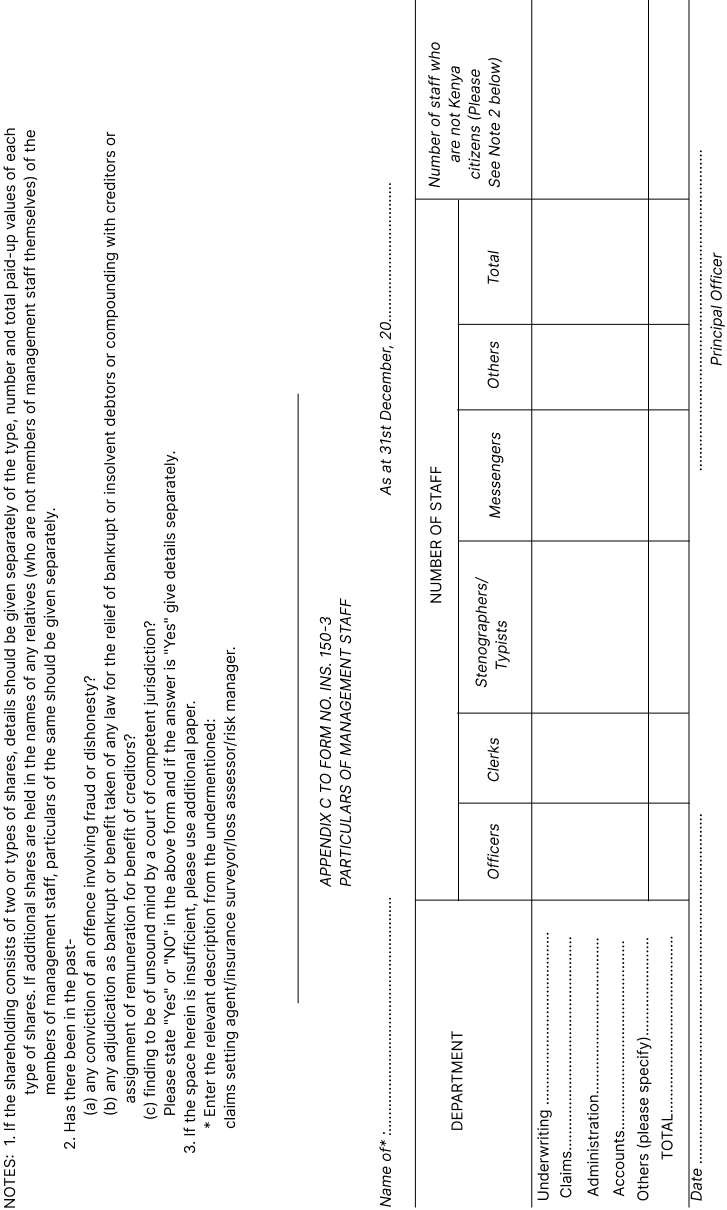

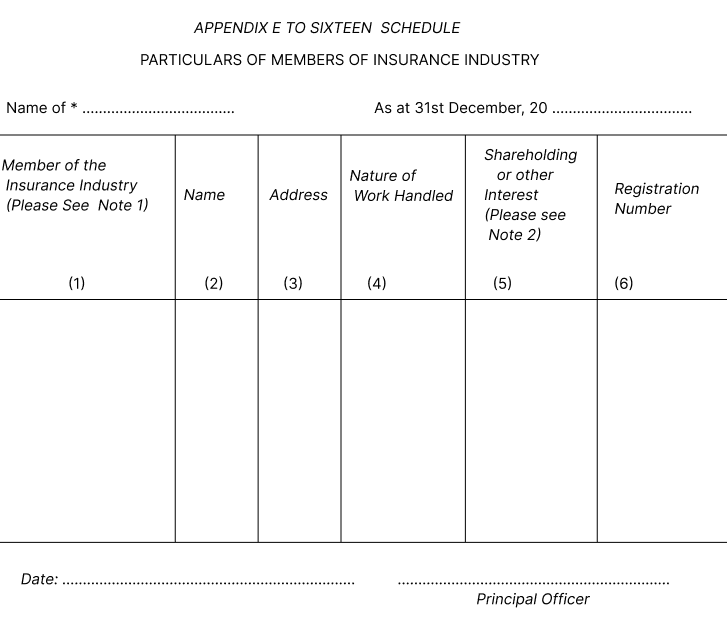

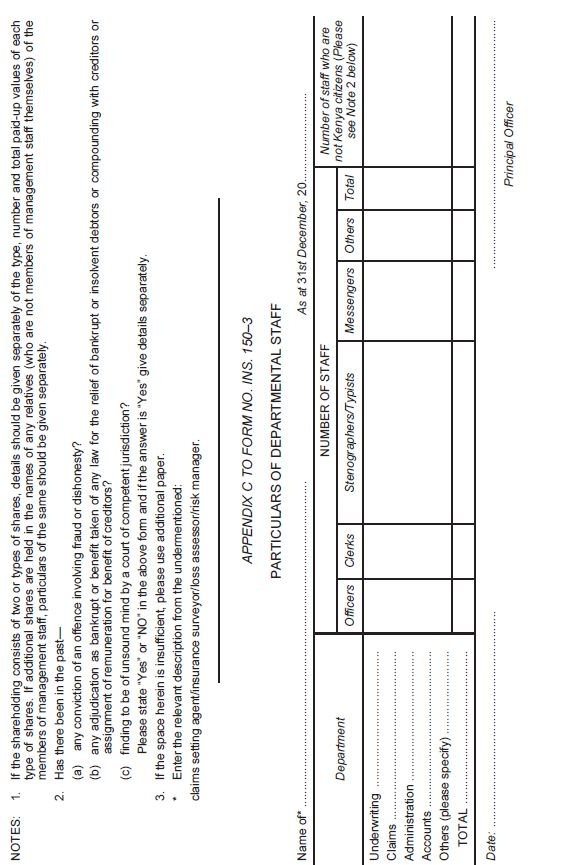

Departmental staff (Appendix C) |

| (iv) |

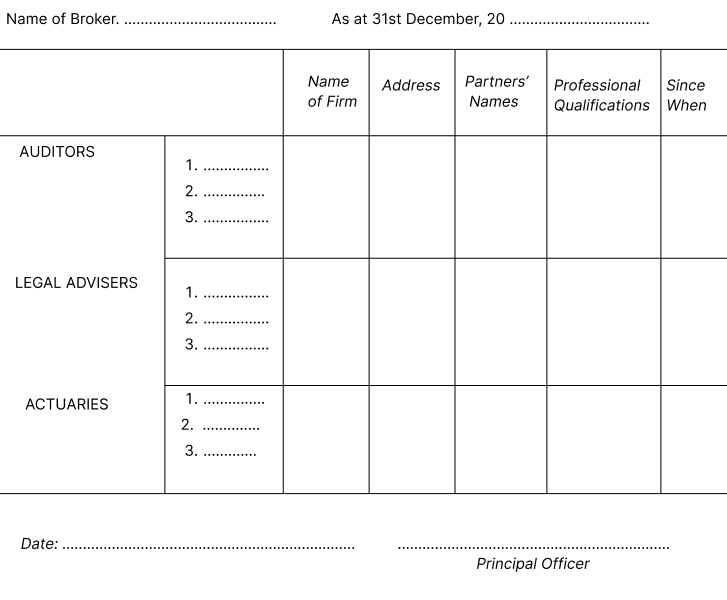

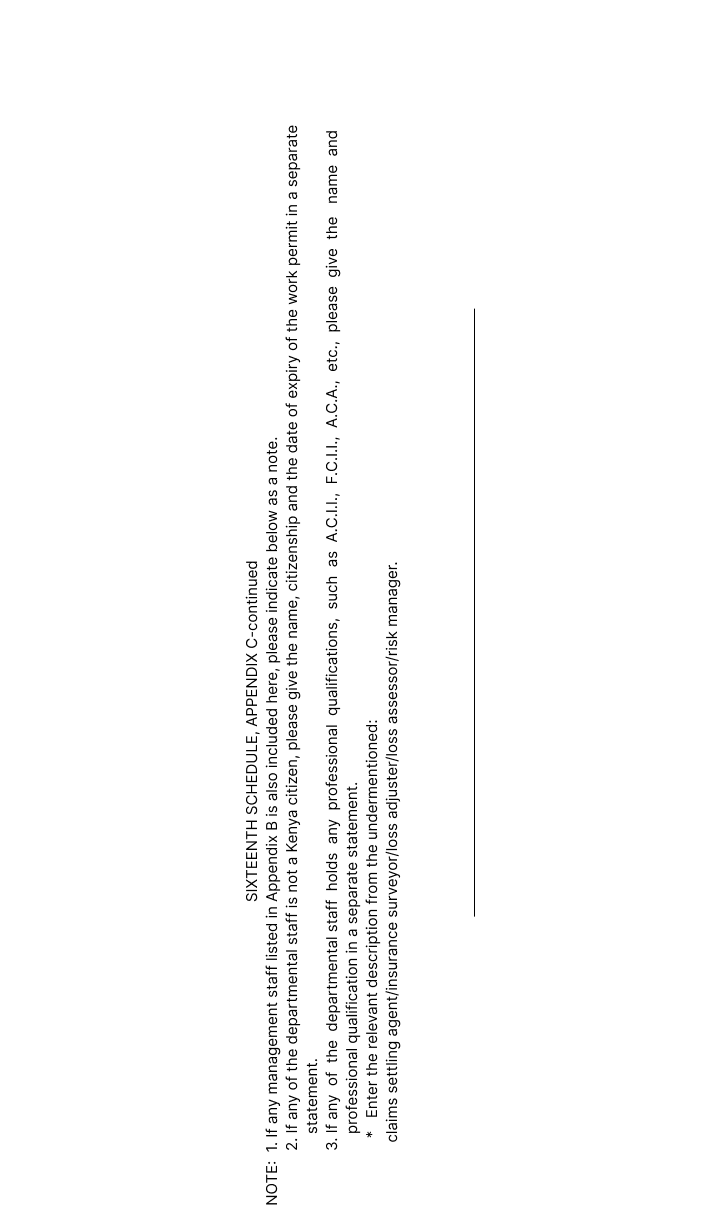

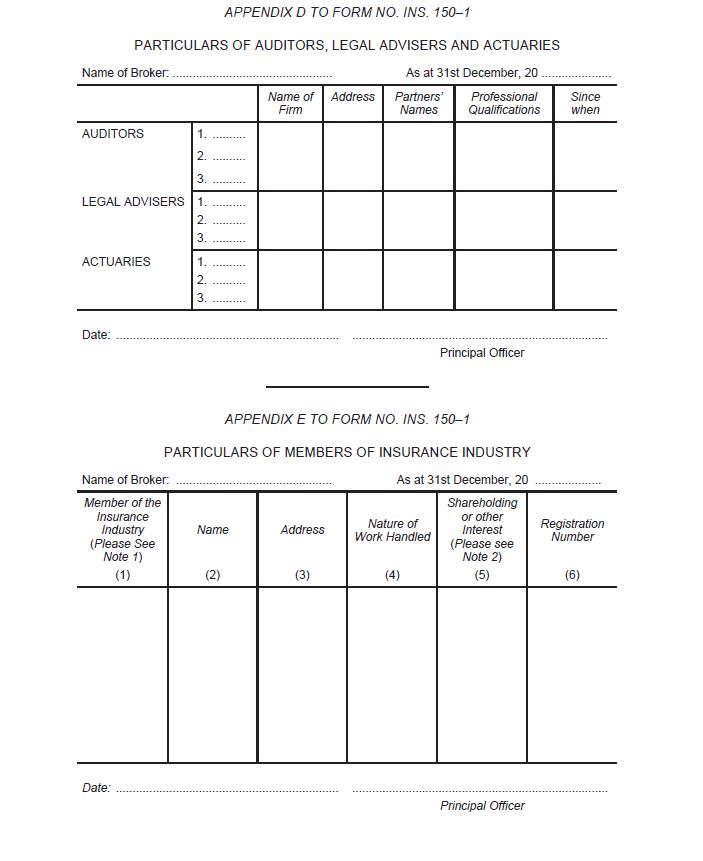

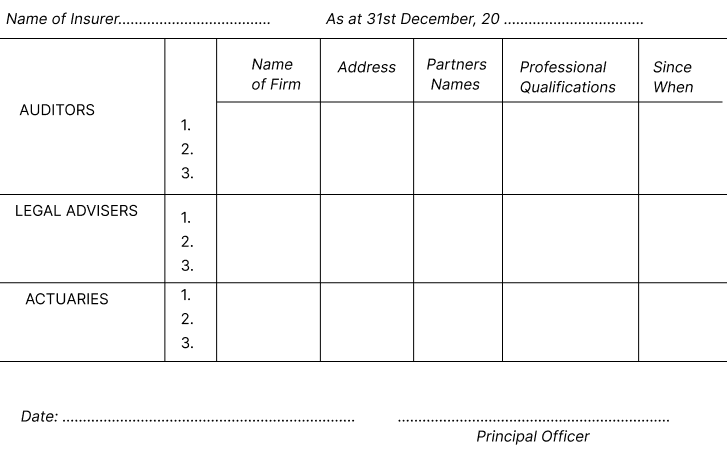

Auditors, Legal Advisers and Actuaries (Appendix D) |

| (v) |

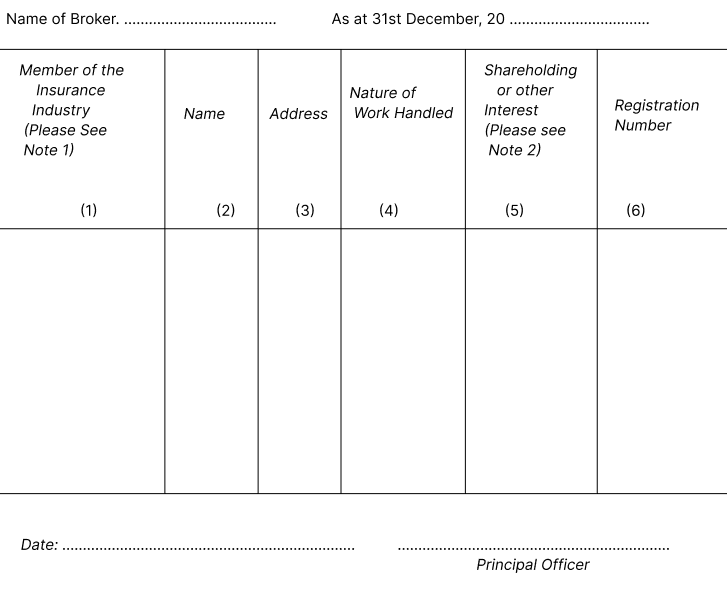

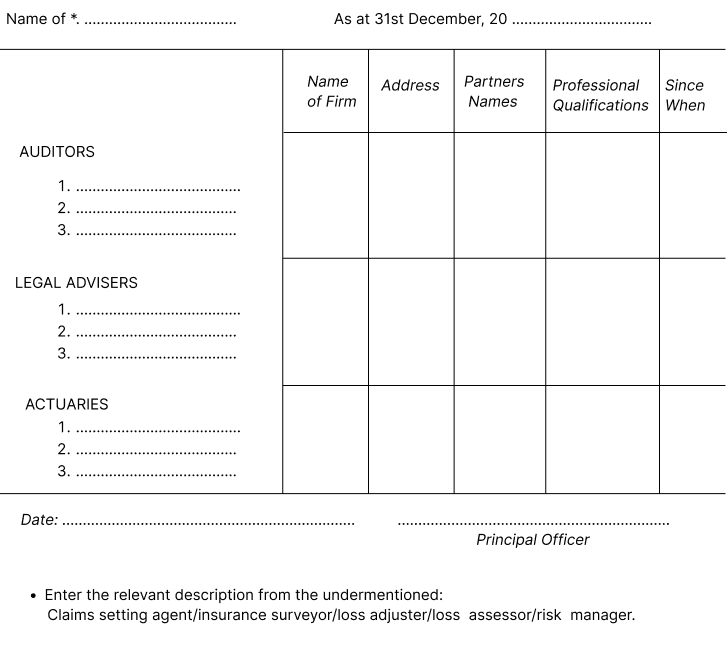

Members of the insurance industry excluding insurers whose services were availed of during the current year (Appendix E) |

|

| 1. |

State here broker, agent or any other capacity in which the member is registered under the Act.

|

| 2. |

Please give information of number and type of shares held, amount, of shareholding and any other interest as per item 7(ii) of FORM INS. 30-1.

|

| 3. |

If the space herein is insufficient, please use additional paper.

|

| 4. |

Please mention in column (6) the reference number of the registration under the Insurance Act, 1984.

|

APPENDIX F TO FORM NO. INS. 30-1

