|

|

PART I – PRELIMINARY

| 1. |

Short title

This Act may be cited as the Estate Duty Act.

|

| 2. |

| (1) |

In this Act, except where the context interpretation otherwise requires—

“administrator” means the executor of the will, or the administrator of the estate, of a deceased person, and includes any person who takes possession of or intermeddles with the property of a deceased person or any part thereof;

“child” includes an adopted child, and, in relation to his mother, an illegitimate child;

“Commissioner” means the Estate Duty Commissioner appointed under section 3 of this Act;

“disposition” means any act which affects the right to the beneficial enjoyment of property;

“estate duty” means the duty imposed by section 7 of this Act;

“relative” means a husband, wife, grandparent, parent, child, grandchild, brother, sister, nephew or niece, and includes relatives of the half blood and any person who is married to any of the foregoing, or who has been married to any of the foregoing and has not since remarried;

“representation” means probate, letters of administration or any instrument (other than a will) appointing a person the executor, administrator or other representative of a deceased person, or empowering him to administer any of his assets, or authenticating any such appointment;

“trust” and “trustee” include respectively a wakf and any person who, whether alone or jointly with another, is in control of any property the subject of a wakf or is in receipt of any income therefrom.

|

| (2) |

Any reference in this Act to the receipt of income from any property shall be deemed to include the use and enjoyment of that property either alone or jointly with any other person, and income shall be deemed to have been received by a person if it is paid for his benefit or at his direction.

|

| (3) |

For the purposes of this Act, a person shall be deemed competent to dispose of property if he had such an estate or interest therein or such general power as would, if he were sui juris, enable him to dispose of the property, including a tenant in tail whether in possession or not; and “general power” includes every power or authority enabling the donee or other holder thereof to appoint or dispose of property as he thinks fit, whether exercisable by instrument inter vivos or by will, or both, but does not include any power exercisable in a fiduciary capacity under a disposition not made by himself, or exercisable as tenant for life under the Settled Land Act, 1882, of the United Kingdom or as mortgagee. [Act No. 45 and 46 Vict. C. 38.]

|

|

PART II – OFFICERS

| 3. |

Appointment of Commissioner, Deputy Commissioner and Assistant

Commissioners

| (1) |

The Minister may appoint an Estate Duty Commissioner, who shall be responsible for the administration of this Act and for the collection of all estate duty and interest payable thereunder.

|

| (2) |

The Minister may appoint a Deputy Estate Duty Commissioner and such number of Assistant Estate Duty Commissioners as the Minister thinks fit, and the Deputy Estate Duty Commissioner and every Assistant Estate Duty Commissioner may subject to any general or special limitations which the Commissioner may impose, do all or any of the acts which the Commissioner is required or authorized by this Act to do, and, subject as aforesaid, any such act done by the Deputy Estate Duty Commissioner or an Assistant Estate Duty Commissioner shall be as valid and effective as if it had been done by the Commissioner.

|

| (3) |

Any act done by the Deputy Estate Duty Commissioner or an Assistant Estate Duty Commissioner shall be deemed to be within the scope of his authority until the contrary is proved.

|

| (4) |

Every appointment made under this section shall be notified in the Gazette.

|

| (5) |

The Registrar-General, the Deputy Registrar-General and every Assistant Registrar-General shall be the Estate Duty Commissioner, the Deputy Estate Duty Commissioner and an Assistant Estate Duty Commissioner respectively, until such time as appointments to those offices are made under this section.

|

| (6) |

The Commissioner may sue and be sued in the name of the Estate Duty Commissioner.

|

|

| 3. |

Appointment of Commissioner, Deputy Commissioner and Assistant

Commissioners

| (1) |

The Minister may appoint an Estate Duty Commissioner, who shall be responsible for the administration of this Act and for the collection of all estate duty and interest payable thereunder.

|

| (2) |

The Minister may appoint a Deputy Estate Duty Commissioner and such number of Assistant Estate Duty Commissioners as the Minister thinks fit, and the Deputy Estate Duty Commissioner and every Assistant Estate Duty Commissioner may subject to any general or special limitations which the Commissioner may impose, do all or any of the acts which the Commissioner is required or authorized by this Act to do, and, subject as aforesaid, any such act done by the Deputy Estate Duty Commissioner or an Assistant Estate Duty Commissioner shall be as valid and effective as if it had been done by the Commissioner.

|

| (3) |

Any act done by the Deputy Estate Duty Commissioner or an Assistant Estate Duty Commissioner shall be deemed to be within the scope of his authority until the contrary is proved.

|

| (4) |

Every appointment made under this section shall be notified in the Gazette.

|

| (5) |

The Administrator-General, the Deputy Administrator-General and every Assistant Administrator-General shall be the Estate Duty Commissioner, the Deputy Estate Duty Commissioner and an Assistant Estate Duty Commissioner respectively, until such time as appointments to those offices are made under this section.

|

| (6) |

The Commissioner may sue and be sued in the name of the Estate Duty Commissioner.

|

|

| 4. |

Proof of documents

Any document purporting to record, contain or be any act, decision, statement, requirement, notice, valuation or assessment of or by the Commissioner and purporting to be signed by him and any document purporting to record, contain or be an act, decision, statement, requirement, notice, valuation or assessment of or by the Deputy or an Assistant Estate Duty Commissioner and purporting to be signed by him shall, until the contrary is proved, be deemed to have been so signed and to have been made by the Commissioner, or the Deputy or an Assistant Estate Duty Commissioner, as the case may be, and may be proved by the production of a copy thereof purporting to be so signed.

|

| 5. |

Indemnity of officers

The Commissioner shall not, nor shall any person acting under his authority, be personally liable for or in respect of any act or matter done or omitted to be done in good faith in the exercise or purported exercise of the powers conferred by this Act, nor shall he be personally liable for any costs awarded against him under this Act.

|

| 6. |

Official secrecy

| (1) |

Every person having any official duty under, or being employed in the administration of, this Act shall treat all information, affidavits and other documents relating to the property and liabilities of any person as secret.

|

| (2) |

Any such person having possession of or control over any such information, affidavit or other document who at any time communicates such information or anything contained in such affidavit or other document to any person otherwise than for the purposes of this Act or of the administration of the estate to which such information or document refers or appertains shall be guilty of an offence and liable to a fine not exceeding three thousand shillings or to imprisonment for a term not exceeding three months, or to both such fine and such imprisonment.