LIST OF DOCUMENTS TO BE SUBMITTED

A. Statements/documents and information required from an insurer applying for registration to the Commissioner—

| (a) |

A copy of the memorandum of association or other instrument or document by which the applicant is constituted.

|

| (b) |

A copy of the articles of association or other rules of the applicant.

|

| (c) |

A certified copy of the published prospectus, if any.

|

| (d) |

A copy of each of the proposal and policy forms, endorsements and any form of written matter describing the terms or conditions of or the benefits to or likely to be derived from policies or intended to be used by the applicant.

|

| (e) |

Statements of the premium rates, advantages and terms and conditions to be offered in connection with insurance policies and details of the bases and formulae from which those rates have been calculated.

|

| (f) |

In connection with long term insurance business, a certificate by an actuary that the rates, advantages, terms and conditions proposed to be offered are sound and workable.

|

| (g) |

Detailed statement of assets and liabilities as at the date of application.

|

| (h) |

A description of all reserves with detailed descriptions of the method, bases and formulae for calculating each of the reserves.

|

| (i) |

A certificate from the Central Bank of Kenya specifying the amounts and details of deposits made by the applicant under section 32 of the Act.

|

| (j) |

Certified copies of reinsurance contracts.

|

| (k) |

the prescribed fee and a certified copy of the receipt should be enclosed.

|

NOTE:— In case the applicant is a member of a tariff body in Kenya, in respect of one or more classes of insurance business, please mention it whilst dealing with (e) and (f) above and indicate variations of any, made in the policy wording and premium rating schedules from those provided under tariff regulations.

B. Statements required in terms of section 30(k) of the Act—

| (a) |

A photo-copy of the certificate of incorporation.

|

| (b) |

Financial forecasts as required under regulation 7(b).

|

| (c) |

An estimate of sources of business as required under regulation 7(c).

|

| (d) |

A summary of reinsurance treaties as per regulation 7(d).

|

| (e) |

Copies or drafts agreements as per regulation 7(e).

|

| (f) |

Copies or drafts of any standard agreements with brokers and agents as per regulation 7(f).

|

| (g) |

In the case of long term insurance business, an actuary’s certificate with regard to adequacy of financing arrangements as per regulation 7(g).

|

| (h) |

In the case of a new insurer or a new class of insurance business of an existing insurer, estimates of cost of installation and other information as per regulation 7(h).

|

| (i) |

Copies of accounts, statements and reports laid before shareholders as per regulation 7(i).

|

| (j) |

In the case of an insurer carrying on long term insurance business, copies of valuation reports as per regulation 7(j).

|

NOTE:— Items (b) to (h) above apply to an insurer who has not transacted insurance business before or where authorization is sought to transact a class of business not transacted before.

SECOND SCHEDULE

Deleted

[s. 41(9), r. 8, L.N. 85/2010, r. 6.]

Deleted by L.N. 104/2015

THIRD SCHEDULE [s. 52 and r. 10]