|

| (3) |

No person appointed under, or employed in carrying out the provisions of, this Act shall be required to produce in court any affidavit or other document, or to divulge or communicate to any court any matter or thing, coming into his possession or under his notice in the performance of his duties under this Act, except as may be necessary for the purpose of carrying into effect the provisions of this Act, for the purpose of administering an estate as aforesaid or in order to bring or assist in the course of a prosecution for an offence under this Act, or an offence committed in relation to estate duty.

|

| (4) |

Notwithstanding anything contained in this section—

| (a) |

the Commissioner may permit the Controller and Auditor-General, or any officer authorized by him, or any officer charged with the collection of any tax or duty in Kenya, or the Director of Economics and Statistics, to have access to such records or documents as may be necessary for the performance of his official duties; and every such person shall treat all such, records or documents as secret;

|

|

| (b) |

the Commissioner may give to any officer in a revenue or statistical department of the government of a country with which reciprocal arrangements have been made such information as may be provided for in those arrangements where such officer has made and subscribed a declaration of secrecy in relation to any information coming to his knowledge in the course of his official duties.

|

|

PART III – IMPOSITION OF ESTATE DUTY EXEMPTIONS AND ALLOWANCES

| 7. |

Imposition of estate duty

| (1) |

Whenever any person dies after the commencement of this Act, a tax known as estate duty shall, save as is hereinafter provided, be levied and paid on—

| (a) |

all property of which the deceased was at the time of his death competent to dispose;

|

| (b) |

all property in which the deceased or any other person had an interest ceasing upon the death of the deceased;

|

| (c) |

all property which immediately before the death was held for the use or enjoyment of two or more persons of whom the deceased was one, either jointly or in accordance with or subject to the exercise of a discretion;

|

| (d) |

the proceeds of any policy of assurance on the life of the deceased;

|

| (e) |

any annuity commencing or benefit becoming due on the death of the deceased which was provided by the deceased, either by himself alone (including by the exercise of a general power of appointment by the deceased) or in concert or by arrangement with any other person, other than an annuity or benefit payable under any written law to or in respect of a dependant of the deceased as such;

|

| (f) |

any property of which or of any interest in which a disposition was made—

| (i) |

within the three years immediately preceding the death of the deceased and after the commencement of this Act; |

| (ii) |

at any time, if, within the three years immediately preceding the death of the deceased and after the commencement of this Act, the deceased had any power of appointment, or power of revocation or of declaration of trusts, in relation to the property, or received any income from the property, or received or retained any benefit under any agreement or arrangement, whether or not enforceable by law, made at any time under or in connexion with the disposition. |

|

|

If and to the extent that—

| (A) |

the property would have been liable to estate duty on the death of the deceased had the deceased died immediately before the disposition was made; and

|

| (B) |

the effect of the disposition concerned would, apart from the provisions of this paragraph, have been to diminish the aggregate value of the property liable for estate duty on the death of the deceased had he died immediately after the disposition was made:

|

Provided that in no case shall estate duty be chargeable, under the foregoing paragraphs, more than once on the same share of or interest in any properly in respect of the same death.

| (2) |

For the purposes of subparagraphs (A) and (B) of paragraph (f) of subsection (1) of this section, where any disposition of property was made before the commencement of this Act, any question whether or to what extent the property would have been liable to estate duty on the death of the deceased had the deceased died immediately before the disposition was made, or whether or to what extent the effect of the disposition would, apart from paragraph (f) aforesaid, have been to diminish the aggregate value of the property liable for estate duty on the death had the deceased died immediately after the, disposition was made, shall be determined as if this Act had been in operation both immediately before and immediately after the disposition was made.

|

| (3) |

This section shall not apply to His Excellency Mzee Jomo Kenyatta, nor to His Excellency Daniel Toroitich arap Moi.

|

|

| 8. |

Property which has changed its character

| (1) |

Where any property would be liable for estate duty under paragraph (f) of section 7(1) of this Act, but since the date of the disposition to which that paragraph refers that property has been converted into or replaced, by any transaction for full value, by other properly of any kind not being property otherwise liable to estate duty on the same death, the property representing at the date of the death of the deceased the property so converted or replaced shall be liable for estate duty in lieu of the property comprised in the disposition:

Provided that where the properly consisted of or is converted into money not forming an identifiable part of a trust fund this subsection shall not apply to any subsequent conversion of that money.

|

| (2) |

Where any properly would be liable for estate duly under paragraph (f) of section 7(1) of this Act or under subsection (1) of this section, but since the date of the disposition, conversion or replacement, as the case may be, that property has been converted into or replaced, by any transaction other than one for full value, by other property of any kind, or has been disposed of, then on the death of the deceased estate duty shall be levied and paid on the full value, at the date of the transaction, of the property so converted or replaced or disposed of, as the case may be, and Part V of this Act shall apply to the valuation of such properly as if references therein to valuation at the date of the death of the deceased were references to valuation at the dale of such transaction.

|

| (3) |

Where any property is liable for estate duty and—

| (a) |

the amount of such duly payable is ascertainable by reference to income or benefits received from, or contributions made to the property at any lime or during any period before the death of the deceased; and

|

| (b) |

income or benefits were received out of or contributions were made to any properly other than the properly liable for estate duty; and

|

|

| (c) |

such other property has, directly or indirectly, since such time or during such period been converted into or replaced by the property which is liable for estate duty, then, for the purpose of ascertaining the amount of estate duty payable, the properly out of which the income or benefits were paid or to which the contributions were made, as the case may be, shall be deemed to be the same as the property liable for the duty.

|

|

| 9. |

Accruals

For the purposes of this Act, wherever any property is augmented by the accrual of any further property derived from, attributable to or accruing by virtue of the ownership of the property so augmented, such further property shall be deemed to be part of the property so augmented.

|

| 10. |

Shares of income

Where estate duty is leviable under section 7(1)(b) of this Act, and the interest ceasing on death extended to part only of the income from the property, estate duty shall be payable on the proportion of the property which the amount of the income to which the deceased or other person, as the case may be, was entitled during the three years immediately preceding the death bore to the income from the property during those years or, where the deceased or other person was entitled to the interest for a lesser period than the said three years, on the like proportion during that lesser period.