GENERAL INSURANCE BUSINESS

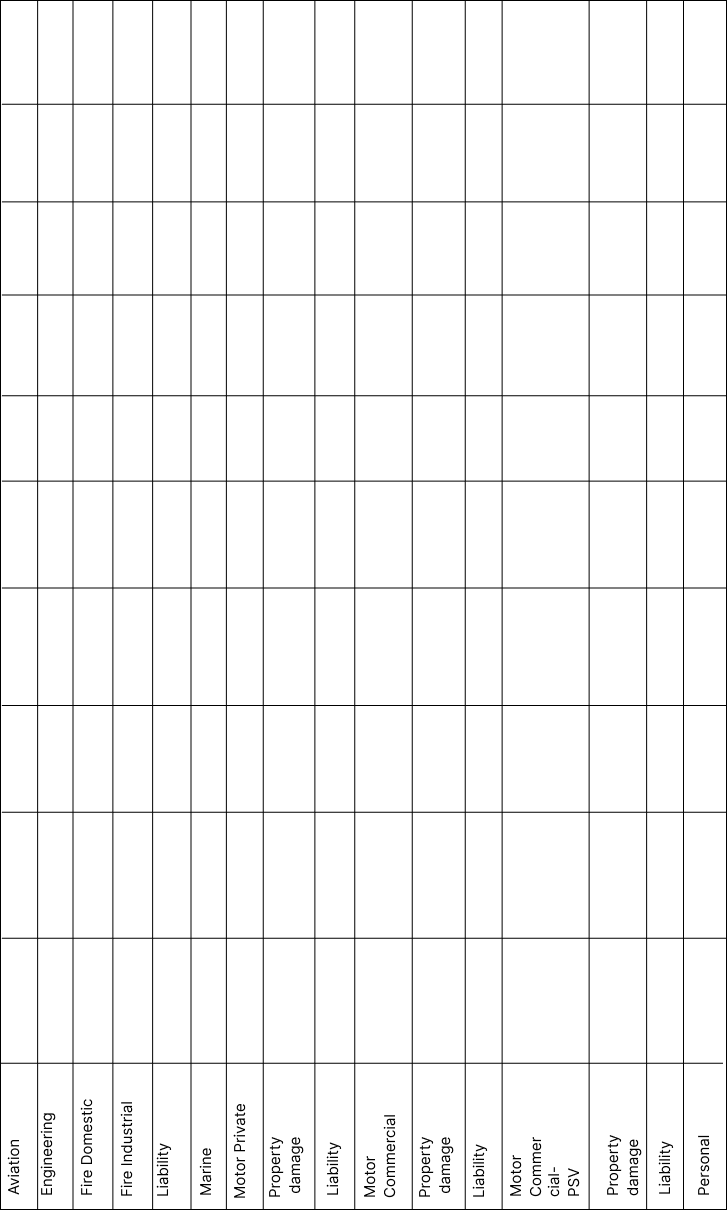

PART A – GENERAL INSURANCE BUSINESS—CLASSES AND SUB-CLASSES

[L.N. 108 of 2002, L.N. 85 of 2010, r. 7, L.N. 51 of 2011, L.N. 57 /2012, r. 16, L.N. 70 /2021, r. 2, L.N. 167 /2021, r. 3.]

|

Serial

Number

|

Class of Business

|

Brief Descriptionof Class

|

Serial

Number

|

Sub-Class of Business

|

|

01

|

AviationInsurance.

|

Aviation

|

010

|

Aviation

|

|

02

|

EngineeringInsurance includingContractor’s Risks,MachineryBreakdown, ErectionAll Risks andConsequentialLoss from Breakdown

|

Engineering

|

020021

|

Contractor’s AllRisksEngineeringInsurance—Others

|

|

03

|

Fire Insurance—DomesticRisksincluding House owners,Householders andother comprehensive package covers.

|

Fire—Domestic

|

030

|

Fire—Domestic

|

|

04

|

Fire Insurance—IndustrialandCommercial Risks andconsequentiallossfrom fire insurance.

|

Fire—Industrial

|

040

|

Fire—Industrial

|

|

05

|

Liability Insurance

|

Liability

|

50

|

Product Liability

|

|

51

|

Professional Indemnity

|

|

52

|

Latent Defects Liability

|

|

53

|

Structural Defects Liability

|

|

54

|

PublicLiability

|

|

55

|

Others

|

|

06

|

MarineInsurance.

|

Marine

|

060061062

|

MarineHullMarineCargoOtherTransit

|

|

07

|

MotorInsurance—Private Vehicles.

|

Motor—Private

|

070

|

Motor—Private

|

|

08

|

Motor Insurance—CommercialVehicles.

|

Motor—Commercial

|

080

|

Motor—Commercial

|

|

09

|

PersonalAccident Insurance.

|

PersonalAccident

|

090091

|

PersonalAccident andSicknessHealth/MedicalExpensesInsurance(where separatepolicies areissued).

|

|

10

|

Theft Insuranceincluding Burglary,Cash-in-Transit andFidelityGuarantee.

|

Theft

|

100101102

|

Cash-in-TransitFidelityGuaranteeBurglary, AllRisks and otherTheftInsurance

|

|

11

|

Workmen’sCompensation andEmployer’sLiability Insurance.

|

Workmen’sCompensation

|

110

|

Workmen’sCompensationand Employer’sLiability

|

|

12

|

Medicalinsurance

|

Medical

|

120

|

Medicalinsurance

|

|

13

|

Micro-Insurance

|

Micro

|

130

|

Micro-insurance

|

|

14

|

MiscellaneousInsurance (i.e., class ofbusiness notincluded under thoselistedabove.

|

Miscellaneous

|

140141142143

|

BondInsuranceLivestockInsuranceCropInsuranceAny otherInsurance

|

NOTE:— The above classes and sub-classes shall have the meanings as per Part B of this Schedule unless otherwise defined in the Act or the Regulations.

Part B - GENERAL INSURANCE BUSINESS

DEFINITIONS OF CLASSES OF INSURANCE

[L.N. 57/2012, r. 16.]

Serial Number

For the purposes of these Regulations the following are the definitions of the classes of general insurance business listed in Part A of this Schedule:

| 01. |

Aviation insurance business— means the business of effecting and carrying out contracts of insurance

| (a) |

upon the aircraft or upon the machinery, tackle or furniture or equipment of aircraft;

|

| (b) |

against damage arising out of or in connection with the use of aircraft or against risks incidental to construction, repair or landing of aircraft, including airport owners liability and third party risks;

|

| (c) |

against loss of life by accident, or injury by accident to aircrew members whilst performing or deemed to be performing their duties in accordance with their employment but does not include contracts of insurance in respect of risks of aviation excess of loss or crew loss of licence.

|

|

| 02. |

Engineering insurance business — means the business of effecting and carrying out contracts of insurance of various perils arising out of plant and machinery, such as explosion or collapse of boilers, breakdown of electrical or mechanical plant and lifts and cranes, and resultant damage to the insured’s surrounding property and liability to third parties arising therefrom, also including contracts of insurance in respect of contract works covering damage to property on site however caused and third party liability arising therefrom. Fire insurance business—means the business of effecting and carrying out of contracts of insurance, otherwise than incidental to some other class of insurance business against loss of or damage to property due to fire, explosion, storm, and other occurrences customarily included among the risks insured against in fire insurance policies.

|

| 03. |

Fire insurance business — Domestic Risks means fire insurance of risks which are of private or personal use, that is, other than commercial or industrial use.

|

| 04. |

Fire insurance business— Industrial and Commercial risks means fire insurance of commercial or industrial risks which are not domestic risks.

|

| 05. |

Liability insurance business — means the business of effecting and carrying out contracts of insurance against risks of persons insured incurring liabilities to third parties not being risks arising out of, or in connection with the use of, motor vehicles or out of, or in connection with the use of, vessels or aircraft or risks incidental to the construction, repair or docking of vessels or aircraft.

|

| 06. |

Marine insurance business — means the business of effecting and carrying out contracts of insurance

| (a) |

upon vessels or upon the machinery, tackle, furniture or equipment of vessels;

|

| (b) |

upon goods, merchandise or property of any description on board of vessels;

|

| (c) |

upon the freight of, or any other interest in or relating to, vessels;

|

| (d) |

against liability arising out of, or in connection with, the use of vessels;

|

| (e) |

against risks incidental to the construction, repair or docking of vessels, including third-party risks;

|

| (f) |

against transit risks (whether the transit is by sea, inland water, land or air, or partly one and partly another), including risks incidental to the transit insured from the commencement of the transit to the ultimate destination covered by the insurance; or

|

| (g) |

against any other risks insurance against which is customarily undertaken in conjunction with, or as incidental to, the undertaking of such business as falls within this definition.

|

Motor insurance business— means the business of effecting and carrying out contracts of insurance against loss of, or damage to, or arising out of or in connection with the use of, motor vehicles, inclusive of third-party risks but exclusive of transit risks.

|

| 07. |

Motor insurance business— Private vehicles means motor insurance of private vehicles i.e. vehicles not used for business or other commercial purposes.

|

| 08. |

Motor insurance business— Commercial vehicles means motor insurance of commercial vehicles used for business and other commercial purposes.

|

| 09. |

Personal Accident Insurance business— means the business of effecting and carrying out contracts of insurance against risks of the persons insured sustaining injury as the result of an accident or an accident of a specified class or dying as the result of an accident or of an accident of a specified class or becoming incapacitated in consequence of disease or of disease of a specified class, not being contracts of Long term insurance business.

|

| 10. |

Theft insurance business— means the business of effecting and carrying out contracts of insurance against loss of or damage to property due to theft or any other cause not covered under any other class and shall include the insurance of cash in transit, fidelity guarantee insurance and all risks insurance.

|

| 11. |

Workmen’s compensation insurance business— means the business of effecting and carrying out contracts of insurance against the liability of the employer to the employees in respect of any injury or disease arising out of and in the course of their employment.

|

| 12. |

Medical insurance business— means the insurance business of paying for medical expenses, including the business of covering disability or long term nursing or custodial care needs.

|

| 13. |

Micro-Insurance business— means the authorized insurance business that provides protection accessible to the low income population, against specific perils in exchange for regular provision payments proportionate to that risk and managed in accordance with generally acceptable insurance principles.

|

| 14. |

Miscellaneous insurance business— means the business of effecting and carrying out

contracts of insurance which are not principally or wholly of any type or types included in other classes of business but shall include insurance of bonds of all types, insurance of livestock and crop insurance.

|

Part D - DIRECTIONS FOR THE PREPARATION OF FORMS

NOS. INS. 54–1, INS. 54–2, AND INS. 54–3

| 1. |

A revenue account in the prescribed form should be prepared in respect of each class of business referred to in regulations 9 and 10.

|

| 2. |

The amount of premium is to be recorded in relation to the date on which the contract of insurance was incepted. In this connection “incepted” refers to the time when the liability to risk of the insurer under a contract of insurance commenced and, for this purpose, a contract providing permanent open cover should be deemed to commence on each anniversary date of the contract.

|

| 3. |

Premiums shall be shown less discounts, refunds and rebates.

|

| 4. |

Premiums, claims, surrenders and annuities shall be shown net of reinsurances and commissions shall be shown after taking into account commissions received on reinsurances ceded and commissions paid on reinsurances accepted.