|

| 11. |

Property enjoyed jointly or according to a discretion

Where estate duty is leviable under section 7(1)I of this Act, estate duty shall be payable on—

| (a) |

the proportion of the property which was provided by the deceased; or

|

| (b) |

the proportion of the property which the amount of income from the property received by the deceased during the three years immediately preceding his death bore to the income from the property during those years or, where the deceased was not entitled to any proportion of the property or was not one of the class of persons in whose favour the discretion was exercisable during the whole of the said three years, the like proportion during the period when he was so entitled or was one of that class, as the case may be,

|

whichever is the greater.

|

| 12. |

Policies of assurance

| (1) |

No estate duty shall be payable in respect of the proceeds of any policy of assurance—

| (a) |

in respect of which the deceased provided no premium during the three years immediately preceding his death; and

|

| (b) |

in or over which the deceased had at no time during the three years immediately preceding his death any interest or power of disposition.

|

|

| (2) |

Subject to subsection (1) of this section, where only part of the premiums paid in respect of a policy of assurance were provided by the deceased, estate duty shall be payable on the proportion of the proceeds of the policy which the amount of the premiums provided by the deceased bore to the amount of all the premiums paid in respect of the policy.

|

|

| 13. |

Exemption of certain gifts

| (1) |

Section 7(1)(f) of this Act shall not apply to any disposition—

| (a) |

made in consideration of marriage; or

|

| (b) |

made for any charitable purpose more than one year before the death of the deceased; or

|

| I |

which, being a gift, was part of the normal expenditure of the deceased and which, having regard to the circumstances, did not exceed a reasonable proportion of his income; or

|

| (d) |

which, being a gift, did not together with all other gifts to the same donee which are or but for this paragraph would have been liable to estate duty, exceed the sum of ten thousand shillings.

|

|

| (2) |

The amount of estate duty payable under section 7(1)(f) of this Act on all gifts made to any one person shall, where necessary, be reduced so as not to exceed half the amount by which the value of the gifts exceeds the sum of ten thousand shillings.

|

|

| 14. |

Exemption of certain property outside Kenya

No estate duty shall be payable on any property situate outside Kenya at the time of the death of the deceased unless it is movable property and—

| (a) |

it is property provided by the deceased or property of which he was at the time of his death competent to dispose, and the deceased died domiciled in Kenya; or

|

| (b) |

it is property which is subject to a trust of which the proper law is the law of Kenya or property which devolves on the death of the deceased in accordance with the law of Kenya.

|

|

| 15. |

Exemption of property bequeathed for public purposes

No estate duty shall be payable on any property bequeathed absolutely to the Government or for a public purpose declared by the Minister to be a public purpose for the purposes of this section or which passes absolutely on the death of the deceased to the Government.

|

| 16. |

Exemption of property belonging to office or charity

No estate duty shall be payable on any property the interest in which of the deceased was only an interest as holder of an office or recipient of the benefits of a charity or as a corporation sole.

|

| 17. |

Exemption on successive deaths of husband and wife

| (1) |

No estate duty shall be payable on any property—

| (a) |

which has borne estate duty on the prior death of the husband or wife of the deceased; and

|

| (b) |

of which the deceased has at no time since that death been competent to dispose.

|

|

| (2) |

Where the prior death of the husband or wife of the deceased occurred before the commencement of this Act, “estate duty” in subsection (1)(a) of this section means estate duty under the Estate Duty Act (Cap. 257 (1948)).

|

|

| 18. |

Allowance for funeral expenses and debts

| (1) |

Subject to subsection (2) of this section, there shall be deducted from the value of the property liable to estate duty on the death of any person—

| (a) |

such sum in respect of funeral expenses as the Commissioner may consider reasonable; and

|

| (b) |

the amount of any debts or encumbrances.

|

|

| (2) |

No deduction shall be made—

| (a) |

for any debt or encumbrance incurred or created by the deceased except so far as it was incurred in consideration of money or money’s worth paid to the deceased for his own use and benefit;

|

| (b) |

for any debts or encumbrances from the value of any property that cannot be made liable for them;

|

| (c) |

for any debt in respect of which there is a right of reimbursement from or a right to indemnity by any other person, unless it is proved to the satisfaction of the Commissioner that such reimbursement or indemnity cannot be obtained;

|

| (d) |

for any debt which is secured upon immovable property outside Kenya, except in respect of the excess of the debt over the value of the security; or

|

| (e) |

where the deceased was domiciled outside Kenya, for any debt due to any person resident outside Kenya at the date of the death, except so far as—

| (i) |

the debt was contracted to be paid in Kenya; or |

| (ii) |

the debt was secured upon property in Kenya; or |

| (iii) |

the total amount of all such debts exceeds the value of the movable assets of the deceased situate outside Kenya. |

|

|

| (3) |

For the purpose of this section, “consideration of money or money’s worth” does not include—

| (a) |

any property which would have been liable for estate duty on the death of the deceased had the deceased died immediately before the debt or encumbrance was incurred or created and had this Act then been in force; or

|

|

| (b) |

the discharge of any debt or encumbrance which would not itself have been deductable under the foregoing provisions of this section.

|

|

| 19. |

Allowance in respect of duties paid in other countries

| (1) |

Where property is situated in any country to which this subsection applies, and by reason of the death of any person duty or tax is payable in respect of such property both in that country and in Kenya, the Commissioner shall allow a sum equal to the amount of the duty or tax payable in that country in respect of that property to be deducted from the estate duty payable in respect of that property under this Act.

|

| (2) |

Where property is situated in any country to which subsection (1) of this section does not apply, and by reason of the death of any person duty is payable in respect of such property both in that country and in Kenya, the Commissioner shall allow a sum equal to the amount of the duty payable in that country in respect of that property to be deducted from the value of the property liable to estate duty under this Act.

|

| (3) |

The Commissioner may, before making any allowance under this section, require to be satisfied that the duty in respect of which the deduction is claimed has been paid.

|

| (4) |

Subsection (1) of this section applies to those countries the laws of which, in the opinion of the Minister, contain provisions substantially similar to those of that subsection, and which are declared by the Minister, by notice in the Gazette, to be countries to which that subsection applies.

|

|

| 20. |

Allowance in case of quick succession

| (1) |

Where estate duty becomes payable in respect of any property twice within five years and one of the persons dying derived his interest in the property by succession directly from the other, the amount of the estate duty in respect of that property payable on the second death shall be reduced by a sum equal to the following proportion of the estate duty which was payable on that property on the first or the second death, whichever is the lower, that is to say—

| (a) |

where the second death occurs within one month of the first death, by one hundred per cent;

|

| (b) |

where the second death occurs after one month but within one year of the first death, by fifty per cent;

|

| (c) |

where the second death occurs after one year but within two years of the first death, by forty per cent;

|

| (d) |

where the second death occurs after two years but within three years of the first death, by thirty per cent;

|

| (e) |

where the second death occurs after three years but within four years of the first death, by twenty per cent;

|

| (f) |

where the second death occurs after four years but within five years of the first death, by ten per cent.