|

| 5. |

If any sum has been deducted from an expenditure item and entered on the assets side of the Balance Sheet, the sum so deducted shall be shown separately.

|

| 6. |

All entries in the above forms shall be in respect of insurer’s total business i.e. Kenya business and outside Kenya business.

|

| 7. |

Particulars of each item of expense or income, as the case may be, included in and which accounts for more than ten percentum of the amount shown in respect of “other” income or “other” expenditure shall be given.

|

| 8. |

The basis on which reserves for unearned premium, unexpired risks and incurred but not reported claims in respect of each class of general insurance business were calculated should be stated by way of supplementary notes.

|

| 9. |

Where in respect of Aviation and/or Marine insurance business an insurer elects to account for the business on a three-year basis, he shall, in addition to the information furnished under Form INS. No. 54–1 (L.N. 108/2002), furnish the break-up in the Form INS. No. 54-3 (L.N. 108/2002), and also attach a certificate, signed by the same persons as are required to sign the revenue account, stating whether the fund carried forward for each of the three years of account is, in their opinion sufficient.

|

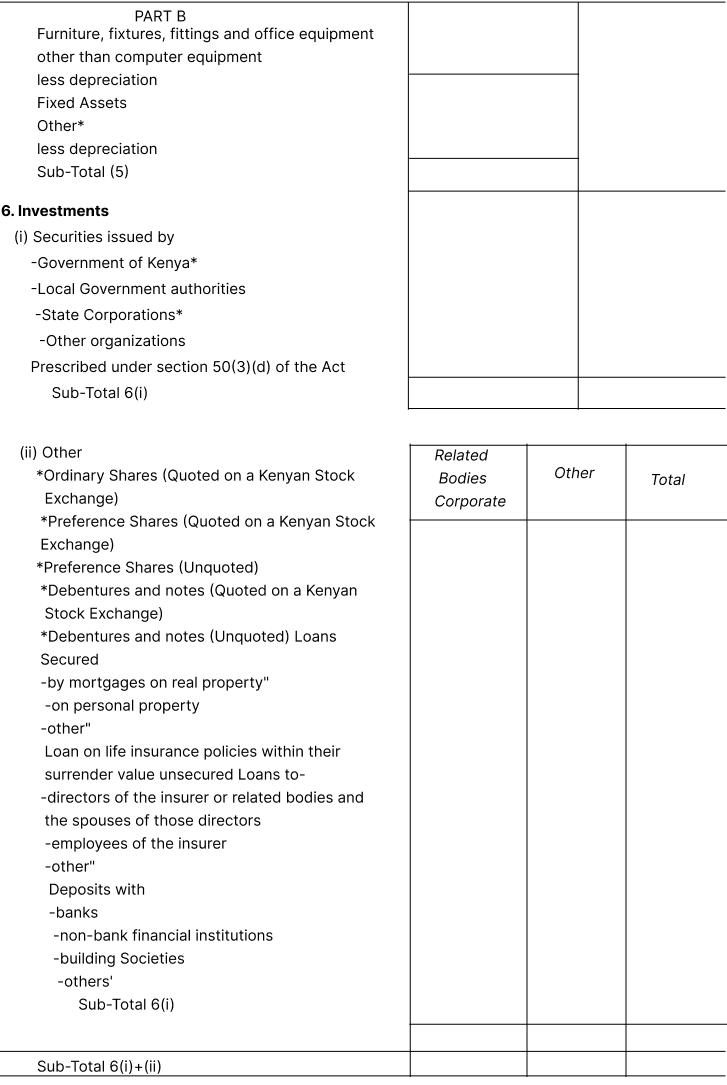

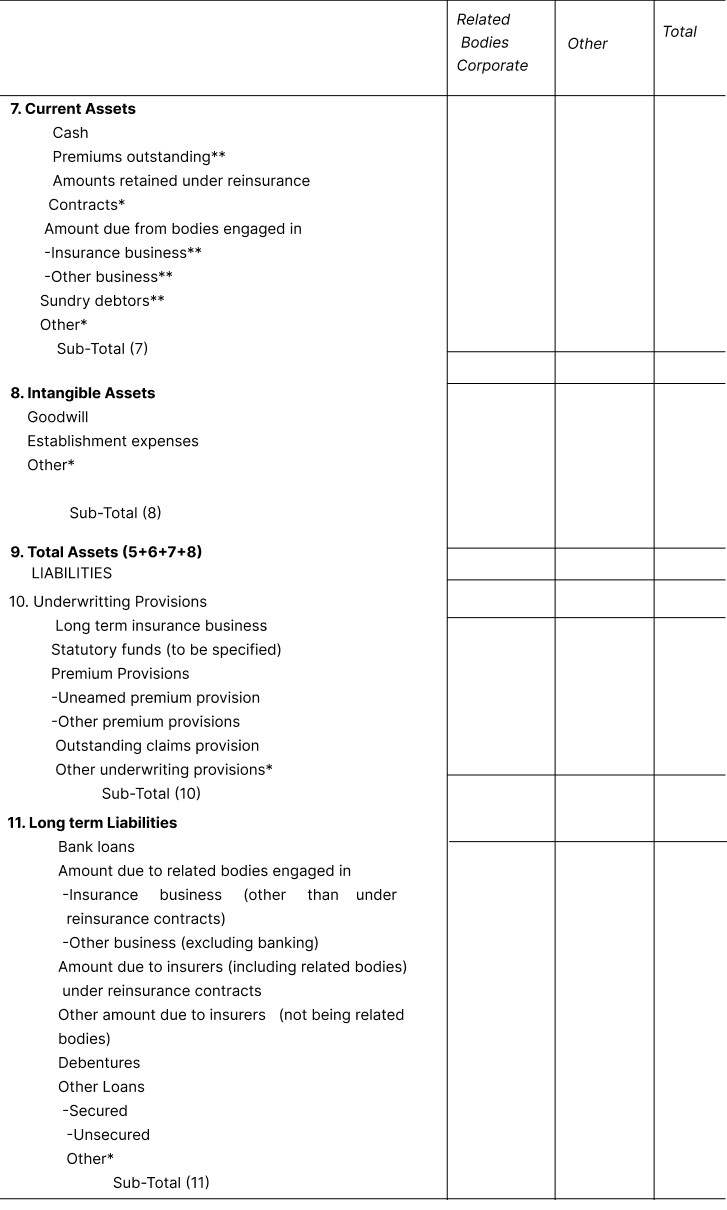

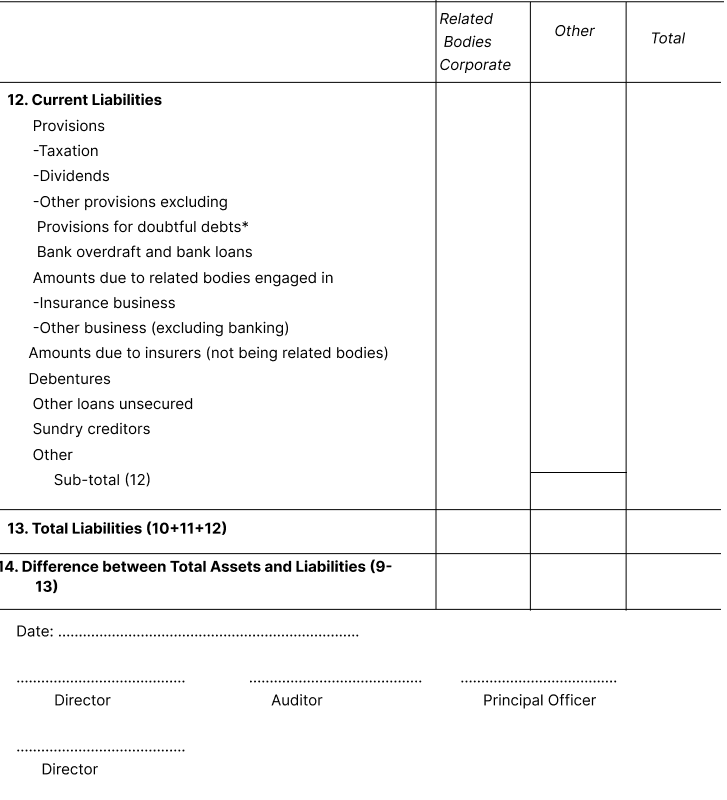

DIRECTIONS FOR PREPARATION OF THE BALANCE SHEET

| 1. |

Separate balance sheets shall be furnished for General Insurance Business and for Long-Insurance Business.

|

| 2. |

An insurer when lodging with the Commissioner a statement in accordance with the above form in the Third Schedule shall—

| (a) |

where any asset which is encumbered is included in a class of assets for which class a value is given in the statement, attach particulars of the asset, the nature of the encumbrance and the amount secured by the encumbrance;