|

|

| (2) |

Where the Commissioner is satisfied that the property which had borne duty on the first death has been converted into or replaced by other property, this section shall apply to such other property as if it were the property which had borne duty on the first death.

|

| (3) |

Where the first death occurred before the commencement of this Act, “estate duty” in subsection (1) of this section means estate duty under the Estate Duty Act (Cap. 257 (1948)).

|

|

PART IV – RATES OF DUTY AND AGGREGATION OF PROPERTY

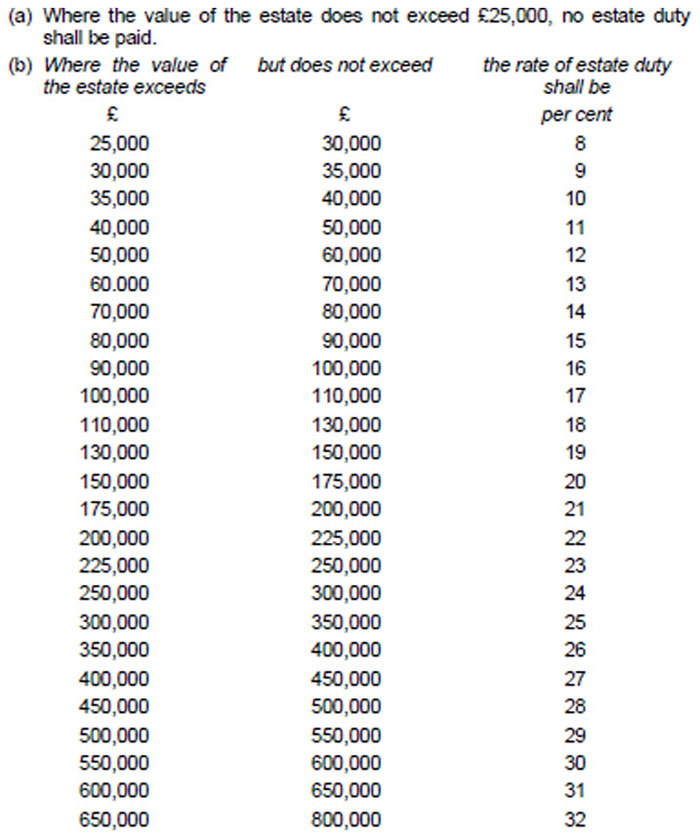

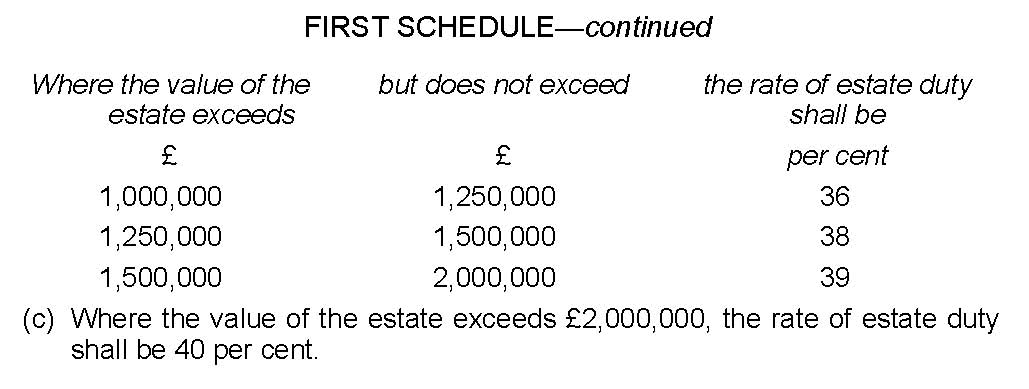

| 21. |

Rates of duty

The rates of estate duty shall be those set out in the First Schedule to this Act.

|

| 22. |

Relief for marginal estates

| (1) |

The amount of estate duty payable shall, where practicable, be reduced so as not to exceed the highest amount of duty which would be payable at the rate of duty next lower than that applicable, with the addition of the amount by which the value of the estate exceeds the value on which the highest amount of duty is payable at the lower rate:

Provided that, where the rate of duty applicable is the lowest rate of duty, the amount of estate duty payable shall, where practicable, be reduced to the amount by which the value of the estate exceeds the minimum value below which an estate is not liable to duty.

|

| (2) |

The benefit of the relief afforded by this section shall be apportioned between the properties liable for the duty.

|

|

| 23. |

Aggregation of property

For determining the rate of estate duty to be paid, all property liable for estate duty on the death of any person shall be aggregated to form a single estate, and estate duty shall be levied on all such property at the rate appropriate to the value of that estate:

Provided that where any property liable to estate duty on the death of any person is property—

| (i) |

in which the deceased never had an interest; or |

| (ii) |

which was not provided directly or indirectly by the deceased and which does not pass on the death of the deceased to or accrue directly for the benefit of any relative of the deceased, |

the property shall form an estate by itself, and estate duty shall be levied thereon at the rate appropriate to that estate, and the property shall not be aggregated with any other property.

|

PART V – VALUATION

| 24. |

Basis of valuation

| (1) |

The value of any property for the purpose of assessing estate duty shall, except as otherwise provided in this Part, be the price which in the opinion of the Commissioner it might reasonably have been expected to realize in a sale between a willing buyer and a willing seller, as a whole or by lots, or generally in whatever manner would have been most advantageous, at the date of the death of the deceased, and in the case of immovable property there may be taken into account the rent which the property might reasonably have been expected to produce:

Provided that, where a person accountable for the estate duty payable on an interest in expectancy elects under section 38 of this Act to pay the duty at the date when the interest is disposed of or falls into possession, the value shall for the purpose of ascertaining the rate and amount of duty payable on that interest be deemed to be the value at the date of the disposition or the date when the interest falls into possession, as the case may be.

|

| (2) |

Where the Commissioner is satisfied that the value of any property has been depreciated by reason of the death of the deceased, the Commissioner shall take such depreciation into account in assessing the value of the property.

|

|

| 25. |

Ascertainment of value

Subject to the provisions of this Part, the Commissioner may ascertain the value of any property for the purpose of assessing estate duty in such manner and by such means as he may think fit.

|

| 26. |

Valuation of shares and debentures in certain companies

| (1) |

Where a company was at the date of the death of a person or at any time during the three years immediately preceding that date controlled by the deceased, or by another company which was itself controlled by the deceased, or by the deceased and any such other company, the value of a share or debenture in that company shall, for the purpose this Act, be the value ascertained according to sections 24 and 25 of this Act or a rateable proportion of the net value of the assets of the company, whichever is the greater, and in a case where there are both shares and debentures of the company issued and outstanding at the death, or different classes of either, the net value of the assets of the company shall be apportioned between them with due regard to the rights attaching thereto respectively.

|

| (2) |

A person shall be deemed to have had control of a company if—

| (a) |

he either alone or together with any relative, was entitled to exercise such voting rights as would yield a majority of votes cast on all questions or on any question affecting the company as a whole, his individual voting rights being such as to yield more than one quarter of the votes cast on all or any such questions; or

|

| (b) |

he had the power to exercise or to control the exercise of the powers of a board of directors or of a governing director of the company, the power to nominate a majority of the directors or a governing director thereof, the power to veto the appointment of a director thereof or any power of a like nature,

|

|

or if he could have obtained such voting rights or power or control by the exercise of any power vested in him, including the power to procure an issue of shares or debentures.

| (3) |

For the purposes of this section, a person shall be deemed to have been able to exercise the voting rights attached to all shares or debentures which are—

| (a) |

held on his behalf by a nominee; or

|

| (b) |

registered in joint names of which his name appears first in the register of members of the company; or

|

| I |

owned by a company of which he had control within the meaning of this section.

|

|

| (4) |

Notwithstanding the provisions of subsection (3) of this section, a person shall not be deemed to have been able to exercise the voting rights attached to shares which he held as a trustee, except where he was a trustee under a disposition made by him or of property provided directly or indirectly by him.

|

| (5) |

For the purposes of this section, the net value of the assets of a company means the value of all the assets of the company ascertained in accordance with this Act, after deducting the amount of all liabilities other than liabilities on account of share capital.

|

| (6) |

This section does not apply to the valuation of shares which were the subject of a gift by the deceased, if—

| (a) |

the shares were given absolutely to a person who was or had been in the employment of the company, or the widow or orphan of such a person, and the donee was not a relative of the deceased; and

|

|

| (b) |

the donee did not have control of the company at the time of the gift or at any subsequent time.

|

|

| 27. |

Establishment of Valuation Appeals Tribunal

| (1) |

There is hereby established a Valuation Appeals Tribunal for the purpose of hearing and determining appeals under section 28 of this Act.

|

| (2) |

The Second Schedule to this Act shall have effect concerning the constitution and proceedings of, and otherwise in relation to the Valuation Appeals Tribunal.

|

|

| 28. |

Objections to and appeals against valuation

| (1) |

Any person who is aggrieved by the value placed on any property by the Commissioner for the purpose of assessing estate duty may, within one month after notice of the assessment has been served on the person accountable, give notice in writing to the Commissioner specifying his objections to the valuation and his reasons for those objections, and, if any such objection is not allowed by the Commissioner, may, within one month of receiving notice of his refusal to allow the objection or such further period as the Tribunal may allow, appeal to the Valuation Appeals Tribunal against the valuation.

|

| (2) |

No appeal to the Valuation Appeals Tribunal shall be entertained unless the duty assessed and interest thereon has been paid to the Commissioner or security for the payment thereof given to the satisfaction of the Commissioner.

|

| (3) |

The Valuation Appeals Tribunal may on appeal confirm the valuation of the Commissioner or substitute another valuation, whether greater or less, and the decision of the Tribunal shall be final and conclusive.

|

|

PART VI – ACCOUNTABILITY AND ASSESSMENT

| 29. |

Duty to render account

| (1) |

It shall be the duty of every administrator to deliver to the Commissioner an affidavit in the prescribed form specifying to the best of his knowledge and belief all the property liable to estate duty on the death of the deceased and the value of all such property at the date of death, and together with such affidavit a certified true copy of any will or testamentary document made by the deceased or, in the case of an oral will, a written statement thereof:

Provided that, where the gross value of all the property to which section 7(1) of this Act refers does not exceed twenty thousand shillings, the administrator need not deliver an affidavit as aforesaid, unless the Commissioner otherwise requires.

|

| (2) |

Where any person has in his possession, power or control, whether beneficially or as a trustee, any property liable to estate duty, it shall be the duty of that person to deliver to the Commissioner an affidavit in the prescribed form specifying the property and the value thereof at the date of death:

Provided that no such affidavit need be delivered, unless expressly required by the Commissioner, where the property has been included in an affidavit delivered to the Commissioner in accordance with subsection (1) of this section.

|

| (3) |

The affidavits required by subsections (1) and (2) of this section shall be delivered to the Commissioner within six months of the death of the deceased or such further period as the Commissioner may allow.

|

| (4) |

If any person required by this section to deliver an affidavit to the Commissioner becomes aware that any affidavit so delivered was incorrect or incomplete in any particular, he shall as soon as practicable deliver to the Commissioner a corrective affidavit:

Provided that the Commissioner may accept an unsworn statement in lieu of a corrective affidavit.

|

| (5) |

Notwithstanding the foregoing provisions of this section, the Public Trustee shall not be required to render any affidavit, but shall, where he is administering any property, deliver to the Commissioner a signed statement in all other respects in the prescribed form.

|

| (6) |

| (a) |

being under a duty, or being required, to deliver an affidavit or statement under this section, fails to deliver it within the time limited therefore, shall be guilty of an offence and liable to a fine not exceeding five thousand shillings or, if in the opinion of the court the offence was committed with a view to hindering or preventing the collection or evading the payment of estate duty or with a fraudulent intent, to a fine not exceeding ten thousand shillings or to imprisonment for a term not exceeding one year, or to both such fine and such imprisonment; and

|

|

| (b) |

in any affidavit or statement delivered under this section, knowingly gives any false information in any material particular or wilfully omits any property liable to estate duty, shall be guilty of an offence and liable to a fine not exceeding twenty thousand shillings or to imprisonment for a term not exceeding two years, or to both such fine and such imprisonment.