|

| (b) |

attach particulars of all contingent liabilities of the insurer (including contingent liabilities arising from the endorsement of bills of exchange) other than liabilities under contracts of insurance;

|

| (c) |

attach particulars of each liability and asset which accounts for more than ten percentum of the total amount shown in respect of each of the items marked on the above form with the symbol*; and

|

| (d) |

deduct amounts for bad and doubtful debts in calculating the amounts to be inserted in respect of the items marked with the symbol**.

|

|

| 3. |

The value of an asset or liability shall be the value of that asset or liability as determined in accordance with such criteria as may be prescribed by a professional body of accountants, if any, or in accordance with generally accepted accounting concepts, bases and policies or other generally accepted methods deemed by accountants practising in Kenya to be appropriate for insurers transacting business in Kenya.

|

FOURTH SCHEDULE [s. 57(1)(b) and r. 12]

PROVISIONS RELATING TO THE PREPARATION OF ABSTRACTS OF ACTUARY’S REPORTS

[L.N. 85/2010, r. 8, L.N. 108/2016, r. 5.]

|

PART A – PROVISIONS RELATING TO THE PREPARATION OF ABSTRACTS OF ACTUARY’S REPORTS

|

|

SECTION 1

|

|

PART 1

|

| 1. |

Abstracts and statements shall be so arranged that the numbers and letters of the paragraph correspond with those of the provisions of section II of this Schedule.

|

| 2. |

The Actuary shall describe a valuation and the presentation of policy liabilities for the Insurer.

|

| 3. |

The Assumptions and method for determination of liability of policies shall be in accordance with generally accepted actuarial principles and as prescribed by the Authority.

|

| 4. |