|

|

| 30. |

Power to require information

| (1) |

The Commissioner may at any time require any person whom he believes to be accountable for estate duty or to have in his possession, power or control any property that is liable to estate duty or any document relating thereto, or any person whom the Commissioner reasonably believes to be capable of giving information relating to the estate of the deceased, within such time as he may specify (not being less than twenty-one days)—

| (a) |

to deliver to the Commissioner a statement giving to the best of his knowledge and belief answers to any questions which may be put to him by the Commissioner regarding the property liable to estate duty on the death of the deceased, and any such statement shall, if the Commissioner so requires, be made on oath;

|

| (b) |

to produce to and allow the Commissioner or any person authorized in writing by him to inspect and take copies of any such document as aforesaid; and

|

| (c) |

to attend before the Commissioner, and to be examined by him on oath as to any matter respecting any property liable to estate duty on the death of the deceased.

|

|

| (2) |

Where any question arises under section 24, section 25 or section 26 of this Act concerning the value of shares in any company, the Commissioner may exercise the powers conferred by subsection (1) of this section as if every person who is or has been at any material time, or who has at any material time exercised the powers of, a director, manager, secretary, liquidator or auditor of the company were a person accountable for duty.

|

| (3) |

(a) Any person who fails to comply with any requirement of the Commissioner made under this section within the time limited for compliance therewith shall be guilty of an offence and liable to a fine not exceeding five thousand shillings or, if in the opinion of the court the offence was committed with a view to hindering or preventing the collection or evading the payment of estate duty or with a fraudulent intent, to a fine not exceeding ten thousand shillings or to imprisonment for a term not exceeding one year, or to both such fine and such imprisonment.

(b) Any person who, in purported compliance with a requirement of the Commissioner made under this section, knowingly gives any false or incomplete information in any material particular shall be guilty of an offence and liable to a line not exceeding twenty thousand shillings or to imprisonment for a term not exceeding two years, or to both such fine and such imprisonment.

|

|

| 31. |

Assessment of duty

| (1) |

Upon receipt of an estate duty affidavit or corrective affidavit or statement, the Commissioner shall, as soon as practicable, assess the duty payable in connexion therewith, and shall serve notice of the assessment on the person who delivered the affidavit or statement or on any person whom that person may nominate in that behalf.

|

| (2) |

Subject to the provisions of section 50 of this Act, the Commissioner shall have power at any time and from time to time to revoke or amend any assessment in the light of any fresh information he may receive or where he is satisfied that any valuation or assessment previously made was erroneous.

|

|

| 32. |

Appeals against decisions other than on valuation

| (1) |

Any person who is aggrieved by any decision of the Commissioner, other than a decision as to the value of any property, may, within one month after notice of the decision has been served on the person accountable, give notice in writing to the Commissioner specifying his objections to the decision and his reasons for such objections, and if any such objection is not allowed by the Commissioner may, within one month of receiving notice of his refusal to allow the objection, appeal to the Supreme Court against the decision.

|

| (2) |

No appeal to the Supreme Court against a decision shall be entertained unless the duty assessed and the interest thereon are paid into Court or security for the payment thereof is given to the satisfaction of the Court.

|

| (3) |

No objection to any decision shall be entertained on appeal unless the grounds for such objection have been notified to the Commissioner under subsection (1) of this section or the failure to do so is accounted for to the satisfaction of the Supreme Court.

|

| (4) |

The Supreme Court shall have power to extend the time for appealing under this section, notwithstanding that the time prescribed by subsection (1) of this section has expired.

|

| (5) |

The Supreme Court may, on an appeal, reverse or alter a decision in such manner as the circumstances require, and may make an order as to costs.

|

|

| 33. |

Special provisions for trustees

| (1) |

Trustees who are desirous of distributing the trust property but who are aware that by reason of a past disposition the trust property may become liable for estate duty on a future death may apply to the Commissioner by affidavit in the prescribed form for a certificate of maximum liability.

|

| (2) |

Every such affidavit shall specify the trust property and all other property likely to attract estate duty on the death and the present value of all such trust and other property.

|

| (3) |

If the Commissioner is satisfied as to the truth of the facts averred, he may issue a certificate specifying an amount which he estimates to be sufficient to pay any estate duty payable on the death in respect of the property specified, and if the trustees retain and invest that amount in investments for the time being authorized by law for the investment of trust funds they shall not be liable as trustees for any estate duty in respect of that property in connexion with the death when it occurs beyond the value of the investments so held.

|

|

PART VII – PAYMENT OF DUTY

| 34. |

Liability for payment

| (1) |

The estate duty becoming due and payable in consequence of any death shall be paid—

| (a) |

as regards property of which the deceased was competent to dispose, by the administrator;

|

| (b) |

as regards trust property, by the trustees for the time being, or if the trust has terminated the last trustees, of the property;

|

| (c) |

as regards estate duty payable under section 8 of this Act, by the person who was entitled to the property immediately before the transaction or disposition referred to therein or the administrator of his estate; and

|

| (d) |

in default of payment by the person liable under the foregoing paragraphs of this subsection, and as regards all other property, by the persons entitled to the property.

|

|

| (2) |

No administrator or trustee shall be liable for any estate duty in excess of the value of the assets which he has received as such administrator or trustee or might but for his own neglect or default have so received.

|

| (3) |

Subject to the provisions of section 33 of this Act—

| (a) |

an administrator or trustee who distributes the estate of the deceased or the trust fund, as the case may be, without paying the estate duty payable by him under this section shall, in default of payment by the persons entitled to the property, be personally liable for payment of the duty; and

|

| (b) |

an administrator of an estate of a person liable to pay estate duty under subsection (1)(c) of this section who distributes that estate without paying the estate duty payable under section 8 of this Act shall be personally liable for payment of the duty.

|

|

| (4) |

Where an administrator or trustee pays any estate duty under subsection (1) of this section, the estate duty shall, subject to the provisions of the will of the deceased or of the trust deed, as the case may be, be borne by the persons entitled on the death of the deceased to the property in respect of which duty has been so paid in proportion to the value of their respective interests therein, and the administrator in distributing the estate of the deceased and the trustee in distributing the trust property shall make such deductions, adjustments and payments as may be necessary for that purpose.

|

| (5) |

For the purposes of this section, “trust property” means property vested in trustees, or property the subject of a wakf, or property which has ceased to be vested in trustees as a result of any disposition.

|

|

| 35. |

Companies liable to pay duty on shares in certain circumstances

If in any register of members kept in Kenya a company registers any transfer of its shares by an administrator who has not obtained a grant of representation in Kenya, the company shall be liable to pay the estate duty leviable in respect of those shares in default of payment, by the person liable therefore under section 34 of this Act.

|

| 36. |

Time for payment

Subject to the provisions of sections 38, 39 and 40 of this Act, estate duty shall be paid within twenty-eight days of the service of a notice of assessment under section 31(1) of this Act.

|

| 37. |

Interest on duty

| (1) |

Subject to the provisions of sections 38, 39 and 40 of this Act, simple interest at the rate of six per cent per annum shall be payable upon all estate duty from six months after the date of the death of the deceased to the date of delivery of the affidavit, corrective affidavit or written statement upon which the assessment is based.

|

| (2) |

Where the whole or any part of the duty assessed remains unpaid at the end of twenty-eight days after the service of the notice of assessment in respect of that duty, interest shall be payable upon the unpaid duty from that time at the rate of nine per cent per annum.

|

| (3) |

Interest shall be payable and recoverable in the same manner as if it formed part of the estate duty.

|

|

| 38. |

Right to defer payment of duty on interests in expectancy

Where an estate includes an interest in expectancy, the payment of estate duty in respect of that interest may, at the option of the person liable for the duty, be postponed until the interest is disposed of or falls into possession, whichever first happens, and where payment is so postponed interest at the rate of nine per cent per annum shall be payable thereon from twenty-eight days after the date of the disposition or the date the interest in expectancy falls into possession, as the case may be until the date of payment.

|

| 39. |

Right to pay duty by instalments in certain cases

| (1) |

The estate duty payable in respect of any land or of any business, not being a business carried on by a company, or any interest therein, or in respect of any shares in a company valued in accordance with section 26 of this Act, or in respect of any annuity commencing on the death of the deceased, may, at the option of the person accountable, be paid by live equal annual instalments with interest at the rate of six per cent per annum, the first instalment being payable within twenty-eight days of the date of the notice of assessment and the remaining instalments on the anniversary of such date:

Provided that, if any instalment is not paid by the due date, the whole of the duty remaining unpaid and the interest thereon shall forthwith become due and payable, and there after the unpaid duty shall bear interest at the rate of nine per cent per annum.

|

| (2) |

Where the estate duty in respect of any property is being paid by instalments, the whole amount of the duty for the time being unpaid and the interest thereon may be paid at any time.

|

| (3) |

Where the estate duty in respect of any property is being paid by instalments, the whole amount of the duty for the time being unpaid and the interest thereon shall become due and payable immediately upon the completion of any sale of the property, and thereafter the unpaid duty shall bear interest at the rate of nine per cent per annum.

|

| (4) |

The Commissioner may require to be furnished with security for the due payment of instalments payable under this section.

|

|

| 40. |

Power to extend time, for payment in certain cases

Where the Commissioner is satisfied that any estate duty cannot without excessive sacrifice be raised at once, he may allow payment to be postponed for such period and to such extent, on payment of such interest not exceeding nine per cent per annum or the rate yielded by the property concerned, whichever is the greater, and on such terms generally, as the Commissioner may think fit.

|

| 41. |

Power to accept properly in lieu of duty

The Minister may, if he is satisfied that it is in the public interest, authorize the Commissioner to accept any part of the property liable to estate duty on a death in lieu of the estate duty or any part thereof or interest thereon, and any such property shall be transferred to the Government.

|

| 42. |

Power to remit trivial amounts

The Commissioner may, if he thinks fit, remit any estate duty or any interest thereon when the amount appears to him to be so small as not to justify the expense and trouble of calculation and collection.

|

| 43. |

Refund of duly

If it is proved to the satisfaction of the Commissioner that any person has paid more estate duty than that for which he was liable, the Commissioner shall refund the amount overpaid:

Provided that, where a refund is claimed after the expiry of three years from the date the excess was paid, such refund shall not be made unless the Minister so directs.

|

PART VIII – RECOVERY OF DUTY

| 44. |

Unpaid duty a debt to Government

Subject to the provisions of sections 38, 39 and 40 of this Act, all estate duty not paid within twenty-eight days of the service of a notice of assessment shall be recoverable from the person liable by civil suit as a debt due to the Government.

|

| 45. |

Recovery of duty

| (1) |

The Commissioner may apply ex parte to a court, without instituting a suit, for a summary order for the payment of any estate duty due and unpaid, and on production of the assessment and on proof of service of the notice of assessment on the person liable the court shall make an order for payment of the unpaid duty and the costs of the application out of the estate of the deceased or other property in respect of which the duty is payable, and may direct the immediate execution of the order.

|

| (2) |

A statement in writing by the Commissioner shall be sufficient evidence of the amount of unpaid duty.

|

| (3) |

The order shall, as soon as practicable, be served on the person accountable, who may at any time within twenty eight days after such service apply to the court for the order to be discharged, and the order may be discharged on any ground which would be a valid defence to proceedings for recovery of the duty.

|

| (4) |

Property liable to attachment and sale in execution of an order made under this section may be seized immediately after the order is made, but shall not be sold until the time for applying for discharge of the order has elapsed and any application for such a discharge has been determined.

|

|

| 46. |

Stay of execution pending appeal

Where, in any proceedings for the recovery of estate duty or for the discharge of an order for payment of estate duty, it appears that an appeal as to the valuation of any property, or against the decision of the Commissioner, is pending or that the time for so appealing has not yet elapsed, the court may if it thinks fit grant a stay of execution for such period and on such terms, including the payment of such interest as is provided for in section 40 of this Act, as it may think just.

|

| 47. |

Estate duty a charge on property

| (1) |

All estate duty which is leviable and unpaid shall be a first charge on the property in respect of which it is leviable, except as against a purchaser thereof in good faith, for valuable consideration and without notice.

|

| (2) |

For the purpose of enforcing such a charge, the Supreme Court shall have power—

| (a) |

to appoint a receiver of the property and of the rents, profits and income thereof; or

|

|

| (b) |

to order the sale of the property.

|

|

PART IX – MISCELLANEOUS

| 48. |

Presumption as to domicile

A person who immediately before his death was ordinarily resident in Kenya shall for the purposes of this Act, in the absence of proof of any domicile elsewhere, be presumed to have died domiciled in Kenya.

|

| 49. |

Representation not to be granted without certificate as

to duty

| (1) |

Save in the case of an application by the Public Trustee, and save as provided in section 72 of Law of Succession Act, 1971, no grant of representation shall be confirmed by any court or authority unless the certificate of the Commissioner is produced to such court or authority to the effect that he is satisfied either that the requirements of this Act in regard to the payment of duty have been or will be complied with or that no estate duty is payable:

Provided that, where the Commissioner has given a certificate of discharge under section 50 of this Act in respect of any property, nothing in this subsection shall prevent a grant of representation being made which is limited to the property specified in that certificate.

|

| (2) |

The Commissioner shall refuse to give a certificate under this section unless he is satisfied that—

| (a) |

the estate duty and interest has been paid or security has been given for it, and the affidavit has been properly completed; or

|

|

| (b) |

he has had sufficient information to enable him to determine, and has determined, that no duty is payable,

|

but shall not otherwise withhold or delay the issue of his certificate.

|

| 50. |

Certificate of discharge

| (1) |

The Commissioner, on being satisfied that in respect of a particular death the full estate duty has been or will be paid on any particular property, shall, on request, give a certificate discharging the property specified in the certificate from any further liability to estate duty.

|

| (2) |

A certificate of the Commissioner under this section shall not discharge any property from liability to estate duty in case of fraud or failure to disclose material facts:

Provided that a certificate purporting to discharge any property shall exonerate from liability to estate duty a purchaser thereof in good faith, for valuable consideration and without notice of the fraud or failure.

|

|

| 51. |

Service of notices

Any notice required to be served under this Act shall be sufficiently served if it is left at the last known place of abode or business in Kenya of the person to be served, or if it is sent by registered post addressed to him by name at his last known postal address in Kenya and is not returned as undelivered by the Post Office.

|

| 52. |

Arrangements for relief from double estate duty

| (1) |

If the Minister by order declares that arrangements specified in the order have been made with the government of some country with a view to affording relief from double taxation in relation to estate duty payable under the laws of Kenya and any duty of a similar character imposed under the laws of that country, and that it is expedient that those arrangements should have effect, the arrangements shall, notwithstanding anything in this Act, have effect so far as they provide for relief from estate duty, or for determining the place where any property is to be treated as being situated for the purposes of estate duty, or for the exchange of information regarding the liability of any person or property for such duties.

|

| (2) |

Any arrangements to which effect is given under this section may include provision for relief from duty in the case of deaths occurring before the making of the arrangements and provision as to property which is not itself subject to double duty, and the provisions of this section shall have effect accordingly.

|

| (3) |

Any order made under this section shall as soon as practicable be laid before the National Assembly.

|

|

| 53. |

Certified true copies of affidavits

The Commissioner shall on request provide certified copies of estate duty affidavits, corrective affidavits or statements and assessments to the administrator or his duly authorized representative, on payment of the prescribed fee.

|

| 54. |

Inventory and accounts to be delivered

The administrator of an estate shall deliver to the Commissioner a copy of the inventory and of all accounts required to be made under section 98 of the Probate and Administration Act, 1881 (No. 5 of 1881) and section 277 of the Indian Succession Act, 1865 (No. 10 of 1865).

|

| 55. |

Power of entry

| (1) |

Any person authorized by the Commissioner in writing in that behalf may, for the purposes of inspecting any premises reasonably believed to form part of a deceased’s estate, at any reasonable time enter and inspect the premises.

|

| (2) |

Any person who refuses or fails to allow entry to a person requiring entry under subsection (1) of this section shall be guilty of an offence and liable to a fine not exceeding two thousand shillings.

|

|

| 56. |

Rules

The Minister may make rules for the better carrying into effect of the provisions of this Act, and, without prejudice to the generality of the foregoing, may prescribe—

| (a) |

anything which may be prescribed under this Act;

|

| (b) |

the forms of affidavits to be used in connexion with this Act;

|

| I |

the fees to be paid under this Act;

|

| (d) |

the procedure to be followed in appeals to the Valuation Appeals Tribunal.

|

|

| 57. |

Limitation of operation of Cap. 257 (1948)

No estate duty within the meaning of the Estate Duty Act shall be levied under that Act on any property which passes on the death of any person dying on or after the 29th April, 1959.

|

| 58. |

Repeal of Act 43 of 1959

The Estate Duty (Abolition) Act, 1959, is repealed.

|

FIRST SCHEDULE [Section 21, Act No. 20 of 1967, s. 6, Act No.

10 of 1972, s. 3, Act No. 10 of 1980, s. 7.]

RATES OF DUTY

(In terms of Act No. 10 of 1982, no estate duty shall be levied or paid on property which passes on the death of any person)

SECOND SCHEDULE [Section 27.]

THE VALUATION APPEALS TRIBUNAL

| 1. |

The Tribunal shall be composed of a chairman and not less than two nor more than four other members, appointed by the Minister.

|

| 2. |

A member of the Tribunal shall hold office for such period not exceeding three years as is specified in his appointment, or until his appointment is revoked; and he shall be eligible for re-appointment.

|

| 3. |

If any member dies, or is permanently incapacitated from holding office for any cause, or resigns, or if his appointment is revoked, the Minister may appoint in his place another person, who shall hold office for the unexpired residue of the period of office of the member in whose place he is appointed.

|

| 4. |

A member may resign by giving notice in writing to the Minister.

|

| 5. |

A quorum of the Tribunal shall be three members.

|

| 6. |

The Tribunal may delegate to any member any of the functions or powers of the Tribunal other than the determination of an appeal.

|

| 7. |

| (1) |

Applications and appeals shall be determined according to the opinion of the majority of the members who hear the same, and the Tribunal shall give its decision in writing.

|

| (2) |

In the event of the Tribunal being equally divided on any issue, the presiding member shall have a casting vote.

|

|

| 8. |

| (1) |

The Tribunal may award costs, which shall be such sum as the Tribunal shall assess, having regard to the nature of the proceedings and the work involved:

Provided that the Tribunal may direct costs to be taxed in such manner as may be prescribed.

|

| (2) |

The Tribunal may award allowances to witnesses at the rate for the time being prescribed for allowances to witnesses in the Supreme Court.

|

| (3) |

An order of the Tribunal awarding costs or allowances to witnesses may be enforced in the same manner as an order of a subordinate court in that behalf, and a subordinate court shall have jurisdiction therein notwithstanding that the sum awarded exceeds any pecuniary limit on its jurisdiction.

|

|

| 9. |

Save as may be provided by rules made under this Act, the Tribunal may regulate its own procedure.

|

|